Global Precision Swine Farming Market Size, Share Analysis Report By Offering (Hardware, Software, and Services), By Farm Size (Small Farms, Medium Farms, and Large Farms), By Application (Feeding Management, Health Monitoring, Environment Control And Welfare, Waste Management, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169047

- Number of Pages: 258

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

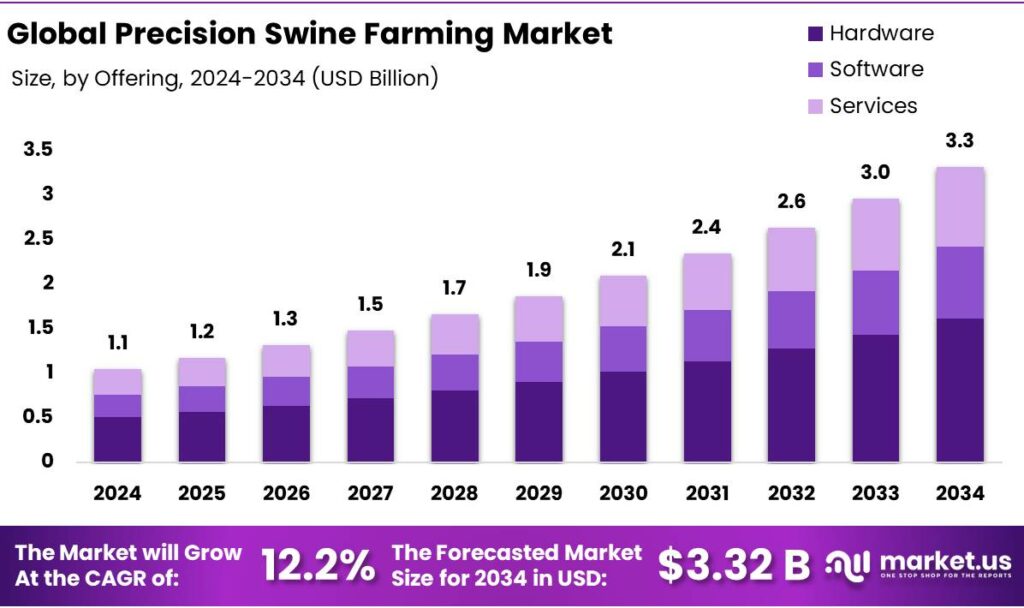

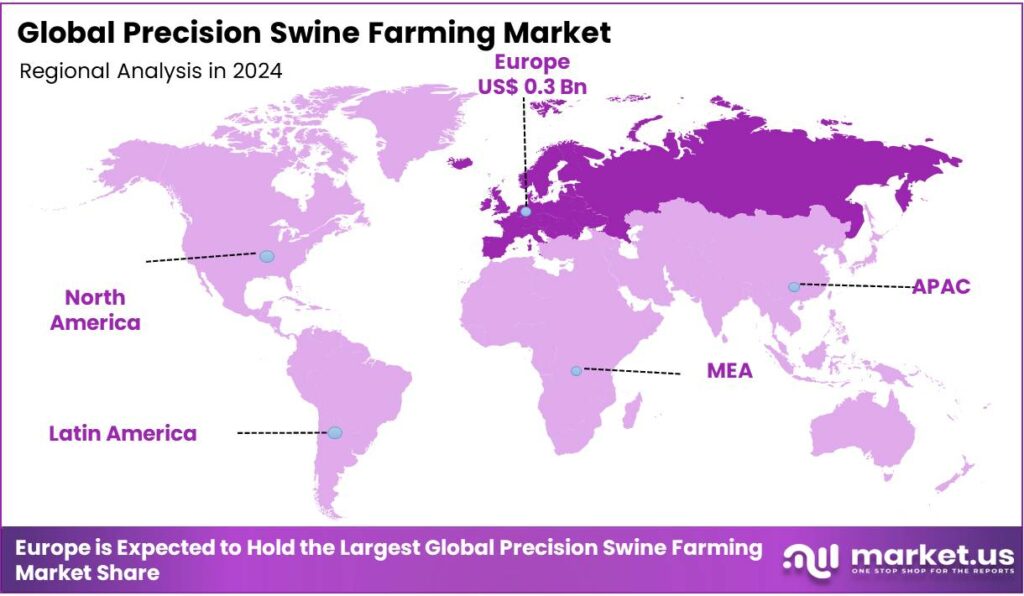

The Global Precision Swine Farming Market size is expected to be worth around USD 3.3 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 12.2% during the forecast period from 2025 to 2034. In 2024, Europe held a dominant market position, capturing more than a 32.3% share, holding USD 0.3 Billion revenue.

