Global Sodium Gluconate Market Size, Share, And Business Benefits By Form (Powder, Liquid), By End-use (Construction, Food and Beverage, Pharmaceuticals, Textiles, Water Treatment, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 149842

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

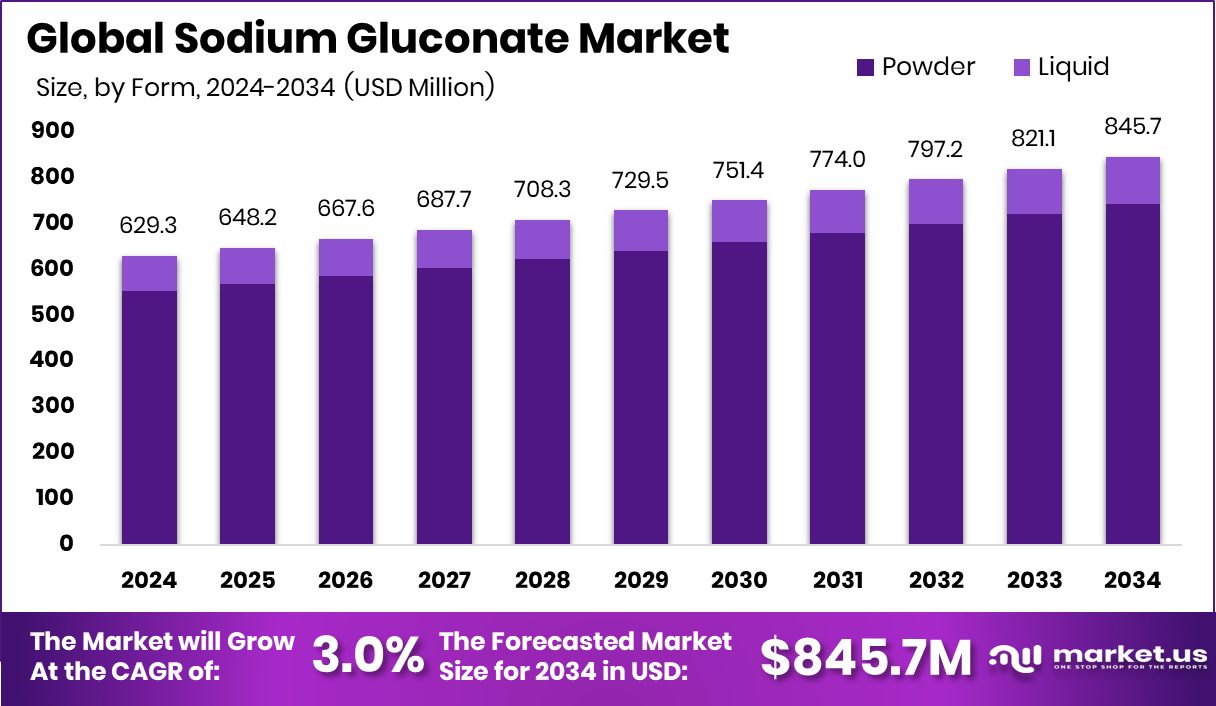

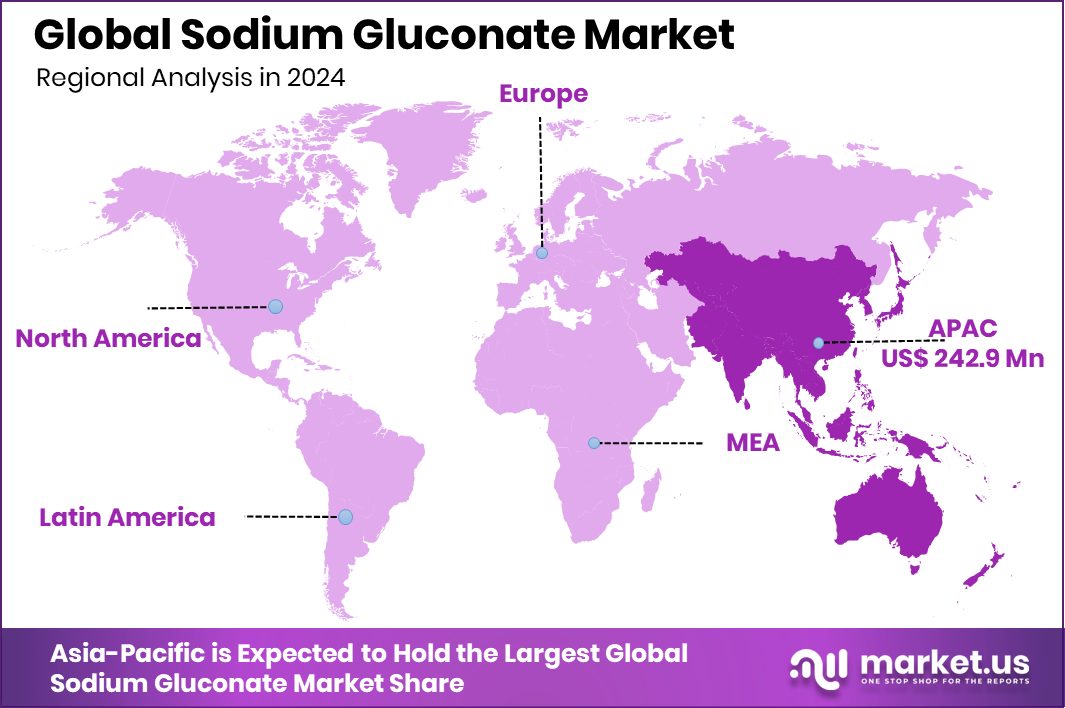

Global Sodium Gluconate Market is expected to be worth around USD 845.7 Million by 2034, up from USD 629.3 Million in 2024, and grow at a CAGR of 3.0% from 2025 to 2034. Strong construction and water treatment demand fueled Asia-Pacific’s USD 242.9 million sodium gluconate market expansion.

Sodium Gluconate is a sodium salt derived from gluconic acid, produced by the fermentation of glucose. It is a white, water-soluble powder with excellent chelating properties, making it effective in binding metal ions like calcium, iron, and magnesium. Its non-toxic, biodegradable, and non-corrosive nature makes it suitable for use in applications such as construction admixtures, water treatment, textile dyeing, detergents, and food preservation.

The expanding construction industry is one of the main growth drivers for the sodium gluconate market. As infrastructure development picks up globally, especially in developing regions, the use of sodium gluconate in concrete admixtures is rising. It helps improve workability and delay setting time, particularly in hot weather concreting, making it a vital additive in modern construction projects.

On the demand side, water treatment is playing a big role. Governments are investing more in clean water projects and wastewater management, where sodium gluconate is used as a chelating agent. Its ability to reduce metal ion interference makes it highly effective in industrial-scale water treatment facilities.

A key opportunity is its growing acceptance in eco-friendly and biodegradable cleaning products. Consumers are shifting away from harsh chemicals, and sodium gluconate’s non-toxic profile makes it a preferred ingredient in green formulations, especially in household and industrial cleaners.

Key Takeaways

- Global Sodium Gluconate Market is expected to be worth around USD 845.7 Million by 2034, up from USD 629.3 Million in 2024, and grow at a CAGR of 3.0% from 2025 to 2034.

- In 2024, powder form held an 87.9% share in the Sodium Gluconate Market due to its versatility.

