Global Portable Water Purifiers Market Size, Share Analysis Report By Technology (Gravity Purifier, UV Purifier, RO Purifier), By End-User (Residential, Commercial, Industrial), By Distribution Channels (Retail Stores, Direct Sales, Online, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161028

- Number of Pages: 381

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

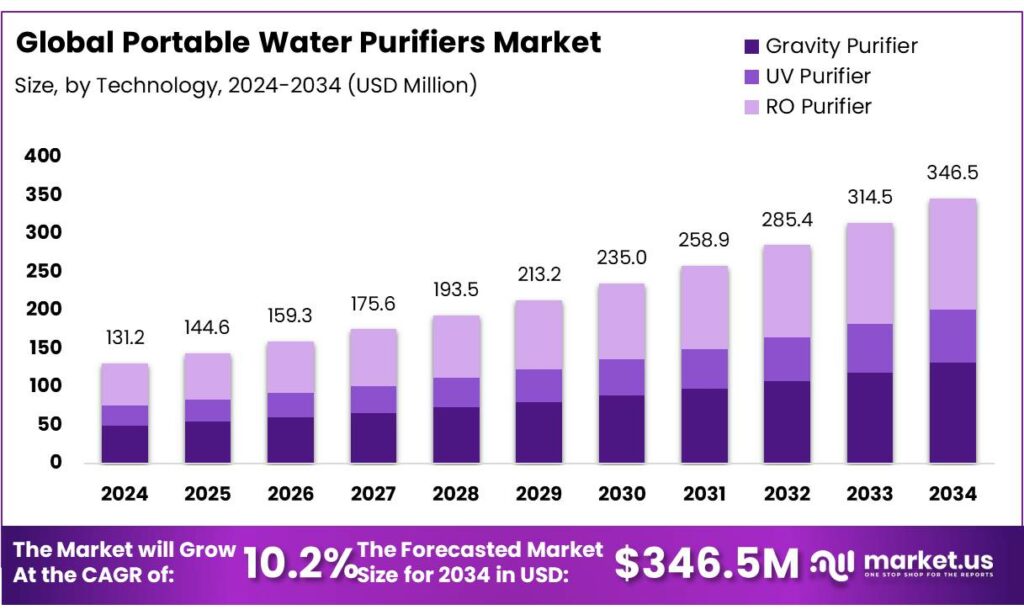

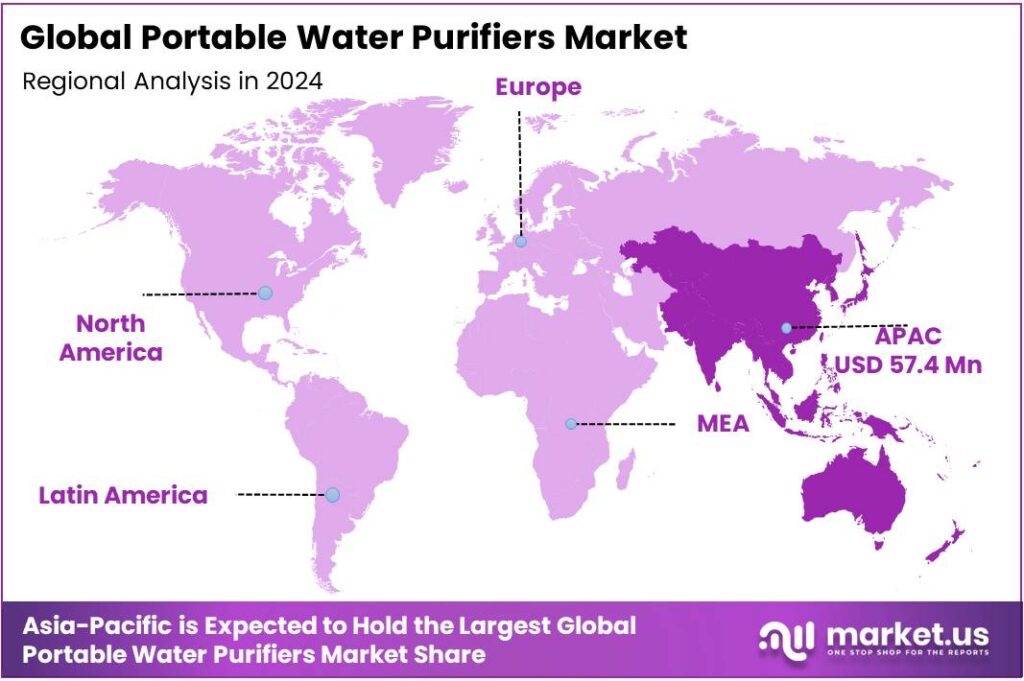

The Global Portable Water Purifiers Market size is expected to be worth around USD 346.5 Million by 2034, from USD 131.2 Million in 2024, growing at a CAGR of 10.2% during the forecast period from 2025 to 2034. Strong industrial growth and rising Chemical production supported Asia-Pacific’s 43.8% leading regional market position.

