Global Quillaia Extracts Market Size, Share, And Business Benefits By Type (Type 1, Type 2), By Function (Foaming Agent, Flavouring Agent, Emulsifying Agent), By Form (Powder, Liquid), By End Use (Food and Beverage (Bakery and Confectionary, Dairy and Dairy Products, Beverage, Others), Cosmetics and Personal Care, Pharmaceutical, Animal Feed, Others), By Sales Channel (Supermarkets/Hypermarkets, Departmental Stores, Convenience Store, Online Sales, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 156936

- Number of Pages: 248

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

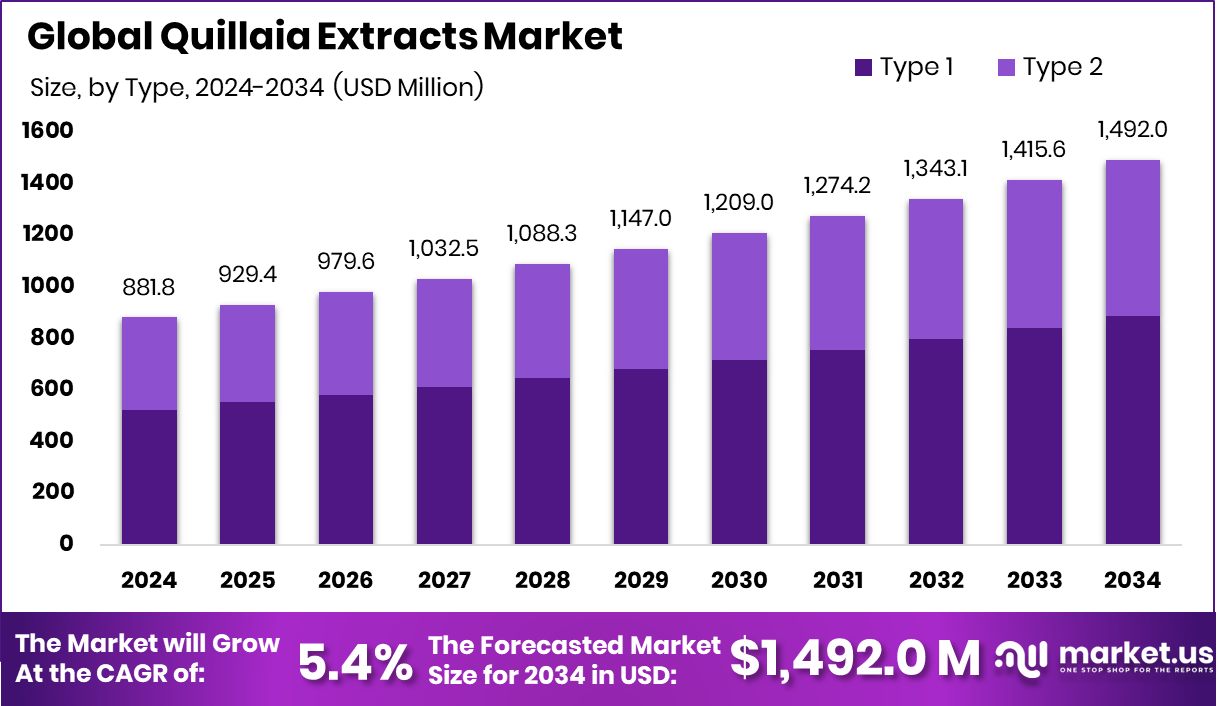

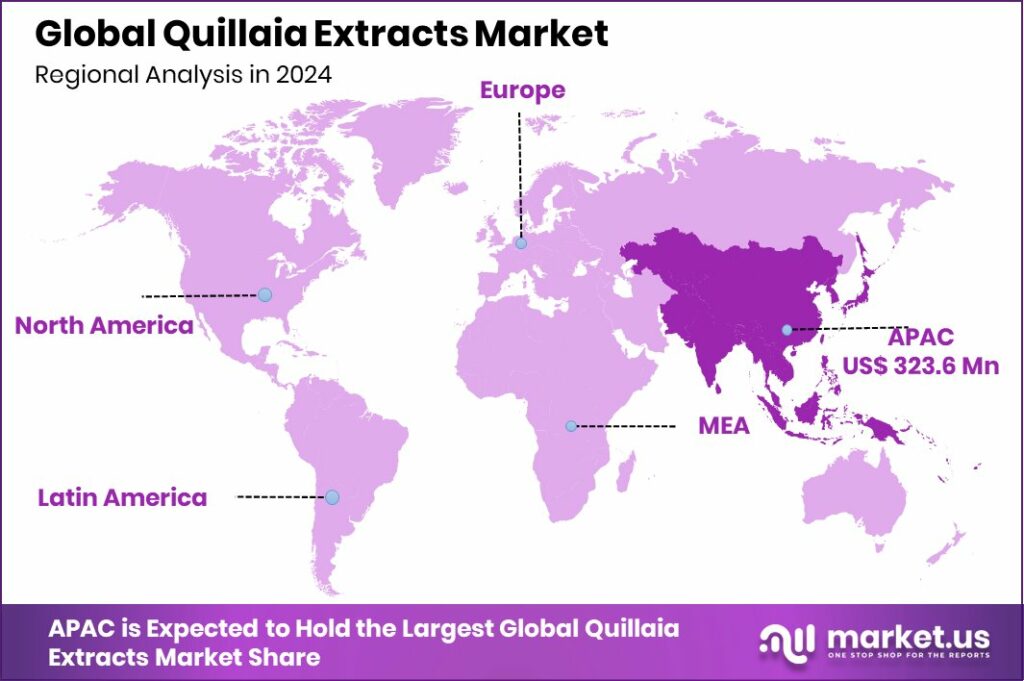

The Global Quillaia Extracts Market is expected to be worth around USD 1,492.0 million by 2034, up from USD 881.8 million in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034. The expanding food and beverage sector supported the Asia Pacific Quillaia Extracts Market at 36.7%, USD 323.6 Mn.

Quillaia extracts are natural substances derived from the bark and wood of the Quillaja saponaria tree, which is native to Chile. They are rich in saponins, a compound known for its foaming and emulsifying properties. Traditionally, these extracts have been used in beverages, cosmetics, pharmaceuticals, and even agriculture due to their ability to stabilize products and provide natural health benefits.

