Global Safflower Seeds Market Size, Share, And Enhanced Productivity By Type (Conventional, Organic), By Seed Variety (High Oleic Safflower Seeds, Conventional Safflower Seeds, Organic Safflower Seeds), By Application (Oil Production, Animal Feed, Food Products, Cosmetics, Others), By Distribution Channel (Online Stores, Supermarkets/Hypermarkets, Specialty Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 178624

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

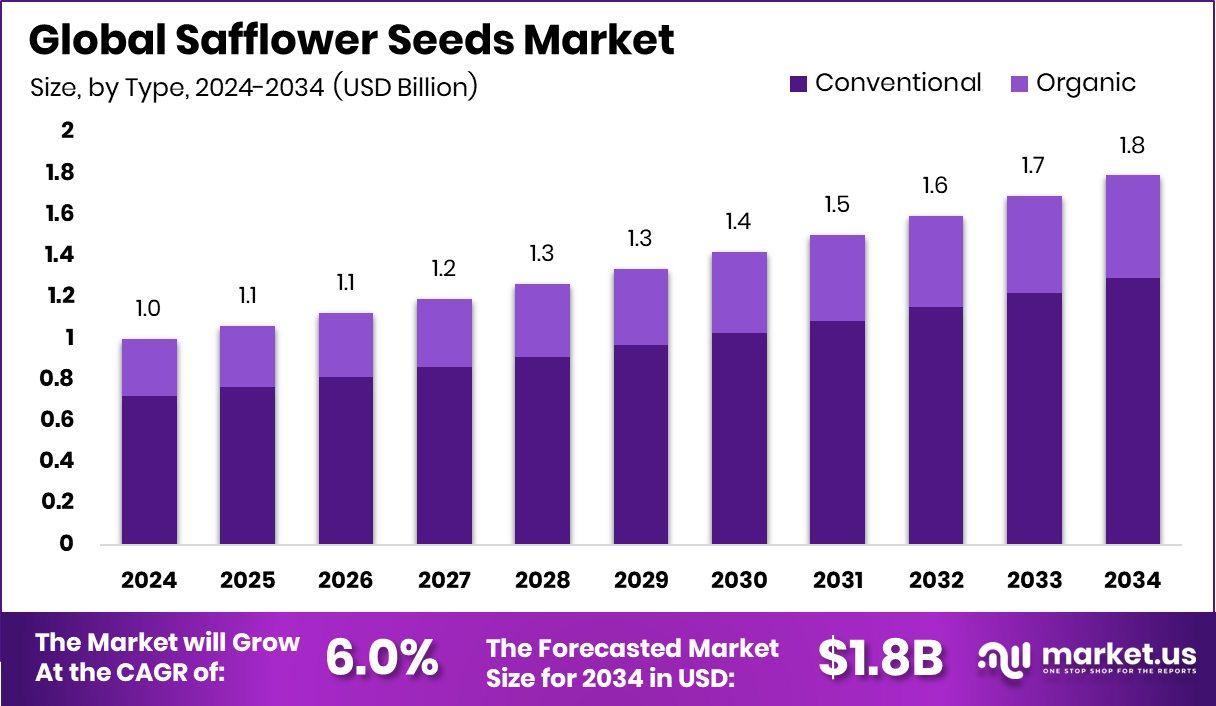

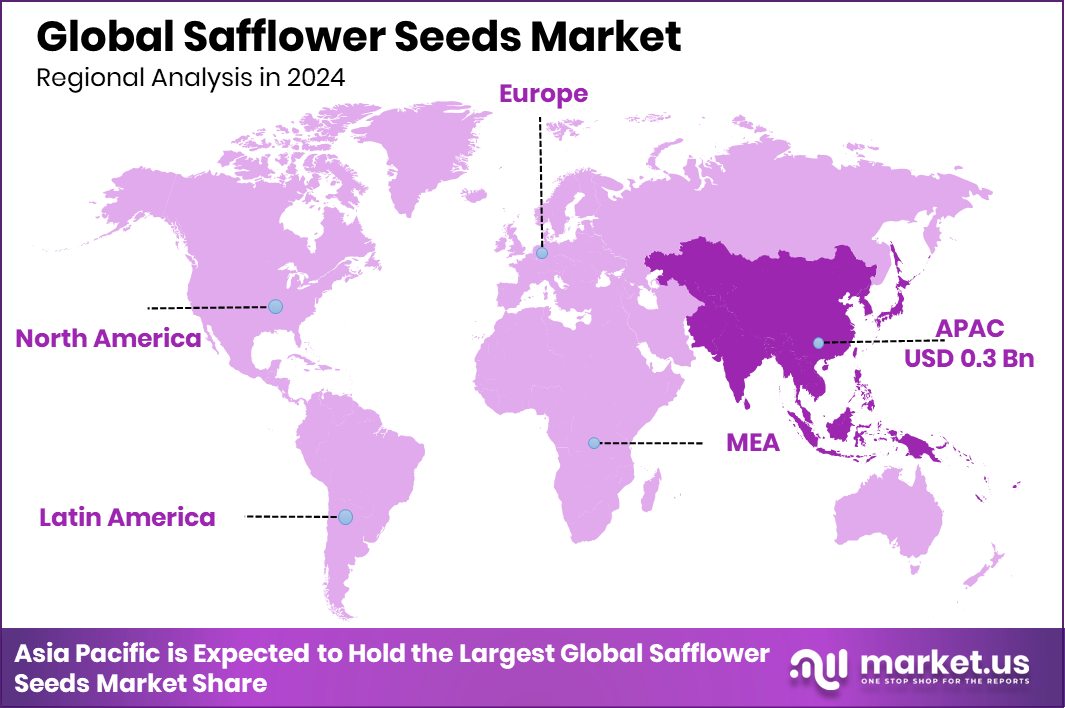

The Global Safflower Seeds Market is expected to be worth around USD 1.8 billion by 2034, up from USD 1.0 billion in 2024, and is projected to grow at a CAGR of 6.0% from 2025 to 2034. Asia Pacific dominates the Safflower Seeds Market at 33.9% and USD 0.3 Bn.

Safflower seeds come from the safflower plant, a dry-land crop known for its oil-rich seeds and long history in food, feed, and cosmetic use. These seeds are valued for their high oleic and linoleic content, making them useful in cooking oils, nutraceutical blends, natural cosmetics, and specialised food products. Their mild flavour and stable oil profile make them a preferred choice in several industries seeking healthier or plant-based ingredients.

The Safflower Seeds Market covers the production, processing, and distribution of seed types such as conventional, organic, and high-oleic varieties. It includes applications in oil production, animal feed, food products, cosmetics, and other industrial uses, distributed through online stores, supermarkets, speciality outlets, and regional retail systems. The market functions within global agricultural and energy-linked economic conditions.

