Global Single-use Bioreactors Market By Component (Single-Use Bioreactor Systems, Single-Use Media Bags, Tubing, Connectors, Assemblies and Others), By Bioreactor Type (Stirred-Tank Bioreactors, Rocker Bioreactors, Air Lift Bioreactors, Fixed-Bed Bioreactors and Others), By Cell Culture Type (Mammalian Cells, Insect Cells, Microbial Cells and Others), By Application (Monoclonal Antibody Production, Vaccine Manufacturing, Viral Vector Manufacturing, Cell Therapy & Stem-Cell Expansion, Recombinant Protein Production and Others), By Workflow Stage (Research & Development, Process Development/Scale-Up, Clinical Manufacturing and Commercial Biomanufacturing), By End-User (Pharmaceutical & Biopharmaceutical Companies, CROs & CDMOs and Academic Institutes & Research Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173070

- Number of Pages: 396

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Component Analysis

- Bioreactor Type Analysis

- Cell Culture Type Analysis

- Application Analysis

- Workflow Stage Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

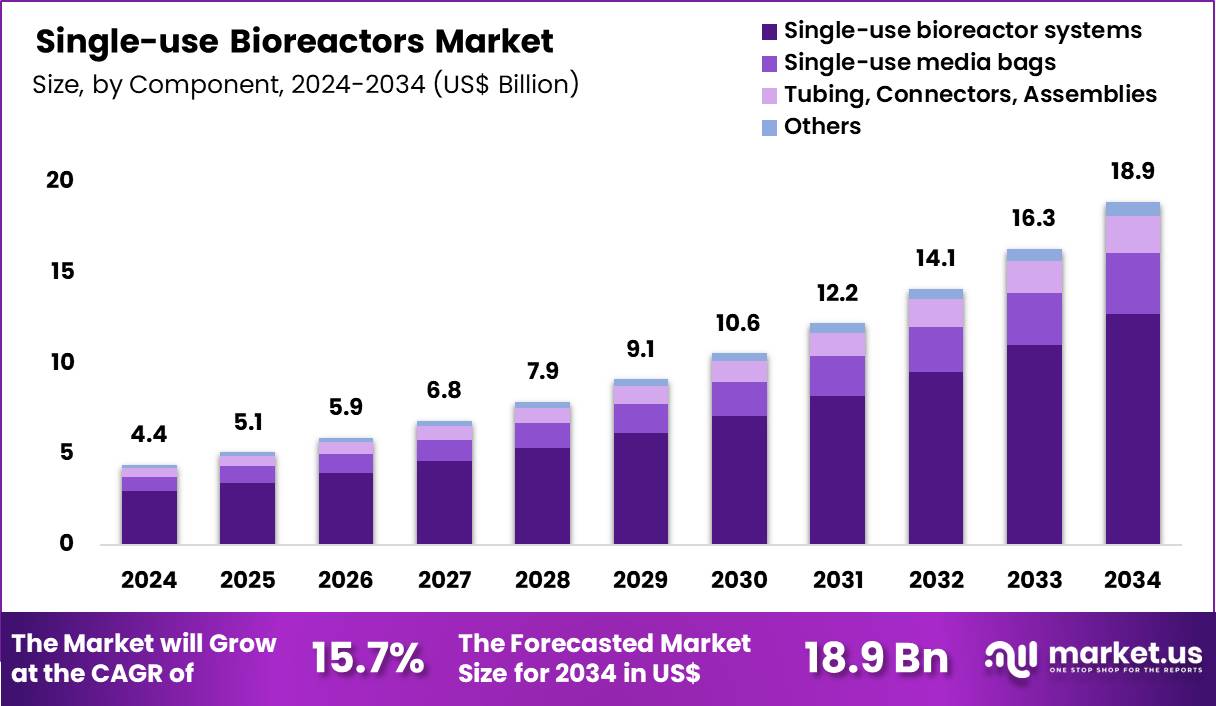

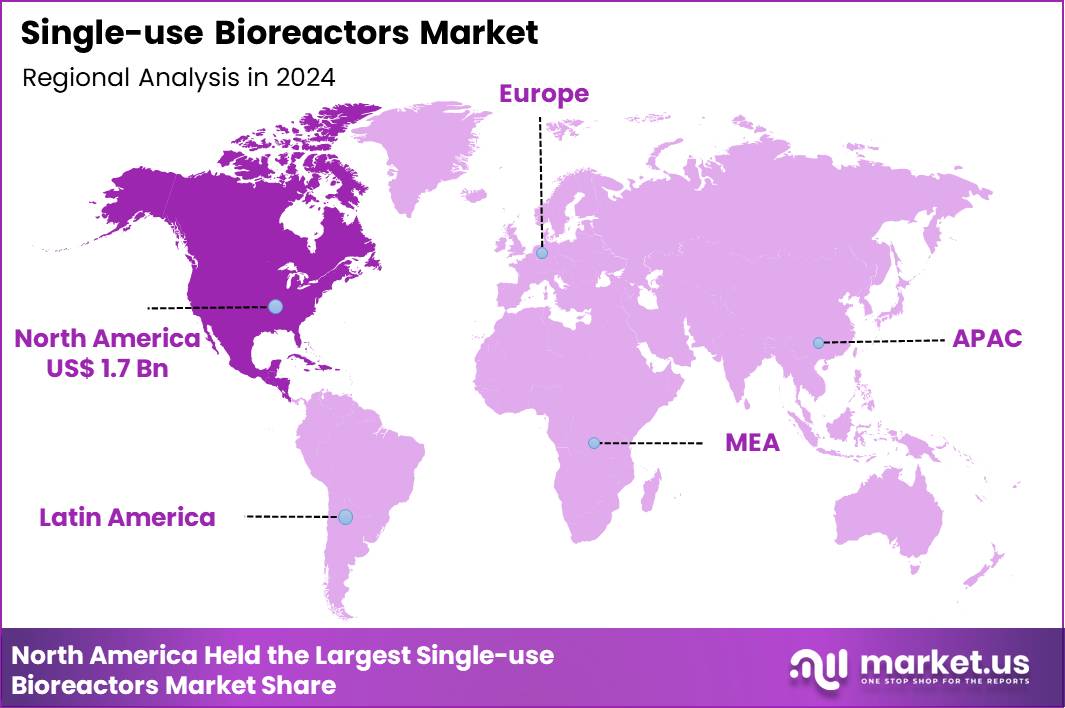

Global Single-use Bioreactors Market size is expected to be worth around US$ 18.9 Billion by 2034 from US$ 4.4 Billion in 2024, growing at a CAGR of 15.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.1% share with a revenue of US$ 1.7 Billion.

Growing complexity in biopharmaceutical production compels manufacturers to adopt single-use bioreactors that provide flexibility and rapid deployment for diverse therapeutic modalities. Bioprocess engineers increasingly utilize these systems for mammalian cell culture expansion in monoclonal antibody production, achieving high cell densities and consistent yields through controlled agitation and aeration. These bioreactors support perfusion processes for intensified manufacturing of recombinant proteins, maintaining steady-state conditions over extended culture durations.

