Global Recloser Control Market Size, Share Report By Type (Hydraulic Recloser, Electronic Recloser), By Phase (Three –Phase, Single –Phase, Triple –Single Phase), By Voltage (Up to 15 Kv, 16-27 Kv, 28-38 Kv), By Insulation Medium (Oil, Air, Epoxy Resin), By Installation Type (Outdoor Installation, Indoor Installation), By Technology (Wired Communication, Wireless Communication), By End User (Utilities, Industrial, Commercial, Residential) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154642

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Type Analysis

- By Phase Analysis

- By Voltage Analysis

- By Insulation Medium Analysis

- By Installation Type Analysis

- By Technology Analysis

- By End User Analysis

- Key Market Segments

- Emerging Trends

- Drivers

- Restraints

- Opportunity

- Regional Insights

- Key Players Analysis

- Recent Industry Developments

- Report Scope

Report Overview

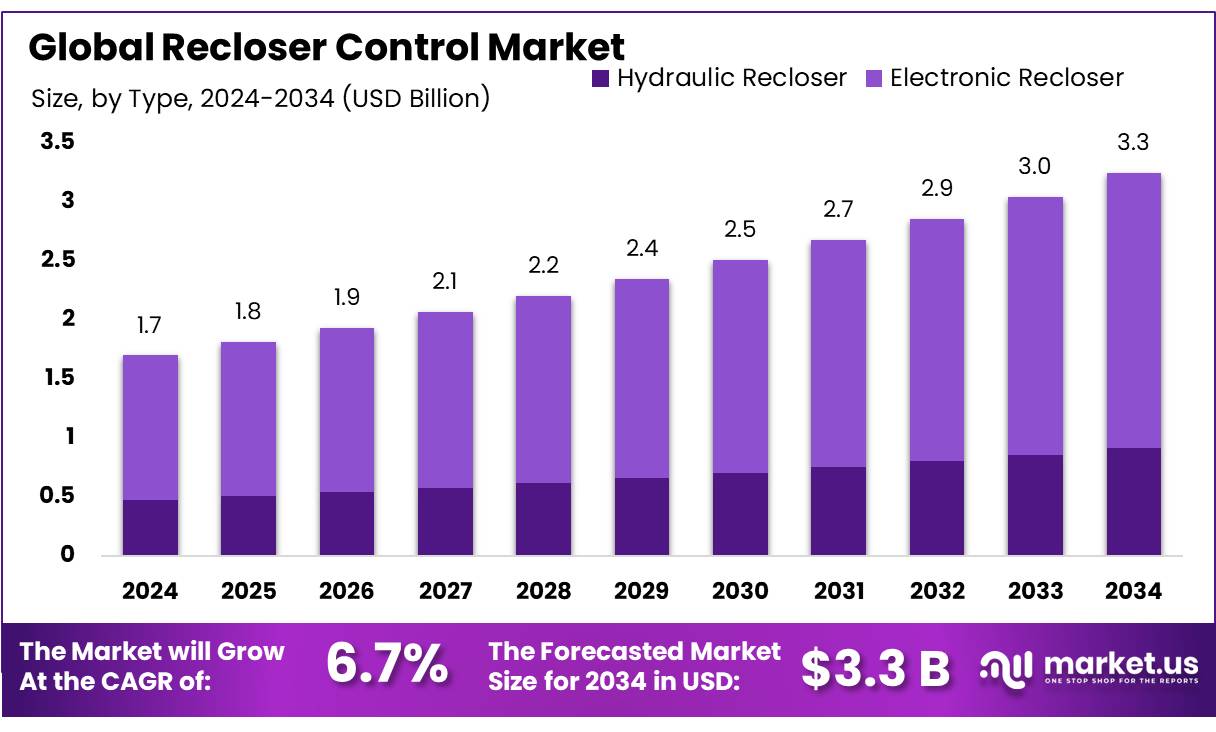

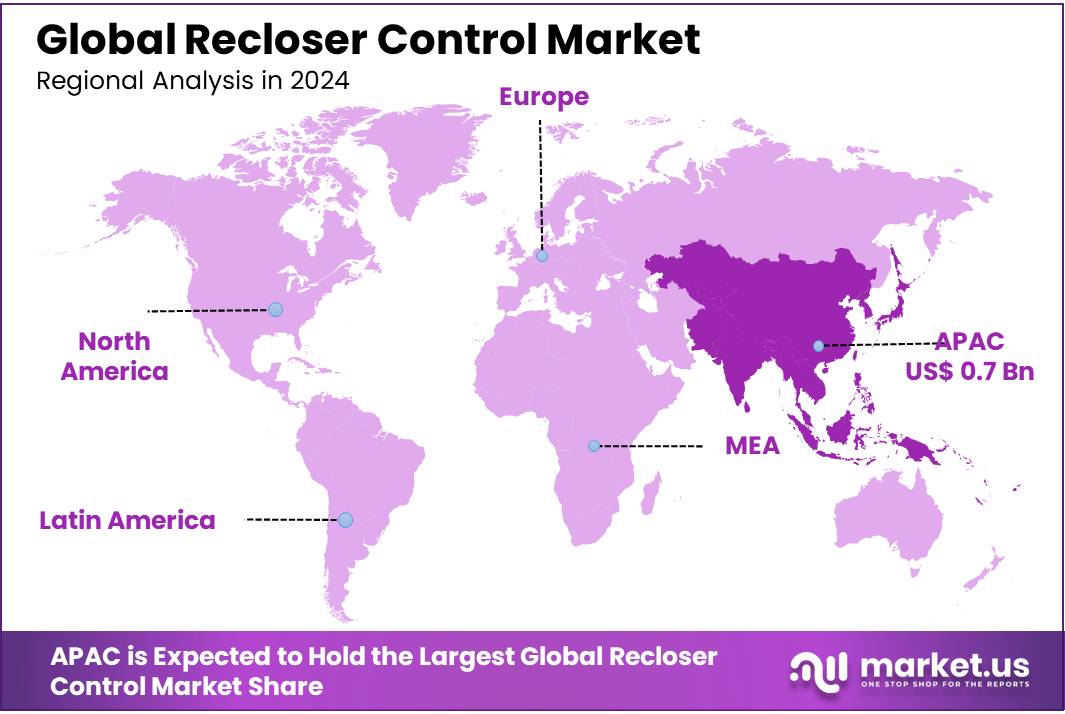

The Global Recloser Control Market size is expected to be worth around USD 3.3 Billion by 2034, from USD 1.7 Billion in 2024, growing at a CAGR of 6.7% during the forecast period from 2025 to 2034. In 2024, Asia Pacific (APAC) held a dominant market position, capturing more than a 41.60% share, holding USD 0.7 Billion in revenue.

Recloser control systems, also known as autoreclosers or automatic circuit reclosers, are automated switchgear deployed on overhead electric distribution networks to detect and interrupt transient faults and restore power via programmed reclose operations. They typically comply with IEC 62271‑111 and IEEE C37.60 standards and operate at standard distribution voltages of 15.5 kV, 27 kV, and 38 kV. Approximately 80 per cent of distribution-level faults are transient and can be cleared via reclosing rather than full outage restoration, making reclosers a critical reliability asset.

Key drivers of this growth include grid modernization objectives, rising electricity demand in developing economies, and integration of renewable energy assets that induce variability requiring precise fault‑management solutions. In the United States, smart grid policy under the Energy Independence and Security Act of 2007 mandates modernization of transmission and distribution systems and provides subsidies covering up to 20% of qualifying smart grid investments via the Department of Energy.

