Global Shale Oil Market Size, Share, And Enhanced Productivity By Product (Shale Gasoline, Shale Diesel, Kerosene, Others), By Technology (In-situ Technology, Ex-situ Technology), By Application (Fuel, Electricity, Cement and Chemicals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170320

- Number of Pages: 250

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

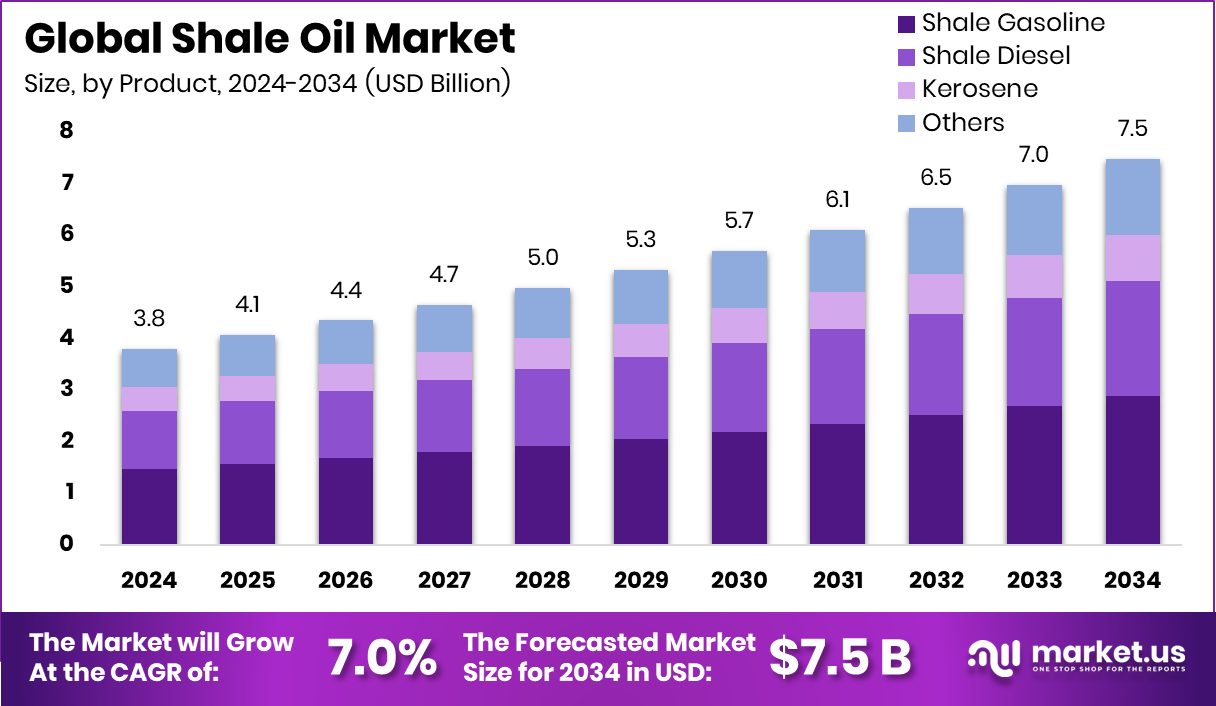

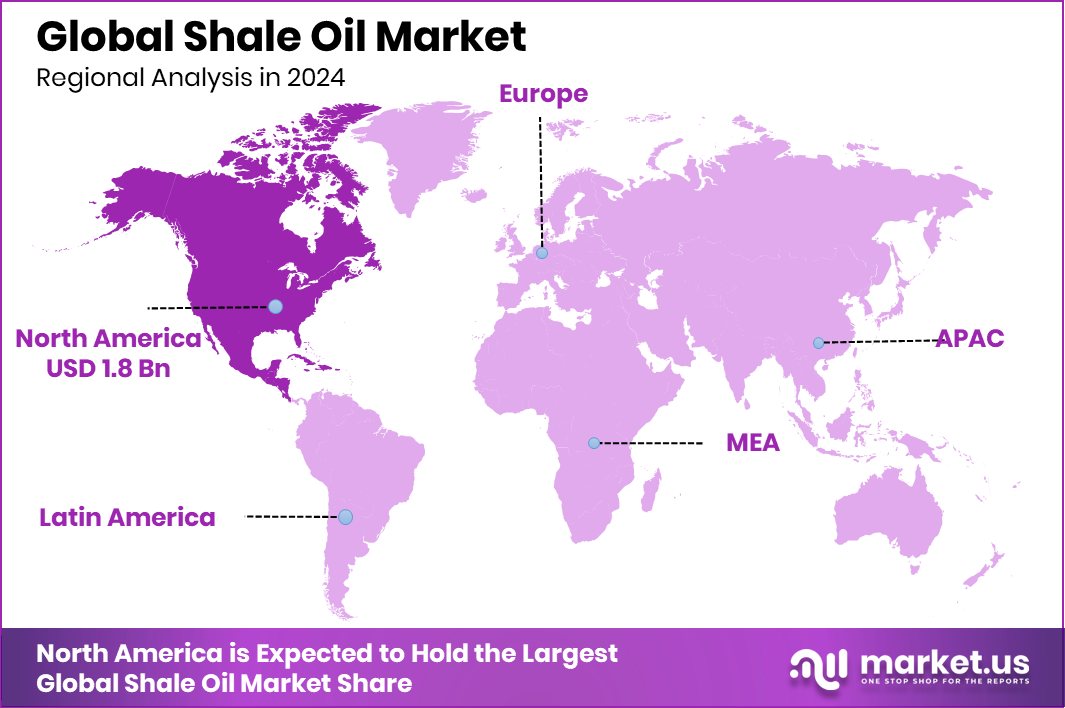

The Global Shale Oil Market is expected to be worth around USD 7.5 billion by 2034, up from USD 3.8 billion in 2024, and is projected to grow at a CAGR of 7.0% from 2025 to 2034. The shale oil market in North America reached USD 1.8 billion, reflecting a 49.40% regional share.

Shale oil is a type of unconventional crude oil trapped within fine-grained shale rock formations. It is extracted using advanced techniques that release oil from tight rock structures, making it usable for refining into fuels and other petroleum products. Shale oil has become an important energy source because it expands recoverable reserves beyond conventional oil fields and supports domestic energy supply in several regions.

The shale oil market represents the commercial activities linked to shale oil exploration, extraction, processing, and end-use applications. This market is shaped by upstream drilling activity, infrastructure development, and downstream fuel demand. Market growth is closely connected to energy security goals, price stability in oil markets, and the ability of producers to scale operations efficiently.

