Global Shoulder Fired Weapons Market Size, Share Analysis By Technology (Guided, Unguided), By Weapon Type (Man-Portable Air Defense Systems (MANPADS), Rocket-Propelled Grenade Launchers (RPGs), Anti-Tank Guided Missile (ATGM) Launchers, Recoilless Rifles, Shoulder-Launched Assault Weapons (SLAW), By Range (Short (Less than 500 m), Medium (500 – 2 km), Long (Greater than 2 km), By Projectile (Launcher/Tube, Projectile/Missile, Fire-Control and Sighting Systems), By End-User (Army, Navy, Air Force, Special Operations Forces, Homeland Security and Law Enforcement), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154956

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

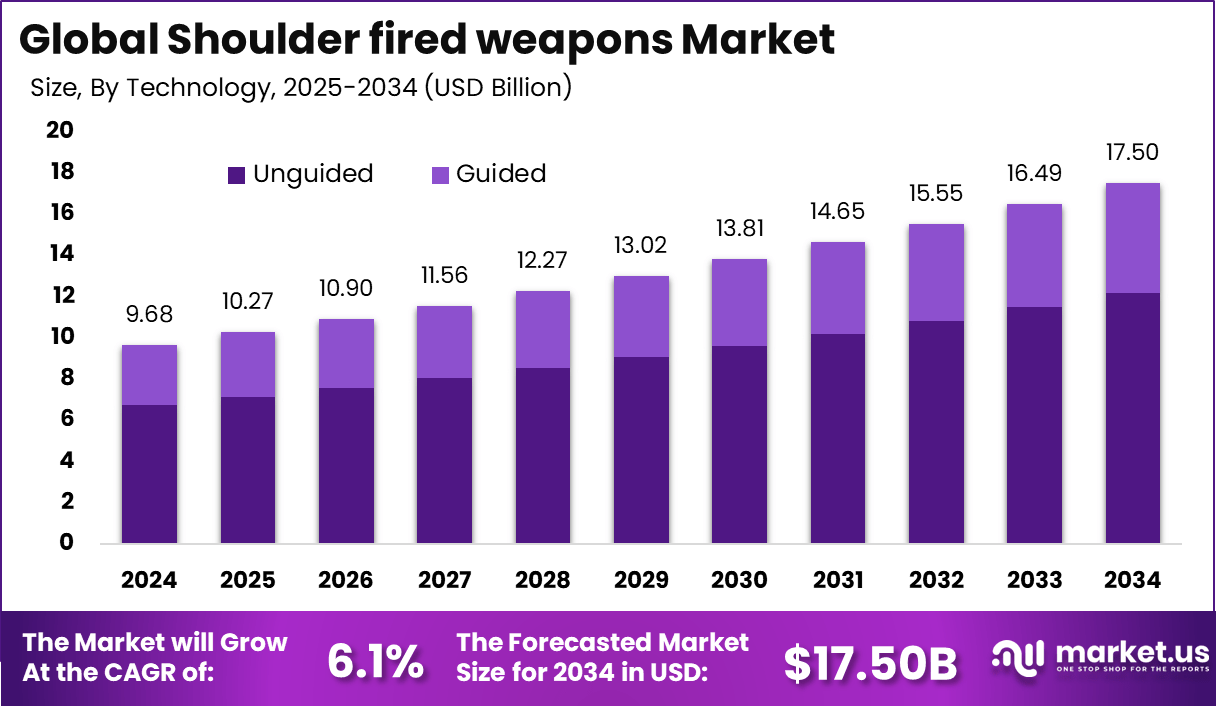

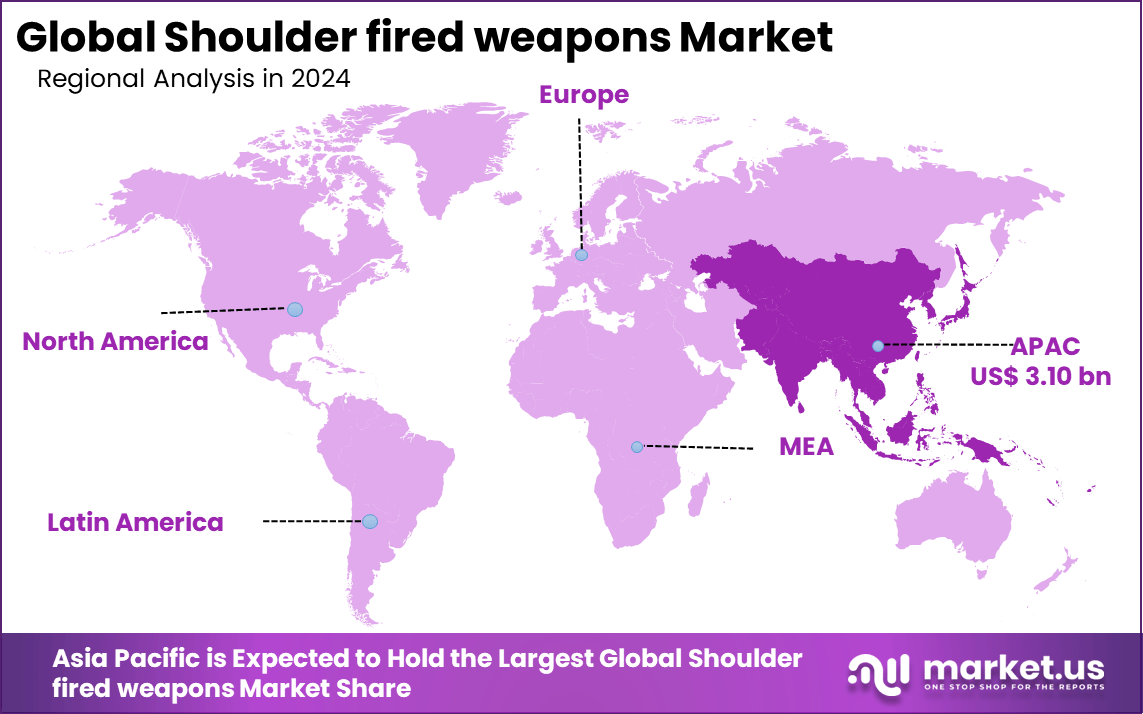

The Global Shoulder fired weapons Market size is expected to be worth around USD 17.50 billion by 2034, from USD 9.68 billion in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 32.1% share, holding USD 3.10 billion in revenue.

The shoulder-fired weapons market revolves around portable, man-carried projectile weapons designed for rapid deployment and effective combat use by infantry. These weapons, which include anti-tank guided missiles, man-portable air defense systems, and rocket-propelled grenades, are essential in modern warfare due to their versatility, mobility, and precision. Their small size lets soldiers fire them from the shoulder to quickly target vehicles, aircraft, and bunkers.

A primary driver of the shoulder-fired weapons market is the increasing geopolitical tensions and ongoing border conflicts that necessitate effective portable defense solutions. Modern military modernization efforts emphasize enhancing mobility and firepower at the infantry level, pushing demand for advanced systems that integrate improved targeting, lighter materials, and modular designs.

