Global Soil Monitoring Market By Offering (Hardware, Software, And Services), By Connectivity (Wired And Wireless), By Application (Agriculture, Environmental Monitoring, Forestry, Construction And Civil Engineering, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168397

- Number of Pages: 293

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

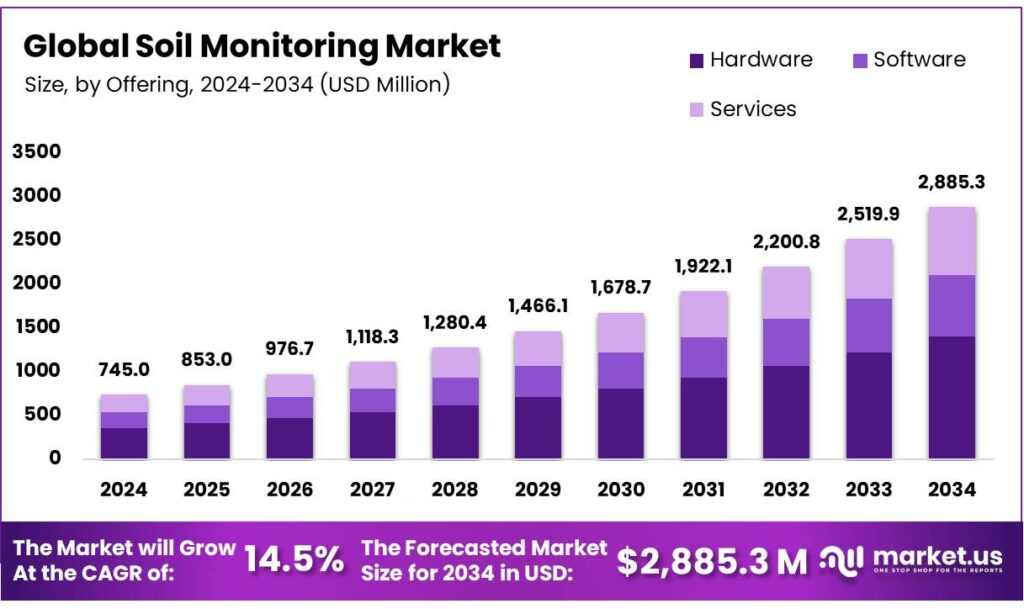

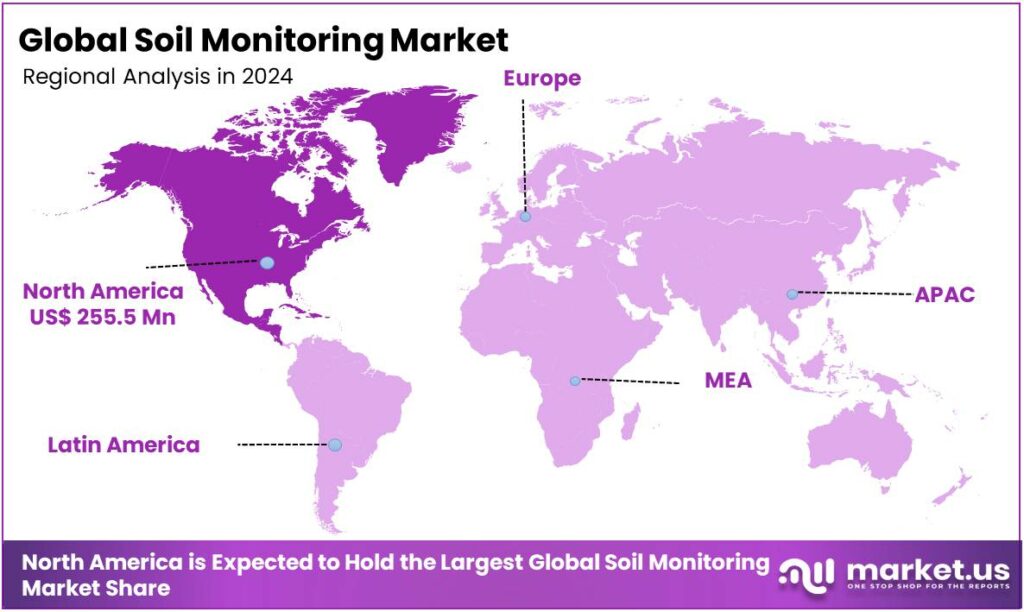

The Global Soil Monitoring Market size is expected to be worth around USD 2885.3 Million by 2034, from USD 745.0 Million in 2024, growing at a CAGR of 14.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 34.3% share, holding USD 255.5 Million revenue.

