Global Smart Fertilizers Market Size, Share, And Enhanced Productivity By Product (Polymer Coated Fertilizers, Sulfur Coated Fertilizers, Organic Based Slow Release Fertilizers, Chemical Compounds), By Application (Grains and Cereals, Pulses and Oilseeds, Commercial Crops, Fruits and Vegetables, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 178273

- Number of Pages: 308

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

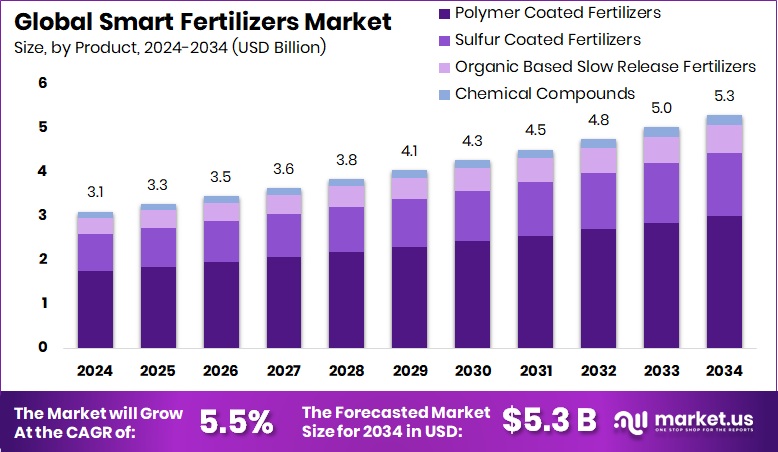

The Global Smart Fertilizers Market is expected to be worth around USD 5.3 billion by 2034, up from USD 3.1 billion in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034. Asia Pacific leads growth with 39.1% share worth USD 1.2 Bn.

Smart fertilizers are advanced nutrient products designed to release essential elements to crops in a controlled and efficient manner. Unlike conventional fertilizers, they improve nutrient use efficiency by reducing losses caused by leaching, volatilization, or runoff. Products such as polymer-coated fertilizers, sulfur-coated fertilizers, organic-based slow-release fertilizers, and specific chemical compounds are developed to match plant nutrient demand over time. These solutions help improve crop yield, soil health, and environmental sustainability.

The Smart Fertilizers Market refers to the global trade and adoption of these enhanced-efficiency fertilizers across key applications, including grains and cereals, pulses and oilseeds, commercial crops, fruits and vegetables, and other specialty crops. The market reflects growing interest in precision agriculture, where farmers aim to optimize input costs while improving productivity and meeting sustainability goals.

Growth in this market is supported by increasing investment in agricultural infrastructure and crop productivity programs. Manitoba is boosting its stake in a cereals centre to $23.5 million, and a $13-million investment in a downtown agriculture exchange highlights stronger support for modern farming systems. Japan’s US$17M funding for a grain terminal in Côte d’Ivoire further strengthens global grain supply chains.

Demand is rising as farmers focus on maximizing output per hectare, especially in staple crops. The EPOSEA $312,000 AGRA-backed project to boost pulses and oilseed exports shows increasing attention toward high-value crops that benefit from efficient nutrient management.

Opportunities are expanding with responsible farming capital flows. GO.FARM’s A$300M capital raise for a Responsible Agriculture Fund signals growing investor confidence in sustainable inputs, creating space for smart fertilizer adoption across diversified crop segments.

Key Takeaways

- The Global Smart Fertilizers Market is expected to be worth around USD 5.3 billion by 2034, up from USD 3.1 billion in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034.

- In the Smart Fertilizers Market, polymer-coated fertilizers hold 56.7% product share globally.

