Global Smart Gas Meter Market Size, Share Analysis Report By Component (Hardware, Software, Services), By Type (Smart Ultrasonic Gas Meter, Smart Diaphragm Gas Meter, Others), By Technology (Advanced Metering Infrastructure (AMI), Auto Meter Reading (AMR)), By End Use (Residential, Commercial, Industrial) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164821

- Number of Pages: 301

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

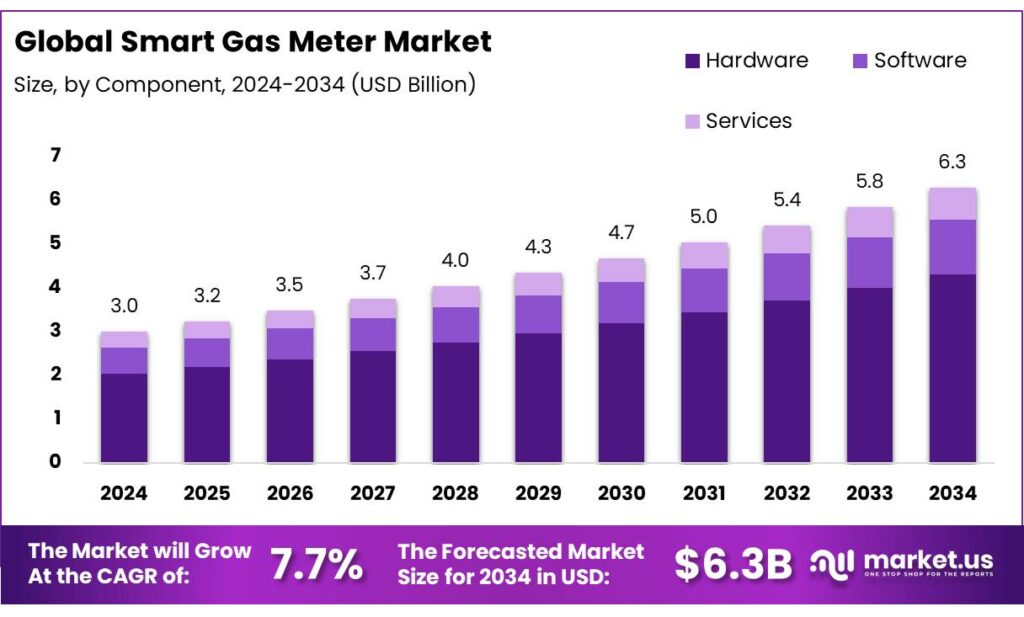

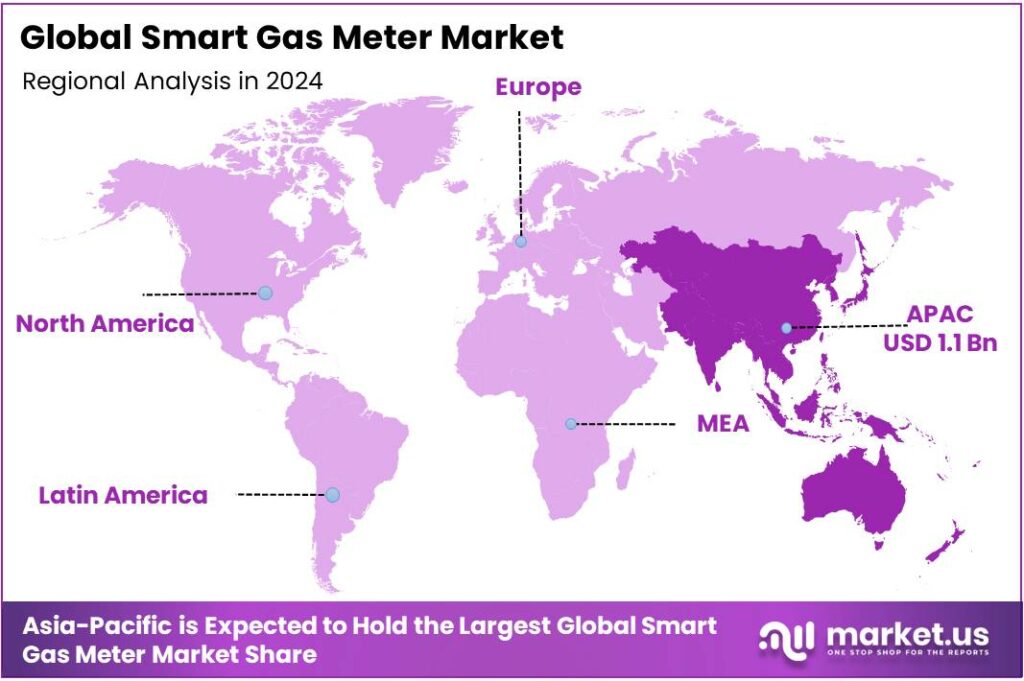

The Global Smart Gas Meter Market size is expected to be worth around USD 6.3 Billion by 2034, from USD 3.0 Billion in 2024, growing at a CAGR of 7.7% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific (APAC) held a dominant market position, capturing more than a 38.90% share, holding USD 1.1 Billion in revenue.

Smart gas meters—advanced metering devices using AMI/AMR communication—are moving from pilots to mainstream as utilities seek safety, accuracy, and real-time data for balancing gas networks. Global gas demand has remained resilient: the IEA estimates natural gas demand rose ~3% in 1H-2024, with emerging Asia responsible for much of the growth; EMDEs in Asia expanded gas demand ~6% in 2024 alone, led by China and India. These demand-side dynamics keep pressure on distribution networks to digitize last-mile measurement and billing, strengthening the business case for smart gas metering.

The European Commission cites ACER data showing 54% of EU households already had smart ELECTRICITY meters by end-2021 and 13 member states topped 80% penetration by end-2022—creating a mature ecosystem of data platforms, standards, and installers that gas networks can leverage.