According to SIPRI, European countries recorded a 16% increase in defense spending in 2024. Notably, eastern NATO members such as Poland and Finland raised their defense budgets by over 30%, reflecting heightened preparedness against regional threats. Shoulder-fired weapons like the FGM-148 Javelin and NLAW have demonstrated proven combat effectiveness in Ukraine, reinforcing their role as critical tactical assets in modern conflict scenarios.

Market Size and Growth

Metric Statistic / Value Market Value (2024) USD 9.68 Bn Forecast Revenue (2034) USD 17.50 Bn CAGR(2025-2034) 6.1% Leading Segment Launcher/Tube: 73.8% Region with Largest Share Asia Pacific [32.1% Market Share] Largest Country China [USD 1.82 bn Market Revenue], CAGR: 8.11% For instance, in April 2024, the Indian Army advanced its ₹6,800 crore indigenous shoulder-fired missile project to strengthen border defense against China and Pakistan. The project focuses on developing advanced missile systems to counter aerial and ground threats along the northern and western borders, enhancing India’s defense capabilities in response to evolving security challenges from neighboring countries.

Technological adoption in shoulder-fired weapons is progressing rapidly through advances in guidance systems, lightweight and durable materials, and integrated digital fire control. Recent trends include the incorporation of laser-guided and infrared homing technologies that enhance accuracy and minimize collateral damage. The integration of artificial intelligence and machine learning in targeting and fire control systems is beginning to improve autonomous target acquisition and decision-making capabilities considerably

Key Takeaway

- The Unguided segment led the market with a 69.6% share, driven by its cost-effectiveness, ease of use, and suitability for short-range engagements in conventional and asymmetric warfare.

