Global Solar Charger Market Size, Share Analysis Report By Type (Solar Panel Chargers, Solar Power Banks, Solar Car-Battery Chargers, Foldable/Flexible Solar Chargers, Solar Backpack Chargers, Integrated Solar-Device Chargers), By Power Output (Below 5 W, 5 to 20 W, 21 to 50 W, Above 50 W), By Application (Consumer Electronics, Automotive and Mobility, Military and Defense, Industrial and Commercial, Remote and Off-grid Locations), By End-user (Individual Consumers, Corporate and Commercial Enterprises, Government and Public Sector, NGOs and Emergency Services) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164425

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

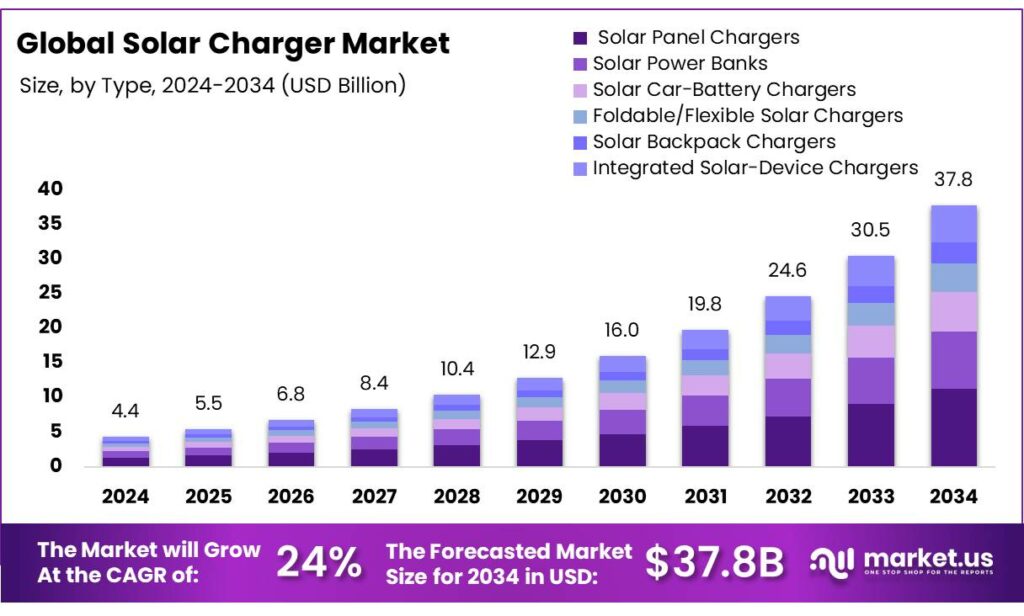

The Global Solar Charger Market size is expected to be worth around USD 37.8 Billion by 2034, from USD 4.4 Billion in 2024, growing at a CAGR of 24% during the forecast period from 2025 to 2034.

Solar chargers—ranging from pocketable USB power banks to rooftop-tied DC controllers—sit at the intersection of consumer electronics, distributed generation, and off-grid energy access. Their addressable market is expanding with record solar build-out and the proliferation of charge-hungry devices. In 2023, global solar PV investment exceeded USD 480 billion, outpacing all other power-generation technologies; this capital formation underpins cheaper modules and balance-of-system components that make solar charging hardware more affordable and widely available.

The industrial backdrop is one of unprecedented capacity additions and maturing supply chains. IRENA reports that 346 GW of solar was added in 2023, accounting for nearly three-quarters of all renewable additions; and renewables overall expanded by a record 585 GW in 2024, a 15.1% jump that still leaves the world short of the 2030 tripling target—signaling continued multi-year growth in PV hardware and downstream devices like chargers, controllers, and portable kits.

