Global Silicon Nitride Market By Type (Reaction-bonded Silicon Nitride (RBSN), Hot-pressed Silicon Nitride (HPSN), and Sintered Silicon Nitride (SSN)), By End-Use (Automotive, Photovoltaic, General Industry, Aerospace, Medical, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 177713

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

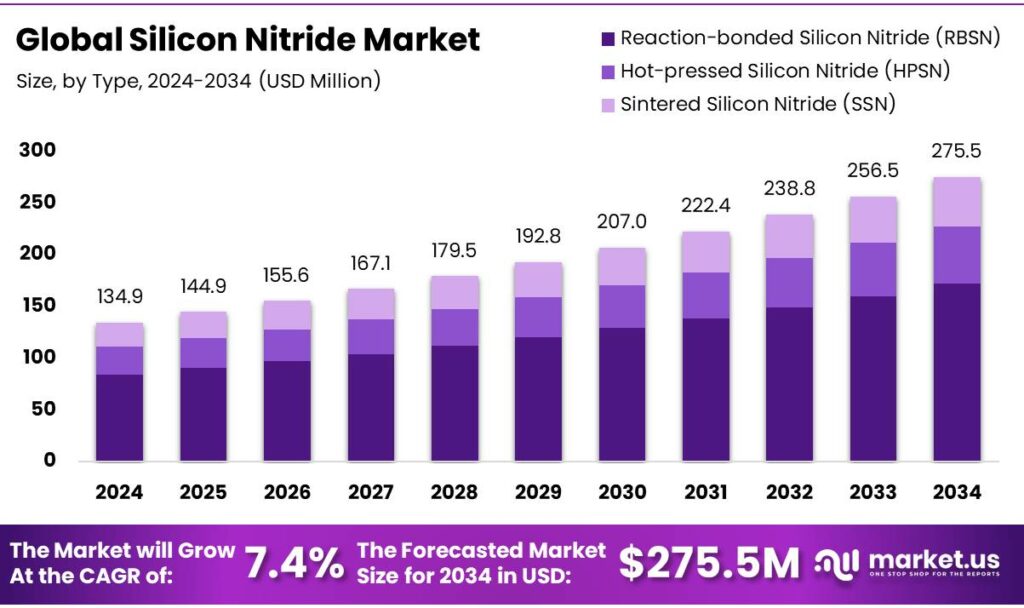

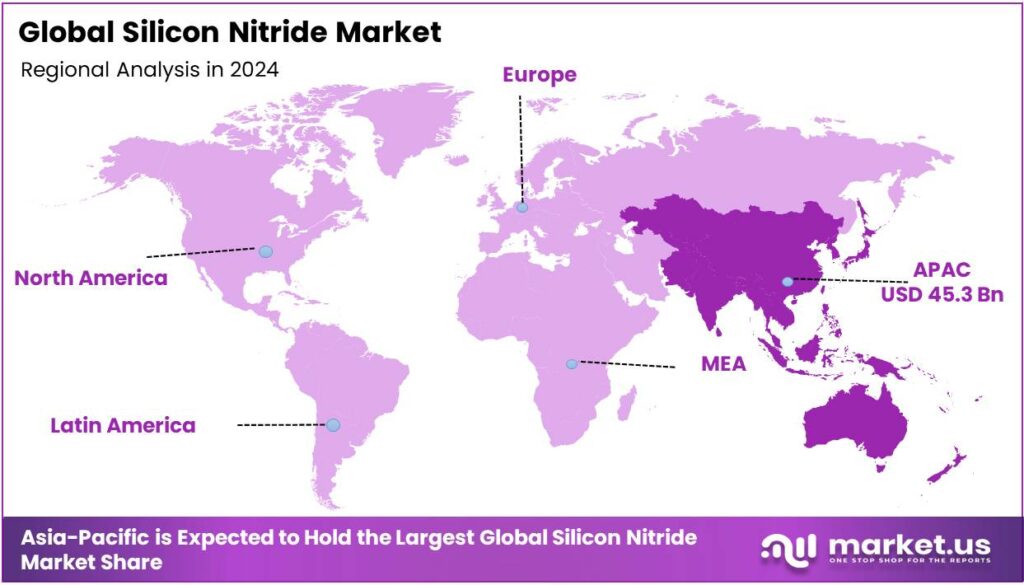

The Global Silicon Nitride Market is expected to be worth around USD 275.5 Million by 2034, up from USD 134.9 Million in 2024, and is projected to grow at a CAGR of 7.4% from 2025 to 2034. The Asia Pacific segment maintained 45.3%, supporting a Psychedelic Mushrooms value of USD 45.3 Mn.

Silicon nitride (Si₃N₄) is an advanced, non-metallic ceramic material known for its exceptional combination of mechanical, thermal, and chemical properties. Composed of silicon and nitrogen atoms held together by strong covalent bonds, it is one of the hardest (approximately 8.5 to 9 on the Mohs scale) and most durable ceramics available. In addition, it is roughly 60% lighter than steel, which is a major advantage for high-speed rotating components.

The silicon nitride market is shaped by a mix of high-volume, cost-driven uses and specialized, performance-critical applications. Photovoltaics account for the largest share of material usage, as silicon nitride thin films are widely applied as anti-reflection and passivation layers in crystalline silicon solar cells, enabling large-scale consumption with relatively simple processing.

