Global Polyvinyl Alcohol Films Market By Grade (Fully Hydrolyzed, Partially Hydrolyzed, Others), By Type (Water-Soluble PVA Films, Polarizer PVA Films), By Thickness (Up to 30 μm, 30–60 μm, and Above 60 μm), By Application (Detergent Packaging, Agrochemical Packaging, Laundry Bags, Embroidery, Polarizing Panels, Medical and Pharmaceutical, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034.

- Published date: Oct 2025

- Report ID: 160864

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overviews

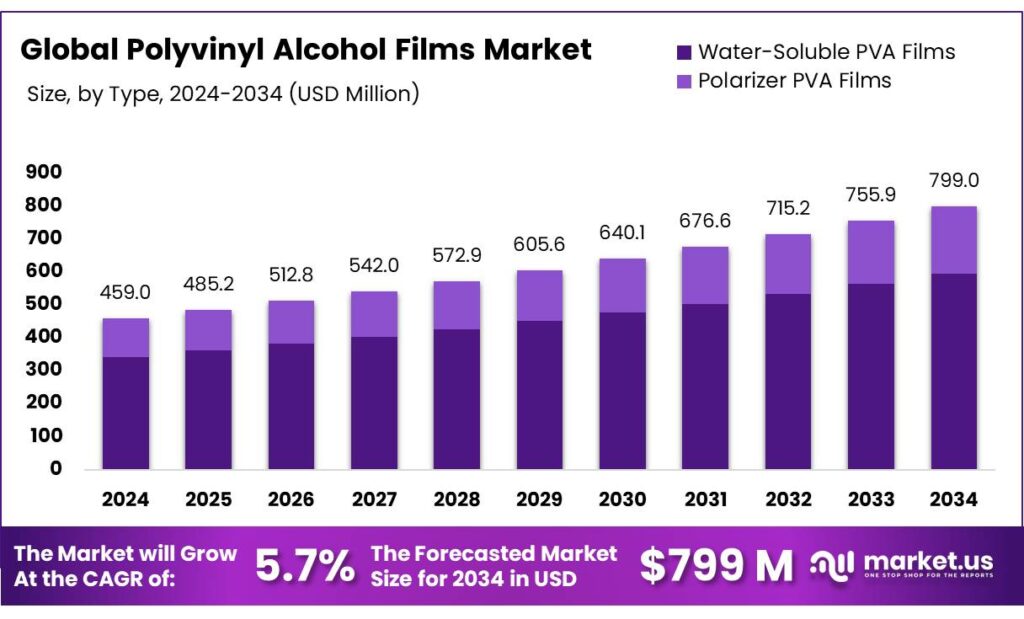

The Global Polyvinyl Alcohol Films Market size is expected to be worth around USD 799 Million by 2034, from USD 459 Million in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034.

Polyvinyl Alcohol (PVA) films are water-soluble, biodegradable plastic films made from a synthetic polymer called polyvinyl alcohol. These thin, flexible films are known for their excellent mechanical strength, high transparency, and impressive barrier properties against oxygen and oils.

One of the major drivers of the films is the demand for sustainable and water-soluble packaging. Common applications include packaging for laundry and dishwasher detergents, pharmaceuticals, and as mold release agents in composite manufacturing, with emerging uses in biomedicine, agriculture, and electronics. There has been an ongoing trend in the market to innovate the PVA films for various applications.

Additionally, as the laws regarding plastics grow stringent, it creates opportunities for manufacturers to innovate the product and its applications. Despite the advantages of the PVA, the market faces several challenges, such as the high upfront cost of producing the PVA films.

- The global production of polyvinyl alcohol is mainly concentrated in a few countries and regions, such as China, Japan, and the United States, with a total plant capacity of about 2 million tons. In addition, China became the largest exporter of PVA in 2024, with 2.12 thousand tons of exports.

Key Takeaways

- The global polyvinyl alcohol films market was valued at USD 459 million in 2024.

