Global Sodium Thiocyanate Market Size, Share, And Business Benefit By Type (Industrial Grade, Technical Grade, Pharmaceutical Grade), By Application (Chemical Analysis Reagent, Polyacrylonitrile Fiber Spinning Solvent, Color Film Rinses, Defoliants and Propylene Fiber, Others), By End Use (Pharmaceutical, Building and Construction, Agriculture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 163661

- Number of Pages: 319

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

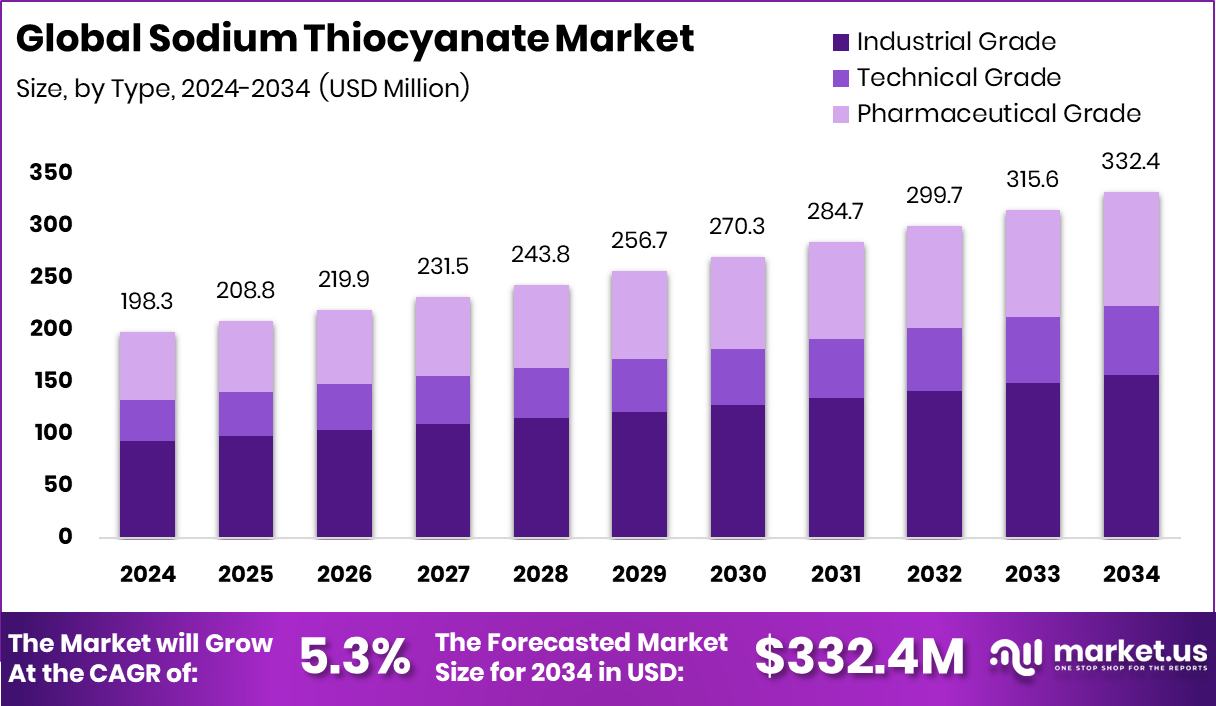

The Global Sodium Thiocyanate Market is expected to be worth around USD 332.4 million by 2034, up from USD 198.3 million in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034. Growing textile, pharmaceutical, and manufacturing activities continue to strengthen Asia-Pacific’s 47.9% market position.

Sodium Thiocyanate is an inorganic compound with the formula NaSCN, recognized for its versatile role in chemical synthesis. It appears as a colorless, hygroscopic crystal highly soluble in water and ethanol. It is primarily used as a raw material in the production of acrylic fibers, pharmaceuticals, herbicides, and dyes. In the textile sector, it acts as a solvent for polyacrylonitrile, while in pharmaceuticals, it aids in developing diagnostic reagents and drug intermediates. Its demand continues to expand due to rising use in chemical formulations and laboratory reagents.

