Global Skim Organic Milk Powder Market Size, Share, And Business Benefits By Type (Regular Type, Instant Type), By Application (Infant Formulas, Confections, Bakery Products, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152432

- Number of Pages: 336

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

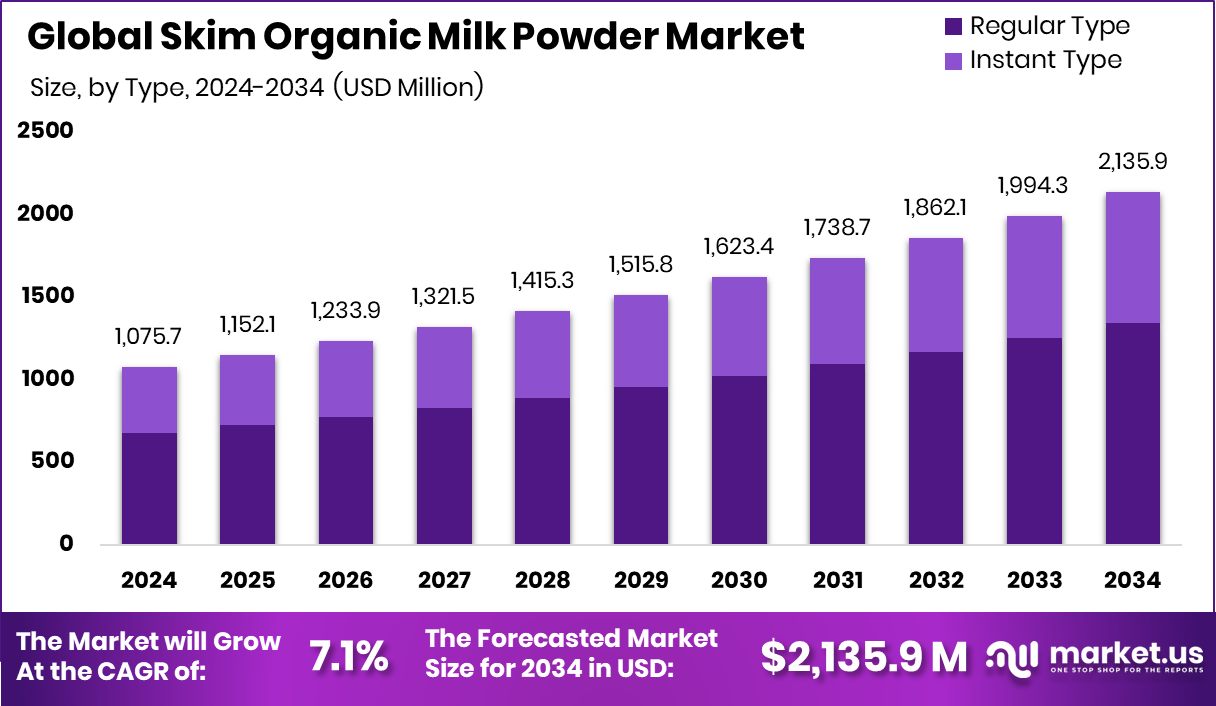

Global Skim Organic Milk Powder Market is expected to be worth around USD 2,135.9 Million by 2034, up from USD 1075.7 Million in 2024, and grow at a CAGR of 7.1% from 2025 to 2034. High demand for clean-label dairy products supported North America’s dominant 46.2% share.

Skim organic milk powder is a dehydrated dairy product made from certified organic skimmed milk, which means it contains minimal fat and no synthetic chemicals, hormones, or antibiotics. It is produced by removing the cream from organic milk and then drying the remaining liquid at low temperatures to preserve nutrients. This powder form enhances shelf life and makes transportation easier while retaining essential nutrients like calcium, protein, and vitamins.

The skim organic milk powder market refers to the global trade and consumption of this dairy product across food, beverage, and nutritional industries. As health and sustainability awareness grows, this market has gained traction due to increasing demand for organic and low-fat food alternatives. It is influenced by factors such as organic food consumption trends, food processing industries, nutritional product manufacturers, and the growing preference for clean-label ingredients.