- The global polyvinyl alcohol films market is projected to grow at a CAGR of 5.7% and is estimated to reach USD 799 million by 2034.

- Based on the grades of polyvinyl alcohol films, fully hydrolyzed PVA films dominated the market in 2024, comprising about 46.3% share of the total global market.

- On the basis of the types of polyvinyl alcohol films, water-soluble PVA films were at the forefront of the market in 2024, accounting for 74.5% share of the total global market.

- Based on the thickness of polyvinyl alcohol films, sodium polyacrylate dominated the market in 2024, comprising about 61.2% share of the total global market.

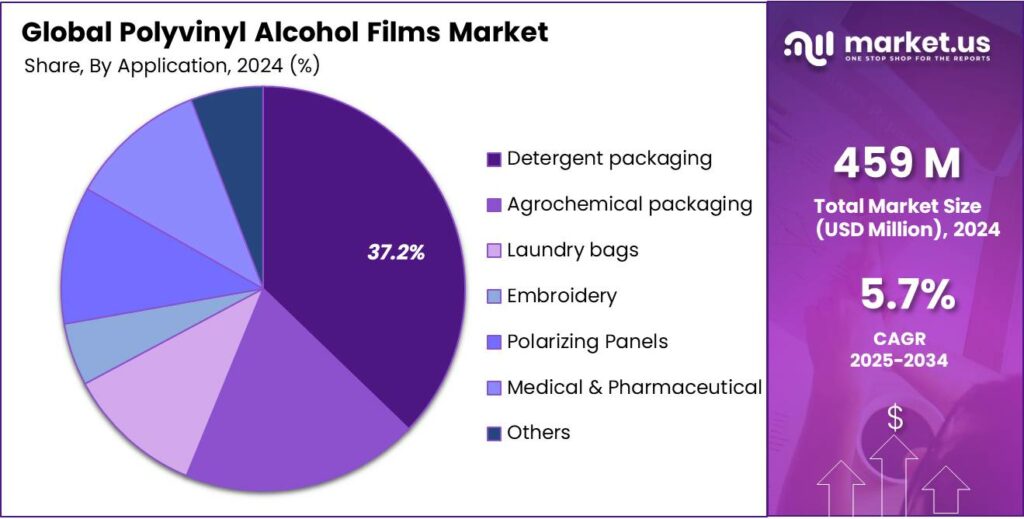

- Among the applications of polyvinyl alcohol films, detergent packaging dominated the market in 2024, accounting for around 37.2% of the market share.

