Global Processed Meat Market Size, Share Analysis Report By Product Type (Fresh-Processed Meat, Raw Fermented Meat, Raw-Cooked Meat, Pre-Cooked Meat, Cured Meat, Dried Meat, Others), By Type (Sausages, Bacon, Ham, Salami, Deli Meats, Others), By Category (Frozen, Canned, Chilled), By Animal Type (Poultry, Beef, Pig, Others), By Distribution Channel ( Supermarket/Hypermarket, Specialty Stores, Convenience Stores, Online Retail, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152740

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

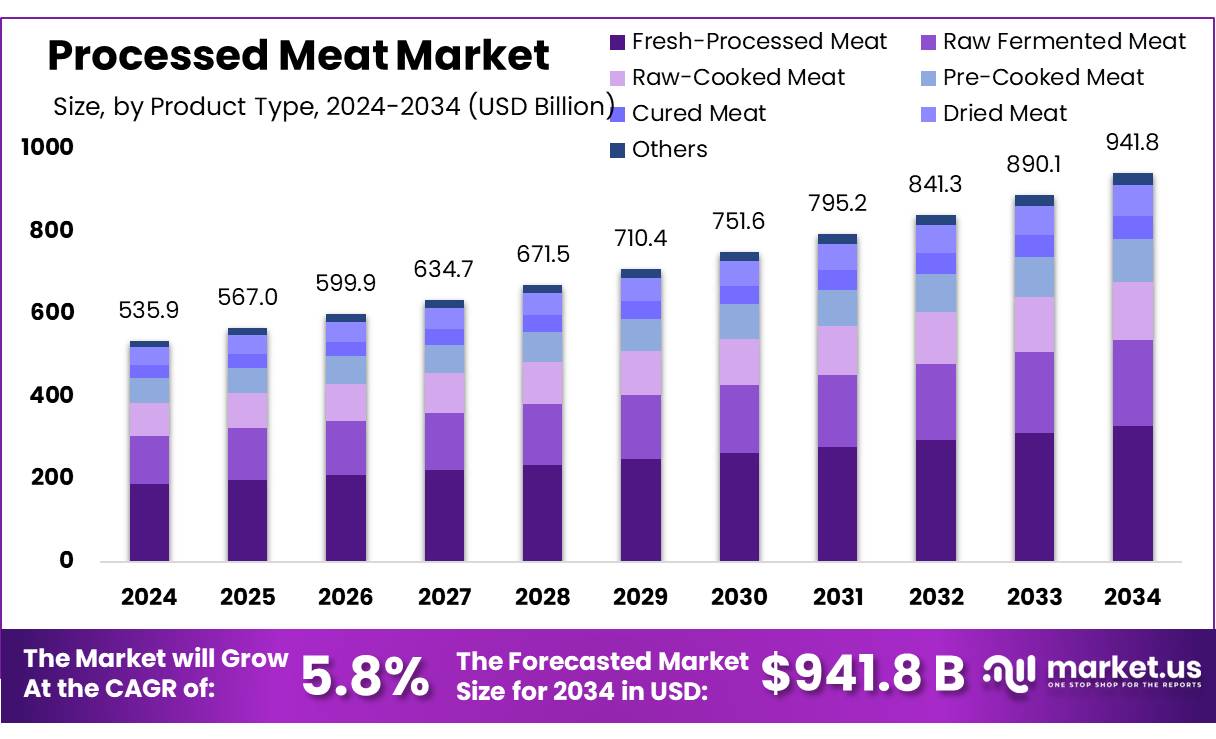

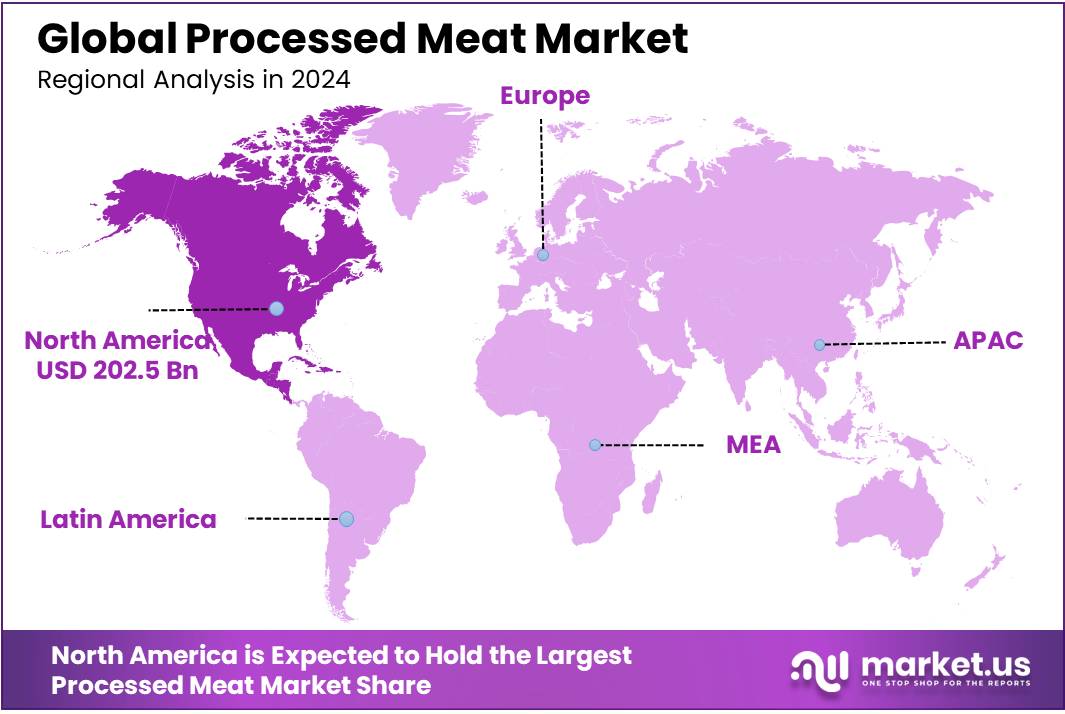

The Global Processed Meat Market size is expected to be worth around USD 941.8 Billion by 2034, from USD 535.9 Billion in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034. In 2024, North American held a dominant market position, capturing more than a 37.8% share, holding USD 202.5 billion revenue.

The processed meat concentrates sector comprises products derived from meats that have undergone operations such as curing, fermentation, smoking, or addition of preservatives to extend shelf life and enhance flavor. Examples include bacon, sausages, cured meats, and meat-based sauces. It is distinct from mere ground or cut meats due to both its technological processes and enhanced shelf stability.

The industrial landscape is characterized by consolidation in key markets globally, with high concentration among dominant players. In the United States, the top four firms purchased approximately 85% of steers and heifers and 67% of hogs in recent years, reflecting significant buyer-side concentration. Globally, two firms—Tyson and JBS—account for around 46% of beef packing, and along with others, dominate pork and poultry packing sectors. This oligopolistic structure favours economies of scale, although it also presents regulatory scrutiny and competitive pressure concerns.

