The Global Polycaprolactone Market Size, Share, And Business Benefits By Form (Pellets, Microsphere, Nanosphere), By Molecular Weight (High Molecular Weight, Low Molecular Weight), By Application (Thermoplastic Polyurethane (TPU), Adhesives, Films and Coatings, Drug Delivery, Sutures, Tissue Engineering, 3D Printing), By End-use (Healthcare, Packaging, Agriculture, Construction, Automotive, Consumer Goods, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153390

- Number of Pages: 356

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

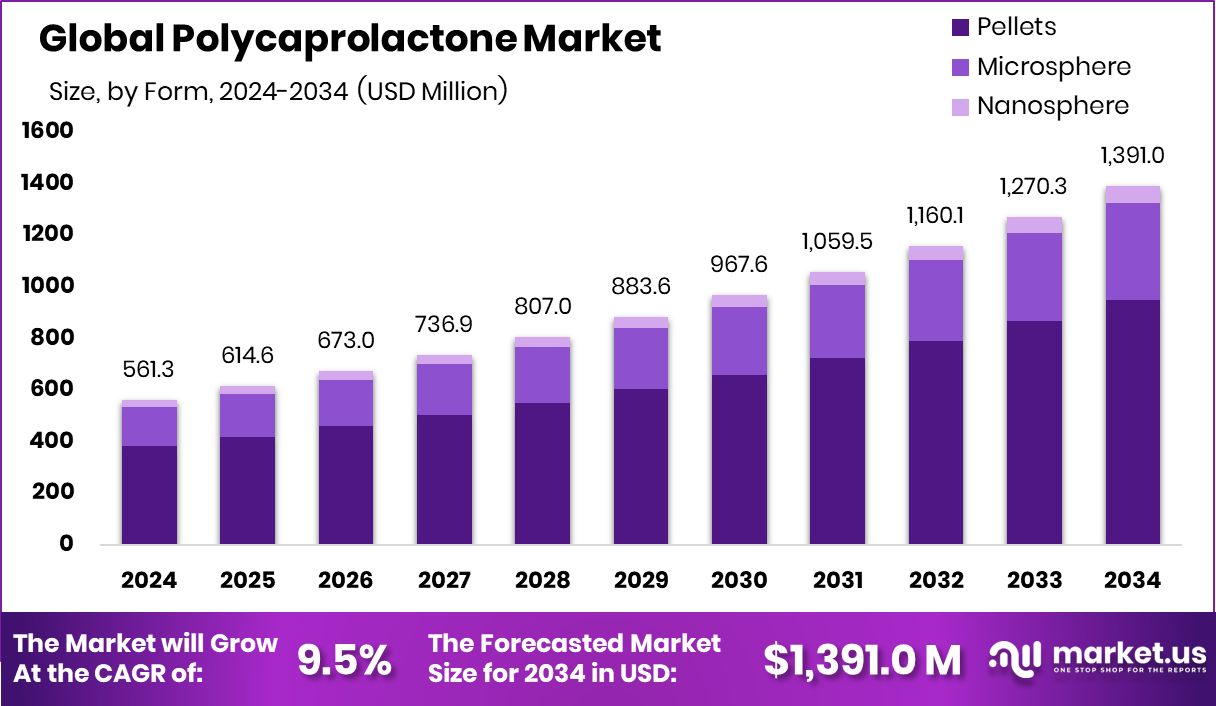

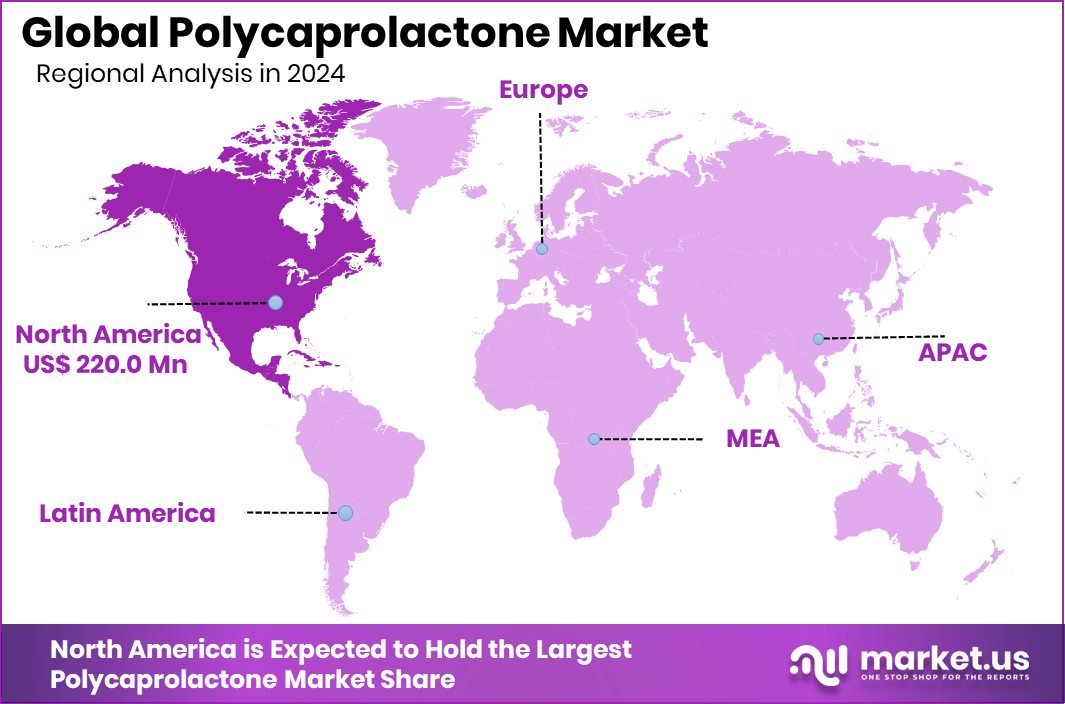

The Global Polycaprolactone Market is expected to be worth around USD 1,391.0 million by 2034, up from USD 561.3 million in 2024, and is projected to grow at a CAGR of 9.5% from 2025 to 2034. North America:39.20% leads due to strong demand from medical and industrial biodegradable applications.

Polycaprolactone (PCL) is a biodegradable polyester with a low melting point, typically around 60°C. It is known for its excellent flexibility, biocompatibility, and slow degradation rate, which makes it widely used in medical applications such as drug delivery systems, sutures, and tissue engineering. Its ease of processing also allows its use in 3D printing, coatings, and packaging solutions.