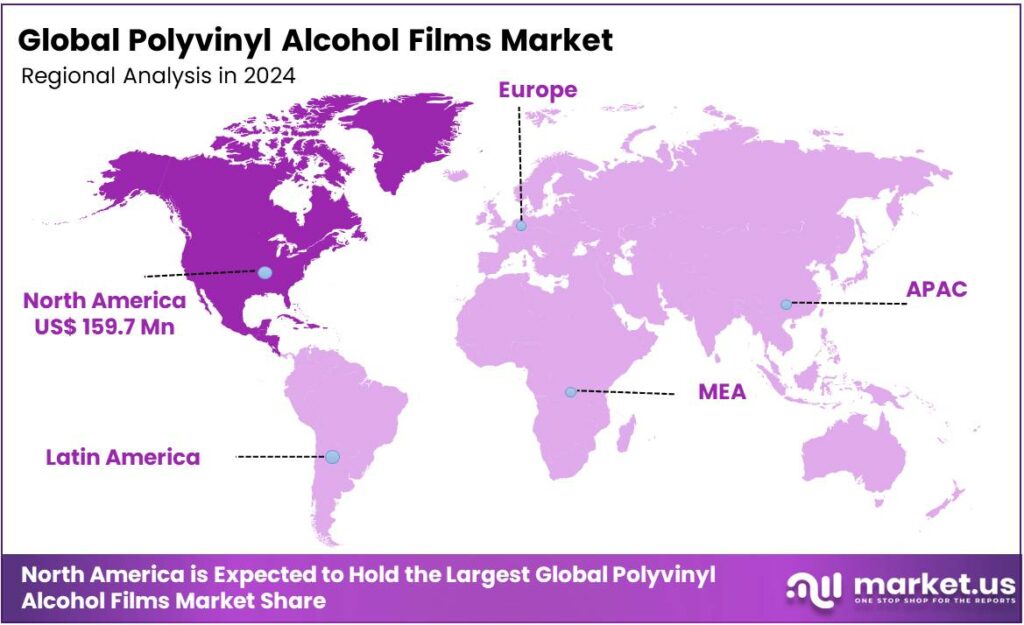

- North America was the largest market for polyvinyl alcohol films in 2024, accounting for around 34.8% of the total global consumption.

Grade Analysis

Fully Hydrolyzed Polyvinyl Alcohol Films were the Leading Segment in the Market.

On the basis of the grades of polyvinyl alcohol films, the market is segmented into fully hydrolyzed, partially hydrolyzed, and others. Fully hydrolyzed polyvinyl alcohol films dominated the market in 2024 with a market share of 46.3%. Fully hydrolyzed polyvinyl alcohol films are more widely utilized than partially hydrolyzed variants due to their superior water resistance, mechanical strength, and film-forming properties.

These films also exhibit excellent tensile strength and gas barrier properties, which enhance durability and product protection. Additionally, fully hydrolyzed PVA is preferred in pharmaceutical and agricultural applications where precise dissolution behavior and chemical resistance are essential for safety and performance.

Type Analysis

Water-Soluble Polyvinyl Alcohol Films Dominated the Market.

Based on the types of polyvinyl alcohol films, the market is segmented into water-soluble PVA films and polarizer PVA films. Water-soluble polyvinyl alcohol films dominated the market in 2024 with a market share of 74.5%. Water-soluble PVA films are more widely utilized than polarizer PVA films due to their broader range of practical applications and higher consumption volume in everyday industries. These films are primarily used in packaging for detergents, agrochemicals, and medical disposables, where their ability to dissolve in water provides convenience, safety, and environmental benefits.

For instance, single-use detergent pods wrapped in PVA eliminate direct contact with chemicals and reduce plastic waste. In contrast, polarizer PVA films are highly specialized and mainly used in electronics, such as LCD screens, where they serve as optical filters. While critical to display technology, polarizer films are limited to niche markets, whereas water-soluble films meet mass-market sustainability and functionality needs.

Thickness Analysis

Polyvinyl Alcohol Films of Thickness 30–60 μm Held the Largest Share of the Market.

On the basis of the thickness of polyvinyl alcohol films, the market is divided into up to 30 μm, 30–60 μm, and above 60 μm. PVA films of thickness 30–60 μm dominated the market in 2024 with a market share of 48.1%. PVA films with thicknesses between 30 and 60 μm are mostly utilized as they strike an optimal balance between strength, flexibility, and cost-effectiveness. Films thinner than 30 μm tend to be more fragile and prone to tearing during handling and packaging processes, limiting their practical use.

Conversely, films thicker than 60 μm offer increased durability but can be less flexible and more expensive to produce, which may not be necessary for many applications, such as packaging or agricultural films. The 30–60 μm range provides sufficient mechanical strength and barrier properties while maintaining ease of processing and affordability, making it ideal for widespread use in industries such as detergents, food packaging, and agriculture.

Application Analysis

Detergent Packaging Emerged as a Leading Segment in the Polyvinyl Alcohol Films Market.

Based on the applications of polyvinyl alcohol films, the market is divided into detergent packaging, agrochemical packaging, laundry bags, embroidery, polarizing panels, medical & pharmaceutical, and others. Detergent packaging dominated the market in 2024 with a market share of 37.2%. Most PVA films are predominantly used in detergent packaging as this application perfectly leverages their key properties like water solubility, safety, and ease of use. Detergent pods require films that dissolve quickly and completely in water, releasing the product without leaving residue, making PVA films ideal.