Growth factors for the shale oil market include strong investment momentum and large-scale infrastructure development. Global upstream oil and gas dealmaking reached USD 105 billion in 2024, highlighting sustained capital flow into production assets. Additionally, a BlackRock-led group’s planned USD 10 billion investment in Aramco’s Jafurah infrastructure reflects continued confidence in unconventional energy systems supporting long-term output.

- USD 10 billion investment planned for Jafurah gas and shale-linked infrastructure

- USD 4 billion borrowing plan for major gas infrastructure through corporate bonds

Demand for shale oil remains supported by fuel consumption patterns and oil price dynamics. Lower fuel prices have encouraged higher consumption, reinforcing steady demand for oil-derived fuels. Shale oil plays a stabilizing role by responding quickly to market signals and balancing supply gaps.

Opportunities are emerging through policy shifts and regional development programs. The EU’s €354 million allocation to help Estonia phase out oil shale in energy production reflects transition-driven restructuring, while education and workforce development are supported by grants such as USD 2.35 million and USD 14,575 awarded to the Utica Shale Academy, strengthening long-term sector capabilities.

Key Takeaways

- The Global Shale Oil Market is expected to be worth around USD 7.5 billion by 2034, up from USD 3.8 billion in 2024, and is projected to grow at a CAGR of 7.0% from 2025 to 2034.

- Shale Gasoline dominates the Shale Oil Market by product, holding 38.5% share due to demand.

- In-situ Technology leads the Shale Oil Market by technology, accounting for 67.2% adoption at industry-wide levels.