The Quillaia extracts market refers to the global trade and usage of these natural extracts across multiple industries. The market is shaped by rising demand for clean-label ingredients, as more consumers prefer natural over synthetic additives. It spans food and beverages, where the extracts are used as foaming agents, to personal care products, and natural health supplements.

One key growth factor for the market is the increasing shift toward plant-based and natural ingredients in food and beverages. Consumers are actively seeking products with fewer chemicals, and quillaia’s role as a natural emulsifier supports this clean-label trend. According to an industry report, Fungu’it secures €4M to convert agricultural by-products into natural flavorings

Demand is also fueled by its use in health supplements and pharmaceuticals, where saponins are valued for potential immune-boosting and cholesterol-lowering properties. This has opened doors for broader applications in wellness and functional foods. According to an industry report, Global funds return to Hong Kong IPOs with Haitian Flavouring’s $1.2 billion share offering.

Key Takeaways

- The Global Quillaia Extracts Market is expected to be worth around USD 1,492.0 million by 2034, up from USD 881.8 million in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034.

- Quillaia Extracts Market by Type shows Type 1 holding a 59.4% share with steady industry demand.

- By function, foaming agent dominates the Quillaia extract market, capturing 49.5% share, driven by beverage applications.

- In terms of form, powder leads the Quillaia Extracts Market with a 57.3% share, ensuring versatile product usage.