National regulatory frameworks have been established to enhance safety and quality in processed meat. In India, the Food Safety and Standards Authority of India (FSSAI), formed under the Food Safety and Standards Act of 2006 and active since 2008, oversees manufacturing, packaging, distribution, and imports of meat products. The authority operates 22 referral laboratories and 72 governmental labs, along with 112 NABL-accredited private labs, to uphold compliance.

Governments and public bodies have instituted several measures to support concentration use and sustainability in meat processing. The U.S. Department of Agriculture’s Sustainable Agriculture Research and Education (SARE) programme invested over USD 30 million in 2023 toward sustainable meat processing innovations, inclusive of concentrates production.

Additionally, USDA and Food Safety Inspection Service (FSIS) data reveal significant industry consolidation the four largest U.S. packers managed 85% of steer and heifer purchases in 2023, prompting antitrust and food-safety oversight initiatives. Legislative and executive directives, including President Biden’s 2021 Executive Order aimed at enhancing competition, alongside updated merger guidelines by the Federal Trade Commission and Department of Justice, aim to rebalance market power and ensure product quality across the value chain.

Key Takeaways

- Processed Meat Market size is expected to be worth around USD 941.8 Billion by 2034, from USD 535.9 Billion in 2024, growing at a CAGR of 5.8%.

- Fresh-Processed Meat held a dominant market position, capturing more than a 32.10% share of the global processed meat market.

- Sausages held a dominant market position, capturing more than a 38.6% share of the global processed meat market.

