Global Rapid Food Safety Testing Market Size, Share, And Enhanced Productivity By Test(Allergen Testing, Chemical and Nutritional Testing, Genetically Modified Organism (GMO) Testing, Microbiological Testing, Residues and Contamination Testing, Others), By Application (Meat, Poultry, and Seafood Products, Dairy and Dairy Products, Processed Food, Beverages, Cereals and Grains, Others), By Technology (Traditional, Rapid (Convenience Based, Polymerase Chain Reaction (PCR), Immunoassay, Chromatography and Spectrometry)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171512

- Number of Pages: 350

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

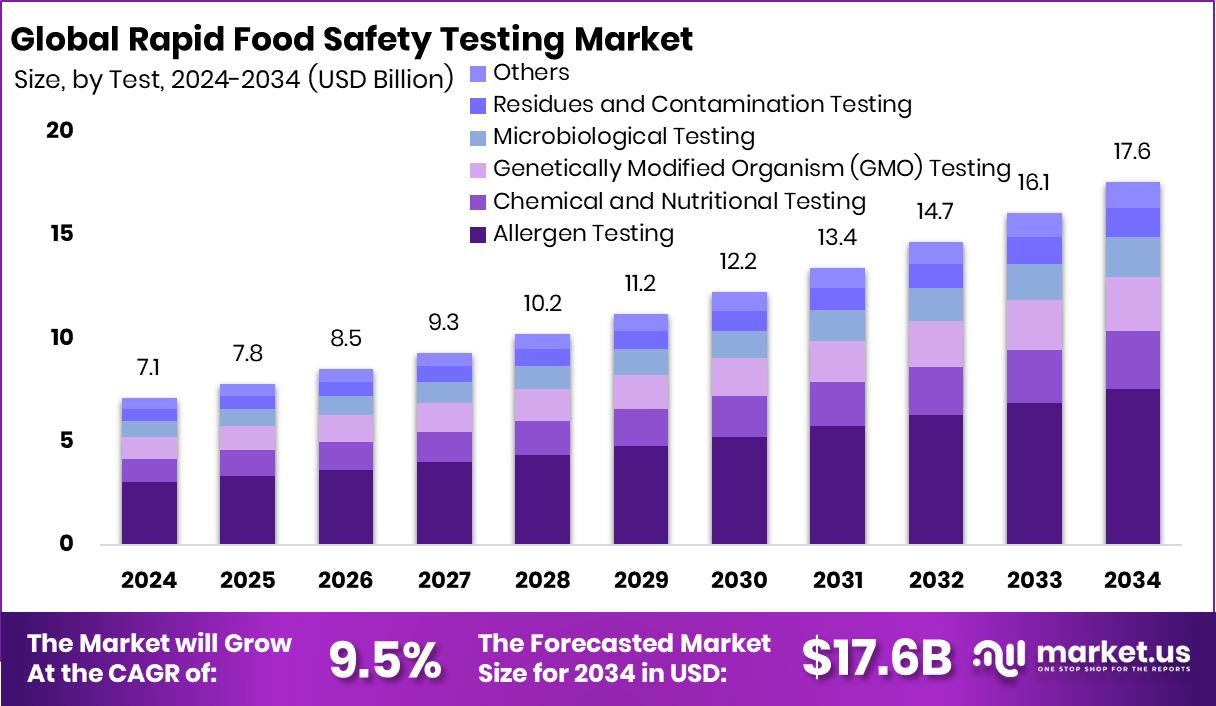

The Global Rapid Food Safety Testing Market is expected to be worth around USD 17.6 billion by 2034, up from USD 7.1 billion in 2024, and is projected to grow at a CAGR of 9.5% from 2025 to 2034. North America accounted for 39.40% of the Rapid Food Safety Testing Market, USD 2.7 Bn.

Rapid Food Safety Testing refers to fast analytical methods used to detect contamination, pathogens, or unsafe substances in food products. These tests are designed to deliver results in a short time, helping food producers, processors, and regulators act quickly before unsafe food reaches consumers. Rapid testing supports everyday quality checks, reduces delays in distribution, and improves confidence in food safety across fresh, processed, and packaged foods.