The Sodium Thiocyanate market is witnessing steady growth due to its wide applications across textiles, medical diagnostics, and agrochemicals. Industrial expansion, particularly in emerging economies, supports this market. The compound’s role in organic synthesis and polymer production also enhances its value in modern industrial chemistry. Increasing urbanization and manufacturing activities across the Asia-Pacific are further driving the market outlook positively.

The main growth factor for the Sodium Thiocyanate market lies in its role in textile fiber manufacturing and pharmaceutical processing. The global push for sustainable textile processing has increased reliance on efficient solvents like sodium thiocyanate. Growing healthcare diagnostics also increases its need for test reagents. Moreover, initiatives such as Rinse’s $23 million Series D funding led by LG Investors and earlier $14 million Series B funding in San Francisco highlight broader chemical and cleaning industry investments, indirectly boosting chemical demand.

Demand for Sodium Thiocyanate continues to rise with increased use in chemical synthesis and laboratory applications. The compound’s versatility in textile dyeing, acrylic fiber spinning, and chemical reagent production makes it an essential industrial material. The surge in laundry and cleaning innovations, backed by Rinse’s $23 million financing round and $3.5 million seed capital, reflects higher chemical consumption in detergents and textile-care industries, contributing to expanding sodium thiocyanate use globally.

Key Takeaways

- The Global Sodium Thiocyanate Market is expected to be worth around USD 332.4 million by 2034, up from USD 198.3 million in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034.

- In 2024, the sodium thiocyanate market was majorly dominated by industrial grade, holding a 47.3% share.

- The Sodium Thiocyanate Market saw strong application in polyacrylonitrile fiber spinning, accounting for a 34.2% share.

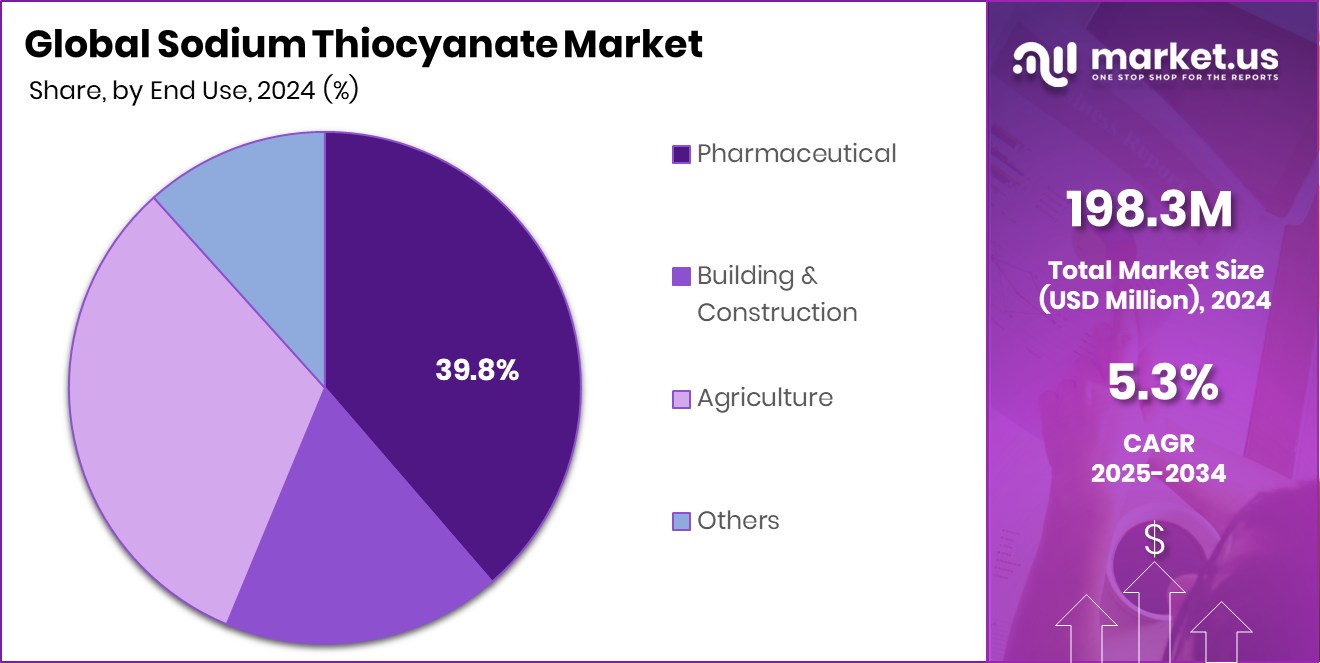

- In the Sodium Thiocyanate Market, pharmaceutical end-use dominated with a 39.8% share in 2024.

