Global Premium Lager Market Size, Share, And Enhanced Productivity By Product (Conventional, Craft), By Distribution Channel (On-trade, Off-trade), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 172318

- Number of Pages: 392

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

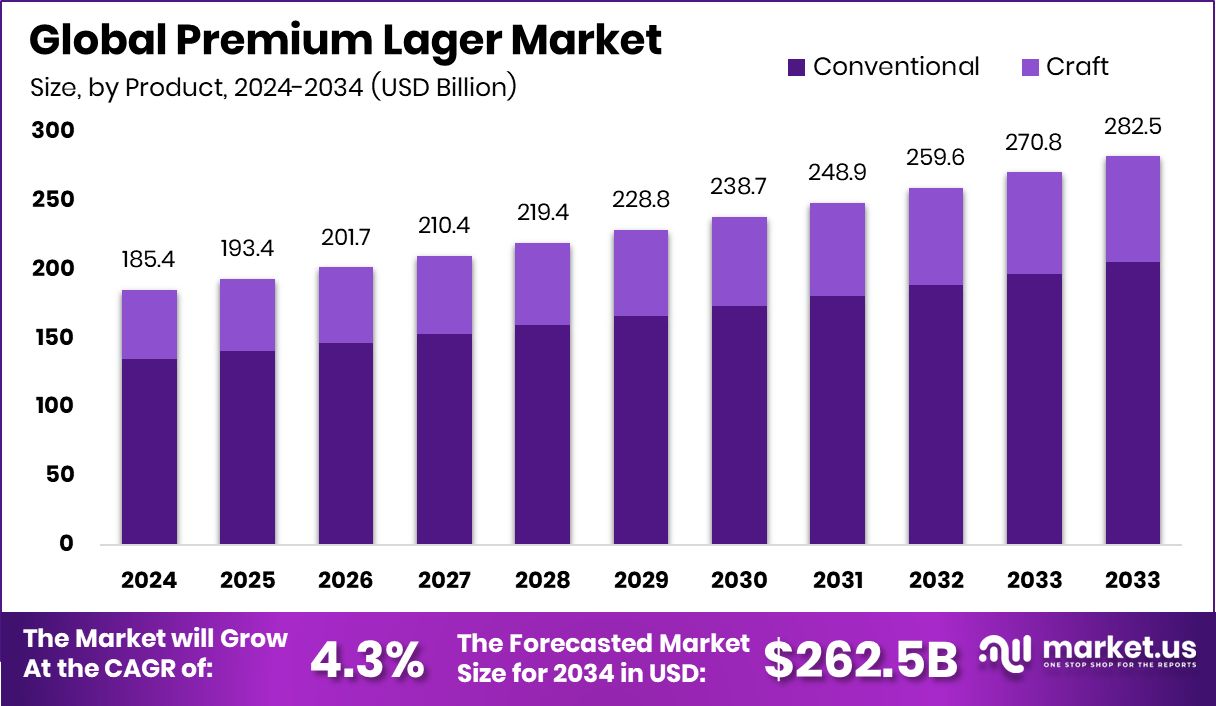

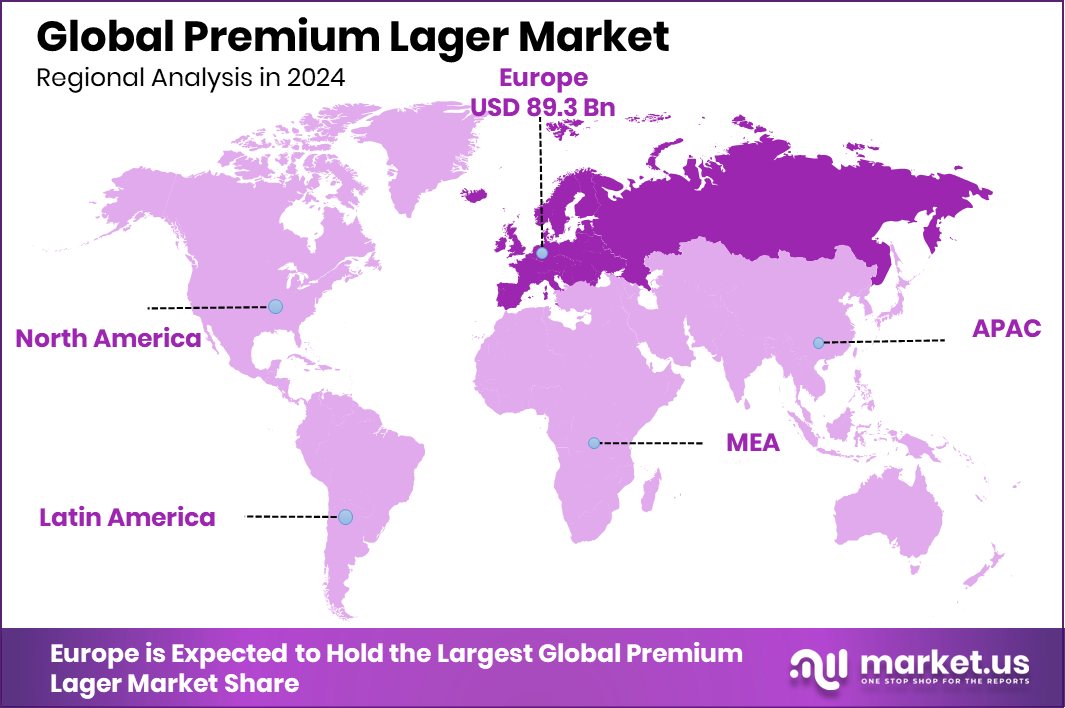

The Global Premium Lager Market is expected to be worth around USD 262.5 billion by 2034, up from USD 185.4 billion in 2024, and is projected to grow at a CAGR of 4.3% from 2025 to 2034. Europe dominates the Premium Lager Market at 48.20%, representing a USD 89.3 Bn market value.

Premium lager is a high-quality beer made using refined ingredients, controlled brewing processes, and longer maturation times. It is known for its clean taste, smooth finish, and consistent flavor. Consumers often associate premium lager with better ingredients, stylish packaging, and a more refined drinking experience compared to mass-market beers.

The premium lager market covers the production, distribution, and sale of higher-priced lager beers positioned above standard offerings. This market is shaped by changing lifestyles, urban consumption patterns, and a growing preference for quality over quantity. Premium lager is commonly consumed during social occasions, dining experiences, and modern leisure activities.

Growth in the premium lager market is strongly linked to rising disposable incomes and exposure to global drinking cultures. In India, this shift is supported by strong investor confidence. Medusa Beverages raised Rs 56 Cr in Series A funding, while premium beer brand White Owl secured Rs 40 Cr in Series B, highlighting belief in long-term category expansion.

Demand is rising as younger consumers seek differentiated, premium experiences. Funding activity reflects this trend, with Proost securing Rs 30 Cr in an ongoing Series A round and Goa Brewing Co raising $700k in funding. These investments support brand building, product innovation, and wider availability across urban markets.

The market offers strong opportunities through premiumization and brand storytelling. Bira 91 raised $70 million in Series D funding from Kirin Holdings, alongside a $30m Sequoia-led round, signaling that India is ready for premium, tech-led food and beverage brands. Such capital inflows support innovation, scale, and long-term market maturity.

Key Takeaways

- The Global Premium Lager Market is expected to be worth around USD 262.5 billion by 2034, up from USD 185.4 billion in 2024, and is projected to grow at a CAGR of 4.3% from 2025 to 2034.

- Conventional products dominate the premium lager market with 72.8% share, driven by familiarity and pricing.

