Global Proteases Market Size, Share, And Enhanced Productivity By Source (Animal, Plant, Microbial), By Application (Food and Beverage (Dairy, Bakery, Beverages, Meat and Poultry, Others), Pharmaceuticals, Animal Feed, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171843

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

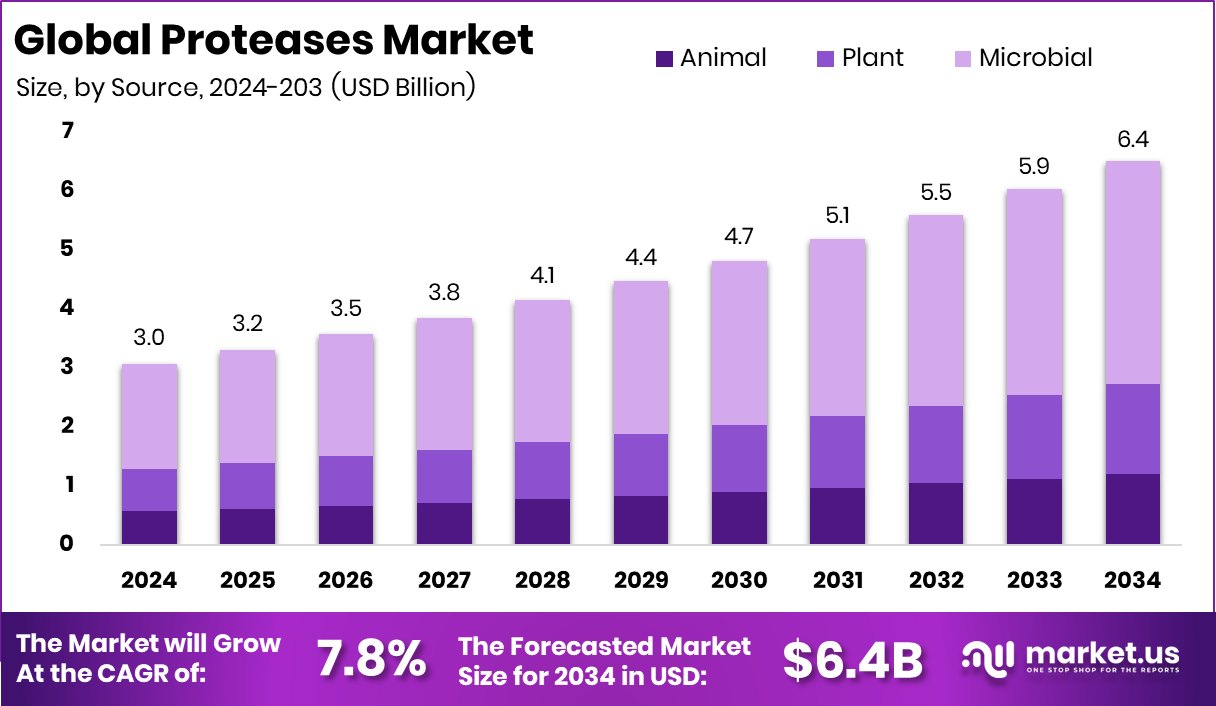

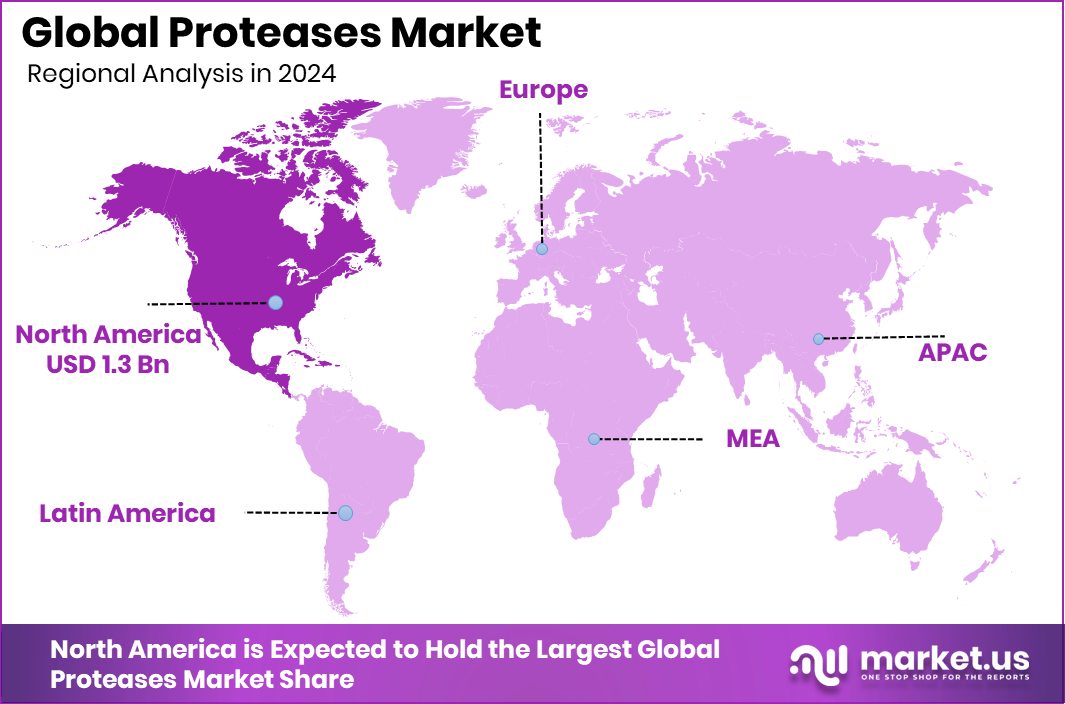

The Global Proteases Market is expected to be worth around USD billion by 2034, up from USD 3.0 billion in 2024, and is projected to grow at a CAGR of 7.8% from 2025 to 2034. North America USD 1.3 Bn maintained growth as enzyme adoption increased across diverse high-volume application sectors.

Proteases are natural enzymes that break down proteins into smaller peptides and amino acids. They play an essential role in biological processes such as digestion, cell repair, and nutrient absorption. In the industry, proteases are valued because they help improve texture, flavor, and processing efficiency across food, nutrition, and other protein-based applications.

The Proteases Market refers to the global business of producing and using protease enzymes across food processing, animal nutrition, pharmaceuticals, and industrial manufacturing. The market continues expanding as industries look for cleaner, efficient, and enzyme-driven processes. Growing attention on high-quality food production and sustainable processing also increases demand for advanced protease formulations.

