Global Sodium Chlorite Market Size, Share Analysis Report By Type (Technical Grade, Food Grade, Pharmaceutical, Others), By Application (Disinfectant, Antimicrobial Agent, Bleaching Agent, Others), By End-use (Water Treatment, Paper, Textile, Medical, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 163574

- Number of Pages: 280

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

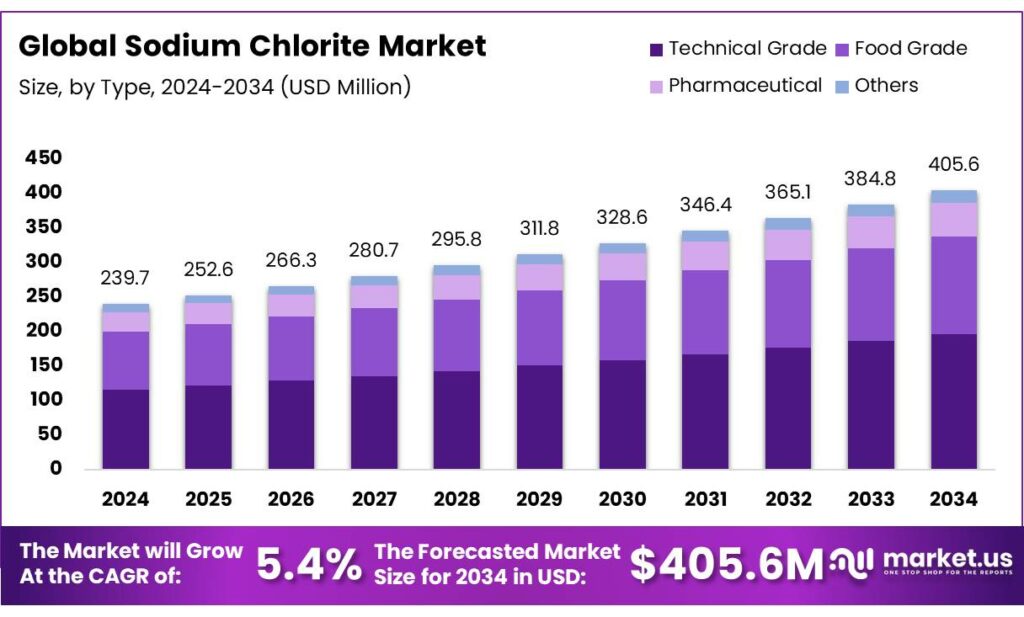

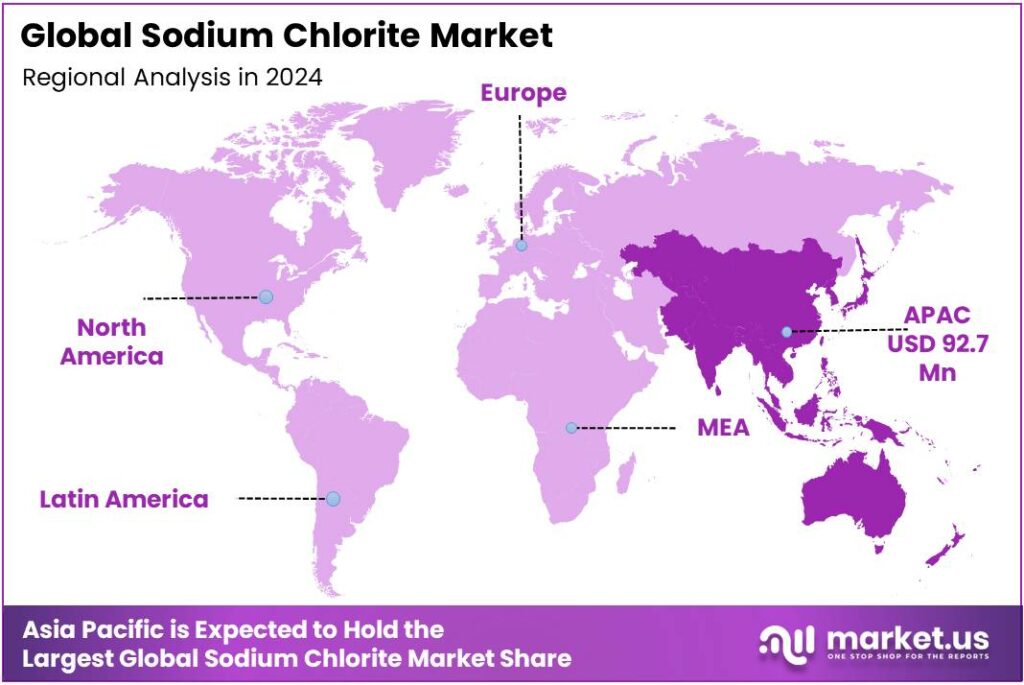

The Global Sodium Chlorite Market size is expected to be worth around USD 405.6 Million by 2034, from USD 239.7 Million in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific (APAC) held a dominant market position, capturing more than a 38.7% share, holding USD 92.7 Million in revenue.

Sodium chlorite is primarily used to generate chlorine dioxide for disinfection and bleaching, making it integral to municipal drinking-water treatment, pulp and paper bleaching, and certain textile processes. In regulated drinking water, the United States sets an enforceable maximum contaminant level for the chlorite by-product at 1.0 mg/L, with a maximum residual disinfectant level goal for chlorine dioxide of 0.8 mg/L, underscoring strict safety controls in public systems.

The industrial backdrop for sodium-chlorite–based chlorine dioxide is shaped by large end markets and widening water challenges. Globally, safely managed drinking-water coverage rose from 68% to 74% between 2015 and 2024, yet 2.1 billion people still lack safely managed services—sustaining demand for scalable disinfection solutions.