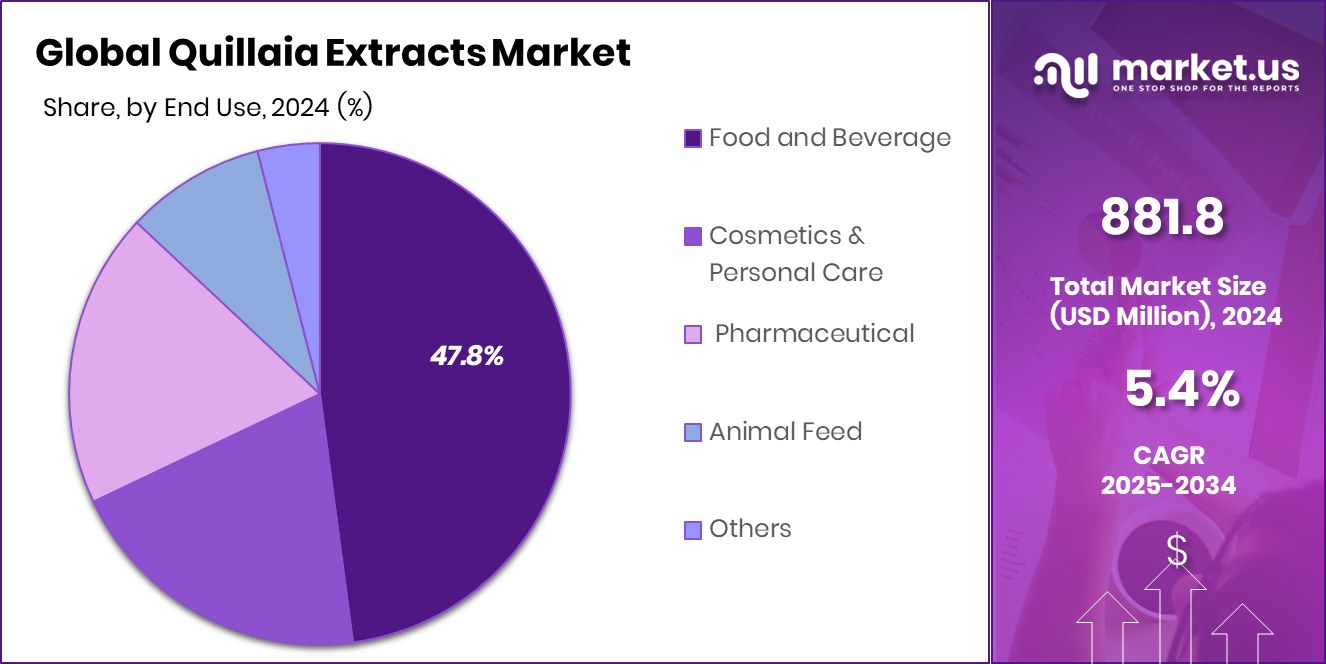

- The food and beverage end-use segment holds a 47.8% share in the Quillaia Extracts Market, showing consistent adoption.

- Supermarkets/hypermarkets capture 45.7% of the sales share in the Quillaia Extracts Market, reflecting consumer preference for accessible distribution.

- Strong consumer preference for natural ingredients boosted Asia Pacific’s 36.7% share, reaching USD 323.6 Mn.

By Type Analysis

The Quillaia Extracts Market by Type shows a 59.4% share, highlighting dominance.

In 2024, Type 1 held a dominant market position in the By Type segment of the Quillaia Extracts Market, with a 59.4% share. This leadership highlights the strong acceptance of Type 1 extracts across industries where functionality and natural origin are highly valued.

Derived primarily from the bark of the Quillaja saponaria tree, Type 1 extracts are rich in saponins, which are widely used as foaming agents, emulsifiers, and stabilizers. Their versatility makes them a preferred choice for food and beverage applications, particularly in carbonated drinks, syrups, and confectionery, where consistent foam and texture are essential.

The growing consumer demand for clean-label and natural ingredients has further strengthened the role of Type 1 extracts. As brands move away from synthetic additives, the adoption of Type 1 has surged due to its plant-based composition and multiple functional properties. Beyond beverages, the extract’s application in cosmetics and personal care products is adding to its market strength, as it meets the rising preference for sustainable, natural formulations.

This solid 59.4% market share underscores not only the reliability of Type 1 extracts in industrial applications but also their alignment with evolving consumer preferences, ensuring continued dominance in the coming years.

By Function Analysis

By function, foaming agents account for 49.5%, driving beverage applications growth.