Soil monitoring is the systematic measurement of soil properties over time to observe its health and quality. It involves using various methods, such as physical methods, laboratory tests, and automated sensors, to track changes in parameters such as moisture, nutrients, temperature, and pH. Soil monitoring systems, which include sensors, data analytics, and cloud platforms, provide real-time insights into soil health, moisture, temperature, and nutrient content, enabling farmers to optimize irrigation, fertilization, and crop management.

The soil monitoring market is experiencing significant growth, driven by the increasing demand for precision agricultural practices and the need for enhanced food security. While agriculture remains the primary application, these systems are being explored in environmental monitoring, forestry, and construction. Wireless soil monitoring is gaining traction due to its ease of installation and scalability, making it ideal for large or remote farms.

The integration of AI and machine learning for predictive analytics is further transforming the market, allowing for more precise and data-driven decision-making. However, high initial costs of hardware and installation remain a challenge, particularly for smaller farmers.

- The European Union has proposed the Soil Monitoring & Resilience Directive that establishes an EU-wide framework requiring Member States to regularly assess soil health through monitoring systems, manage soils sustainably, and remediate contaminated sites, with the long-term goal of achieving healthy soils across Europe by 2050.

Key Takeaways

- The global soil monitoring market was valued at USD 744.9 Million in 2024.

- The global soil monitoring market is projected to grow at a CAGR of 14.5% and is estimated to reach USD 2885.3 Million by 2034.

- Based on the offerings, hardware dominated the soil monitoring market, with 48.6% of the total global market.

- On the basis of connectivity of the soil monitoring systems, the wireless systems held a major share of the market, around 64.9%.

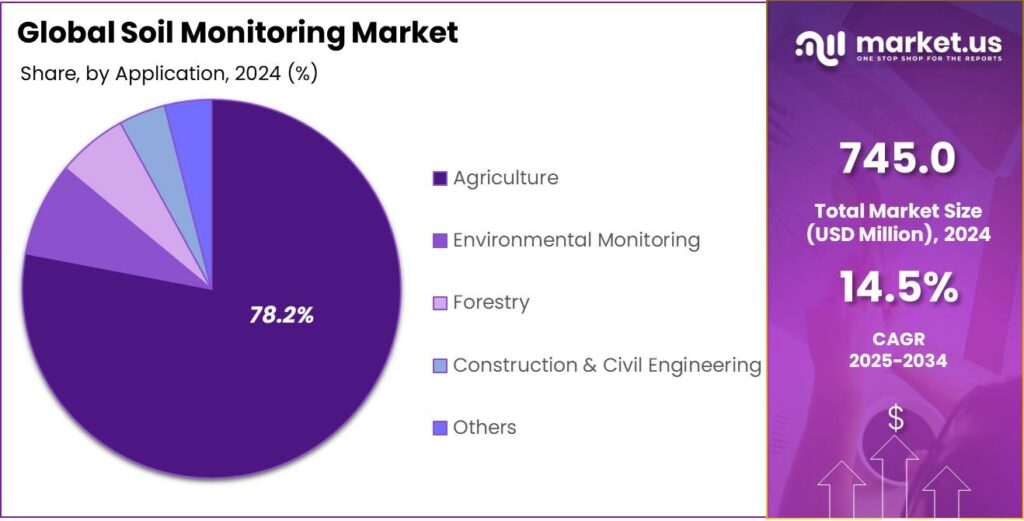

- Among the applications, the agriculture sector emerged as a major segment in the soil monitoring market, with a substantial market share of 78.2%.

- In 2024, North America was the most dominant region in the soil monitoring market, accounting for 34.3% of the total global consumption.

Offering Analysis

Hardware Dominated the Soil Monitoring Market in 2024.