In parallel, the world’s 401 million-tonne paper output in 2023 continues to rely on chlorine-dioxide bleaching for many grades, keeping sodium chlorite relevant despite cyclical paper demand. The wastewater treatment gap remains large: an estimated 80% of the world’s wastewater is discharged without adequate treatment, creating public-health risks and motivating investments in oxidation-based treatment trains where chlorine dioxide can play a role.

Public health needs remain pressing: the JMP series underscores continued global investment in safely managed water and sanitation services, with 57% of people using safely managed sanitation in 2022, leaving a large capex pipeline where chlorine-dioxide technologies remain competitive.

Energy-water dynamics further reinforce sodium chlorite’s role. The International Energy Agency notes that energy demand for desalination has nearly doubled since 2010 and could double again by 2030, with about 21,000 desalination plants operating in ~150 countries and roughly half of installed capacity in MENA—regions where robust, non-chlorinating oxidants are often favored to manage biofouling and disinfection by-products.

Desalination is energy-intensive, and in 2023 the Middle East’s desalination energy use equaled almost half of the region’s residential electricity consumption—pressuring operators to optimize treatment chemistries that reduce downstream fouling and improve energy efficiency. Large government-led projects also anchor demand: Dubai’s Hassyan reverse-osmosis complex is slated to produce 818,000 m³/day with an energy intensity of 2.9 kWh/m³, demonstrating how mega-plants institutionalize advanced disinfection regimes that complement membrane processes.

Key Takeaways

- Sodium Chlorite Market size is expected to be worth around USD 405.6 Million by 2034, from USD 239.7 Million in 2024, growing at a CAGR of 5.4%.

- Technical Grade held a dominant market position, capturing more than a 48.3% share of the global sodium chlorite market.