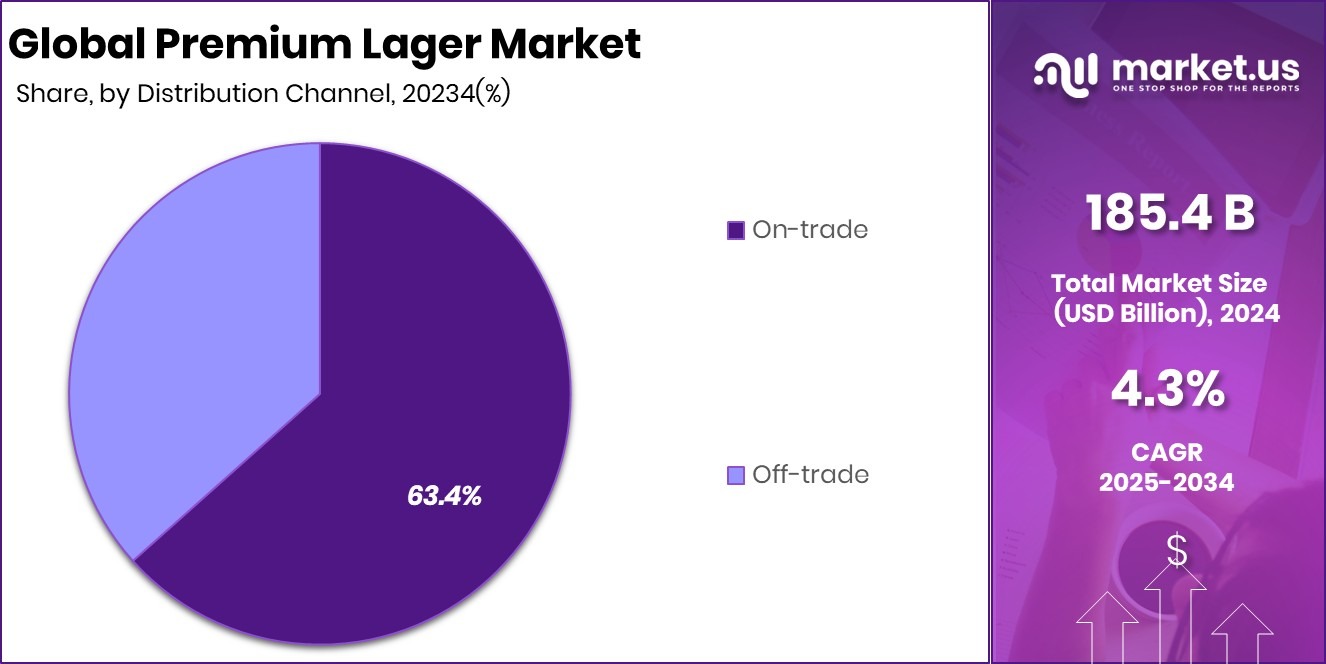

- On-trade channels lead the premium lager market with a 63.4% share, supported by bars and restaurants.

- The premium lager market in Europe reached 48.20% share, generating USD 89.3 Bn revenue.

By Product Analysis

In the Premium Lager Market, conventional products account for 72.8% share globally.

In 2024, the Premium Lager Market saw the conventional segment hold a dominant position with a 72.8% share, reflecting strong consumer preference for well-established taste profiles and trusted brewing methods. Conventional premium lagers continue to benefit from consistent quality, brand heritage, and wide availability across mature and emerging markets. Many consumers associate conventional variants with authenticity, balanced flavor, and social drinking occasions, which supports repeat purchases.

Large-scale breweries also maintain efficient production and supply chains for conventional premium lagers, enabling stable pricing and reliable distribution. This dominance highlights how traditional formulations remain central to premium positioning, even as craft and flavored alternatives gain attention. The segment’s strength is further reinforced by marketing investments and long-standing brand loyalty across urban and semi-urban consumers.

By Distribution Channel Analysis

In the Premium Lager Market, on-trade channels represent 63.4% sales share overall.

In 2024, the Premium Lager Market was strongly led by the on-trade channel, accounting for a 63.4% share, driven by consumption in bars, pubs, hotels, and restaurants. On-trade venues play a critical role in shaping premium brand perception, as consumers often associate premium lagers with social experiences and curated environments. Draft availability, glassware presentation, and food pairing options enhance perceived value and justify premium pricing.