While PVA is also used in agrochemical packaging, laundry bags, embroidery, polarizing panels, and medical/pharmaceutical fields, these applications often demand specialized PVA grades or additional processing to meet unique requirements such as controlled dissolution, enhanced strength, or optical clarity. Additionally, detergent packaging involves high-volume, standardized production, making it a dominant market for PVA films compared to more niche or technically complex uses in other sectors.

Key Market Segments

By Grade

- Fully Hydrolyzed

- Partially Hydrolyzed

- Others

By Type

- Water-Soluble PVA Films

- Normal Temperature Soluble

- Medium Temperature Soluble

- High Temperature Soluble

- Polarizer PVA Films

By Thickness

- Up to 30 μm

- 30–60 μm

- Above 60 μm

By Application

- Detergent packaging

- Agrochemical packaging

- Laundry bags

- Embroidery

- Polarizing Panels

- Medical & Pharmaceutical

- Others

Drivers

Demand for Sustainable and Water-Soluble Packaging Drives the Polyvinyl Alcohol Films Market.

The growing demand for sustainable and eco-friendly packaging solutions is significantly driving the polyvinyl alcohol films market. As environmental concerns intensify, industries are actively seeking alternatives to conventional plastic packaging, which is often non-biodegradable and harmful to ecosystems. PVA films, known for their water solubility and biodegradability, offer an ideal solution.

These films dissolve completely in water without leaving microplastics, making them especially attractive for applications such as detergent pods, agrochemical packaging, and medical laundry bags. For instance, single-use laundry pods wrapped in PVA films eliminate the need for plastic containers, reducing plastic waste in households.

Additionally, PVA films are used in agriculture for packaging seeds and pesticides, ensuring safe handling and complete dissolution in the field. Their oxygen and oil barrier properties also make them suitable for food packaging. The European Union regulations, such as the Packaging and Packaging Waste Regulation (PPWR), mandate that all packaging be recyclable by 2030 and establish targets for recycled content.

Similarly, in California, the USA, the Plastic Pollution Prevention and Packaging Producer Responsibility Act (SB 54) sets targets for 2032, including 100% recyclability, 65% recycling rate, and a 25% reduction in single-use plastics sold. With increasing government regulations on plastic use and rising consumer awareness, the shift toward water-soluble, sustainable packaging is expected to expand PVA film adoption across various sectors.

Restraints

Hard to Completely Decompose and High Cost of the PVA Films Might Hamper the Growth of the Polyvinyl Alcohol Films Market.

Despite their environmental advantages, certain limitations of polyvinyl alcohol (PVA) films may hinder their widespread adoption. One of the main challenges is that while PVA is water-soluble and biodegradable under specific conditions, complete decomposition often requires industrial composting environments with controlled microbial activity, temperature, and humidity. In natural settings such as landfills or marine environments, degradation may be significantly slower, raising concerns about its true eco-friendliness.

Additionally, the production of high-quality PVA films involves complex processes and expensive raw materials, leading to higher costs compared to conventional plastic films. For instance, the need for petroleum-derived feedstocks and energy-intensive polymerization increases overall manufacturing expenses. These cost barriers make it difficult for smaller companies and price-sensitive sectors to switch to PVA-based packaging.

Furthermore, the limited availability of advanced recycling or composting infrastructure in many regions restricts the effective end-of-life management of PVA products, potentially reducing the material’s environmental appeal and slowing market penetration.

Opportunity

Increasing Environmental Awareness and Government Regulations Create Opportunities in the Market.