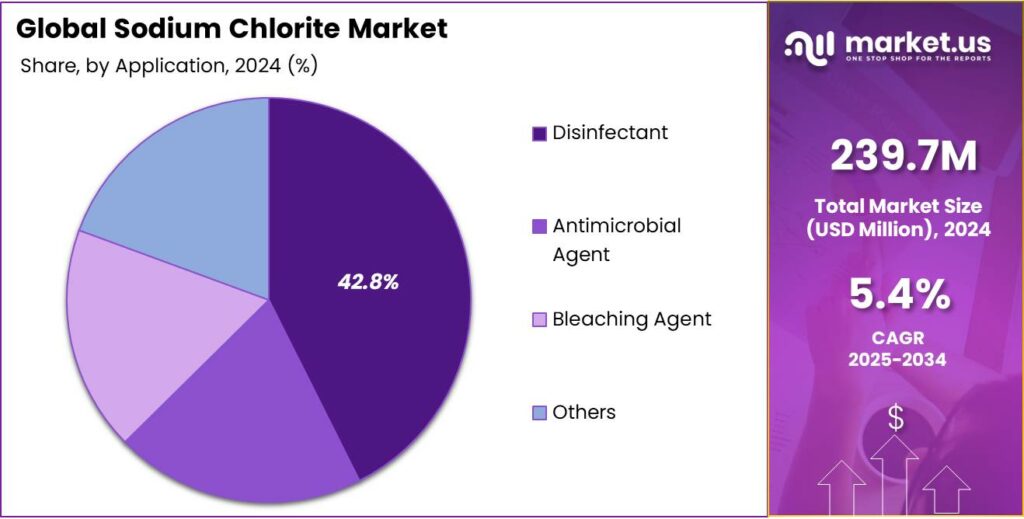

- Disinfectant held a dominant market position, capturing more than a 42.6% share of the global sodium chlorite market.

- Water Treatment held a dominant market position, capturing more than a 38.2% share of the global sodium chlorite market.

- Asia-Pacific (APAC) emerged as the dominant region in the global sodium chlorite market, accounting for 38.7% of total revenue, valued at approximately USD 92.7 million.

By Type Analysis

Technical Grade Leads the Market with 48.3% Share in 2024

In 2024, Technical Grade held a dominant market position, capturing more than a 48.3% share of the global sodium chlorite market. The strong demand for this grade was primarily driven by its extensive use in industrial and municipal water treatment facilities, where high-purity sodium chlorite is required for the safe and efficient generation of chlorine dioxide. The technical grade variant, typically containing around 80% active sodium chlorite, is preferred for large-scale disinfection, bleaching, and oxidation processes due to its consistent quality and stability during handling.

Saw a notable rise in consumption across sectors such as pulp and paper bleaching, textile processing, and wastewater treatment, reflecting increasing environmental regulations and the growing need for effective antimicrobial agents. Several water utilities across North America, Europe, and Asia-Pacific expanded their reliance on technical grade sodium chlorite to meet stricter drinking water standards, which contributed significantly to its market dominance.

By Application Analysis

Disinfectant Application Leads with 42.6% Share in 2024

In 2024, Disinfectant held a dominant market position, capturing more than a 42.6% share of the global sodium chlorite market. This strong presence was mainly supported by the growing use of sodium chlorite in generating chlorine dioxide for water disinfection and sanitation processes. Municipal water treatment plants, food processing units, and healthcare facilities increasingly relied on sodium chlorite-based disinfectants to ensure microbial control and maintain hygiene standards. The compound’s effectiveness against a broad spectrum of bacteria, viruses, and fungi made it an essential choice for public health protection.

Several regions, particularly in Asia-Pacific and North America, witnessed a significant increase in disinfectant consumption due to heightened concerns over waterborne diseases and stricter hygiene regulations. The year also marked wider adoption of sodium chlorite solutions in industrial cleaning and surface sanitation, driven by government initiatives promoting safe water treatment and workplace hygiene.

By End-use Analysis

Water Treatment Leads with 38.2% Market Share in 2024

In 2024, Water Treatment held a dominant market position, capturing more than a 38.2% share of the global sodium chlorite market. The strong demand from this segment was largely driven by the compound’s essential role in producing chlorine dioxide for purifying drinking water and treating industrial wastewater. Sodium chlorite’s efficiency in removing pathogens, organic contaminants, and odor-causing compounds made it a preferred choice for municipal and industrial water treatment facilities worldwide. Increasing urbanization and rising demand for clean water further reinforced the importance of sodium chlorite as a reliable and safe disinfection chemical.

Several countries expanded their investments in water infrastructure and sanitation programs, which contributed to higher consumption levels of sodium chlorite across municipal systems. The continued implementation of strict environmental and water quality standards also played a key role in promoting its use. In developing regions, particularly in Asia-Pacific and Latin America, rapid industrialization and limited access to clean water accelerated the adoption of sodium chlorite-based solutions to meet water safety regulations.