- Chilled held a dominant market position, capturing more than a 48.2% share in the global processed meat market.

- Poultry held a dominant market position, capturing more than a 44.7% share in the global processed meat market.

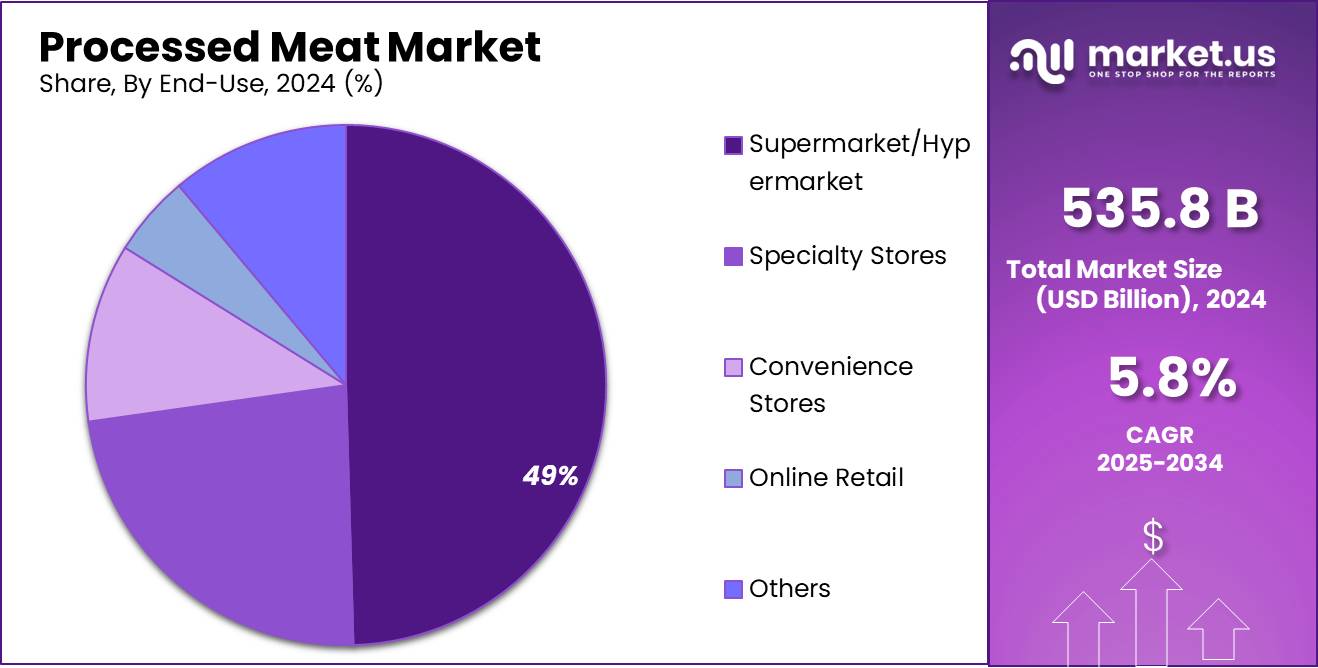

- Supermarket/Hypermarket held a dominant market position, capturing more than a 49.1% share of the global processed meat market.

- North America remains the dominant region in the global processed meat market, holding approximately 37.8% share, equivalent to around USD 202.5 billion.

By Product Type Analysis

Fresh-Processed Meat leads with 32.10% share, driven by demand for convenience and freshness

In 2024, Fresh-Processed Meat held a dominant market position, capturing more than a 32.10% share of the global processed meat market. This strong performance is mainly due to rising consumer preference for ready-to-cook and semi-prepared meat products that offer the freshness of raw cuts with the convenience of processed items.

Products such as marinated chicken, pre-seasoned pork chops, and pre-cooked sausages fall under this segment, and their popularity is growing rapidly in urban and semi-urban areas. The trend is especially notable in countries where dual-income households and fast-paced lifestyles are driving the shift toward time-saving food options. Fresh-processed meat combines traditional meat quality with modern processing, allowing extended shelf life without compromising on taste or texture.

By Type Analysis

Sausages dominate with 38.6% share due to versatility and strong consumer appeal

In 2024, Sausages held a dominant market position, capturing more than a 38.6% share of the global processed meat market. Their popularity continues to grow across both developed and developing regions, driven by their wide variety, convenience, and adaptability to different cuisines.