- Rocket-Propelled Grenade Launchers (RPGs) dominated the product category with a 52.7% share, widely adopted due to their portability, firepower, and tactical versatility in combat zones.

- The Short-range (less than 500 m) segment held a dominant 61.3% share, reflecting the operational demand for close-combat weapons, especially in urban and rugged terrains.

- Launcher/Tube systems captured the largest component share at 73.8%, as these are integral to deploying shoulder-fired munitions and are widely used across defense forces.

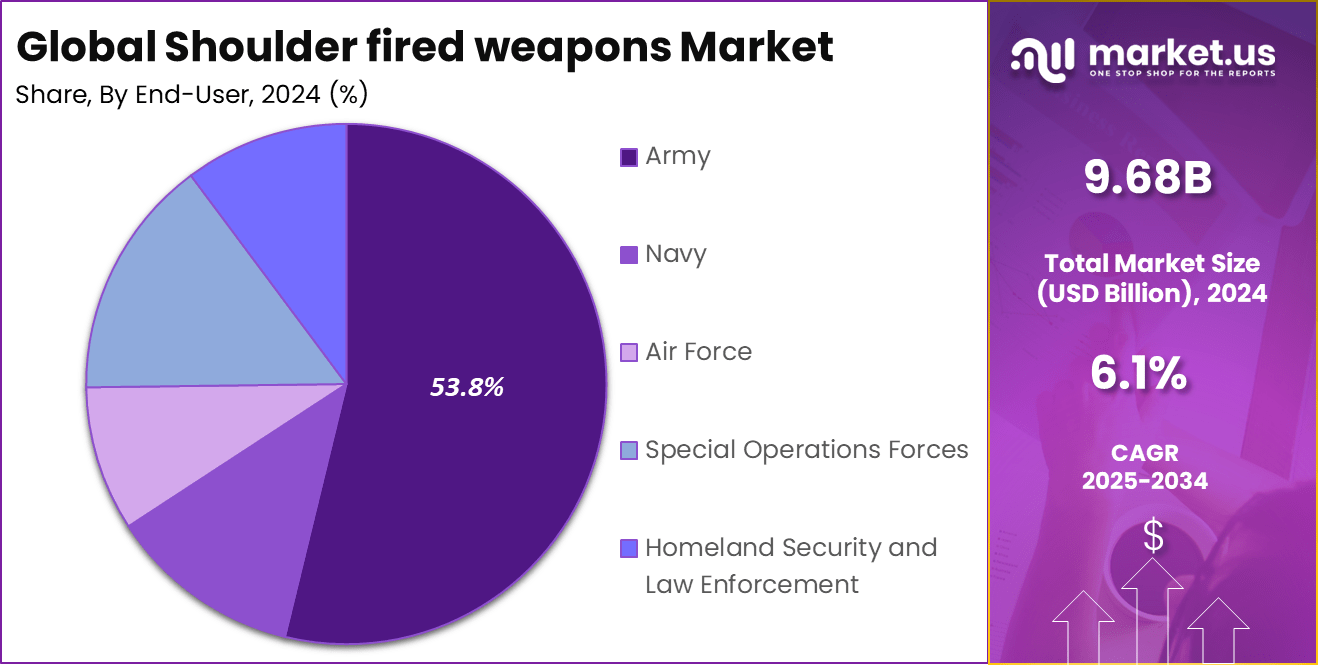

- The Army segment accounted for 53.8% of the market, with strong procurement activity to enhance infantry mobility, anti-armor capability, and tactical readiness.