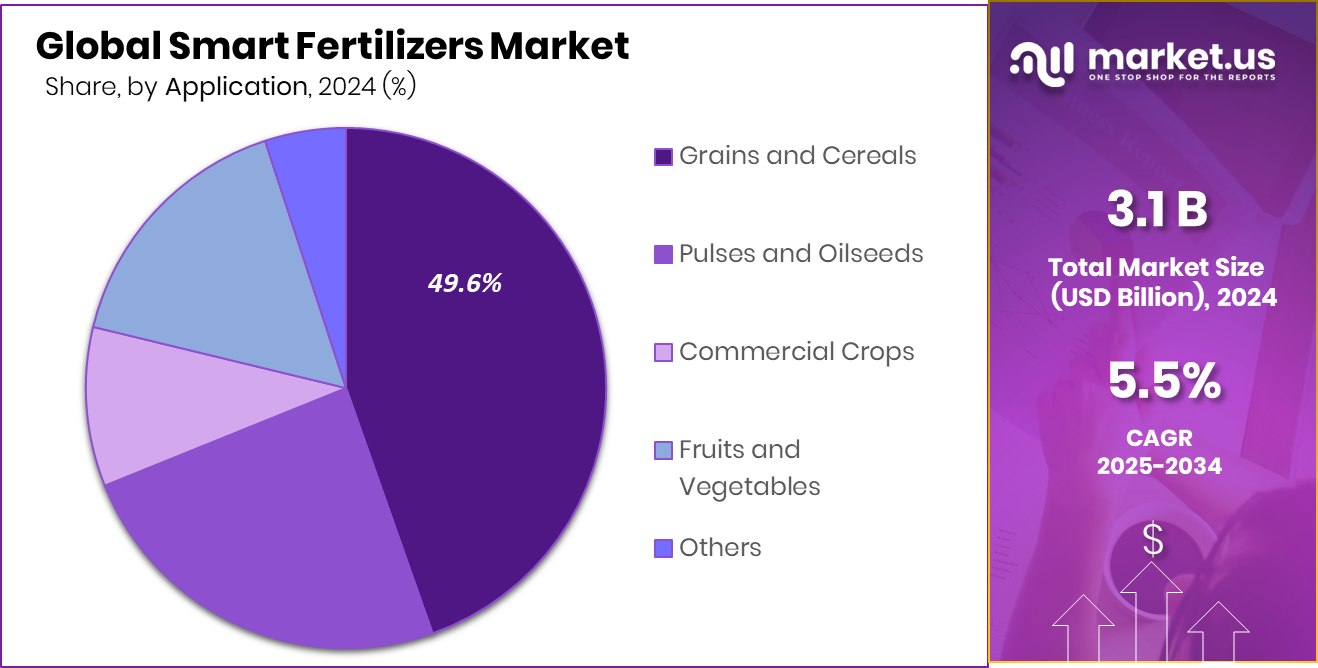

- Within the Smart Fertilizers Market, grains and cereals account for 49.6% application demand.

- The Asia Pacific generated USD 1.2 Bn in revenue.

By Product Analysis

Polymer-coated fertilizers dominate the smart fertilizers market with 56.7% share.

In 2024, the Smart Fertilizers Market continued to show strong momentum, with polymer coated fertilizers accounting for 56.7% of the total product share. This segment remained dominant as farmers increasingly preferred controlled-release solutions that improve nutrient efficiency and reduce environmental losses. Polymer-coated fertilizers help release nutrients gradually, matching crop demand and minimizing leaching and volatilization. With rising fertilizer prices and tighter environmental regulations, growers are focusing on maximizing output per unit of input.

The adoption rate has been particularly strong in regions facing soil degradation and water scarcity issues. Manufacturers are also investing in advanced coating technologies to enhance nutrient release precision, durability, and cost-effectiveness. As sustainable farming practices gain wider acceptance, polymer-coated fertilizers are expected to maintain their leadership position across both developed and emerging agricultural economies.

By Application Analysis

Grains and cereals lead the Smart Fertilizers Market applications with 49.6%.

In 2024, grains and cereals represented 49.6% of the total application share in the Smart Fertilizers Market, reflecting the global importance of staple crop production. Major crops such as wheat, rice, and corn require consistent nutrient management to ensure stable yields and food security. Smart fertilizers play a key role in improving nutrient uptake efficiency, supporting better root development and higher productivity.

With growing population pressure and limited arable land, farmers are increasingly turning to precision agriculture inputs to boost output without expanding farmland. Government support programs promoting sustainable agriculture have further strengthened adoption in this segment. In addition, climate variability has increased the need for reliable nutrient management solutions. As global demand for grains continues to rise, smart fertilizers are becoming a critical tool for improving yield stability and profitability.

Key Market Segments

By Product

- Polymer Coated Fertilizers

- Sulfur Coated Fertilizers

- Organic-Based Slow-Release Fertilizers

- Chemical Compounds

By Application

- Grains and Cereals

- Pulses and Oilseeds

- Commercial Crops

- Fruits and Vegetables

- Others

Driving Factors

Rising adoption of precision farming

The Smart Fertilizers Market is strongly driven by the rising adoption of precision farming practices across major agricultural regions. Farmers are increasingly using soil testing, GPS-based equipment, and data-driven crop management systems to apply nutrients more accurately. Smart fertilizers support this shift by releasing nutrients in a controlled way, improving efficiency and reducing waste.

