Global Plastic Additives Market Size, Share, And Enhanced Productivity By Product (Plasticizers, Flame Retardants, Impact Modifiers, Antioxidants, Antimicrobials, UV Stabilizers, Others), By Plastic (Commodity Plastics, Engineering Plastics, High Performance Plastics), By End-use (Packaging, Automotive, Consumer Goods, Construction, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 173460

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

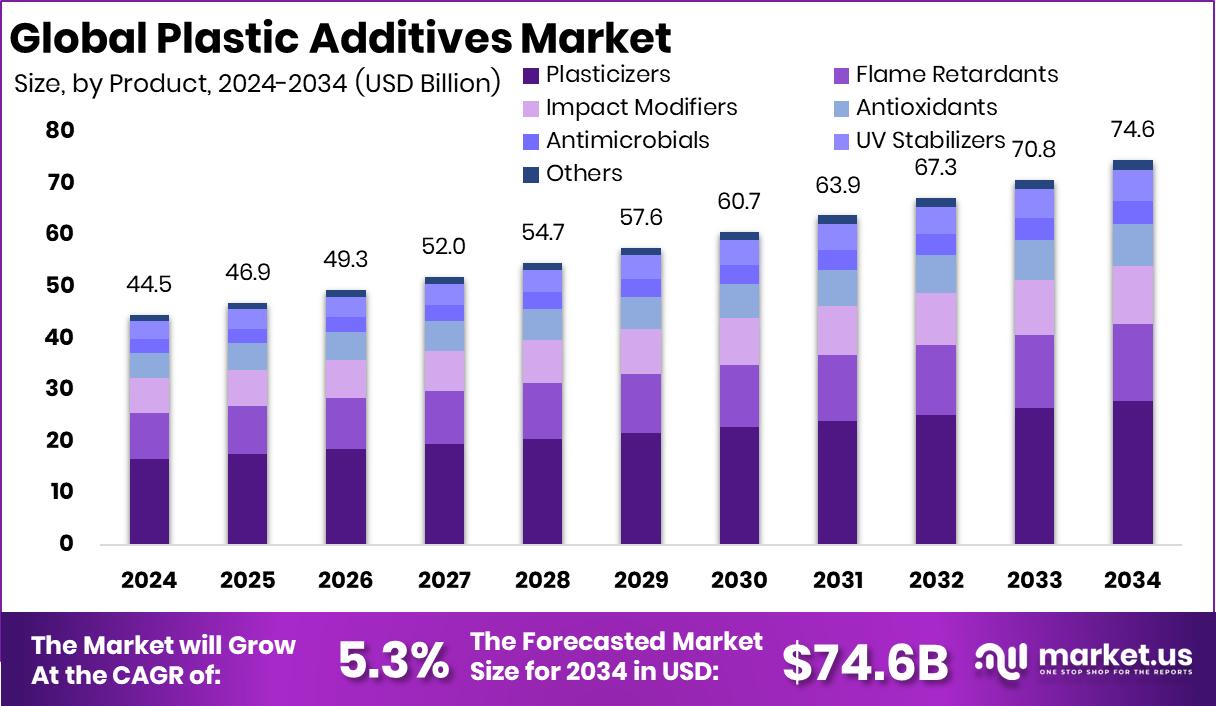

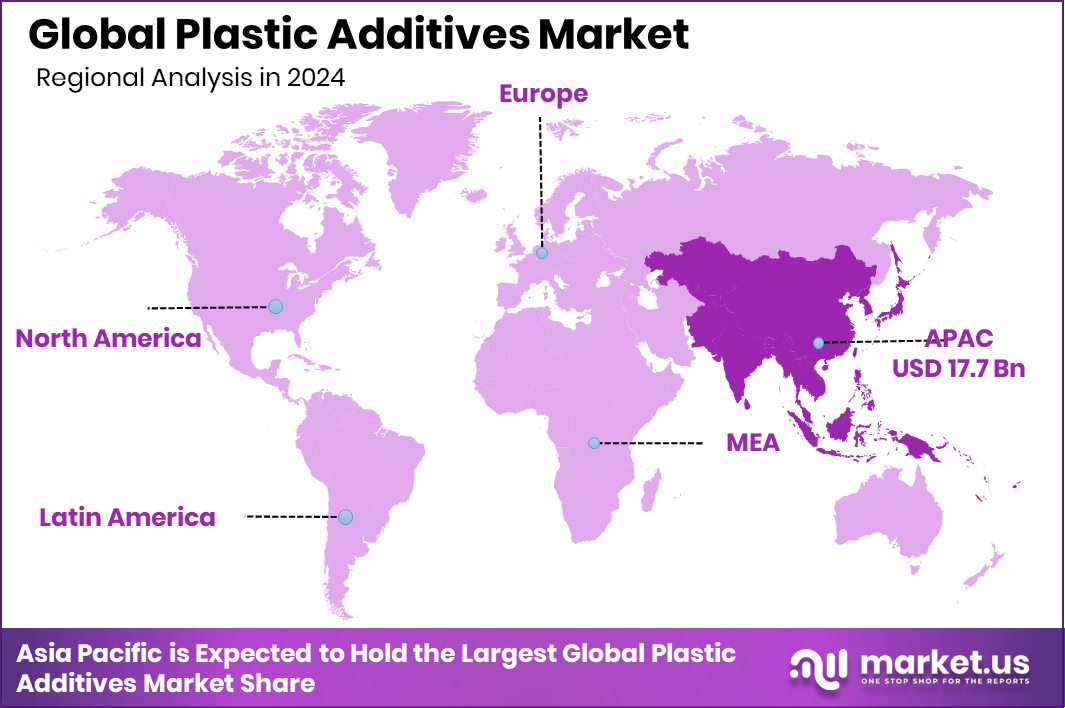

The Global Plastic Additives Market is expected to be worth around USD 74.6 billion by 2034, up from USD 44.5 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034.Plastic Additives Market in Asia Pacific achieved 39.80% share, totaling USD 17.7 Bn.

Plastic additives are special materials mixed into plastics to improve how they perform and last. They help plastics become stronger, more flexible, heat-resistant, or safer to use. Common additives support durability, color stability, processing ease, and protection against sunlight, heat, or wear during daily use.

The plastic additives market refers to the global activity around producing, supplying, and using these additives across industries. It exists because raw plastics alone cannot meet modern performance needs. Additives allow plastics to fit many applications, from packaging and construction to electronics and consumer products.

Growth in the plastic additives market is driven by rising plastic production and the need for better material performance. Investment activity supports this growth, such as Arclin investing $60 million to expand its South Carolina plant, strengthening supply capacity and advanced material development for industrial plastic applications.

Demand for plastic additives continues to rise as manufacturers seek longer-lasting and safer plastic products. Innovation funding plays a role here, with FRX Polymers securing $22 million in Series D equity financing, supporting development of advanced additive technologies that improve safety and functionality in plastic materials.

Future opportunities are linked to innovation, research, and specialized applications. Public research support, including $1 million granted for weapons of mass destruction research, indirectly strengthens advanced material science, opening new pathways for high-performance plastic additives used in safety-critical and regulated environments.

Key Takeaways

- The Global Plastic Additives Market is expected to be worth around USD 74.6 billion by 2034, up from USD 44.5 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034.

- In the Plastic Additives Market, plasticizers dominate by product, holding 37.5% share globally across industries.

- Within the Plastic Additives Market, commodity plastics lead by plastic type with 58.3% share worldwide.