The Rapid Food Safety Testing Market covers tools, kits, and services that enable faster food safety decisions across the supply chain. It supports manufacturers facing rising scrutiny over ingredients, processing methods, and product labelling. As concerns grow around ultra-processed foods and preservatives, rapid testing helps verify safety claims and maintain consistent quality in evolving food formulations.

Growth factors are closely linked to investment flowing into cleaner and safer food production. Companies developing preservative-free or reformulated foods are scaling operations, increasing the need for frequent safety checks. Funding such as Tender Food (Lasso) evolving into Lasso after a USD 6.5 million raise, and Khetika securing USD 18 million for preservative-free foods, highlights this shift.

Demand is rising as food exports grow and regulatory expectations tighten. Farm and processed food exports increased by 10% during April–August, increasing pressure on producers to meet safety standards consistently. Additional funding activity, including Modern Baker raising €2.8 million and Actual Veggies attracting USD 7 million, reflects a growing emphasis on verified food quality.

Opportunities are strongest in emerging food innovation ecosystems. India’s food processing industry has seen over INR 70 billion in investments under the PLI scheme, while startups like Fambo raised INR 21.55 crore and SuperGround secured €2.5 million, expanding the need for rapid, reliable food safety validation.

Key Takeaways

- The Global Rapid Food Safety Testing Market is expected to be worth around USD 17.6 billion by 2034, up from USD 7.1 billion in 2024, and is projected to grow at a CAGR of 9.5% from 2025 to 2034.

- In the Rapid Food Safety Testing Market, Microbiological Testing dominates with a 42.8% share, driven by pathogen detection demand.

- Meat, Poultry, & Seafood Products lead applications at 31.7%, reflecting strict hygiene regulations in food processing.

- Rapid testing technologies account for 69.4% share, supported by faster results and real-time food safety monitoring.

- The rapid food safety testing market in North America reached a 39.40% share, USD 2.7 Bn.

By Test Analysis

In the Rapid Food Safety Testing Market, microbiological testing leads with a 42.8% share globally.

In 2024, Microbiological Testing held a dominant market position in the By Test segment of the Rapid Food Safety Testing Market, with a 42.8% share. This dominance reflects the critical role of microbiological methods in identifying foodborne pathogens that directly impact consumer health and regulatory compliance. Food producers and processors rely heavily on this testing approach to ensure products meet strict hygiene and safety standards before reaching the market.

The strong adoption of microbiological testing is also linked to its wide applicability across routine quality checks and contamination monitoring. Its ability to deliver reliable and actionable results supports faster decision-making in production environments. As food safety expectations continue to rise, this segment remains a cornerstone for maintaining trust, reducing recalls, and safeguarding brand reputation across the food supply chain.

By Application Analysis

Meat, poultry, and seafood applications dominate the Rapid Food Safety Testing Market at 31.7% usage.

In 2024, Meat, Poultry, & Seafood Products held a dominant market position in the By Application segment of the Rapid Food Safety Testing Market, with a 31.7% share. This leadership is driven by the high risk of microbial contamination associated with animal-based products and their short shelf life. Producers in this category prioritise frequent testing to prevent outbreaks and ensure product integrity from processing to distribution.

The dominance of this application segment also reflects tighter oversight and quality control practices across slaughtering, processing, and cold-chain handling. Rapid testing supports timely interventions, helping manufacturers maintain freshness, comply with safety norms, and reduce economic losses. As consumption volumes remain high, this application continues to command focused testing efforts across the industry.

By Technology Analysis

Rapid technologies account for 69.4%, driving speed and efficiency in the Rapid Food Safety Testing Market.

In 2024, Rapid held a dominant market position in the By Technology segment of the Rapid Food Safety Testing Market, with a 69.4% share. This strong position highlights the industry’s shift toward faster testing solutions that minimise waiting times without compromising accuracy. Rapid technologies enable quicker release of food products, supporting operational efficiency and supply chain continuity.

The widespread adoption of rapid technology is closely tied to its ability to deliver near real-time insights, which is crucial in high-throughput food processing environments. By reducing delays in quality verification, rapid testing helps manufacturers respond swiftly to safety risks, optimise production workflows, and meet growing demand for timely and safe food products.

