Global Post-Consumer Recycled Plastics Market Size, Share, And Enhanced Productivity By Source (Bottles, Non-bottle Rigid, Others), By Type (Polypropylene (PP), Polystyrene (PS), Polyethylene (PE), Polyvinyl Chloride (PVC), Polyurethane (PUR), Polyethylene Terephthalate (PET), Others), By Recycling Process (Mechanical Recycling, Chemical Recycling, Biological Recycling, Pyrolysis, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 167420

- Number of Pages: 213

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

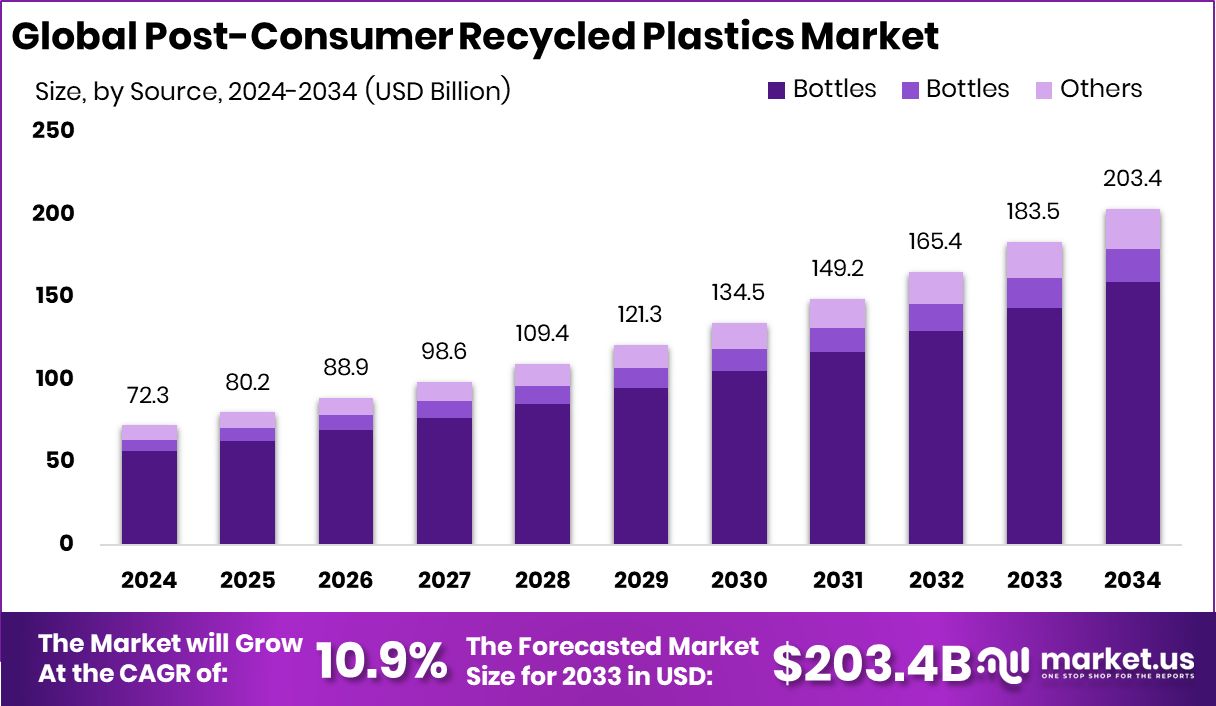

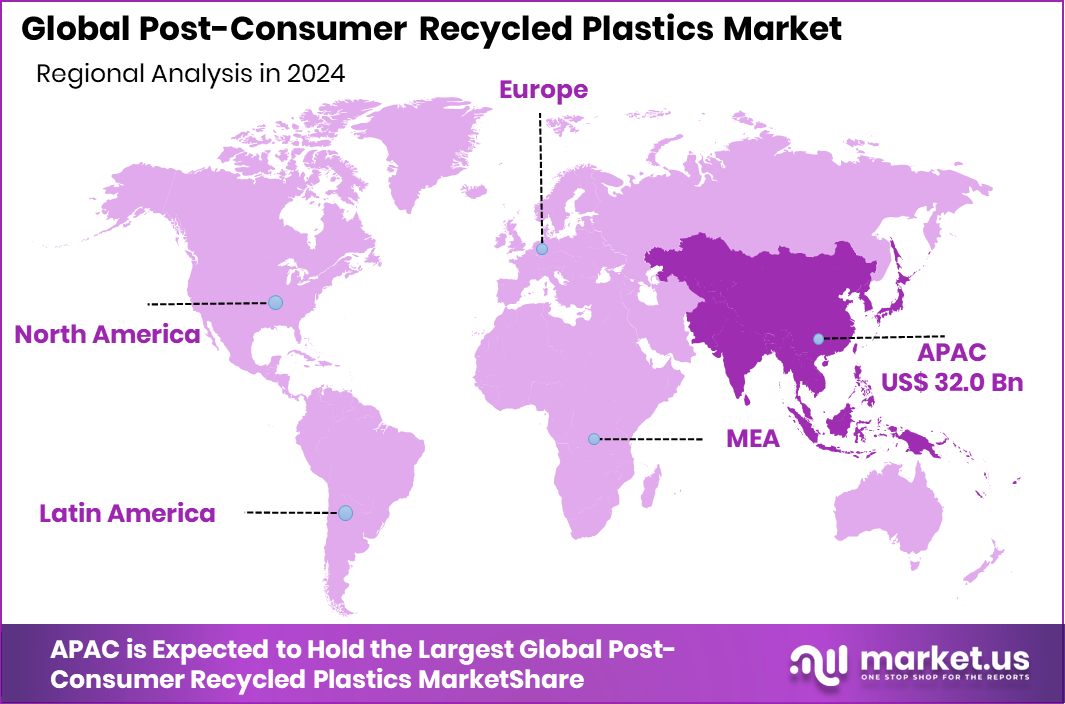

The Global Post-Consumer Recycled Plastics Market is expected to be worth around USD 203.4 billion by 2034, up from USD 72.3 billion in 2024, and is projected to grow at a CAGR of 10.9% from 2025 to 2034. Asia-Pacific leads sustainability commitments, achieving 44.3% market and USD 32.0 Bn recycled growth.

Post-consumer recycled plastics are materials collected after consumer use, such as bottles, containers, packaging films, and everyday plastic products that have completed their life cycle. These plastics are collected, sorted, cleaned, and reprocessed into usable raw materials, helping reduce landfill waste and lowering the need for virgin fossil-fuel-based plastics. They support a circular economy where products are reused instead of being discarded, improving environmental sustainability.