Rising environmental awareness and the implementation of stricter government regulations on plastic waste are creating significant opportunities in the polyvinyl alcohol (PVA) films market. Over 300 million tons of plastic waste are produced annually worldwide. As plastic pollution continues to be a major global issue, with a large portion ending up in oceans, governments and organizations globally are pushing for alternatives through bans, taxes, and recycling mandates. This shift is making industries focus on PVA films due to their water solubility, biodegradability, and low environmental impact.

For instance, in countries with strict single-use plastic bans, such as India and parts of the European Union, PVA films are increasingly used for packaging items like detergents, sanitary products, and agricultural inputs. Moreover, eco-conscious consumers are influencing brands to adopt sustainable packaging, driving demand further. With PVA films capable of fully dissolving in water without leaving toxic residues, they align well with both regulatory compliance and environmental goals, positioning them as a key solution in sustainable packaging.

Trends

Focus on Innovations in Film Technology.

Innovation in film technology is a key trend shaping the polyvinyl alcohol (PVA) films market, as manufacturers focus on enhancing film performance to meet diverse industry needs. Researchers and companies are developing advanced PVA films with improved mechanical strength, thermal stability, and moisture resistance to expand their usability beyond traditional applications. For instance, nano-composite PVA films reinforced with materials such as graphene oxide or cellulose nanofibers have shown up to a 60% increase in tensile strength and better barrier properties, making them suitable for high-performance packaging and biomedical uses.

In addition, innovations include multilayered or coated PVA films that can withstand varying environmental conditions while maintaining water solubility, making them ideal for applications such as electronic device packaging or water-soluble labels. In the agricultural sector, time-controlled release PVA films are being developed to deliver fertilizers or pesticides more efficiently. These technological advancements are enabling broader adoption of PVA films in more demanding and specialized environments.

Geopolitical Impact Analysis

Geopolitical Tensions Leading to Supply Chain Disruptions in the Polyvinyl Alcohol Films Market.

Geopolitical tensions have a significant impact on the polyvinyl alcohol films market by disrupting global supply chains, increasing raw material costs, and creating trade uncertainties. For instance, PVA production relies heavily on raw materials such as vinyl acetate monomer, which is primarily sourced from a few countries, including China, the United States, and Japan. Political instability or trade restrictions between major economies can lead to shortages or delays in VAM supply, affecting PVA film manufacturers worldwide. For instance, trade tensions between the United States and other countries have led to shortages of chemicals.

Similarly, disruptions in sea routes, such as in South China or in the Strait of Hormuz, have led to delays in the shipping of raw materials for manufacturing. Additionally, the production of PVA films is an energy-intensive process, where conflict between countries leads to a rise in the prices of energy, which directly affects the price of the production of the compound, leading to a surge in the price. For instance, the conflict between Russia and Ukraine has led to a doubling of the price of oil. Similarly, the conflicts in the Middle East and Eastern Europe have hindered the flow of key ingredients and surges in the energy prices. Companies dependent on global sourcing may struggle to maintain consistent quality and pricing, prompting some to seek regional alternatives or invest in localized production, reshaping market dynamics.

Regional Analysis

North America is the Largest Market for Polyvinyl Alcohol Films.

North America held the major share of the global polyvinyl alcohol films market, valued at around US$159.7 million, commanding an estimated 34.8% of the total revenue share. The region stands out as the largest market for polyvinyl alcohol (PVA) films, driven by strong demand across diverse industries such as packaging, agriculture, healthcare, and textiles. The region’s advanced manufacturing infrastructure and focus on sustainable technologies have accelerated the adoption of PVA films, particularly in the United States. For instance, water-soluble packaging for unit-dose detergents has become increasingly common in American households, reducing plastic waste and promoting convenience.

