Global Potato Flour Market Size, Share, And Enhanced Productivity By Type (Industrial Grade, Food Grade), By Form (Granules, Powder, Flakes), By Application (Food, Paper, Textile, Feed, Others), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 176309

- Number of Pages: 386

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

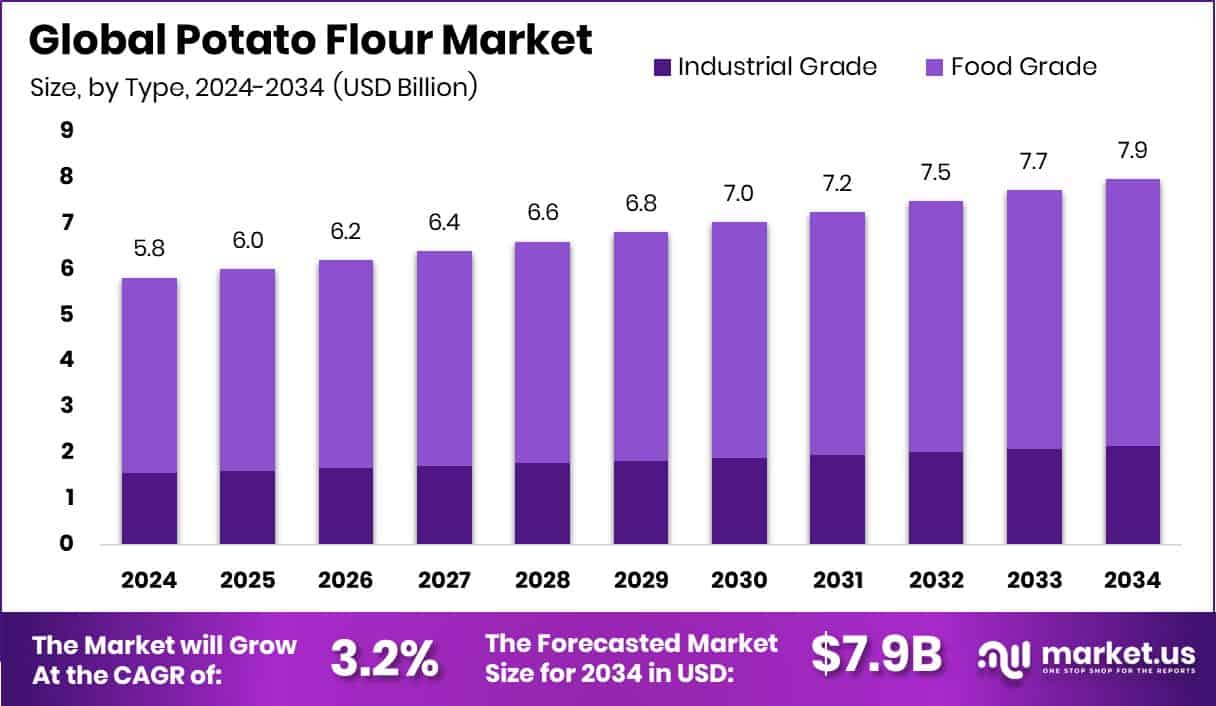

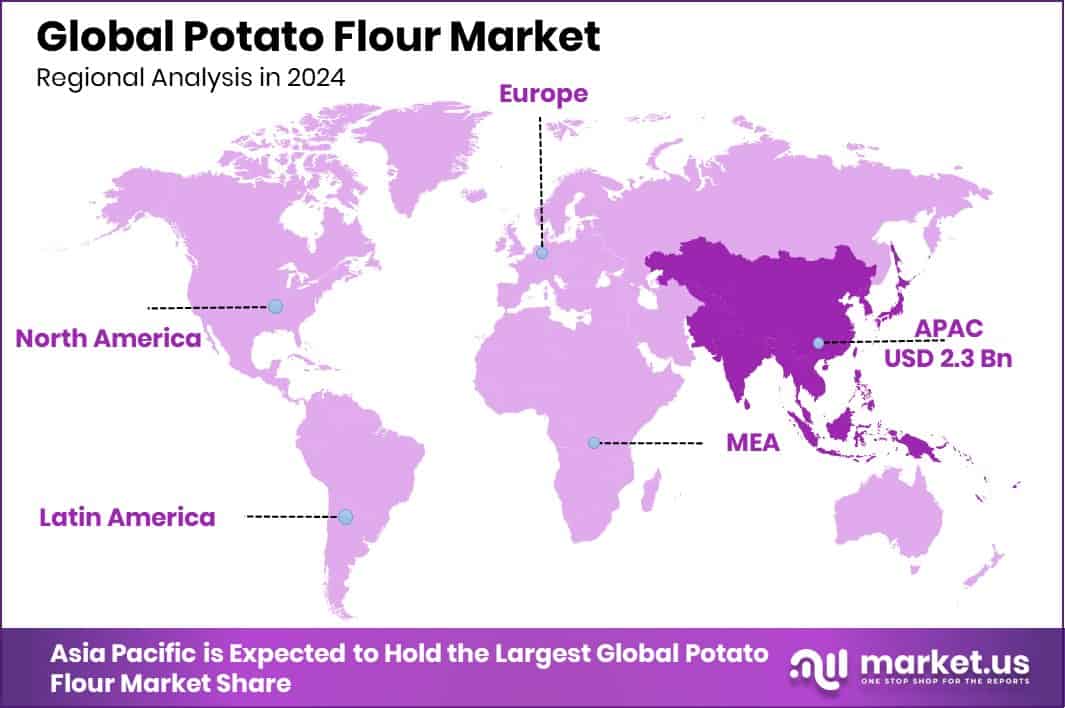

The Global Potato Flour Market is expected to be worth around USD 7.9 billion by 2034, up from USD 5.8 billion in 2024, and is projected to grow at a CAGR of 3.2% from 2025 to 2034. Strong demand in the Asia Pacific pushed its share to 39.9%, totaling USD 2.3 Bn.

Potato flour is a finely milled product made from whole potatoes that are cooked, dried, and ground to form a smooth flour used for thickening, baking, binding, and improving texture in various foods. It differs from starch because it retains the potato’s natural flavor, color, and nutrients. The global Potato Flour Market includes Industrial Grade and Food Grade products, available in forms such as granules, powder, and flakes, and distributed through both online and offline channels.

The Potato Flour Market continues to grow as more industries use potato-based ingredients for consistent texture and moisture retention. Demand increases further as governments introduce initiatives to reduce wheat imports, such as local programs announced to cut a 178-billion-F wheat import bill by 2028, encouraging processors to explore alternative flours. Opportunity also rises with agricultural investments, including $465,700 allocated through specialty crop grants and US$180K awarded for NextGen sweet potato projects, supporting crop diversification that strengthens potato supply chains.

Funding in the broader potato and alt-protein sectors also influences future growth. Innovations backed by Spudsy’s $3.3 million Series A and Better Meat Co.’s $31 million Series A show how potato-based ingredients are gaining attention in snacks and hybrid foods. Even large-scale government actions, such as the $30-billion Hanford waste glassification project, reflect long-term stability trends that indirectly support agricultural reliability. Together, these developments create steady demand and new opportunities for potato flour across food, paper, textile, and feed applications.

Key Takeaways

- The Global Potato Flour Market is expected to be worth around USD 7.9 billion by 2034, up from USD 5.8 billion in 2024, and is projected to grow at a CAGR of 3.2% from 2025 to 2034.

- The Potato Flour Market shows strong dominance in the Food Grade segment with 73.5% share.

- In the Potato Flour Market, the Powder form leads consumption trends, capturing a notable 56.2% share.

- The Potato Flour Market remains driven by Food applications, which account for a significant 58.8% share.