Portable water purifiers are compact, transportable devices designed to treat raw or unsafe water sources to a potable standard. They commonly employ technologies such as membranes, ultraviolet (UV) disinfection, activated carbon adsorption, or combinations thereof. Their mobility and flexibility make them especially useful in outdoors, emergency relief, military, travel, and remote/underserved areas where municipal treatment may be unreliable or absent.

Several key drivers underpin the momentum in this industry. First, rising awareness of waterborne diseases, microbial contamination, and chemical pollutants spurs consumer demand for safe drinking water solutions. In India alone, the economic burden of waterborne diseases is estimated at around USD 600 million per year. Unsafe drinking water remains a major public health burden.

The WHO estimates that ~505,000 diarrhoeal deaths occur each year due to contaminated drinking water. Moreover, WHO suggests that 1.4 million deaths annually could be averted through improvements in safe water, sanitation, and hygiene (WASH) services. This drives demand for portable treatment solutions, especially in rural, disaster, or transit settings.

Governmental and programmatic support: Large public programs have affected the market footprint by reducing some demand while creating new last-mile opportunities for complementary technologies. For example, India’s Jal Jeevan Mission reported that by October 6, 2024 more than 15.19 crore (151.9 million) rural households had been provided household tap connections (coverage ~78.6%), a development that is reshaping the product mix sought by rural consumers—shifting need toward point-of-use/portable solutions for intermittent or contaminated supplies.

Government and institutional support also play a pivotal role. For instance, in the U.S., the Infrastructure Investment and Jobs Act channels over USD 50 billion toward improving drinking water, wastewater, and stormwater infrastructure, which can indirectly stimulate demand for supplementary purification technologies. In many developing countries, national drinking water and sanitation programs or rural water supply initiatives promote safe water access and sometimes distribute portable purification kits in underserved areas.

For example, some pilot projects that pair solar-powered filtration with local wells (e.g. a ₹50-crore well rejuvenation and tertiary filtration project in Thane, India) reflect the kind of hybrid government-driven water purification deployment.

Key Takeaways

- Portable Water Purifiers Market size is expected to be worth around USD 346.5 Million by 2034, from USD 131.2 Million in 2024, growing at a CAGR of 10.2%.

- RO Purifier held a dominant market position, capturing more than a 48.5% share of the portable water purifier market.

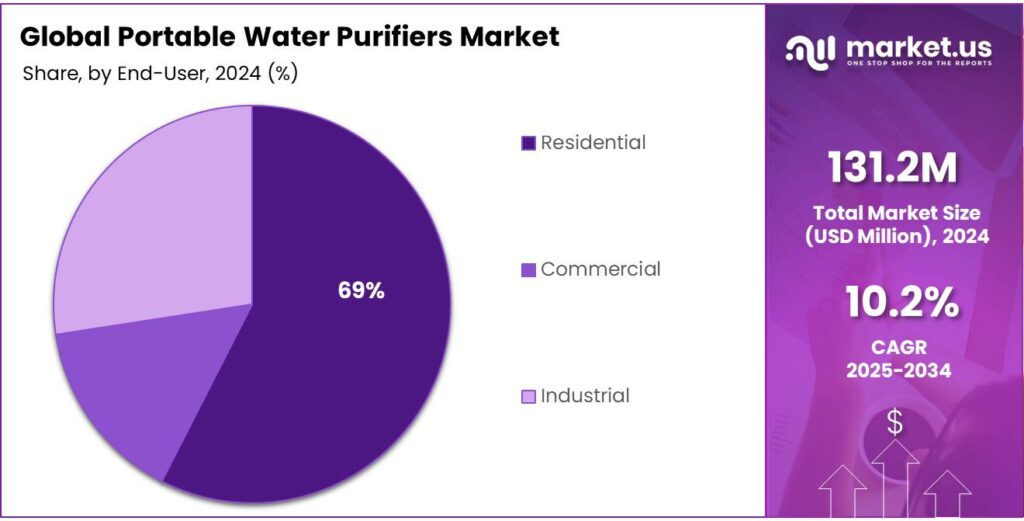

- Residential held a dominant market position, capturing more than a 69.2% share of the portable water purifier market.