Key Market Segments

By Type

- Technical Grade

- Food Grade

- Pharmaceutical

- Others

By Application

- Disinfectant

- Antimicrobial Agent

- Bleaching Agent

- Others

By End-use

- Water Treatment

- Paper

- Textile

- Medical

- Others

Emerging Trends

Residue-smart chlorine-dioxide programs with tighter verification in food plants

Residue limits in the EU have accelerated this “measure twice, dose once” mindset. EFSA set a tolerable daily intake for chlorate of 3 µg/kg body weight/day, and the European Commission added commodity-specific MRLs for chlorate in 2020 on an ALARA basis, with a review clause. That has nudged processors to rigorously control chlorate/chlorite carryover from chlorine-dioxide programs generated from sodium chlorite—refreshing solutions more often, tightening contact times and temperatures, and proving compliance with more frequent lab checks.

The same verification culture is expanding where volumes are growing fastest. FAO reports global fisheries and aquaculture output reached a record 223.2 million tonnes in 2022, with aquaculture supplying 130.9 million tonnes—now the majority of aquatic animal production. More farmed fish and shellfish move through centralized chilling, glazing, and ice systems, where on-demand chlorine dioxide from sodium chlorite can be metered and monitored for both efficacy and residues.

In fresh produce, rising throughput in wash flumes and cut rooms is met with the same playbook: dose control, method-based verification, and documentation against regulatory benchmarks. Together, higher food volumes and residue-aware rules are pushing a practical, data-driven expansion of sodium-chlorite–based sanitizing—less about “more chemistry,” more about measured chemistry that stands up to audits.

Water standards also shape the operating envelope and reinforce careful dosing. WHO’s drinking-water fact sheet sets provisional guideline values of 0.7 mg/L for both chlorite and chlorate, explicitly noting that values should never compromise adequate disinfection—so plants are adopting fresher make-up solutions, shorter storage, and inline checks to stay compliant without losing antimicrobial performance.

The bottom line: the latest trend is not merely the use of sodium chlorite; it is the measured use—tight control of ppm and pH, documented verification, and alignment with residue and water guidelines—so that food safety goals and residue caps can be met at the same time.

Drivers

Tougher food-safety demands across produce and proteins

A single, powerful force is pushing sodium chlorite demand higher: the steady tightening of food-safety expectations from farm to factory. Unsafe food still makes 600 million people ill and causes 420,000 deaths each year worldwide, costing US$110 billion in productivity and medical expenses across low- and middle-income countries. Processors, retailers, and regulators respond to that burden with stricter hygiene steps—especially antimicrobial washes—where sodium chlorite generates chlorine dioxide at the point of use.

Scale magnifies the need. Global fruit and vegetable output reached 2.1 billion tonnes in 2023, up 1% year-on-year, meaning more wash water, more sanitation cycles, and more validated chemistries are required to keep contamination low without damaging quality. In the United States alone, the public-health imperative is visible: the CDC estimates 48 million foodborne illnesses, 128,000 hospitalizations, and 3,000 deaths each year, keeping preventive controls front and center for fresh-cut produce, poultry, seafood, and ready-to-eat lines.

Clear regulatory guardrails further catalyze adoption. The U.S. Food and Drug Administration permits chlorine dioxide—typically made on-site from sodium chlorite—as an antimicrobial in produce wash water at ≤ 3 ppm residual ClO₂, with a potable rinse, under 21 CFR 173.300/173.315. FDA also recognizes ASC under 21 CFR 173.325 for poultry, red meat, seafood, and certain raw agricultural commodities, with defined operating ranges: 500–1,200 ppm sodium chlorite for sprays/dips and 50–150 ppm in poultry chillers. Such specificity gives plants the confidence to standardize programs, train staff, and document compliance.

Restraints

Chlorate/chlorite residue limits that are hard to meet consistently

The biggest brake on sodium chlorite use is residue compliance—keeping chlorate and chlorite below strict food and water limits across real-world plants. Europe’s food regulator set a tolerable daily intake (TDI) for chlorate at 3 µg/kg body weight/day, with an acute reference dose of 36 µg/kg bw. EFSA also warned that average dietary exposures in certain groups exceeded the TDI in available monitoring data—so authorities pushed industry to drive residues down. These numbers make processors cautious about scaling chlorine-dioxide programs generated from sodium chlorite without robust monitoring.

