Global Recycled Polypropylene In Packaging Market Size, Share, And Business Benefit By Process (Mechanical, Chemical), By Packaging Type (Flexible Packaging, Rigid Packaging), By End Use (Food and Beverage, Personal Care and Cosmetics, Pharmaceuticals, Automotive, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161126

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

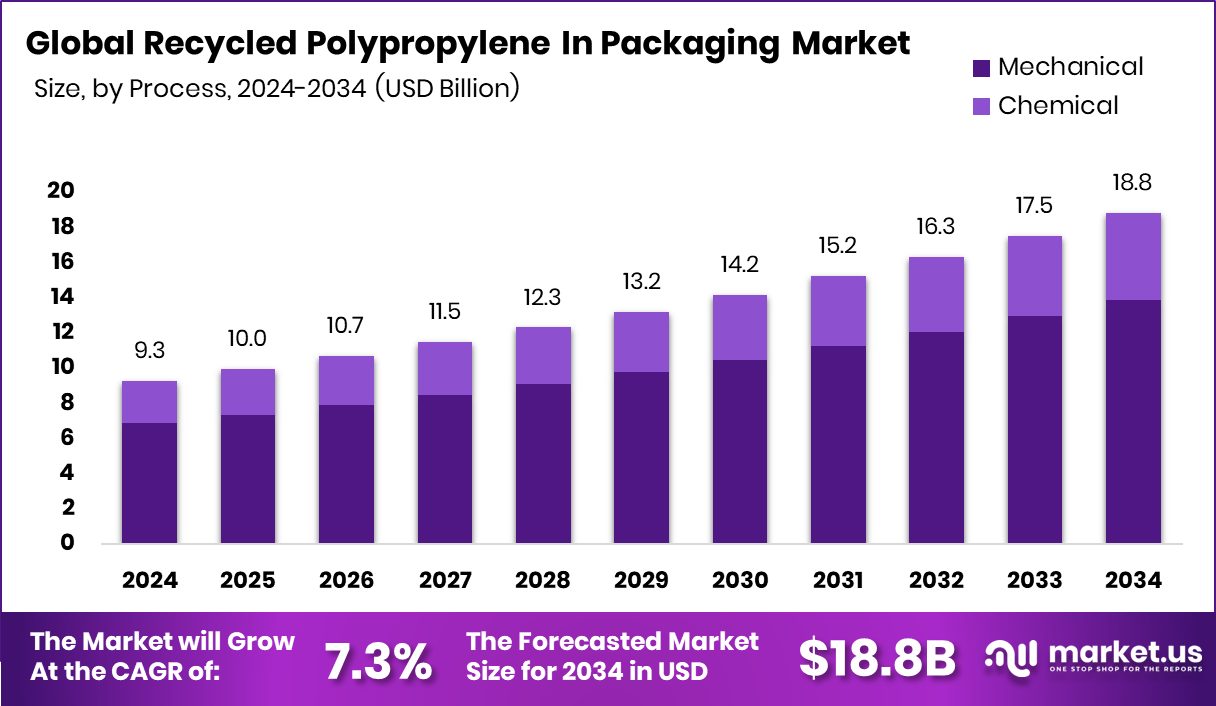

The Global Recycled Polypropylene In Packaging Market is expected to be worth around USD 18.8 billion by 2034, up from USD 9.3 billion in 2024, and is projected to grow at a CAGR of 7.3% from 2025 to 2034. Growing sustainability goals and recycling investments continue driving North America’s USD 3.6 billion market expansion.

Recycled polypropylene (rPP) in packaging refers to the use of polypropylene materials recovered from post-consumer and post-industrial waste streams, cleaned, processed, and reformed into usable resin for packaging products such as containers, caps, films, and rigid trays. It helps reduce demand for virgin PP, lowers carbon emissions, and supports circular economy goals in packaging.

Growth is driven by stricter regulations toward recycled content, corporate sustainability goals, and consumer pressure for eco-friendly packaging. Also, rising investments support infrastructure upgrades: for instance, plastic resin makers launched a US$25 million recycling fund targeting PP/PE plastics.

