Global Smart Water Meter Market Size, Share, And Enhanced Productivity By Meter Type (Ultrasonic, Electromagnetic, Smart Mechanical), By Application (Water Utilities, Industries), By Technology (AMI, AMR), By Communication Technology (Radio-frequency (Proprietary RF), LoRaWAN / Other LPWAN, Cellular (NB-IoT/LTE-M), Wired (M-Bus/Ethernet)), By Deployment (New Installations, Retrofit/Replacement), By Application (Residential, Commercial, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174449

- Number of Pages: 239

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Meter Type Analysis

- By Application Analysis

- By Technology Analysis

- By Communication Technology Analysis

- By Deployment Analysis

- By Application Analysis

- Key Market Segments

- By Application

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

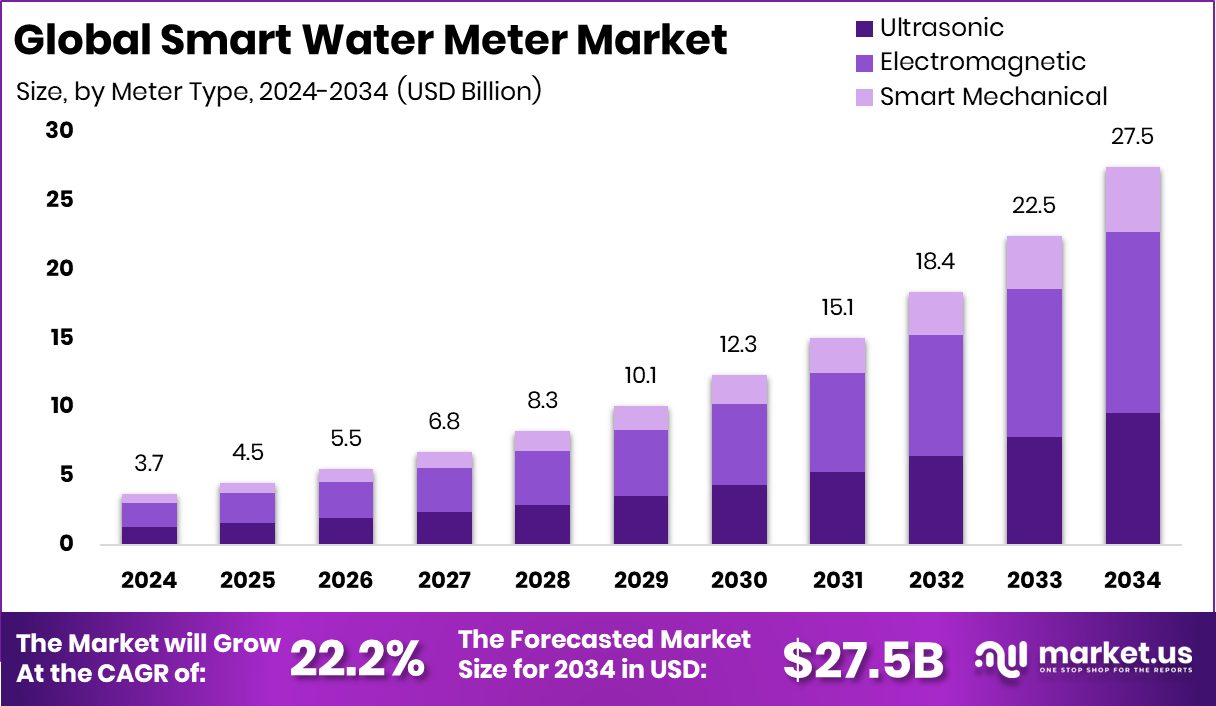

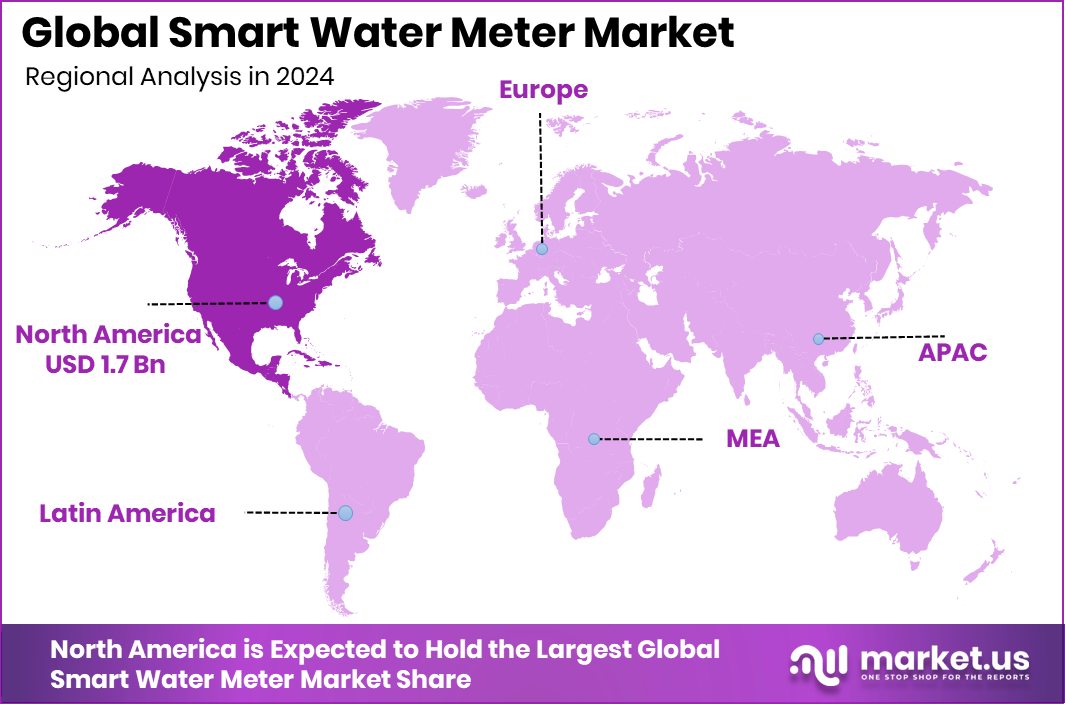

The Global Smart Water Meter Market is expected to be worth around USD 27.5 billion by 2034, up from USD 3.7 billion in 2024, and is projected to grow at a CAGR of 22.2% from 2025 to 2034. North America market strength remains high at 46.3%, generating USD 1.7 Bn revenues.

A smart water meter is a digital device that automatically measures water consumption and sends usage data to utilities in real time. Unlike traditional meters, it removes the need for manual readings and helps identify leaks, abnormal usage, and system inefficiencies early. Governments are actively supporting adoption, such as Japan approving a $3.5 million grant for smart water meters and rolling out 8,400 smart water meters in Faisalabad under a Japan-funded project, showing global confidence in this technology.

The Smart Water Meter Market refers to the ecosystem of digital meters, communication systems, and software used to monitor water consumption across residential, commercial, and utility networks. Large-scale deployments highlight market expansion, including 1.4 million smart water meters rolled out across Puerto Rico and a new water-monitoring program expected to save 1.5 billion litres of water annually, reinforcing the market’s role in conservation and efficiency.

Growth factors are strongly linked to public investment and infrastructure upgrades. Governments are allocating major budgets, such as $153 million announced for Arkansas water projects and $80 million approved in Bahrain for Al Dur Project expansion, to modernize water systems. These initiatives drive demand for accurate monitoring and data-driven water management.

Demand is rising as regions face water scarcity, losses, and accountability challenges. At the same time, Greece’s investigation into alleged €500 million overspending on smart meter projects highlights the need for transparent, efficient deployment, pushing authorities to adopt smarter, performance-focused solutions.

Opportunities are expanding through innovation and funding support. Startups and technology developers are attracting capital, including $35 million raised by an Israeli leak-detection startup, $6 million Series A funding to scale IoT water technology, $2 million raised by Comminent to scale smart metering in India, and over Rs 3 crore in government funding for an IIT Kanpur-incubated startup, signaling long-term market potential.