Cost–benefit work referenced by the Commission projects up to €47 billion in smart-meter investments by 2030 and quantifies average lifecycle savings per metering point of €230 for gas , alongside 2–10% energy savings from better feedback and billing accuracy. These figures, combined with June 2023 interoperability rules, underpin large-scale metering rollouts and data-sharing frameworks.

The United Kingdom illustrates how gas-specific penetration is now material. Official DESNZ statistics show that by end-March 2025, 61% of all domestic meters run in smart mode; for gas specifically the figure is 56% in smart mode and 65% when including meters temporarily operating in traditional mode.

Across homes and small businesses there were about 39 million smart/advanced meters in operation, with 35 million in smart mode, and 67% of all meters were smart/advanced. This scale demonstrates proven installation capacity and consumer acceptance, despite quarter-to-quarter cadence changes.

Key Takeaways

- Smart Gas Meter Market size is expected to be worth around USD 6.3 Billion by 2034, from USD 3.0 Billion in 2024, growing at a CAGR of 7.7%.

- Hardware held a dominant market position, capturing more than a 68.3% share of the overall smart gas meter market.

- Smart Diaphragm Gas Meter held a dominant market position, capturing more than a 59.2% share of the overall smart gas meter market.

- Advanced Metering Infrastructure (AMI) held a dominant market position, capturing more than a 67.9% share of the smart gas meter market.