The polycaprolactone market represents the global trade and consumption of this specialty polymer across multiple industries. It covers the supply chain from raw material suppliers and chemical processors to end-users in sectors like healthcare, agriculture, construction, and packaging. The market is shaped by innovation in sustainable materials, regulatory support for biodegradable plastics, and increasing industrial demand for environment-friendly alternatives to conventional polymers.

The growth of the polycaprolactone market is supported by rising awareness of environmental protection and the transition from petroleum-based plastics to biodegradable alternatives. Strong demand from the medical sector, especially in bioresorbable implants and tissue scaffolds, is contributing significantly. The ability of PCL to be easily modified and processed adds to its adoption across industries.

Global demand for PCL is driven by the healthcare industry, where it is used in long-term drug release and tissue regeneration. The rising number of surgical procedures and the need for biocompatible materials are accelerating its adoption. Furthermore, increasing consumer preference for compostable and eco-friendly packaging materials supports demand in the packaging segment.

Key Takeaways

- The Global Polycaprolactone Market is expected to be worth around USD 1,391.0 million by 2034, up from USD 561.3 million in 2024, and is projected to grow at a CAGR of 9.5% from 2025 to 2034.

- Pellets dominate the Polycaprolactone Market with 68.2% due to easy processing.

- High Molecular Weight Polycaprolactone leads with 67.7% share for superior strength.