- Demand is propelled by both resilience needs and policy. The World Bank notes off-grid solar solutions benefited over 560 million people as of 2023, with >50 million products sold across 2022–2023 and market turnover of USD 3.9 billion (2022) and USD 3.8 billion (2023)—a signal of robust end-market pull for lanterns, chargers, and small kits that power phones and appliances at the last mile.

policy and cost curves accelerate uptake across consumer and professional segments. In India, the PM-KUSUM program targets 34,800 MW of decentralized solar and 1.4 million stand-alone solar pumps with ₹34,422 crore central support—expanding the installed base that relies on portable charging and DC accessories. In the U.S., the IRA’s Low-Income Communities Bonus spurred USD 3.5 billion of 2023 solar investments from 49,000 facilities, widening community-level markets for affordable solar hardware and accessories. The EU’s common-charger law mandates USB-C for most small devices from 28 Dec 2024, simplifying solar-charger interoperability.

Government programs in emerging economies are equally catalytic for charger ecosystems. India’s PM Surya Ghar (Muft Bijli Yojana) targets 10 million rooftop-solar households, with the government portal citing ₹75,000 crore investment intent and subsidies that have already reached hundreds of thousands of beneficiaries—unlocking mass deployment of in-home DC charging, smartphone power, and e-mobility trickle charging at the household edge.

Key Takeaways

- Solar Charger Market size is expected to be worth around USD 37.8 Billion by 2034, from USD 4.4 Billion in 2024, growing at a CAGR of 24%

- Solar Panel Chargers held a dominant market position, capturing more than a 29.7% share of the global solar charger market.

- 21 to 50 W power output solar chargers held a dominant market position, capturing more than a 39.4% share of the overall solar charger market.

- Consumer Electronics held a dominant market position, capturing more than a 39.6% share of the global solar charger market.

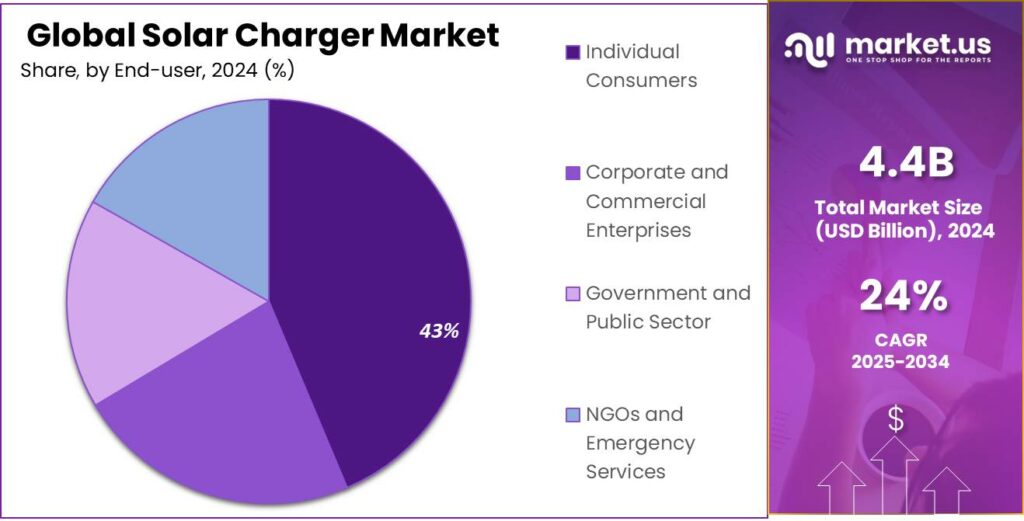

- Individual Consumers held a dominant market position, capturing more than a 44.2% share of the global solar charger market.