Technological innovation is also accelerating growth. Nitricity, raising $50M to expand globally with its unique technology that transforms almond waste into organic fertilizer, reflects how innovation is reshaping nutrient production. Such developments show growing confidence in advanced fertilizer solutions that align with sustainable agriculture goals. As growers seek better yield stability and improved soil performance, demand for efficient and environmentally responsible fertilizer products continues to strengthen worldwide.

Restraining Factors

High cost of advanced formulations

Despite steady growth, the Smart Fertilizers Market faces challenges linked to the high cost of advanced formulations. Polymer coatings, stabilization technologies, and specialty compounds increase production expenses, making these products more expensive than conventional fertilizers. This price gap can limit adoption, particularly among small and mid-sized farmers operating under tight margins. In addition, policy and regulatory shifts create uncertainty in agricultural investment planning.

Industry reaction to USDA’s new rules for the $3.1 billion Climate-Smart Program highlights how changes in funding criteria and compliance requirements can influence purchasing decisions. When financial incentives or guidelines change, farmers may delay investments in premium nutrient products. These cost pressures and policy adjustments can temporarily slow market expansion, even as long-term sustainability goals remain strong.

Growth Opportunity

Expansion in emerging agricultural economies

The Smart Fertilizers Market holds significant opportunities in emerging agricultural economies where productivity improvement is a priority. Many developing regions are modernizing farming systems to enhance food security and export competitiveness. As infrastructure improves, the adoption of controlled and efficiency-enhanced fertilizers becomes more viable. Investment flows are supporting this transition. Khosla Ventures and other investors pouring $20m into Nitricity’s on-farm nitrogen production technology demonstrate growing financial backing for localized and sustainable fertilizer solutions.

Such funding supports innovations that reduce dependence on traditional supply chains and lower environmental impact. Expanding access to modern nutrient technologies in high-growth agricultural markets presents strong long-term potential. As governments and private investors continue to promote sustainable intensification, smart fertilizers are positioned to benefit from rising modernization efforts.

Latest Trends

Development of controlled release technologies

A key trend shaping the Smart Fertilizers Market is the continued development of controlled-release technologies. Manufacturers are refining coating materials and nutrient stabilization methods to better match plant growth cycles. This trend reflects the broader push toward climate-smart agriculture and resource efficiency. Financial markets are also supporting this shift.

AFEX’s $100m bond, aimed at unlocking climate-smart capital for Nigeria’s agricultural secto,r highlights how structured finance is being directed toward sustainable farming initiatives. Such capital availability strengthens the ecosystem required for advanced input adoption, including smart fertilizers. The combination of technological refinement and targeted agricultural financing is helping move the market toward more resilient, environmentally responsible crop nutrition systems across diverse regions.

Regional Analysis

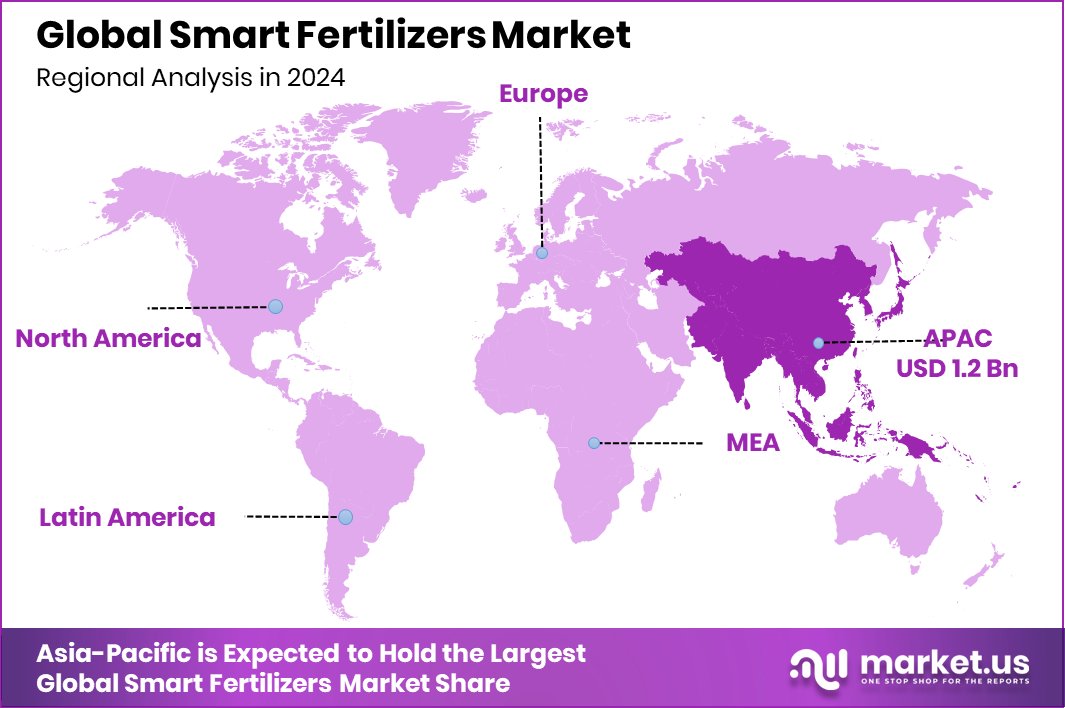

In 2024, Asia Pacific held 39.1% Smart Fertilizers Market share.