Key Market Segments

By Test

- Allergen Testing

- Chemical and Nutritional Testing

- Genetically Modified Organism (GMO) Testing

- Microbiological Testing

- Residues and Contamination Testing

- Others

By Application

- Meat, Poultry, and Seafood Products

- Dairy and Dairy Products

- Processed Food

- Beverages

- Cereals and Grains

- Others

By Technology

- Traditional

- Rapid

- Convenience Based

- Polymerase Chain Reaction (PCR)

- Immunoassay

- Chromatography and Spectrometry

Driving Factors

Rising Public Investment Strengthens Food Safety Infrastructure

One major driving factor for the Rapid Food Safety Testing Market is increasing government investment in food, grain, and cereal research infrastructure. Public funding is being directed toward improving crop quality, contamination detection, and post-harvest safety, which directly increases the need for faster and more reliable food testing methods. In Manitoba, the government boosted its stake in a cereals research centre to USD 23.5 million, reinforcing its long-term focus on grain quality and safety.

Additionally, another USD 10.5 million was committed to the Gate project, alongside a call for federal funding, highlighting strong institutional support for advanced food systems. These initiatives expand research activity, pilot testing, and commercial-scale validation, all of which rely on rapid safety testing tools. Separate research grants of USD 150,000 for grain projects further encourage innovation, increasing routine testing needs across laboratories, processors, and research facilities.

Restraining Factors

Clean Label Innovation Raises Cost Pressures Testing Adoption

A key restraining factor for the Rapid Food Safety Testing Market is the cost pressure created by rapid clean-label innovation and premium product development. Food brands focusing on simplified ingredients and reformulated cereals often prioritise product launches and branding over expanded testing budgets.

A clean-label cereal company raising USD 6 million shows how early funding is directed toward formulation and scale rather than advanced safety systems. Similarly, Magic Spoon raising USD 85 million to expand better-for-you cereals into retail highlights how capital is heavily allocated to marketing, distribution, and shelf presence.

At the upstream level, provincial grain grower organisations committing USD 13.4 million to Cereals Canada’s GATE project reflects strong support for grain research, but such funds are spread across infrastructure, breeding, and quality initiatives. This allocation can slow direct investment into rapid testing adoption, especially for smaller processors managing tight margins.

Growth Opportunity

Alternative Dairy Expansion Creates New Testing Demand

A major growth opportunity for the Rapid Food Safety Testing Market is the fast expansion of dairy and alternative dairy ecosystems. Governments and startups are investing heavily in safer, more sustainable dairy production, increasing the need for rapid testing at farm, processing, and product levels. In the U.S., Governor Hochul announced USD 15.8 million awarded to help dairy farmers protect water quality, which raises testing needs for contamination, residues, and hygiene compliance.

At the same time, innovation in animal-free dairy is accelerating. A bioengineered animal-free dairy startup in India raised USD 4 million, while Imagindairy reached USD 28 million in total funding. These new production models rely on rapid safety testing to validate novel ingredients, fermentation processes, and final product safety before commercialisation.

Latest Trends

Cell-Based Seafood Drives Advanced Safety Testing

A key latest trend in the Rapid Food Safety Testing Market is the rapid rise of cultivated and alternative seafood, which requires faster and more precise safety validation. New seafood production methods introduce novel proteins, growth media, and processing steps that must be tested quickly before products reach consumers.

Bluu Seafood raised USD 17.5 million to commercialise cultivated fish, increasing demand for rapid microbial and quality testing. Early-stage innovation is also supported as seafood entrepreneurs can access USD 50,000 in funding, encouraging pilot production and safety checks.

Government backing further strengthens this trend, with USD 5 million invested in Canada to boost plant-based food production and USD 5.95 million invested by New Zealand to develop cultivated seafood. Additionally, an algae-based alternative seafood startup secured €3.2 million, highlighting the growing need for fast, reliable food safety testing across emerging seafood formats.

Regional Analysis

North America led the Rapid Food Safety Testing Market with a 39.40% share, USD 2.7 Bn.