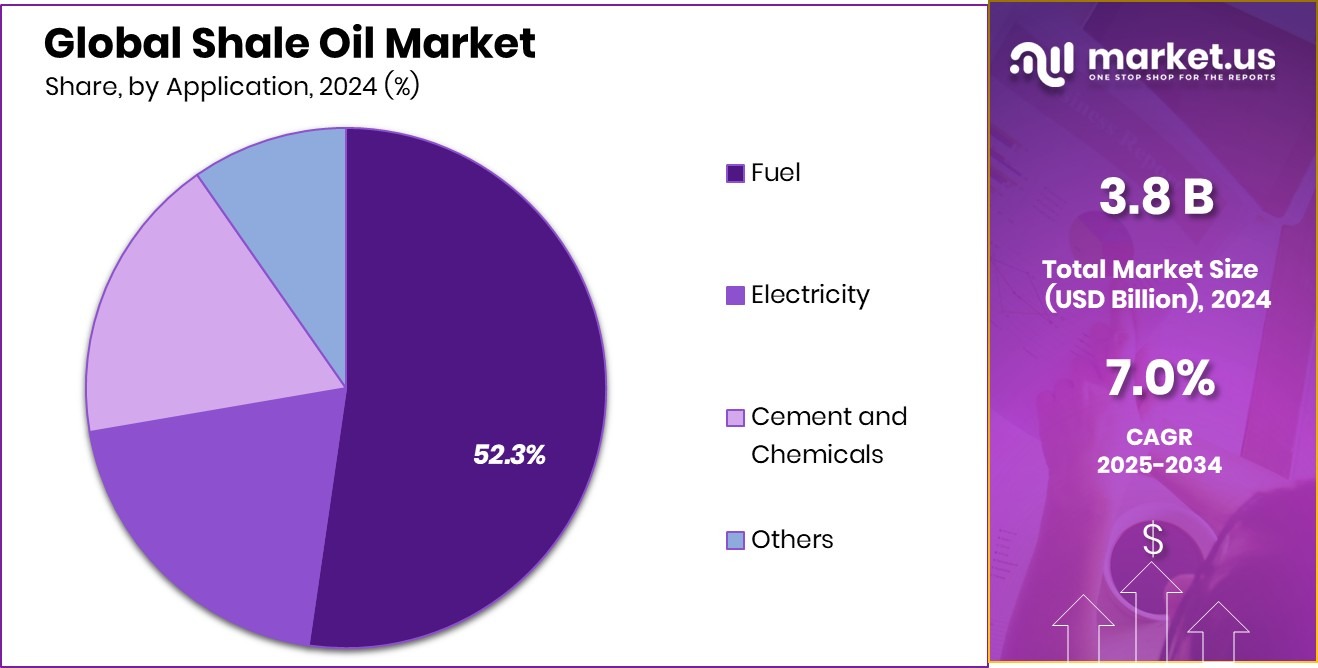

- Fuel application dominates the Shale Oil Market, representing 52.3% share, driven by energy consumption growth.

- North America leads regional shale oil demand, holding a 49.40% share worth USD 1.8 billion.

By Product Analysis

In Shale Oil Market, shale gasoline leads products with a 38.5% share globally.

In 2024, Shale Gasoline held a dominant market position in the By Product segment of the Shale Oil Market, with a 38.5% share. This dominance reflects its strong alignment with downstream fuel blending needs and its suitability for refining into transportation-grade fuels. Shale gasoline continues to gain traction due to its compatibility with existing refinery configurations, supporting consistent off-take across major shale-producing regions.

The 38.5% share also indicates stable demand from end-use industries that rely on lighter hydrocarbon fractions for fuel optimization. As shale oil extraction improves in efficiency, shale gasoline remains a preferred output due to its favorable composition and market acceptance. This positioning reinforces its role as a core product stream within the shale oil value chain, sustaining its leading status in the product segmentation landscape.

By Technology Analysis

In Shale Oil Market, in-situ technology dominates operations, capturing 67.2% adoption worldwide.

In 2024, In-situ Technology held a dominant market position in the By Technology segment of the Shale Oil Market, with a 67.2% share. This significant share highlights the industry’s strong preference for extraction methods that enable resource recovery directly within the shale formation. In-situ technology supports operational continuity by reducing surface disruption while allowing controlled heating and conversion processes underground.