- Thermoplastic Polyurethane (TPU) holds 36.1% share, driven by flexible material applications.

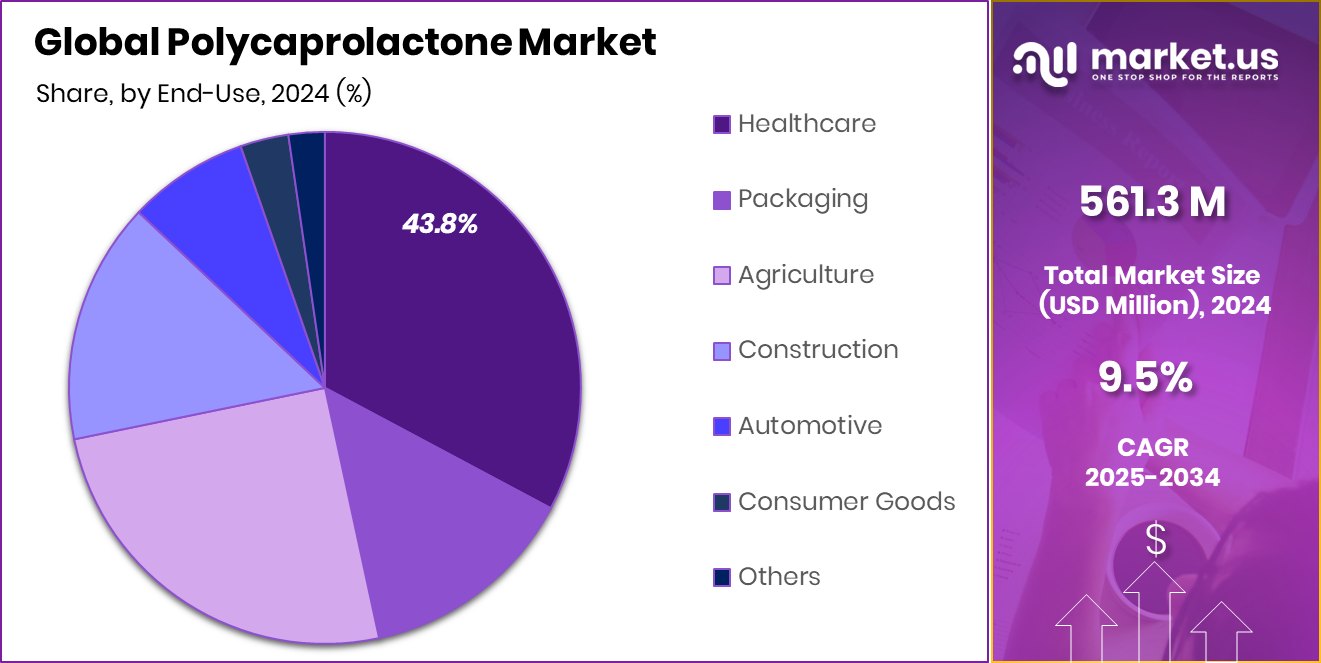

- Healthcare sector captures 43.8% share, supported by growing biomedical product demand.

- The North America market value reached approximately USD 220.0 million during the same year.

By Form Analysis

In the Polycaprolactone market, pellets led with 68.2% due to easy processing and versatility.

In 2024, Pellets held a dominant market position in the By Form segment of the Polycaprolactone market, with a 68.2% share. This substantial share can be attributed to the pellets’ ease of handling, uniform melting characteristics, and compatibility with large-scale manufacturing processes.

Their physical form allows consistent feeding into extrusion and injection molding machines, making them the preferred choice for industrial applications. The medical, packaging, and additive manufacturing industries particularly benefit from the reliability and process efficiency that pellets offer.

Pellets also enable precise control over product dimensions and surface properties during processing, which is essential for producing high-quality biodegradable products. Their storage stability and extended shelf life further support their widespread adoption across end-use sectors.