Beyond solar, demand is driven by automotive and aerospace applications, where silicon nitride’s low density, high strength, thermal stability, and wear resistance support use in bearings, turbocharger components, and high-speed rotating systems. The semiconductor industry represents another important opportunity, using silicon nitride as a dielectric, passivation layer, and hard mask in advanced device fabrication.

Furthermore, biomedical applications, particularly orthopedic and spinal implants, are emerging due to proven biocompatibility and antibacterial behavior. However, broader adoption is constrained by high production costs and complex manufacturing, especially for dense sintered grades. Moreover, Asia Pacific dominates consumption, reflecting its concentration of photovoltaic manufacturing, semiconductor fabrication, and advanced ceramics production.

Key Takeaways

- The global silicon nitride market was valued at USD 134.9 million in 2024.

- The global silicon nitride market is projected to grow at a CAGR of 7.4% and is estimated to reach USD 275.5 million by 2034.

- Based on the type, reaction-bonded silicon nitride (RBSN) dominated the market, with a market share of around 62.5%.

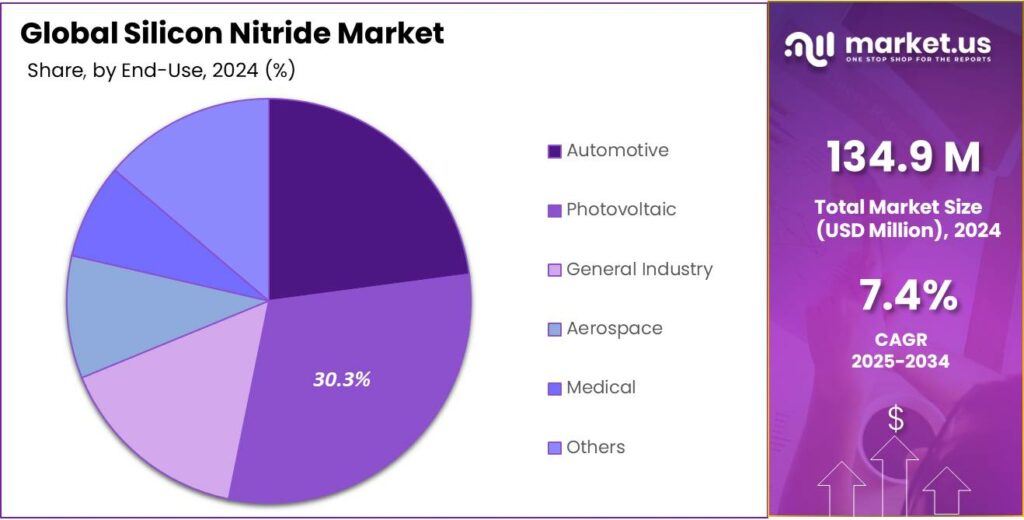

- Among the end-uses of silicon nitride, the photovoltaic sector held a major share in the market, 30.3% of the market share.