In 2024, Foaming Agent held a dominant market position in the By Function segment of the Quillaia Extracts Market, with a 49.5% share. This dominance reflects the vital role quillaia extracts play in enhancing texture and stability, particularly in beverages where foam quality is a defining attribute. Soft drinks, carbonated beverages, and certain alcoholic drinks rely heavily on natural foaming agents to deliver consumer-preferred sensory experiences, and quillaia extracts have become a trusted choice due to their rich saponin content.

The appeal of quillaia as a foaming agent is also tied to the clean-label movement, as it provides a natural alternative to synthetic foaming additives. Its plant-based origin supports the growing consumer demand for transparency and healthier product formulations, giving manufacturers a competitive edge. Additionally, quillaia’s consistent performance in creating stable foams enhances product shelf life and quality, making it indispensable for beverage producers.

With 49.5% of the functional segment, the foaming agent application is expected to maintain its stronghold, supported by the expansion of the global beverage industry and increasing innovation in natural ingredient use. This leadership showcases how functional benefits, combined with natural positioning, drive sustained growth and preference for quillaia extracts in this category.

By Form Analysis

Powder form leads the Quillaia Extracts Market with 57.3% global usage.

In 2024, Powder held a dominant market position in the By Form segment of the Quillaia Extracts Market, with a 57.3% share. The powder form has emerged as the preferred choice across industries due to its convenience, longer shelf life, and ease of incorporation into a wide range of products.

Manufacturers favor powder quillaia extracts, as they offer stability during storage and transport, ensuring consistent quality in large-scale production processes. This makes them particularly attractive for food and beverage applications, where precise dosing and reliable functionality are essential.

The dominance of powder form is also linked to its versatility. It dissolves effectively in formulations, making it suitable for instant beverages, confectionery, and health supplements. Its ability to act as a natural foaming agent and emulsifier in powder form enhances efficiency for producers seeking to meet consumer demand for clean-label and plant-based solutions. Moreover, powder extracts align with sustainability goals, as they often require less packaging and are easier to ship compared to liquid alternatives.

With a 57.3% share, powder quillaia extracts underscore their strong position as the go-to form for industrial and commercial use. This trend reflects both practicality and alignment with evolving consumer and industry priorities.

By End Use Analysis

The food and beverage sector holds a 47.8% share, ensuring consistent market demand.

In 2024, Food and Beverage held a dominant market position in the By End Use segment of the Quillaia Extracts Market, with a 47.8% share. This strong position reflects the extensive use of quillaia extracts in products where natural foaming, emulsifying, and stabilizing properties are highly valued.

Within the food and beverage industry, quillaia extracts are particularly important in carbonated drinks, flavored beverages, confectionery, and syrups, where they deliver consistent foam and enhance overall product texture. Their natural origin and saponin-rich composition make them a preferred alternative to synthetic additives, aligning with the rising demand for clean-label and plant-based ingredients.

The growth of this segment is further supported by changing consumer lifestyles and increasing preference for healthier formulations. As consumers prioritize natural and transparent labels, food and beverage producers are integrating quillaia extracts to strengthen brand trust and appeal. Additionally, the extract’s compatibility with a wide variety of recipes provides manufacturers with flexibility to innovate while maintaining product stability.

Holding 47.8% of the end-use share, the food and beverage sector demonstrates how essential quillaia extracts have become to this industry. Their role not only meets functional needs but also supports market trends centered on sustainability and natural product adoption.

By Sales Channel Analysis

Supermarkets and hypermarkets contribute 45.7% of sales, strengthening consumer accessibility worldwide.

In 2024, Supermarkets/Hypermarkets held a dominant market position in By Sales Channel segment of the Quillaia Extracts Market, with a 45.7% share. This dominance highlights the crucial role of large-format retail stores in driving consumer access to quillaia-based products.

Supermarkets and hypermarkets offer an extensive range of food, beverage, and personal care items, many of which incorporate quillaia extracts as natural foaming agents, stabilizers, or emulsifiers. Their ability to provide wide product visibility and immediate availability has positioned them as the primary choice for both consumers and manufacturers.