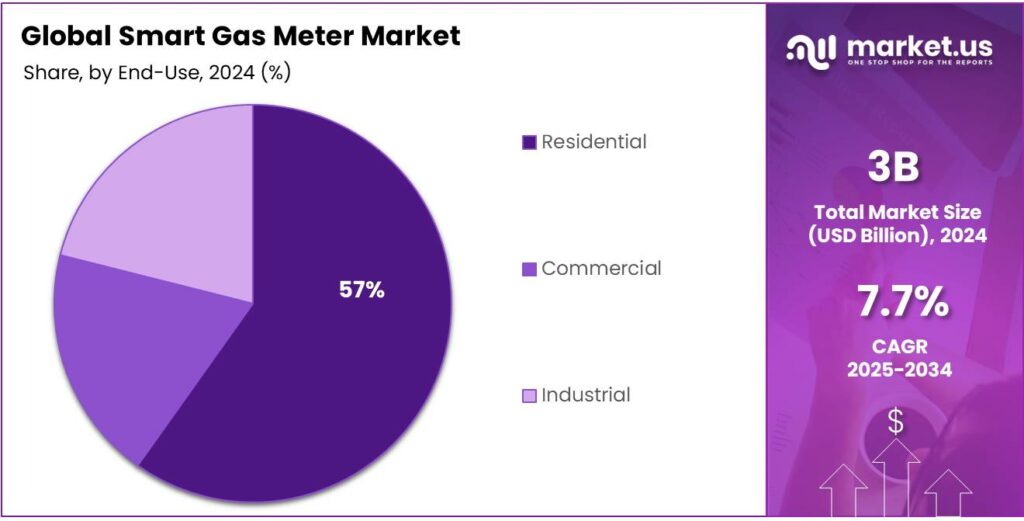

- Residential held a dominant market position, capturing more than a 56.8% share of the overall smart gas meter market.

- Asia Pacific region held a dominant position in the global smart gas meter market, capturing approximately 38.90% share, valued at USD 1.1 billion.

By Component Analysis

Hardware dominates with 68.3% share driven by large-scale meter installations and infrastructure upgrades

In 2024, Hardware held a dominant market position, capturing more than a 68.3% share of the overall smart gas meter market. This dominance can be attributed to the extensive deployment of physical metering devices, sensors, communication modules, and data collection units that form the backbone of advanced metering infrastructure. Utilities and gas distribution companies have continued to invest heavily in robust and tamper-proof hardware systems to ensure accurate consumption measurement, enhanced safety, and seamless integration with existing gas supply networks.

The hardware segment is expected to maintain its commanding position, supported by ongoing modernization projects and government-led smart utility programs across North America, Europe, and Asia-Pacific. The shift toward Internet of Things (IoT)-enabled gas metering systems and the demand for real-time monitoring solutions are increasing the adoption of smart modules, pressure sensors, and microcontrollers integrated within meter hardware.

By Type Analysis

Smart Diaphragm Gas Meter leads with 59.2% share owing to its high accuracy and reliability in residential use

In 2024, Smart Diaphragm Gas Meter held a dominant market position, capturing more than a 59.2% share of the overall smart gas meter market. This strong position is largely due to its proven accuracy, cost efficiency, and suitability for residential and small commercial applications where consistent gas flow measurement is critical. The segment’s growth has been supported by increasing replacement of conventional diaphragm meters with smart-enabled versions capable of remote monitoring, leak detection, and real-time data communication.

By 2025, the demand for smart diaphragm gas meters is projected to continue rising as government-backed smart metering programs and gas infrastructure modernization accelerate. Their easy installation, long operational life, and compatibility with wireless communication networks such as NB-IoT and RF mesh are further boosting adoption. Moreover, ongoing efforts to improve consumer energy awareness and safety standards are reinforcing their deployment across urban and suburban regions.

By Technology Analysis

Advanced Metering Infrastructure (AMI) leads with 67.9% share owing to its integration with digital utility networks and real-time data capabilities

In 2024, Advanced Metering Infrastructure (AMI) held a dominant market position, capturing more than a 67.9% share of the smart gas meter market. The segment’s strength is driven by growing demand for two-way communication systems that enable utilities to remotely monitor gas consumption, detect leaks, and manage billing more efficiently. AMI systems have become the backbone of modern gas distribution networks, allowing real-time data exchange between meters and control centers, which enhances both safety and operational transparency.