Brand owners increasingly require recycled content to meet ESG targets and appeal to green consumers, boosting demand for rPP packaging. Demand is also spurred by mandates or incentives. Moreover, a $120 million polypropylene recycling project was launched to scale the supply of recycled PP.

Large capital flows into recycling tech and infrastructure present a strong opportunity: for example, GreenMantra received a $10 million loan from Closed Loop infrastructure group. Closed Loop Partners themselves received a $10 million investment for PP/PE recycling initiatives. Also, the DOE offered a $182 million loan to an IRG plastics recycling project, which can accelerate the adoption of chemical recycling for PP.

Key Takeaways

- The Global Recycled Polypropylene In Packaging Market is expected to be worth around USD 18.8 billion by 2034, up from USD 9.3 billion in 2024, and is projected to grow at a CAGR of 7.3% from 2025 to 2034.

- In 2024, mechanical recycling dominated the recycled polypropylene in the packaging market with a 73.9% share.

- Flexible packaging led the Recycled Polypropylene in Packaging Market, accounting for 68.3% of the total share.

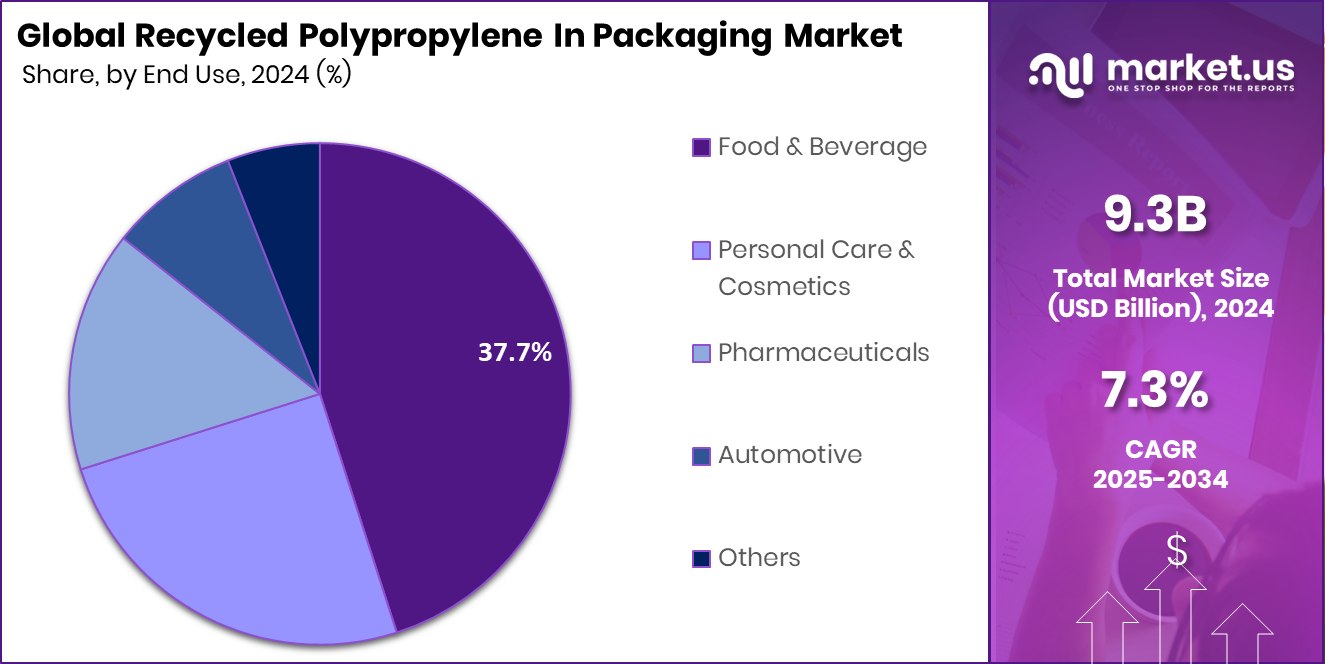

- The food and beverage sector held a 37.7% share in the Recycled Polypropylene in Packaging Market.