Growth in the protease industry is supported by the rising need for efficient protein processing in food and agriculture. This demand indirectly benefits from broader investments such as the USDA reimbursing states with $14.5 million for food safety inspections, because stronger inspection systems encourage more regulated, enzyme-supported processing methods in protein-related supply chains. Such developments help expand opportunities for safe and improved protein handling.

The market also sees demand momentum from meat, poultry, and alternative-protein sectors. Funding such as the €3M investment in a mycelium-based meat startup, along with Cream Co. Meats raising $4M, indicates growing activity in protein innovation. These sectors frequently rely on enzymes like proteases to improve texture and processing performance, which strengthens future market opportunities.

Several large public programs are creating additional openings for enzyme-based solutions. The USDA’s $110 million investment in meat and poultry processing, the final Local MCap round totaling $55.8 million, the USDA’s $9.5 million Local Meat Capacity grant, the $215 million USDA grant program, and the Saudi agricultural fund’s $533 million in food-sector loans all support expanded protein production. As facilities grow and diversify, the use of proteases becomes even more essential, driving long-term demand.

Key Takeaways

- The Global Proteases Market is expected to be worth around USD billion by 2034, up from USD 3.0 billion in 2024, and is projected to grow at a CAGR of 7.8% from 2025 to 2034.

- The Proteases Market is strongly driven by microbial sources, holding a dominant 59.4% global share.