Key Takeaways

- The Global Smart Water Meter Market is expected to be worth around USD 27.5 billion by 2034, up from USD 3.7 billion in 2024, and is projected to grow at a CAGR of 22.2% from 2025 to 2034.

- In the Smart Water Meter Market, electromagnetic meters dominate with 47.8% share.

- Within Smart Water Meter Market applications, water utilities lead adoption at 67.2%.

- AMI technology drives Smart Water Meter Market growth, accounting for 58.9% deployments.

- Radio-frequency proprietary RF dominates Smart Water Meter Market communication technologies at 49.3%.

- Retrofit and replacement deployments lead Smart Water Meter Market implementation with 67.9%.

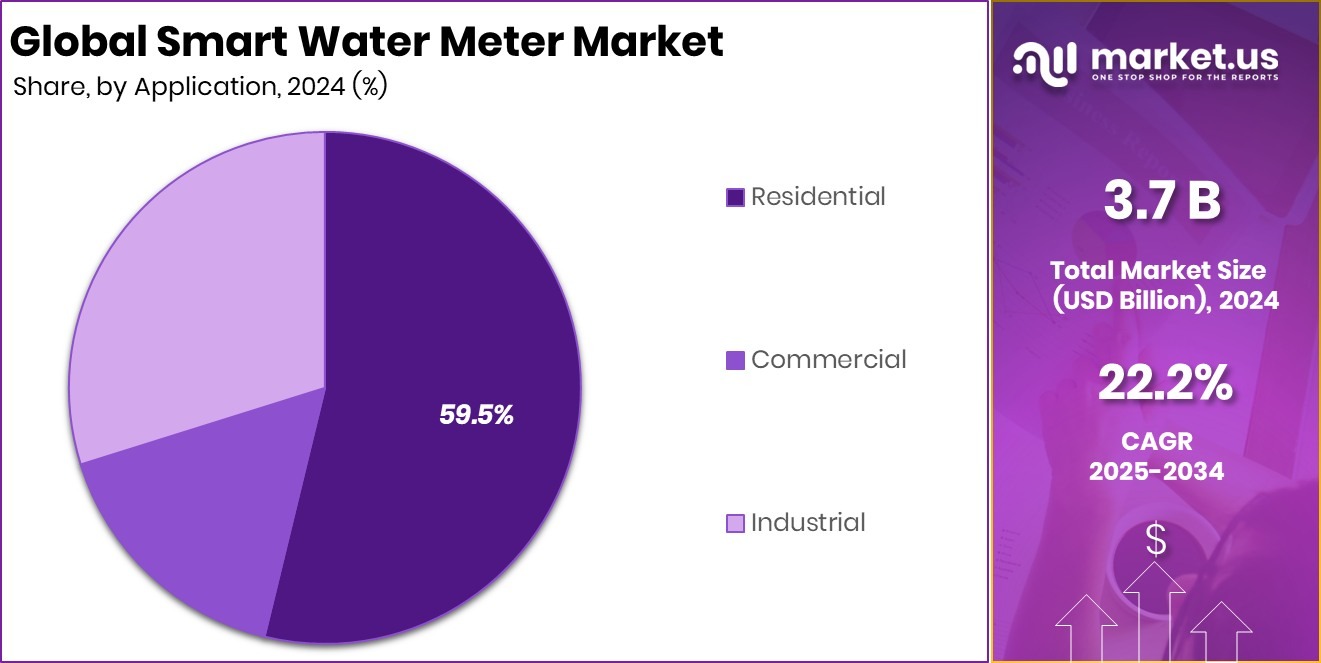

- Residential usage represents the major Smart Water Meter Market application segment, holding 59.5%.

- North America’s dominance reflects strong adoption, holding 46.3% share and USD 1.7 Bn.

By Meter Type Analysis

In the Smart Water Meter Market, electromagnetic meters dominate with 47.8% share due to their accuracy globally.

In 2024, the Smart Water Meter Market saw strong dominance from electromagnetic meters, which accounted for 47.8% of total deployments. This leadership is driven by their high accuracy, long operational life, and ability to measure low and high flow rates reliably. Electromagnetic meters are widely preferred by utilities because they have no moving parts, reducing maintenance costs and performance losses over time. Their suitability for large-diameter pipelines and compatibility with digital monitoring systems further support adoption.

