Global Power and Distribution Transformers Market Size, Share, And Enhanced Productivity By Transformer Type (Power Transformers, Distribution Transformers, Instrument Transformers), By Material Type (Silicon Steel, Amorphous Steel, Copper, Aluminum), By Voltage Level (Low Voltage (up to 1 kV), Medium Voltage (1 kV to 33 kV), High Voltage (above 33 kV)), By Cooling Type (Oil-Cooled Transformers, Air-Cooled Transformers, Dry-Type Transformers), By Application (Industrial, Commercial, Utility, Renewable Energy Systems), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 168696

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Transformer Type Analysis

- By Material Type Analysis

- By Voltage Level Analysis

- By Cooling Type Analysis

- By Application Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

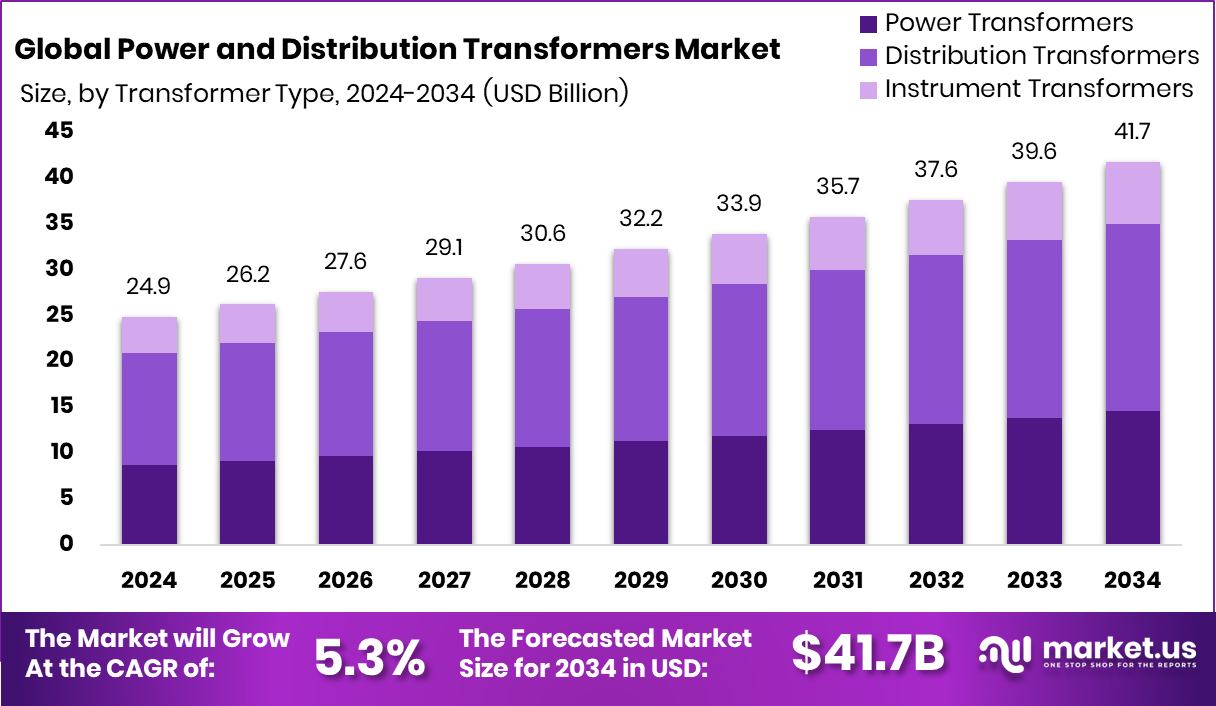

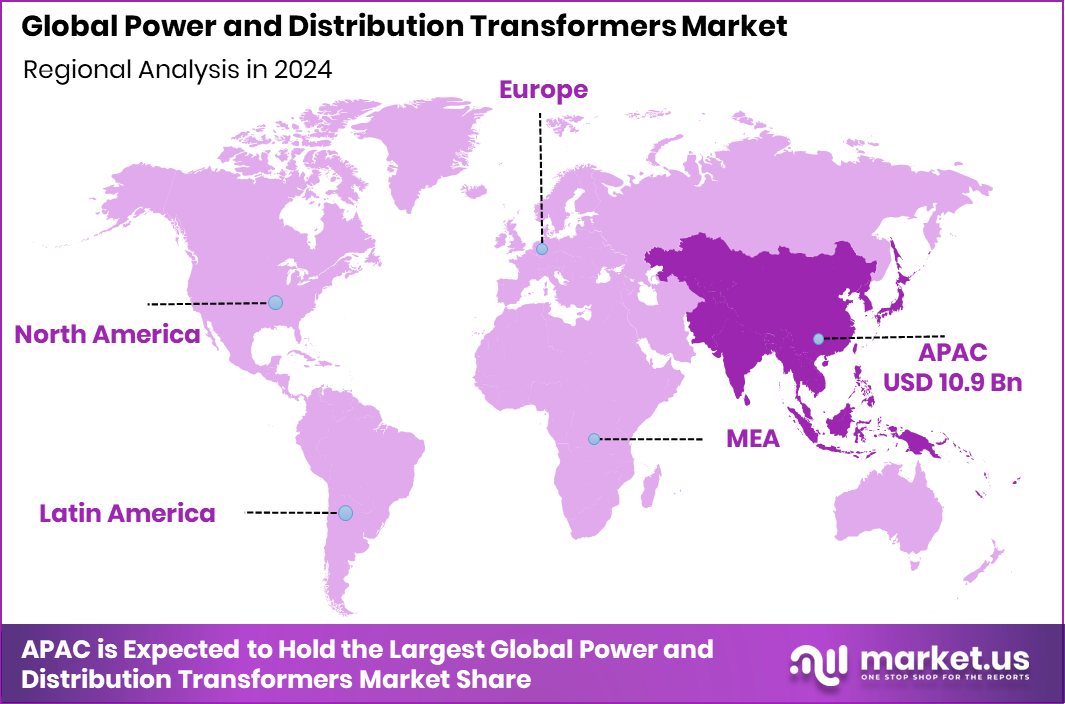

The Global Power and Distribution Transformers Market is expected to be worth around USD 41.7 billion by 2034, up from USD 24.9 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034. Rising electricity demand positioned Asia-Pacific as dominant at 43.80%, generating USD 10.9 Bn revenue.

Power and distribution transformers are electrical devices used to transfer power between voltage levels in the grid. Power transformers handle high-voltage transmission between generation plants and substations, while distribution transformers step electricity down to safer levels for homes, offices, and industries. Together, they form the backbone of a reliable electricity supply.

The power and distribution transformers market includes the design, manufacturing, installation, and replacement of these systems across transmission and distribution networks. It closely follows growth in electricity consumption, grid upgrades, renewable integration, and infrastructure expansion, especially in fast-growing economies.

Growth factors are strongly linked to grid strengthening and electrification. Rising investments in electrical steel are critical, as this material directly affects transformer efficiency. JSW Steel and Japan’s JFE are investing $669 million (₹58 billion) to boost electrical steel output, while India’s SAIL and JCIL plan $692 million for new production capacity. These moves support higher transformer manufacturing volumes.

Demand is rising due to renewable energy integration and energy efficiency rules. JSW Steel’s arm is raising ₹2.6k crore for a Thyssenkrupp unit buyout, securing advanced steel technology needed for modern transformers with lower losses.

Opportunities are emerging from decarbonisation and supply restructuring. Marseille-based GravitHy secured €60 million to advance low-carbon iron production, supporting cleaner transformer supply chains. At the same time, China’s polysilicon firms planning a $7 billion fund to shut one-third of capacity may reshape energy investments, indirectly boosting grid and transformer upgrades worldwide.