- Retail Stores held a dominant market position, capturing more than a 49.6% share of the portable water purifier market.

- Asia-Pacific region held a dominant position in the portable water purifier market, capturing more than 43.8% of the global share, equating to an estimated market value of USD 57.4 million.

By Technology Analysis

RO Purifier dominates with 48.5% share in 2024 due to high efficiency in contaminant removal

In 2024, RO Purifier held a dominant market position, capturing more than a 48.5% share of the portable water purifier market. This strong performance can be attributed to its high efficiency in removing dissolved salts, heavy metals, and other harmful contaminants, making it the preferred choice for households and offices seeking safe drinking water. RO technology has gained popularity in regions where water hardness and chemical impurities are prevalent, ensuring reliable purification.

Consumers increasingly favor RO purifiers for their ability to provide consistent water quality, especially in areas with uncertain water sources. The segment’s growth is also supported by rising health awareness and the demand for easy-to-use, compact purification devices suitable for domestic and semi-commercial use. With continued emphasis on clean drinking water and technological improvements in RO systems, this segment is expected to maintain a leading position in the market beyond 2024.

By End-User Analysis

Residential dominates with 69.2% share in 2024 driven by increasing household demand for safe drinking water

In 2024, Residential held a dominant market position, capturing more than a 69.2% share of the portable water purifier market. The segment’s leadership is primarily driven by growing health awareness among households and the rising need for safe and clean drinking water. Increasing concerns over waterborne diseases and contamination in municipal and local water supplies have encouraged families to adopt reliable purification solutions. Portable water purifiers for residential use are preferred due to their compact size, ease of installation, and ability to deliver consistent water quality.

Additionally, the segment benefits from the trend of urbanization, where households seek convenient water treatment options that require minimal maintenance. With continuous improvements in purification technology and growing focus on health and hygiene, the residential segment is expected to sustain its dominant position in the market beyond 2024.

By Distribution Channel Analysis

Retail Stores dominate with 49.6% share in 2024 due to convenience and wide product availability

In 2024, Retail Stores held a dominant market position, capturing more than a 49.6% share of the portable water purifier market. This strong performance is driven by the convenience and accessibility that retail outlets offer to consumers, allowing them to directly compare products, check specifications, and make informed purchase decisions. Retail channels remain preferred for first-time buyers and those seeking immediate product availability without waiting for delivery.

The presence of branded stores, supermarkets, and electronics outlets further strengthens this segment by providing reliable after-sales support and installation services. Additionally, promotional activities and discounts offered at retail points encourage higher adoption among urban households. With continued consumer preference for in-person shopping experiences and easy access to water purification solutions, retail stores are expected to maintain a leading share in the market beyond 2024.

Key Market Segments

By Technology

- Gravity Purifier

- UV Purifier

- RO Purifier

By End-User

- Residential

- Commercial

- Industrial

By Distribution Channels

- Retail Stores

- Direct Sales

- Online

- Others

Emerging Trends

Rise of Chemical-Contaminant Filtering & Multi-Barrier Purification

One of the most interesting recent trends in portable water purifiers is the growing focus on removing chemical contaminants — not just microbes — and using multi-barrier approaches (combining filtration, adsorption, catalytic removal, etc.). As awareness of chemical pollutants like heavy metals, industrial residues, PFAS (per- and polyfluoroalkyl substances), pesticides, and endocrine disruptors rises, users and regulators are demanding devices that clean more than just bacteria or viruses. This shift is giving portable purifier makers a chance to differentiate and gain trust in challenging environments.

According to the WHO drinking‐water fact sheet, in 2022, at least 1.7 billion people used a drinking water source contaminated with faecal matter, but the microbial risk is just one piece of the puzzle. As water infrastructure improves in many places, microbial loads may fall, but chemical contamination (e.g. from agricultural runoff, industrial effluent, mining) tends to persist or even worsen. In many agricultural or food-production regions, water used for irrigation or cleaning can carry residual agrochemicals or heavy metals, which pose risks to food safety and health.

This is especially relevant in the food and agriculture sector. In May 2025, FAO and WHO convened experts to discuss chemical water quality in agri-food systems, recognizing that water used across production, processing, and cleaning must meet stricter standards to protect food safety. That initiative signals that regulators and food businesses are pushing for more stringent control over chemical contaminants in water, pushing demand for purification solutions capable of addressing both microbial and chemical hazards.