North America dominated the Rapid Food Safety Testing Market, holding a 39.40% share and reaching a value of USD 2.7 Bn, reflecting the region’s strong focus on food safety compliance and quality assurance across the supply chain. The region benefits from well-established testing infrastructure, high adoption of rapid diagnostic technologies, and strict enforcement of food safety standards across food processing and distribution channels. Frequent product testing and strong awareness among food manufacturers continue to support market leadership in North America.

Europe represents a mature and regulation-driven market, where food safety testing is deeply embedded in routine operations across processing, packaging, and retail. The region’s emphasis on traceability, standardised testing procedures, and consumer protection sustains steady demand for rapid testing solutions. Asia Pacific shows consistent market expansion, supported by rising food production volumes, growing urban consumption, and increasing focus on quality control in large-scale processing facilities.

The Middle East & Africa remain an emerging region, where improving food supply chains and gradual adoption of modern testing practices are shaping market development. Latin America continues to progress steadily, driven by expanding food exports and the need to meet international safety requirements, reinforcing the role of rapid testing in regional food systems.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

SGS S.A. holds a strong strategic position in the global Rapid Food Safety Testing Market in 2024 due to its long-standing expertise in testing, inspection, and certification services. The company’s broad laboratory network and technical depth allow it to support food manufacturers across multiple stages of the value chain. SGS focuses on delivering reliable, standardized testing solutions that help food producers maintain consistency, reduce safety risks, and meet compliance expectations in domestic and export-oriented markets.

NSF International is widely recognised for its role in food safety standards, certification, and testing services. In 2024, its strength lies in combining scientific expertise with practical industry guidance. NSF International supports food companies by validating safety processes, improving quality systems, and enhancing consumer trust. Its emphasis on preventive testing and transparent safety practices positions it as a trusted partner for manufacturers aiming to strengthen food safety credibility.

Bureau Veritas continues to play a critical role by offering comprehensive food testing and assurance services. The company’s global operational presence enables consistent testing practices across regions. Bureau Veritas focuses on helping food businesses manage safety risks, improve operational controls, and align internal processes with recognised food safety frameworks, reinforcing its relevance in the rapidly evolving food testing landscape.

Top Key Players in the Market

- SGS S.A.

- NSF International

- Bureau Veritas

- Intertek Group PLC

- Merieux Nutrisciences

- TUV SUD

- AsureQuality Ltd

- Agilent Technologies, Inc.

- QIAGEN

- Bio-Rad Laboratories, Inc.

Recent Developments

- In September 2025, NSF launched the NSF P525 Safe Food Packaging Certification, a new protocol to test and certify packaging materials for food contact safety by checking for harmful chemicals like PFAS, BPA, and heavy metals, helping manufacturers demonstrate safer packaging.

- In April 2024, SGS expanded its Food Contact Product Certification Mark services to cover more product types and geographies, including EEA, Canada, Mercosur, and more, enhancing its ability to test and certify food-related products for safety and compliance. This development supports food testing and contact material evaluation efforts globally.

Report Scope

Report Features Description Market Value (2024) USD 7.1 Billion Forecast Revenue (2034) USD 17.6 Billion CAGR (2025-2034) 9.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Test (Allergen Testing, Chemical and Nutritional Testing, Genetically Modified Organism (GMO) Testing, Microbiological Testing, Residues and Contamination Testing, Others), By Application (Meat, Poultry, and Seafood Products, Dairy and Dairy Products, Processed Food, Beverages, Cereals and Grains, Others), By Technology (Traditional, Rapid (Convenience Based, Polymerase Chain Reaction (PCR), Immunoassay, Chromatography and Spectrometry)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape SGS S.A., NSF International, Bureau Veritas, Intertek Group PLC, Merieux Nutrisciences, TUV SUD, AsureQuality Ltd, Agilent Technologies, Inc., QIAGEN, Bio-Rad Laboratories, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Rapid Food Safety Testing MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Rapid Food Safety Testing MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- SGS S.A.

- NSF International

- Bureau Veritas

- Intertek Group PLC

- Merieux Nutrisciences

- TUV SUD

- AsureQuality Ltd

- Agilent Technologies, Inc.

- QIAGEN

- Bio-Rad Laboratories, Inc.