The soil monitoring market is segmented based on the offerings into hardware, software, and services. The hardware dominated the soil monitoring market, comprising 48.6% of the market share. The hardware of soil monitoring systems typically generates more revenue than software or related services due to its high initial cost and essential role in data collection. Soil sensors, probes, and other physical devices require significant investment in manufacturing, research, and technology development.

For instance, advanced sensors that measure parameters such as soil moisture, pH levels, and nutrient content can be expensive to manufacture due to the precision and durability required for long-term field use. In contrast, software and related services, though crucial for data analysis and management, tend to be more scalable. They often involve subscription-based models or cloud services, which generate recurring revenue; however, the initial financial outlay for software is often less compared to the high cost of physical hardware.

Connectivity Analysis

Wireless Systems are a Prominent Segment in the Soil Monitoring Market.

The soil monitoring market is segmented on the basis of connectivity into wired and wireless systems. The wireless soil monitoring systems led the market, constituting 64.9% of the market share, due to their flexibility, ease of installation, and cost-effectiveness. Wireless sensors can be effectively deployed across large or remote agricultural areas without the need for extensive wiring, which reduces installation time and labor costs.

For instance, in large-scale farms or fields with uneven terrain, laying wires can be cumbersome and expensive, while wireless systems can be installed rapidly and with minimal disruption to the soil. Additionally, wireless systems offer greater scalability, as new sensors can be added to the network without major infrastructure changes. Similarly, they provide real-time data transmission via cellular networks or Wi-Fi, enabling farmers to monitor soil conditions remotely from smartphones or computers conveniently.

Application Analysis

The Agriculture Sector Emerged as a Leading Segment in the Soil Monitoring Market.

On the basis of applications, the soil monitoring market is segmented into agriculture, environmental monitoring, forestry, construction & civil engineering, and others. Approximately 78.2% of the soil monitoring market revenue is generated by the agriculture sector. Soil monitoring systems are most commonly used in agriculture as the correlation between soil health and crop yield marks the systems as essential for efficient farming. In agriculture, soil conditions, such as moisture, pH, temperature, and nutrient levels, significantly influence crop productivity.

For instance, soil sensors can help farmers monitor soil moisture levels, reducing irrigation costs up to 70%. While soil monitoring is valuable in environmental monitoring, forestry, and construction, the scale of its impact in agriculture, where soil directly affects food production, creates a higher demand. Additionally, the agriculture sector has established infrastructure for the integration of these systems, making them a widespread solution compared to other industries.

Key Market Segments

By Offering

- Hardware

- Software

- Services

By Connectivity

- Wired

- Wireless

By Application

- Agriculture

- Protected Cultivation

- Open Field Cultivation

- Environmental Monitoring

- Forestry

- Construction & Civil Engineering

- Others

Drivers

Shift Towards Precision Agriculture Due to Demand for Food Security Drives the Soil Monitoring Market.

- According to the Food and Agriculture Organization (FAO), the world will need 50% more food by 2050 to feed the increasing global population in the context of natural resource constraints, environmental pollution, ecological degradation, and climate change. With the world’s population expected to reach 9.7 billion by 2050, reaching a peak of around 10.3 billion individuals in the mid-2080s, up from 8.2 billion in 2024, agricultural productivity must increase significantly to meet the demand for food security.

Soil monitoring technologies enable farmers to make data-driven decisions that enhance crop yields while conserving vital resources such as water and soil nutrients. For instance, soil sensors help optimize irrigation systems, reducing water usage by up to 30%, which is crucial in water-scarce areas such as parts of Africa and Asia.

Additionally, precision agriculture techniques such as soil nutrient tracking allow for more efficient fertilizer use, cutting down on costs and environmental impact. In agriculturally developed nations, such as the United States, China, and Israel, farmers are increasingly adopting IoT-enabled systems to monitor soil health in real-time, leading to more precise farming practices. This shift toward smarter, sustainable farming practices is essential for maintaining long-term food security and ensuring resource efficiency.

Restraints

High Cost of Soil Monitoring Poses a Significant Challenge to the Market.

The high cost of soil-monitoring technologies continues to pose a major obstacle to widespread adoption, particularly among small and medium-sized farms in developing regions. Soil-moisture sensors depend on advanced technology to accurately measure water content. High-end devices frequently employ sophisticated electronics to determine dielectric constants, electrical resistance, or other parameters that correlate with soil moisture, thereby increasing overall costs. Additionally, these sensors integrate complex algorithms to process collected data, enabling more precise and informed analysis.