Additionally, the U.S. agricultural sector uses PVA films for pesticide and fertilizer packaging that dissolves directly in the field, minimizing chemical exposure and packaging waste. The region’s stringent environmental regulations and growing consumer awareness around sustainability further support the shift toward biodegradable alternatives. The presence of key industry players and ongoing research into film innovation also contribute to North America’s dominant position in the PVA films market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The major global participants in the polyvinyl alcohol films market are Kuraray, Mitsubishi Chemical, Aicello Corporation, Sekisui Chemical, Chang Chun Group, Jiangmen Proudly Water-soluble Plastic, Foshan Polyva Materials, Amtrex Nature Care, Arrow GreenTech, Cortec Corporation, Ecopol SpA, Noble Industries, ElephChem Holding, and Medanos Claros HK. These companies are focused on the expansion of manufacturing facilities to cater to the growing need for the product. Several companies focus on their R&D to innovate the PVA films for various applications.

Kuraray Co., Ltd. is a global specialty chemical company that manufactures high-performance polyvinyl alcohol films and resins for various industries. Kuraray is dedicated to developing sustainable materials that meet regulatory standards and contribute to a greener future.

Mitsubishi Chemical Group is a significant player in polyvinyl alcohol films, particularly focusing on optical PVA films for displays and expanding its production capacity to meet growing demand.

Aicello Corporation is a Japanese company that supplies materials, including water-soluble polyvinyl alcohol films under its Solublon brand. Aicello has prioritized environmental consciousness and sustainability, shifting its focus from cellophane to polyethylene and now PVA films to address environmental concerns.

The major players in the industry

- Kuraray Co., Ltd.

- Mitsubishi Chemical Group Corporation

- Aicello Corporation

- Sekisui Chemical Co., Ltd.

- Chang Chun Group

- Jiangmen Proudly Water-soluble Plastic Co., Ltd.

- Foshan Polyva Materials Co., Ltd.

- Amtrex Nature Care Pvt. Ltd.

- Arrow GreenTech Ltd.

- Cortec Corporation

- Ecopol SpA

- Noble Industries

- ElephChem Holding Ltd.

- Medanos Claros HK Ltd.

- Other Players

Key Developments

- In October 2024, Mitsubishi Chemical Group announced it to expand its optical polyvinyl alcohol (PVOH) film production capacity at its plant in Ogaki City, Gifu Prefecture, Japan. The upgraded and expanded new facility is scheduled to be operational in the second half of fiscal year 2027.

- In October 2025, POLYVA, a key player in water-soluble packaging, introduced its pesticide packaging solution designed to enhance safety and ease of use. The solution, which relies on water-soluble polyvinyl alcohol (PVA) film, addresses several critical issues associated with traditional pesticide packaging, including user safety and environmental concerns.

Report Scope

Report Features Description Market Value (2024) USD 459 Mn Forecast Revenue (2034) USD 799 Mn CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Fully Hydrolysed, Partially Hydrolysed, Others), By Type (Water-Soluble PVA Films, Polarizer PVA Films), By Thickness (Up to 30 μm, 30–60 μm, and Above 60 μm), By Application (Detergent Packaging, Agrochemical Packaging, Laundry Bags, Embroidery, Polarizing Panels, Medical & Pharmaceutical, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Kuraray, Mitsubishi Chemical, Aicello Corporation, Sekisui Chemical, Chang Chun Group, Jiangmen Proudly Water-soluble Plastic, Foshan Polyva Materials, Amtrex Nature Care, Arrow GreenTech, Cortec Corporation, Ecopol SpA, Noble Industries, ElephChem Holding, Medanos Claros HK, Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Polyvinyl Alcohol Films MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Polyvinyl Alcohol Films MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Kuraray Co., Ltd.

- Mitsubishi Chemical Group Corporation

- Aicello Corporation

- Sekisui Chemical Co., Ltd.

- Chang Chun Group

- Jiangmen Proudly Water-soluble Plastic Co., Ltd.

- Foshan Polyva Materials Co., Ltd.

- Amtrex Nature Care Pvt. Ltd.

- Arrow GreenTech Ltd.

- Cortec Corporation

- Ecopol SpA

- Noble Industries

- ElephChem Holding Ltd.

- Medanos Claros HK Ltd.

- Other Players