The growth of the skim organic milk powder market is driven by rising consumer awareness around the health risks of synthetic additives and saturated fats. As more people shift towards clean-label and low-fat diets, this product finds relevance across diverse demographics. According to an industry report, Bakingo, a bakery startup, secures $16 million in funding to accelerate its pan-India expansion.

There is a consistent rise in demand from health-focused consumers, parents seeking safer nutrition options for children, and aging populations needing high-calcium, low-fat foods. Urban consumers are especially drawn to convenient, nutrient-dense, and ethically produced food products. According to an industry report, The Baker’s Dozen raises $5 million in a pre-Series A funding round, led by Fireside Ventures, to support its growth journey.

Key Takeaways

- Global Skim Organic Milk Powder Market is expected to be worth around USD 2,135.9 Million by 2034, up from USD 1075.7 Million in 2024, and grow at a CAGR of 7.1% from 2025 to 2034.

- In the Skim Organic Milk Powder Market, the regular type dominates with 62.9% due to widespread food applications.

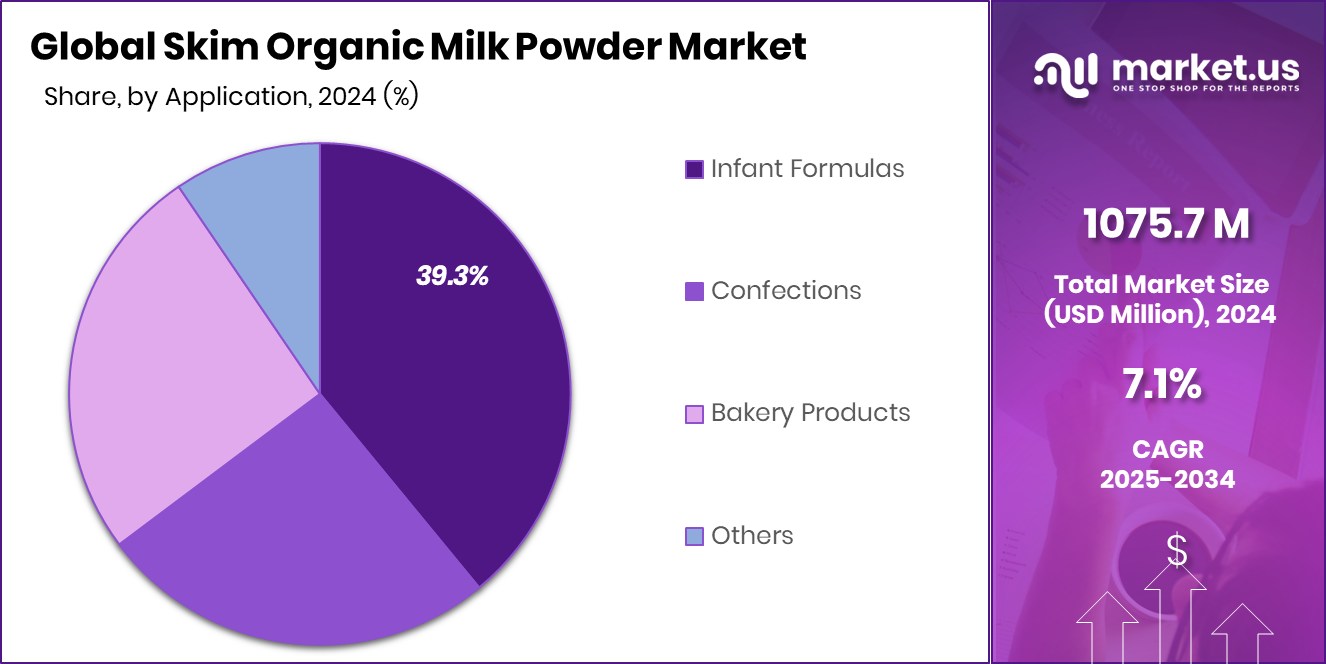

- Infant formulas account for a 39.3% share of the Skim Organic Milk Powder Market, driven by safety concerns.