The Smart Fertilizers Market demonstrates varied regional performance across North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, reflecting differences in agricultural practices and technology adoption. Asia Pacific emerged as the dominating region, accounting for 39.1% of the global market and generating USD 1.2 Bn in revenue. The region’s leadership is supported by its large agricultural base, strong focus on improving crop productivity, and increasing adoption of controlled-release and efficiency-enhanced fertilizers.

Countries across this region are prioritizing higher yield per hectare to meet rising food demand, strengthening overall market penetration. North America and Europe represent mature markets, characterized by advanced farming techniques and strong awareness of sustainable nutrient management solutions.

Meanwhile, Latin America and the Middle East & Africa are witnessing gradual adoption driven by expanding commercial farming activities and the need to optimize fertilizer use in challenging climatic conditions. Overall, regional dynamics highlight Asia Pacific’s clear dominance, while other regions continue to expand steadily in alignment with precision agriculture trends.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, BASF SE continued to strengthen its position in the global Smart Fertilizers Market through its strong focus on innovation and sustainable agricultural solutions. The company’s expertise in advanced materials and chemical technologies allows it to develop enhanced-efficiency fertilizers that improve nutrient uptake while reducing environmental impact. BASF’s integrated production capabilities and global distribution network give it a competitive advantage in serving large-scale farming operations. Its emphasis on research-driven product development supports precision farming practices and aligns well with evolving regulatory standards on nutrient management and emissions reduction.

Nutrien Ltd. remains a major force in smart fertilizer adoption due to its extensive retail network and direct engagement with growers. The company combines crop nutrient manufacturing with agronomic advisory services, enabling practical on-field implementation of controlled-release and stabilized fertilizer products. Nutrien’s scale and supply chain strength allow it to respond quickly to seasonal demand patterns while maintaining consistent product availability. Its grower-focused model reinforces the adoption of advanced fertilizer technologies across key agricultural regions.

ICL Group continues to expand its footprint through specialty fertilizer offerings and controlled-release technologies. The company’s focus on high-efficiency nutrient formulations supports improved crop yields and soil health. ICL’s innovation-driven strategy and strong presence in specialty plant nutrition position it as a reliable supplier within the evolving smart fertilizers landscape.

Top Key Players in the Market

- BASF SE

- Nutrien Ltd.

- ICL Group

- Haifa Chemicals

- Yara International

- Dakota

- The Mosaic Company

- Haifa Group

- K+S Aktiengesellschaft

Recent Developments

- In April 2025, BASF Professional & Specialty Solutions introduced a new nitrification inhibitor called Ampliqan® for fertilizers. This product is designed to protect nitrogen in fertilizer from being lost and to make more nitrogen available to plants. It helps improve nitrogen use efficiency, supports better crop yields, and reduces greenhouse gas emissions. The product is compatible with many nitrogen fertilizers and is part of BASF’s efforts to promote climate-smart agriculture worldwide.

- In June 2024, Nutrien Ag Solutions completed the purchase of Suncor Energy’s AgroScience assets, gaining new patented biocontrol technology. This technology gives farmers new tools for protecting crops and managing pests, supporting healthier plant growth and nutrient efficiency in farming practices. It aligns with Nutrien’s strategy to expand its crop input offerings.

Report Scope

Report Features Description Market Value (2024) USD 3.1 Billion Forecast Revenue (2034) USD 5.3 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Polymer Coated Fertilizers, Sulfur Coated Fertilizers, Organic Based Slow Release Fertilizers, Chemical Compounds), By Application (Grains and Cereals, Pulses and Oilseeds, Commercial Crops, Fruits and Vegetables, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Nutrien Ltd., ICL Group, Haifa Chemicals, Yara International, Dakota, The Mosaic Company, Haifa Group, K+S Aktiengesellschaft Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smart Fertilizers MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Smart Fertilizers MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Nutrien Ltd.

- ICL Group

- Haifa Chemicals

- Yara International

- Dakota

- The Mosaic Company

- Haifa Group

- K+S Aktiengesellschaft