Developers employ single-use platforms in viral vector production for gene therapies, minimizing contamination risks during upstream expansion of adherent or suspension cells. These technologies facilitate vaccine manufacturing by enabling quick scale-up of antigen-expressing cells in response to emerging infectious threats.

In April 2025, WuXi Biologics completed its first commercial Process Performance Qualification campaign at the MFG20 site in Hangzhou, China. The campaign was carried out on the second drug substance line equipped with three 5,000-liter single-use bioreactors, marking an important step in validating large-scale single-use manufacturing readiness for commercial biologics production.

Manufacturers pursue opportunities to integrate single-use bioreactors into cell therapy workflows, supporting expansion of CAR-T cells and other immunotherapies with closed, automated systems that ensure sterility and patient-specific batch handling. Developers engineer scalable bags for microbial fermentation applications, broadening utility in recombinant enzyme and microbial-derived biologic production. These platforms enable hybrid manufacturing approaches that combine single-use upstream with traditional downstream purification, optimizing efficiency in complex protein therapeutics.

Opportunities expand in personalized medicine, where small-batch capabilities accommodate autologous therapies and rare disease treatments with minimal facility reconfiguration. Companies advance perfusion-capable designs for intensified fed-batch processes, reducing footprint and resource consumption in high-value biologic pipelines. Firms invest in sensor-integrated bags for real-time monitoring, enhancing process understanding in stem cell-derived product development.

Industry leaders advance larger-volume single-use bioreactors with improved mass transfer characteristics, supporting commercial-scale mammalian processes while maintaining performance comparable to stainless-steel systems. Developers incorporate advanced agitation technologies in stirred-tank configurations, optimizing oxygen transfer and shear protection for sensitive cell lines in viral vector and protein therapeutics.

