Global Reclaimed Lumber Market Size, Share, And Enhanced Productivity By Wood Type (Softwood, Hardwood), By Application (Flooring, Paneling, Beams and Boards, Furniture, Others), By End-Use (Residential, Commercial, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 173598

- Number of Pages: 204

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

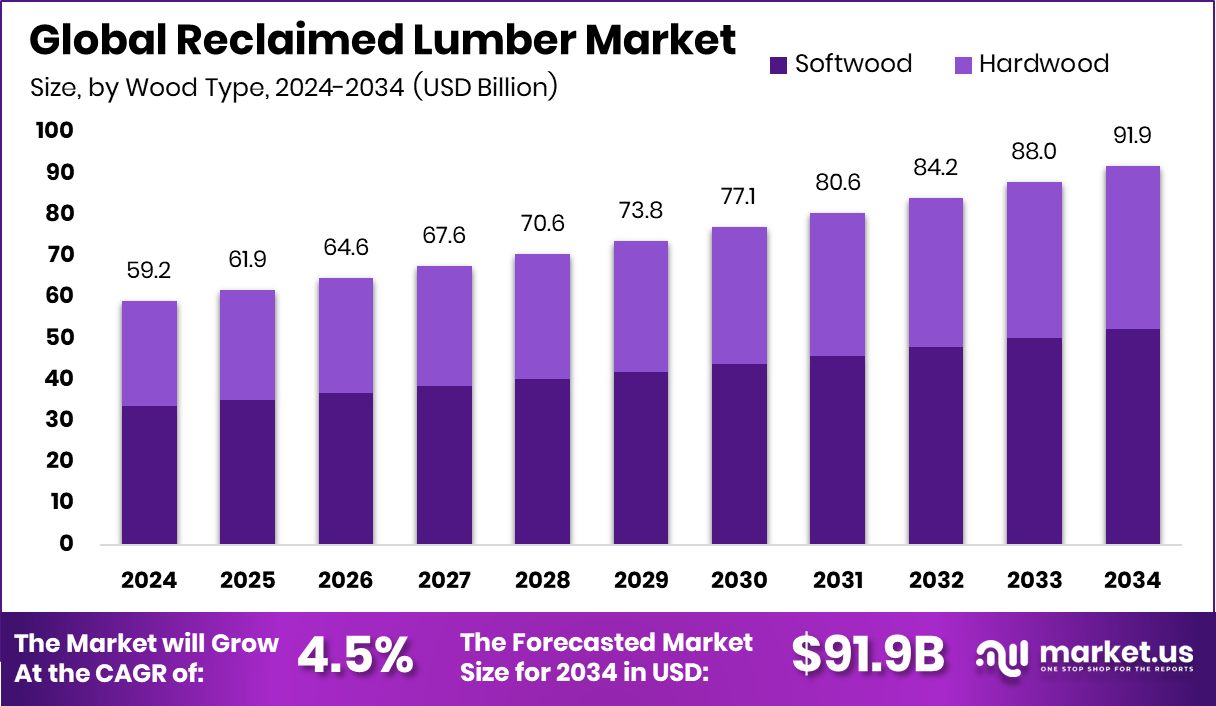

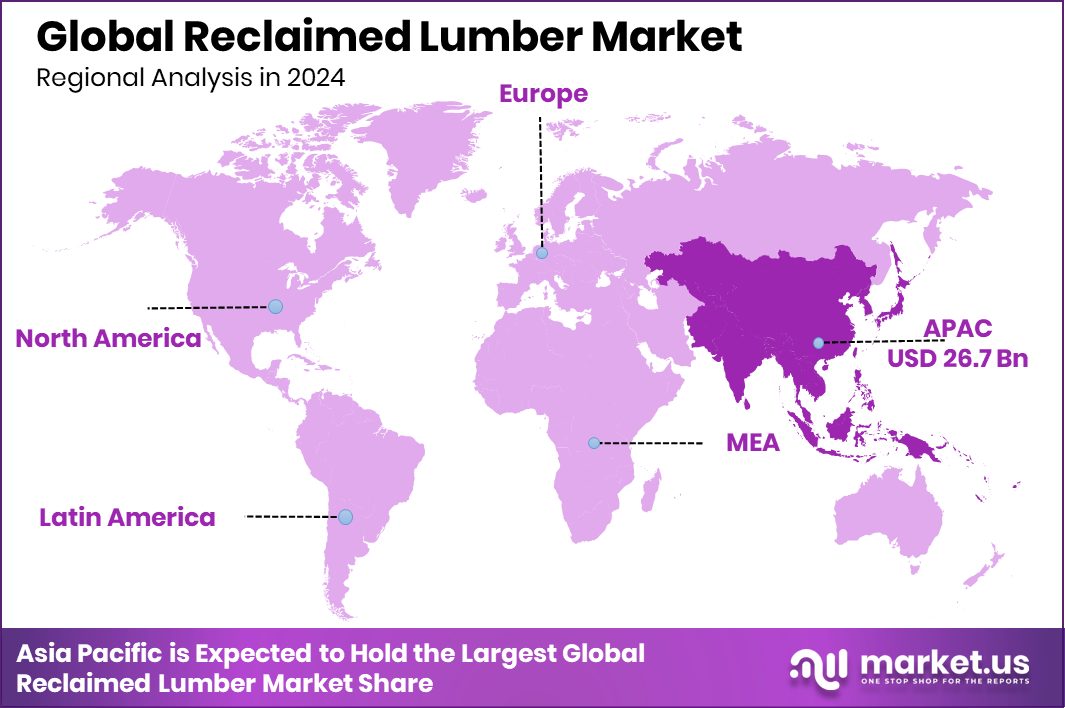

The Global Reclaimed Lumber Market is expected to be worth around USD 91.9 billion by 2034, up from USD 59.2 billion in 2024, and is projected to grow at a CAGR of 4.5% from 2025 to 2034. Reclaimed Lumber Market in the Asia Pacific reached 45.20%, generating USD 26.7 Bn revenue overall region.

Reclaimed lumber refers to wood that has been recovered from old buildings, barns, factories, warehouses, bridges, and other structures instead of being newly harvested. This wood is cleaned, processed, and reused for construction, flooring, furniture, and interior applications. Its aged appearance, strength, and reduced environmental impact make it highly valued.

The Reclaimed Lumber Market covers the production, processing, distribution, and use of reclaimed wood across residential, commercial, and industrial projects. It supports sustainable construction by extending the life cycle of wood materials, lowering landfill waste, and reducing pressure on natural forests, while also delivering a unique visual character.

Growth in the reclaimed lumber market is supported by broader activity in the lumber sector. Canada announced $700M to support its struggling softwood lumber sector, while Ottawa separately committed $20M to assist British Columbia’s forest sector during ongoing softwood trade challenges. These measures stabilize raw material flows and recovery operations.

Demand for reclaimed lumber continues to rise as builders and designers seek durable, low-impact materials. In the U.S., allegations that Canada is subsidizing the softwood industry with $1.2 billion highlight the scale of government involvement shaping lumber availability, indirectly influencing reclaimed supply chains.

Opportunities in the reclaimed lumber market are expanding alongside policy support. Cautious optimism emerged in British Columbia after the Prime Minister announced $1.2B in softwood lumber support, strengthening forest-sector resilience and creating more long-term recovery, reuse, and value-added opportunities for reclaimed wood.

Key Takeaways

- The Global Reclaimed Lumber Market is expected to be worth around USD 91.9 billion by 2034, up from USD 59.2 billion in 2024, and is projected to grow at a CAGR of 4.5% from 2025 to 2034.

- Reclaimed Lumber Market by wood type shows softwood is dominant with a 56.9% share globally today.

- Reclaimed Lumber Market by application indicates flooring dominated demand with a 38.1% share worldwide currently.