As utilities focus on reducing non-revenue water and improving billing accuracy, electromagnetic technology continues to gain preference in both developed and emerging regions. The segment also benefits from rising investments in modern water infrastructure and stricter regulatory requirements for precise water measurement.

By Application Analysis

Water utilities lead Smart Water Meter Market applications with 67.2% adoption driven by infrastructure upgrades worldwide.

In 2024, water utilities emerged as the largest application segment in the Smart Water Meter Market, holding a substantial 67.2% share. Utilities are rapidly adopting smart meters to improve operational efficiency, detect leaks early, and enhance demand forecasting. The shift toward data-driven water management has made smart metering essential for utility providers facing water scarcity and aging infrastructure.

Governments and municipal authorities are supporting this transition through funding programs and digital water initiatives. Smart water meters enable real-time monitoring and remote reading, reducing manual labor and billing errors. As utilities aim to meet sustainability targets and improve customer service, this segment continues to dominate overall market demand.

By Technology Analysis

AMI technology leads the Smart Water Meter Market with 58.9% share, enabling real-time monitoring and analytics.

In 2024, Advanced Metering Infrastructure (AMI) technology led the Smart Water Meter Market with a commanding 58.9% share. AMI systems enable two-way communication between utilities and meters, allowing real-time data collection, remote meter reading, and faster issue resolution. This technology supports advanced analytics, helping utilities optimize water distribution and reduce losses.

AMI adoption is accelerating as utilities move away from traditional Automated Meter Reading (AMR) systems toward more intelligent and connected networks. The ability to integrate AMI with smart city platforms and utility management software further strengthens its market position. Long-term cost savings and improved transparency continue to drive widespread AMI implementation.

By Communication Technology Analysis

Proprietary RF communication dominates Smart Water Meter Market deployments holding 49.3% share for reliability and scalability.

In 2024, radio-frequency (proprietary RF) systems dominated the Smart Water Meter Market by communication technology, capturing 49.3% of the market. Proprietary RF networks are favored for their reliability, secure data transmission, and strong performance in dense urban and underground environments.

Utilities prefer RF solutions due to lower operational costs compared to cellular networks and reduced dependence on third-party telecom providers. These systems also support scalable network expansion and consistent data delivery, which is critical for large utility deployments. As utilities prioritize secure and uninterrupted communication, proprietary RF technology remains a key choice for smart water metering projects globally.

By Deployment Analysis

Retrofit and replacement deployments lead the Smart Water Meter Market with 67.9% share across aging networks globally.

In 2024, retrofit and replacement deployments accounted for 67.9% of the Smart Water Meter Market, reflecting utilities’ focus on upgrading existing infrastructure rather than installing entirely new systems. Aging mechanical meters are being replaced with smart alternatives to improve accuracy and reduce water losses.

Retrofit projects are cost-effective and allow utilities to modernize networks with minimal disruption. Many municipalities are prioritizing replacement programs to comply with efficiency regulations and sustainability goals. The ability to integrate smart meters into existing pipelines and billing systems accelerates adoption. This deployment approach remains dominant as utilities balance modernization needs with budget constraints.

By Application Analysis

Residential applications dominate the Smart Water Meter Market, capturing 59.5% share, driven by conservation initiatives worldwide.

In 2024, the residential segment led the Smart Water Meter Market by application, holding 59.5% of total demand. Residential adoption is driven by rising urban populations, smart city initiatives, and growing consumer awareness of water conservation. Smart meters empower households with real-time usage data, helping reduce wastage and manage utility costs. Utilities benefit from improved billing accuracy and reduced customer disputes.

Government-led programs promoting digital utilities and resource efficiency further support residential deployments. As water scarcity concerns grow and smart home technologies expand, residential smart water metering continues to be the largest and most stable application segment.