Market participants refine rocking-motion systems for gentle mixing, facilitating applications in adherent cell expansion and organoid culture for regenerative medicine. Innovators prioritize sustainability-focused materials that reduce plastic waste, aligning with environmental goals in continuous bioprocessing.

Companies emphasize plug-and-play assemblies that accelerate setup for multi-product facilities, enabling agile responses in vaccine and biosimilar production. Ongoing refinements focus on digital integration with process analytical technologies, delivering data-driven optimization across diverse biomanufacturing applications.

Key Takeaways

- In 2024, the market generated a revenue of US$ 4.4 Billion, with a CAGR of 15.7%, and is expected to reach US$ 18.9 Billion by the year 2034.

- The component segment is divided into single-use bioreactor systems, single-use media bags, tubing, connectors, assemblies and others, with single-use bioreactor systems taking the lead in 2023 with a market share of 67.4%.

- Considering bioreactor type, the market is divided into stirred-tank bioreactors, rocker bioreactors, air lift bioreactors, fixed-bed bioreactors and others. Among these, stirred-tank bioreactors held a significant share of 56.2%.

- Furthermore, concerning the cell culture type segment, the market is segregated into mammalian cells, insect cells, microbial cells and others. The mammalian cells sector stands out as the dominant player, holding the largest revenue share of 58.8% in the market.

- The application segment is segregated into monoclonal antibody production, vaccine manufacturing, viral vector manufacturing, cell therapy & stem-cell expansion, recombinant protein production and others, with the monoclonal antibody production segment leading the market, holding a revenue share of 39.5%.

- The workflow stage segment is divided into research & development, process development/scale-up, clinical manufacturing and commercial biomanufacturing, with commercial biomanufacturing taking the lead in 2023 with a market share of 46.3%.

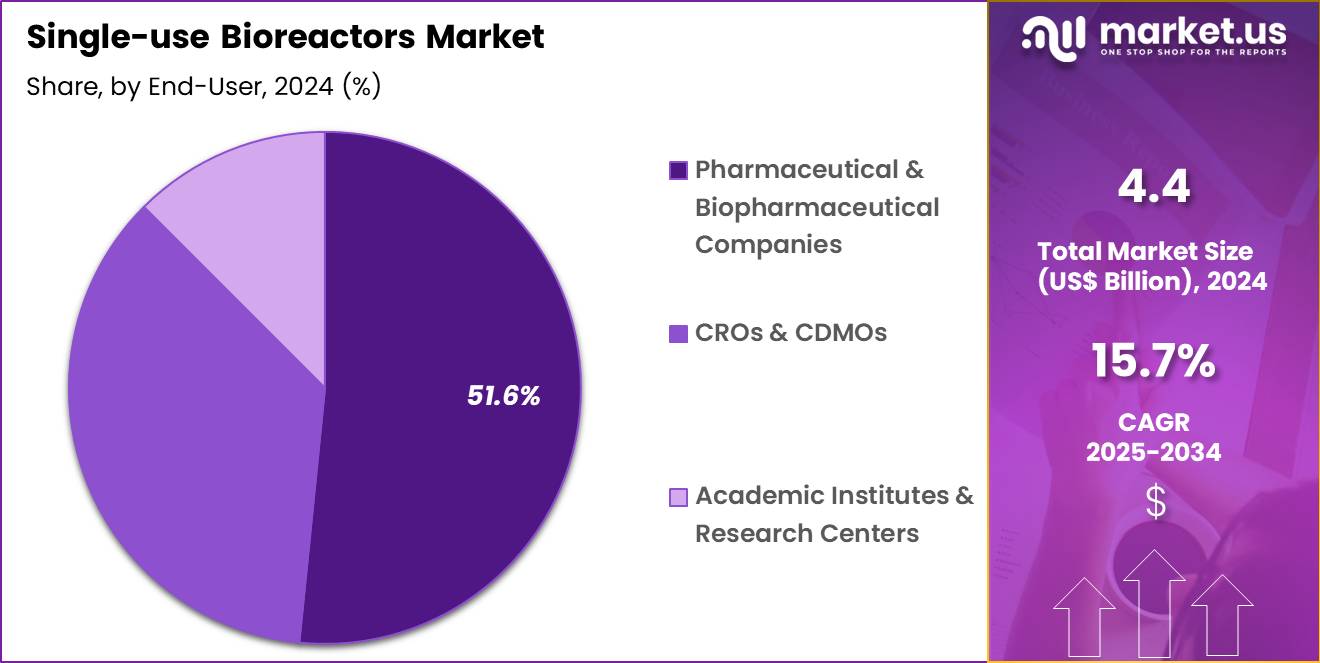

- Considering end-user, the market is divided into pharmaceutical & biopharmaceutical companies, CROs & CDMOs and academic institutes & research centers. Among these, pharmaceutical & biopharmaceutical companies held a significant share of 51.6%.