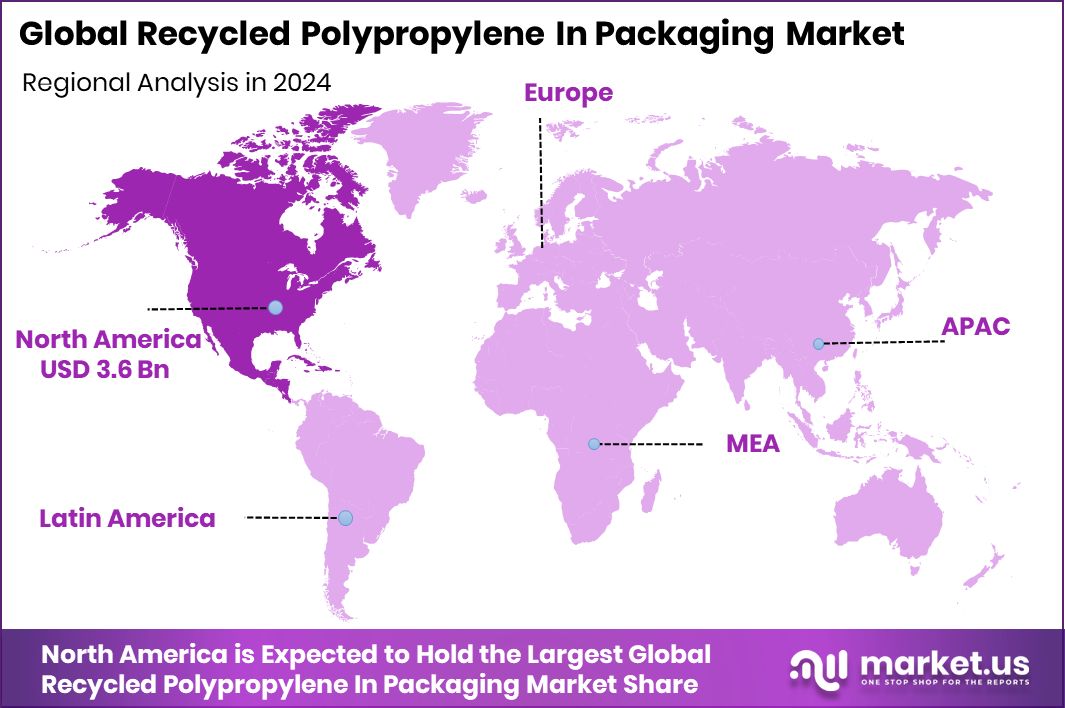

- The North American recycled polypropylene packaging market reached a strong valuation of USD 3.6 billion.

By Process Analysis

Mechanical recycling accounted for 73.9%, emphasizing its efficiency and scalability for packaging.

In 2024, Mechanical held a dominant market position in the By Process segment of the Recycled Polypropylene in Packaging Market, capturing a significant 73.9% share. Mechanical recycling remains the most widely adopted process due to its cost efficiency, scalability, and ability to maintain consistent polymer quality for various packaging applications. The process involves sorting, washing, shredding, and remelting post-consumer polypropylene waste into reusable pellets, which are then molded into packaging films, containers, and caps.

Its minimal chemical input and lower carbon footprint make it a preferred choice among packaging manufacturers focused on circular economy goals. Growing investments in advanced sorting technologies and recycling infrastructure further strengthen the dominance of mechanical recycling across the packaging value chain.

By Packaging Type Analysis

Flexible packaging dominated the Recycled Polypropylene in Packaging Market with 68.3% share.

In 2024, Flexible Packaging held a dominant market position in the By Packaging Type segment of the Recycled Polypropylene in Packaging Market, accounting for a substantial 68.3% share. Flexible packaging formats—such as films, pouches, and wraps—are highly favored due to their lightweight nature, cost-effectiveness, and adaptability to various product categories, including food, personal care, and household goods. The use of recycled polypropylene in flexible packaging supports sustainability goals while maintaining strength, heat resistance, and barrier performance.