For instance, in Vidarbha, over 1,000 feeder separation projects and the enhancement of 727 substations are nearing completion, aiming to ensure a seamless and high-quality electricity supply to all consumers. Additionally, the National Smart Grid Mission (NSGM) provides a framework for implementing smart grid technologies, including recloser control systems, to create a secure, adaptive, and digitally enabled power distribution network.

Reliability mandates and government‑level programs reinforce adoption. For instance, the U.S. Infrastructure Investment and Jobs Act allocates USD 11 billion toward grid investment, with USD 3.46 billion directed to resiliency and smart grid grants supporting projects that enable up to 35 GW of renewable energy integration and 400 microgrids by 2030.

These investments often include the deployment of automation assets such as recloser controls to meet utility and regulatory requirements. Smart grid pilot programs have further accelerated deployment of digital protection devices. For example, South Korea committed USD 65 million to a smart‑grid pilot on Jeju Island serving 6,000 households, integrating advanced control equipment to support automated switching and renewable integration

Key Takeaways

- The global recloser control market is projected to reach USD 3.3 billion by 2034, up from USD 1.7 billion in 2024, registering a CAGR of 6.7% over the forecast period.

- Electronic Recloser led the market in 2024, holding a dominant share of 72.9%.

- Three-Phase systems held the top position, accounting for 46.2% of the market share in 2024.

- Reclosers rated Up to 15 kV captured a leading market share of 44.1% in 2024.

- Oil-insulated reclosers led this category with a 43.9% market share in 2024.

- Outdoor Installations dominated with a commanding 78.6% share in 2024.

- Wired Communication systems accounted for the highest share at 56.2% in 2024.

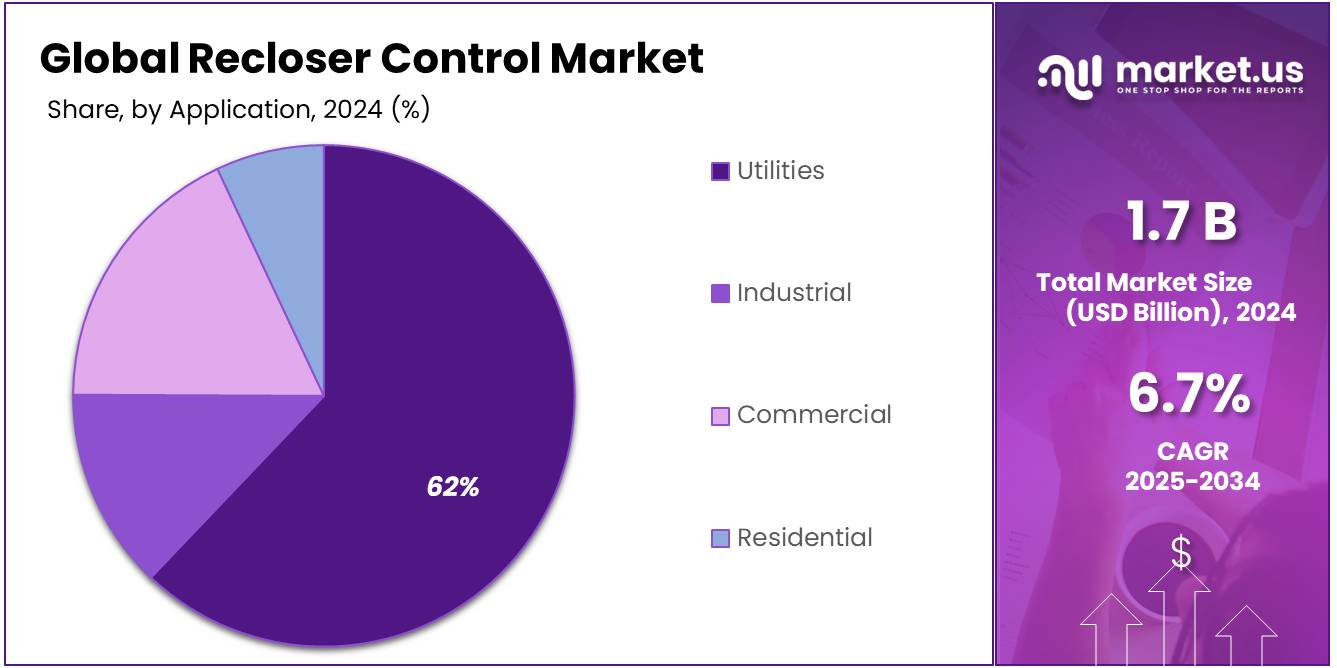

- The Utilities segment led the market with a 62.30% share in 2024.