- The strong market presence in Asia-Pacific 47.9% share, is driven by expanding industrial chemical applications.

By Type Analysis

Growing industrial demand supports the Sodium Thiocyanate market’s 47.3% type-based share.

In 2024, Industrial Grade held a dominant market position in the By Type segment of the Sodium Thiocyanate Market, accounting for a 47.3% share. This dominance is attributed to its extensive utilization in textile fiber manufacturing, chemical synthesis, and dye formulation processes.

Industrial-grade sodium thiocyanate serves as a critical solvent and reagent in large-scale industrial applications, offering superior solubility and stability. Its demand remains strong due to the rising production of acrylic fibers and increased use in electroplating and photographic chemicals.

The growing industrial output and advancements in chemical manufacturing have further strengthened the market position of industrial-grade sodium thiocyanate, making it a key contributor to overall market revenue and industrial development across multiple sectors.

By Application Analysis

Sodium Thiocyanate holds a 34.2% share as a polyacrylonitrile fiber solvent.

In 2024, Polyacrylonitrile Fiber Spinning Solvent held a dominant market position in the By Application segment of the Sodium Thiocyanate Market, accounting for a 34.2% share. This strong position is driven by the compound’s essential role as a solvent in the production of polyacrylonitrile fibers, which are widely used in textiles and industrial fabrics.

Its excellent solubility and stability make it an ideal medium for polymer spinning processes, ensuring uniform fiber formation and high-quality end products. Increasing demand for synthetic fibers in clothing, carpets, and industrial materials has further reinforced its market dominance.

The segment’s steady growth reflects sodium thiocyanate’s indispensable role in supporting fiber manufacturing efficiency and maintaining consistent product performance.

By End Use Analysis

Pharmaceutical applications lead the sodium thiocyanate market with a 39.8% share.

In 2024, Pharmaceutical held a dominant market position in the By End Use segment of the Sodium Thiocyanate Market, accounting for a 39.8% share. This dominance is attributed to its wide utilization in the synthesis of pharmaceutical intermediates, diagnostic reagents, and therapeutic formulations.

Sodium thiocyanate plays a vital role in producing compounds used in medical diagnostics and drug development due to its strong reactivity and purity standards. The growing focus on healthcare advancements and the expansion of pharmaceutical manufacturing facilities have reinforced the segment’s market strength.

Its continued demand in laboratory reagents and clinical testing processes further underlines the importance of sodium thiocyanate within pharmaceutical production and biomedical applications.

Key Market Segments

By Type

- Industrial Grade

- Technical Grade

- Pharmaceutical Grade

By Application

- Chemical Analysis Reagent

- Polyacrylonitrile Fiber Spinning Solvent

- Color Film Rinses

- Defoliants and Propylene Fiber

- Others

By End Use

- Pharmaceutical

- Building and Construction

- Agriculture

- Others

Driving Factors

Rising Use in Textile Fiber Manufacturing

One of the major driving factors for the Sodium Thiocyanate Market is its increasing use in textile fiber manufacturing, particularly for producing polyacrylonitrile fibers. These fibers are widely used in clothing, industrial fabrics, and home furnishings. Sodium thiocyanate serves as a vital solvent in the spinning process, ensuring better fiber uniformity, strength, and durability.

The growth of the global textile industry, especially in emerging economies, has significantly boosted the demand for sodium thiocyanate. Its high solubility and chemical stability make it ideal for large-scale fiber production. With ongoing advancements in textile technology and growing demand for synthetic fibers, the industrial consumption of sodium thiocyanate continues to rise steadily worldwide.

Restraining Factors

Health and Environmental Concerns Limiting Wider Usage

A key restraining factor for the Sodium Thiocyanate Market is the rising health and environmental concerns linked with its handling and disposal. Sodium thiocyanate can release toxic fumes when heated and may pose risks to human health if inhaled or ingested. Prolonged exposure can lead to skin irritation, thyroid problems, and other health issues.