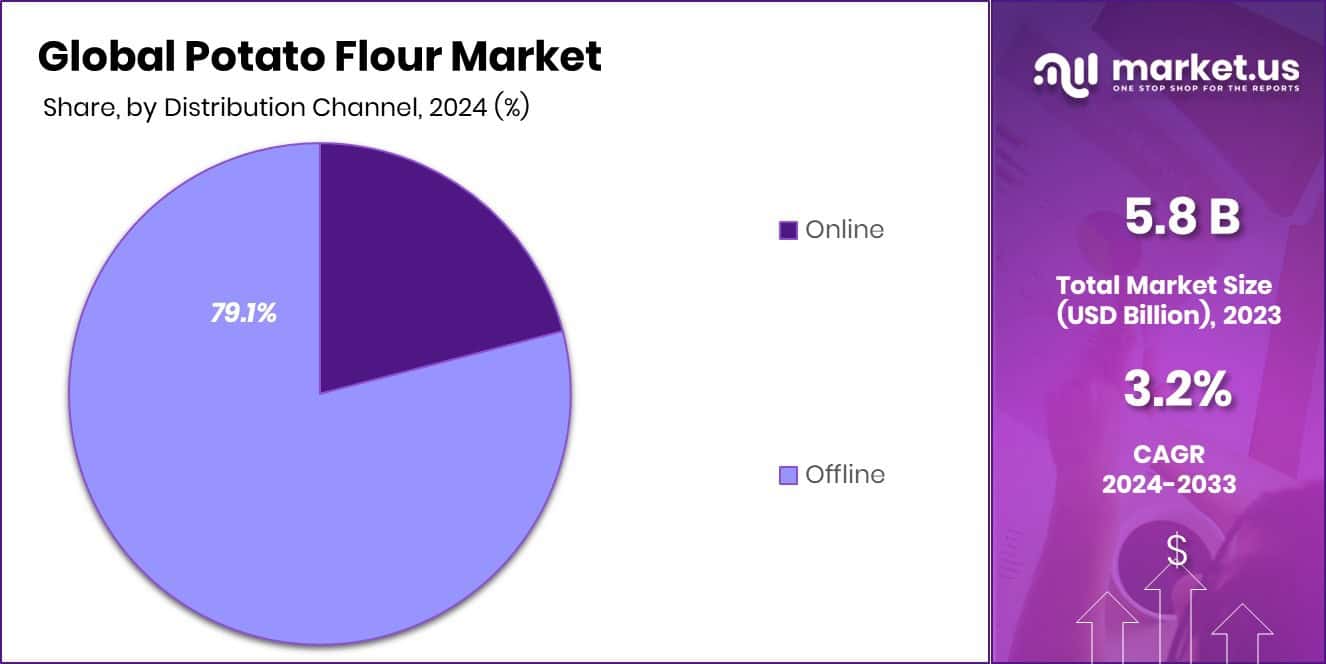

- The Potato Flour Market is primarily supported by Offline distribution, holding a commanding 79.1% share globally.

- The Asia Pacific region maintained 39.9% market dominance, generating USD 2.3 Bn revenue.

By Type Analysis

The Potato Flour Market sees Food Grade leading with a strong 73.5% share.

In 2024, the Potato Flour Market saw Food Grade potato flour take the lead with a strong 73.5% share, mainly because food manufacturers continued relying on clean, simple ingredients for bakery and snack applications. The segment benefited from rising consumer interest in gluten-free and allergen-friendly products, encouraging large bakeries and packaged food companies to replace wheat-based thickeners with potato-derived alternatives.

Food-grade potato flour also gained momentum in ready-to-eat meals, where processors prioritized stable texture and consistent flavor. As global brands expanded convenience food portfolios, the demand for high-quality potato-based ingredients increased steadily. This shift kept Food Grade flour at the center of product innovation across bakery, snacks, soups, and instant meal formulations.

By Form Analysis

Powder form dominates the Potato Flour Market, capturing a notable 56.2% share.

In 2024, the Potato Flour Market continued to favor the Powder form, which held a clear 56.2% share due to its versatility and ease of use in industrial food processing. Powdered potato flour mixes evenly in doughs, batters, and thickening systems, making it a preferred ingredient among commercial bakeries and quick-service food manufacturers. Its longer shelf life and moisture-retention ability helped producers improve texture in gluten-free breads and pastries.

Small and large food businesses increasingly use powder form for economical bulk storage and consistent batch formulation. This reliability boosted adoption across bakery, confectionery, and snack manufacturing, reinforcing Powder’s role as the most convenient and scalable form of potato flour for both domestic and export-driven processors.