Holding a 67.2% share, this technology reflects growing reliance on scalable and field-adaptable extraction approaches. Its dominance indicates consistent deployment across shale projects where geological conditions favor in-place processing. The widespread use of in-situ methods strengthens production stability and supports long-term shale oil output, making it a central technological pillar in the overall market structure.

By Application Analysis

In Shale Oil Market, fuel applications dominate demand, accounting for 52.3% consumption.

In 2024, Fuel held a dominant market position in the By Application segment of the Shale Oil Market, with a 52.3% share. This leadership underscores shale oil’s primary utilization as a fuel source, driven by its integration into energy supply systems serving transportation and industrial demand. Fuel applications continue to anchor shale oil consumption due to consistent volume requirements.

The 52.3% share reflects steady reliance on shale-derived outputs to meet fuel needs where conventional sources face supply pressure. Shale oil’s role in fuel applications reinforces its commercial relevance, positioning it as a dependable energy input. This dominance highlights fuel usage as the most economically significant application area, sustaining shale oil’s demand base across producing regions.

Key Market Segments

By Product

- Shale Gasoline

- Shale Diesel

- Kerosene

- Others

By Technology

- In-situ Technology

- Ex-situ Technology

By Application

- Fuel

- Electricity

- Cement and Chemicals

- Others

Driving Factors

Industrial Water Demand From Clean Energy Projects

Rising clean energy and fuel production projects are strongly driving demand in the Municipal Water Market. Large hydrogen and synthetic fuel plants require a reliable municipal water supply for processing, cooling, and electrolysis operations. Germany’s approval to grant €350 million to a producer of green hydrogen-based synthetic aviation fuel highlights how public utilities must expand water treatment and distribution capacity to support such projects.

The new plant planned to meet 20% of Germany’s e-kerosene needs from 2026 will rely heavily on consistent municipal water availability. Similarly, ZeroAvia’s €21 million European Union grant to develop hydrogen aircraft infrastructure in Norway increases pressure on local water systems to meet industrial and operational needs. As energy transition projects scale up, municipalities are investing in water infrastructure upgrades, driving long-term growth in municipal water supply, treatment, and management services.

- €350 million grant supporting hydrogen-based synthetic fuel production

- €21 million EU grant for hydrogen aviation infrastructure

Restraining Factors

Capital Diversion Limits Municipal Water Infrastructure Investment

Limited funding availability remains a key restraining factor for the Municipal Water Market, as capital is increasingly diverted to faster-growing sectors. Investment flows are shifting toward technology, space, and digital services, reducing budget priority for municipal water upgrades. For instance, Verteva secured $33 million in Series A funding to launch a digitised home loan solution, highlighting how financial resources favor innovation-led industries over essential utilities.

Similarly, China’s Space Pioneer raised 1.5 billion yuan to develop reusable rockets, drawing attention and capital away from public infrastructure needs. Even smaller grants, such as the $80,000 funding provided by NCIC/All-On, illustrate how limited-scale support often falls short of addressing large municipal water system challenges. This imbalance slows modernization of water treatment plants, distribution networks, and leakage control systems, restraining market growth despite rising demand.

- $33 million Series A funding for digital finance innovation

- 1.5 billion yuan raised for space technology development

Growth Opportunity

Clean Energy Transition Expands Municipal Water Demand

The shift toward cleaner energy systems creates a strong growth opportunity for the Municipal Water Market. The discontinuation of 150,000 kerosene lamps under cleaner energy goals signals a broader move toward modern energy access, which increases reliance on municipal water for power generation, cooling, and community infrastructure upgrades. As households and public facilities adopt cleaner alternatives, municipalities must expand water treatment and distribution systems to support new electrical and energy-related installations.

In parallel, the approval of Shree Pushkar Chemicals’ EGM resolutions reflects rising industrial readiness to align operations with sustainability goals, indirectly increasing municipal water demand for compliant industrial processes. These developments encourage local governments to invest in resilient water networks, creating opportunities for system expansion, efficiency upgrades, and long-term service contracts within the municipal water ecosystem.