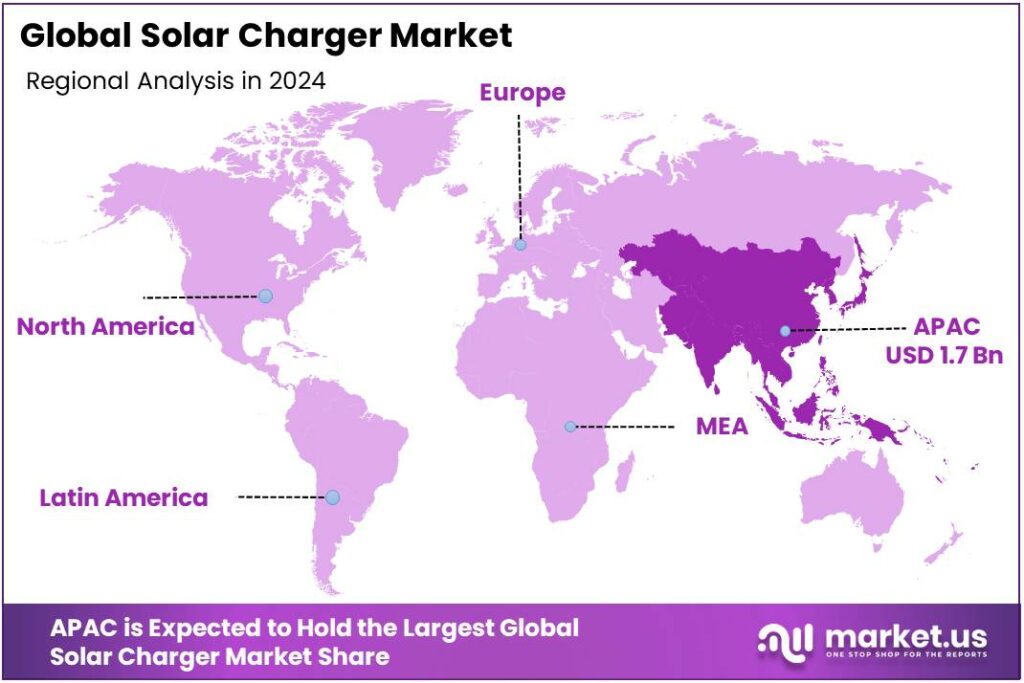

- Asia Pacific (APAC) region held a dominant market position, capturing 38.9% USD 1.7 billion.

By Type Analysis

Solar Panel Chargers dominate with 29.7% market share in 2024 driven by portable power demand

In 2024, Solar Panel Chargers held a dominant market position, capturing more than a 29.7% share of the global solar charger market by type. This growth can be attributed to the increasing demand for portable power solutions, particularly in outdoor and remote applications. The growing reliance on renewable energy sources, combined with a rising preference for eco-friendly charging options, has contributed to the increased adoption of solar panel chargers.

By 2025, the segment is expected to continue its growth as consumers and businesses alike seek more sustainable energy alternatives. The development of lightweight, efficient, and more affordable solar panels has further stimulated market demand, with technological advancements allowing for better charging speeds and more compact designs. The increasing popularity of outdoor activities, coupled with a push towards sustainable living, is expected to drive the adoption of solar panel chargers even further in the coming years.

By Power Output Analysis

21 to 50 W dominates with 39.4% market share in 2024 driven by balanced power needs

In 2024, 21 to 50 W power output solar chargers held a dominant market position, capturing more than a 39.4% share of the overall solar charger market by power output. This segment’s strong performance can be attributed to its balance between portability and sufficient power capacity, making it ideal for a wide range of applications, including outdoor activities, emergency backup, and small electronic device charging.

As consumers increasingly demand efficient, compact, and cost-effective charging solutions, solar chargers in the 21 to 50 W range have become the preferred choice. By 2025, this segment is expected to maintain its leadership as the popularity of portable and off-grid energy solutions continues to rise. The increasing use of solar-powered chargers in camping, hiking, and RV travel, along with a surge in eco-consciousness, is projected to further boost demand for solar chargers in this power range.

By Application Analysis

Consumer Electronics dominates with 39.6% market share in 2024 due to rising portable device usage

In 2024, Consumer Electronics held a dominant market position, capturing more than a 39.6% share of the global solar charger market by application. This growth is driven by the increasing reliance on portable electronic devices such as smartphones, tablets, laptops, and wearables, all of which require reliable and convenient charging solutions. Solar chargers have become a preferred choice for consumers seeking eco-friendly, off-grid power sources to keep their devices charged during outdoor activities or emergencies.

