Global Silage Film Market Size, Share, And Business Benefits By Type (3-Layered, 5-Layered, 7-Layered, Others), By Resin (LLDPE and LDPE, HDPE, Ethylene Vinyl Acetate (EVA), Others), By Application (Grasses Silage, Corn Silage, Vegetables Silage, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151251

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

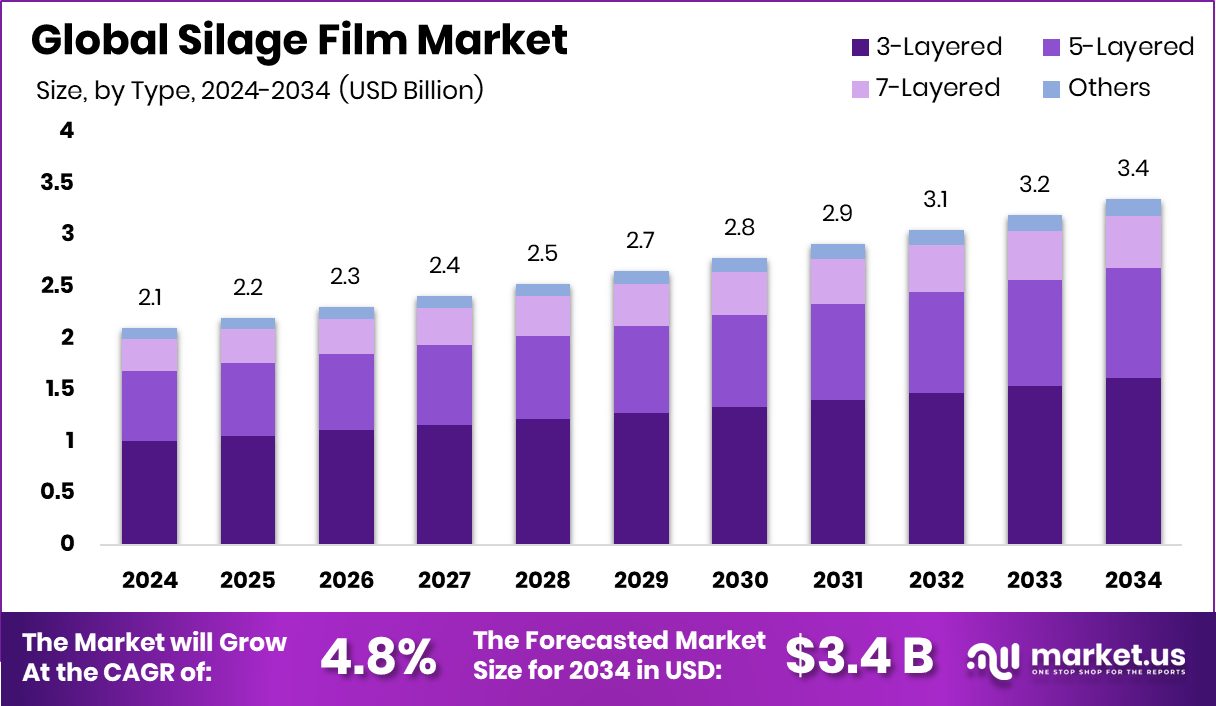

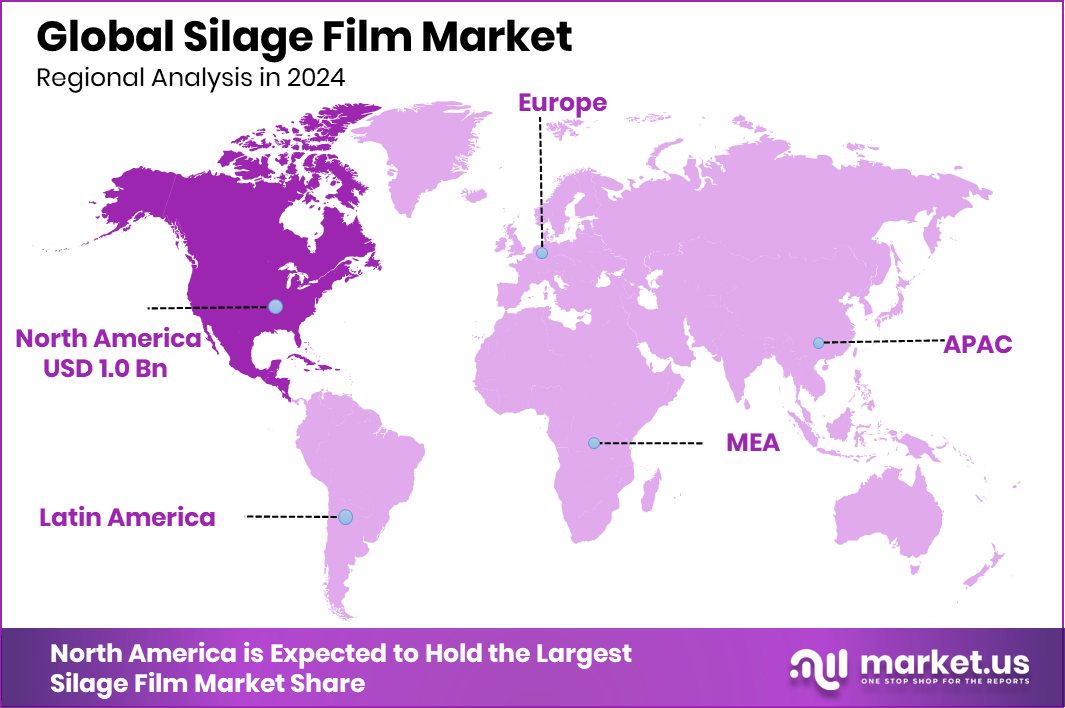

Global Silage Film Market is expected to be worth around USD 3.4 billion by 2034, up from USD 2.1 billion in 2024, and grow at a CAGR of 4.8% from 2025 to 2034. With a 49.3% share, North America leads the Silage Film Market in 2024.

Silage film is a type of stretchable plastic film used in agriculture to wrap and preserve silage, a fermented feed made from grass, corn, or other crops. It helps in maintaining the nutritional value of the feed by creating an airtight seal, preventing exposure to air and moisture. This promotes anaerobic fermentation, which is essential for preserving the feed over a long period.

The silage film market refers to the industry involved in the production, distribution, and sale of silage wrapping solutions used in farming operations. As livestock farming and dairy production grow globally, so does the demand for efficient silage storage methods. This market includes various film types such as black, white, and colored films, each serving different climatic or functional purposes.

The growth of the silage film market is largely driven by the increasing demand for high-quality livestock feed throughout the year. The rising awareness among farmers about feed preservation, combined with changing weather patterns that make traditional storage less reliable, is accelerating adoption. According to an industry report, Agritech Startup Cornext Raises $2.2 Million to Expand Silage Production

Demand for silage film is especially strong in regions with large-scale cattle and dairy farms. As global meat and milk consumption continues to rise, the pressure on farmers to ensure consistent feed availability grows. This directly impacts the need for better feed storage options like silage films. The shift towards more efficient and sustainable farming practices is further supporting this trend.

Key Takeaways

- Global Silage Film Market is expected to be worth around USD 3.4 billion by 2034, up from USD 2.1 billion in 2024, and grow at a CAGR of 4.8% from 2025 to 2034.

- 3-layered silage film dominates the market, capturing 48.1% due to its enhanced durability.

- LLDPE and LDPE hold 62.5% market share and are preferred for flexibility and sealing performance.