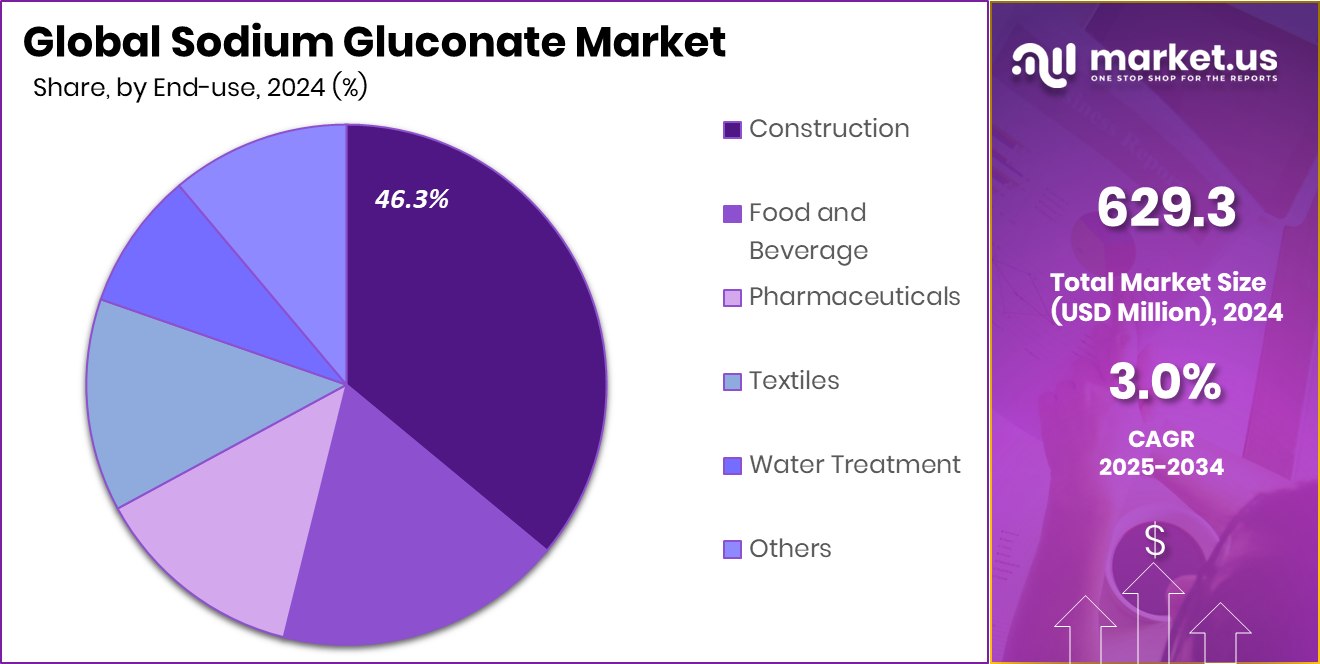

- Construction end-use dominated the market with a 46.3% share, driven by concrete admixture and infrastructure expansion.

- The Asia-Pacific region recorded a market value of USD 242.9 million during the year.

By Form Analysis

In 2024, powder form dominated the Sodium Gluconate Market with 87.9% share.

In 2024, Powder held a dominant market position in the By Form segment of the Sodium Gluconate Market, with an 87.9% share. This clear dominance reflects the widespread industry preference for the powdered form due to its ease of handling, transportation, and long shelf life. Powdered sodium gluconate is highly stable and dissolves readily in water, making it suitable for precise dosing in industrial applications such as construction additives, detergents, and water treatment chemicals.

The form’s dry nature significantly reduces the risk of spoilage or degradation during storage and transit, which is especially valuable in bulk applications across regions with varying climates. Moreover, the powdered form is compatible with automated dosing systems used in manufacturing and processing plants, adding to its operational efficiency.

Its high concentration level also ensures better cost-effectiveness per unit of active ingredient compared to other forms. This has led to strong uptake in sectors requiring bulk volume use, particularly construction and water treatment.

By End-use Analysis

The construction sector led end-use in the Sodium Gluconate Market with a 46.3% share.

In 2024, Construction held a dominant market position in the By End-use segment of the Sodium Gluconate Market, with a 46.3% share. This leadership is primarily due to the extensive use of sodium gluconate as a concrete admixture in modern construction activities. Its ability to act as a set retarder and plasticizer enhances concrete performance, especially in projects that require extended workability or are undertaken in high-temperature environments.