- Asia Pacific (APAC) held a leading regional position, capturing 41.60% of the global market in 2024, valued at approximately USD 0.7 billion.

By Type Analysis

Electronic Recloser dominates with 72.9% share in 2024 due to its smart automation and grid reliability features.

In 2024, Electronic Recloser held a dominant market position, capturing more than a 72.9% share. This strong lead was driven by its ability to offer real-time fault detection, faster response times, and seamless integration with SCADA and smart grid systems. Utilities are increasingly choosing electronic models over traditional hydraulic or mechanical types because of their advanced features such as programmable logic, remote control capabilities, and improved reliability. As power distribution networks grow more complex—especially with the addition of renewable energy sources and electric vehicle charging infrastructure—electronic reclosers help in maintaining system stability and reducing outage durations.

By Phase Analysis

Three-Phase dominates with 46.2% share in 2024 due to its suitability for high-load utility applications.

In 2024, Three-Phase held a dominant market position, capturing more than a 46.2% share in the global recloser control market. This segment is widely preferred by utilities and industrial users because it offers stable and balanced power distribution across large electrical networks. Three-phase reclosers are essential in medium to high-voltage lines, where maintaining load balance and preventing prolonged outages is critical. Their ability to handle higher current loads and coordinate with smart grid infrastructure makes them the go-to option for expanding transmission systems. With ongoing rural electrification and infrastructure development projects in emerging economies, the demand for reliable three-phase systems is growing steadily.

By Voltage Analysis

Up to 15 kV dominates with 44.1% share in 2024 due to its strong demand in urban and utility distribution networks.

In 2024, Up to 15 kV held a dominant market position, capturing more than a 44.1% share in the recloser control market. This voltage range is widely used across urban distribution grids and short-distance power lines, especially in residential and commercial zones. Its popularity stems from the fact that most city and town-level power infrastructure operates below 15 kV, making this segment essential for everyday grid protection. These systems are compact, cost-effective, and ideal for controlling medium load faults, helping utilities reduce downtime and improve service reliability.

By Insulation Medium Analysis

Oil insulation dominates with 43.9% share in 2024 due to its proven reliability and durability in outdoor applications.

In 2024, Oil held a dominant market position, capturing more than a 43.9% share in the recloser control market by insulation medium. Oil-insulated reclosers have remained a preferred choice for many power utilities, particularly in outdoor and remote installations, where durability and long-term performance are critical. The insulating oil provides effective arc quenching and thermal management, which ensures reliable operation under varied environmental conditions. These systems are especially favored in regions with harsh weather, where solid or gas insulation might face performance limitations. Oil-based reclosers are also easier to maintain and have a longer track record of field-proven reliability.

By Installation Type Analysis

Outdoor Installation dominates with 78.6% share in 2024 due to its wide use in overhead power distribution systems.

In 2024, Outdoor Installation held a dominant market position, capturing more than a 78.6% share in the recloser control market. This strong preference is driven by the widespread use of overhead distribution lines, especially in suburban and rural areas where outdoor installations are more practical and cost-efficient. Outdoor recloser systems are built to withstand harsh environmental conditions such as heat, rain, wind, and dust, making them ideal for utility-scale deployments. These installations are also easier to access for maintenance and upgrades, which helps utilities improve service reliability and reduce outage durations. As power infrastructure continues to expand into less urbanized regions, outdoor systems remain the top choice due to their versatility and low operational costs.