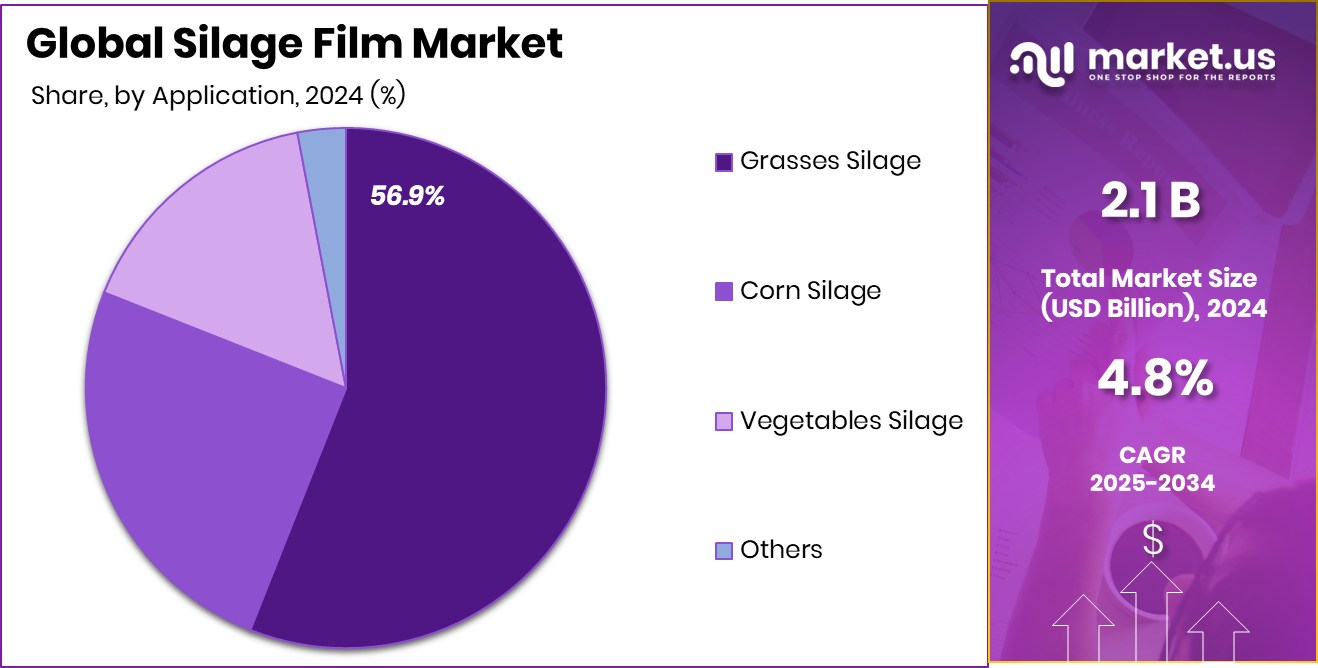

- Grass silage leads usage at 56.9%, as farmers prioritize preserving nutrient-rich forage for livestock.

- North America’s strong dairy farming boosted Silage Film demand to USD 1.0 Bn.

By Type Analysis

In the silage film market, 3-layered films dominate with 48.1% usage due to durability.

In 2024, 3-Layered held a dominant market position in the By Type segment of the Silage Film Market, with a 48.1% share. This strong performance is attributed to its balance of durability, flexibility, and cost-effectiveness, making it a preferred choice among farmers and agricultural businesses.

The 3-layered structure provides enhanced puncture resistance and superior oxygen barrier properties, which are critical for preserving the quality of silage over extended periods. Its performance in various climatic conditions further adds to its appeal, especially in regions with fluctuating weather patterns that demand reliable wrapping solutions.

The widespread adoption of 3-layered silage films also reflects growing awareness of feed preservation efficiency. Farmers are increasingly recognizing the value of investing in films that reduce spoilage and improve fermentation, ultimately leading to better livestock productivity.

The 48.1% market share highlights the growing reliance on this film type, particularly in regions where dairy and cattle farming form a significant part of the agricultural economy. With its proven performance and practical advantages, 3-layered silage film continues to maintain a competitive edge in the market, setting a benchmark in quality and reliability within the By Type segment of the silage film industry.

By Resin Analysis

LLDPE and LDPE resins lead the silage film market, comprising 62.5% of total consumption.

In 2024, LLDPE and LDPE held a dominant market position in the By Resin segment of the Silage Film Market, with a 62.5% share. This dominance is largely due to the favorable material properties these resins offer, including high flexibility, excellent tensile strength, and superior tear resistance. These characteristics make LLDPE and LDPE ideal for agricultural applications like silage wrapping, where durability and film integrity are essential for maintaining airtight conditions.

The ability of these resins to provide consistent thickness and uniform film quality contributes to reliable silage preservation, reducing the risk of spoilage caused by oxygen infiltration. Additionally, their compatibility with multi-layer film extrusion technologies enhances the mechanical performance of silage films, further solidifying their preference among manufacturers and end-users alike. The cost-effectiveness of LLDPE and LDPE, combined with their wide availability, supports their extensive use across various farming scales.