Drivers

Health Risk from Waterborne Diseases & Public Safety Concerns

One of the strongest forces pushing adoption of portable water purifiers is the pervasive threat of waterborne diseases, which impose heavy human and economic burdens—especially in areas with weak water infrastructure. When people don’t have reliable access to safe drinking water, even a short lapse or contamination in supply can lead to serious outbreaks. Portable purifiers act as a frontline defense at the individual level.

Globally, unsafe water, sanitation, and hygiene (often called “WASH”) were responsible for about 1,656,887 deaths in 2019 (95% uncertainty interval: 1,198,865 to 2,312,688) according to peer-reviewed estimates. In that same year, the burden translated into approximately 1244 disability-adjusted life years (DALYs) per 100,000 people attributable to unsafe WASH. Of all diarrhea deaths globally, about 505,000 per year are estimated to result from contaminated drinking water.

In the United States, despite widespread water treatment infrastructure, waterborne disease remains a serious concern. The U.S. Centers for Disease Control and Prevention (CDC) estimates that each year more than 7.15 million people suffer domestically acquired waterborne illnesses, leading to 120,000 hospitalizations and 6,630 deaths, with a cost burden in direct health care of some USD 3.33 billion.

This risk factor is especially acute in developing countries or rural zones with weak piped systems, intermittent supply, or frequent contamination events. During floods, infrastructure damage, or seasonal monsoons, water sources often mix with sewage or surface runoff. Throughout India, for instance, municipal data often show spiking diarrheal disease cases after monsoon rains—a phenomenon observed also in regions like Maharashtra, where waterborne disease outbreaks during 2025 monsoon more than tripled compared to earlier quarters (from 8 to 27 outbreaks, affecting over 1,300 people) in some localities.

Restraints

High Upfront Cost And Affordability Barrier

One of the biggest obstacles holding back wider adoption of portable water purifiers is the high upfront cost relative to what many households or users are able or willing to pay. While a portable purifier offers convenience and safety, many consumers or low-income communities find the initial investment too steep compared to their budget constraints, especially when the perceived benefit is uncertain or incremental. This affordability barrier slows down market penetration in regions that most need these solutions.

To understand this in context, consider how water affordability is already a struggle even for basic piped services. In the United States, for example, a study found that 17 % of households struggle to afford basic water and wastewater services, spending more than what is considered sustainable on utility bills. In that same study, researchers noted that households spending over 4.6 % of income on water services were considered under undue financial burden, and this threshold reveals how precarious water affordability can be.

Furthermore, governments often emphasize providing piped, centrally treated water to all households, reducing demand for alternatives. For example, in India the Jal Jeevan Mission (“Har Ghar Jal”) aims to supply 55 liters per capita per day of tap water to every rural home by 2024 through proper infrastructure and network expansion. In such a policy environment, many households may prefer waiting for free or subsidized piped water rather than paying for a portable purifier.

Moreover, from a public health and food safety perspective, many institutions (food processing, agriculture) rely on bulk water treatment rather than individual units, making the portable purifier less relevant for industrial or institutional buyers. Leading bodies like WHO emphasize ensuring safe drinking-water at source or through central systems, not necessarily point-of-use devices as the first line. For instance, WHO states that about 1 million people die annually due to diarrhoea caused by unsafe water, sanitation and hygiene—pointing to the need for system-level interventions.

Opportunity

Expanding Reach in Regions without Safely Managed Water Access

One of the biggest growth opportunities for portable water purifiers lies in regions where people still lack safely managed drinking water. According to the latest WHO/UNICEF Joint Monitoring Programme, about 2.1 billion people globally still do not have access to safely managed drinking water services in 2025 — nearly 1 in 4 people around the world. This gap is especially large in rural zones, fragile states, and underserved communities where centralized water systems are incomplete or unreliable.

Because portable purifiers give individuals a fallback option—especially in places with intermittent supply, microbial contamination, or chemical pollution—they become highly relevant in such geographies. Many families that get only “basic” or “limited” water service may still face safety risks. The JMP report shows that while global coverage of safely managed water has risen from 68 % in 2015 to 74 % by 2024, that still leaves billions behind. In communities with aging pipes, seasonal contamination, or drought-strained systems, portable purifiers can be a practical stopgap or complementary solution.