As demand for consumer electronics continues to rise globally, this segment is expected to maintain its leading position through 2025. Advancements in solar panel technology, including more efficient and compact designs, along with growing awareness of sustainable energy sources, will further fuel the adoption of solar chargers for personal devices. The surge in outdoor lifestyles, coupled with the need for off-the-grid power options, is likely to support steady growth in this application segment in the coming years.

By End-user Analysis

Individual Consumers dominate with 44.2% market share in 2024 driven by growing demand for portable power

In 2024, Individual Consumers held a dominant market position, capturing more than a 44.2% share of the global solar charger market by end-user. This dominance is driven by the growing trend of individuals seeking sustainable and portable power solutions for their everyday devices, especially smartphones, tablets, laptops, and other personal electronics. The rise in outdoor activities, travel, and emergency preparedness has further fueled the demand for solar chargers among individual consumers who value eco-friendly and off-grid charging options.

By 2025, the segment is expected to continue its strong growth trajectory as more people become aware of the environmental benefits of solar energy and the increasing need for energy independence. The development of lightweight, affordable, and efficient solar chargers tailored to individual needs will further contribute to the expansion of this market segment. With rising eco-consciousness and the need for portable power solutions, individual consumers are expected to remain the largest user group for solar chargers in the coming years.

Key Market Segments

By Type

- Solar Panel Chargers

- Solar Power Banks

- Solar Car-Battery Chargers

- Foldable/Flexible Solar Chargers

- Solar Backpack Chargers

- Integrated Solar-Device Chargers

By Power Output

- Below 5 W

- 5 to 20 W

- 21 to 50 W

- Above 50 W

By Application

- Consumer Electronics

- Smartphones and Tablets

- Laptops and Wearables

- Cameras and Drones

- Automotive and Mobility

- Passenger Vehicles

- Micromobility

- Military and Defense

- Industrial and Commercial

- Remote and Off-grid Locations

By End-user

- Individual Consumers

- Corporate and Commercial Enterprises

- Government and Public Sector

- NGOs and Emergency Services

Emerging Trends

USB-C Standardization + Food-System Use Is Shaping Today’s Solar-Charger Trend

A clear, fast-moving trend is the convergence on USB-C, USB Power Delivery, and efficient DC loads, which is making solar chargers simpler to use and far more useful in real-world settings like farms, markets, and relief sites. From 28 December 2024, the European Union requires most small devices sold in the EU to use USB-C; laptops follow in 2026.

A second piece of the trend sits squarely in food systems: powering cold-chain and market-day tasks with small solar plus DC appliances. The FAO estimates 13.2% of food is lost between harvest and retail, making reliable, light-touch cooling and monitoring increasingly valuable at the last mile—loads that modern solar chargers (with USB-C/PD, 12–20 V DC rails) can support alongside phones, payment devices, and sensors.

Cooling is central. UNEP/FAO highlight that the food cold chain accounts for ~4% of global GHG emissions, combining technology emissions with losses due to missing refrigeration. That stark footprint is pushing donors, NGOs, and ag-projects toward efficient DC coolers, fans, and data loggers, all compatible with USB-C power banks and compact panels.

On the demand side, the off-grid solar kit market shows continued appetite for small solar solutions that complement chargers. 9.3 million solar energy kits were sold in 2024, up 4% year-on-year, reflecting steady adoption despite macro headwinds—evidence that small PV + battery + USB ecosystems are normalizing in daily life.

Drivers

Access to Electricity and Demand for Solar Chargers

One of the major driving factors in the solar charger market is the huge need for off-grid electricity access in remote and underserved regions, which creates a clear use-case for portable solar charging solutions. According to International Energy Agency (IEA), in 2023 there were still approximately 750 million people worldwide lacking access to electricity.

This gap in electrification means many households and small enterprises cannot rely on conventional grid power, and so portable solar chargers represent a practical, flexible solution. For example, a family in a rural village without grid access may charge a mobile device, power LED lighting or small fans using a compact solar charger, thereby improving connectivity, education and income-generating possibilities.