By Technology Analysis

Wired Communication leads with 56.2% share in 2024 due to its stable performance and secure data transmission.

In 2024, Wired Communication held a dominant market position, capturing more than a 56.2% share in the recloser control market by technology. This segment’s strength lies in its ability to provide reliable and uninterrupted connectivity, which is crucial for critical grid operations. Wired systems are widely adopted by utilities for their lower susceptibility to signal interference and higher data security, especially in mission-critical environments like substations and distribution hubs. These systems are typically integrated with SCADA platforms, enabling precise fault detection and real-time control. In many legacy grid infrastructures, wired networks remain the default choice due to their compatibility and ease of maintenance.

By End User Analysis

Utilities dominate with 62.3% share in 2024 due to large-scale adoption in national and regional power grids.

In 2024, Utilities held a dominant market position, capturing more than a 62.30% share in the recloser control market by end-use. This segment’s leadership is strongly linked to the increasing demand for grid automation and fault protection across wide-area electricity distribution networks. Utilities rely heavily on recloser control systems to improve power reliability, minimize downtime, and efficiently manage load distribution.

As governments and regulatory bodies continue to push for smarter, more resilient grids, public and private utilities are investing in modern protection systems, especially in regions experiencing rapid urbanization and grid expansion. These control systems are also critical in managing the rising number of grid connections from renewable sources, which require quick and precise fault isolation.

Key Market Segments

By Type

- Hydraulic Recloser

- Electronic Recloser

By Phase

- Three –Phase

- Single –Phase

- Triple –Single Phase

By Voltage

- Up to 15 Kv

- 16-27 Kv

- 28-38 Kv

By Insulation Medium

- Oil

- Air

- Epoxy Resin

By Installation Type

- Outdoor Installation

- Indoor Installation

By Technology

- Wired Communication

- Wireless Communication

By End User

- Utilities

- Industrial

- Commercial

- Residential

Emerging Trends

Increasing Integration of Smart Grid Technologies

The recloser control market is experiencing a significant shift towards the integration of smart grid technologies. These advancements are transforming traditional power distribution systems into more intelligent, automated, and resilient networks. Smart grids enable utilities to monitor and manage electricity flow in real-time, detect and isolate faults swiftly, and restore service with minimal downtime. This evolution is particularly crucial in industries like food processing, where consistent and reliable power supply is essential to maintain product quality and safety.

Approximately 40% of new recloser installations now feature remote control and monitoring capabilities, allowing utility operators to detect and address issues in real-time. This trend is primarily driven by the need for improved grid management and operational efficiency. Furthermore, smart grid technologies, which are growing at a rate of 35%, are playing a crucial role in the adoption of recloser control systems. These technologies allow utilities to integrate reclosers into larger grid management frameworks, enhancing their ability to respond to faults and minimize service interruptions.

In the food industry, the adoption of smart grid technologies is becoming increasingly important. Food processing facilities often operate around the clock and cannot afford power interruptions that could lead to product spoilage or safety concerns. By integrating recloser controls with smart grid systems, these facilities can benefit from enhanced fault detection and quicker restoration times, thereby reducing the risk of production downtime.

Governments and regulatory bodies are also recognizing the importance of smart grid technologies in enhancing grid reliability and efficiency. For instance, the U.S. Department of Energy has been promoting the integration of smart grid technologies, which include recloser systems, to enhance grid reliability and efficiency. Such initiatives aim to reduce the financial burden on industries and accelerate the modernization of electrical infrastructure.

Drivers

Enhanced Grid Reliability and Automation

One of the primary driving factors behind the adoption of recloser control concentrators in India is the pressing need to enhance grid reliability and automation. As the country experiences rapid urbanization, industrial growth, and increasing electricity demand, the traditional power distribution infrastructure faces significant challenges in maintaining consistent and uninterrupted service. Recloser control concentrators address these challenges by providing advanced fault detection, isolation, and restoration capabilities, thereby minimizing downtime and improving overall system reliability.