Key Market Segments

By Meter Type

- Ultrasonic

- Electromagnetic

- Smart Mechanical

By Application

- Water Utilities

- Industries

By Technology

- AMI

- AMR

By Communication Technology

- Radio-frequency (Proprietary RF)

- LoRaWAN / Other LPWAN

- Cellular (NB-IoT/LTE-M)

- Wired (M-Bus/Ethernet)

By Deployment

- New Installations

- Retrofit/Replacement

By Application

- Residential

- Commercial

- Industrial

Driving Factors

Advanced Ultrasonic Innovation Driving Smart Meter Adoption

The Smart Water Meter Market is strongly driven by advances in ultrasonic sensing and data accuracy. Modern smart meters increasingly use ultrasonic technology to detect flow, leaks, and pressure changes with high precision and no moving parts. This innovation is gaining wider attention as major investments accelerate technology maturity. For example, Samsung invested in ultrasound imaging startup Exo, which has now raised $320M, showing strong confidence in ultrasonic-based systems.

Additionally, $8.9m funding to support ultrasound-based tumour clinical trials in Singapore highlights how ultrasonic technology is being validated across critical applications. In the water sector, Megaliter Varunaa securing INR 15 Cr funding to boost urban water circularity reflects growing interest in precise water measurement to reduce losses. Together, these developments encourage utilities to adopt smart meters for reliable, long-term monitoring.

Restraining Factors

High Technology Costs Limiting Faster Market Expansion

Despite strong potential, the Smart Water Meter Market faces restraints linked to high technology and development costs. Advanced ultrasonic components, sensors, and analytics platforms require heavy upfront investment, slowing adoption for smaller utilities. Innovation funding also raises expectations and costs. For instance, Distran raising CHF 10.8 million to accelerate growth in ultrasonic camera technology highlights the capital-intensive nature of advanced ultrasonic systems.

Similarly, a UVA assistant professor earning a $5.5M grant for focused ultrasound research shows how complex and expensive this technology can be. At the infrastructure level, Austin Water is securing $55 million in low-interest funding to strengthen water and wastewater infrastructure, which reflects that utilities often prioritize basic upgrades before full smart metering rollouts. These financial pressures can delay smart meter deployment, especially in budget-constrained regions.

Growth Opportunity

Ultrasonic Intelligence Creating New Smart Meter Opportunities

Growth opportunities in the Smart Water Meter Market are expanding as ultrasonic intelligence becomes more versatile and cost-effective. Emerging technologies are improving how systems detect flow, leaks, and anomalies in real time. Innovations such as new 3D ultrasonic technology changing how robots see demonstrate how ultrasonic sensing is evolving toward advanced spatial awareness, which can also benefit smart metering.

Healthcare-focused innovation, including Nami Surgical raising £3.2m to pioneer ultrasonic technology, further accelerates component development and miniaturization. At the same time, Thames Water’s plunge to a £1.6 billion loss highlights financial strain on utilities, increasing the need for smart meters to reduce water loss and improve efficiency. This environment creates strong opportunities for scalable, data-driven water monitoring solutions.

Latest Trends

Ultrasonic-Enabled Smart Infrastructure Becomes Market Trend

A key trend shaping the Smart Water Meter Market is the integration of ultrasonic systems into broader smart infrastructure networks. Compact, mobile, and intelligent ultrasonic solutions are gaining traction due to their flexibility and accuracy. This trend is supported by innovation funding, such as a proprietary mobile ultrasound system receiving $2.1M in early funding, signaling rising interest in portable and adaptable ultrasonic platforms.

On the infrastructure side, the EPA is granting North Carolina over $400 million for drinking water infrastructure, which shows growing public investment in modernizing water systems. As utilities upgrade networks, smart water meters are increasingly viewed as essential digital assets rather than standalone devices. This trend supports long-term adoption, driven by efficiency, sustainability, and real-time water management needs.

Regional Analysis

North America leads the Smart Water Meter Market with 46.3% share, USD 1.7 Bn.

In the Smart Water Meter Market, North America dominates regional performance, accounting for 46.3% of the global market and reaching a value of USD 1.7 Bn. This leadership is supported by early adoption of digital metering, mature utility infrastructure, and strong regulatory emphasis on water efficiency and leakage reduction. Utilities across the region increasingly rely on smart meters to improve billing accuracy, system transparency, and operational control.

