Global Sodium Tetraborate Market Size, Share, And Business Benefits By Type (Pentahydrate Sodium Tetraborate, Anhydrous Sodium Tetraborate, Decahydrate Sodium Tetraborate), By End-Use (Chemicals, Construction, Automotive, Consumer Goods, Agriculture), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 162928

- Number of Pages: 353

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

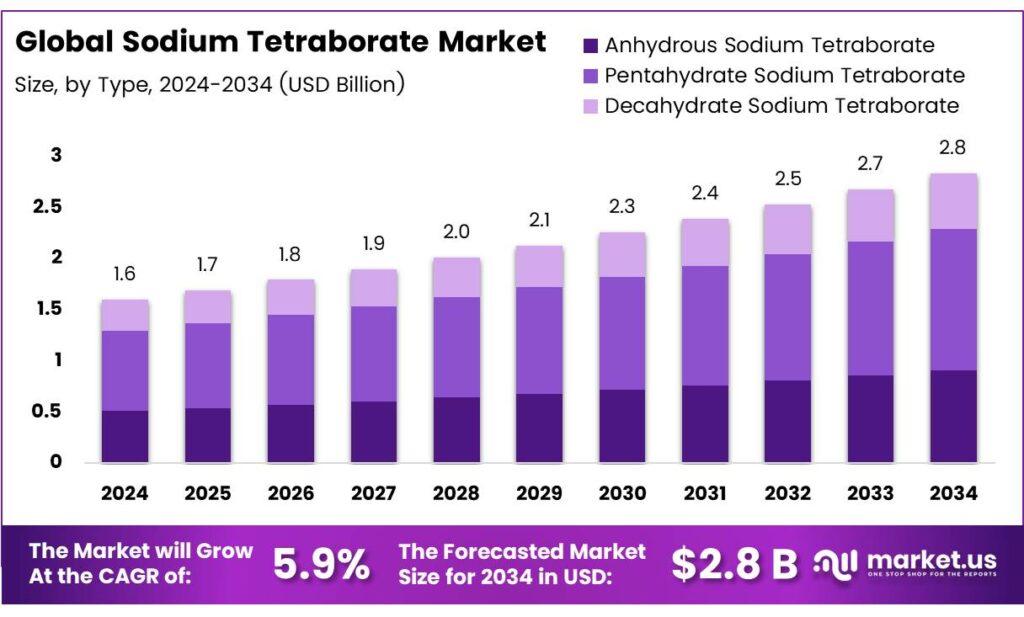

The Global Sodium Tetraborate Market size is expected to be worth around USD 2.8 Billion by 2034, from USD 1.6 Billion in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034.

Sodium tetraborate, commonly known as borax (Na₂B₄O₇), is highly water-soluble and widely used in washing powders, glass manufacturing, and wax emulsions. Boric acid, derived from borax and visually similar, primarily acts as a pesticide by targeting insects’ stomachs and nervous systems. A 10% borax solution effectively kills roaches, prevents moths, and serves as a fungicide and herbicide. In industries, it functions as a water-softening agent and food preservative.

Boron compounds, particularly boric acid, are essential in producing high-strength lightweight structural and refractory materials. Boric acid is the most commonly used boron compound across industrial and consumer products, serving as a starting material for synthesizing organic borate salts, boron phosphate, fluoroborates, boron trihalides, borate esters, boron carbide, and metal alloys like ferroboron. Most organic nonlinear optical (NLO) crystals exhibit poor mechanical and thermal properties, complicating the characterization of bulk crystals.

For analytical characterization, synthesized crystals are finely ground and analyzed via powder X-ray diffraction (PXRD) using a Bruker D8 Discover instrument with graphite-monochromated Cu Kα radiation. The PXRD pattern is recorded over a 5–80° range with a step size of 0.01° and a step time of 1 second. Infrared (IR) absorption spectroscopy is performed on a Perkin Elmer Fourier transform infrared spectrometer, where the sample, 5 mg, is thoroughly mixed with dried KBr, 500 mg, pelletized, and examined.

- In high-temperature applications, the dehydrated form of borax is critical to prevent the charge from being expelled from the pot due to water of crystallization. Molten borax, which melts at approximately 750°C, is an excellent solvent for nearly all metal oxides. It becomes a free-flowing, strongly acidic liquid at higher temperatures, lowering slag melting points and effectively dissolving inert materials like bone ash and clay. At around 500°C, it decomposes into Na₂O and B₂O₃, with boron oxide readily forming borates with basic oxides; the optimal basic-to-acidic oxygen ratio is 1:3, as in metaborate.

Key Takeaways

- The Global Sodium Tetraborate Market is projected to grow from USD 1.6 billion in 2024 to USD 2.8 billion by 2034 at a 5.9% CAGR.