Precision swine farming, known as precision livestock farming (PLF), uses technology such as sensors, AI, and automation to continuously monitor and manage individual pigs in real time. This approach allows for highly detailed data collection on everything from animal health, behavior, and feeding to environmental conditions, enabling farmers to make data-driven decisions to improve efficiency, health, and welfare while reducing costs and labor.

The precision swine farming market is driven by advancements in technology aimed at improving efficiency, productivity, and sustainability in pig farming. The market is particularly prominent in large farms, where the scale of operations benefits from automation, reducing labor costs and optimizing resources.

The adoption of precision farming is influenced by factors such as the growing demand for pork, animal welfare concerns, and the need for regulatory compliance. While hardware solutions are more widely used than software or services, the trend is shifting as farmers increasingly recognize the value of data-driven decision-making. However, challenges such as high initial investments, the need for reliable sensors, and financial constraints for smaller farms limit widespread adoption. Despite these barriers, the market continues to evolve as technologies become more accessible and integrated into farm management practices.

- Around 34%-36% of all meat consumed in the world is pork. China is the top consumer of pork overall, with other major consumers including the European Union and the United States.

- China consumes the largest total amount of pork, over 55 million metric tons annually, which is more than half of its total meat consumption. The European Union is estimated to consume around 20.5 million metric tons annually.

Key Takeaways

- The global precision swine farming market was valued at USD 1.1 billion in 2024.

- The global precision swine farming market is projected to grow at a CAGR of 12.2% and is estimated to reach USD 3.3 billion by 2034.

- Based on the offerings, hardware dominated the precision swine farming market, with 48.9% of the total global market.

- On the basis of applications of precision swine farming, large farms held a major share of the market, around 52.6%.

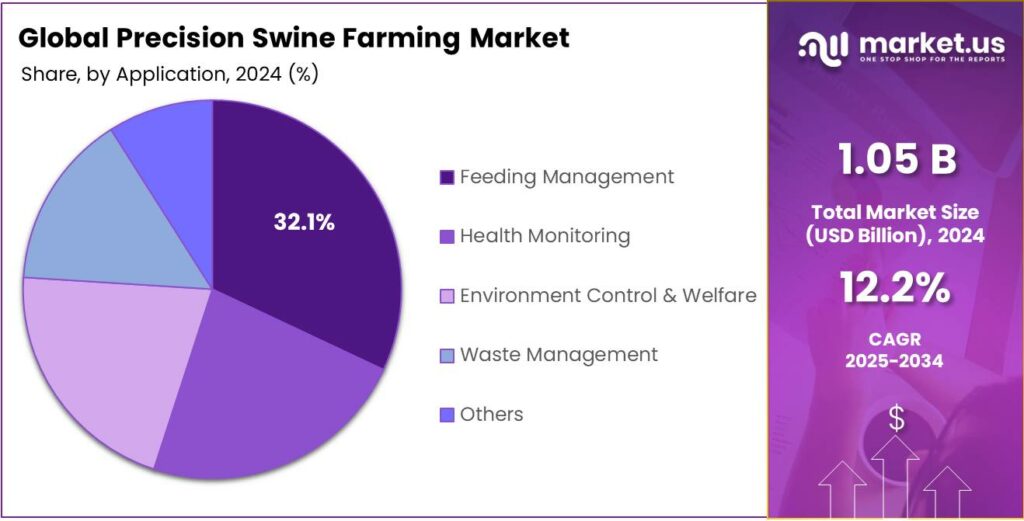

- Among the applications, the feeding management sector emerged as a major segment in the precision swine farming market, with a market share of 32.1%.