The post-consumer recycled plastics market focuses on processing used plastics into new applications such as packaging, consumer goods, textiles, automotive parts, and construction materials. Demand is rising as governments enforce sustainability mandates and industries transition toward low-carbon and recycled content products. The market is also being shaped by new technologies in sorting, chemical recycling, and recovery infrastructure.

Growth is strongly supported by investments and funding. For example, Polystyvert secured $16M for advanced polystyrene recycling technology, and a Houston-based company raised $12M Series A to scale a decarbonization plant. Additionally, Nayara Energy tied up Rs 4,000 crore for a petrochemical project aimed at expanding circular materials capacity.

Demand is fueled by rising consumer awareness, plastic taxes, and global commitments toward zero-waste packaging. Recycling infrastructure is improving, with over $1 million in grant funding awarded since the Foam Recycling Coalition’s 2015 inception, accelerating collection and processing systems.

Opportunity continues to grow as industries seek scalable recycled content solutions, especially in packaging and manufacturing, where replacing virgin plastics helps meet environmental and regulatory goals.

Key Takeaways

- The Global Post-Consumer Recycled Plastics Market is expected to be worth around USD 203.4 billion by 2034, up from USD 72.3 billion in 2024, and is projected to grow at a CAGR of 10.9% from 2025 to 2034.

- In the Post-Consumer Recycled Plastics Market, bottles dominate with 78.2%, driven by packaging recovery systems and growing circular economy commitments.

- Polyethylene (25.4%) leads by type in the Post-Consumer Recycled Plastics Market due to its versatility and wide application use.