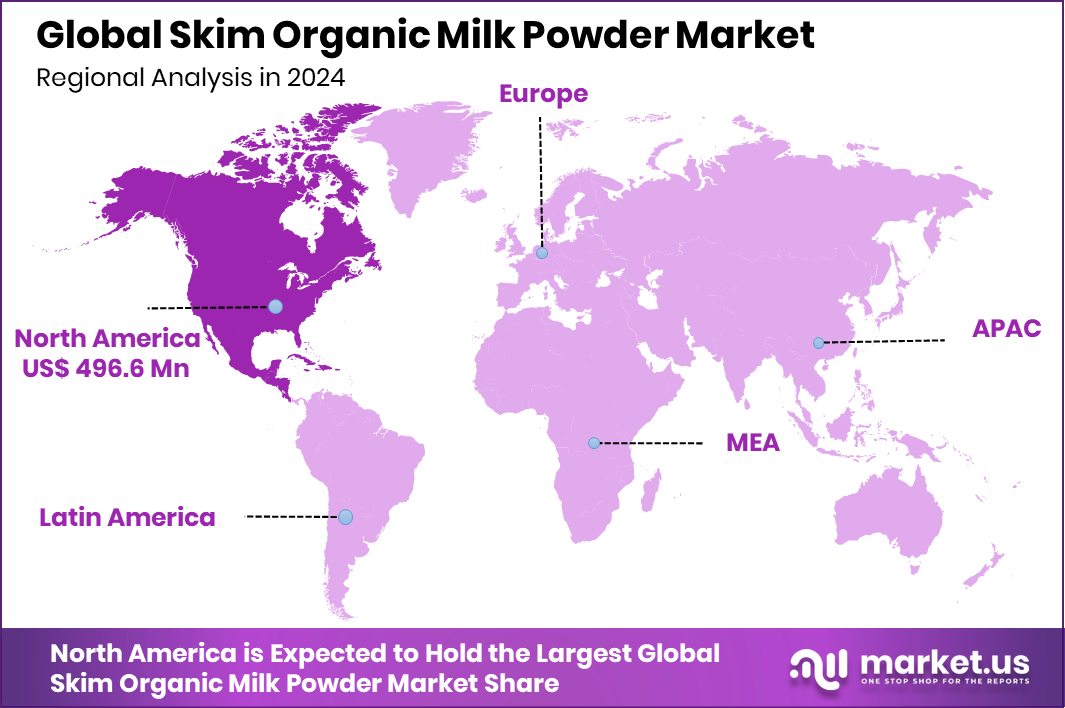

- The North American market was valued at approximately USD 496.6 million during the same year.

By Type Analysis

Regular type dominates the Skim Organic Milk Powder Market with 62.9%.

In 2024, Regular Type held a dominant market position in the By Type segment of the Skim Organic Milk Powder Market, with a 62.9% share. This dominance can be attributed to the widespread acceptance of regular formulation among both households and industrial users.

Regular-type skim organic milk powder offers a well-balanced combination of affordability, nutritional value, and versatility, making it suitable for use in a variety of food applications such as bakery products, beverages, infant nutrition, and dairy blends. Its compatibility with existing food processing systems further enhances its demand among manufacturers who prefer consistency and cost-efficiency without compromising on organic standards.

The strong market position of this segment also reflects consumer trust in traditional dairy formats, particularly in regions where organic certification carries significant weight in purchasing decisions. Moreover, the Regular Type is often selected for its closer resemblance to conventional skim milk in terms of taste and solubility, which appeals to a broad consumer base.

As the preference for clean-label, low-fat, and long-shelf-life dairy products continues to rise, Regular Type remains the go-to option for bulk procurement and retail consumption alike. Its established presence across both retail and industrial channels reinforces its leading role in the current market landscape.

By Application Analysis

Infant formulas lead the application segment with a 39.3% market share.