- In 2024, the Asia Pacific was the most dominant region in the silicon nitride market, accounting for around 45.3% of the total global consumption.

Type Analysis

Reaction-bonded Silicon Nitride (RBSN) Held the Largest Share in the Market.

The silicon nitride market is segmented based on type into reaction-bonded silicon nitride (RBSN), hot-pressed silicon nitride (HPSN), and sintered silicon nitride (SSN). The reaction-bonded silicon nitride (RBSN) dominated the market, comprising around 62.5% of the market share, primarily due to manufacturing practicality and cost efficiency. RBSN is produced by nitriding compacted silicon powder, a process that occurs at lower pressures and avoids the need for expensive hot-pressing equipment or sintering aids. This enables near-net-shape fabrication with minimal shrinkage (often below 1%), reducing machining requirements and material waste.

In contrast, HPSN and SSN require high temperatures, applied pressure, and precise atmosphere control, increasing energy use and capital intensity. Although RBSN exhibits lower fracture toughness and strength than HPSN or SSN, its adequate thermal shock resistance, oxidation stability, and dimensional control make it suitable for many structural, thermal, and furnace applications. These production and performance trade-offs support its broader adoption in cost- and geometry-sensitive uses.

End-Use Analysis

Silicon Nitride Was Mostly Utilized in the Photovoltaic Sector.

Based on the end-uses of silicon nitride, the market is divided into automotive, photovoltaic, general industry, aerospace, medical, and others. The photovoltaic sector dominated the market, with a market share of 30.3%, as it aligns well with high-volume manufacturing and standardized specifications that characterize the solar industry. In crystalline silicon solar cells, silicon nitride thin films are widely applied as anti-reflection and surface passivation coatings, where only micrometer-scale material thickness is required per wafer. This enables large aggregate consumption without the need for complex shaping, precision machining, or extreme mechanical performance.

In contrast, automotive, aerospace, medical, and general industrial uses often require bulk silicon nitride components with tightly controlled microstructures, higher purity, and extensive qualification, which significantly raise production cost and limit volumes. Consequently, silicon nitride’s optical, chemical, and electrical properties can be leveraged at scale in photovoltaics, whereas other applications remain more selective, specialized, and constrained by cost, certification, and processing complexity.

Key Market Segments

By Type

- Reaction-bonded Silicon Nitride (RBSN)

- Hot-pressed Silicon Nitride (HPSN)

- Sintered Silicon Nitride (SSN)

By End-Use

- Automotive

- Photovoltaic

- General Industry

- Aerospace

- Medical

- Others

Drivers

Rising Demand from Automotive and Aerospace Industries Drives the Silicon Nitride Market.

The rising demand for silicon nitride in automotive and aerospace sectors is rooted in its intrinsic material properties, including low density, high strength, and thermal stability at above 1000 °C, which enable performance in extreme environments.

In automotive applications, silicon nitride components such as turbocharger rotors and engine parts are produced at significant volumes; for instance, more than 300,000 sintered silicon nitride turbochargers are manufactured annually due to reduced inertia and improved responsiveness versus metal counterparts. Additionally, silicon nitride ball bearings are increasingly adopted in electric vehicle drivetrains to mitigate electrical erosion and improve life in high-speed, high-stress environments.

In aerospace, silicon nitride is specified for high-speed turbomachinery and hybrid ceramic rolling element bearings, including research into cryogenic rocket engine applications where durability at high speeds in liquid hydrogen environments is under evaluation. Silicon nitride bearings previously served in NASA Space Shuttle main engines, offering up to 80% lower friction and up to 10 times longer life compared with metal bearings, critical in flight and propulsion systems.