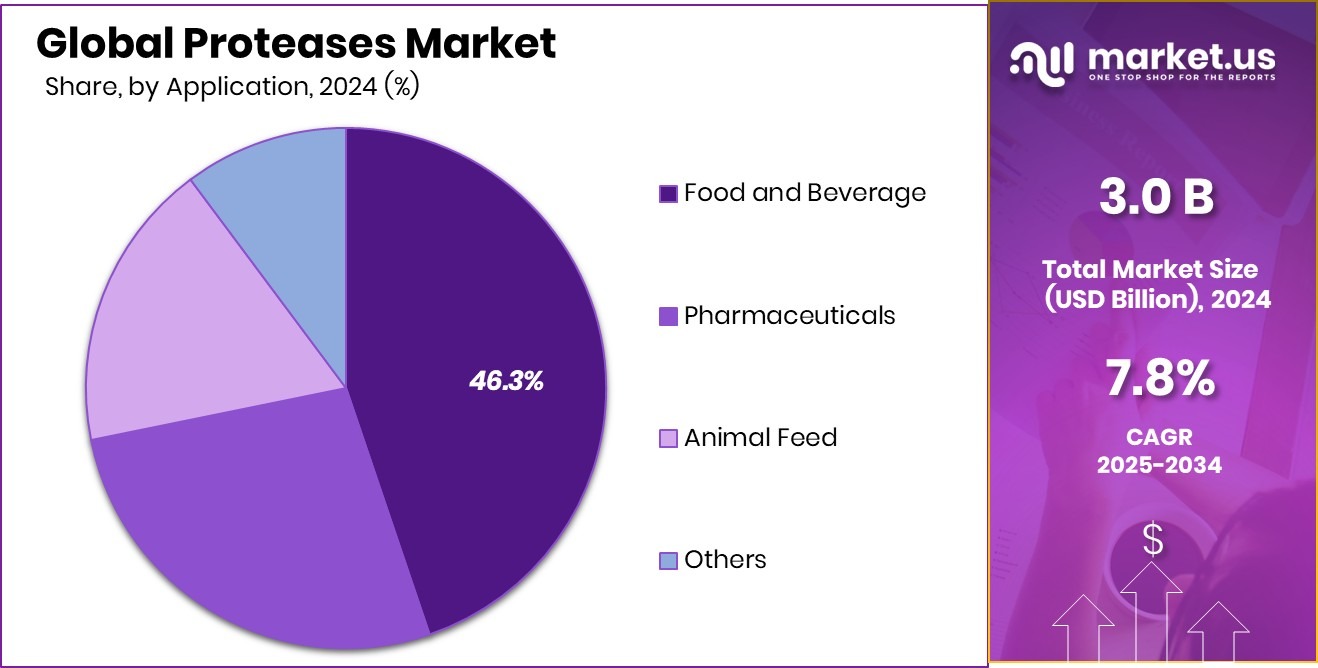

- In the Proteases Market, food and beverage applications lead demand, accounting for a major 44.8% share.

- The North America Proteases Market value reached USD 1.3 Bn, reflecting sustained industrial demand.

By Source Analysis

The microbial segment dominates the Proteases Market with 59.4% due to efficient bioprocessing.

In 2024, Microbial held a dominant market position in the By Source segment of the Proteases Market, with a 59.4% share. This strong lead reflects the growing preference for microbial-derived proteases due to their consistent quality, reliability, and ability to perform efficiently across a wide range of industrial processes. Companies increasingly favor microbial sources because they offer stable production, controlled fermentation conditions, and cost-effective scalability.

Microbial proteases also support flexible formulation requirements, enabling industries to achieve desired performance in food processing, detergents, and other enzyme-driven applications. Their wide adaptability and ease of standardization have helped maintain their leadership within the source category. With industries prioritizing dependable and high-yield enzyme inputs, microbial proteases continue to reinforce their dominant position.

By Application Analysis

Food and beverage applications lead the Proteases Market with 44.8% global share.

In 2024, Food and Beverage held a dominant market position in the By Application segment of the Proteases Market, with a 44.8% share. This strong share reflects the heavy reliance on proteases for improving texture, flavor development, and processing efficiency across numerous food categories. Manufacturers use these enzymes to enhance protein breakdown, support fermentation, and optimize product consistency.

The dominance of the food and beverage sector also stems from the steady demand for processed and value-added foods, where proteases play a central role in achieving desirable functional outcomes. As producers focus on better-quality formulations, higher productivity, and controlled enzymatic reactions, proteases remain essential to modern food processing. This continued integration firmly supports the segment’s leading position.

Key Market Segments

By Source

- Animal

- Plant

- Microbial

By Application

- Food and Beverage

- Dairy

- Bakery

- Beverages

- Meat and Poultry

- Others

- Pharmaceuticals

- Animal Feed

- Others

Driving Factors

Rising Protein Processing Needs Boost Proteases Demand

The Proteases Market is growing strongly because industries now rely more on enzyme-based processing to improve texture, flavor, and efficiency in dairy, plant-based, and specialty protein products. This momentum is supported by fresh investments across the food sector. For example, Ace International raising $35 million strengthens dairy processing capacity, where proteases help achieve smoother textures and faster production cycles. Such expansions increase direct demand for reliable enzyme solutions.