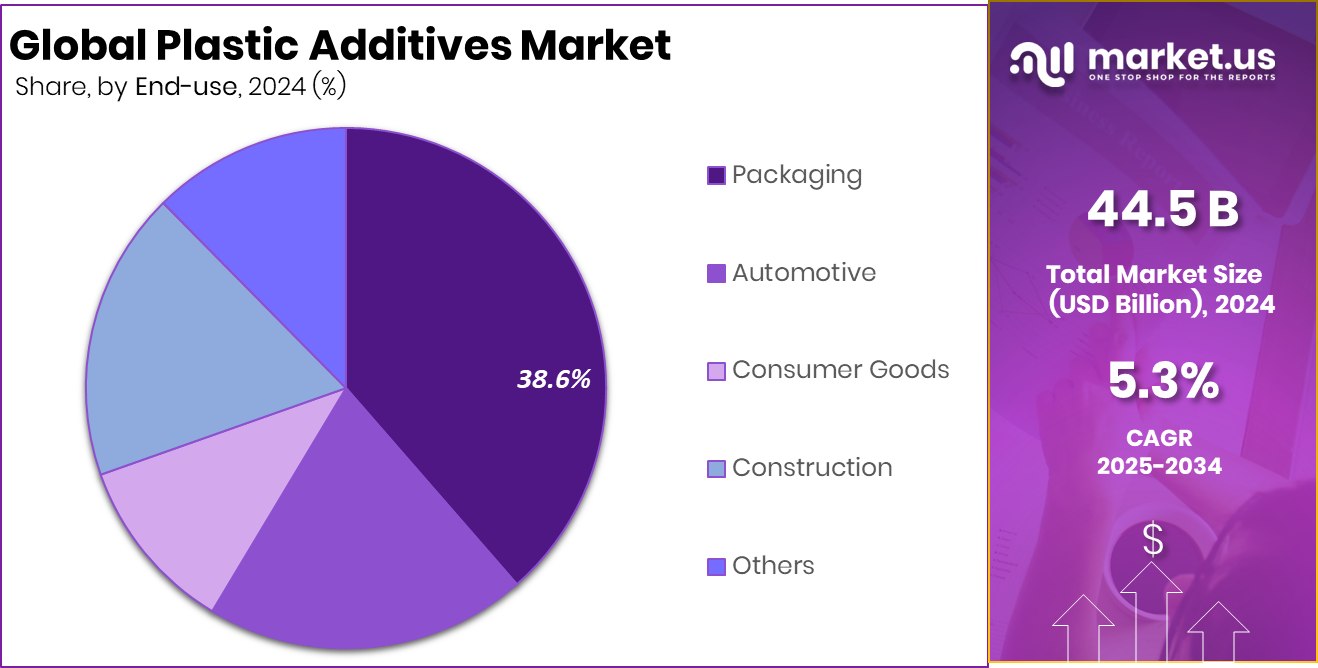

- In the Plastic Additives Market, packaging leads end-use demand, accounting for 38.6% consumption globally today.

- Asia Pacific accounted for 39.80% of Plastic Additives Market, reaching USD 17.7 Bn.

By Product Analysis

In Plastic Additives Market, plasticizers led products with 37.5% share globally overall.

In 2024, the Plastic Additives Market saw plasticizers hold a strong 37.5% share, reflecting their essential role in improving flexibility, softness, and durability of plastic products. Plasticizers are widely used to enhance performance in PVC and other polymers used across daily-life applications. Growth was supported by steady demand from packaging films, cables, flooring, and consumer goods.

Manufacturers focused on improving efficiency and compatibility while gradually shifting toward safer and low-volatility formulations. Regulatory pressure on harmful additives encouraged innovation rather than slowing adoption. In construction and packaging, plasticizers remained critical for extending product life and reducing brittleness. Their high usage rate shows how indispensable they are in maintaining plastic performance standards, especially where flexibility and long-term stability are required across large-volume applications.

By Plastic Analysis

Within Plastic Additives Market, commodity plastics dominated plastic types holding 58.3% share.

In 2024, the Plastic Additives Market was largely driven by commodity plastics, which accounted for 58.3% of total consumption. Materials such as polyethylene, polypropylene, and PVC dominate everyday manufacturing, creating consistent demand for stabilizers, plasticizers, and impact modifiers. Commodity plastics rely heavily on additives to improve heat resistance, processing efficiency, and durability during mass production.

Growth was supported by rising output in packaging, household goods, and industrial components. Cost sensitivity in these plastics pushed additive producers to deliver high-performance solutions at scale. The dominance of commodity plastics highlights their role as the backbone of global polymer consumption, where additives are essential for meeting functional requirements while maintaining affordability across high-volume end-use markets.