From breakfast patties to smoked and spicy variants, sausages are favored for their ease of preparation and long shelf life, making them a preferred choice among busy households and foodservice providers. The segment benefits from strong demand in fast food, quick-service restaurants, and ready-to-eat meals, where sausages serve as a staple protein option. Moreover, product innovation, including low-fat, organic, and plant-blended sausages, has expanded the consumer base beyond traditional buyers.

By Category Analysis

Chilled segment leads with 48.2% share, backed by freshness and retail demand

In 2024, Chilled held a dominant market position, capturing more than a 48.2% share in the global processed meat market. This category continues to attract strong consumer interest due to its perception of higher freshness, better taste, and minimal processing compared to frozen or shelf-stable alternatives.

Chilled processed meats—such as sliced ham, deli turkey, and marinated cuts—are commonly found in supermarket refrigerated sections and are especially popular among health-conscious and quality-focused buyers. The segment benefits from rising demand for clean-label products and short-ingredient lists, which align with chilled offerings. In many urban centers, consumers prefer chilled meats for daily meals and quick lunch solutions, contributing to strong sales across both retail and foodservice channels.

By Animal Type

Poultry dominates with 44.7% share due to affordability and lean protein appeal

In 2024, Poultry held a dominant market position, capturing more than a 44.7% share in the global processed meat market. This strong lead is largely driven by the rising demand for leaner protein options, with chicken and turkey products gaining popularity across all income groups. Poultry is widely preferred due to its lower fat content, quicker cooking time, and affordability compared to red meats. Processed poultry products such as chicken nuggets, sausages, patties, and deli slices are increasingly consumed in ready-to-eat meals, fast food chains, and school lunches, especially in regions with growing youth populations.

By Distribution Channel Analysis

Supermarkets and Hypermarkets lead with 49.1% share thanks to wide availability and consumer trust

In 2024, Supermarket/Hypermarket held a dominant market position, capturing more than a 49.1% share of the global processed meat market. This dominance is largely attributed to their extensive product range, competitive pricing, and the convenience of one-stop shopping. These large retail formats allow consumers to access a wide variety of processed meat products—such as sausages, cold cuts, and marinated meat—under one roof, often with the added benefit of promotional discounts and loyalty programs. The growing urban population and expansion of organized retail chains, particularly in emerging markets, have significantly contributed to the rising footfall in supermarkets and hypermarkets.

Key Market Segments

By Product Type

- Fresh-Processed Meat

- Raw Fermented Meat

- Raw-Cooked Meat

- Pre-Cooked Meat

- Cured Meat

- Dried Meat

- Others

By Type

- Sausages

- Bacon

- Ham

- Salami

- Deli Meats

- Others

By Category

- Frozen

- Canned

- Chilled

By Animal Type

- Poultry

- Beef

- Pig

- Others

By Distribution Channel

- Supermarket/Hypermarket

- Specialty Stores

- Convenience Stores

- Online Retail

- Others

Emerging Trends

Growing Consumer Demand for Clean‑Label & Alternative Ingredients

Consumers—especially younger generations—are increasingly cautious about processed foods and gravitate toward products that feel wholesome. Big food firms are now advertising things like “no nitrates,” “no added hormones,” or “minimally processed.” Many are blending processed meats with plant-based proteins, not only to appeal to health-conscious customers but also to reduce environmental impact.

What’s fueling this movement? Health agencies and governments are lending support. For example, the U.S. Dietary Guidelines Advisory Committee (DGAC), in its 2025 advisory, encourages Americans to”reduce red and processed meat” and swing toward legumes, nuts, seeds, and plant proteins. Though final guidelines will be released later in 2025, this signals strong institutional backing for the clean-label trend.

Similar steps are being taken around the globe. In the U.K., health groups like the Food Foundation—backed by the NHS—are urging schools to significantly reduce processed meat in meals, citing cancer risks linked to these products. Meanwhile in Australia, South Australia will ban public-transport ads featuring ham sandwiches and other processed foods starting July 1, 2025, recognizing the need to curb meat-heavy diets for better public health.

This trend is reshaping the processed-meat market from within. From large brands reformulating recipes to meet clean-label standards, to shifts in government recommendations and policies, the market is adapting. Ultimately, this change isn’t just about numbers—it’s about making food feel safer, simpler, and more honest, and many consumers now expect nothing less.