The shift toward IoT-enabled devices and cloud-based analytics platforms is improving data accuracy and predictive maintenance capabilities, making AMI systems the preferred choice for large-scale deployments. Additionally, growing urbanization and increasing demand for energy-efficient solutions in residential and commercial sectors are accelerating the integration of AMI technology. As utilities focus on optimizing gas distribution and enhancing customer engagement, AMI-based smart gas meters will continue to play a crucial role in driving the transition toward intelligent and sustainable energy management systems worldwide.

By End Use Analysis

Residential sector dominates with 56.8% share driven by rapid adoption of household smart metering systems

In 2024, Residential held a dominant market position, capturing more than a 56.8% share of the overall smart gas meter market. This dominance is primarily driven by the large-scale installation of smart meters in homes to improve billing accuracy, energy efficiency, and leak detection. Growing urbanization, government mandates for advanced metering, and consumer awareness of energy management have significantly accelerated the adoption of smart gas meters across residential households.

By 2025, the residential segment is expected to sustain its leading position, supported by ongoing government initiatives promoting nationwide smart metering rollouts and digitized utility infrastructure. Rising gas consumption in urban housing projects, along with the demand for efficient and safe gas distribution networks, continues to fuel the market expansion. Moreover, integration of IoT-based features such as mobile alerts, automated billing, and consumption analytics is making smart meters more attractive to homeowners.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Type

- Smart Ultrasonic Gas Meter

- Smart Diaphragm Gas Meter

- Others

By Technology

- Advanced Metering Infrastructure (AMI)

- Auto Meter Reading (AMR)

By End Use

- Residential

- Commercial

- Industrial

Emerging Trends

Interoperable, data-sharing smart gas metering with consumer-protection teeth

Across major markets, the newest wave of smart gas-meter rollouts is being shaped by interoperability-by-design and stronger consumer protections—turning meters into reliable, standards-based data endpoints that support safety analytics, fair billing, and future low-carbon gases.

In the EU, the European Commission’s Implementing Regulation (EU) 2023/1162 requires common procedures so different vendors’ meters and platforms can exchange metering and consumption data on a non-discriminatory basis. The Commission notes the regulation “aims to improve access to metering and consumption data” through interoperability requirements; the rules took effect on 5 January 2025, with Member States asked to report national practices by 5 July 2025.

Why this matters in practice: large-scale deployments are already producing the data volumes—and the operational expectations—that these rules are designed to support. In Great Britain, official statistics show ~39 million smart/advanced meters were in operation by end-March 2025, with ~91% of smart meters working in smart mode at that point. Those numbers indicate that interoperable data flows and remote firmware/communications are no longer niche—they are baseline capabilities utilities need to operate at national scale.

At the same time, regulators are raising service standards so customers actually feel the benefits. Ofgem’s draft impact assessment on Guaranteed Standards of Performance references the same rollout scale—over 39 million meters installed and 67% of all meters classed as smart/advanced by March 2025—and sets out proposals for automatic compensation (e.g., £40) for delayed installs or slow fixes to non-communicating “dumb” smart meters.

Drivers

Methane-safety and loss-Reduction Mandates

The single strongest tailwind for smart gas meters is the global push to cut methane leaks across gas distribution and end-use points. Methane is responsible for roughly 30% of the rise in global temperatures since the Industrial Revolution, putting intense policy and utility focus on faster detection and elimination of fugitive emissions. The International Energy Agency (IEA) estimates the energy sector emitted ~120 Mt of methane in 2023, and notes that around 40% of these emissions could be abated at no net cost—a striking signal that low-cost digital monitoring and analytics can deliver quick wins.

Governments have translated that urgency into targets that amplify utility spending on measurement, verification, and leak reduction—capabilities that advanced meters directly support through high-frequency consumption data, tamper flags, and pressure/flow anomaly detection. Under the Global Methane Pledge, 150+ countries aim to reduce anthropogenic methane 30% from 2020 levels by 2030. Utilities connecting tens of millions of homes must therefore document and shrink losses at the edge of the network—where smart meters are the most scalable, customer-side sensor.