Additionally, pellets are well-suited for blending with other biodegradable polymers, enhancing formulation flexibility without compromising environmental performance. As industries increasingly shift toward sustainable materials, pelletized polycaprolactone continues to be the form of choice for manufacturers aiming to balance performance with eco-consciousness.

By Molecular Weight Analysis

High molecular weight polycaprolactone captured a 67.7% share, offering superior strength and better mechanical properties.

In 2024, High Molecular Weight held a dominant market position in the By Molecular Weight segment of the Polycaprolactone market, with a 67.7% share. This leading share is primarily driven by the superior mechanical strength, enhanced thermal stability, and extended degradation time associated with high molecular weight polycaprolactone.

These characteristics make it especially suitable for demanding applications such as biomedical implants, long-term drug delivery systems, and structural components in additive manufacturing.

High molecular weight variants offer greater tensile strength and flexibility, which are critical for performance in medical-grade products and engineered biodegradable solutions. Their improved processing behavior during extrusion and molding operations further supports their industrial-scale usage.

Additionally, the slower degradation profile aligns with the needs of sectors requiring prolonged material stability, including regenerative medicine and orthopedics. The strong preference for this grade in both research and commercial applications reinforces its leadership position within the market.

By Application Analysis

Thermoplastic polyurethane applications dominated with a 36.1% share, driven by flexible, durable, and biodegradable material demand.

In 2024, Thermoplastic Polyurethane (TPU) held a dominant market position in the By Application segment of the Polycaprolactone market, with a 36.1% share. This strong market presence is largely due to the compatibility of polycaprolactone with TPU formulations, enabling the production of flexible, durable, and biodegradable materials.

The integration of polycaprolactone into TPU enhances its softness, elasticity, and processing versatility, which is essential for a wide range of consumer and industrial applications.

The use of PCL in TPU provides a balance between mechanical strength and environmental sustainability, making it highly attractive in sectors seeking alternatives to conventional plastics. TPU compounds containing PCL are widely used in applications such as flexible films, wires and cables, footwear soles, and other molded products where both performance and degradability are required.

The ability to fine-tune TPU properties through the incorporation of high-purity PCL supports broader design flexibility and innovation across product lines. The 36.1% market share held by TPU in 2024 reflects its critical role in driving the adoption of polycaprolactone in commercial-scale applications, and this trend is expected to continue as industries prioritize both performance efficiency and sustainability in material selection.

By End-use Analysis

Healthcare sector held a 43.8% share in 2024, supported by rising surgical procedures and biodegradable implant usage.

In 2024, Healthcare held a dominant market position in the By End-use segment of the Polycaprolactone market, with a 43.8% share. This leadership is primarily driven by the material’s high biocompatibility, slow degradation rate, and ease of processing, which make it ideal for various medical applications.

Polycaprolactone is widely used in the healthcare sector for bioresorbable sutures, controlled drug delivery systems, wound dressings, and tissue engineering scaffolds, where long-term stability and patient safety are crucial.

The ability of polycaprolactone to degrade predictably within the human body without causing toxicity supports its growing use in medical devices and regenerative medicine. Additionally, the healthcare sector benefits from the polymer’s customization capabilities, allowing precise formulation to meet specific clinical requirements.

The rising number of surgical procedures, growing investments in advanced medical technologies, and increasing demand for biodegradable implants have further propelled its adoption. The 43.8% market share captured by the healthcare segment in 2024 reflects the material’s established position as a trusted and effective solution for modern medical needs.

Key Market Segments

By Form

- Pellets

- Microsphere

- Nanosphere

By Molecular Weight

- High Molecular Weight

- Low Molecular Weight

By Application

- Thermoplastic Polyurethane (TPU)

- Adhesives

- Films and Coatings

- Drug Delivery

- Sutures

- Tissue Engineering

- 3D Printing

By End-use

- Healthcare

- Packaging

- Agriculture

- Construction

- Automotive

- Consumer Goods

- Others

Driving Factors

Rising Demand for Biodegradable and Safe Polymers

One of the main driving factors for the polycaprolactone (PCL) market is the growing demand for biodegradable and safe polymers. Industries are now focusing more on materials that are eco-friendly and break down naturally without harming the environment. PCL fits this need perfectly because it is both biodegradable and non-toxic.