Another boost comes from companies preparing for major growth. Milky Mist Dairy Food filing for a ₹2,035 crore IPO highlights rising modernization needs in dairy operations. As plants upgrade, they depend on advanced enzymes like proteases for consistent quality and better protein functionality. This creates long-term market opportunities.

Innovation in alternative dairy also fuels demand. Nutropy securing $8 million for animal-free cheese development and a Finnish plant-based dairy factory receiving $11.8 million both highlight rapid movement toward new protein formats. These segments require precise protein breakdown and improved fermentation, making proteases essential for product development. Together, these funding-driven expansions across traditional and plant-based categories reinforce proteases as a key ingredient for modern food processing.

Restraining Factors

High Production Challenges Slow Proteases Expansion

One major restraining factor for the Proteases Market is the rising complexity of modern dairy and plant-based protein processing. As facilities adopt advanced technologies, maintaining consistent enzyme performance becomes more challenging. This is visible in the growing need for expensive operational upgrades. For example, Stellapps securing USD 26 million for dairy tech and sustainability highlights how much investment is required merely to improve efficiency. Such high upgrade costs limit how quickly manufacturers can adopt new protease-based processes.

Environmental compliance also adds pressure. Governor Hochul’s $15.8 million award to help dairy farmers protect water quality reflects the increasing regulatory responsibilities placed on producers. These obligations often shift attention and budgets toward environmental control rather than enzyme integration, slowing protease adoption.

The situation is similar in the emerging plant-based dairy space. Companies like Kinish raising 120 million yen for sustainable dairy alternatives, and Future Cow securing R$4.85 million for fermentation-based dairy protein,s show that new categories require heavy early-stage funding just to scale. While these innovations create future opportunities, the high cost of development and the need for specialized fermentation setups make it harder for producers to immediately integrate proteases, thereby restraining market growth.

Growth Opportunity

Growing Alternative Dairy Innovations Create Major Opportunities

A strong growth opportunity for the Proteases Market comes from the rapid expansion of modern dairy and animal-free dairy technologies. Traditional dairy producers are upgrading their operations, which naturally increases the need for efficient protein-modifying enzymes. The New York State Agriculture Department reminding producers to apply for its $21.6 million Dairy Modernization Grant Program reflects how modernization efforts are accelerating. When plants upgrade equipment and processing lines, they typically adopt more enzyme-based solutions, creating new openings for protease usage.

Growth is even stronger in the animal-free and bioengineered dairy segment. An Indian startup developing bioengineered animal-free dairy and raising $4 million shows how alternative protein ventures are scaling quickly. These companies rely heavily on enzymes such as proteases to refine protein structures, enhance taste, and improve fermentation efficiency.

Another major boost comes from Imagindairy reaching $28 million in funding, signaling rising global confidence in precision-fermented dairy proteins. These formulations require controlled protein breakdown and optimized enzymatic reactions during processing. As these new dairy formats reach commercial scale, the demand for specialized proteases will rise sharply. Together, these developments create a strong long-term opportunity for protease suppliers across both traditional and next-generation dairy sectors.

Latest Trends

Enzyme Adoption Accelerates in Next-Gen Dairy Systems

A major trend shaping the Proteases Market is the fast shift toward new dairy and animal-free dairy systems that rely heavily on enzymes for better texture, flavor, and protein stability. This trend is strengthened by strong funding activity. For example, Imagindairy raising $15 million in a seed extension round shows how fast the alt-milk space is growing. As these companies move closer to launching consumer products, they depend more on proteases to fine-tune protein behavior and improve product quality.

The modernization of dairy supply chains also pushes enzyme adoption forward. Stellapps Technologies’ securing $26 million in Series C funding reflects the rising investment in dairy digitization and processing upgrades. When processing lines become more advanced, the demand for precise enzyme control, including proteases, increases significantly.

Another strong trend comes from animal-free dairy innovation. Zero Cow Factory receiving $4 million to scale its animal-free dairy solutions signals growing commercial interest in fermentation-based proteins. These products require well-designed enzymatic processes for structure building and protein modification. As more startups enter this space with fresh funding, proteases become an essential part of product development, making enzyme-driven dairy and alt-dairy applications one of the strongest emerging trends in the market.