Drivers

Rising Global Meat Consumption is Fueling Processed Meat Market Growth

One of the main driving forces behind the processed meat market is the steady increase in global meat consumption, particularly in urban areas where busy lifestyles push people toward convenience foods. Processed meat products—such as sausages, bacon, ham, and deli slices—offer ready-to-eat or easy-to-cook options, which appeals strongly to the working population and families looking to save time.

According to the Food and Agriculture Organization (FAO) of the United Nations, global meat consumption reached around 339 million tonnes in 2023, up from 328 million tonnes in 2020. The FAO projects that this number could grow by 14% by 2030, driven by population growth and rising incomes, especially in middle-income countries such as India, Brazil, and China.

Urbanization plays a major role in this shift. As per the World Bank, 56% of the global population lived in urban areas by 2023, and this trend is expected to continue rising. With less time to prepare traditional meals, consumers are increasingly purchasing vacuum-packed, refrigerated, and frozen meat products. Additionally, many countries have developed cold chain infrastructures and food processing zones to support growing demand.

Governments are also contributing to this growth. For example, the Indian government’s Pradhan Mantri Kisan SAMPADA Yojana (PMKSY) supports the meat processing industry through financial assistance for infrastructure development, especially in mega food parks and integrated cold chains. This makes it easier for companies to distribute processed meat to remote areas while maintaining quality and safety standards.

Restraints

Health Concerns and Rising Awareness Restrain Processed Meat Market Growth

A major challenge facing the processed meat industry is growing public concern over health risks associated with frequent consumption of processed meat products. More people today are becoming aware of the links between processed meats and chronic illnesses such as heart disease, obesity, and certain cancers, leading to more cautious eating habits and a shift toward healthier alternatives.

The World Health Organization (WHO) classified processed meats like bacon, sausages, and ham as Group 1 carcinogens back in 2015, meaning there is sufficient evidence they cause cancer in humans, particularly colorectal cancer. This classification has had a long-lasting impact on consumer behavior. According to the Global Burden of Disease Study, diets high in processed meats contributed to over 34,000 cancer-related deaths globally per year.

This has sparked a rise in plant-based diets, particularly in developed regions like North America and Europe. For instance, the British Nutrition Foundation reported in 2022 that 1 in 3 UK adults were actively reducing meat intake, citing health as a primary reason. Government-led awareness campaigns are also influencing public perception. In countries like Canada, the updated Canada Food Guide (2019) encourages citizens to eat more plant-based protein sources and reduce processed meat consumption.

As a result, manufacturers in the processed meat space are facing mounting pressure to reformulate products with cleaner labels, lower sodium, and fewer preservatives. While innovation can help soften this impact, the fundamental challenge remains: people want convenience, but not at the cost of their health. This balancing act makes it harder for the processed meat market to grow at its full potential, especially in health-conscious segments of the global population.

Opportunity

Rise of Hybrid & Plant-Based Alternatives Opens New Market Avenues

Consumers today are more health-aware and eco-conscious than ever before. This has created an exciting growth opportunity for the processed meat industry—by embracing hybrid and plant-based alternatives alongside traditional products. These new offerings combine meat with plant-based ingredients or fully replace meat, helping producers stay relevant and tap into a fast-growing segment.

According to the International Panel on Experts on Sustainable Food Systems (IPES), plant-based meat currently makes up only about 1% of the global meat market, but is projected to grow to 10% by 2030. That means there’s tremendous room for companies to innovate and capture a share of this emerging trend, especially by offering hybrid meats—such as blends of 30–70% plant proteins with meat. These blended products cater to flexitarians who want the familiar taste and texture of meat but with health and environmental benefits.

The Good Food Institute reports that globally, plant-based meat was valued at USD 7.5 billion in 2023 compared to USD 1.4 trillion for all animal meats. Even though plant-based options are still a small slice, their rapid growth suggests companies who invest now could significantly diversify their product lines. Governments are also supporting this shift. The OECD/FAO projects a 14% rise in global meat protein consumption by 2030—and have identified plant‑based innovations as critical to meeting sustainably growing demand. In response, several nations are offering R&D incentives to improve alternative protein technologies and support infrastructure.