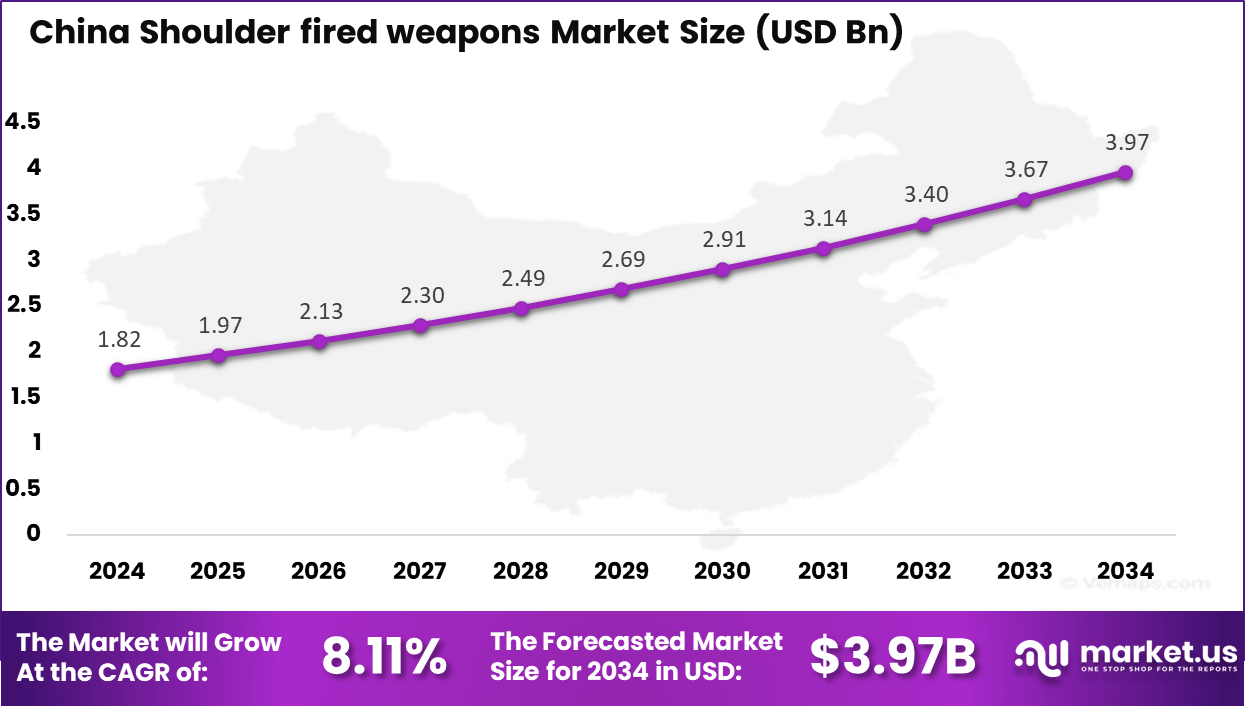

- China contributed USD 1.82 billion in 2024 and is projected to grow at a healthy CAGR of 8.1%, driven by ongoing modernization programs and regional security dynamics.

- Asia Pacific led globally with a 32.1% share, supported by rising defense expenditures, cross-border tensions, and indigenous weapon development across key economies.

China’s Market Size

The market for Shoulder fired weapons within China is growing tremendously and is currently valued at USD 1.82 billion, the market has a projected CAGR of 8.11%. The market is experiencing rapid growth as governments increase their defense spending, upgrade their military equipment, and strive to enhance the proficiency of foot soldiers.

Innovations in guidance systems and multi-role capabilities are further driving this growth. The market is also growing with the latest advancements in targeting systems and versatile functions. Additionally, the U.S. continues to prioritize the development of advanced shoulder-fired weapons to maintain military superiority in various global defense scenarios, including urban and asymmetric warfare.

For instance, In May 2025, China unveiled a new variant of the DZJ-08 80mm rocket launcher, now equipped with a programmable warhead to improve performance in urban combat. The system features a detachable fire control unit with a digital display and keypad, enabling precise targeting. This upgrade underscores China’s continued focus on modernizing its shoulder-fired weapons for close-quarters operational effectiveness.

In 2024, Asia Pacific held a dominant market position in the Global Shoulder fired weapons Market, capturing more than a 32.1% share, holding USD 3.10 billion in revenue. The market is expanding due to the rising defense budgets and the modernization of military forces in the Asia Pacific. Nations like India, China, and Japan are heavily investing in advanced, portable weapon systems to enhance their defense amid growing geopolitical tensions.

The demand for lightweight, versatile weapons to address asymmetric and urban warfare needs, along with the requirement to counter emerging threats, is further propelling market growth. Additionally, significant government investments in indigenous development and advanced systems like ATGMs and MANPADS are driving this expansion.

For instance, in May 2025, the Indian Army received new supplies of Russian-origin Igla-S shoulder-fired air defense missiles, further enhancing its defense capabilities. This delivery is part of India’s ongoing effort to modernize its armed forces with advanced weaponry. The Igla-S missile system is known for its effectiveness in countering low-altitude aerial threats, particularly in urban and asymmetric warfare scenarios.