Environmental regulations on chemical waste disposal have also become stricter, especially in the European Union and North America, limiting its large-scale industrial use. Companies are required to invest more in safe waste management and worker protection systems, which increases operational costs. These regulatory and safety challenges are slowing down the overall market expansion and affecting production efficiency in several end-use industries.

Growth Opportunity

Expanding Use in Pharmaceutical and Diagnostic Applications

A major growth opportunity for the Sodium Thiocyanate Market lies in its expanding use within pharmaceutical and diagnostic applications. The compound plays a key role in synthesizing pharmaceutical intermediates and diagnostic reagents used for medical testing. As global healthcare systems grow and demand for precise diagnostics increases, sodium thiocyanate’s importance continues to rise.

Its ability to form stable complexes with metal ions makes it valuable in developing chemical assays and laboratory reagents. The rapid expansion of pharmaceutical manufacturing in the Asia-Pacific region, along with growing investments in medical research, is creating new market opportunities. With increasing healthcare spending and ongoing innovation in drug formulation, sodium thiocyanate is set to gain stronger traction across the medical and biochemical sectors.

Latest Trends

Growing Shift Toward Sustainable Chemical Production Practices

A key latest trend in the Sodium Thiocyanate Market is the growing shift toward sustainable and eco-friendly chemical production. Manufacturers are focusing on cleaner synthesis routes and improved waste management systems to reduce environmental impact. This shift is driven by stricter global regulations and the industry’s movement toward greener technologies. Many production facilities are adopting closed-loop systems to minimize chemical discharge and energy consumption.

Additionally, research initiatives are exploring renewable raw materials and safer catalysts to enhance process efficiency. These sustainability-driven efforts are helping companies maintain compliance while appealing to environmentally conscious customers. As industries embrace responsible manufacturing, the adoption of green chemistry principles is becoming central to the future growth of sodium thiocyanate production worldwide.

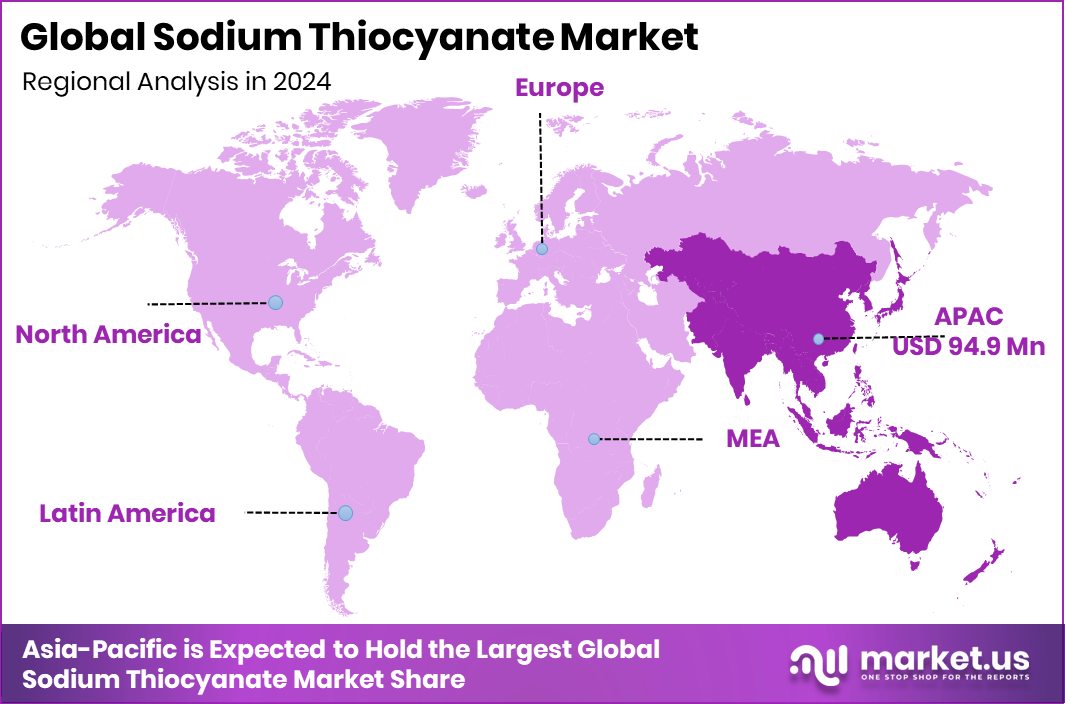

Regional Analysis

In 2024, Asia-Pacific held a 47.9% share, valued at USD 94.9 million.