Advancements in mechanical recycling have improved material clarity and consistency, enabling greater use of recycled PP in multilayer films. The shift toward circular packaging models and demand for reduced plastic waste continue to reinforce the strong market presence of flexible packaging solutions.

By End Use Analysis

The food and beverage sector held a 37.7% share in 2024.

In 2024, Food and Beverage held a dominant market position in the By End Use segment of the Recycled Polypropylene in Packaging Market, capturing a notable 37.7% share. The segment’s growth is driven by increasing use of recycled polypropylene for food containers, caps, films, and ready-to-eat meal packaging due to its durability, lightweight structure, and moisture resistance.

Manufacturers are adopting rPP to meet sustainability targets and comply with circular packaging initiatives. The material’s excellent sealing properties and compatibility with high-temperature processing make it suitable for various food applications. Rising consumer preference for eco-conscious packaging and investments in food-grade recycled PP technologies have further solidified the segment’s leadership within the packaging market.

Key Market Segments

By Process

- Mechanical

- Chemical

By Packaging Type

- Flexible Packaging

- Rigid Packaging

By End Use

- Food and Beverage

- Personal Care and Cosmetics

- Pharmaceuticals

- Automotive

- Others

Driving Factors

Growing Push for Sustainable and Circular Packaging Solutions

One of the key driving factors for the Recycled Polypropylene in Packaging Market is the global shift toward sustainable and circular packaging systems. Companies and governments are promoting the use of recycled materials to reduce landfill waste and carbon emissions. Recycled polypropylene offers strength, versatility, and cost benefits, making it ideal for food, personal care, and e-commerce packaging. The rising consumer awareness of eco-friendly products further accelerates their adoption.

In this direction, Movopack secured $2.5 million in funding to advance sustainable e-commerce packaging solutions, supporting innovations that replace single-use plastics with recycled and reusable materials. Such initiatives highlight how financial investments are fueling growth and scaling infrastructure for circular packaging systems across industries.

Restraining Factors

Quality Inconsistency and Limited Food-Grade Material Supply

A major restraining factor for the Recycled Polypropylene in Packaging Market is the challenge of maintaining consistent material quality, especially for food-grade applications. Recycled polypropylene often contains impurities or mixed polymer residues that can affect strength, color, and safety standards. Achieving the same performance and purity level as virgin polypropylene requires advanced sorting and cleaning technologies, which are costly and not widely available.

This limits its use in sensitive packaging sectors like food, beverage, and pharmaceuticals. Inadequate recycling infrastructure and regional differences in waste collection further intensify the problem. As a result, manufacturers face difficulties in securing reliable, high-quality recycled PP feedstock, restricting large-scale adoption across the global packaging industry.

Growth Opportunity

Expansion of Biodegradable and Recycled Packaging Facilities

A key growth opportunity in the Recycled Polypropylene in Packaging Market lies in expanding biodegradable and recycled packaging production facilities. As global demand rises for eco-friendly packaging, manufacturers are exploring ways to merge recycled polypropylene with biodegradable materials to create hybrid, sustainable solutions. These materials not only reduce plastic waste but also meet tightening environmental regulations and consumer expectations for greener packaging.

Supporting this transition, Pakka of India raised $29.4 million to develop a biodegradable packaging facility, signaling growing investor confidence in circular and low-impact packaging technologies. Such developments open new avenues for innovation, localized recycling capacity, and sustainable packaging ecosystems, accelerating the market’s long-term growth potential worldwide.

Latest Trends

Rising Adoption of Recycled PP in Pharmaceutical Packaging

One of the latest trends in the Recycled Polypropylene in Packaging Market is the increasing use of recycled PP in pharmaceutical packaging. The industry is shifting toward sustainable materials that maintain product safety, integrity, and regulatory compliance while reducing environmental impact.