Technology Analysis

In 2024, The Unguided segment held a dominant market position, capturing a 69.6% share of the Global Shoulder fired weapons Market. The affordability, simplicity, and reliability of unguided systems make them the preferred choice for short-range battles and specific tactical scenarios.

Both military groups and other organizations favor rocket-propelled grenades (RPGs) due to their ease of use, minimal training requirements, and ability to handle uneven conflicts. This is particularly relevant in areas where the budget is limited or where sophisticated targeting tools are not required for specific operations.

For Instance, In February 2025, the development of the improvised S8 rocket for shoulder-fired weapons emphasized the sustained relevance of unguided systems in modern warfare. Valued for their simplicity, affordability, and quick deployment, these rockets continue to serve effectively in combat, especially against ground targets in less complex operational settings, despite the rise of guided technologies.

Weapon Type Analysis

In 2024, the Rocket-Propelled Grenade Launchers (RPGs) segment held a dominant market position, capturing a 52.7% share of the Global Shoulder fired weapons Market. The demand for Rocket-Propelled Grenade Launchers (RPGs) is due to their versatility and effectiveness in targeting both stationary and moving threats.

Widely used in asymmetric warfare, RPGs offer portability and the ability to engage armored vehicles and fortified structures, making them vital for ground forces. Their cost-effectiveness and ease of accessibility also play a significant role in their popularity. These factors, combined with their proven effectiveness, ensure that RPGs remain a preferred choice in various military operations.

For instance, in February 2025, Chinese tanks equipped with active protection systems were observed intercepting rocket-propelled grenades (RPGs) fired by drones, showcasing advancements in counter-defense technology. The ability of these systems to neutralize RPGs highlights the evolving tactics in modern warfare, where RPGs are increasingly targeted by defensive systems designed to protect armored vehicles and military assets.

Range Analysis

In 2024, The Short (Less than 500 m) segment held a dominant market position, capturing a 61.3% share of the Global Shoulder fired weapons Market. This leadership stems from a strong need for small and easy-to-use weapons that can be easily transported to and from battle in tight spaces and cities.

Popular weapons include rockets that can be fired from the shoulder and are designed to hit people or tanks, as well as being quick to set up and effective in rapidly changing fighting situations. These weapons are in high demand worldwide, being used by both official military units and unofficial units facing unequal difficulties due to their usefulness in various battle zones.

For Instance, in March 2024, the Carl-Gustaf M4 Multi-role Weapon System, a short-range shoulder-fired weapon with a range of less than 500 meters, continued to gain prominence due to its versatility and effectiveness in close-quarter combat. This system, known for its portability and rapid deployment, allows infantry units to engage a variety of targets, including armored vehicles, personnel, and bunkers.

Projectile Analysis

In 2024, The Launcher/Tube segment held a dominant market position, capturing a 73.8% share of the Global Shoulder fired weapons Market. This dominance is due to the critical role launchers and tubes play in the effectiveness and versatility of shoulder-fired systems.

As the primary platform for launching various types of projectiles, including anti-tank missiles and rockets, launchers provide the necessary stability and precision. Their adaptability to different types of ammunition and ease of use in combat scenarios further drive their widespread adoption across military forces worldwide.

For Instance, In August 2024, Saab secured a contract with the U.S. Army to supply the XM919 shoulder-fired anti-armor launcher, reinforcing the dominance of the Launcher/Tube segment in the shoulder-fired weapons market. Engineered for greater accuracy and versatility, the XM919 supports advanced anti-armor projectiles and reflects the rising demand for multi-role launchers capable of improving infantry effectiveness across diverse combat environments.

End-User Analysis

In 2024, The Army segment held a dominant market position, capturing a 53.8% share of the Global Shoulder fired weapons Market. The dominance of the Army segment is due to the crucial role of shoulder-fired weapons in ground combat, essential for infantry operations. Armies prioritize these weapons for their mobility, precision, and force-enhancing capabilities, supported by robust defense budgets and ongoing upgrades.

Geopolitical tensions and the need for rapid inventory replenishment in conflict zones further strengthen the Army’s position in the market. The widespread use of shoulder-fired systems, including anti-tank and anti-aircraft missiles, drives the sustained demand for these weapons globally.