Key Takeaways

- The Global Power and Distribution Transformers Market is expected to be worth around USD 41.7 billion by 2034, up from USD 24.9 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034.

- Distribution transformers dominate the power and distribution transformers market with a 48.9% share, driven by urban networks.

- Silicon steel leads power and distribution transformer materials with a 52.4% share due to efficiency requirements.

- Medium voltage transformers lead the Power and Transformers Market with a 49.5% share, supporting industrial distribution needs.

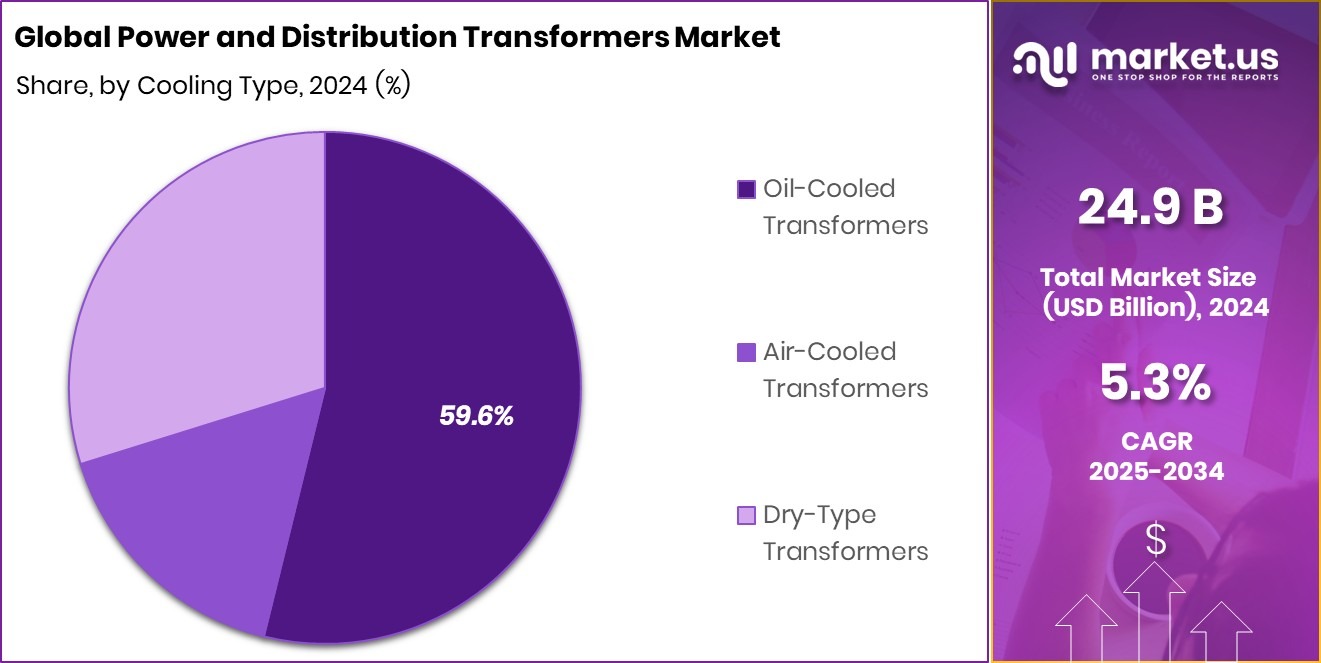

- Oil-cooled transformers dominate the power and distribution transformers market with a 59.6% share due to reliability advantages.

- Industrial applications hold the power and distribution transformers market demand with a 38.3% share from manufacturing expansion.

- Strong grid expansion and rapid urbanization helped the Asia-Pacific secure 43.80%, reaching USD 10.9 Bn.

By Transformer Type Analysis

Distribution transformers lead the Power and Distribution Transformers Market, holding 48.9% share.