By End-use Analysis

Packaging emerged as leading end-use in Plastic Additives Market, accounting 38.6% demand.

In 2024, packaging emerged as the leading end-use segment in the Plastic Additives Market, capturing a 38.6% share. Flexible and rigid packaging formats depend heavily on additives for strength, clarity, shelf-life protection, and processing stability. Food, beverage, and consumer goods packaging continued to expand, supporting steady additive demand. Additives such as antioxidants, UV stabilizers, and plasticizers helped improve product safety and durability during transportation and storage.

Sustainability efforts also influenced additive selection, with manufacturers optimizing formulations to reduce material usage without compromising performance. The strong share of packaging reflects its constant production cycles and essential role in modern supply chains, making it a reliable and high-volume consumer of plastic additives worldwide.

Key Market Segments

By Product

- Plasticizers

- Flame Retardants

- Impact Modifiers

- Antioxidants

- Antimicrobials

- UV Stabilizers

- Others

By Plastic

- Commodity Plastics

- Engineering Plastics

- High Performance Plastics

By End-use

- Packaging

- Automotive

- Consumer Goods

- Construction

- Others

Driving Factors

Rising Innovation Investments Accelerate Plastic Additives Demand

Growing innovation across materials science is a key driving factor for the Plastic Additives Market. Companies and research institutions are investing heavily to develop safer, high-performance, and sustainable additive solutions. Denmark-based Cellugy receiving €8 million in EU funding for fossil-free skincare materials highlights how bio-based innovation is influencing additive development beyond traditional plastics.

At the same time, UF Health researchers securing an $11.8 million grant to fight antibiotic-resistant bacteria shows how advanced material research is expanding functional additive use in hygiene-sensitive plastics. Industry confidence is further reflected by Capital Group acquiring a 1.67% stake in Shaily Engineering Plastics worth ₹148 crore, signaling strong belief in long-term plastics processing and additive demand. Together, these investments strengthen innovation pipelines, expand applications, and drive steady market growth.

Restraining Factors

Regulatory Pressure And Sustainability Concerns Limit Additive Usage

A major restraining factor for the Plastic Additives Market is rising pressure to reduce environmental and health risks linked to plastics. Danish biotech startup Cellugy securing €8.1 million to eradicate microplastics in personal care products highlights increasing resistance to certain additive uses.

Similarly, iFAST Diagnostics raising over €5.9 million to combat antimicrobial resistance reflects global concern over chemical exposure and long-term health impacts. These developments encourage stricter regulations and reformulation requirements for additives.

On the industry side, Shaily Engineering Plastics granting 94,500 stock options to employees indicates internal restructuring and talent retention efforts amid compliance challenges. Together, sustainability demands, regulatory scrutiny, and evolving safety expectations slow adoption of some traditional additives and increase development costs.

Growth Opportunity

Public Health Programs Open New Additive Applications

Growth opportunities in the Plastic Additives Market are emerging from public health and social support initiatives that rely on durable plastic systems. DoorDash launching emergency food response programs as SNAP funding pressures affect 40 million Americans increases demand for safe, temperature-resistant, and hygienic packaging materials enhanced by additives.

At the same time, the Italian government providing $21 million to a BU-led effort for developing new antibiotics, vaccines, and diagnostics supports advanced medical infrastructure. These healthcare and food security programs require specialized plastics with antimicrobial, stability, and safety-focused additives. As public services expand, additives tailored for medical, logistics, and food protection applications gain strong long-term growth potential.

Latest Trends

Government Grants Drive Advanced Additive Research Focus

The latest trend in the Plastic Additives Market is the growing role of government-backed research funding in shaping innovation. Two Richmond-based companies receiving $4.7 million in federal grants shows how public funds are supporting material innovation and manufacturing expansion.

On a global scale, the Antimicrobial Resistance Action Fund committing $1 billion toward developing new antibiotics highlights the urgency of antimicrobial solutions. This trend directly influences plastic additives used in medical devices, packaging, and hygiene applications. Additives with antimicrobial, protective, and performance-enhancing functions are gaining attention as governments prioritize health security. Public funding is increasingly steering additive development toward safety-driven and high-value applications.