For instance, In May 2025, the Indian Army received a new batch of Russian-made Igla-S shoulder-fired air defense missiles. These systems strengthen India’s ability to counter low-altitude aerial threats and protect forces on the battlefield. The delivery supports ongoing defense modernization efforts and enhances operational readiness.

Top 5 Emerging Trends

Trend/Innovation Description Advanced Guided Fire-Control Systems Integration of algorithm-driven systems for moving target lock-on, airburst, and delay detonation modes Lightweight Composite Materials Use of carbon-fiber launch tubes and high-energy propellants to reduce carry weight by about 20% Extended Range Systems Developing shoulder-fired weapons capable of engaging targets beyond 2 km while maintaining portability Anti-Drone and Dual-Role Capabilities Increasing deployment of shoulder-fired systems with counter-UAV functionality and versatile payloads Networked Battlefield Integration Enhanced compatibility with tactical communications, command-and-control architectures, and battlefield networking Top 5 Growth Factors

Key Factors Description Intensifying Asymmetric Warfare Demand for portable anti-armor and anti-air weapons in conflict zones, especially in Middle East, Africa, and Eastern Europe Defense Modernization Programs Military modernization amid geopolitical tensions driving procurement of advanced shoulder-fired systems Rising Counter-Drone Needs Growing need for cost-effective MANPADS to counter low-cost and agile UAV threats Lightweight and Multi-Role Launchers Adoption of portable, versatile launchers by special forces and modern militaries to enhance battlefield agility Indigenous Production & Industrial Localization Growth of domestic manufacturing capabilities in Asia-Pacific, Middle East, and Latin America fueling market expansion Key Market Segments

By Technology

- Guided

- Unguided

By Weapon Type

- Man-Portable Air Defense Systems (MANPADS)

- Rocket-Propelled Grenade Launchers (RPGs)

- Anti-Tank Guided Missile (ATGM) Launchers

- Recoilless Rifles

- Shoulder-Launched Assault Weapons (SLAW)

By Range

- Short (Less than 500 m)

- Medium (500 – 2 km)

- Long (Greater than 2 km)

By Projectile

- Launcher/Tube

- Projectile/Missile

- Fire-Control and Sighting Systems

By End-User

- Army

- Navy

- Air Force

- Special Operations Forces

- Homeland Security and Law Enforcement

Drivers

Modernization of Armed Forces

Countries are concentrating on improving their military capabilities by developing lighter and more portable weapons to enhance the skills of infantrymen, particularly in difficult situations like urban or street battles. The development of India’s Very Short Range Air Defence System (VSHORADS) is a clear indication of this trend, as it is designed to handle low-flying air attacks.

Countries are seeking to improve their ability to respond quickly and with greater effectiveness in different scenarios, leading to a surge in demand for shoulder-based weapons that can be fired from the shoulder, particularly for their quick response and effective defense in various battle scenarios.

For instance, In July 2025, Poland secured a $4 billion U.S. loan guarantee to modernize its armed forces. The funding supports the acquisition of advanced shoulder-fired weapon systems, reflecting a broader shift toward modern, portable arms for infantry. This move highlights rising global demand for next-generation shoulder-fired weapons.

Restraint

Regulatory and Export Controls

The International Traffic in Arms Regulations (ITAR) and the Missile Technology Control Regime (MTCR) are among the international agreements for arms control that enforce strict regulations on the sale of advanced weapons.

These controls limit the sale of shoulder-fired weapons to non-allied nations, hampering market growth in certain regions. Additionally, countries are cautious about the potential misuse or dissemination of their technology, which can lead to non-Western companies taking over markets with limited sales.

For instance, in August 2024, the ongoing discussions around the AUKUS defense agreement highlight the significant impact of regulatory and export controls on the shoulder-fired weapons market. The agreement between Australia, the UK, and the U.S. emphasizes the need for reforms in defense trade controls to enhance collaboration while ensuring compliance with international regulations.

Opportunities

New Technologies and Applications

Advancements in smart guidance, networked targeting, and non-line-of-sight (NLOS) strike capabilities open new possibilities for the shoulder-fired weapons market. As armed forces require more versatile and multi-role launchers, these emerging technologies present opportunities for manufacturers to develop advanced systems that meet evolving defense needs.

For instance, In May 2025, the U.S. Army advanced its shoulder-launched missile systems, such as the Stinger, by integrating solid-fueled ramjet technology. This upgrade enables longer-range engagements and improved versatility. The development reflects a broader shift toward smart guidance, networked targeting, and non-line-of-sight strike capabilities.