Growth is supported by rising interest in natural oils, especially as global energy and commodity movements shift. Recent financial moves—like DNO securing a $500M financing facility and South Sudan aiming to fund a $1.6 billion budget through oil and gas activity—indirectly influence agricultural sectors as investors seek diversification. Demand is also shaped by changing market strategies, such as Saudi Arabia’s willingness to adjust crude oil targets to maintain competitiveness.

Opportunities emerge as premium oil producers gain support, shown by the £1.8M raised by the UK’s Citizens of Soil for high-quality oil production, which reflects growing consumer willingness to pay for healthier, speciality plant oils.

Key Takeaways

- The Global Safflower Seeds Market is expected to be worth around USD 1.8 billion by 2034, up from USD 1.0 billion in 2024, and is projected to grow at a CAGR of 6.0% from 2025 to 2034.

- The safflower seeds market is dominated by the conventional type, holding a strong 72.3% share globally.

- Within varieties, the Safflower Seeds Market is dominated by conventional safflower seeds with a 53.2% share.

- The safflower seeds market for oil production is dominated by this segment, capturing a 54.7% share.

- The safflower seeds market is dominated by supermarkets and hypermarkets, commanding a notable 41.6% share.

- In the Asia Pacific, Safflower Seeds Market reaches USD 0.3 Bn with a 33.9% share.

By Type Analysis

Safflower Seeds Market was dominated by the conventional type, holding 72.3% share globally.

Safflower Seeds Market continues to be shaped strongly by cultivation choices, and the conventional category maintains a clear lead with 72.3% share, making it the dominant type across major producing regions. Farmers prefer conventional safflower because of its stable yield patterns, lower production risks, and compatibility with existing farming methods. This dominance is also supported by long-established supply chains that make conventional seeds more accessible and affordable for both growers and processors.