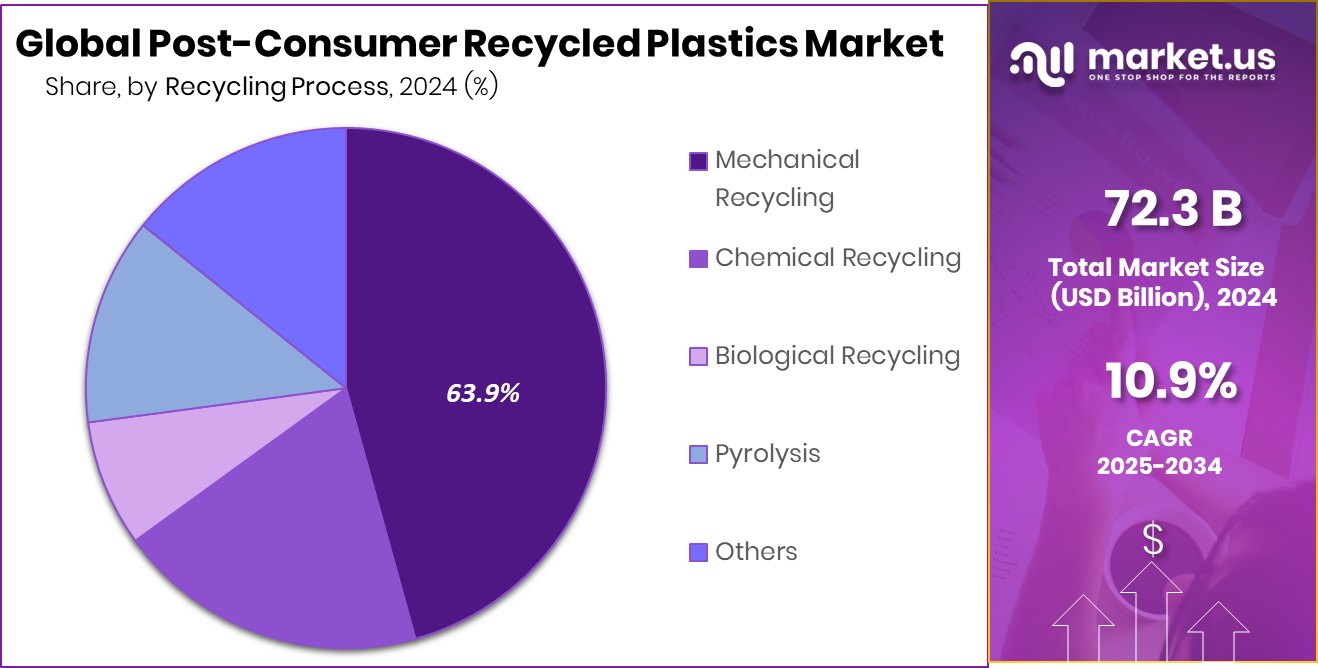

- Mechanical recycling holds a 63.9% share in the Post-Consumer Recycled Plastics Market, supported by low processing cost and scalability.

- Asia-Pacific drives the Post-Consumer Recycled Plastics Market with 44.3% and USD 32.0 Bn dominance.

By Source Analysis

The Post-Consumer Recycled Plastics Market is largely driven by bottles at 78.2%.

In 2024, Bottles held a dominant market position in the By Source segment of the Post-Consumer Recycled Plastics Market, with a 78.2% share. This strong position reflects the high availability of PET and HDPE bottles collected through organized municipal and commercial recycling systems.

Bottles remain the most accessible and efficiently sorted post-consumer plastic stream, which makes them the preferred feedstock for recycling operations. Their consistent supply supports steady production of recycled granules used across packaging, textiles, and consumer goods.

Growing recycling infrastructure and public participation programs continue to strengthen bottle recovery. With increasing demand for circular packaging and recycled content mandates, bottles are expected to maintain their lead as the primary contributor to post-consumer recycled plastic output.

By Type Analysis

The Post-Consumer Recycled Plastics Market sees 25.4% demand led by polyethylene.

In 2024, Polyethylene (PE) held a dominant market position in the By Type segment of the Post-Consumer Recycled Plastics Market, with a 25.4% share. This leadership is mainly due to its widespread use in packaging formats such as bags, bottles, and films, which generate a steady and consistent waste stream for recycling.