Furthermore, the underlying technology must be sufficiently robust to manage variability arising from differences in soil composition, temperature fluctuations, and external influences such as rainfall and irrigation. This level of technical sophistication substantially contributes to the expense of such systems. The precision-agriculture technologies offer significant long-term benefits; however, the initial installation and investment costs may exceed immediate economic returns. Due to the challenges, there is a growing interest in developing more cost-effective solutions, including lower-cost sensor models and scalable subscription-based services, to make soil-monitoring technologies more accessible to a broader spectrum of farmers.

Opportunity

Adoption of Soil Monitoring Beyond Agriculture Creates Opportunities in the Soil Monitoring Market.

The adoption of soil monitoring technologies beyond agriculture in various sectors, such as construction and environmental conservation, is creating opportunities in the market. For instance, in urban development, soil monitoring plays a crucial role in assessing ground stability and suitability for construction, helping prevent issues such as subsidence or foundation failures.

Additionally, soil health monitoring is becoming increasingly important in land reclamation and environmental restoration efforts for assessing baseline conditions, guiding targeted interventions, and tracking the recovery progress of degraded land. For instance, in forestry, a soil monitoring system involves using ground-based and remote sensing tools to track soil conditions such as moisture, nutrients, and compaction, which helps manage forest health, sustainability, and resource allocation.

Similarly, soil monitoring systems are utilized in many commercial projects. For instance, in February 2025, Toro announced an exclusive partnership with TerraRad to introduce a first-of-its-kind software tool for precision irrigation control. This partnership between Toro and TerraRad is driving new possibilities in golf course irrigation. As environmental concerns and technological advancements grow, industries beyond traditional agriculture are valuing soil data for reducing risks and enhancing long-term sustainability, broadening the scope and potential of the soil monitoring market.

Trends

Integration of AI and ML for Advanced Analytics.

The integration of artificial intelligence (AI) and machine learning (ML) into advanced analytics, combined with the adoption of cloud-based platforms, is significantly transforming the soil monitoring market. Through the utilization of AI and ML, farmers and land managers can process large volumes of soil data more efficiently, obtaining deeper insights into soil health, moisture content, and nutrient availability. Additionally, these technologies support predictive analytics, enabling more accurate forecasting of crop yields and the determination of optimal planting schedules.

For instance, several AI-powered systems in the market are able to predict soil erosion risks and identify nutrient deficiencies before they affect crop performance, allowing farmers to implement preventive measures. Furthermore, cloud-based platforms facilitate real-time data sharing and collaboration, offering scalable and easily accessible solutions for soil monitoring.

This trend is increasingly evident in precision agriculture systems that employ IoT sensors in combination with cloud-based analytics. By leveraging AI, ML, and cloud technologies, the soil monitoring process becomes more dynamic, precise, and widely accessible, ultimately enhancing decision-making and improving resource efficiency across multiple industries.

Geopolitical Impact Analysis

Geopolitical Tensions Cause Price Volatility in the Soil Monitoring Market.

Geopolitical tensions impact the soil monitoring market by increasing demand for soil health monitoring technology due to climate change and food security concerns, while creating challenges through supply chain disruptions for hardware and components, and affecting demand by influencing commodity prices, which impacts farmer profitability.

The trade disputes and sanctions have led to shortages of critical components for soil monitoring technologies, such as sensors and microchips, which rely on international trade routes. For instance, the trade war between the U.S. and China and the Brexit agreement between the UK and the EU have affected the sourcing, procurement, and technological innovations in the sensors market. This disruption has delayed the availability of soil monitoring systems and increased their costs.

Moreover, regions affected by conflict or instability may struggle to implement advanced agricultural technologies, as limited access to resources or capital can hinder adoption. In countries heavily dependent on agriculture, geopolitical tensions lead to food security concerns, pushing governments and farmers to prioritize short-term solutions over long-term, data-driven strategies such as soil monitoring. In regions facing trade blockades, such as parts of Eastern Europe or the Middle East, governments are investing more in local agricultural innovations, including soil monitoring systems, to boost domestic food production.