Buyers in the edible oil and food sectors still rely heavily on conventionally grown safflower, mainly due to consistent oil content and predictable crop behaviour. As a result, the conventional segment remains firmly positioned as the backbone of safflower seed production globally.

By Seed Variety Analysis

Safflower Seeds Market dominance continued as conventional safflower seeds secured 53.2% market share.

Safflower Seeds Market demand continues to favour traditional genetics, and conventional safflower seeds hold a dominant 53.2% share, reflecting their strong acceptance among growers and processors. These varieties are preferred for their compatibility with different climates, making them a safer choice for farmers who want predictable performance without high input costs.

Many crushing facilities also design their processes around the oil profile of conventional varieties, strengthening their market position. The dominance of this segment is further reinforced by decades of cultivation experience, which gives producers confidence in crop resilience and post-harvest quality. Even as hybrid and speciality variants emerge, conventional seeds still command the majority due to reliability and easy integration into existing agricultural systems.

By Application Analysis

Safflower Seeds Market was dominated by oil production segment, capturing 54.7% total share.

Safflower Seeds Market activity is heavily driven by downstream uses, and oil production dominates the application landscape with a 54.7% share. This reflects the long-standing consumer and industrial demand for safflower oil, widely valued for its light texture, high linoleic acid content, and role in cooking, cosmetics, and nutraceutical formulations.

Oil processors consistently prioritise safflower due to its steady extraction rates and versatile applications across food and wellness sectors. In many regions, safflower oil is also promoted as a healthier alternative to conventional edible oils, sustaining its strong demand base. The dominance of this segment is reinforced by ongoing interest from skincare and speciality oil manufacturers, keeping oil production the central driver of safflower seed utilisation.

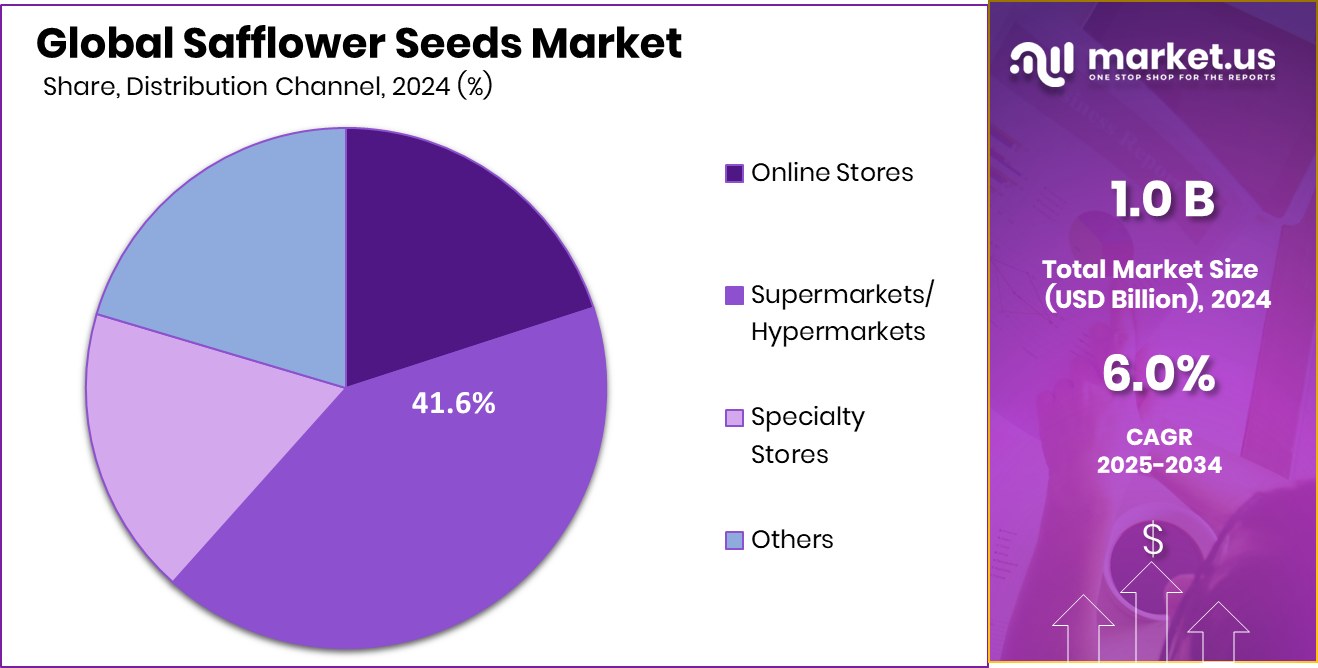

By Distribution Channel Analysis

Safflower Seeds Market distribution was dominated by supermarkets and hypermarkets with a 41.6% share.