Latest Trends

Industrial Water Pressure From Energy Transitions

A key latest trend in the Municipal Water Market is rising pressure from industrial energy projects that depend heavily on a reliable water supply. Large industrial facilities linked to fuels, chemicals, and energy transitions are increasing operational water needs, affecting municipal networks. The reported $87 million loss faced by SCG Chemicals from its Vietnam-based Long Son Petrochemicals operations highlights operational stress and efficiency challenges, including utilities such as water management.

At the same time, Germany’s approval to grant €350 million for green hydrogen-based synthetic aviation fuel production shows how new energy projects demand secure municipal water access for processing and cooling. As these projects scale, municipalities are upgrading water treatment capacity, reuse systems, and distribution reliability to support industrial users, making industrial-linked water demand a defining market trend.

Regional Analysis

North America dominates the Shale Oil Market with a 49.40% share valued at USD 1.8 billion.

North America dominates the Shale Oil Market, holding a leading 49.40% share and generating USD 1.8 Bn in market value. This strong regional position reflects North America’s established shale resource base, mature extraction infrastructure, and sustained production activity across major shale basins. The region continues to anchor global shale oil supply due to consistent output levels and large-scale commercial operations, positioning it as the primary revenue contributor within the overall market structure.

Europe, Asia Pacific, Middle East & Africa, and Latin America represent developing regional segments within the Shale Oil Market. These regions maintain comparatively smaller market participation, primarily driven by exploratory activities, regulatory frameworks, and evolving production capabilities. While Europe and the Asia Pacific show interest in unconventional oil resources, their shale oil presence remains limited when compared to North America’s scale. Similarly, the Middle East & Africa and Latin America continue to explore shale potential, but market contribution remains modest due to geological, economic, and operational constraints.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, ExxonMobil Corporation continues to hold a strategically influential position in the global Shale Oil Market due to its long-standing operational expertise and integrated business model. The company’s shale-focused activities benefit from disciplined capital allocation, advanced subsurface understanding, and operational scale. ExxonMobil’s ability to align upstream shale production with downstream processing and marketing capabilities strengthens margin control and supports stable long-term performance. Its approach reflects a balance between volume optimization and operational efficiency, reinforcing its role as a core shale oil participant.

Royal Dutch Shell plc maintains a measured and portfolio-driven presence in the Shale Oil Market, emphasizing strategic flexibility and asset optimization. In 2024, Shell’s shale oil positioning reflects a focus on selective resource development aligned with broader energy portfolio objectives. The company’s operational philosophy prioritizes efficiency, risk management, and integration with existing energy assets. This measured involvement allows Shell to retain shale oil exposure while managing market volatility and long-term transition considerations.

Chevron Corporation remains a consistent and performance-oriented player in the global Shale Oil Market. Its shale oil operations are characterized by disciplined execution, strong asset productivity, and cost-focused development strategies. In 2024, Chevron’s shale activities support steady output and operational resilience, underpinned by technical expertise and streamlined project execution. This approach reinforces Chevron’s reputation for stable shale oil operations within the competitive global landscape.

Top Key Players in the Market

- ExxonMobil Corporation

- Royal Dutch Shell plc

- Chevron Corporation

- BP plc

- Marathon Oil Corporation

- Pioneer Natural Resources Company

Recent Developments

- In December 2025, ExxonMobil updated its corporate plan through 2030 to increase projected earnings and cash flow by $5 billion compared with earlier guidance. This reflects stronger contributions from its core oil and shale production assets, highlighting continued focus on growth in output and operational efficiency.

- In January 2025, Chevron began producing oil from its Future Growth Project, which is expected to boost its total shale and crude output to about 1 million barrels of oil equivalent per day, reflecting increased production efficiency.

Report Scope

Report Features Description Market Value (2024) USD 3.8 Billion Forecast Revenue (2034) USD 7.5 Billion CAGR (2025-2034) 7.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Shale Gasoline, Shale Diesel, Kerosene, Others), By Technology (In-situ Technology, Ex-situ Technology), By Application (Fuel, Electricity, Cement and Chemicals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ExxonMobil Corporation, Royal Dutch Shell plc, Chevron Corporation, BP plc, Marathon Oil Corporation, Pioneer Natural Resources Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ExxonMobil Corporation

- Royal Dutch Shell plc

- Chevron Corporation

- BP plc

- Marathon Oil Corporation

- Pioneer Natural Resources Company