In 2024, Infant Formulas held a dominant market position in the By Application segment of the Skim Organic Milk Powder Market, with a 62.9% share. This significant market share highlights the growing reliance on organic and low-fat dairy ingredients in the formulation of infant nutrition products.

Skim organic milk powder is widely recognized for its safety, digestibility, and nutritional adequacy, making it a preferred base in infant formula production. The absence of synthetic hormones, antibiotics, and chemical residues aligns with strict quality standards expected in infant food manufacturing, thereby enhancing consumer confidence and product appeal.

Parents across both developed and emerging economies are increasingly prioritizing organic-certified products for early childhood nutrition, driving demand for this segment. Regulatory support for organic infant nutrition and rising awareness about the long-term health benefits of chemical-free products further reinforce this trend.

Manufacturers favor skimming organic milk powder for its consistent quality, easy blending properties, and suitability in developing formulations that meet infant dietary needs. The dominant position of infant formulas in this segment underlines the product’s critical role in delivering safe, clean, and nutritionally balanced milk-based nutrition to a sensitive consumer group and is expected to remain strong as health-conscious parenting continues to shape the dairy ingredients market.

Key Market Segments

By Type

- Regular Type

- Instant Type

By Application

- Infant Formulas

- Confections

- Bakery Products

- Others

Driving Factors

Rising Health Awareness Fuels Organic Dairy Demand

One of the top driving factors of the skim organic milk powder market is the growing awareness among consumers about health, nutrition, and food safety. People are becoming more cautious about what they eat and are actively choosing products that are free from synthetic additives, hormones, and antibiotics. Skim organic milk powder fits this demand well, offering a natural, low-fat, and nutrient-rich alternative to traditional dairy products.

It supports weight management and heart health, making it especially attractive to health-conscious individuals, parents, and elderly consumers. This shift in dietary preferences, driven by clean-label trends and lifestyle changes, is directly boosting the market’s growth as more consumers turn to trusted, certified organic dairy sources for their daily nutrition needs.

Restraining Factors

Higher Price Limits Consumer Adoption in Some Segments

One of the main restraining factors for the skim organic milk powder market is its relatively higher price compared to conventional milk powder. Organic skimming requires adherence to strict certification standards, organic feed for cows, and more controlled production processes, all of which increase production costs. As a result, manufacturers need to charge more for these products, which can deter price-sensitive consumers.

In many regions, especially those with lower disposable incomes, customers often choose cheaper conventional or non-organic options. Even among health-conscious consumers, the premium pricing of organic powders can limit frequent or bulk purchases. Consequently, this cost barrier slows down overall market expansion by restricting access to a broader demographic who might otherwise benefit from the product’s advantages.

Growth Opportunity

Expanding Infant Nutrition Offers Major Growth Potential

An important growth opportunity for the skim organic milk powder market is expanding its use in infant nutrition products. As more parents seek safer, cleaner food options for their babies, organic ingredients gain strong traction. Skim organic milk powder, being low in fat, rich in protein, and free from synthetic chemicals, fits perfectly into infant formula and toddler food applications.

Manufacturers can leverage this trend by developing certified organic infant formulas and ready-to-drink nutritional beverages that appeal to health-focused families. Furthermore, tailored packaging—such as single-serve sachets—can address convenience for busy parents.

Latest Trends

Clean Label Products Driving Consumer Purchase Decisions

A key trend shaping the skim organic milk powder market is the rising demand for clean-label products. Consumers today are reading ingredient lists more carefully and prefer products with simple, transparent, and natural compositions. Skim organic milk powder, with its minimal processing and absence of synthetic additives, aligns well with this expectation.

This trend is especially strong among young parents, fitness enthusiasts, and health-conscious individuals who prioritize trust and quality in food choices. The shift toward clean labels also encourages innovation in processing and packaging to maintain purity and traceability, making it a long-term direction that influences how organic dairy products are marketed and consumed.

Regional Analysis

In North America, skim organic milk powder held a 46.2% market share in 2024.