Regional Analysis

North America Held the Largest Share of the Global Soil Monitoring Market.

In 2024, North America dominated the global soil monitoring market, holding about 34.3% of the total global consumption. The region has historically held the largest share of the global soil monitoring market, driven by its advanced agricultural practices and high adoption of technology. The U.S., in particular, has been at the forefront of implementing precision farming techniques, using soil sensors, remote sensing technologies, and data analytics to optimize crop production and resource management.

- According to the U.S. Department of Agriculture, over the last decade, U.S. farms have substantially increased their adoption of precision agriculture, and numerous precision technologies are now widespread. For instance, yield monitors, yield maps, and soil maps were used on 68% of large-scale crop-producing farms.

The adoption rates of precision agriculture technologies increase sharply with farm size, with small family farms, those with gross cash farm income of less than US$ 350,000, having the lowest rates of use within each technology category. Furthermore, the region’s well-established infrastructure for agricultural technology, along with government support for sustainable farming practices, accelerates the adoption of soil monitoring solutions. Moreover, large agricultural enterprises in North America have the financial capacity to invest in cutting-edge technology, creating a favorable environment for the growth of soil monitoring. North America continues to lead the market, with many farmers leveraging advanced tools to increase yield efficiency and sustainability.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Companies in the soil monitoring market employ several strategies to gain a competitive edge and boost sales. The companies are focusing on offering integrated solutions that combine soil sensors, data analytics, and cloud platforms, providing customers with a comprehensive, user-friendly system. For instance, companies are increasingly incorporating AI and machine learning to deliver predictive insights on the farmlands. In addition, several companies focus on the development of cost-effective, scalable products, enabling adoption by smaller farms or emerging markets.

Similarly, the companies emphasize partnerships with agricultural cooperatives and local governments to extend their reach, particularly in regions where soil monitoring is less common. Furthermore, there is a focus on providing robust after-sales support, including training, data interpretation, and system maintenance, to ensure long-term customer satisfaction and retention. Moreover, companies focus on collaborations with several sensor and probe manufacturers to improve the quality of the products.

The Major Players in The Industry

- METER Group

- CropX Inc.

- SGS SA

- Sentek Technologies

- Stevens Water Monitoring Systems, Inc.

- Campbell Scientific

- The Toro Company

- Irrometer Company, Inc.

- AquaCheck

- Pessl Instruments

- Arable Labs, Inc.

- Soil Scout Oy

- EOS Data Analytics, Inc.

- Acclima, Inc.

- Endress+Hauser Group

- Other Key Players

Key Development

- In November 2025, Internet Initiative Japan Inc. (IIJ) and Sony Semiconductor Solutions Corp. announced the signing of an agreement to establish a joint venture that will offer soil moisture sensors and irrigation navigation services for smart agriculture.

- In April 2024, GroGuru, a leader in strategic water management for commercial farmers, announced the commercial launch of the fully integrated wireless soil sensor probe, in partnership with AquaCheck, for continuous root zone monitoring of annual field crops, fully integrating the patented GroGuru WUGS, wireless underground system.

Report Scope

Report Features Description Market Value (2024) USD 744.96 Mn Forecast Revenue (2034) USD 2885.3 Mn CAGR (2025-2034) 14.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Offering (Hardware, Software, and Services), By Connectivity (Wired and Wireless), By Application (Agriculture, Environmental Monitoring, Forestry, Construction & Civil Engineering, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape METER Group, CropX Inc., SGS SA, Sentek Technologies, Stevens Water Monitoring Systems, Inc., Campbell Scientific, The Toro Company, Irrometer Company, Inc., AquaCheck, Pessl Instruments, Arable Labs, Inc., Soil Scout Oy, EOS Data Analytics, Inc., Acclima, Inc., Endress+Hauser Group, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- METER Group

- CropX Inc.

- SGS SA

- Sentek Technologies

- Stevens Water Monitoring Systems, Inc.

- Campbell Scientific

- The Toro Company

- Irrometer Company, Inc.

- AquaCheck

- Pessl Instruments

- Arable Labs, Inc.

- Soil Scout Oy

- EOS Data Analytics, Inc.

- Acclima, Inc.

- Endress+Hauser Group

- Other Key Players