The compound plays a crucial role in improving the durability and finish quality of concrete structures, making it an essential additive in infrastructure development. With the rising volume of construction projects—ranging from commercial buildings to residential complexes and transportation networks—the demand for performance-enhancing concrete additives like sodium gluconate has surged.

Additionally, the compatibility of sodium gluconate with other admixtures and its non-corrosive, eco-friendly profile make it a preferred choice for contractors focused on sustainability and long-term structural integrity. This has resulted in continued demand growth within the construction sector.

Key Market Segments

By Form

- Powder

- Liquid

By End-use

- Construction

- Food and Beverage

- Pharmaceuticals

- Textiles

- Water Treatment

- Others

Driving Factors

Growing Infrastructure Projects Driving Product Use Worldwide

One of the biggest reasons for the growth of the sodium gluconate market is the rise in infrastructure and construction projects around the world. Governments and private companies are spending more on roads, bridges, buildings, and industrial structures. In these projects, sodium gluconate is widely used as a concrete admixture.

It helps slow down the setting time of concrete, which is important during large or complicated construction tasks, especially in hot weather. It also improves the flow and finish of concrete. Because of its useful properties and safe nature, builders are choosing it more often. As construction work increases in both developing and developed countries, the demand for sodium gluconate continues to rise steadily.

Restraining Factors

High Production Costs Limit Market Growth Potential

One major factor holding back the growth of the sodium gluconate market is its high production cost. The manufacturing process involves the fermentation of glucose, which requires controlled conditions and specific equipment.

This makes the overall process expensive, especially when compared to other chemical alternatives used in similar applications. In developing countries, where price sensitivity is high, buyers often choose cheaper substitutes, even if they are less eco-friendly.

Additionally, the fluctuation in raw material prices—especially glucose and energy—can add further cost pressure. These challenges make it difficult for some industries to adopt sodium gluconate on a large scale. As a result, high production cost becomes a major barrier to market expansion in cost-conscious regions.

Growth Opportunity

Eco-Friendly Cleaners Creating Strong Future Demand

A big growth opportunity for the sodium gluconate market comes from the rising use of eco-friendly cleaning products. More people and industries are now choosing cleaners that are safe for health and the environment. Sodium gluconate is non-toxic, biodegradable, and gentle on surfaces, which makes it a perfect ingredient for green cleaning formulas.

It works well as a chelating agent, helping to remove hard water stains, dirt, and metal ions. As environmental rules become stricter and awareness about chemical-free cleaning increases, manufacturers are looking for safer raw materials. This shift in preference is opening new doors for sodium gluconate in the home care and industrial cleaning markets, especially in Europe, North America, and urban parts of Asia.

Latest Trends

Sustainable Production Methods Gain Industry Momentum

A key trend shaping the sodium gluconate market is the shift toward sustainable and eco-friendly production methods. Manufacturers are increasingly adopting green chemistry principles, utilizing renewable energy sources, and implementing efficient waste management practices to produce sodium gluconate sustainably.

By focusing on sustainable production, companies aim to reduce their carbon footprint and align with global sustainability goals. This trend not only enhances the environmental profile of sodium gluconate but also opens up new market opportunities, as industries seek greener alternatives for various applications, including construction, food processing, and personal care products.

Regional Analysis

In 2024, Asia-Pacific led the sodium gluconate market with 38.6% share.

In 2024, Asia-Pacific dominated the Sodium Gluconate Market with a 38.6% share, accounting for a total market value of USD 242.9 million. The region’s strong lead is driven by large-scale infrastructure development, expanding water treatment projects, and growing demand from the construction industry, especially in countries like China and India.

These factors have established Asia-Pacific as the most influential regional market. North America followed with steady demand supported by rising adoption in food additives and environmentally friendly cleaning agents. Europe also maintained a notable presence, supported by strict environmental standards encouraging the use of biodegradable chelating agents like sodium gluconate.