To operationalize that caution, the EU introduced commodity-specific maximum residue levels (MRLs) for chlorate in 2020. Examples include 0.05 mg/kg for citrus fruits, 0.05 mg/kg for pome fruits, 0.05 mg/kg for potatoes, 0.3 mg/kg for many “inedible-peel” fruits, and a high-risk case of 0.7 mg/kg for table olives—values set under an ALARA principle using extensive occurrence data. Plants that rely on sodium-chlorite-based sanitizing must now prove they can meet these MRLs while upholding microbial safety, which increases testing frequency, documentation, and costs.

Water limits add another layer. The World Health Organization’s chemical fact sheet assigns provisional guideline values of 0.7 mg/L for chlorite and 0.7 mg/L for chlorate in drinking water. WHO also notes these values are often stressed by real operations—aged hypochlorite or chlorine-dioxide use can push residues upward—so meeting the numbers demands fresh chemicals, careful pH control, short storage times, and periodic verification. For food plants that recirculate wash water or blend potable water into brines and ice, staying within 0.7 mg/L while achieving target log reductions is a persistent balancing act that can cap sodium-chlorite adoption.

Regulators in the United States permit acidified sodium chlorite (ASC) and chlorine dioxide for specific uses, but they do so with tight numeric guardrails that complicate line design and auditing. For example, FDA rules allow chlorine dioxide in produce wash water at ≤ 3 ppm residual ClO₂ with a potable rinse; ASC provisions specify typical 500–1,200 ppm sodium chlorite ranges for sprays/dips at pH ~2.3–2.9, and 50–150 ppm sodium chlorite in poultry chillers at pH ~2.8–3.2. These windows are workable, yet they force plants to invest in metering, pH control, and validated test methods—costs that can steer small or decentralized processors toward non-chlorite options.

Opportunity

validated antimicrobial washes for booming fresh produce And seafood lines

Aquaculture is expanding too. FAO’s latest review shows total fisheries and aquaculture production hit a record 223.2 million tonnes in 2022, with aquaculture contributing 130.9 million tonnes—now the majority of aquatic animal supply—pulling more fish and shellfish through hygienic water and ice systems where on-site chlorine dioxide generation from sodium chlorite can fit well.

In the United States, the CDC still cites tens of millions of illnesses each year, reminding processors that validated antimicrobial steps are a necessity, not a luxury. These numbers translate into purchase orders for interventions that deliver consistent log reductions, work in high-organic-load waters, and can be audited without guesswork—precisely the niche for sodium-chlorite-based systems that generate chlorine dioxide or acidified sodium chlorite (ASC) at the point of use.

FDA also authorizes acidified sodium chlorite for meat, poultry, and seafood under 21 CFR 173.325, with defined sodium-chlorite concentrations and pH windows—parameters plants can train against and monitor. USDA-FSIS operationalizes these allowances through its “Safe and Suitable Ingredients” directive, which processors use when writing HACCP and SSOPs, creating a clear paper trail for compliance and audits.

This environment rewards solutions that combine efficacy with tight residue management. Modern sodium-chlorite programs can be engineered to meet numeric caps and verification practices while supporting product quality. They can be metered into produce flumes and seafood glaze/ice systems, with inline checks for residuals and pH.

In produce, the demand is boosted by the steady rise in minimally processed and ready-to-eat items; in seafood, aquaculture’s growth shifts more volume into centralized plants where standardized sanitation beats ad-hoc methods. FAO’s production gains—2.1 billion tonnes of fruits and vegetables and aquaculture’s 51% share of aquatic animal output—are not abstract statistics; they describe lines that must wash, chill, and pack more kilos every hour, under sharper scrutiny.

Regional Insights

Asia-Pacific Leads the Sodium Chlorite Market with 38.7% Share Valued at USD 92.7 Million in 2024

In 2024, Asia-Pacific (APAC) emerged as the dominant region in the global sodium chlorite market, accounting for 38.7% of total revenue, valued at approximately USD 92.7 million. The region’s leadership is primarily attributed to its expanding industrial base, growing water treatment infrastructure, and increasing demand for effective disinfection chemicals. Rapid urbanization and industrial growth across China, India, Japan, and South Korea have significantly increased the need for sodium chlorite, particularly in municipal water purification, textile bleaching, and pulp & paper processing applications.