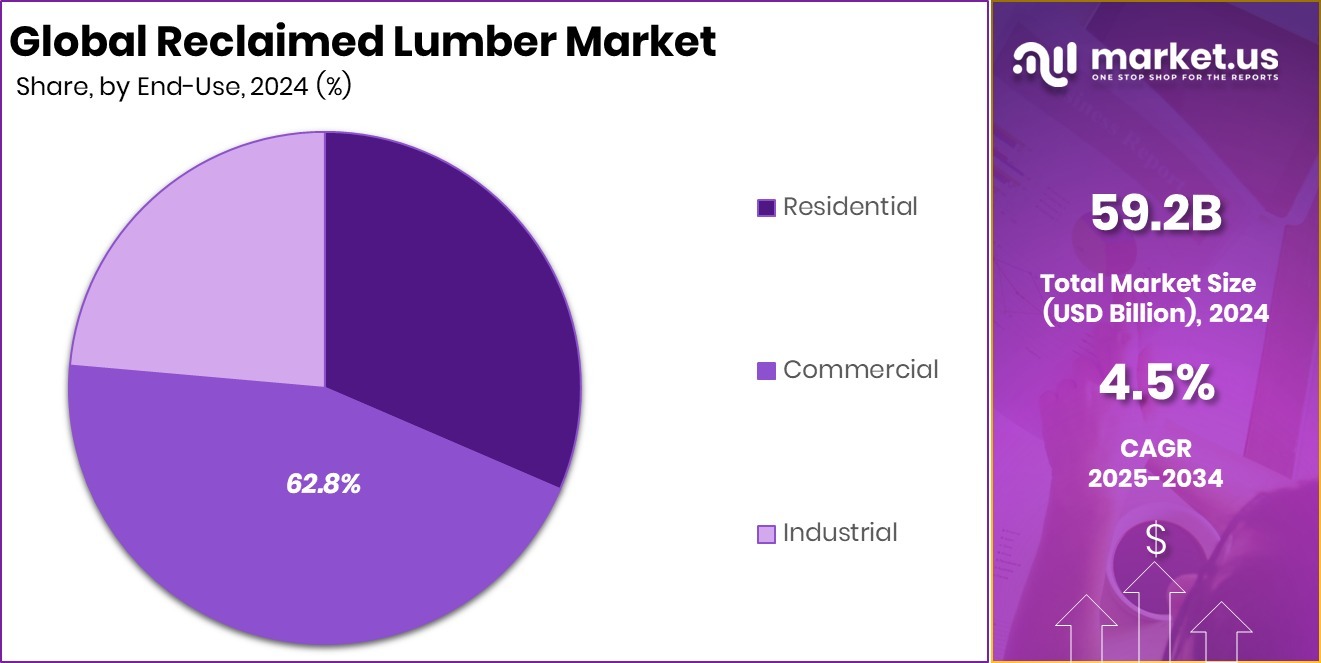

- Reclaimed Lumber Market by end-use highlights commercial-dominated consumption, holding a 62.8% share across sectors.

- Asia Pacific dominated the reclaimed lumber market with a 45.20% share, valued at USD 26.7 Bn revenue.

By Wood Type Analysis

In 2024, the Reclaimed Lumber Market saw softwood dominate the wood type segment, holding a leading 56.9% share. This dominance is driven by the wide availability of reclaimed softwood from old barns, warehouses, shipping pallets, and industrial structures. Softwood species such as pine, fir, and spruce are easier to recover, process, and repurpose, making them highly suitable for structural reuse and decorative applications. Their lighter weight and workability reduce refurbishment costs, which appeals to builders and designers seeking sustainable materials.

Additionally, reclaimed softwood aligns well with green building certifications and carbon-reduction goals. Growing awareness of circular construction practices and rising demand for eco-friendly materials continue to strengthen softwood’s leadership within the reclaimed lumber value chain.

By Application Analysis

Flooring dominated the Reclaimed Lumber Market by application, accounting for 38.1% share.

In 2024, flooring emerged as the dominant application within the Reclaimed Lumber Market, capturing a strong 38.1% share. Reclaimed wood flooring is valued for its durability, aged appearance, and unique grain patterns that cannot be replicated by new materials. Architects and interior designers increasingly specify reclaimed flooring to deliver rustic, vintage, or industrial aesthetics in residential and commercial spaces.

Moreover, reclaimed lumber used in flooring often comes from mature trees, offering superior hardness and long service life. Sustainability considerations also play a major role, as reclaimed flooring reduces deforestation and landfill waste. As renovation activity and demand for premium interior finishes rise, reclaimed lumber flooring continues to maintain its leading application position.