The United States alone, gas distribution operators reported ~2.37 million miles of mains plus estimated service lines in 2024. Given this footprint, old manual reads and periodic surveys cannot reliably find small, chronic leaks or unauthorized use; interval data and remote firmware diagnostics from smart meters improve situational awareness at a fraction of traditional inspection cost.

Regulatory frameworks now reward that digitalization. The European Commission’s smart-metering work shows that across the EU, smart devices deliver average lifecycle savings of ~€230 per gas metering point and 2–10% energy-use reductions thanks to accurate billing, faster leak detection and better customer feedback—benefits that strengthen investment cases even before factoring in carbon pricing or methane-fee proposals. In parallel, the EU’s Implementing Regulation (EU) 2023/1162 codifies interoperability and data-access rules, reducing integration risk for utilities planning mass deployments.

Restraints

High Upfront Costs and Infrastructure Hurdles

One of the major restraining factors slowing the widespread adoption of smart gas meters is the significant up-front investment and infrastructure burden that utilities must bear. When a utility company considers replacing legacy meters with advanced smart gas meters, it isn’t just buying a new device. They must also upgrade communications networks, deploy remote data concentrators, install firmware and software platforms, manage backend integration, and train operations staff.

In many cases, smaller utilities or those in developing economies simply lack the capital or financing models to cover these costs, which makes them cautious about proceeding. A European review noted that the average cost of installing a smart meter in the EU is between €200 and €250 per unit, making it a non-trivial barrier in cost-sensitive regions.

- According to one market commentary, across the European Union the total investment required for deploying 266 million smart meter endpoints by 2030 is estimated at €47 billion. This kind of capital commitment means utilities must be confident both of regulatory stability and of operational savings over time—otherwise the business case can appear weak especially if benefits are deferred or uncertain.

Regulatory uncertainty compounds the problem. If a utility is uncertain whether future standards will change (for example, interoperability, data access rules, or communications protocols), it may delay investment. In addition, the business case for gas smart meters is often weaker than electricity smart meters, because gas usage tends to have fewer dynamic tariff options or demand response applications compared to electrical loads.

As a result, the return on investment may appear more modest, making it harder to justify the initial spend. Some credible commentary states that “high upfront installation costs and heightened cybersecurity compliance add expense and slow uptake, especially in cost-sensitive regions.”

Opportunity

Decarbonising gas grids with biomethane and hydrogen—meters as the edge bridge

Smart gas meters have a clear runway for growth as gas networks decarbonise by injecting biomethane and low-percentage hydrogen blends into distribution grids. Europe’s REPowerEU plan sets an explicit demand signal: 35 billion cubic metres (bcm) of biomethane per year by 2030, with an estimated €37 billion investment need. Utilities that scale biomethane will need device-level accuracy for energy-content (CV) changes, billing transparency, prepayment, and tamper/leak analytics at the last mile—all functions that advanced meters enable.

Hydrogen pilots strengthen the case. The UK HyDeploy trials showed that up to 20% hydrogen by volume blended into natural gas did not negatively affect existing infrastructure or appliances; the project team estimated that a UK-wide 20% blend could avoid around 6 million tonnes of CO₂ annually—the equivalent of taking 2.5 million cars off the road. Transitioning such pilots into day-to-day operations hinges on interval data and firmware-updatable meters that can flag abnormal consumption, pressure events, or appliance compatibility.

- Policy momentum and standards reduce deployment risk. The European Commission’s interoperability rules (Implementing Regulation (EU) 2023/1162) create common procedures for non-discriminatory access to metering and consumption data, simplifying integration of new meter generations as gas quality changes with biomethane/hydrogen. Separately, the Commission’s smart-metering analysis quantifies average lifecycle savings of ~€230 per gas metering point and 2–10% energy-use reductions, supporting investment committees that must balance upfront costs against measurable system benefits.