- According to the Ministry of Power, India successfully met an all-time maximum power demand of 250 GW during FY 2024-25. This surge in demand underscores the strain on existing distribution networks and the necessity for intelligent automation solutions.

Reclosers equipped with control concentrators enable utilities to swiftly detect and isolate faults, automatically restoring service to unaffected areas and reducing the impact of outages on consumers. This proactive approach not only enhances reliability but also optimizes operational efficiency by minimizing the need for manual intervention.

Furthermore, the integration of renewable energy sources into the grid introduces additional complexities, such as variability and intermittency. Recloser control concentrators facilitate the seamless integration of distributed energy resources by providing real-time monitoring and dynamic response capabilities. This adaptability ensures that the grid can accommodate fluctuations in renewable generation while maintaining stability and reliability.

The Indian government’s initiatives, such as the Deendayal Upadhyaya Gram Jyoti Yojana (DDUGJY) and the Integrated Power Development Scheme (IPDS), aim to strengthen rural and urban distribution networks. These programs focus on feeder separation, system strengthening, and the implementation of smart grid technologies, creating a conducive environment for the deployment of recloser control concentrators. By aligning with these initiatives, utilities can leverage advanced recloser technologies to achieve the objectives of enhanced grid reliability and automation.

Restraints

High Initial Investment Costs

One of the significant challenges in adopting recloser control systems in the food industry is the substantial upfront capital required. The installation of reclosers involves significant expenses, including equipment, infrastructure, and integration with existing electrical systems. The cost of a single recloser can range from $10,000 to $30,000, depending on the technology and features.

For food processing facilities, especially small to medium-sized enterprises, this high initial investment can be a deterrent. These companies often operate on tight margins and may prioritize immediate operational needs over long-term infrastructure improvements. As a result, the adoption of recloser control systems may be delayed or overlooked, potentially compromising the reliability and safety of their electrical distribution networks.

Recognizing this barrier, some governments and industry bodies are offering incentives and support to encourage the adoption of advanced electrical protection systems. For instance, the U.S. Department of Energy has been promoting the integration of smart grid technologies, which include recloser systems, to enhance grid reliability and efficiency. Such initiatives aim to reduce the financial burden on industries and accelerate the modernization of electrical infrastructure .

Opportunity

Government Initiatives Driving Recloser Control Adoption

A significant growth opportunity for recloser control concentrators in India arises from the government’s strategic investments in grid modernization and renewable energy integration. These initiatives are pivotal in enhancing the reliability and efficiency of the power distribution network, thereby accelerating the adoption of advanced technologies like reclosers.

The Revamped Distribution Sector Scheme (RDSS), launched by the Ministry of Power, aims to strengthen the distribution infrastructure across the country. This scheme focuses on reducing Aggregate Technical & Commercial (AT&C) losses, improving the quality and reliability of power supply, and enhancing consumer satisfaction. By promoting the adoption of smart grid technologies, including reclosers, RDSS facilitates real-time monitoring and fault detection, leading to quicker restoration of services and reduced downtime.

Additionally, the National Smart Grid Mission (NSGM) serves as a comprehensive initiative to modernize India’s electricity distribution systems. The mission emphasizes the integration of Information and Communication Technology (ICT) to enable two-way communication between utilities and consumers. This integration supports the deployment of reclosers by providing the necessary infrastructure for remote monitoring and control, thereby enhancing the overall efficiency and reliability of the grid.

Furthermore, India’s commitment to increasing its renewable energy capacity necessitates the modernization of the power distribution network. The integration of renewable energy sources, such as solar and wind, introduces variability in power generation, which can affect grid stability. Reclosers play a crucial role in mitigating these challenges by quickly isolating faults and restoring service, thus ensuring a stable and reliable power supply.