By Application Analysis

Food applications drive the Potato Flour Market forward with an impressive 58.8% share.

In 2024, the Food segment remained the strongest application area in the Potato Flour Market, accounting for 58.8% of total demand. Its growth was driven by the wide use of potato flour in bakery items, infant foods, ready meals, and specialty diets that rely on clean-label, plant-based ingredients.

Manufacturers continued incorporating potato flour to improve product stability, enhance moisture, and achieve a natural thickening effect without artificial additives. The rising popularity of gluten-free snacks and convenient meal solutions also increased usage among mainstream food brands. As consumers sought simpler, less-processed ingredients, potato flour emerged as a dependable choice for companies aiming to balance taste, nutrition, and functionality across multiple food categories.

By Distribution Channel Analysis

Offline channels lead the Potato Flour Market distribution, holding a substantial 79.1% share.

In 2024, the Potato Flour Market was dominated by the Offline distribution channel, securing an impressive 79.1% share. Supermarkets, hypermarkets, and specialty food stores remained the main purchasing points as buyers preferred physically verifying quality, packaging, and texture before selecting flour products.

Food processors and bakery units continued sourcing bulk quantities through offline wholesalers for assured supply, stable pricing, and immediate availability. Traditional retail networks also played a key role in rural and semi-urban regions, where online penetration was still developing. As food manufacturers maintained strong partnerships with distributors and cash-and-carry outlets, offline channels stayed essential for both household consumption and industrial procurement across regions.

Key Market Segments

By Type

- Industrial Grade

- Food Grade

By Form

- Granules

- Powder

- Flakes

By Application

- Food

- Paper

- Textile

- Feed

- Others

By Distribution Channel

- Online

- Offline

Driving Factors

Rising preference for clean-label flour alternatives

Growth in the Potato Flour Market continues as more consumers choose simple, recognizable ingredients for everyday cooking and packaged foods. Clean-label trends encourage food processors to replace synthetic thickeners with potato-based alternatives for better texture and transparency. Momentum is further supported by strong investments in the potato processing ecosystem.

For example, Wave and Agristo announced a Rs 750 crore investment in Uttar Pradesh to expand potato processing capacity, strengthening raw material availability for potato flour applications. These improvements boost supply consistency, helping manufacturers meet rising demand for clean-label bakery mixes, snacks, and fortified products.

Restraining Factors

Limited potato supply impacts production stability

Despite rising demand, potato flour manufacturers occasionally face challenges linked to supply fluctuations, especially during poor harvest cycles or regional shortages. Limited supply can increase production costs and affect contract pricing for food producers, slowing overall market momentum. Investor sentiment also reflects cautious optimism in the broader food sector.

The recent IPO launch of Shivashrit Foods, with a 9% GMP, signals mixed confidence, suggesting that unpredictable crop conditions and pricing pressures continue to influence investor evaluations of potato-based industries. Such uncertainties restrict large-scale expansion plans and create hesitation among processors dependent on stable potato availability.

Growth Opportunity

Expanding usage in fortified food products

Opportunities remain strong as potato flour gains a place in fortified foods, gluten-free baking, and functional nutrition products. Its natural fiber content, clean flavor, and ability to enhance moisture make it suitable for snacks, instant mixes, and blended flours. Investment activity also supports future growth pathways. 360 ONE Asset announced an investment of USD 70 million in Iscon Balaji Foods, strengthening potato processing capacity and modernizing supply chains. This financial backing encourages product diversification, enabling companies to develop high-quality fortified and specialty flour solutions aligned with changing consumer preferences.

Latest Trends

Rapid shift toward minimally processed flours

A clear trend in the Potato Flour Market is the move toward minimally processed, naturally derived flour options that retain more of the potato’s original characteristics. Growing focus on simple ingredients aligns with global snack and convenience-food expansion. India’s emerging role in regional food supply chains also influences this trend.

According to GTRI, Indian potato exports surged 450% to USD 63.3 million, with nearly 80% of shipments going to Malaysia, the Philippines, Indonesia, Japan, and Thailand. This integration supports broader adoption of potato-derived ingredients, including flour, across fast-growing Asian snack markets.