PE’s flexibility, durability, and ability to be reprocessed without significant performance loss make it suitable for high-volume recycled applications. The growing push toward circular packaging standards further supports its adoption, especially in consumer goods and logistics sectors.

With increasing recycling infrastructure and mandates for recycled content, PE continues to be the most preferred and scalable material in the post-consumer recycled plastics landscape.

By Recycling Process Analysis

The Post-Consumer Recycled Plastics Market is dominated by mechanical recycling at 63.9%.

In 2024, Mechanical Recycling held a dominant market position in the By Recycling Process segment of the Post-Consumer Recycled Plastics Market, with a 63.9% share. This strong position is driven by its cost-effectiveness, established infrastructure, and ability to process large volumes of plastic waste efficiently.

Mechanical recycling remains widely adopted for converting collected plastics into pellets used in packaging, construction materials, and consumer products. Its lower operational complexity compared to newer technologies supports faster scalability across municipal and industrial recycling systems.

With increasing emphasis on resource efficiency, waste reduction, and recycled content usage requirements, mechanical recycling continues to play a central role in supporting circular economy goals and expanding post-consumer recycled plastic availability.

Key Market Segments

By Source

- Bottles

- Non-bottle Rigid

- Others

By Type

- Polypropylene (PP)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyurethane (PUR)

- Polyethylene Terephthalate (PET)

- Others

By Recycling Process

- Mechanical Recycling

- Chemical Recycling

- Biological Recycling

- Pyrolysis

- Others

Driving Factors

Rising Demand for Circular and Sustainable Plastics

Growing awareness about plastic pollution and landfill waste is pushing governments, brands, and consumers toward circular solutions, increasing demand for post-consumer recycled plastics. Many industries are shifting from virgin plastics to recycled materials to meet sustainability goals and regulatory requirements. Investments and technology advancements are accelerating this shift, especially in recycling and waste processing systems.

A recent example includes a breakthrough funding milestone where a project that began as a high school experiment reached $18.3M to develop AI-accelerated enzymes designed to break down fast fashion plastic waste faster and more efficiently. This kind of innovation shows the growing global commitment toward closing the loop and reducing the dependence on fossil-based plastics.

Restraining Factors

Limited Quality and Consistency in Recycled Plastics

One major challenge holding back the Post-Consumer Recycled Plastics Market is the inconsistency in material quality. Recycled plastics often vary in color, purity, and performance because they come from mixed waste streams with different grades and additives. This makes it difficult for manufacturers to maintain product standards, especially in sectors like food packaging, healthcare, and high-performance applications.

The sorting and cleaning process also requires advanced equipment, and when contamination levels are high, recycling becomes less efficient and more expensive. As a result, some industries still rely on virgin plastics for reliability, slowing the full transition toward recycled content use. Consistency improvements and better waste collection systems are needed to overcome this restraint.

Growth Opportunity

Expanding Advanced Recycling and Innovation Opportunities

A major opportunity in the Post-Consumer Recycled Plastics Market comes from advancing recycling technologies and stronger research investments to turn difficult-to-recycle plastics into usable materials. As industries look for ways to reduce landfill waste and increase recycled content in packaging, textiles, and consumer products, innovations like chemical recycling, enzymatic breakdown, and AI-based material sorting are gaining attention.

Support for research and infrastructure continues to grow, including a recent initiative where a university will share in £100 million in funding to lead a major science and technology hub focused on reducing plastic waste and improving recycling efficiency. These developments open doors for scalable, high-quality recycled materials and help industries meet sustainability and regulatory targets.

Latest Trends

Growing Focus on Advanced Biological Recycling Methods

A key trend in the Post-Consumer Recycled Plastics Market is the shift toward biological and next-generation recycling methods that can handle complex and mixed plastic waste streams more efficiently. Traditional systems struggle with contamination, dyes, and multi-layer films, but biological processes such as enzyme-based recycling and engineered microorganisms offer cleaner outputs and higher recovery potential.

