Global Plant Growth Regulator Market Size, Share, And Business Benefits By Type (Cytokinins, Auxins, Gibberellins, Ethylene, Others), By Crop Type (Fruits and Vegetables (Fruits, Vegetables), Cereals and Grains (Corn, Wheat, Rice, Others), Oilseeds and Pulses (Cotton, Soybean, Sunflower, Others), Turf and Ornamentals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152626

- Number of Pages: 243

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

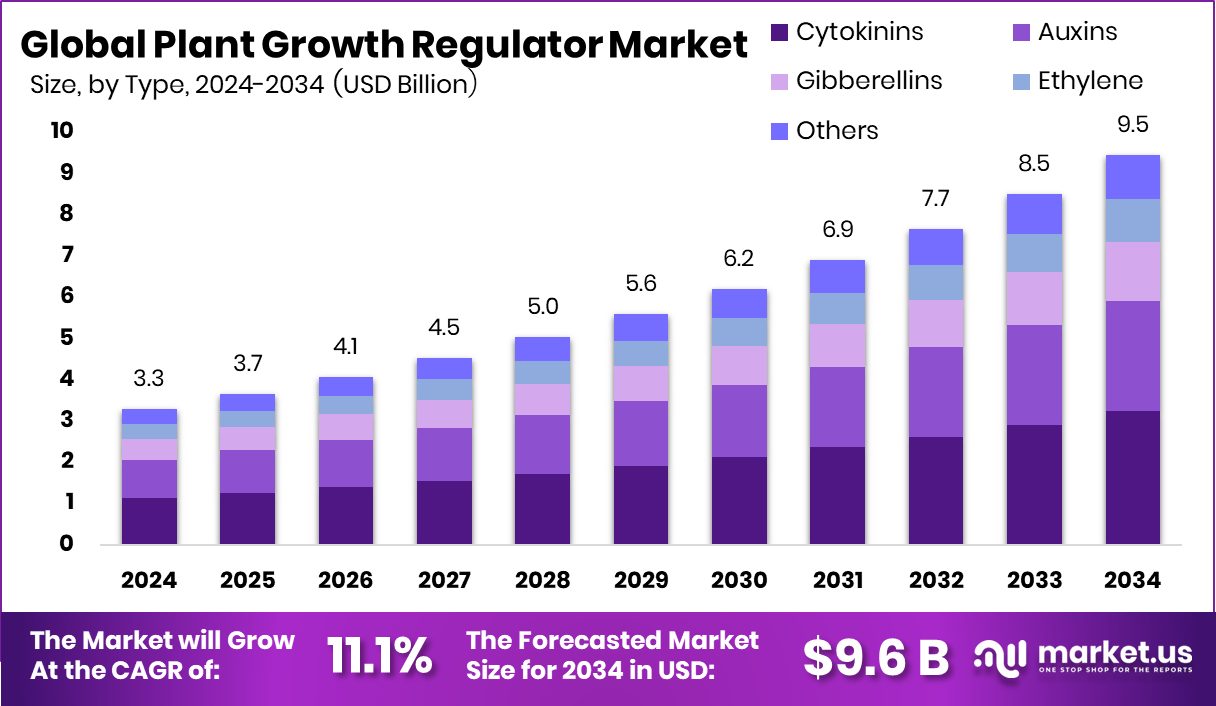

Global Plant Growth Regulator Market is expected to be worth around USD 9.5 billion by 2034, up from USD 3.3 billion in 2024, and grow at a CAGR of 11.1% from 2025 to 2034. Strong demand for quality crops boosted Europe’s 41.9% dominance in the global regulator market.

Plant Growth Regulators (PGRs) are natural or synthetic chemical substances that influence various physiological processes in plants. They work in very small quantities and can stimulate or inhibit growth, depending on the type and application. These regulators help manage plant activities such as cell division, elongation, flowering, fruiting, and dormancy. Common types include auxins, gibberellins, cytokinins, ethylene, and abscisic acid.