Europe follows as a technologically advanced market, driven by sustainability mandates, water conservation targets, and widespread modernization of municipal water networks, particularly in urban areas.

Asia Pacific represents a high-growth landscape, supported by rapid urbanization, expanding residential developments, and rising awareness of non-revenue water management across emerging economies.

In the Middle East & Africa, smart water meters are gaining relevance due to chronic water scarcity and increasing focus on monitoring consumption efficiency in arid regions. Meanwhile, Latin America shows steady adoption, supported by gradual upgrades of aging water infrastructure and growing interest in digital utility solutions to improve service reliability and reduce distribution losses.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Hubbell plays a strategic role in the global Smart Water Meter Market by leveraging its strong presence in utility infrastructure and grid-connected solutions. The company’s focus on reliability, ruggedized components, and system-level integration aligns well with utility requirements for long-life smart metering deployments. Hubbell’s experience in supporting utility networks positions it as a value-driven partner for water utilities seeking scalable and resilient smart metering ecosystems in 2024.

BMETERS Srl brings strong technical depth to the smart water metering landscape through precision engineering and a broad portfolio of mechanical and smart meters. The company emphasizes accuracy, durability, and digital-readiness, making its solutions suitable for both residential and utility-scale applications. In 2024, BMETERS Srl continues to strengthen its relevance by aligning smart metering designs with evolving utility expectations for remote reading, data consistency, and long-term measurement stability.

Diehl Stiftung & Co. KG stands out as a technology-focused contributor to the Smart Water Meter Market, supported by its strong engineering heritage and emphasis on intelligent metering systems. The company’s approach centers on advanced data capture, system interoperability, and metering accuracy, which are critical for utilities managing water efficiency and transparency. In 2024, Diehl’s structured focus on digital water measurement reinforces its position as a trusted supplier for modern utility-driven smart water networks.

Top Key Players in the Market

- Hubbell

- BMETERS Srl

- Diehl Stiftung & Co. KG

- Datamatics Global Services Limited

- Honeywell International Inc.

- Badger Meter, Inc.

- Itron Inc.

- Kamstrup A/S

- Landis+Gyr.

- Xylem

- Neptune Technology Group Inc.

- ZENNER International GmbH & Co. KG

Recent Developments

- In March 2025, Honeywell announced that its smart meters will include Verizon 5G connectivity, enabling utilities and customers to access data remotely and improve monitoring and response times.

- In January 2024, Badger Meter acquired select remote water monitoring hardware and software from Trimble, including the Telog brand of remote telemetry units and monitoring software. This move expanded Badger Meter’s smart water offerings and strengthened its network monitoring capabilities for water, wastewater, and stormwater applications.

Report Scope

Report Features Description Market Value (2024) USD 3.7 Billion Forecast Revenue (2034) USD 27.5 Billion CAGR (2025-2034) 22.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Meter Type (Ultrasonic, Electromagnetic, Smart Mechanical), By Application (Water Utilities, Industries), By Technology (AMI, AMR), By Communication Technology (Radio-frequency (Proprietary RF), LoRaWAN / Other LPWAN, Cellular (NB-IoT/LTE-M), Wired (M-Bus/Ethernet)), By Deployment (New Installations, Retrofit/Replacement), By Application (Residential, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Hubbell, BMETERS Srl, Diehl Stiftung & Co. KG, Datamatics Global Services Limited, Honeywell International Inc., Badger Meter, Inc., Itron Inc., Kamstrup A/S, Landis+Gyr., Xylem , Neptune Technology Group Inc., ZENNER International GmbH & Co. KG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smart Water Meter MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Smart Water Meter MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Hubbell

- BMETERS Srl

- Diehl Stiftung & Co. KG

- Datamatics Global Services Limited

- Honeywell International Inc.

- Badger Meter, Inc.

- Itron Inc.

- Kamstrup A/S

- Landis+Gyr.

- Xylem

- Neptune Technology Group Inc.

- ZENNER International GmbH & Co. KG