Finally, methane-abatement economics add another tailwind. The IEA estimates the energy sector emits roughly 120 Mt of methane annually, and that ~40% of these emissions can be avoided at no net cost at 2023 average energy prices. As utilities chase methane-reduction compliance and leak-loss targets, high-resolution metering becomes a practical “edge sensor” to detect anomalies, quantify avoided losses, and verify outcomes—all while supporting decarbonised gas blends. The same digital infrastructure that helps cut methane also de-risks biomethane/hydrogen integration, aligning climate goals with commercial returns.

Regional Insights

Asia Pacific dominates with 38.90% share, valued at around USD 1.1 billion in 2024

In 2024, the Asia Pacific region held a dominant position in the global smart gas meter market, capturing approximately 38.90% share, valued at USD 1.1 billion. This strong regional performance is primarily driven by rapid urbanization, increasing energy demand, and government-backed smart metering programs across major economies such as China, Japan, South Korea, and India.

Countries in this region are actively modernizing their utility infrastructure to improve gas distribution efficiency, reduce energy losses, and enhance billing transparency. China remains the largest contributor, supported by its national smart city initiatives and large-scale smart metering rollout plans covering millions of households.

The region’s momentum is further reinforced by India’s accelerating gas grid expansion under the “City Gas Distribution” program, targeting over 125 million new household connections by 2034, which is expected to substantially increase the demand for smart gas meters. Japan and South Korea are also advancing digital utility frameworks, integrating IoT-based monitoring systems and advanced metering infrastructure (AMI) for improved consumer data analytics and remote management.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ABB Ltd: ABB is a Switzerland-based global industrial technology company with strong credentials in smart metering and grid infrastructure. It offers smart metering and monitoring solutions that claim up to a 7% improvement in energy efficiency and payback periods of under three years. While its publicised examples focus on electricity, ABB’s broad metering footprint positions it to supply smart gas meters through its existing utility partnerships and global reach.

Apator S.A.: Apator, headquartered in Poland, specializes in gas, water and electricity metering solutions including the smart gas meter “iSMART 2” series that uses NB-IoT and Wireless M-BUS for dual-sensor flow detection. Apator’s manufacturing capacity of ~1.5 million gas meters per year and its leading share in European gas-meter exports give it strong credibility in the advanced smart gas meter segment.

Hansen Technologies: Hansen is an Australia-based software and services provider focused on energy/utility applications, including meter data management (MDM) for smart meters. It serves utilities in over 80 countries and emphasises analytics, customer engagement and data back-ends. While not a meter manufacturer, Hansen’s strength is enabling smart gas meter deployments through its data platforms—making it an important ecosystem player in the market.

Top Key Players Outlook

- ABB

- Apator S.A.

- Eaton

- Hansen Technologies

- Honeywell International, Inc.

- Itron, Inc.

- Landis+Gyr

- Schneider Electric

- Siemens

- Wasion Holdings International

Recent Industry Developments

In FY2024, Hansen reported US$353.1 million operating revenue and US$12.0 million NPAT, with its Energy & Utilities vertical delivering US$183.2 million “core” revenue, +14.7% YoY (ex-powercloud)—healthy proof that utilities are scaling digital metering programs.

In 2024 Apator S.A, reported PLN 31.9 million EBITDA and PLN 12.0 million net profit (up 37% y/y) underlining healthy financial footing.

Report Scope

Report Features Description Market Value (2024) USD 3.0 Bn Forecast Revenue (2034) USD 6.3 Bn CAGR (2025-2034) 7.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, Services), By Type (Smart Ultrasonic Gas Meter, Smart Diaphragm Gas Meter, Others), By Technology (Advanced Metering Infrastructure (AMI), Auto Meter Reading (AMR)), By End Use (Residential, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB, Apator S.A., Eaton, Hansen Technologies, Honeywell International, Inc., Itron, Inc., Landis+Gyr, Schneider Electric, Siemens, Wasion Holdings International Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ABB

- Apator S.A.

- Eaton

- Hansen Technologies

- Honeywell International, Inc.

- Itron, Inc.

- Landis+Gyr

- Schneider Electric

- Siemens

- Wasion Holdings International