- In 2024, Europe was the most dominant region in the precision swine farming market, accounting for 32.3% of the total global consumption.

Offering Analysis

Hardware Dominated the Precision Swine Farming Market in 2024.

The precision swine farming market is segmented based on the offerings into hardware, software, and services. The hardware dominated the precision swine farming market, comprising 48.9% of the market share. The hardware in the precision swine farming market tends to be more widely used than software or services due to its direct, tangible benefits in improving farm operations.

Devices such as automated feeders, climate control systems, and health-monitoring sensors provide immediate, physical improvements in animal welfare, productivity, and efficiency. For instance, automated feeding systems ensure pigs receive adequate nutrients at regular times, while sensors track health indicators, reducing the need for manual labor and enhancing disease prevention.

The adoption of software and services often requires additional investment in data infrastructure, training, and integration with existing systems, which can be a barrier for some farmers. In contrast, hardware delivers visible results, making it the more attractive option for farms seeking to quickly improve operations. However, software and services are likely to gain traction as more farms integrate data-driven decision-making into their daily operations.

Application Analysis

The Feeding Management Sector Emerged as a Leading Segment in the Precision Swine Farming Market.

On the basis of applications, the precision swine farming market is segmented into feeding management, health monitoring, environment control & welfare, waste management, and others. Approximately 32.1% of the precision swine farming market revenue is generated by the feeding management sector, as it directly impacts productivity and cost-efficiency.

Automated feeding systems allow for precise control over nutrition, ensuring pigs receive optimal amounts of feed based on their age, weight, and health status. This improves feed conversion rate and reduces waste and labor costs, making it an immediate priority for farmers.

For instance, systems such as electronic sow feeders (ESF) can track individual pigs’ feed intake, improving growth rates and overall production. While health monitoring, environmental control, and waste management are important sectors, they often require more complex setups and integration with other systems, making them less widely adopted. Feeding management provides a clear, measurable return on investment, which drives its quicker adoption compared to other areas of precision farming that may involve higher upfront costs or longer-term benefits.

Farm Size Analysis

Large Farms are a Prominent Segment in the Precision Swine Farming Market.

The precision swine farming market is segmented on the basis of farm size into small farms, medium farms, and large farms. The large farm systems led the precision swine farming market, constituting 52.6% of the market share, due to the scale of operations and the higher potential for return on investment.

Large farms often have more pigs and greater labor demands, making automation and technology essential for improving efficiency and reducing operational costs. For instance, automated feeding systems, health-monitoring sensors, and climate control systems can optimize resources, improve productivity, and lower labor costs across large operations.

In contrast, small and medium farms often face financial constraints, making it difficult to invest in the high initial costs of precision farming technologies. These farms may not have the volume needed to justify the expense or may rely on more traditional methods. Furthermore, the integration of advanced technologies into smaller operations can be more complex, requiring specialized knowledge and additional infrastructure that smaller farms may not have the resources to implement.

Key Market Segments

By Offering

- Hardware

- Software

- Services

By Application

- Feeding Management

- Health Monitoring

- Environment Control & Welfare

- Waste Management

- Others

By Farm Size

- Small Farms

- Medium Farms

- Large Farms

Drivers

Global Pork Demand Drives the Precision Swine Farming Market.

Global pork demand is a key driver behind the growth of the precision swine farming market. With the world’s population expected to reach 9.7 billion by 2050, reaching a peak of around 10.3 billion people in the mid-2080s, up from 8.2 billion in 2024, agricultural productivity must increase significantly to meet the demand for security.

According to the Food and Agriculture Organization (FAO), the world will need 50% more food by 2050 to feed the increasing global population in the context of natural resource constraints, environmental pollution, ecological degradation, and climate change. As the world’s population increases and the middle class expands, pork remains a staple protein source in various developing countries. For instance, in countries such as China, the world’s largest consumer of pork, demand is particularly high, driven by population size and cultural preferences.

To meet this growing demand, farmers are increasingly turning to precision farming technologies, which help optimize pig production by improving efficiency and reducing waste. Tools such as automated feeding systems, health monitoring devices, and data analytics enable farmers to monitor individual animals, track their health, and fine-tune feed schedules for optimal growth.