- North America led the market by securing a market share of 38.1% in 2024.

Component Analysis

Single-use bioreactor systems accounted for 67.4% of the single-use bioreactors market, reflecting their role as the core platform enabling disposable bioprocessing. Biomanufacturers prioritize integrated systems to reduce cleaning validation, downtime, and cross-contamination risk. Faster setup and turnaround times support accelerated production schedules.

Capital efficiency compared with stainless steel facilities strengthens adoption decisions. Modular scalability allows rapid capacity expansion to meet fluctuating demand. Standardized system designs improve process reproducibility across sites. Supplier innovation enhances sensor integration and process control capabilities.

Regulatory familiarity with disposable systems supports commercial deployment. Workforce efficiency improves due to simplified operations and maintenance. This segment is projected to expand steadily due to speed, flexibility, and cost advantages.

Bioreactor Type Analysis

Stirred-tank bioreactors represented 56.2% of the single-use bioreactors market, driven by their versatility across scales and processes. Manufacturers favor stirred-tank designs for precise control of mixing, oxygen transfer, and temperature. Strong compatibility with mammalian cell cultures supports biologics production. Scale-up predictability reduces process development risk.

Established process models accelerate technology transfer from development to manufacturing. Advances in impeller and bag design improve mass transfer performance. Broad vendor availability enhances supply reliability. Training familiarity lowers operational learning curves. Integration with automated control systems improves consistency. This segment is anticipated to maintain leadership due to proven performance and scalability.

Cell Culture Type Analysis

Mammalian cell culture accounted for 58.8% of the single-use bioreactors market, reflecting dominance of biologics in pharmaceutical pipelines. These cells enable complex post-translational modifications required for therapeutic efficacy. Rising demand for monoclonal antibodies and recombinant proteins expands usage.

Disposable systems align well with contamination-sensitive mammalian processes. Optimized media and feeds improve productivity economics. Process intensification strategies favor flexible single-use platforms. Regulatory expectations for product quality reinforce controlled culture environments. Increased adoption of CHO-based platforms sustains demand. Rapid scale adjustments support market responsiveness. This segment is expected to grow due to biologics-driven manufacturing needs.

Application Analysis

Monoclonal antibody production represented 39.5% of the single-use bioreactors market, supported by sustained growth in antibody-based therapeutics. Pharmaceutical pipelines continue to prioritize antibodies for oncology, autoimmune, and inflammatory diseases. High batch success rates benefit from closed, disposable processing.

Commercial demand requires flexible capacity to manage product life cycles. Single-use systems reduce time to market for new antibodies. Process standardization improves global manufacturing consistency. Continuous improvements in titers increase output per batch. Contract manufacturing adoption expands production volumes. Long product lifespans support sustained utilization. This application segment is likely to remain dominant due to strong therapeutic demand.

Workflow Stage Analysis

Commercial biomanufacturing accounted for 46.3% of the single-use bioreactors market, reflecting broad acceptance of disposables at production scale. Manufacturers deploy single-use systems to accelerate facility build and validation timelines. Reduced capital expenditure improves return on investment. Flexible production supports multi-product facilities and rapid changeovers.

Regulatory confidence in disposable manufacturing enables large-scale approvals. Supply chain resilience improves through modular capacity additions. Workforce efficiency increases due to simplified operations. Energy and water savings strengthen sustainability goals. Global capacity expansion drives demand for scalable solutions. This workflow stage is projected to sustain growth due to efficiency and flexibility benefits.

End-User Analysis

Pharmaceutical and biopharmaceutical companies held 51.6% of the single-use bioreactors market, reflecting their central role in biologics development and production. These organizations manage extensive pipelines requiring adaptable manufacturing platforms. Strategic investments favor technologies that shorten development-to-market timelines. Single-use adoption supports risk mitigation across multiple products.