It is especially useful in medical applications like drug delivery systems, sutures, and tissue scaffolds, where safety and gradual absorption in the body are very important. In packaging and consumer products, PCL helps reduce plastic waste and supports sustainable practices.

As governments and companies push for greener materials, the use of polycaprolactone is expected to grow steadily across many sectors in the coming years.

Restraining Factors

High Production Costs Limit Mass Market Adoption

A key restraining factor for the polycaprolactone (PCL) market is its high production cost. Compared to traditional plastics, manufacturing PCL involves more complex processes and expensive raw materials. This makes the final product costlier, which limits its use in price-sensitive industries like consumer goods and packaging.

While PCL offers many benefits such as biodegradability and safety, the higher cost often discourages manufacturers from switching from cheaper, petroleum-based plastics. Small and medium-sized companies, in particular, may find it difficult to justify the added expense without clear financial or regulatory incentives.

Until the production process becomes more efficient or raw material prices drop, cost will remain a major barrier to the wider adoption of polycaprolactone in global markets.

Growth Opportunity

Expanding Use in 3D Printing Medical Applications

A major growth opportunity for the polycaprolactone (PCL) market lies in its expanding use in 3D printing for medical applications. PCL’s low melting point, flexibility, and biocompatibility make it ideal for producing custom medical implants, surgical guides, and tissue scaffolds.

In 3D printing, it allows precise shaping and layering, enabling the creation of personalized medical devices tailored to individual patient needs. As healthcare providers adopt more advanced technologies, the demand for safe, customizable materials like PCL is increasing.

Furthermore, its slow and predictable degradation rate is perfect for long-term use inside the body. With ongoing innovation in healthcare and additive manufacturing, this niche is expected to become a strong and fast-growing area for polycaprolactone soon.

Latest Trends

Blending Polycaprolactone with Other Biodegradable Polymers

A key trend in the polycaprolactone (PCL) market is the growing practice of blending PCL with other biodegradable polymers. This approach helps improve its overall performance, such as strength, flexibility, and degradation rate, while keeping the material eco-friendly.

Manufacturers are increasingly mixing PCL with polylactic acid (PLA) or starch-based materials to make customized solutions for specific uses like packaging, agriculture films, or medical implants. These blends offer better control over how the material behaves during use and how quickly it breaks down in the environment.

As industries continue to look for smart, sustainable material options, this trend of creating polymer blends using PCL is becoming more popular and is likely to shape product development in the coming years.

Regional Analysis

In 2024, North America held a 39.20% share in the polycaprolactone market.

In 2024, North America emerged as the dominant region in the global Polycaprolactone market, capturing a significant 39.20% share, with a market value of USD 220.0 million. The region’s leadership is driven by high demand for biodegradable polymers in healthcare, particularly for applications such as drug delivery systems, tissue engineering, and medical implants.

The well-established medical infrastructure and early adoption of advanced biodegradable materials have supported the region’s consistent market growth. Europe continues to demonstrate steady progress, supported by strong environmental regulations and the region’s focus on sustainable materials. Asia Pacific is witnessing growing interest in polycaprolactone due to rising industrial development and awareness around eco-friendly polymers.

Meanwhile, the Middle East & Africa and Latin America show gradual market expansion, supported by increasing use of biodegradable products in niche applications. However, North America’s strong industrial base, innovation in medical technologies, and growing emphasis on sustainable solutions position it at the forefront of the global polycaprolactone market in 2024.

The demand for high-performance, bioresorbable materials continues to grow across regions, but North America remains the key contributor to overall market revenue and development.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ChemPoint continued to leverage its broad distribution network and technical-service capabilities to supply PCL to industrial and biomedical manufacturers worldwide. Its ability to offer custom material formulations in pellet and solution forms enabled streamlined integration for clients, reinforcing ChemPoint’s reputation as a responsive and service-oriented supplier.