Regional Analysis

North America led the Proteases Market with a strong 43.70% regional share.

North America dominated the proteases market, holding 43.70% of the total share and reaching a value of USD 1.3 Bn, reflecting the region’s strong adoption of enzyme-based processing across food, industrial, and biotechnology sectors. This leadership is supported by a mature manufacturing landscape and steady demand for high-performance proteolytic solutions.

Europe follows as a significant region with consistent uptake driven by established food processing industries and increasing use of functional ingredients, although it remains behind North America in overall scale. Asia Pacific continues to expand steadily, supported by rising consumption of processed foods and broader industrial enzyme usage across emerging economies, positioning it as an important growth-oriented region despite not surpassing North America.

The Middle East & Africa region shows moderate progress with gradual industrial diversification, while Latin America maintains a stable market presence driven by food and agricultural processing needs. Across all regions, North America’s clear dominance highlights its advanced industrial base, higher enzyme integration rates, and stronger technological readiness, reinforcing its position as the leading regional contributor to the global Proteases Market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Novonesis Group maintains a strategic position by emphasizing performance-driven enzyme formulations tailored for food processing, nutrition enhancement, and industrial use. Its consistent investment in optimized protease efficiency supports broader adoption across manufacturing environments that rely on stable enzymatic performance.

DSM-Firmenich AG strengthens the market through its established expertise in biochemical innovation and ingredient development. The company’s integrated capabilities help drive efficient protease applications in food systems, nutritional solutions, and fermentation processes, enabling customers to enhance product quality and processing yield. DSM-Firmenich’s disciplined approach to specialty ingredient engineering continues to reinforce its relevance in the protease ecosystem.

International Flavors & Fragrances Inc. (IFF) contributes through its diverse portfolio and experience in functional ingredients that support both flavor development and enzyme-supported processing. Its protease offerings complement its broad ingredients platform, allowing the company to address evolving formulation needs across food and beverage applications. Together, these companies influence market direction through their technological depth, portfolio strength, and continuous adaptation to industry needs.

Top Key Players in the Market

- Novonesis Group

- DSM-Firmenich AG

- International Flavors & Fragrances Inc.

- Associated British Foods plc (AB Enzymes)

- Amano Enzyme Inc.

- Novus International Inc.

- Biocatalysts Ltd.

- BASF SE

- Kemin Industries Inc.

- Enzyme Development Corp.

Recent Developments

- In February 2025, Novonesis agreed to buy out DSM-Firmenich’s share of the Feed Enzyme Alliance, ending a 25-year collaboration. With this move, Novonesis will take over sales and distribution of feed enzymes, giving it a stronger reach in the animal biosolutions enzyme market. This acquisition expands Novonesis’ presence across the enzyme value chain.

- In February 2025, DSM-Firmenich AG announced that it would sell its stake in the Feed Enzymes Alliance to Novonesis. This business had a strong portfolio of feed enzymes, which include protease and other enzyme products used in animal nutrition. The sale marked a strategic shift as DSM-Firmenich separated this enzyme business from its core operations.

- In November 2024, International Flavors & Fragrances Inc. introduced TEXSTAR™, a new enzymatic solution designed to improve texture in fresh fermented dairy and plant-based products. This enzyme helps achieve better viscosity and texture without stabilizers, offering food producers a more natural and efficient formulation option.

Report Scope

Report Features Description Market Value (2024) USD 3.0 Billion Forecast Revenue (2034) USD Billion CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Animal, Plant, Microbial), By Application (Food and Beverage (Dairy, Bakery, Beverages, Meat and Poultry, Others), Pharmaceuticals, Animal Feed, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Novonesis Group, DSM-Firmenich AG, International Flavors & Fragrances Inc., Associated British Foods plc (AB Enzymes), Amano Enzyme Inc., Novus International Inc., Biocatalysts Ltd., BASF SE, Kemin Industries Inc., Enzyme Development Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Novonesis Group

- DSM-Firmenich AG

- International Flavors & Fragrances Inc.

- Associated British Foods plc (AB Enzymes)

- Amano Enzyme Inc.

- Novus International Inc.

- Biocatalysts Ltd.

- BASF SE

- Kemin Industries Inc.

- Enzyme Development Corp.