In 2024, Distribution Transformers held a dominant market position in the By Transformer Type segment of the Power and Distribution Transformers Market, with a 48.9% share. This leadership reflects their essential role in delivering electricity from local substations to residential, commercial, and small industrial users.

Rapid urban development and steady expansion of distribution networks increased the need for reliable voltage step-down solutions. Distribution transformers are widely installed across city grids, rural electrification programs, and infrastructure projects, making them the most frequently deployed transformer type. Their dominance is also supported by the ongoing replacement of aging units to improve efficiency, safety, and load management.

As electricity access expands and consumption patterns shift toward decentralized usage, utilities continue to prioritise distribution transformers for last-mile connectivity. This sustained focus on strengthening local power delivery systems helped distribution transformers maintain their leading 48.9% share within the transformer type segmentation in 2024.

By Material Type Analysis

Silicon steel dominates the Power and Distribution Transformers Market with a 52.4% share.

In 2024, Silicon Steel held a dominant market position in the By Material Type segment of the Power and Distribution Transformers Market, with a 52.4% share. This dominance was driven by its critical role in transformer core manufacturing, where low magnetic loss and high permeability are essential for efficient power transfer.

Silicon steel enables transformers to operate with reduced energy losses, supporting stable voltage regulation across transmission and distribution networks. Its proven performance and long service life make it the preferred material for core laminations in grid infrastructure.

Utilities and equipment manufacturers continued to rely on silicon steel to meet efficiency standards and operational reliability requirements. As power systems expand and modernize, the consistent use of silicon steel helped it secure a leading 52.4% share in the material type segmentation during 2024.

By Voltage Level Analysis

Medium voltage drives the Power and Distribution Transformers Market, accounting for 49.5% demand.

In 2024, Medium Voltage (1 kV to 33 kV) held a dominant market position in the By Voltage Level segment of the Power and Distribution Transformers Market, with a 49.5% share. This dominance reflects the wide application of medium-voltage transformers across distribution substations, industrial facilities, and urban infrastructure networks.

They play a central role in balancing power flow between high-voltage transmission systems and low-voltage end-use applications. Their suitability for densely populated areas and industrial clusters supported steady installations and replacements. Medium-voltage transformers are also preferred for their operational flexibility and ability to handle varying load conditions efficiently.

As electricity networks continued to expand and modernize distribution frameworks, reliance on medium-voltage systems remained strong, enabling this segment to secure a leading 49.5% share within the voltage level classification in 2024.

By Cooling Type Analysis

Oil-cooled units dominate the Power and Distribution Transformers Market with 59.6% preference.

In 2024, Oil-Cooled Transformers held a dominant market position in the By Cooling Type segment of the Power and Distribution Transformers Market, with a 59.6% share. This leadership was supported by their proven ability to manage heat effectively under continuous and heavy load conditions.

Oil-cooled systems offer stable thermal performance, which is critical for maintaining reliability in transmission and distribution networks. Their long operational life and consistent performance in diverse climatic conditions made them a preferred choice for utility-scale applications.

These transformers are commonly used where high efficiency, durability, and ease of maintenance are required over extended periods of operation. The continued dependence on established cooling technologies enabled oil-cooled transformers to retain a strong 59.6% share in the cooling type segmentation during 2024.

By Application Analysis

Industrial applications support the Power and Distribution Transformers Market, contributing 38.3% usage.

In 2024, Industrial held a dominant market position in the By Application segment of the Power and Distribution Transformers Market, with a 38.3% share. This dominance was driven by the consistent need for a reliable and continuous power supply across manufacturing plants, processing facilities, and heavy infrastructure operations.

Industrial applications demand transformers capable of handling high loads, voltage stability, and uninterrupted performance to support critical equipment and production lines. The expansion of industrial capacity and modernization of existing facilities supported steady installations and upgrades of transformer systems.