Challenges

Training and Maintenance Requirements

Special training and regular care, and support are necessary for soldiers who use weapons fired from their shoulders correctly. These needs can put a strain on the defense spending and resources of smaller or less developed countries. Keeping up with rapidly evolving technology poses significant challenges for armed forces, particularly in maintaining advanced systems and training personnel.

For instance, in September 2024, the U.S. Army introduced a new shoulder-launched munition designed to lighten the load for infantry while delivering greater firepower. This new weapon system requires specialized training to ensure its effective deployment. Troops must undergo rigorous training to master the system’s handling, targeting, and maintenance, ensuring operational readiness.

Key Players Analysis

General Dynamics Corporation, Lockheed Martin Corporation, and Northrop Grumman Corporation are recognized as dominant players in the shoulder fired weapons market. These companies have maintained strong global footprints through innovation, advanced R&D capabilities, and strategic government contracts.

Saab AB and RTX Corporation have further expanded their presence by integrating smart guidance systems and improving multi-role launcher versatility. These firms are focused on enhancing product reliability, range, and operational adaptability to meet modern battlefield requirements.

Rafael Advanced Defense Systems Ltd., Rheinmetall AG, and MBDA have demonstrated significant progress through precision engineering and modular launcher systems. Bharat Dynamics Ltd. and AirTronic USA LLC are focusing on cost-effective solutions and customized systems for domestic and international forces. Kongsberg Gruppen ASA and Nexter KNDS Group are advancing networked targeting systems to boost soldier efficiency and situational awareness.

Israel Aerospace Industries Ltd., Denel SOC Ltd., and Nammo AS are diversifying their product lines to cater to varied mission needs, including anti-armor, anti-air, and bunker-busting roles. Roketsan A.Ş. is strengthening its exports through partnerships and new-generation portable launchers. BAE Systems plc is focusing on lightweight, rugged launchers for rapid deployment.

Top Key Players in the Market

- General Dynamics Corporation

- Rafael Advanced Defense Systems Ltd.

- Rheinmetall AG

- Roketsan A.Ş.

- Bharat Dynamics Ltd.

- AirTronic USA LLC

- Northrop Grumman Corporation

- Kongsberg Gruppen ASA

- Saab AB

- Lockheed Martin Corporation

- RTX Corporation

- MBDA

- BAE Systems plc

- Israel Aerospace Industries Ltd.

- Nexter KNDS Group

- Denel SOC Ltd.

- Nammo AS

- Others

Recent Developments

- In July 2025, Rheinmetall commenced series production of the SSW40, the world’s first magazine-fed automatic shoulder-fired grenade launcher capable of firing both low-velocity (LV) and medium-velocity (MV) 40mm ammunition. This innovation enhances infantry firepower with a flatter trajectory and an effective range of up to 900 meters.

- In July 2025, Bharat Dynamics Ltd. secured an ₹809 crore (approximately $100 million) order from the Armoured Vehicles Nigam Limited (AVNL) for the supply of ATGMs. This contract highlights India’s commitment to enhancing its indigenous shoulder-fired weapon capabilities.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Technology (Guided, Unguided), By Weapon Type (Man-Portable Air Defense Systems (MANPADS), Rocket-Propelled Grenade Launchers (RPGs), Anti-Tank Guided Missile (ATGM) Launchers, Recoilless Rifles, Shoulder-Launched Assault Weapons (SLAW), By Range (Short (Less than 500 m), Medium (500 – 2 km), Long (Greater than 2 km), By Projectile (Launcher/Tube, Projectile/Missile, Fire-Control and Sighting Systems), By End-User (Army, Navy, Air Force, Special Operations Forces, Homeland Security and Law Enforcement) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape General Dynamics Corporation, Rafael Advanced Defense Systems Ltd., Rheinmetall AG, Roketsan A.Ş., Bharat Dynamics Ltd., AirTronic USA LLC, Northrop Grumman Corporation, Kongsberg Gruppen ASA, Saab AB, Lockheed Martin Corporation, RTX Corporation, MBDA, BAE Systems plc, Israel Aerospace Industries Ltd., Nexter KNDS Group, Denel SOC Ltd., Nammo AS, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Shoulder Fired Weapons MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Shoulder Fired Weapons MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-