- Pentahydrate Sodium Tetraborate dominated the By Type segment in 2024 with 48.9% share, driven by use in detergents and glass production.

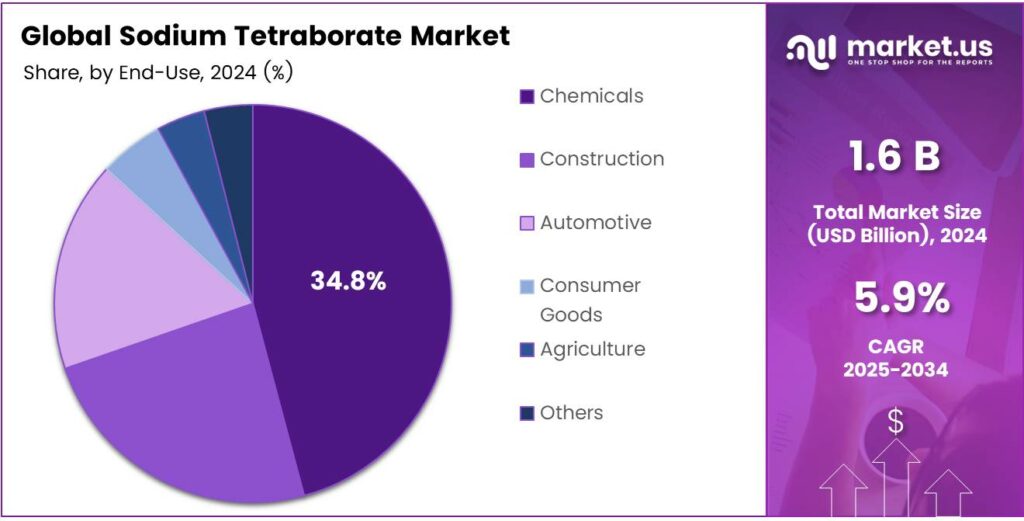

- Chemicals led by the End-Use segment in 2024, with a 34.8% share, valued for pH buffering in syntheses and pharmaceutical processes.

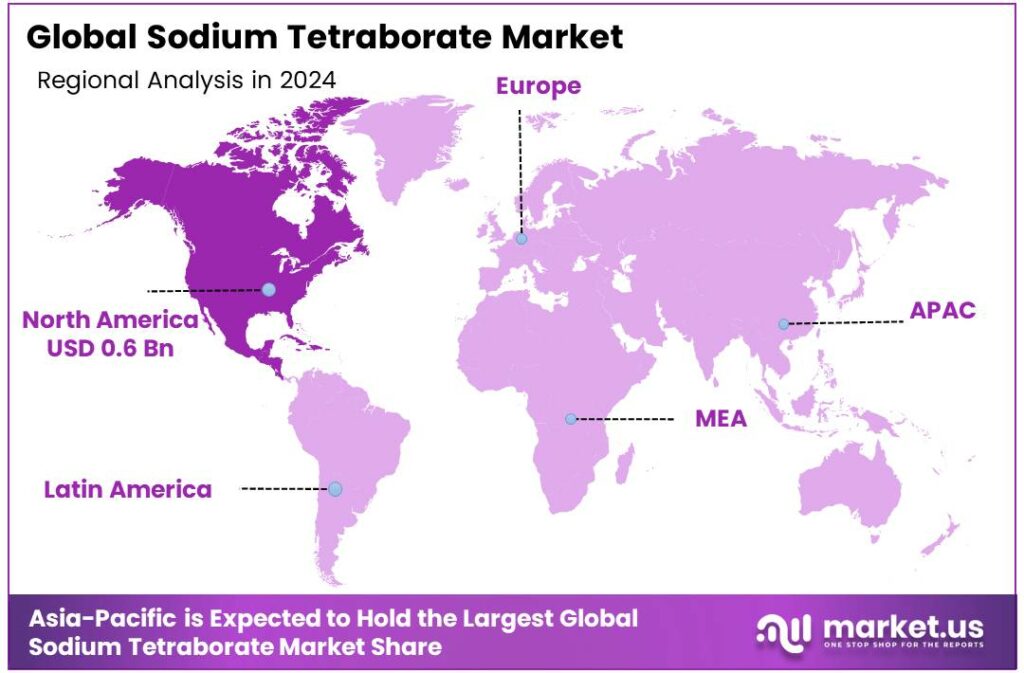

- North America held 42.8% market share in 2024, USD 0.6 billion, fueled by demand in glass, ceramics, detergents, agriculture, and sustainable initiatives.

By Type Analysis

Pentahydrate Sodium Tetraborate dominates with 48.9% due to its superior solubility and versatility across industries.

In 2024, Pentahydrate Sodium Tetraborate held a dominant market position in the By Type Analysis segment of the Sodium Tetraborate Market, with a 48.9% share. This form excels in detergents and glass production. Manufacturers favor it for easy handling and stability. Demand surges as industries seek efficient fluxes. Overall, it drives market growth through broad applications. Transitions to sustainable processes further boost its adoption.