Restraints

High Production Costs and Complex Manufacturing Pose Challenges to the Silicon Nitride Market.

Production of silicon nitride ceramics involves technically demanding processes, including powder preparation, high-temperature sintering (above 1,700 °C), hot pressing, and gas pressure sintering, which require advanced equipment, controlled atmospheres, and energy-intensive operations. These factors contribute to production costs far exceeding conventional ceramic materials, with reductions targeted as an industry priority.

The complexity extends to manufacturing yields and fabrication, including achieving tight tolerances for precision components, which often results in yield rates substantially below those of traditional ceramics, increasing per-unit costs due to scrap and extended processing time. In addition, real-world production cycles can span 20-40 hours at high temperatures, amplifying energy consumption and capital requirements for facilities.

Moreover, brittleness and machining challenges further necessitate specialized tooling and inspection, reinforcing barriers to adoption in cost-sensitive sectors where alternative materials remain economically preferable.

Opportunity

Application in Semiconductor Manufacturing Creates Opportunities in the Market.

Silicon nitride presents a material opportunity in semiconductor manufacturing due to its well-documented roles in device fabrication. Thin films of silicon nitride are widely used as dielectric and passivation layers in integrated circuits, where they act as protective barriers against ionic and moisture diffusion after most processing steps, enhancing device reliability.

Similarly, in semiconductor lithography and etch processes, silicon nitride functions as a hard mask material with high mechanical and chemical stability, facilitating pattern transfer with minimal erosion relative to softer dielectrics.

Moreover, silicon nitride is employed in micro-electromechanical systems (MEMS) fabrication and can serve as an isolation spacer in advanced transistor architectures, indicating utility across diverse device types. These manufacturing applications underscore silicon nitride’s technical advantages as a high-performance material within semiconductor fabrication.

Trends

Demand for Silicon Nitride in Biomedical Applications.

Silicon nitride is increasingly recognized in the biomedical sector due to its biocompatibility, osteogenic activity, and antibacterial properties. It has been used in orthopedic and spinal implants cleared by regulatory bodies such as the FDA and CE authorities, meeting animal study and compliance standards for clinical use. Its mechanical properties make the compound suitable for load-bearing implant applications where durability is critical. Additionally, the material demonstrates simultaneous inhibition of bacterial proliferation and support for eukaryotic cell activity, distinguishing it from many traditional biomaterials.

The material shows non-toxic cytocompatibility and antibacterial performance against common pathogens such as Staphylococcus aureus and Escherichia coli, indicating potential to reduce implant-associated infections. Additionally, it contributes to enhanced bone cell adhesion and osteogenic responses in scaffold and implant systems, reinforcing its utility in bone tissue engineering. These technical and biological characteristics underscore a tangible uptake trend in biomedical sectors where longevity and infection control are priorities.

Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the Silicon Nitride Market by Shifting Trade Flows.

The geopolitical tensions, particularly between the United States and China, are materially reshaping global supply chains for advanced materials and technologies integral to semiconductor manufacturing, and by extension, affect inputs such as silicon nitride used in specialized equipment and processes. The U.S. export controls on semiconductor manufacturing technologies have been expanded to restrict China’s access to advanced chips, tools, and related materials, reflecting national security concerns and influencing global production networks.

Similarly, export licensing regimes instituted by China for critical minerals and technologies, such as tightened controls in late 2025 on rare earths and processing technology relevant to high-tech industries, illustrate reciprocal policy measures that can disrupt material flows. China produces more than 90% of the world’s processed rare earths and related materials, which interface with semiconductor and high-performance ceramic supply chains.