Regional Insights

Asia Pacific dominates the recloser control market with 41.60% share, valued at USD 0.7 billion in 2024, driven by rapid urbanization, grid expansion, and government electrification programs.

In 2024, the Asia Pacific (APAC) region held a commanding position in the global recloser control market, accounting for over 41.60% of the total share, which translated to a value of approximately USD 0.7 billion. This dominance is largely attributed to the significant investments made by regional governments and utilities in modernizing power infrastructure, particularly in countries like China, India, Indonesia, and Vietnam. These nations are witnessing a rapid rise in electricity demand due to population growth, industrialization, and rural electrification efforts.

For instance, India’s Deendayal Upadhyaya Gram Jyoti Yojana (DDUGJY) and the Integrated Power Development Scheme (IPDS) have allocated billions of dollars towards improving distribution networks, directly supporting the adoption of recloser control systems for fault management and reliability improvement.

China, as the largest electricity producer and consumer in the region, is also expanding its distribution automation and deploying smart grid technologies across urban and peri-urban areas, further boosting demand for intelligent recloser controls. Moreover, Southeast Asian countries are increasingly integrating distributed renewable energy sources, which require faster and more efficient fault isolation solutions, where recloser control units play a vital role.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ABB is a key player in the recloser control market, offering advanced automation and protection solutions for medium-voltage networks. The company provides smart recloser control units integrated with communication protocols like IEC 61850, ensuring high reliability and real-time grid responsiveness. ABB’s products are widely used in smart grid deployments and distribution automation projects across North America, Asia, and Europe. In 2024, ABB continued investing in digital technologies and remote monitoring systems to support efficient fault management and grid modernization efforts globally.

General Electric provides comprehensive recloser control solutions through its Grid Solutions division, supporting utilities with digital protection and control technologies. GE’s controllers are designed for high-speed performance and grid reliability, compatible with IEC and ANSI standards. In 2024, the company focused on delivering cybersecure and scalable systems, catering to global smart grid expansion. GE’s strong presence in North America, Europe, and emerging Asian markets reflects its role in large-scale infrastructure projects aimed at modernizing electricity distribution systems.

Siemens is recognized for its robust recloser control systems designed to enhance grid reliability and performance. The company’s solutions offer seamless integration with digital substations and smart grids, utilizing advanced protection relays and communication modules. In 2024, Siemens focused on sustainable and energy-efficient infrastructure, aligning its control technologies with global electrification trends. Its presence is strong across Europe, Asia, and Latin America, where utilities are upgrading legacy systems with intelligent fault detection and automation supported by Siemens’ innovative technologies.

Top Key Players Outlook

- ABB

- Eaton

- Siemens

- G&W

- General Electric’s

- Schneider

- Noja Power

- Stelmec

- Arteche

- Entec Electric and Electronic

Recent Industry Developments

In 2024, Eaton reported revenues of nearly USD 25 billion globally, with a significant portion derived from its utility grid solutions including recloser controls.

In 2024, G&W Electric recorded peak annual revenue of approximately USD 124.0 million and achieved ISO 9001:2015 quality certification across its design and manufacturing operations.

Report Scope

Report Features Description Market Value (2024) USD 1.7 Bn Forecast Revenue (2034) USD 3.3 Bn CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Hydraulic Recloser, Electronic Recloser), By Phase (Three –Phase, Single –Phase, Triple –Single Phase), By Voltage (Up to 15 Kv, 16-27 Kv, 28-38 Kv), By Insulation Medium (Oil, Air, Epoxy Resin), By Installation Type (Outdoor Installation, Indoor Installation), By Technology (Wired Communication, Wireless Communication), By End User (Utilities, Industrial, Commercial, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB, Eaton, Siemens, G&W, General Electric’s, Schneider, Noja Power, Stelmec, Arteche, Entec Electric and Electronic Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ABB

- Eaton

- Siemens

- G&W

- General Electric’s

- Schneider

- Noja Power

- Stelmec

- Arteche

- Entec Electric and Electronic