The strong performance of this channel is also linked to the growing consumer preference for one-stop shopping experiences. These outlets allow shoppers to directly compare brands and product labels, making it easier to identify items featuring natural and clean-label ingredients. Quillaia-based products benefit from this trend, as transparency and sustainability are becoming strong purchasing drivers.

With a 45.7% share, this channel demonstrates its continued relevance and effectiveness in influencing consumer choices. Its wide reach and trust among shoppers ensure that it remains a dominant pathway for quillaia extract distribution.

Key Market Segments

By Type

- Type 1

- Type 2

By Function

- Foaming Agent

- Flavouring Agent

- Emulsifying Agent

By Form

- Powder

- Liquid

By End Use

- Food and Beverage

- Bakery and Confectionery

- Dairy and Dairy Products

- Beverage

- Others

- Cosmetics and Personal Care

- Pharmaceutical

- Animal Feed

- Others

By Sales Channel

- Supermarkets/Hypermarkets

- Departmental Stores

- Convenience Store

- Online Sales

- Others

Driving Factors

Rising Demand for Natural and Clean-Label Ingredients

One of the key driving factors in the Quillaia Extracts Market is the growing consumer demand for natural and clean-label ingredients. People today are more aware of what goes into their food, drinks, and personal care products. They prefer items that are plant-based, chemical-free, and sustainable.

Quillaia extracts, being natural and rich in saponins, fit perfectly into this trend. They act as foaming agents, emulsifiers, and stabilizers without the need for artificial additives. This not only makes products safer but also enhances trust among health-conscious buyers.

As companies reformulate their offerings to meet consumer expectations, the demand for quillaia extracts continues to rise, strengthening their role across the global food, beverage, and wellness industries.

Restraining Factors

Limited Raw Material Supply from Quillaja Trees

A major restraining factor in the Quillaia Extracts Market is the limited availability of raw material. Quillaia extracts are obtained mainly from the bark and wood of the Quillaja saponaria tree, which grows in specific regions such as Chile.

Since supply depends on controlled harvesting of these trees, it creates natural limitations in production. Overharvesting can harm the environment and disrupt ecosystems, making sustainable sourcing a challenge. This restricted supply can lead to price fluctuations and may affect the ability of manufacturers to meet rising global demand.

Unless alternative sources or improved cultivation practices are developed, the limited raw material availability will continue to slow down the wider adoption of quillaia extracts in various industries.

Growth Opportunity

Expanding Use in Natural Personal Care Products

A key growth opportunity for the Quillaia Extracts Market lies in their increasing use within natural personal care and cosmetic products. Consumers today are shifting toward eco-friendly, plant-based, and chemical-free options for skincare and haircare. Quillaia extracts, rich in natural saponins, provide foaming and cleansing properties that make them a perfect fit for shampoos, facial cleansers, and body washes.

Their natural origin also supports sustainability goals, which is an important factor influencing buyer choices. As demand for green beauty products rises, manufacturers are exploring quillaia extracts as a safer alternative to synthetic surfactants.

This creates room for innovation and product diversification, allowing companies to tap into a fast-growing personal care segment while meeting consumer expectations for clean-label solutions.

Latest Trends

Growing Popularity of Plant-Based Functional Beverages

One of the latest trends in the Quillaia Extracts Market is their rising use in plant-based functional beverages. Consumers are increasingly choosing drinks that not only refresh but also provide health benefits. Quillaia extracts, known for their natural foaming and emulsifying properties, are being widely used in sparkling beverages, energy drinks, and wellness-focused formulations.

Their plant-based origin matches perfectly with the clean-label and vegan trends, making them highly attractive to health-conscious buyers. Beverage makers are also highlighting quillaia extracts on product labels to appeal to customers seeking natural ingredients.

This trend is strengthening the position of quillaia extracts in the food and beverage industry, creating steady growth opportunities while aligning with global lifestyle shifts toward healthier choices.

Regional Analysis

In 2024, the Asia Pacific held a 36.7% share of the Quillaia Extracts Market, worth USD 323.6 Mn.

The Quillaia Extracts Market shows varied regional dynamics, with Asia Pacific emerging as the leading region in 2024. Holding a dominant 36.7% share, valued at USD 323.6 million, Asia Pacific is at the forefront of growth, driven by rising demand for natural and plant-based ingredients across food, beverage, and personal care industries.