Regional Insights

North America: The Leading Regional Force – 37.8% Market Share (USD $202.5 Bn)

North America remains the dominant region in the global processed meat market, holding approximately 37.8% share, equivalent to around USD 202.5 billion—a testament to the region’s mature consumption, robust infrastructure, and product innovation.

Canada contributes a significant share, supported by strong urbanization and foodservice expansion, while Mexico shows the region’s fastest growth rate, with mid-single-digit CAGR, thanks to rising disposable incomes and household convenience demand.

On the regulatory side, North American governments actively support the sector. The USDA has made strategic investments to expand meat-processing capacities, including grants through initiatives like the Sustainable Canadian Agricultural Partnership, which poured CAD 13 million into enhancing Canadian processed meat infrastructure.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BRF S.A., headquartered in Brazil, is one of the world’s largest food companies and a major player in the processed meat market. The company operates in over 100 countries and is widely known for brands like Sadia and Perdigão. BRF specializes in poultry, pork, and beef products, including frozen, chilled, and ready-to-eat meat. In 2024, BRF continued expanding its global footprint, with a strong focus on halal markets and sustainability in its supply chain operations.

Cargill Incorporated, based in the United States, is a leading global food producer and a significant stakeholder in the processed meat industry. The company offers a wide portfolio of value-added meat products, including burgers, sausages, and deli meats. Cargill serves retail, foodservice, and industrial clients across multiple continents. In 2024, the company focused on improving supply chain transparency and reducing environmental impact, while also investing in innovation for plant-based and blended meat products to meet evolving consumer preferences.

Danish Crown Group, based in Denmark, is one of Europe’s largest meat processing companies and a major exporter of pork and beef. The company supplies a wide range of processed meat products to retailers, foodservice, and industrial clients. In 2024, Danish Crown prioritized sustainability, aiming to become climate neutral by 2050. Investments were made in automation and product innovation, especially within the chilled meat segment. The group continues to expand its presence across European and Asian markets with premium quality offerings.

Top Key Players Outlook

- BRF S A

- Cargill Incorporated

- Conagra Brands Inc.

- Danish Crown Group

- Foster Farms

- Hormel Foods Corporation

- JBS S.A.

- Maple Leaf Foods Inc

- Nippon Meat Packers Inc.

- Pilgrim’s Pride Corporation

- Smithfield Foods, Inc.

- The Kraft Heinz Company

- Tyson Foods Inc.

- WH Group (Smithfield Foods)

Recent Industry Developments

In 2024, Cargill Incorporated reported USD 160 billion in annual revenue—a 10% decline from USD 177 billion in fiscal 2023—largely due to lower crop prices and a reduced cattle herd caused by drought conditions, which impacted its meatpacking operations.

In 2024, BRF S.A. achieved a record net revenue of BRL 61.4 billion, marking a 14% increase compared to the previous year, while its annual EBITDA surged to a historic BRL 10.5 billion, more than doubling from 2023 levels, illustrating strong operational efficiency.

Report Scope

Report Features Description Market Value (2024) USD 535.9 Bn Forecast Revenue (2034) USD 941.8 Bn CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Fresh-Processed Meat, Raw Fermented Meat, Raw-Cooked Meat, Pre-Cooked Meat, Cured Meat, Dried Meat, Others), By Type (Sausages, Bacon, Ham, Salami, Deli Meats, Others), By Category (Frozen, Canned, Chilled), By Animal Type (Poultry, Beef, Pig, Others), By Distribution Channel ( Supermarket/Hypermarket, Specialty Stores, Convenience Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BRF S A, Cargill Incorporated, Conagra Brands Inc., Danish Crown Group, Foster Farms, Hormel Foods Corporation, JBS S.A., Maple Leaf Foods Inc, Nippon Meat Packers Inc., Pilgrim’s Pride Corporation, Smithfield Foods, Inc., The Kraft Heinz Company, Tyson Foods Inc., WH Group (Smithfield Foods) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BRF S A

- Cargill Incorporated

- Conagra Brands Inc.

- Danish Crown Group

- Foster Farms

- Hormel Foods Corporation

- JBS S.A.

- Maple Leaf Foods Inc

- Nippon Meat Packers Inc.

- Pilgrim's Pride Corporation

- Smithfield Foods, Inc.

- The Kraft Heinz Company

- Tyson Foods Inc.

- WH Group (Smithfield Foods)