With a 62.5% share, the strong presence of LLDPE and LDPE in the By Resin segment reflects market confidence in these materials’ ability to meet evolving agricultural demands. Their continued use is expected to remain steady as farmers prioritize efficiency, durability, and consistent feed protection in their silage management practices.

By Application Analysis

Grasses silage represents 56.9% of the silage film market, reflecting strong demand in livestock feeding.

In 2024, Grasses Silage held a dominant market position in the By Application segment of the Silage Film Market, with a 56.9% share. This significant share underscores the widespread use of silage film in preserving grass-based feed, which is a primary component in livestock diets, particularly for dairy and cattle farming. Grasses are harvested in large volumes during peak seasons, making efficient storage methods crucial to maintaining their nutritional quality over extended periods.

Silage films play a key role in ensuring proper fermentation of grass silage by providing an airtight seal, which prevents spoilage and minimizes feed loss. The dominance of grass silage in this segment also reflects the global reliance on grass crops as a cost-effective and readily available fodder option. Farmers prefer wrapping grass silage due to its high moisture content, which demands reliable sealing to prevent aerobic degradation.

With a 56.9% share, the grass silage application continues to lead due to its consistency, compatibility with silage film technologies, and year-round feeding importance. The preference for grass silage highlights the essential role of silage film in supporting livestock productivity through well-preserved, high-quality feed, reinforcing its dominance in this application segment.

Key Market Segments

By Type

- 3-Layered

- 5-Layered

- 7-Layered

- Others

By Resin

- LLDPE and LDPE

- HDPE

- Ethylene Vinyl Acetate (EVA)

- Others

By Application

- Grasses Silage

- Corn Silage

- Vegetables Silage

- Others

Driving Factors

Rising Need for Better Livestock Feed Storage

One of the top driving factors for the silage film market is the growing need for better ways to store livestock feed. Farmers across the world are facing challenges with changing weather conditions and the rising cost of animal feed. Silage films help protect the feed from air and moisture, keeping it fresh and nutritious for longer periods.

This means less waste and healthier animals. As livestock farming increases, especially in dairy and meat production, the demand for safe and long-lasting storage methods also grows. Silage film is a simple yet powerful solution, making it an essential part of modern farming.

Restraining Factors

Environmental Concerns About Plastic Waste Disposal

A key restraining factor in the silage film market is the growing concern over plastic waste and its impact on the environment. Most silage films are made from plastic materials like LLDPE and LDPE, which are not biodegradable and can be difficult to recycle, especially in rural farming areas. As awareness about pollution and sustainability increases, governments and environmental groups are pushing for stricter regulations on plastic use.

Farmers may face challenges in disposing of used films properly, leading to hesitation in using them. This concern can slow down the adoption of silage films, especially where eco-friendly disposal systems are not available, and may shift interest toward alternative materials that are more environmentally friendly.

Growth Opportunity

Growing Demand for Eco-Friendly Silage Films

A major growth opportunity in the silage film market lies in the rising demand for eco-friendly and biodegradable film options. As environmental concerns increase, both farmers and regulators are looking for greener alternatives to traditional plastic films. This shift opens up a new space for innovation and product development. Companies that invest in sustainable materials and recycling solutions have the chance to stand out in the market.

Many farmers are also becoming more aware of their environmental impact and are willing to adopt solutions that reduce waste. Offering biodegradable silage films not only meets these needs but also builds long-term customer trust, creating strong growth potential for businesses focused on sustainability in agriculture.

Latest Trends

Multi-Layer Films Becoming Popular Among Farmers

One of the latest trends in the silage film market is the growing use of multi-layer films, especially 3-layer and 5-layer options. These films offer better strength, flexibility, and protection compared to single-layer films. Farmers prefer them because they seal more tightly, keeping air and moisture out, which helps preserve feed for a longer time.

Multi-layer films also reduce the risk of tears or holes during wrapping and storage. This makes them more reliable, especially in harsh weather conditions. As awareness of their benefits spreads, more farmers are switching to multi-layer films. This trend is helping improve feed quality while reducing waste, making it a smart choice for modern, efficient farming practices.

Regional Analysis

North America held 49.3% market share in Silage Film, reaching USD 1.0 Bn.