Recycled polypropylene offers durability, moisture resistance, and excellent barrier properties, making it suitable for medicine bottles, caps, and blister packs. This trend is further supported by growing innovation in clean recycling processes that ensure purity and consistency.

In line with this movement, pharmaceutical packaging startup Sorich raised $1 million to enhance its sustainable packaging capabilities, highlighting how investment-driven innovation is driving the integration of recycled PP into high-value, health-focused packaging applications.

Regional Analysis

In 2024, North America dominated the market with a 38.90% share, showcasing leadership.

In 2024, North America dominated the Recycled Polypropylene in Packaging Market, accounting for a substantial 38.90% share, valued at around USD 3.6 billion. The region’s leadership stems from strong recycling infrastructure, high consumer awareness, and corporate commitments to sustainable packaging. Stringent environmental regulations in the United States and Canada have accelerated the use of recycled polypropylene in food, beverage, and e-commerce packaging.

Europe follows closely, supported by circular economy mandates and extended producer responsibility programs that promote recycled-content packaging. The Asia Pacific region is rapidly emerging as a key growth hub, driven by industrial expansion and government initiatives to reduce plastic waste.

Meanwhile, Latin America shows steady adoption, particularly in flexible and rigid packaging applications, as regional recycling capacities expand. The Middle East & Africa are gradually strengthening their recycling ecosystems through policy reforms and private investments to address plastic waste management challenges.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Braskem strengthened its position through continuous investment in sustainable polymers and advanced recycling collaborations. The company emphasized expanding its circular polypropylene portfolio using mechanical and chemical recycling technologies. Its efforts align with global packaging brands seeking consistent, high-quality recycled content to meet sustainability targets, reinforcing Braskem’s leadership in low-carbon polymer solutions.

Borealis AG maintained a strong presence by scaling its circular economy initiatives across Europe. The company advanced closed-loop systems for post-consumer PP packaging and invested in improving material traceability. Borealis also focused on enhancing mechanical recycling efficiency, helping manufacturers achieve better performance and appearance in recycled packaging applications.

Mitsubishi Chemical focused on developing eco-friendly polymer compounds integrating recycled polypropylene for packaging solutions. The company emphasized innovative material blends that maintain performance while reducing environmental impact. Its research and development efforts concentrated on improving recyclability and extending product lifespan within packaging systems.

Top Key Players in the Market

- Braskem

- Borealis AG

- Mitsubishi Chemical

- Exxon Mobil Corporation

- Nexam Chemical

- Pashupati Group of Industries

- Sumitomo Chemical Co., Ltd.

- Nexeo Plastics, LLC

- Shell Chemicals

- ECOPLAS (HK) LIMITED

Recent Developments

- In September 2025, Borealis opened or announced a new compounding line in Belgium (Beringen) that can process both recycled polypropylene (rPP) and recycled polyethylene (rPE) from mechanically recycled plastic feedstock.

- In June 2024, Braskem’s Wenew brand sold its first commercially certified chemically recycled polypropylene to Georg Utz AG, to be used in reusable food transport packaging.

Report Scope

Report Features Description Market Value (2024) USD 9.3 Billion Forecast Revenue (2034) USD 18.8 Billion CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Process (Mechanical, Chemical), By Packaging Type (Flexible Packaging, Rigid Packaging), By End Use (Food and Beverage, Personal Care and Cosmetics, Pharmaceuticals, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Braskem, Borealis AG, Mitsubishi Chemical, Exxon Mobil Corporation, Nexam Chemical, Pashupati Group of Industries, Sumitomo Chemical Co., Ltd., Nexeo Plastics, LLC, Shell Chemicals, ECOPLAS (HK) LIMITED Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Recycled Polypropylene In Packaging MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Recycled Polypropylene In Packaging MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Braskem

- Borealis AG

- Mitsubishi Chemical

- Exxon Mobil Corporation

- Nexam Chemical

- Pashupati Group of Industries

- Sumitomo Chemical Co., Ltd.

- Nexeo Plastics, LLC

- Shell Chemicals

- ECOPLAS (HK) LIMITED