Corbion, a specialist in sustainable biopolymers, capitalized on its robust R&D infrastructure to advance high-performance PCL grades. The company emphasized innovation in biodegradable profiles tailored for medical devices and eco-friendly packaging. Corbion’s focus on purity and process consistency helped secure customer trust in sensitive applications, reinforcing its market position.

Daicel Corporation excelled in combining material science with manufacturing excellence. Drawing upon its strong background in organic chemical synthesis, Daicel advanced PCL formulations with controlled molecular weights and tailored melting characteristics. Its manufacturing precision supported scalable production, which was particularly beneficial for additive manufacturing and medical-grade applications.

Durect Corporation, with its medical-oriented polymer expertise, concentrated on developing advanced PCL-based drug delivery systems. By optimizing polymer degradation and release kinetics, Durect strengthened its presence in controlled-release formulations. The company’s focus on regulatory compliance and biocompatibility further solidified its standing in the healthcare sector.

Top Key Players in the Market

- BASF SE

- ChemPoint

- Corbion

- Daicel Corporation

- Durect Corporation

- Esun Industrial Co., Ltd

- eSUNMed Biotechnology (Shenzhen) Co., Ltd.

- Haihang Group

- Hunan Juren Chemical Hitechnology Co., Ltd.

- JenKem Technology

- Kashima Polymers Corporation BASF

- Perstorp Holding AB

- Polymer Source. Inc.

- Polysciences, Inc.

- Shenzhen Esun Industrial Co., Ltd

- Shenzhen Polymtek Biomaterial Co., Ltd

- SK Functional Polymer.

- Spectrum Chemical

- Unilong Industry Co., Ltd.

- VIZAG Chemicals

Recent Developments

- In February 2024, eSUN’s medical division, eSUNMED, achieved a significant milestone by registering its self‑developed medical-grade polycaprolactone material with China’s National Medical Products Administration. This approval signifies that eSUNMED’s PCL meets strict standards for use in medical and healthcare applications, confirming its safety and quality for clinical purposes.

Report Scope

Report Features Description Market Value (2024) USD 561.3 Million Forecast Revenue (2034) USD 1,391.0 Million CAGR (2025-2034) 9.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Pellets, Microsphere, Nanosphere), By Molecular Weight (High Molecular Weight, Low Molecular Weight), By Application (Thermoplastic Polyurethane (TPU), Adhesives, Films and Coatings, Drug Delivery, Sutures, Tissue Engineering, 3D Printing), By End-use (Healthcare, Packaging, Agriculture, Construction, Automotive, Consumer Goods, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, ChemPoint, Corbion, Daicel Corporation, Durect Corporation, EsunIndustrial Co., Ltd, eSUNMed Biotechnology (Shenzhen) Co.,Ltd, Haihang Group, Hunan Juren Chemical Hitechnology Co.,Ltd, JenKem Technology, Kashima Polymers Corporation, BASF, Perstorp Holding AB, Polymer Source, Inc., Polysciences, Inc., Shenzhen Esun Industrial Co., Ltd, Shenzhen Polymtek Biomaterial Co., Ltd, SK Functional Polymer, Spectrum Chemical, Unilong Industry Co., Ltd., VIZAG Chemicals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- ChemPoint

- Corbion

- Daicel Corporation

- Durect Corporation

- Esun Industrial Co., Ltd

- eSUNMed Biotechnology (Shenzhen) Co., Ltd.

- Haihang Group

- Hunan Juren Chemical Hitechnology Co., Ltd.

- JenKem Technology

- Kashima Polymers Corporation BASF

- Perstorp Holding AB

- Polymer Source. Inc.

- Polysciences, Inc.

- Shenzhen Esun Industrial Co., Ltd

- Shenzhen Polymtek Biomaterial Co., Ltd

- SK Functional Polymer.

- Spectrum Chemical

- Unilong Industry Co., Ltd.

- VIZAG Chemicals