In 2024, North America emerged as the dominating region in the Silage Film Market, accounting for 49.3% of the global share, valued at USD 1.0 Bn. This leadership is driven by the region’s advanced livestock farming practices, particularly in the United States and Canada, where high demand for quality feed storage solutions supports the strong adoption of silage films. The consistent growth in dairy and meat production continues to reinforce the region’s leading position.

Europe also holds a notable share, supported by widespread awareness of silage preservation and regulatory support for modern agricultural practices. Asia Pacific is witnessing steady growth due to the expanding livestock sector in countries such as China and India, although it still lags behind North America in terms of market value. The Middle East & Africa and Latin America represent emerging markets, where adoption is gradually increasing with improvements in agricultural infrastructure.

However, these regions remain smaller in value compared to established markets. Despite regional variations, North America’s dominant 49.3% share reflects its mature agricultural systems and growing emphasis on feed efficiency, making it the most influential player in the global silage film landscape in 2024.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, key companies such as Maschinenfabrik Bernard KRONE GmbH & Co. KG, Berry Global Inc., RKW Group, and Trioworld have shown a strong and strategic presence in the global silage film market. Each of these players brings distinct strengths that contribute to the competitive structure of the industry.

Maschinenfabrik Bernard KRONE GmbH & Co. KG, known for its agricultural machinery, continues to expand its influence in silage handling by offering film solutions that integrate well with its baling systems. This vertical integration enhances user experience and strengthens brand loyalty in the farming community.

Berry Global Inc., with its global manufacturing reach and deep expertise in plastic technologies, maintains a competitive edge through innovation in material science. Its focus on product performance and sustainability allows it to meet rising farmer demand for durable and eco-friendly silage wraps.

RKW Group has leveraged its expertise in film manufacturing to provide high-performance silage films that support efficient feed preservation. Its emphasis on consistent quality and product reliability keeps it well-positioned in both mature and developing markets.

Trioworld continues to focus on multi-layer film technology, offering products that ensure superior sealing and stretch capabilities. Its commitment to research and user-focused development has helped it remain a trusted name among large-scale agricultural operations.

Top Key Players in the Market

- Maschinenfabrik Bernard KRONE GmbH & Co. KG

- Berry Global Inc.

- RKW Group

- Trioworld

- Joachim Behrens Scheessel Gmbh

- Rani Group

- Coveris

- Shandong Longxing Plastic Film Company

- BSK & Lakufol Kunststoffe GmbH

- Groupe Barbier

- GABRIEL-CHEMIE GROUP

- IRIS Polymers

- Bialpak

- DUO PLAST AG

- Silopak

- XINJIANG RIVAL TECH CO., LTD

Recent Developments

- In April 2025, Trioworld restructured its business structure, introducing a brand-new Recycling Division. This unit focuses on processing industrial stretch and silage film waste into high-quality recycled material, furthering their sustainability goals.

- In October 2024, Rani Plast acquired UAB Umaras, a well-known Lithuanian manufacturer of flexible packaging films with around €40 million in annual sales. This move helps Rani Plast expand its geographic reach and broaden its product portfolio, including silage films—an important step in strengthening its European presence.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Billion Forecast Revenue (2034) USD 3.4 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (3-Layered, 5-Layered, 7-Layered, Others), By Resin (LLDPE and LDPE, HDPE, Ethylene Vinyl Acetate (EVA), Others), By Application (Grasses Silage, Corn Silage, Vegetables Silage, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Maschinenfabrik Bernard KRONE GmbH & Co. KG, Berry Global Inc., RKW Group, Trioworld, Joachim Behrens Scheessel Gmbh, Rani Group, Coveris, Shandong Longxing Plastic Film Company, BSK & Lakufol Kunststoffe GmbH, Groupe Barbier, GABRIEL-CHEMIE GROUP, IRIS Polymers, Bialpak, DUO PLAST AG, Silopak, XINJIANG RIVAL TECH CO., LTD Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Maschinenfabrik Bernard KRONE GmbH & Co. KG

- Berry Global Inc.

- RKW Group

- Trioworld

- Joachim Behrens Scheessel Gmbh

- Rani Group

- Coveris

- Shandong Longxing Plastic Film Company

- BSK & Lakufol Kunststoffe GmbH

- Groupe Barbier

- GABRIEL-CHEMIE GROUP

- IRIS Polymers

- Bialpak

- DUO PLAST AG

- Silopak

- XINJIANG RIVAL TECH CO., LTD