In India, the central government’s flagship scheme PM‑KUSUM specifically targets solar pumps and decentralised solar power: the scheme aims to install 1.4 million stand-alone solar agricultural pumps under its Component B. In addition, the scheme targets 34,800 MW of solar capacity in total. This push creates infrastructure and awareness gains that further enhance demand for smaller solar accessories such as portable chargers.

For instance, as of October 2024 it was reported that over 540,000 solar pumps had already been installed under PM-KUSUM, which is about 42 % of the target number of 1.3 million pumps.

From a human-perspective, what this means is that in regions where the grid is unreliable or absent, people increasingly rely on decentralised renewable devices. A portable solar charger becomes more than a gadget: it becomes a lifeline to power communication devices, medical equipment, lighting for students, fans in warm climates, and even small business tools. As grid power remains elusive or intermittent for many, the attractiveness of a self-contained solar charger grows significantly.]

Restraints

Affordability and Total-Cost Barriers Limit Solar-Charger Uptake

A major restraint on solar-charger adoption is simple affordability—the upfront price and lifetime costs feel high to low-income users, especially when food and essentials take priority. Global food prices, while below their 2022 peak, remain elevated: the FAO Food Price Index averaged 128.8 in September 2025, up 3.4% year-on-year, squeezing disposable income that could otherwise finance small energy devices.

Taxes and import charges further raise shelf prices. In several African markets, analyses show that solar products have faced import duty up to 25% plus 18% VAT (e.g., Uganda after policy changes), which can lift end-user prices well beyond what cash-constrained households can pay.

Regulatory compliance and end-of-life handling add another cost layer. Batteries and small electronics are increasingly captured by e-waste rules; while essential for safety, these requirements impose logistics and producer-responsibility costs that can be material for small devices. The UN’s Global E-waste Monitor reports 62 million tonnes of e-waste generated in 2022, with only 22.3% formally collected/recycled, and projects 82 million tonnes by 2030—a backdrop that pushes governments toward stricter take-back and recycling regimes that vendors of chargers must fund.

Policy can help, but uncertainty itself restrains demand. Where governments temporarily exempt solar products from VAT/duty and later reverse course, distributors price in risk, and consumers delay purchases. A GOGLA/KEREA Kenya assessment estimated that foregone VAT/duty revenue from exemptions was only ~0.1% of national revenue, yet removal of exemptions weighed on solar sales and access goals.

Opportunity

Food-Cold-Chain & Humanitarian Needs Create Big Openings

A powerful growth opportunity for solar chargers sits where food systems and humanitarian needs meet: keeping harvests fresh, phones connected, and small cold boxes running in places with weak or no grid. Globally, 13.3% of food is lost after harvest and before retail—a loss that better last-mile power and cooling can reduce.

UNEP and FAO report that developing countries could save 144 million tonnes of food annually with cold-chain infrastructure comparable to advanced economies—an enormous opportunity for low-power solar cooling and monitoring solutions. The same report estimates the food cold chain drives ~4% of global GHG emissions today—so efficient, solar-powered alternatives can cut waste and emissions together.

Human need is also pushing procurement. In 2023, ~282 million people in 59 countries faced high levels of acute hunger, intensifying demand for reliable off-grid power in relief operations. In parallel, 733 million people were hungry in 2023, underscoring fragile food systems that benefit from solar-enabled cold storage and communications. Relief and ag-development programs increasingly standardize on portable solar power for phones, payment devices, vaccine/food coolers, and sensors—precisely the loads modern solar chargers can serve.

Policy adds momentum. India’s PM-KUSUM targets 34,800 MW of decentralized solar and 1.4 million stand-alone solar pumps—expanding rural solar literacy and accessory demand. As farm solar proliferates, the addressable base for durable chargers grows—from powering ag-IoT gateways to topping up smartphones used for market prices and digital payments.