Capital availability enables rapid facility expansion and upgrades. Integration with digital manufacturing enhances process visibility. Regulatory compliance priorities align with closed-system processing. Portfolio diversification increases demand for flexible capacity. Partnerships with suppliers strengthen innovation adoption. This end-user segment is expected to remain dominant due to sustained biologics investment and commercial scale requirements.

Key Market Segments

By Component

- Single-use bioreactor systems

- <10L

- 10-100L

- 101-500L

- 501-1500L

- Above 1500L

- Single-use media bags

- 2D Bags

- 3D Bags

- Others

- Tubing, Connectors, Assemblies

- Others

By Bioreactor Type

- Stirred-tank bioreactors

- Rocker bioreactors

- Air lift bioreactors

- Fixed-bed bioreactors

- Others

By Cell Culture Type

- Mammalian Cells

- Insect Cells

- Microbial Cells

- Others

By Application

- Monoclonal Antibody Production

- Vaccine Manufacturing

- Viral Vector Manufacturing

- Cell Therapy & Stem-Cell Expansion

- Recombinant Protein Production

- Others

By Workflow Stage

- Research & Development

- Process Development/Scale-up

- Clinical Manufacturing

- Commercial Biomanufacturing

By End-User

- Pharmaceutical & Biopharmaceutical Companies

- CROs & CDMOs

- Academic Institutes & Research Centers

Drivers

Increasing demand for biopharmaceutical production is driving the market

The single-use bioreactors market is driven by the increasing demand for biopharmaceutical production, which requires flexible and scalable systems to meet the growing needs of monoclonal antibody and vaccine manufacturing. Biopharmaceutical companies adopt single-use bioreactors to reduce cross-contamination risks and accelerate process development timelines. Regulatory agencies support the shift to single-use technologies for their ability to enhance manufacturing efficiency in compliant environments.

Healthcare systems benefit from faster product availability, addressing global demands for biologics in oncology and immunology. Academic research integrates single-use systems to facilitate high-throughput experiments in drug discovery. Global supply chains favor single-use bioreactors for their ease of deployment in remote or emerging facilities.

Pharmaceutical partnerships focus on system optimizations to support large-scale production volumes. Patient access to innovative therapies improves with reduced lead times enabled by single-use platforms. Economic factors emphasize cost savings from eliminated cleaning validation in repetitive runs. Sartorius Bioprocess Solutions division, a key provider of single-use bioreactors, reported sales revenue of €2,690.2 million in 2024, up from €2,678.2 million in 2023.

Restraints

Environmental and sustainability concerns are restraining the market

The single-use bioreactors market is restrained by environmental and sustainability concerns, as the reliance on plastic-based components contributes to waste generation and resource depletion. Developers face pressure to address the ecological footprint of disposable systems, which require fossil-derived materials for production. Regulatory bodies impose stricter guidelines on waste management, increasing compliance costs for manufacturers.

Healthcare facilities in eco-conscious regions hesitate to adopt single-use technologies without sustainable alternatives. Pharmaceutical firms invest in assessments to mitigate negative impacts on circular economy principles. Global supply chains encounter challenges in recycling single-use items due to contamination risks. Clinical operations must balance convenience with environmental responsibilities, complicating system selection.

Academic studies highlight the need for bio-based substitutions to reduce long-term restraints. Patient safety protocols intersect with sustainability demands, adding operational layers. Sartorius reports that 60-70% of its turnover comes from plastic-based products, with negative impacts on resource use from fossil-based disposables in 2024.

Opportunities

Growth in advanced therapies like cell and gene therapy is creating growth opportunities

The single-use bioreactors market offers growth opportunities through the expansion of advanced therapies such as cell and gene therapy, where flexible systems support small-batch production and rapid scaling. Developers can innovate bioreactors with enhanced mixing and aeration features tailored to viral vector manufacturing. Regulatory pathways for advanced therapies encourage investment in single-use platforms to meet stringent quality requirements.

Healthcare providers adopt these systems to enable personalized treatments in specialized centers. Pharmaceutical collaborations focus on integrating single-use bioreactors into modular facilities for decentralized production. Clinical research benefits from reduced setup times, facilitating faster therapy development.