Urbanization, nightlife culture, and tourism continue to support on-trade demand, especially in metropolitan areas. Additionally, breweries actively collaborate with hospitality outlets through exclusive taps, promotional events, and seasonal offerings. This channel dominance underscores how experiential consumption remains a key growth pillar for premium lager sales worldwide.

Key Market Segments

By Product

- Conventional

- Craft

By Distribution Channel

- On-trade

- Off-trade

Driving Factors

Rising Urban Premium Drinking Culture Fuels Demand

One of the strongest driving factors for the Premium Lager Market is the rapid rise of urban premium drinking culture. Consumers, especially young professionals, are shifting from volume-based consumption to quality-focused choices. Premium lagers are increasingly seen as lifestyle products linked to socializing, dining out, and modern experiences. Clean taste, better ingredients, and stylish branding make premium lager more appealing during occasions such as gatherings, celebrations, and after-work meetups.

This cultural shift is clearly reflected in startup activity and investor confidence. Beer startup Medusa raised Rs 56 Crore in Series A funding, showing growing belief in premium beer demand across Indian cities. Such funding supports product refinement, brand visibility, and wider distribution, helping premium lagers reach new consumers. As urban lifestyles evolve, this preference for premium, experience-led beer continues to push steady market growth.

Restraining Factors

High Operating Costs Limit Premium Lager Expansion

A key restraining factor for the Premium Lager Market is the high cost of operating and scaling premium beer production. Premium lagers require better raw materials, controlled brewing processes, and strong quality checks, which raise production expenses. In addition, compliance costs, state-wise regulations, licensing fees, and cold-chain requirements add financial pressure, especially for smaller breweries and new entrants.

Although funding support exists, cost challenges remain significant. Optimistic Capital launched a Rs 200 Cr fund for microbreweries, aimed at easing financial barriers and supporting infrastructure growth. However, even with such backing, breweries still face slow break-even periods and limited pricing flexibility. These cost pressures restrict rapid expansion, limit regional reach, and make premium lager affordability a challenge for wider consumer adoption, slowing overall market momentum.

Growth Opportunity

Export-Led Premium Lager Expansion Creates New Growth

A major growth opportunity for the Premium Lager Market lies in expanding exports and accessing new international consumers. Premium lagers often carry a strong identity, quality perception, and consistent taste, making them suitable for overseas markets seeking differentiated beer options. As global interest in craft and premium beer rises, export channels allow breweries to scale beyond domestic demand and improve brand value.

This opportunity is reinforced by institutional support. The Brewers Association was awarded a $2M USDA grant to advance craft beer exports, helping breweries improve market access, compliance, and international promotion. Such funding supports logistics readiness, quality standards, and export marketing efforts. With this support, premium lager producers can enter new regions, diversify revenue streams, and reduce dependence on local markets, positioning exports as a strong long-term growth driver.

Latest Trends

Premium Lager Moves Toward Low Alcohol Choices

One of the latest trends shaping the Premium Lager Market is the growing shift toward low-alcohol and non-alcoholic premium options. Consumers increasingly want the taste, quality, and experience of premium lager without the effects of alcohol. This trend is driven by health awareness, mindful drinking habits, and social occasions where moderation matters. Premium lagers are now being developed to match traditional flavor profiles while offering lower or zero alcohol content.

Investment activity highlights the strength of this trend. Best Day Brewing secured $22.5M in funding, fueling more growth in the non-alcoholic beer space. This funding supports product innovation, taste improvement, and wider availability. As more consumers seek balance rather than abstinence, premium low-alcohol lagers are becoming an important pathway for market expansion and long-term consumer engagement.

Regional Analysis

Europe leads the Premium Lager Market with 48.20% share, valued at USD 89.3 Bn.

In the Premium Lager Market, Europe emerged as the dominating region in 2024, holding a 48.20% share, valued at USD 89.3 Bn, reflecting the region’s deep-rooted beer culture and strong preference for premium-quality lagers. European consumers demonstrate high brand awareness and loyalty, supporting sustained demand for premium offerings across both mature and developing beer markets. Established brewing traditions, consistent product standards, and widespread availability across retail and hospitality channels continue to reinforce Europe’s leadership position.