These technologies are essential for managing large-scale operations where resource management and cost efficiency are critical. In addition, precision swine farming can enhance sustainability by minimizing environmental impact through better resource use, aligning with the global trend of more sustainable farming practices.

Restraints

The Continuous Development of Efficient and Reliable Sensors Poses a Significant Challenge to the Market.

One of the significant challenges in the precision swine farming market is the high initial investment required for adopting advanced technologies such as automation, robotics, and sensor systems. Farmers, particularly those operating smaller-scale farms, often face financial barriers when installing cutting-edge equipment such as automated feeders, health monitoring sensors, and climate control systems. While these technologies offer long-term benefits, they can require substantial upfront costs for purchase, installation, and integration.

In addition, the continuous development of efficient and reliable sensors, key to monitoring animal health, behavior, and environmental conditions, remains a challenge. While sensor technology has advanced, achieving the necessary accuracy, durability, and affordability is a work in progress. For instance, sensors used to monitor pig health are needed to provide real-time, precise data under varying environmental conditions without failure. The cost of research and development for these high-performance sensors can be prohibitive, which may delay widespread adoption, particularly in regions where farming budgets are tight.

Opportunity

Animal Welfare and Regulatory Compliance Create Opportunities in the Precision Swine Farming Market.

Animal welfare and regulatory compliance are significant factors creating opportunities in the precision swine farming market. With increasing consumer awareness around animal treatment and ethical farming, farmers are under growing pressure to ensure better living conditions for livestock.

In addition, precision technologies are being adopted to improve animal welfare by monitoring health indicators such as temperature, behavior, and feed intake. For instance, wearables can track the health of individual pigs, helping farmers detect illness early and reduce the need for antibiotics, which aligns with growing concerns over antimicrobial resistance.

Furthermore, regulatory frameworks in many regions are becoming more stringent, requiring farmers to adopt more humane and sustainable practices. For instance, in the European Union, the use of gestation crates for pigs has been banned, pushing for more open and comfortable housing systems. Precision swine farming provides solutions to these challenges by optimizing farm management, reducing animal stress, and ensuring compliance with both animal welfare standards and regulations, while improving operational efficiency.

Trends

The Integration of Automation and Robotics for Various Tasks.

The integration of automation and robotics in precision swine farming is transforming the industry, enhancing efficiency and reducing labor costs. For instance, automated feeding systems ensure that pigs receive optimal nutrition based on their age, size, and health status. These systems can operate every time, adjusting feed quantities and schedules without human intervention, thus minimizing waste and improving feed conversion ratios.

Additionally, robotics plays a key role in sanitation tasks. Automated cleaning systems, such as robotic scrubbers and manure handling machines, are increasingly used to maintain hygiene in pig barns. These systems reduce the risk of disease transmission and minimize the need for manual labor, which is often a challenge in large-scale farms.

Systems such as sensoritronic integrate temperature, humidity, and gas sensors, such as ammonia or CO₂. The implementation of precision swine farming can be done progressively, starting with high-impact processes, such as feeding or environmental control, and expanding to other areas.

Geopolitical Impact Analysis

Geopolitical Tensions Cause Price Volatility in the Precision Swine Farming Market.

The geopolitical tensions have a significant impact on the precision swine farming market. Trade disruptions, particularly in pork-exporting nations such as the U.S. and the EU, have affected global supply chains, leading to fluctuations in the availability of key resources such as feed, equipment, and technology. For instance, trade barriers or sanctions imposed on major pork-exporting countries have limited access to international markets, forcing farmers to adjust production strategies or shift focus to domestic markets.

In addition, rising fuel and transportation costs due to geopolitical conflicts, such as the Russia-Ukraine war, which affects oil prices, have made the transportation of pigs, feed, and equipment more expensive. This has directly impacted operating costs for swine farmers, making it more challenging for them to invest in advanced precision farming technologies, which often require significant upfront capital.