Meanwhile, Latin America and the Middle East & Africa regions witnessed moderate growth, primarily fueled by increasing construction activities and gradual industrial expansion. Although their market share remained comparatively lower, improving urban infrastructure and rising awareness of non-toxic chemical solutions are slowly supporting sodium gluconate usage.

While Asia-Pacific leads in both volume and value, North America and Europe are expected to retain stable consumption levels, with growing applications across the industrial and institutional cleaning sectors

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE continued to leverage its extensive global presence and robust R&D capabilities to maintain its position in the sodium gluconate market. The company’s focus on innovation and sustainability is evident in its operations, as it strives to meet the evolving needs of various industries. BASF’s commitment to quality and environmental responsibility supports its role as a key supplier in the market.

Fermentation Products, Inc. (PMP), based in the United States, maintained its reputation for producing high-purity sodium gluconate suitable for food and pharmaceutical applications. The company’s adherence to stringent quality standards and regulatory compliance ensures its products meet the demands of sensitive industries. PMP’s focus on consistent product quality and customer satisfaction reinforces its position as a reliable supplier in the market.

Gulbrandsen Technologies Inc. demonstrated its commitment to sustainability and innovation in 2024. The company’s efforts in environmental compliance and responsible manufacturing practices underscore its dedication to producing high-quality chemical solutions. Gulbrandsen’s focus on customer-centric approaches and continuous improvement supports its role in the sodium gluconate market, particularly in applications requiring eco-friendly solutions.

Top Key Players in the Market

- BASF SE

- Fermentation Products, Inc.

- Food Ingredients Solutions

- Gulbrandsen Technologies Inc.

- Hefei TNJ Chemical Industry Co., Ltd.

- Hubei Chengxin Chemical Co., Ltd.

- Jungbunzlauer Suisse AG

- Karnataka Antibiotics & Pharmaceuticals Limited

- Shandong Kaison

- Shandong Qilu Pharmaceutical Co., Ltd.

- Weifang Honghai

- Zhucheng Dongxiao Biotechnology Co., Ltd

Recent Developments

- In May 2025, Qilu entered into an exclusive licensing and collaboration agreement with Minghui Pharmaceutical for the development, manufacturing, and commercialization of MHB088C, an antibody-drug conjugate (ADC), in Greater China.

- In April 2023, the European Commission conducted an expiry review of anti-dumping measures on sodium gluconate imports from China. Shandong Kaison Biochemical Co., Ltd. was subject to a reduced anti-dumping duty rate of 5.6%, significantly lower than the general rate of 53.2% for other Chinese exporters.

Report Scope

Report Features Description Market Value (2024) USD 629.3 Million Forecast Revenue (2034) USD 845.7 Million CAGR (2025-2034) 3.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Powder, Liquid), By End-use (Construction, Food and Beverage, Pharmaceuticals, Textiles, Water Treatment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Fermentation Products, Inc., Food Ingredients Solutions, Gulbrandsen Technologies Inc., Hefei TNJ Chemical Industry Co., Ltd., Hubei Chengxin Chemical Co., Ltd., Jungbunzlauer Suisse AG, Karnataka Antibiotics & Pharmaceuticals Limited, Shandong Kaison, Shandong Qilu Pharmaceutical Co., Ltd., Weifang Honghai, Zhucheng Dongxiao Biotechnology Co., Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Fermentation Products, Inc.

- Food Ingredients Solutions

- Gulbrandsen Technologies Inc.

- Hefei TNJ Chemical Industry Co., Ltd.

- Hubei Chengxin Chemical Co., Ltd.

- Jungbunzlauer Suisse AG

- Karnataka Antibiotics & Pharmaceuticals Limited

- Shandong Kaison

- Shandong Qilu Pharmaceutical Co., Ltd.

- Weifang Honghai

- Zhucheng Dongxiao Biotechnology Co., Ltd