In 2024, Asia-Pacific held a dominant market position in the global Sodium Thiocyanate Market, accounting for a 47.9% share, valued at USD 94.9 million. The region’s strong position is primarily supported by its large-scale textile, pharmaceutical, and chemical manufacturing industries, particularly in China, India, and Japan.

Continuous industrial expansion and high production capacities in the acrylic fiber and dye sectors contribute to the region’s leadership. North America follows, driven by pharmaceutical advancements and strict industrial standards promoting consistent demand for sodium thiocyanate in laboratory reagents and chemical synthesis.

Europe demonstrates steady growth due to its well-established chemical sector and ongoing sustainability initiatives. Meanwhile, Latin America and the Middle East & Africa show gradual market development supported by emerging textile and industrial activities.

Overall, Asia-Pacific remains the key contributor to global revenue, reflecting robust industrial utilization and expanding manufacturing capabilities across the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Taisheng Chemical continues to leverage its production capabilities and longstanding manufacturing base to supply sodium thiocyanate for fibres, dyes, and specialty chemical applications. The firm’s broad product portfolio and domestic industrial network give it a strong foundation, allowing it to respond to fluctuations in demand and capture opportunities in textile-grade and chemical-intermediate segments. With upstream access and established customer relationships, Taisheng is positioned to benefit from increased industrial uses and regional growth in Asia.

Also noteworthy is Dongsheng Chemical, which has developed a recognized presence in sodium thiocyanate supply chains, particularly in Asia. Its positioning as a listed supplier in market-supplier directories underscores its role in the value chain. Dongsheng’s ability to serve mid-size chemical buyers and maintain pricing flexibility gives it an operational advantage amid cost and raw-material pressures.

Meanwhile, Hebei Chengxin stands out for its commitment to derivative chemical production and quality control, offering sodium thiocyanate as part of its broader portfolio of cyanide and thiocyanate salts. The company’s dedicated factories for each product category support consistency and product quality, which is critical given the purity requirements in pharmaceutical, spinning-solvent, and reagent applications. Its R&D capability and customer-service orientation further help it maintain cost efficiencies and market responsiveness.

Top Key Players in the Market

- Taisheng Chemical

- Dongsheng Chemical

- Hebei Chengxin

- Jiaozuo Henghua Chemical

- Shandong Tiancheng Chemical

- Anhui Shuguang Chemical

- Henan Province Tianshui Chemical

- Ronas Chemical

- Honeywell

Recent Developments

- In October 2024, Honeywell said it will spin off its Advanced Materials business into a separate U.S.-listed company by late 2025/early 2026. This unit houses specialty chemicals and research-grade products used in labs; Honeywell lists sodium thiocyanate in its research chemicals catalog. The move streamlines focus and could sharpen product investment and supply execution for lab reagents

Report Scope

Report Features Description Market Value (2024) USD 198.3 Million Forecast Revenue (2034) USD 332.4 Million CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Industrial Grade, Technical Grade, Pharmaceutical Grade), By Application (Chemical Analysis Reagent, Polyacrylonitrile Fiber Spinning Solvent, Color Film Rinses, Defoliants and Propylene Fiber, Others), By End Use (Pharmaceutical, Building and Construction, Agriculture, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Taisheng Chemical, Dongsheng Chemical, Hebei Chengxin, Jiaozuo Henghua Chemical, Shandong Tiancheng Chemical, Anhui Shuguang Chemical, Henan Province Tianshui Chemical, Ronas Chemical, Honeywell Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sodium Thiocyanate MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Sodium Thiocyanate MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Taisheng Chemical

- Dongsheng Chemical

- Hebei Chengxin

- Jiaozuo Henghua Chemical

- Shandong Tiancheng Chemical

- Anhui Shuguang Chemical

- Henan Province Tianshui Chemical

- Ronas Chemical

- Honeywell