Global health initiatives target rare diseases, broadening applications for single-use technologies. Patient outcomes improve with customized bioreactor configurations for autologous cell therapies. Economic models project returns from addressing unmet needs in regenerative medicine. Sartorius expanded its offerings for cell and gene therapies in 2024, including single-use solutions for viral vector production and purification.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic expansions energize the single-use bioreactors market as robust biopharmaceutical investments and vaccine production demands push manufacturers to scale up disposable systems for cost-effective, scalable operations. Executives at leading firms strategically deploy innovative designs to capitalize on economic booms in emerging regions, enhancing flexibility and reducing contamination risks in high-growth sectors.

Inflationary pressures, however, inflate raw material and energy costs, compelling companies to tighten budgets and delay facility upgrades during slowdowns. Geopolitical tensions, particularly U.S.-China trade disputes and the BIOSECURE Act’s restrictions on Chinese suppliers like WuXi, disrupt global supply chains for critical components, heightening risks and forcing reshoring efforts amid regulatory uncertainties.

Current U.S. tariffs under Section 301 impose duties up to 25% on Chinese-origin laboratory equipment as of December 2025, elevating import expenses for American distributors and squeezing margins while exemptions provide limited relief. These tariffs also trigger retaliatory measures from trading partners, complicating exports of U.S.-made bioreactors and straining international collaborations.

Despite these challenges, the tariff regime accelerates investments in domestic production hubs and nearshoring to allies like Europe, bolstering supply security. This strategic pivot fosters greater autonomy, drives technological advancements, and positions the market for resilient, profitable expansion in the years ahead.

Latest Trends

Greater standardization of bioreactor bags is a recent trend

In 2025, the single-use bioreactors market has shown a prominent trend toward greater standardization of bioreactor bags, enabling consistent performance across different manufacturing scales and facilities. Developers prioritize uniform designs to reduce variability in process validation and regulatory submissions. Healthcare manufacturers adopt standardized bags to streamline supply chains and minimize custom engineering costs.

Regulatory agencies advocate for standardization to enhance quality control in bioprocessing. Clinical production benefits from interchangeable components, facilitating technology transfers between sites. Academic research incorporates standardized systems to improve reproducibility in comparative studies. Global collaborations refine bag specifications for compatibility with diverse cell lines.

Patient therapies gain from reliable bag performance in critical applications like vaccine production. Ethical protocols ensure standardization supports equitable access to biomanufacturing tools. Cytiva reports that 85% of biomanufacturing facilities use single-use technologies, underscoring the trend toward standardization in 2025.

Regional Analysis

North America is leading the Single-use Bioreactors Market

In 2024, North America captured a 38.1% share of the global single-use bioreactors market, driven by the booming biopharmaceutical sector’s need for flexible, scalable manufacturing solutions that minimize cross-contamination risks and accelerate production timelines for monoclonal antibodies and cell therapies. Biomanufacturers increasingly adopted single-use systems to facilitate rapid process development and validation, aligning with stringent FDA guidelines that emphasize sterility and efficiency in vaccine and gene therapy outputs.

Contract development organizations expanded capacities with stirred-tank and wave-mixed bioreactors, enabling cost-effective small-batch runs for personalized medicine amid talent shortages in traditional stainless-steel setups. Rising investments in upstream bioprocessing optimized perfusion modes, supporting higher cell densities for chronic disease treatments like hemophilia. Pharmaceutical giants integrated sensor-equipped disposable bags to monitor pH and dissolved oxygen in real-time, enhancing yield predictability during scale-up phases.

Regulatory incentives promoted eco-friendly alternatives, reducing water and energy consumption in high-volume facilities. Collaborative R&D refined liner materials for durability, bridging gaps in long-term culture stability. The FDA’s Center for Biologics Evaluation and Research approved 11 novel biologic products in 2024, underscoring the reliance on adaptable single-use technologies to meet accelerated therapeutic demands.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Industry leaders project substantial momentum in single-use bioreactor deployment across Asia Pacific throughout the forecast period, propelled by governmental drives to localize biologic production and counter escalating demands for affordable therapeutics. Manufacturers invest in rocker-style units to streamline viral vector cultivation, catering to infectious disease vaccines in densely populated nations.

Health ministries subsidize facility upgrades with gamma-irradiated assemblies, equipping emerging hubs to handle autologous cell expansions for oncology trials. Biotech firms customize flexible film compositions, adapting to humid environments that challenge reusable equipment integrity. Regional consortia validate hybrid perfusion strategies, optimizing outputs for insulin biosimilars amid diabetes surges.