China remains the largest consumer within the region, driven by large-scale water treatment projects and stringent environmental regulations aimed at reducing chemical pollutants in industrial discharge. According to regional government data, China treated over 90% of urban wastewater in 2024, demonstrating the growing dependence on chlorine dioxide-based technologies. Similarly, India’s “Jal Jeevan Mission,” targeting safe drinking water for all rural households, has boosted local demand for sodium chlorite in water disinfection processes. Japan and South Korea have also contributed significantly due to their focus on high-purity applications in electronics and healthcare industries.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Alfa Aesar serves laboratory and pilot-scale customers with consistent sodium chlorite quality, commonly used to generate chlorine dioxide for research, textile, and pulp applications. Its technical-grade ~80% sodium chlorite and multiple pack sizes help bridge R&D and small production needs, supported by lot-level CoAs and global distribution through Thermo Fisher. This breadth, plus documentation and hazardous-materials logistics experience, makes Alfa Aesar a reliable specialty route into regulated end-markets that demand purity traceability and safety data.

Shree Chlorates is an India-based manufacturer offering sodium chlorite in multiple forms—solutions (e.g., 7.5%, 25%, 31%) and powders (50%, 80%). This range supports chlorine-dioxide generation for water treatment, pulp & paper, and textiles, with domestic “Make in India” positioning and long operating history (since 1987). The company’s product menu and local footprint suit public-utility tenders and industrial users seeking shorter lead times, localized service, and compliance documentation under Indian standards.

Airedale Chemical (UK) supplies BPR-compliant sodium chlorite solutions in standardized strengths (e.g., 2%–25%), targeting water treatment, food processing hygiene, and bleaching. The company combines toll manufacturing, small-pack filling, and distribution to serve utilities and processors that prefer ready-to-dose liquids with documentation aligned to EU/UK biocidal regulations. Its service model—packaging options from 25 L to bulk IBCs—positions Airedale as a dependable supplier for European customers seeking flexible volumes, regulatory support, and quick deliveries.

Top Key Players Outlook

- Alfa Aesar

- Nanjing Kaimubo Pharmatech Company Limited

- Shree Chlorates

- Dongying Shengya Chemical Co., Ltd.

- Airedale Chemical Company Limited

- Shandong Gaomi Gaoyuan Chemical Industry Co., Ltd.

- DuPont

- ERCO Worldwide

- Occidental Petroleum Corporation

- Others

Recent Industry Developments

In 2024, Alfa Aesar continued supplying its technical-grade sodium chlorite product for industrial use, including water treatment, textile bleaching and chemical synthesis. The product specification indicates an assay of 80 % active sodium chlorite with typical pack sizes of 500 g, 2 kg and 10 kg.

In 2024, Nanjing Kaimubo Pharmatech Co, reinforced its position as a notable supplier in the sodium chlorite sector by offering its “KM-Sodium Chlorite 80%” solid grade and “KM-Chlorite Liquid 31%” solution, for industrial uses such as water treatment and sanitation.

Report Scope

Report Features Description Market Value (2024) USD 239.7 Mn Forecast Revenue (2034) USD 405.6 Mn CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Technical Grade, Food Grade, Pharmaceutical, Others), By Application (Disinfectant, Antimicrobial Agent, Bleaching Agent, Others), By End-use (Water Treatment, Paper, Textile, Medical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Alfa Aesar, Nanjing Kaimubo Pharmatech Company Limited, Shree Chlorates, Dongying Shengya Chemical Co., Ltd., Airedale Chemical Company Limited, Shandong Gaomi Gaoyuan Chemical Industry Co., Ltd., DuPont, ERCO Worldwide, Occidental Petroleum Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alfa Aesar

- Nanjing Kaimubo Pharmatech Company Limited

- Shree Chlorates

- Dongying Shengya Chemical Co., Ltd.

- Airedale Chemical Company Limited

- Shandong Gaomi Gaoyuan Chemical Industry Co., Ltd.

- DuPont

- ERCO Worldwide

- Occidental Petroleum Corporation

- Others