This trend is supported by rising investments in scientific innovation, including a major initiative where UKRI pumped £100 million to transform engineering biology projects aimed at improving the breakdown and reuse of plastic waste. As these technologies mature, they are expected to make recycling faster, less energy-intensive, and capable of producing higher-quality recycled material for packaging and manufacturing industries.

Regional Analysis

Asia-Pacific holds a 44.3% share worth USD 32.0 Bn, reflecting strong demand, regional leadership.

In 2024, Asia-Pacific dominated the Post-Consumer Recycled Plastics Market with a 44.3% share valued at USD 32.0 Bn, driven by strong recycling policies, large-scale manufacturing demand, and expanding adoption of circular materials across packaging and consumer goods. The region continues to benefit from improving waste collection systems and growing public awareness of plastic reuse.

North America shows steady progress as recycling programs expand across municipalities and more industries commit to integrating post-consumer recycled content in products. Europe remains an active region with strict sustainability regulations and widespread adoption of recycled plastics in packaging and industrial materials.

Latin America is gradually shifting toward organized recycling systems, supported by community programs and growing policy direction. Meanwhile, the Middle East & Africa is witnessing early-stage adoption, with recycling initiatives emerging alongside industrial diversification efforts.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, BASF SE continued to strengthen its role in the Post-Consumer Recycled Plastics Market by focusing on improving material performance and supporting circular applications. The company’s approach includes developing recycled-content solutions designed for packaging, automotive, and consumer goods where consistent quality is important. BASF SE remains active in advancing recycled grades that align with sustainability targets and regulatory expectations.

SABIC maintains a strategic position in the market by supporting large-scale recycling initiatives and focusing on post-consumer feedstock integration into new plastic applications. The company’s work reflects growing industry expectations for traceability, material certification, and recycled content expansion across supply chains. Their initiatives align with rising demand for circular economy-based plastic production.

Evonik Industries AG plays a meaningful role by enabling technologies and materials that support recycling efficiency and higher-quality output from post-consumer waste. The company focuses on solutions that help improve processing performance, purity, and consistency in recycled plastics. Evonik’s contribution supports an ecosystem where recycled plastics can replace virgin materials in more applications.

Top Key Players in the Market

- BASF SE

- SABIC

- Evonik Industries AG

- Sumitomo Chemical Co., Ltd.

- Arkema

- LyondellBasell Industries N.V.

- Celanese Corporation

- Eastman Chemical Company

- Chevron Phillips Chemical Company

- SUEZ SA

- Exxon Mobil Corporation

Recent Developments

- In February 2024, BASF launched its ChemCycling® program in the United States at its Port Arthur, Texas facility, using feedstock from plastic waste to produce Ccycled® building blocks for engineering plastics and polyurethanes. The new production enables recycled raw materials to replace fossil-based feedstock and supports high-performance applications.

- In June 2024, SABIC signed a cooperation agreement with Attero of the Netherlands to supply post-consumer recycled feedstock. Through this deal, sorted used plastics will be converted into pyrolysis oil, which SABIC will use to produce its TRUCIRCLE™ certified circular polymers.

Report Scope

Report Features Description Market Value (2024) USD 72.3 Billion Forecast Revenue (2034) USD 203.4 Billion CAGR (2025-2034) 10.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Bottles, Non-bottle Rigid, Others), By Type (Polypropylene (PP), Polystyrene (PS), Polyethylene (PE), Polyvinyl Chloride (PVC), Polyurethane (PUR), Polyethylene Terephthalate (PET), Others), By Recycling Process (Mechanical Recycling, Chemical Recycling, Biological Recycling, Pyrolysis, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, SABIC, Evonik Industries AG, Sumitomo Chemical Co., Ltd., Arkema, LyondellBasell Industries N.V., Celanese Corporation, Eastman Chemical Company, Chevron Phillips Chemical Company, SUEZ SA, Exxon Mobil Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Post-Consumer Recycled Plastics MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Post-Consumer Recycled Plastics MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- SABIC

- Evonik Industries AG

- Sumitomo Chemical Co., Ltd.

- Arkema

- LyondellBasell Industries N.V.

- Celanese Corporation

- Eastman Chemical Company

- Chevron Phillips Chemical Company

- SUEZ SA

- Exxon Mobil Corporation