The expanding population, combined with increasing health awareness and preference for clean-label products, is fueling the adoption of quillaia extracts in beverages, confectionery, and wellness formulations. North America and Europe also represent important markets, supported by strong consumer interest in sustainable and chemical-free alternatives, especially in functional beverages and cosmetics.

Meanwhile, the Middle East & Africa and Latin America are gradually adopting quillaia extracts, encouraged by urbanization and evolving dietary patterns. However, Asia Pacific’s stronghold is attributed to its large-scale consumption base and rapid product innovation across sectors. The region’s manufacturers are actively integrating natural foaming and emulsifying agents like quillaia to cater to growing consumer expectations for transparency and health-focused offerings.

This clear leadership position underscores Asia Pacific’s significance in shaping the future trajectory of the global Quillaia Extracts Market while also setting benchmarks for other regions to follow in terms of growth and innovation.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Garuda International Inc. continues to hold a strong position in the quillaia extracts market with its focus on high-quality natural ingredients. The company has built a reputation for supplying extracts rich in saponins that meet the needs of the food, beverage, and nutraceutical industries. By emphasizing purity and consistency, Garuda International supports the growing demand for clean-label and plant-based solutions, making it a trusted name for manufacturers worldwide.

Chile Botanics S.A., with its roots close to the natural habitat of the Quillaja saponaria tree, benefits from sustainable sourcing and regional expertise. The company’s direct access to raw materials allows it to deliver authentic, high-quality quillaia extracts while maintaining environmental responsibility. In 2024, Chile Botanics leverages its regional advantage to strengthen its global footprint, supplying extracts for functional beverages, cosmetics, and wellness products.

Ingredion Incorporated stands out for its ability to integrate quillaia extracts into a broad portfolio of specialty ingredients. Known for innovation and large-scale distribution, the company ensures that quillaia-based solutions reach diverse end-use markets. In 2024, Ingredion’s focus remains on supporting food and beverage manufacturers with natural foaming and emulsifying solutions, catering to evolving clean-label trends.

Top Key Players in the Market

- Garuda International Inc.

- Chile Botanics S.A

- Ingredion Incorporated

- Baja Yucca Company

- Naturex S.A

- Alfa Chemicals

- Desert King International

- Givaudan SA

- Plantae Labs

- Ataman Kimya A.S

Recent Developments

- In May 2025, Ingredion and Amyris ended their joint venture tied to the Precision Fermentation Plant in Barra Bonita, Brazil. Amyris took over full ownership, and Ingredion will now exclusively use Amyris’s fermentation technology

- In April 2025, Desert King International became the first Chilean company and the only Quillaja supplier worldwide to achieve EXCiPACT™ certification. This confirms their compliance with Good Manufacturing Practices (GMP) and Good Distribution Practices (GDP) at their Valparaíso pharmaceutical site, strengthening their leadership in supplying safe, high-quality Quillaja extracts for vaccines.

Report Scope

Report Features Description Market Value (2024) USD 881.8 Million Forecast Revenue (2034) USD 1,492.0 Million CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Type 1, Type 2), By Function (Foaming Agent, Flavouring Agent, Emulsifying Agent), By Form (Powder, Liquid), By End Use (Food and Beverage (Bakery and Confectionary, Dairy and Dairy Products, Beverage, Others), Cosmetics and Personal Care, Pharmaceutical, Animal Feed, Others), By Sales Channel (Supermarkets/Hypermarkets, Departmental Stores, Convenience Store, Online Sales, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Garuda International Inc., Chile Botanics S.A., Ingredion Incorporated, Baja Yucca Company, Naturex S.A., Alfa Chemicals, Desert King International, Givaudan SA, Plantae Labs, Ataman Kimya A.Ş Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Quillaia Extracts MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Quillaia Extracts MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Garuda International Inc.

- Chile Botanics S.A

- Ingredion Incorporated

- Baja Yucca Company

- Naturex S.A

- Alfa Chemicals

- Desert King International

- Givaudan SA

- Plantae Labs

- Ataman Kimya A.S