Consequently, governments are responding with strategic initiatives such as the U.S.-led Pax Silica Declaration, aiming to strengthen supply chains for semiconductors and critical materials across allied nations, targeting resilience from extraction through manufacturing. These policy-driven shifts underscore geopolitical risk as a structural factor in the silicon nitride supply base tied to semiconductor ecosystems.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Silicon Nitride Market.

In 2024, the Asia Pacific dominated the global silicon nitride market, holding about 45.3% of the total global consumption, commanding the largest share of global consumption and production. This prominence is supported by concentrated manufacturing capabilities in China, Japan, South Korea, and India, where industrial adoption spans electronics, photovoltaics, and advanced ceramics applications.

- According to the United States Geological Survey, China accounted for more than 70% of the total global estimated production of silicon materials in 2023.

In particular, China plays a central role with strategic emphasis on high-technology manufacturing and advanced materials aligned with national industrial policies. As a major producer and consumer of semiconductor and automotive components, the country is a focal point for silicon nitride integration into high-performance applications.

Japan and South Korea contribute advanced fabrication expertise, especially for semiconductors and electronics, reinforcing the region’s material demand base. Asia Pacific’s combination of industrial scale, diversified applications, and technology focus substantiates its role as the largest regional market for silicon nitride.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Manufacturers of silicon nitride focus on a set of operational and technology-driven strategies to strengthen competitiveness and expand market presence. They focus on process optimization, including improvements in powder synthesis, sintering methods, and yield control, aimed at reducing defect rates and lowering unit production costs while maintaining high material purity. Additionally, the focus is on product differentiation with several manufacturers developing application-specific grades for components that meet tighter performance and regulatory requirements.

Furthermore, companies emphasize vertical integration and long-term supply agreements to secure access to high-purity raw materials and stabilize production continuity. Similarly, there is emphasis on collaboration with end-use industries, such as joint development programs with automotive, semiconductor, or medical device manufacturers.

Key Development

- In December 2025, SINTX Technologies announced a supply deal with Evonik to produce its patented silicon nitride-PEEK (SiN/PEEK) compound, designed for AI-assisted additive manufacturing of patient-specific implants, using SINTX’s existing U.S. production equipment.

- In November 2024, Niterra Co., Ltd. announced the acquisition of all shares of Toshiba Materials Co., Ltd. Toshiba Materials specializes in the development, production, and sale of fine ceramics and related components and materials. The acquisition was anticipated to create synergies in the production of silicon nitride ceramic balls for electric vehicle motor bearings and silicon nitride heat-dissipation substrates for power semiconductors used in inverters.

The Major Players in The Industry

- Denka Company Limited

- UBE Corporation

- Saint-Gobain

- Precision Ceramics

- Alzchem Group

- KYOCERA Corporation

- 3M Company

- Niterra Materials Corporation

- Morgan Advanced Materials plc

- CoorsTek

- Paul Rauschert GmbH & Co. KG

- Reade Advanced Materials

- Evonik

- Other Key Players

Report Scope

Report Features Description Market Value (2024) US$134.9 Mn Forecast Revenue (2034) US$275.5 Mn CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Reaction-bonded Silicon Nitride (RBSN), Hot-pressed Silicon Nitride (HPSN), and Sintered Silicon Nitride (SSN)), By End-Use (Automotive, Photovoltaic, General Industry, Aerospace, Medical, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Denka Company Limited, UBE Corporation, Saint-Gobain, Precision Ceramics, Alzchem Group, KYOCERA Corporation, 3M Company, Niterra Materials Corporation, Morgan Advanced Materials plc, CoorsTek, Paul Rauschert GmbH & Co. KG, Reade Advanced Materials, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Denka Company Limited

- UBE Corporation

- Saint-Gobain

- Precision Ceramics

- Alzchem Group

- KYOCERA Corporation

- 3M Company

- Niterra Materials Corporation

- Morgan Advanced Materials plc

- CoorsTek

- Paul Rauschert GmbH & Co. KG

- Reade Advanced Materials

- Evonik

- Other Key Players