Additionally, industries place strong emphasis on operational efficiency and power quality, reinforcing the preference for robust transformer solutions. These factors collectively enabled the industrial application segment to maintain a leading 38.3% share within the application-based segmentation in 2024.

Key Market Segments

By Transformer Type

- Power Transformers

- Distribution Transformers

- Instrument Transformers

By Material Type

- Silicon Steel

- Amorphous Steel

- Copper

- Aluminum

By Voltage Level

- Low Voltage (up to 1 kV)

- Medium Voltage (1 kV to 33 kV)

- High Voltage (above 33 kV)

By Cooling Type

- Oil-Cooled Transformers

- Air-Cooled Transformers

- Dry-Type Transformers

By Application

- Industrial

- Commercial

- Utility

- Renewable Energy Systems

Driving Factors

Grid Expansion Fueled by Industrial Energy Investments

A key driving factor for the power and distribution transformers market is the steady expansion of industrial energy use and supporting infrastructure. As industries grow, they require stable electricity with proper voltage control, which directly increases demand for transformers across networks.

New industrial projects also push utilities to strengthen substations and local distribution lines. This trend is supported by fresh funding into energy-intensive manufacturing. Golden Aluminum secured $22 million to support its Nexcast project, which relies on efficient and reliable power systems to operate advanced production facilities.

Similarly, Found Energy raised $12 million to scale its industrial technology, increasing electricity needs at the plant level. Such investments raise load requirements, driving upgrades in transformers to ensure reliable, safe, and continuous power delivery.

Restraining Factors

High Grid Upgrade Costs Slow Transformer Replacement

One major restraining factor for the power and distribution transformers market is the high cost involved in upgrading aging grid infrastructure. Replacing old transformers requires large capital spending, skilled labor, and planned outages, which many utilities delay due to budget pressure.

Even when demand rises, financial limits slow procurement and installation timelines. This challenge is visible alongside large renewable investments. ReNew secured $331 million from the Asian Development Bank for a renewable energy project in Andhra Pradesh, highlighting how funding often prioritizes generation capacity first.

As a result, spending on transmission and distribution equipment can lag behind. When grid upgrades are postponed, transformer replacement cycles extend, limiting short-term market growth despite long-term power demand needs.

Growth Opportunity

Clean Energy Manufacturing Boosts Long-Term Grid Investment

A major growth opportunity for the power and distribution transformers market comes from the expansion of clean and low-carbon manufacturing. As industries decarbonize, electricity demand shifts toward cleaner but more power-intensive processes, requiring stronger and more efficient grid infrastructure.

This creates a fresh need for modern transformers across industrial and utility networks. Arvedi Group raised €900 million to expand production and support decarbonization, which increases electricity use in advanced steelmaking operations.

In parallel, Sicona Battery Technologies raised AUD 22 million from leading industries to scale battery material production, adding pressure on local grids to ensure stable power. These investments encourage utilities to reinforce distribution and substation capacity, opening sustained growth opportunities for transformer deployments.

Latest Trends

Growing Focus on Transformer Material Self-Reliance

One of the latest trends in the power and distribution transformers market is the growing focus on securing key raw materials locally. Transformer manufacturing depends heavily on special steels and silicon-based materials, and supply reliability has become a priority. Recent developments reflect this shift.

JSW Steel increased steel production by 5% year-on-year in November, helping strengthen the domestic supply of key transformer inputs and reduce dependence on imports. At the same time, Australia’s only silicon manufacturer was awarded a $39.8 million government grant, supporting local silicon production critical for electrical applications.

This trend toward material self-reliance helps stabilize transformer manufacturing timelines, supports cost control, and improves long-term supply security for power grid expansion projects.

Regional Analysis

Asia-Pacific led the Power and Distribution Transformers Market with 43.80% share, valued at USD 10.9 Bn.