However, geopolitical instability has prompted countries to enhance domestic food security by improving local production capabilities, which drives investments in technology, including automation and sensor systems, to boost productivity and self-sufficiency. For instance, disruptions in global supply chains could incentivize swine farms to adopt more efficient, technology-driven practices to reduce dependency on external suppliers. While geopolitical tensions create short-term challenges, they encourage long-term innovation and resilience in the industry.

Regional Analysis

Europe Held the Largest Share of the Global Precision Swine Farming Market.

In 2024, Europe dominated the global precision swine farming market, holding about 32.3% of the total global consumption. The region dominates the global precision swine farming market, driven by its advanced agricultural technologies and strong focus on sustainability. The adoption of precision farming solutions in the region has been rapid, which includes sensors, automated feeding systems, and data analytics to optimize pig health and productivity.

For instance, countries such as Denmark, the Netherlands, and Germany have integrated sophisticated monitoring systems to track animal behavior, growth rates, and environmental conditions, significantly improving the efficiency of pork production. In addition, the European Union’s strict regulations on animal welfare and food safety encourage farmers to invest in technologies that ensure better animal management and compliance.

Moreover, EU-funded research initiatives, such as Horizon Europe 2020, have supported innovation in precision farming, further boosting the region’s market share. With an increasing emphasis on reducing the environmental impact of farming, Europe’s commitment to sustainable practices strengthens its position as the leader in the global precision swine farming market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Companies in the precision swine farming market focus on several strategies to boost sales and gain a competitive edge. The companies invest heavily in product innovation, developing more efficient, cost-effective technologies that improve farm productivity, such as advanced automated feeding systems and real-time health monitoring sensors. In addition, companies emphasize the integration of data analytics and software platforms, offering end-to-end solutions that provide actionable insights to farmers.

Moreover, they focus on customer education and training, helping farmers understand the full benefits of precision farming and how to integrate new technologies. Strategic partnerships with large farms and agricultural cooperatives help companies expand their reach. Furthermore, companies are increasingly adopting sustainability-focused approaches, aligning with growing consumer demand for environmentally responsible and humane farming practices, which further enhances their market appeal.

The Major Players in The Industry

- Nedap N.V.

- Big Dutchman Inc.

- CTB, Inc.

- Topigs Norsvin

- Zoetis Inc.

- Genus plc

- Hendrix Genetics BV

- Big Herdsman

- Osborne Industries, Inc.

- Merck & Co., Inc.

- Boehringer Ingelheim International GmbH

- Hotraco Agri B.V.

- Guangzhou Yingzi Technology Co, Ltd

- VDL Agrotech BV

- PigBrother

- Other Key Players

Key Development

- In August 2025, Roxell launched the next-generation Discaflex feed transport system, which introduced precision and adaptability to feed distribution.

- In October 2025, Big Herdsman, a Chinese company providing solutions for feeding, drinking, ventilation, and environmental control for poultry and livestock, solidified its presence in Southeast Asia by exhibiting its products at Ildex Indonesia.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Bn Forecast Revenue (2034) USD 3.3 Bn CAGR (2025-2034) 12.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Offering (Hardware, Software, and Services), By Farm Size (Small Farms, Medium Farms, and Large Farms), By Application (Feeding Management, Health Monitoring, Environment Control & Welfare, Waste Management, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Nedap N.V., Big Dutchman Inc., CTB, Inc., Topigs Norsvin, Zoetis Inc., Genus plc, Hendrix Genetics BV, Big Herdsman, Osborne Industries, Inc., Merck & Co., Inc., Boehringer Ingelheim International GmbH, Hotraco Agri B.V., Guangzhou Yingzi Technology Co., Ltd, VDL Agrotech BV, PigBrother, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Precision Swine Farming MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Precision Swine Farming MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Nedap N.V.

- Big Dutchman Inc.

- CTB, Inc.

- Topigs Norsvin

- Zoetis Inc.

- Genus plc

- Hendrix Genetics BV

- Big Herdsman

- Osborne Industries, Inc.

- Merck & Co., Inc.

- Boehringer Ingelheim International GmbH

- Hotraco Agri B.V.

- Guangzhou Yingzi Technology Co, Ltd

- VDL Agrotech BV

- PigBrother

- Other Key Players