Market access in off-grid communities is real and measurable. GOGLA reports 9.3 million off-grid solar energy kits sold in 2024 (up 4% vs. 2023), even amid macro headwinds—evidence of resilient willingness to pay for small solar solutions that include and complement chargers.

Regional Insights

Asia Pacific leads the market with 38.9% share (USD 1.7 billion) in 2024

In 2024, the Asia Pacific (APAC) region held a dominant market position, capturing 38.9% (USD 1.7 billion) of the global solar charger market. The dominance of APAC in this market can be attributed to the rapidly expanding consumer base in countries such as China, India, Japan, and Southeast Asia, where the adoption of solar energy solutions is growing in line with increased environmental awareness and demand for off-grid power options.

The significant economic growth in the region, particularly in emerging markets, has led to a rise in disposable income and a greater need for portable energy solutions. As outdoor activities, such as camping, hiking, and travel, become more popular, there is an increasing preference for solar chargers that can offer an eco-friendly alternative to conventional battery-powered solutions. Furthermore, the APAC region benefits from favorable sunlight conditions, making solar energy an ideal power source for mobile and consumer electronics.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Anker Innovations: Founded in 2011 in Changsha (China) and operating globally, Anker Innovations reported its 2024 revenue at CNY 24.71 billion (≈ US $3.4 billion), up 41.1% year-on-year, and energy-storage business revenue at over CNY 3 billion (≈ US $410 million), up 184%. Its SOLIX brand supplies portable solar panels (e.g., 30 W foldable) and charging solutions, positioning the company as a broad smart-hardware brand evolving into solar chargers and energy storage.

Renogy: Founded in 2005, Renogy (U.S.-based) manufactures portable solar panels, kits and power systems spanning off-grid, RV and outdoor markets. It lists portable solar panels from ~30 W to 400 W, foldable suitcase styles and monocrystalline tech, showing broad power-scale offering rather than tiny USB chargers alone.

Jackery Inc.: Founded in 2012 in Silicon Valley, Jackery has sold over 5 million units by late 2024. It offers portable power stations paired with solar panels (SolarSaga) and solar chargers for outdoor and home backup use, marking its pivot from pure power station maker toward integrated solar-charging ecosystems.

Top Key Players Outlook

- Anker Innovations

- Goal Zero

- Renogy

- Jackery Inc.

- EcoFlow

- SunJack

- RAVPower

- Instapark

- Voltaic Systems

- Xtorm BV

- BigBlue

- Poweradd

Recent Industry Developments

In 2024, SunJack reported an approximate US $30.9 million in annual revenue, according to industry-tracker data.

In 2024, Renogy continued to deepen its role in the solar-charger and off-grid power segment, offering foldable panels, kits ranging from 10 W to 300 W, and system bundles for outdoor and RV markets. Its estimated annual revenue stood at around US$ 36 million.

Report Scope

Report Features Description Market Value (2024) USD 4.4 Bn Forecast Revenue (2034) USD 37.8 Bn CAGR (2025-2034) 24% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Solar Panel Chargers, Solar Power Banks, Solar Car-Battery Chargers, Foldable/Flexible Solar Chargers, Solar Backpack Chargers, Integrated Solar-Device Chargers), By Power Output (Below 5 W, 5 to 20 W, 21 to 50 W, Above 50 W), By Application (Consumer Electronics, Automotive and Mobility, Military and Defense, Industrial and Commercial, Remote and Off-grid Locations), By End-user (Individual Consumers, Corporate and Commercial Enterprises, Government and Public Sector, NGOs and Emergency Services) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Anker Innovations, Goal Zero, Renogy, Jackery Inc., EcoFlow, SunJack, RAVPower, Instapark, Voltaic Systems, Xtorm BV, BigBlue, Poweradd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Anker Innovations

- Goal Zero

- Renogy

- Jackery Inc.

- EcoFlow

- SunJack

- RAVPower

- Instapark

- Voltaic Systems

- Xtorm BV

- BigBlue

- Poweradd