Asia-Pacific dominates the Power and Distribution Transformers Market with a 43.80% share, valued at USD 10.9 Bn, making it the leading regional market. This dominance is supported by the rapid expansion of electricity networks, strong industrial growth, and continuous investment in transmission and distribution infrastructure across developing and emerging economies. Large-scale urbanization, rural electrification programs, and the strengthening of intercity power links have increased transformer installations across utilities and industrial users. The region’s focus on grid stability and capacity enhancement has positioned Asia-Pacific as the central hub for transformer demand.

North America represents a mature yet steadily evolving market, driven by the modernization of aging power infrastructure and grid reliability upgrades. Utilities in the region focus on replacing obsolete transformer units to improve efficiency, safety, and load handling, supporting stable market activity.

Europe shows consistent demand due to strict energy efficiency standards and grid optimization efforts. Power system upgrades, cross-border interconnections, and renewable energy integration continue to support transformer installations across the region.

The Middle East & Africa market is developing gradually, driven by the expansion of power access, new substations, and the strengthening of national grids. Infrastructure development remains a key contributor to transformer demand.

Latin America demonstrates steady growth supported by regional electricity network expansion and improving power distribution systems, particularly in urban and industrial zones.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ABB continues to play a critical role in the global power and distribution transformers market, thanks to its strong focus on grid reliability, digital monitoring, and energy-efficient equipment. In 2024, ABB’s transformer portfolio aligns closely with utility needs for reducing losses and improving grid resilience. Its emphasis on smart transformers and condition-monitoring solutions supports utilities facing aging infrastructure and rising power demand. ABB’s ability to integrate transformers with digital grid platforms strengthens its long-term relevance.

Siemens brings a system-level perspective to the transformer market, linking transformers with substations, grid automation, and power management solutions. In 2024, Siemens’ approach reflects growing demand for flexible and future-ready grids. Its transformers support renewable integration, transmission expansion, and urban power needs. Siemens’ strength lies in delivering end-to-end grid solutions, making its transformer offerings attractive for large-scale and complex power networks.

GE remains a key participant by addressing both transmission and distribution requirements with a focus on durability and operational performance. In 2024, GE’s transformer solutions support utilities managing high-load conditions and grid stability challenges. The company’s engineering depth and experience in large power equipment allow it to serve heavy industrial and utility applications effectively. GE’s continued focus on grid infrastructure positions it well as power networks modernize globally.

Top Key Players in the Market

- BB

- Siemens

- GE

- Schneider

- Eaton Corporation

- Emerson

- Crompton Greaves Ltd

- Alstom SA.

- Others

Recent Developments

- In 2025, ABB announced plans to invest US$110 million in the United States to expand its R&D and manufacturing capacity for advanced electrification solutions, which support power grid and transformer infrastructure.

- In September 2025, Siemens Energy announced a €220 million investment to enlarge its long-standing transformer production site in Nuremberg, Germany. The plan will raise output by roughly 50% and create around 350 new jobs.

Report Scope

Report Features Description Market Value (2024) USD 24.9 Billion Forecast Revenue (2034) USD 41.7 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Transformer Type (Power Transformers, Distribution Transformers, Instrument Transformers), By Material Type (Silicon Steel, Amorphous Steel, Copper, Aluminum), By Voltage Level (Low Voltage (up to 1 kV), Medium Voltage (1 kV to 33 kV), High Voltage (above 33 kV)), By Cooling Type (Oil-Cooled Transformers, Air-Cooled Transformers, Dry-Type Transformers), By Application (Industrial, Commercial, Utility, Renewable Energy Systems) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BB, Siemens, GE, Schneider, Eaton Corporation, Emerson, Crompton Greaves Lt, Alstom SA., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Power and Distribution Transformers MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Power and Distribution Transformers MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BB

- Siemens

- GE

- Schneider

- Eaton Corporation

- Emerson

- Crompton Greaves Ltd

- Alstom SA.

- Others