By End-Use Analysis

Commercial dominated the Reclaimed Lumber Market by end-use, representing 62.8% share overall.

In 2024, the commercial segment dominated the end-use landscape of the Reclaimed Lumber Market, accounting for a substantial 62.8% share. Commercial spaces such as offices, retail stores, hotels, restaurants, and corporate campuses increasingly use reclaimed lumber to enhance brand identity and sustainability credentials. Businesses prefer reclaimed wood for feature walls, flooring, ceilings, and furniture to create warm, authentic environments that resonate with eco-conscious consumers.

Large-scale commercial projects also benefit from the consistent supply volumes achievable through organized reclamation channels. Additionally, green building standards and corporate sustainability commitments are accelerating adoption across commercial construction and renovation projects, reinforcing the segment’s strong leadership in overall reclaimed lumber demand.

Key Market Segments

By Wood Type

- Softwood

- Hardwood

By Application

- Flooring

- Paneling

- Beams and Boards

- Furniture

- Others

By End-Use

- Residential

- Commercial

- Industrial

Driving Factors

Sustainability Funding Accelerates Reclaimed Lumber Adoption

Growing focus on sustainability strongly drives the Reclaimed Lumber Market across construction and interiors. Builders increasingly prefer reclaimed wood to reduce landfill waste and lower carbon footprints. This shift aligns with green building standards and responsible sourcing policies. Financial support across related value chains strengthens this movement. For instance, Direct Flooring receives a £1.5m funding package from the Bank of Scotland, supporting the expansion of flooring solutions that often integrate reclaimed timber.

Such funding improves processing capacity, supply reliability, and market visibility. As flooring is a major application for reclaimed lumber, investment in downstream businesses indirectly boosts demand. Moreover, easier financing helps suppliers modernize storage and grading operations. Overall, sustainability awareness combined with targeted funding accelerates the adoption of reclaimed lumber as a practical, eco-friendly building material for residential and commercial projects worldwide today.

Restraining Factors

Public Funding Shifts Limit Construction Material Demand

One key restraint for the Reclaimed Lumber Market is the uneven allocation of public funding away from construction activities. When governments prioritize social infrastructure over building materials, demand growth can slow. For example, Commerce boosts child care with more than $7 million for 64 early learning centers, directing budgets toward services rather than physical construction upgrades. Such funding decisions may reduce short-term investment in renovation and commercial building projects where reclaimed lumber is widely used.

Additionally, smaller construction firms may delay refurbishment plans due to limited capital availability. This shift can impact reclaimed lumber suppliers that rely on steady renovation cycles. As a result, market growth faces pressure from changing public spending priorities, even as sustainability interest remains strong across long-term development strategies.

Growth Opportunity

Venture Capital Supports Innovation In Sustainable Materials

The Reclaimed Lumber Market has a strong growth opportunity through innovation and new business models supported by private capital. Investors increasingly back sustainability-focused ventures that improve material efficiency and circular use. Portal Innovations’ raising $100 million life sciences venture fund highlights growing confidence in advanced, impact–driven investments.

While focused on life sciences, such large venture funds signala broader investor appetite for sustainable infrastructure, lab spaces, and adaptive reuse projects. These developments often favor reclaimed lumber for interiors, structural accents, and custom fittings.

Access to large investment pools encourages startups to develop digital marketplaces, better wood tracing, and advanced treatment technologies. Over time, these innovations improve quality, consistency, and scalability. This financial momentum opens new commercial and institutional opportunities, strengthening reclaimed lumber adoption across modern, innovation-led building environments globally.

Latest Trends

Government Grants Encourage Heritage And Sustainable Renovation

A key latest trend in the Reclaimed Lumber Market is rising government support for heritage conservation and sustainable renovation. Public funding increasingly targets restoration of historic buildings, community facilities, and aging infrastructure. Mountbatten to receive almost £1m in government funds reflects this direction, supporting renovation projects that often favor reclaimed materials to preserve character and authenticity.

Such grants promote the use of reclaimed lumber in flooring, beams, wall panels, and custom interiors. This trend strengthens demand from public institutions and nonprofit projects. Additionally, government-backed renovations raise awareness of reclaimed wood benefits among architects and contractors. As more funded projects specify sustainable materials, reclaimed lumber gains credibility as both a functional and culturally valuable resource within modern renovation practices.