Safflower Seeds Market distribution patterns show that modern retail continues to hold a meaningful role, with supermarkets and hypermarkets dominating at 41.6% share. These stores provide consumers with easier access to packaged safflower seeds and safflower-based oils, supported by strong shelf visibility and frequent brand promotions.

Shoppers rely on supermarkets for quality-assured products and consistent availability, which strengthens the position of this channel over local stores. The dominance also stems from the growing preference for organised retail in urban areas, where consumers seek convenience and reliable packaging standards. Although online sales are rising, supermarkets remain the primary choice for households looking for trusted edible oil and seed brands, keeping this channel firmly in the lead.

Key Market Segments

By Type

- Conventional

- Organic

By Seed Variety

- High Oleic Safflower Seeds

- Conventional Safflower Seeds

- Organic Safflower Seeds

By Application

- Oil Production

- Animal Feed

- Food Products

- Cosmetics

- Others

By Distribution Channel

- Online Stores

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

Driving Factors

Rising demand for natural edible oils

Rising demand for natural edible oils continues to shape the Safflower Seeds Market as consumers look for cleaner, plant-based options in everyday cooking and wellness products. Safflower oil’s light texture and high nutritional value keep it relevant across household and commercial use. The momentum is further reinforced by broader innovation happening in adjacent agricultural sectors, such as French animal nutrition firm Aviwell securing EUR 11 million in investment funds to advance microbiota-driven solutions.

While the funding is not directly for safflower, it reflects a wider industry push toward healthier, naturally sourced ingredients, supporting long-term demand for oilseed crops like safflower. This collective shift strengthens the role of safflower seeds within evolving global dietary patterns.

Restraining Factors

Limited global cultivation reduces supply

Limited global cultivation reduces supply, creating a natural bottleneck for processors and distributors who depend on consistent seed availability. Safflower remains a niche crop in many regions, leading to seasonal gaps and price swings that influence both farmers and the industries using safflower-based products.

The challenge is highlighted in broader agricultural funding movements, such as MDARD surpassing $250 million in grants awarded during the Whitmer administration, a signal that policymakers are prioritizing infrastructure and crop diversification. While not safflower-specific, these grants underscore how certain regions require structured support to expand speciality crop cultivation. Without similar targeted interventions, safflower production may continue facing supply limitations.

Growth Opportunity

Growing interest in organic safflower production

Growing interest in organic safflower production opens new avenues for producers aiming to meet rising consumer preference for chemical-free oils and natural food ingredients. Organic safflower seeds appeal strongly to health-driven markets and premium product makers who value traceable and sustainably grown oilseeds.

Momentum in this direction aligns with recent developments such as Wastelink raising $3M to strengthen the animal feed supply chain, demonstrating investor confidence in cleaner, transparent agricultural ecosystems. As global buyers increasingly seek certified organic varieties, safflower producers adopting organic practices can access higher-value segments, strengthen long-term contracts, and diversify their market presence beyond traditional edible oil processing.

Latest Trends

Shift toward cold-pressed safflower oils

A major trend is the shift toward cold-pressed safflower oils, driven by consumers who want minimally processed, nutrient-retaining plant oils for cooking and skincare. Cold-pressed safflower oil fits well into the clean-label and artisanal product categories, gaining traction worldwide. Parallel industry advancements, such as BinSentry raising $68.8 million CAD in Series C funding to expand remote feed monitoring into Brazil, reflect a broader movement toward tech-enabled, quality-focused agricultural operations.

While this funding is not directly tied to safflower, it signals rising interest in precision-driven supply chains. This environment encourages processors to adopt better extraction methods and maintain high-grade seed quality, pushing cold-pressed safflower products into the mainstream.

Regional Analysis

Safflower Seeds Market Asia Pacific holds a 33.9% share valued at USD 0.3 Bn.