Regional Analysis

Asia Pacific led Additives Market with 39.80% share, valued at USD 17.7 Bn.

Asia Pacific emerged as the dominating region in the Plastic Additives Market, holding a 39.80% share and valued at USD 17.7 Bn, reflecting its strong manufacturing base and large-scale plastic consumption across multiple industries. The region benefits from high production volumes of commodity plastics, steady packaging demand, and a well-established processing ecosystem, which together sustain consistent additive usage.

In comparison, North America represents a mature regional market, where demand is shaped by stable industrial activity, regulatory compliance requirements, and replacement-driven consumption rather than rapid volume expansion. Europe follows a similar pattern, with measured growth supported by quality-focused applications and emphasis on performance optimization in plastic formulations.

The Middle East & Africa region shows selective market participation, largely influenced by industrial development pace and region-specific consumption patterns. Latin America remains a developing market, characterized by gradual adoption of plastic additives aligned with expanding packaging and consumer goods sectors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, BASF SE continued to play a central role in the global Plastic Additives Market through its broad and integrated additives portfolio. The company’s strength lies in combining additives with polymer expertise, enabling customers to improve durability, processing efficiency, and product consistency. BASF’s focus on high-performance stabilizers and tailored solutions supports large-scale packaging, automotive, and industrial plastics. Its global manufacturing footprint and technical service capabilities allow close collaboration with converters, reinforcing long-term customer relationships and steady market influence.

Clariant AG maintained a strong competitive position in 2024 by emphasizing specialty-driven plastic additives designed for performance enhancement and compliance needs. The company is known for its expertise in stabilizers, flame retardants, and masterbatches that help manufacturers achieve precise functional outcomes. Clariant’s application-focused approach supports value-added plastics used in packaging, consumer goods, and technical applications. Its ability to customize formulations strengthens its relevance in markets where quality, consistency, and regulatory alignment remain critical decision factors.

In 2024, Albemarle Corporation remained a key player in plastic additives through its established presence in specialty additives, particularly bromine-based solutions. The company’s products are widely used where performance and safety characteristics are essential, such as flame retardancy in durable plastics. Albemarle’s technical depth and long-standing industry relationships support stable demand across industrial and consumer applications. Its focused portfolio strategy enables it to serve niche but high-importance segments within the broader plastic additives landscape.

Top Key Players in the Market

- BASF SE

- Clariant AG

- Albemarle Corporation

- Songwon Industrial Co., Ltd.

- Nouryon

- LANXESS AG

- Evonik Industries AG

- Kaneka Corporation

- The Dow Chemical Company

- ExxonMobil Corporation

Recent Developments

- In July 2024, Dow launched the DOWSIL CC-8000 Series UV and dual moisture cure conformal coatings for electronics protection. Although not strictly a traditional plastic additive, this new silicone-based coating range strengthens Dow’s portfolio of high-performance materials that protect components in renewable energy, motors, and appliances.

- In May 2024, ExxonMobil introduced 20-liter lubricant pails in India made with 50% post-consumer recycled plastic content. This marks a practical step toward heavier use of recycled materials in plastic packaging while maintaining performance.

Report Scope

Report Features Description Market Value (2024) USD 44.5 Billion Forecast Revenue (2034) USD 74.6 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Plasticizers, Flame Retardants, Impact Modifiers, Antioxidants, Antimicrobials, UV Stabilizers, Others), By Plastic (Commodity Plastics, Engineering Plastics, High Performance Plastics), By End-use (Packaging, Automotive, Consumer Goods, Construction, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Clariant AG, Albemarle Corporation, Songwon Industrial Co., Ltd., Nouryon, LANXESS AG, Evonik Industries AG, Kaneka Corporation, The Dow Chemical Company, ExxonMobil Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Plastic Additives MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Plastic Additives MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Clariant AG

- Albemarle Corporation

- Songwon Industrial Co., Ltd.

- Nouryon

- LANXESS AG

- Evonik Industries AG

- Kaneka Corporation

- The Dow Chemical Company

- ExxonMobil Corporation