Anhydrous Sodium Tetraborate plays a key role in high-temperature uses. It suits metallurgy and specialty glassmaking. Without water, it offers pure reactions and better efficiency. Industries select it for precision in enamels and fluxes. Growth stems from rising needs in electronics. Thus, it supports innovation in advanced materials.

Decahydrate Sodium Tetraborate thrives in household cleaners and agriculture. Its high water content aids dissolution in water-based products. Farmers use it as a boron source for crops. This variant ensures mild antiseptic properties in preservatives. Consequently, it meets eco-friendly demands in consumer goods.

By End-Use

Chemicals lead with 34.8% thanks to their essential buffering role in reactions.

In 2024, Chemicals held a dominant market position in the By End-Use Analysis segment of the Sodium Tetraborate Market, with a 34.8% share. It acts as a pH buffer in various syntheses. Factories rely on it for stable chemical processes. Demand rises with pharmaceutical expansions.

Hence, it anchors industrial efficiency and quality control. Construction leverages Sodium Tetraborate in flame retardants and glass. Builders incorporate it for durable, fire-safe materials. Urban growth fuels its use in insulation and ceramics. This segment benefits from infrastructure booms worldwide.

As a result, it enhances safety in modern buildings. Automotive employs it in fiberglass and welding fluxes. Vehicle makers value its thermal resistance in components. Electric car trends increase the need for lightweight materials. Thus, it supports innovation in sustainable transport solutions.

Key Market Segments

By Type

- Pentahydrate Sodium Tetraborate

- Anhydrous Sodium Tetraborate

- Decahydrate Sodium Tetraborate

By End-Use

- Chemicals

- Construction

- Automotive

- Consumer Goods

- Agriculture

- Others

Emerging Trends

Growth in Energy-Efficient Glass & Ceramic Applications

The use of Sodium tetraborate (borax) is increasingly shaped by the demand for energy-efficient glass and ceramic materials, driven by climate goals and building insulation regulations. In the U.S., the United States Geological Survey (USGS) reported that in 2023, the glass and ceramics industries accounted for an estimated 65% of total borate consumption.

Globally, this shift is very visible: borate compounds support the production of fiberglass insulation, borosilicate glass for solar panels, and specialty ceramic glazes. For example, under the European Critical Raw Materials Act (CRMA), borate has been identified as a strategic raw material, linked to energy-transition technologies like wind turbines and insulation materials.

On the materials side, as building codes across Europe, North America, and Asia increasingly demand higher thermal insulation and lower carbon footprint glazing, borate-based fluxes and glass additives become more sought-after. This means sodium tetraborate supply and refined borate chemicals are likely to gain incremental growth.

Drivers

Agriculture Micronutrient Adoption

The push to correct soil micronutrient deficiencies globally is a major driver for sodium tetraborate use in fertilisers. Boron-bearing compounds (including borates) have wide agricultural utility. While the USGS doesn’t break out sodium tetraborate explicitly, it emphasises the broad borate family usages.

In many parts of Asia and Africa, soil boron deficiency is recognised as a yield-limiting factor. Governments and agricultural ministries are encouraging the addition of boron-based fertilisers; this supports demand for sodium tetraborate as a boron source. For instance, the fact sheet on borates indicates that global agricultural soils are deficient in micronutrients such as boron.

Moreover, sustainable-agriculture programmes are increasingly incorporating micronutrient management as part of public-sector policy. This means that sodium tetraborate is indirectly supported by agricultural-development initiatives and subsidy programmes in key farming regions. As farmers apply boron-enriched fertilisers, this creates a steady incremental demand stream for borate compounds.

Restraints

Supply-Chain Concentration & Import Dependency

- One important restraint facing sodium tetraborate is the concentrated supply base and high import dependency for many consuming regions. The European import data show that in 2023–24, the European Commission’s statistics list that EU imports of borates rose from 423,000 t to 441,000 t, while exports dropped to about 40,000 t, giving an import-to-export ratio of roughly 11:1.

More starkly, Turkey supplies about 81% of borates imported into the EU, with the U.S. supplying about 15% in 2024. This concentration creates supply risk: if Turkey’s mine output is disrupted, or logistics are affected, downstream users have little alternative. The EU’s CRMA sets a target that no more than 65% of annual consumption of a strategic raw material should come from a single third country.

For sodium tetraborate, this means: while demand is rising, the supply side may be hampered or costly due to logistics, geopolitical risk, or export policy changes from dominant producing countries. This constraint can lead to price volatility, longer lead times, or substitution pressures.