North America represents a stable and mature premium lager landscape, driven by evolving consumer tastes and strong demand for high-quality, well-positioned beer brands. Premium lagers benefit from social consumption patterns, urban nightlife, and a steady presence across on-trade and off-trade channels. The region maintains consistent consumption supported by brand-led differentiation and premium pricing acceptance.

In the Asia Pacific, premium lager demand is shaped by urbanization, rising disposable incomes, and growing exposure to international beer styles. Consumers increasingly associate premium lagers with modern lifestyles and social status, supporting gradual market expansion.

The Middle East & Africa market shows selective premium lager consumption, influenced by tourism, hospitality growth, and regulated alcohol availability. Meanwhile, Latin America reflects growing interest in premium lagers, supported by shifting consumer preferences toward higher-quality alcoholic beverages and experiential drinking occasions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Anheuser-Busch InBev continues to play a defining role in shaping the global premium lager landscape through its extensive brand portfolio and disciplined execution. The company’s strength lies in its ability to balance global scale with local relevance, allowing premium lager brands to maintain consistent quality while adapting to regional taste preferences. Its strong distribution reach and long-standing relationships with on-trade and off-trade channels reinforce brand visibility and consumer trust. Strategic focus on premium positioning supports margin stability and long-term brand equity.

Heineken N.V. remains a benchmark for premium lager branding, built on heritage, consistent taste, and strong global recognition. The company’s emphasis on brand storytelling and experiential consumption supports premium perception across diverse markets. Heineken’s disciplined approach to portfolio management and marketing execution enables its premium lagers to resonate with both mature and emerging consumer segments, reinforcing its leadership in the premium category.

China Resources Snow Breweries plays a significant role in premium lager expansion within its domestic market. The company’s deep local market understanding and operational scale allow it to strengthen premium offerings while leveraging established distribution networks. Its focus on upgrading consumer preferences toward higher-quality lager supports sustained premium segment development.

Top Key Players in the Market

- Anheuser-Busch InBev

- Heineken N.V.

- China Resources Snow Breweries

- Carlsberg Breweries A/S

- Molson Coors Brewing

- Tsingtao Brewery Group

- Bira 91

- Asahi Group Holdings

- Constellation Brands

- B9 Beverages Pvt. Ltd.

- The Beijing Yanjing Beer Group Corporation

Recent Developments

- In January 2025, Molson Coors announced a partnership with Fever-Tree, giving it exclusive rights to sell Fever-Tree tonics, ginger beers, and mixers in the U.S. Molson Coors also took an 8.5% stake in Fever-Tree Drinks plc, helping expand its portfolio beyond beer into premium mixers and beverages.

- In July 2024, Carlsberg completed the purchase of the remaining 40% stake in Carlsberg Marston’s Brewing Company from Marston’s, giving Carlsberg full control of the UK brewing business. This strengthens Carlsberg’s brewery footprint and distribution in the UK market.

Report Scope

Report Features Description Market Value (2024) USD 185.4 Billion Forecast Revenue (2034) USD 262.5 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Conventional, Craft), By Distribution Channel (On-trade, Off-trade) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Anheuser-Busch InBev, Heineken N.V., China Resources Snow Breweries, Carlsberg Breweries A/S, Molson Coors Brewing, Tsingtao Brewery Group, Bira 91, Asahi Group Holdings, Constellation Brands, B9 Beverages Pvt. Ltd., The Beijing Yanjing Beer Group Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Anheuser-Busch InBev

- Heineken N.V.

- China Resources Snow Breweries

- Carlsberg Breweries A/S

- Molson Coors Brewing

- Tsingtao Brewery Group

- Bira 91

- Asahi Group Holdings

- Constellation Brands

- B9 Beverages Pvt. Ltd.

- The Beijing Yanjing Beer Group Corporation