Regional Analysis

Asia Pacific leads the Potato Flour Market with 39.9%, reaching USD 2.3 Bn.

In the Potato Flour Market, the Asia Pacific region remained the dominant contributor, holding a significant 39.9% share valued at USD 2.3 Bn, supported by strong consumption from bakery, snacks, and traditional food sectors across major economies. This leadership was reinforced by rising demand for gluten-free and clean-label ingredients within India, China, Japan, and Southeast Asia.

North America continued to show steady growth driven by consumer interest in speciality flours and wider adoption of potato-based ingredients in processed foods. Europe maintained consistent usage across bakery and convenience food applications, with established food manufacturers integrating potato flour into diverse product lines.

In Latin America, demand grew gradually as more regional food processors incorporated potato-derived ingredients into snacks and bakery mixes. Meanwhile, the Middle East & Africa observed moderate expansion, supported by increasing interest in versatile flour alternatives suitable for bakery and meal preparation.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ardent Mills continued strengthening its specialty ingredients portfolio, and its presence in potato-based flours helped support consistent adoption among bakeries and snack manufacturers. The company’s focus on delivering reliable, consistently milled flour positioned it as a dependable partner for processors aiming for predictable texture and performance in gluten-free applications.

Meanwhile, August Topfer & Co. (GmbH & Co.) KG maintained its role in supplying diversified food ingredients, including potato derivatives used across packaged foods and culinary formulations. Its established distribution networks across Europe supported stable market participation, especially for processors seeking bulk, uniform-quality flour suitable for commercial use. The company’s emphasis on broad ingredient availability contributed to its ongoing relevance in the regional supply chain.

Authentic Foods played a targeted role by focusing on gluten-free and speciality baking solutions. Its potato-based products remained valuable in premium bakery mixes and artisan formulations where texture, flavor retention, and allergen-free performance are essential. The company’s emphasis on specialty flour innovation supported demand from small bakeries and health-focused consumers. Collectively, these players helped reinforce product accessibility, quality consistency, and application diversity across the global market in 2024.

Top Key Players in the Market

- Ardent Mills

- August Topfer & Co. (GmbH & Co.) KG

- Authentic Foods

- Bob’s Red Mill Natural Foods

- Health Connection Wholefoods

- Idaho Pacific Holdings Inc.

- Keystone Potato Products LLC

- King Arthur Baking Company

- Rakusens Limited

Recent Developments

- In July 2025, Ardent Mills announced an agreement to acquire Stone Mill, a specialty grain cleaning facility based in Richardton, North Dakota. This strategic move expands Ardent Mills’ capabilities, especially in gluten-free and specialty ingredients, strengthening its supply chain and ingredient innovation. The acquisition aims to improve the processing of identity-preserved grains, pulses, and seeds, enhancing product quality and customer service across alternative flour solutions. This development shows Ardent Mills’ focus on diversifying beyond traditional flour milling into broader speciality ingredient markets.

- In October 2024, Keystone Potato Products LLC, a Pennsylvania-based processor of potato products including potato flour, won the 2024 Green Plant of the Year Award. The award, given by Food Processing Magazine, recognized Keystone for its strong commitment to environmental sustainability and innovation in food production operations. This includes its dehydration line that turns off-grade potatoes into flakes and flour, as well as efficient water and energy practices.

Report Scope

Report Features Description Market Value (2024) USD 5.8 Billion Forecast Revenue (2034) USD 7.9 Billion CAGR (2025-2034) 3.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Industrial Grade, Food Grade), By Form (Granules, Powder, Flakes), By Application (Food, Paper, Textile, Feed, Others), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ardent Mills, August Topfer & Co. (GmbH & Co.) KG, Authentic Foods, Bob’s Red Mill Natural Foods, Health Connection Wholefoods, Idaho Pacific Holdings Inc., Keystone Potato Products LLC, King Arthur Baking Company, Rakusens Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ardent Mills

- August Topfer & Co. (GmbH & Co.) KG

- Authentic Foods

- Bob’s Red Mill Natural Foods

- Health Connection Wholefoods

- Idaho Pacific Holdings Inc.

- Keystone Potato Products LLC

- King Arthur Baking Company

- Rakusens Limited