Opportunity

Circular Economy and Recycling Potential

A meaningful growth opportunity for sodium tetraborate lies in the circular economy and recycling of borate-bearing waste streams. Although recycling of borates is currently negligible, regulatory frameworks are beginning to push for improved materials circularity. For example, the EU’s CRM strategy under the CRMA includes targets that at least 25% of annual consumption of strategic raw materials should come from recycled sources.

For sodium tetraborate producers and users, this means there is upside in developing closed-loop systems: recovering boron from glass recycling, insulation debris, or industrial ceramic waste can create a secondary supply pipeline, reduce dependence on mined ore, and align with sustainability goals. In countries like India, where soil-health programmes and building renovation schemes are scaling, stakeholders that can offer recycled-borate solutions may capture preferential procurement.

Treating sodium tetraborate not just as a mined raw material but as a recoverable commodity opens new business angles. The sustainability trend in construction, agriculture, and industrial manufacturing creates a favourable backdrop for recycled-borate programs. Circular-economy strategies linked to policy incentives offer a tangible growth opportunity for sodium tetraborate beyond traditional mining-based demand.

Regional Analysis

North America leads with a 42.8% share and a USD 0.6 Billion market value.

In 2024, North America held a dominant position with a 42.8% share, valued at USD 0.6 billion in the global sodium tetraborate market. The region’s leadership stems from strong demand across the glass, ceramics, detergent, and agriculture sectors. North America’s dominance is supported by integrated mining operations, strong industrial manufacturing networks, and government-backed sustainability initiatives.

The United States and Canada represent the core consumers, where sodium tetraborate is extensively used in fiberglass insulation, borosilicate glass, and detergents, driven by the region’s energy efficiency regulations and advanced manufacturing systems. Primarily from California’s Mojave mines operated the U.S. Borax division. This strong domestic supply base stabilizes prices and ensures regional self-reliance.

Additionally, agriculture contributes significantly to sodium tetraborate consumption. U.S. Department of Agriculture (USDA) initiatives on micronutrient soil enhancement have encouraged the adoption of boron-based fertilizers, where sodium tetraborate acts as a key boron source for crop productivity.

Environmental protection frameworks led by the EPA have also promoted eco-friendly detergents and flame-retardant formulations, indirectly boosting borate applications in household and industrial cleaning products. Furthermore, the construction rebound across the U.S. and Mexico—fueled by insulation and glass demand—has enhanced consumption of borate-derived materials.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

3M is a significant player in the sodium tetraborate market, leveraging its vast industrial reach. Its strength lies in integrating borates into high-value, specialty products across multiple sectors, including adhesives, abrasives, and advanced materials. This downstream integration provides a competitive edge, moving beyond commodity sales. 3M’s strong R&D capabilities and established global distribution network ensure a consistent and reliable supply for a diverse industrial customer base, solidifying its influential market position.

American Borate Company focuses on the mining and refining of boron specialties, including sodium tetraborate. Its strategic ownership of a domestic mine in Nevada ensures control over a critical supply chain, catering primarily to the North American market. This positions the company as a vital regional supplier, reducing dependency on imports. By specializing in high-purity borate products for agricultural, industrial, and specialty applications.

Eti Maden, the Turkish state-owned enterprise, is a global titan in the sodium tetraborate market. It commands a dominant position by controlling the world’s largest and highest-grade boron reserves. This near-monopoly on raw materials allows Eti Maden to heavily influence global pricing and supply. The company operates an integrated production chain, from mining to refined borates, ensuring cost efficiency and quality control.

Top Key Players in the Market

- 3M Company

- American Borate Company

- Eti Maden

- Rio Tinto

- Gujarat Boron Derivatives Pvt. Ltd.

- Minera Santa Rita S.R.L.

Recent Developments

- In 2024, 3M continues to leverage boron nitride for thermal management in electronics and aerospace, emphasizing sustainability-driven solutions. The company holds with recent efforts to integrate boron compounds into eco-friendly industrial applications. This aligns with broader boron market growth in high-tech sectors.

- In 2024, A small-scale boric acid facility in California, linked to U.S. borate suppliers like American Borate, began operations. Plans aim to scale, focusing on specialty products for defense, electric vehicles, food security, and agriculture. This supports U.S. efforts to reduce reliance on imports.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Billion Forecast Revenue (2034) USD 2.8 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Pentahydrate Sodium Tetraborate, Anhydrous Sodium Tetraborate, Decahydrate Sodium Tetraborate), By End-Use (Chemicals, Construction, Automotive, Consumer Goods, Agriculture, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape 3M Company, American Borate Company, Eti Maden, Rio Tinto, Gujarat Boron Derivatives Pvt. Ltd., Minera Santa Rita S.R.L. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Sodium Tetraborate MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Sodium Tetraborate MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M Company

- American Borate Company

- Eti Maden

- Rio Tinto

- Gujarat Boron Derivatives Pvt. Ltd.

- Minera Santa Rita S.R.L.