Pharmaceutical exporters forge alliances for technology transfers, ensuring compliance with international good manufacturing practices in export-oriented economies. Training academies equip engineers with automation interfaces, fostering self-sufficiency in upstream operations for orphan drug initiatives. China’s National Medical Products Administration approved 104 drugs in 2023, including numerous novel biologics, signaling robust infrastructural needs for disposable systems.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Single-use Bioreactors market drive growth by delivering scalable, ready-to-run systems that shorten setup time and reduce contamination risk for biologics and cell therapy manufacturing. Companies expand adoption by aligning products with flexible production models that support rapid changeovers and smaller batch sizes demanded by modern pipelines.

Commercial strategies focus on long-term supply agreements with biopharma firms and CDMOs, ensuring consistency of bags, sensors, and consumables. Innovation priorities include improved mixing, single-use sensors, and digital control software that enhances process visibility and yield.

Geographic expansion targets emerging biomanufacturing hubs where speed to clinic and lower capital expenditure matter most. Sartorius stands out as a leading company through its comprehensive bioprocess portfolio, global manufacturing footprint, and deep integration of single-use technologies across upstream and downstream workflows.

Top Key Players

- Sartorius AG

- Danaher (Cytiva & Pall)

- Thermo Fisher Scientific

- Merck KGaA

- Eppendorf SE

- PBS Biotech Inc.

- ABEC Inc.

- Corning Life Sciences

- Distek Inc.

- Cellexus Ltd.

- Celltainer Biotech BV

- Repligen Corporation

- Synthecon Inc.

- OmniBRx Biotechnologies

- Getinge AB

- Lonza

- Avantor

- Parker Hannifin Corp

- Entegris

Recent Developments

- In August 2025, Cytiva (a Danaher company) partnered with Culture Biosciences to integrate cloud-connected bioreactor technology into its hardware portfolio. This collaboration allows biopharmaceutical companies to manage single-use bioreactor runs remotely via a digital twin interface. The initiative aims to standardize data collection across scales, from lab-scale process development to commercial-scale manufacturing.

- In April 2025, AGC Biologics outlined its investment approach for large-scale single-use manufacturing at its upcoming facility in Yokohama, Japan. The site will incorporate two 5,000-liter single-use bioreactors to support production of mammalian cell–based biologics, positioning the facility among the most advanced biologics manufacturing operations in the country and strengthening domestic capacity for large-scale biologic drug production.

Report Scope

Report Features Description Market Value (2024) US$ 4.4 Billion Forecast Revenue (2034) US$ 18.9 Billion CAGR (2025-2034) 15.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Single-Use Bioreactor Systems (<10L, 10-100L, 101-500L, 501-1500L and Above 1500L), Single-Use Media Bags (2D Bags, 3D Bags and Others), Tubing, Connectors, Assemblies and Others), By Bioreactor Type (Stirred-Tank Bioreactors, Rocker Bioreactors, Air Lift Bioreactors, Fixed-Bed Bioreactors and Others), By Cell Culture Type (Mammalian Cells, Insect Cells, Microbial Cells and Others), By Application (Monoclonal Antibody Production, Vaccine Manufacturing, Viral Vector Manufacturing, Cell Therapy & Stem-Cell Expansion, Recombinant Protein Production and Others), By Workflow Stage (Research & Development, Process Development/Scale-Up, Clinical Manufacturing and Commercial Biomanufacturing), By End-User (Pharmaceutical & Biopharmaceutical Companies, CROs & CDMOs and Academic Institutes & Research Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape xSartorius AG, Danaher, Thermo Fisher Scientific, Merck KGaA, Eppendorf SE, PBS Biotech Inc., ABEC Inc., Corning Life Sciences, Distek Inc., Cellexus Ltd., Celltainer Biotech BV, Repligen Corporation, Synthecon Inc., OmniBRx Biotechnologies, Getinge AB, Lonza, Avantor, Parker Hannifin Corp, Entegris Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Single-use Bioreactors MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Single-use Bioreactors MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Sartorius AG

- Danaher (Cytiva & Pall)

- Thermo Fisher Scientific

- Merck KGaA

- Eppendorf SE

- PBS Biotech Inc.

- ABEC Inc.

- Corning Life Sciences

- Distek Inc.

- Cellexus Ltd.

- Celltainer Biotech BV

- Repligen Corporation

- Synthecon Inc.

- OmniBRx Biotechnologies

- Getinge AB

- Lonza

- Avantor

- Parker Hannifin Corp

- Entegris