Safflower Seeds Market performance varies across major regions, reflecting differences in crop adoption, processing capacity, and consumer demand. Asia Pacific remains the dominating region with a 33.9% share valued at USD 0.3 Bn, driven by strong usage of safflower seeds for edible oil and traditional food applications.

North America shows steady consumption supported by health-focused product preferences, while Europe maintains consistent demand through its established food ingredients and speciality oil sectors. The Middle East & Africa region continues to participate through smaller but stable seed usage linked to local culinary and oil production needs.

Latin America records moderate growth as safflower cultivation expands in select countries. Together, these regions form a diverse market landscape where Asia Pacific clearly leads, supported by its large population base, higher edible oil utilisation, and long-standing reliance on safflower as both a commercial and household crop.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global safflower seed market in 2024 reflects steady operational strength from leading agribusiness firms, with Archer Daniels Midland Company leveraging its broad oilseed handling network to support reliable sourcing and processing. The company’s established supply chain offers stability in procurement and export flows, which is essential for a crop like safflower that depends on efficient collection and crushing capacity. ADM’s ability to integrate safflower seeds into its wider edible oil portfolio also provides scale advantages, especially in regions where speciality oils are gaining preference.

Cargill Incorporated remains another influential participant, supported by its global logistics strength and strong relationships across farming communities. Its operational reach allows consistent movement of safflower seeds from producing areas to processing hubs, contributing to stable availability for food and oil manufacturers. Cargill’s presence in multiple commodity chains means safflower fits naturally into its broader raw-material strategy, helping the company respond efficiently to shifting demand patterns across regions.

In the Asia-linked supply landscape, Olam International Limited plays a strategic role through its focus on agricultural origination and ingredient supply. Olam’s procurement networks, particularly in emerging markets, help streamline safflower seed aggregation and export. Its emphasis on traceable sourcing supports buyers seeking consistent quality, positioning the company as a dependable partner in the global safflower seed value chain.

Top Key Players in the Market

- Archer Daniels Midland Company

- Cargill Incorporated

- Olam International Limited

- Colorado Mills LLC

- Richardson International Limited

- United Oilseeds Producers Ltd.

- Gansu Yasheng Industrial Group Co., Ltd.

- Bunge Limited

- Jiuquan Hongda Seed Industry Co., Ltd.

- Altai Agro LLC

- Ethiopian Oilseeds Processors Association

Recent Developments

- In September 2025, ADM signed a deal with Alltech to create a North American animal feed joint venture. ADM will contribute its 11 U.S. feed mills to the new business, while Alltech brings in 17 U.S. and 15 Canadian mills. ADM will be a minority owner, and the venture aims to launch in Q1 2026. This move lets ADM focus more on high-value ingredients and streamline operations.

- In July 2025, Cargill announced plans to acquire Mig-Plus, a Brazilian animal nutrition company focusing on feed premixes and complete feeds. This deal will help Cargill be closer to farmers in Brazil and offer stronger nutrition solutions for animals once regulatory approval is completed.

Report Scope

Report Features Description Market Value (2024) USD 1.0 Billion Forecast Revenue (2034) USD 1.8 Billion CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Conventional, Organic), By Seed Variety (High Oleic Safflower Seeds, Conventional Safflower Seeds, Organic Safflower Seeds), By Application (Oil Production, Animal Feed, Food Products, Cosmetics, Others), By Distribution Channel (Online Stores, Supermarkets/Hypermarkets, Speciality Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Archer Daniels Midland Company, Cargill Incorporated, Olam International Limited, Colorado Mills LLC, Richardson International Limited, United Oilseeds Producers Ltd., Gansu Yasheng Industrial Group Co., Ltd., Bunge Limited, Jiuquan Hongda Seed Industry Co., Ltd., Altai Agro LLC, Ethiopian Oilseeds Processors Association Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Safflower Seeds MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Safflower Seeds MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Archer Daniels Midland Company

- Cargill Incorporated

- Olam International Limited

- Colorado Mills LLC

- Richardson International Limited

- United Oilseeds Producers Ltd.

- Gansu Yasheng Industrial Group Co., Ltd.

- Bunge Limited

- Jiuquan Hongda Seed Industry Co., Ltd.

- Altai Agro LLC

- Ethiopian Oilseeds Processors Association