In 2024, North America emerged as the leading region in the Skim Organic Milk Powder Market, holding a dominant share of 46.2%, which translated to a market value of approximately USD 496.6 million. The high market concentration in this region reflects strong consumer awareness of organic food products, particularly among health-conscious individuals and parents seeking safer nutritional options. Demand is further supported by a well-established dairy processing industry and the presence of regulated organic certification standards, which enhance consumer trust and drive product adoption.

Europe also plays a key role in the global market, benefiting from growing demand for clean-label and environmentally sustainable food ingredients. The region’s preference for ethically sourced dairy and its focus on low-fat nutritional products supports steady growth in this segment. In the Asia Pacific region, market expansion is fueled by rising urbanization, increased disposable income, and growing interest in organic diets, particularly in countries such as China and India.

Meanwhile, the Middle East & Africa, and Latin America represent emerging markets, where rising health awareness and improving distribution networks are gradually increasing the adoption of organic milk powders. However, North America remains the primary growth engine for the global market, driven by a combination of consumer trends and robust infrastructure.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global skim organic milk powder market was notably shaped by the active presence of key dairy processors such as Prolactal GmbH (ICL), Ingredia SA, Aurora Foods Dairy Corp, and Hochdorf Swiss Nutrition. These companies demonstrated strong capabilities in delivering high-quality organic dairy ingredients, maintaining rigorous production standards, and responding effectively to consumer demand for clean-label, low-fat dairy solutions.

Prolactal GmbH (ICL) continued to build on its strength in sourcing premium organic milk from alpine regions, supporting its positioning as a trusted supplier in both European and export markets. Its commitment to traceability and organic certification has enabled it to remain a preferred choice for nutritionally sensitive applications such as infant nutrition and health foods.

Ingredia SA leveraged its expertise in dairy innovation and technological processing to expand its footprint in the global market. Its focus on protein-rich and functional dairy powders helped strengthen its position among food and beverage manufacturers seeking value-added organic ingredients.

Aurora Foods Dairy Corp maintained a steady presence in North America, benefiting from regional consumer preference for certified organic dairy products. The company’s streamlined supply chain and retail relationships allowed it to respond effectively to growing demand, especially in the U.S.

Hochdorf Swiss Nutrition upheld its reputation through advanced nutritional formulations and quality assurance systems. Its strategic emphasis on infant and early childhood nutrition segments reinforced its role in high-value markets, where organic certification is a critical requirement. Collectively, these players contributed to market stability and innovation.

Top Key Players in the Market

- HiPP GmbH & Co. Vertrieb KG

- Verla (Hyproca)

- OMSCo

- Prolactal GmbH (ICL)

- Ingredia SA

- Aurora Foods Dairy Corp

- Hochdorf Swiss Nutrition

- Organic West Milk

- HiPP GmbH & Co.

- RUMI (Hoogwegt)

Recent Developments

- In August 2024, HOCHDORF Swiss Nutrition Ltd. was placed under a definitive agreement to be acquired by AS Equity Partners, marking a strategic shift toward private investment spurred by the brand’s advanced capabilities in organic dairy powder processing.

Report Scope

Report Features Description Market Value (2024) USD 1075.7 Million Forecast Revenue (2034) USD 2,135.9 Million CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Regular Type, Instant Type), By Application (Infant Formulas, Confections, Bakery Products, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape HiPP GmbH & Co. Vertrieb KG, Verla (Hyproca), OMSCo, Prolactal GmbH (ICL), Ingredia SA, Aurora Foods Dairy Corp, Hochdorf Swiss Nutrition, Organic West Milk, HiPP GmbH & Co., RUMI (Hoogwegt) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Skim Organic Milk Powder MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Skim Organic Milk Powder MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- HiPP GmbH & Co. Vertrieb KG

- Verla (Hyproca)

- OMSCo

- Prolactal GmbH (ICL)

- Ingredia SA

- Aurora Foods Dairy Corp

- Hochdorf Swiss Nutrition

- Organic West Milk

- HiPP GmbH & Co.

- RUMI (Hoogwegt)