On the food and agriculture side, access to safe water is vital not only for drinking but also for food production and food safety. In food processing, water contamination can spoil food or spread pathogens. A review article “Safety of Water Used in Food Production” emphasizes how food systems depend on water that meets microbiological standards. When local water supply is uncertain or tainted, portable purification modules or point-of-use systems can serve as a buffer to safeguard food quality in small food enterprises, local dairy farms, street food vendors, and remote processing units.

Another compelling case is water scarcity itself. UNICEF notes that 4 billion people, nearly two-thirds of the world’s population, experience severe water scarcity for at least one month each year. In water-stressed settings, local water sources may be reused, stored, or contaminated—making purification necessary. Portable purifiers that can handle varied source qualities (river, pond, borewell, rainwater) will be especially important.

Regional Insights

Asia-Pacific leads with 43.8% share in 2024, valued at USD 57.4 million, driven by urbanization and health awareness

In 2024, the Asia-Pacific region held a dominant position in the portable water purifier market, capturing more than 43.8% of the global share, equating to an estimated market value of USD 57.4 million. This leadership is attributed to rapid urbanization, escalating concerns over waterborne diseases, and increasing consumer awareness regarding the health risks associated with impure water. Countries such as China, India, Japan, and Southeast Asian nations are experiencing significant demand for portable water purification solutions due to challenges like water scarcity, contamination, and the need for convenient access to safe drinking water.

The market’s growth is further supported by government initiatives aimed at improving water quality and access. For instance, India’s “Jal Jeevan Mission” seeks to provide safe drinking water to all households by 2024, fostering the adoption of water purification technologies. Additionally, the Asia-Pacific region is witnessing technological advancements in water purification systems, enhancing their efficiency and affordability, thereby driving consumer adoption.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Whirlpool Corporation, a global leader in home appliances, offers a variety of water filtration systems, including under-sink filters, whole-house systems, and refrigerator filters. The company’s products are designed to provide clean and safe drinking water, reducing contaminants like chlorine taste and odor. Whirlpool’s filtration solutions aim to protect plumbing and appliances from hard water damage, contributing to the overall efficiency and longevity of home systems. With a commitment to quality and innovation, Whirlpool continues to serve households worldwide with reliable water purification solutions.

Brita GmbH, founded in 1966 in Germany, is a leading manufacturer of water filtration products. The company’s offerings include pitchers, faucet filters, and water bottles equipped with advanced filtration technology. Brita’s products are designed to reduce contaminants such as chlorine, lead, and copper, improving the taste and quality of drinking water. With a presence in over 69 countries, Brita is committed to providing sustainable and effective water purification solutions for households and businesses alike.

General Ecology Inc., established over 45 years ago, designs and manufactures advanced water purification systems for residential, commercial, and industrial applications. The company’s products utilize chemical-free, environmentally friendly technologies to remove contaminants such as viruses, bacteria, and protozoa. General Ecology’s purification systems are known for their durability and effectiveness, making them suitable for various environments, including remote and off-grid locations. With a commitment to quality and innovation, General Ecology continues to provide reliable water purification solutions worldwide.

Top Key Players Outlook

- Kent RO limited

- GE Corporation

- Whirlpool

- Brita

- SteriPEN

- General Ecology Inc.

- SAFH20 UV

- GRAYL, Inc

- Aquasana, Inc..

- Panasonic

Recent Industry Developments

In 2024 GE Appliances,announced plans to invest over $3 billion in its U.S. operations over the next five years, aiming to enhance domestic manufacturing capabilities and product offerings, including water heaters and air conditioning units.

Kent RO Systems Limited, a prominent player in India’s water purification sector, reported a revenue of ₹1,260.66 crore for the financial year ending March 31, 2024, marking an 8.7% increase from ₹1,160.66 crore in FY 2022-23

Report Scope

Report Features Description Market Value (2024) USD 131.2 Mn Forecast Revenue (2034) USD 346.5 Mn CAGR (2025-2034) 10.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Gravity Purifier, UV Purifier, RO Purifier), By End-User (Residential, Commercial, Industrial), By Distribution Channels (Retail Stores, Direct Sales, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Kent RO limited, GE Corporation, Whirlpool, Brita, SteriPEN, General Ecology Inc., SAFH20 UV, GRAYL, Inc, Aquasana, Inc.., Panasonic Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Portable Water Purifiers MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Portable Water Purifiers MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Kent RO limited

- GE Corporation

- Whirlpool

- Brita

- SteriPEN

- General Ecology Inc.

- SAFH20 UV

- GRAYL, Inc

- Aquasana, Inc..

- Panasonic