Regional Analysis

Asia Pacific led the Reclaimed Lumber Market demand at 45.20%, totaling USD26.7Bn market revenue.

In the Reclaimed Lumber Market, Asia Pacific emerged as the dominating region, accounting for 45.20% of total demand and generating USD 26.7 Bn in market value. This leadership reflects strong construction activity, widespread renovation of aging infrastructure, and growing acceptance of sustainable building materials across major economies in the region. The availability of reclaimed timber from old industrial facilities and urban redevelopment projects further supports regional dominance.

North America represents a mature and well-established market, driven by strong sustainability awareness, reuse practices, and demand from commercial interiors, hospitality spaces, and green building projects. Europe continues to show steady uptake, supported by strict environmental norms, circular-economy practices, and architectural preferences for reclaimed aesthetics in both residential and commercial developments.

Meanwhile, the Middle East & Africa is gradually expanding as premium construction, tourism-led projects, and sustainable design concepts gain traction. Latin America shows emerging potential, supported by increasing urban renewal activities and growing awareness of material reuse. Collectively, these regions reflect a market shaped by sustainability priorities, architectural trends, and resource efficiency, with Asia Pacific clearly maintaining its dominant regional position.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Vintage Timberworks, Inc plays a strong role in shaping the premium segment of the global Reclaimed Lumber Market in 2024. The company is widely recognized for transforming reclaimed wood into high-value architectural elements, including beams, flooring, and custom interior products. Its emphasis on craftsmanship, material authenticity, and consistent quality positions it well among architects and designers seeking distinctive reclaimed solutions. By focusing on customization and long-life applications, the company reinforces reclaimed lumber’s value beyond cost savings, highlighting durability, heritage, and aesthetic appeal.

Carpentier Hardwood Solutions, NV, demonstrates a structured and professional approach to reclaimed lumber utilization. The company’s strength lies in blending reclaimed materials with engineered hardwood expertise, enabling reliable performance across commercial and residential projects. Its solutions support sustainability goals while meeting technical standards expected by modern construction stakeholders. This balanced positioning allows the company to address both design-driven and performance-driven demand, making it a steady contributor to market maturity.

Meanwhile, Imondi Flooring stands out through its focus on reclaimed wood flooring solutions. The company leverages reclaimed lumber to deliver flooring products valued for durability, character, and visual uniqueness. Its design-oriented product portfolio aligns well with renovation-led demand and premium interior projects. Collectively, these players reinforce reclaimed lumber’s credibility as a mainstream, design-forward building material in 2024.

Top Key Players in the Market

- Vintage Timberworks, Inc

- Carpentier Hardwood Solutions, NV

- Imondi Flooring

- TerraMai

- Jarmak Corporation

- Elemental Republic

- Olde Wood Ltd.

- Trestlewood

- True American Grain Reclaimed Wood

- Beam and Board, LLC

Recent Developments

- In 2025, Carpentier Hardwood Solutions, NV, a supplier of eco-friendly wood and reclaimed barnwood for cladding, decking, ceilings, and panelling, added new wood products to its range. These include the CP5 plank in HOTwood Clear Pine and updated Jump Line cladding in flush style, giving builders and designers more reclaimed wood options for exterior and interior projects.

Report Scope

Report Features Description Market Value (2024) USD 59.2 Billion Forecast Revenue (2034) USD 91.9 Billion CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Wood Type (Softwood, Hardwood), By Application (Flooring, Paneling, Beams and Boards, Furniture, Others), By End-Use (Residential, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Vintage Timberworks, Inc, Carpentier Hardwood Solutions, NV, Imondi Flooring, TerraMai, Jarmak Corporation, Elemental Republic, Olde Wood Ltd., Trestlewood, True American Grain Reclaimed Wood, Beam and Board, LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Reclaimed Lumber MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Reclaimed Lumber MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Vintage Timberworks, Inc

- Carpentier Hardwood Solutions, NV

- Imondi Flooring

- TerraMai

- Jarmak Corporation

- Elemental Republic

- Olde Wood Ltd.

- Trestlewood

- True American Grain Reclaimed Wood

- Beam and Board, LLC