The Plant Growth Regulator market refers to the commercial production, distribution, and use of these compounds across agriculture, horticulture, and gardening sectors. This market is driven by the need for higher agricultural productivity and the growing demand for quality crops. The application of PGRs helps in managing plant behavior, especially under changing climatic conditions, which makes them a valuable tool in modern farming practices.

Market growth is supported by the increasing focus on sustainable agriculture. As farmers seek alternatives to heavy pesticide use and genetically modified crops, PGRs offer a more controlled and environmentally friendly approach. Their ability to enhance crop output while minimizing resource input creates long-term value.

Demand is further fueled by the rising need for food security, especially in developing countries with limited arable land. Controlled plant growth helps maximize yields even in sub-optimal conditions. Additionally, the ornamental and turf management sectors contribute to steady market expansion. According to an industry report, Agriculture and related sectors receive an allocation of ₹1.52 lakh crore.

Key Takeaways

- Global Plant Growth Regulator Market is expected to be worth around USD 9.5 billion by 2034, up from USD 3.3 billion in 2024, and grow at a CAGR of 11.1% from 2025 to 2034.

- Cytokinins dominate the Plant Growth Regulator Market, capturing 34.2% due to their role in cell division.

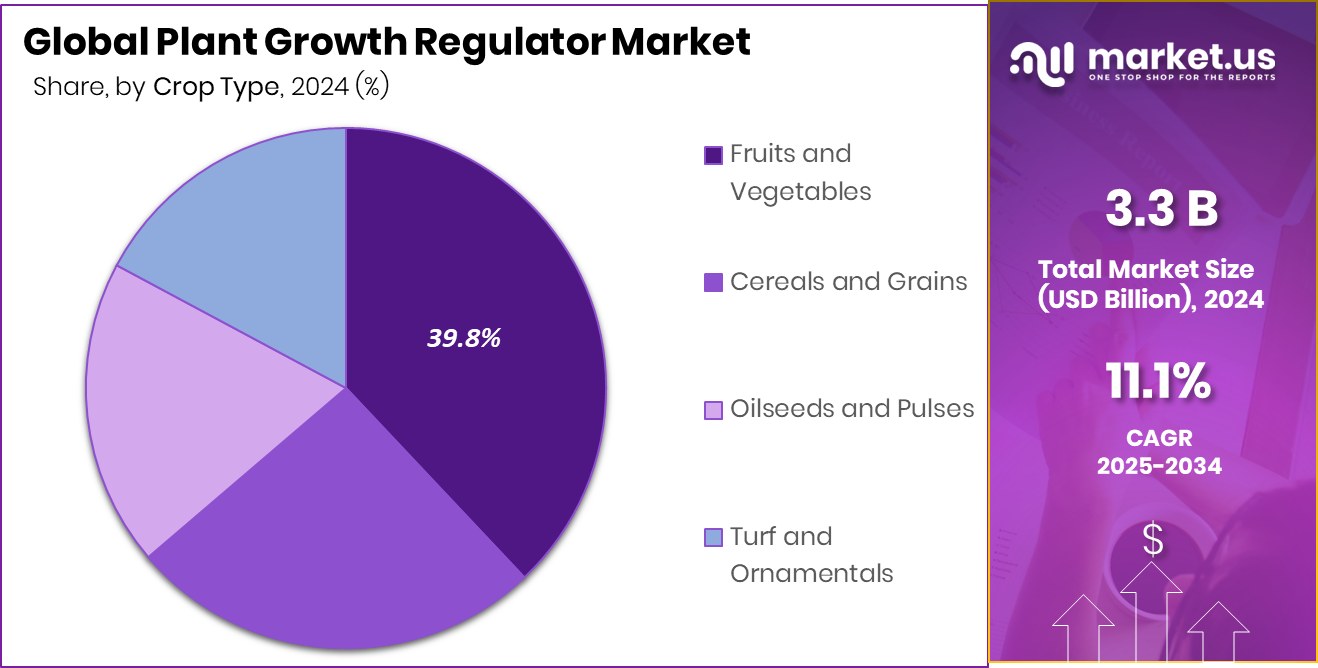

- Fruits and Vegetables lead the Plant Growth Regulator Market with 39.8%, driven by quality and yield demands.

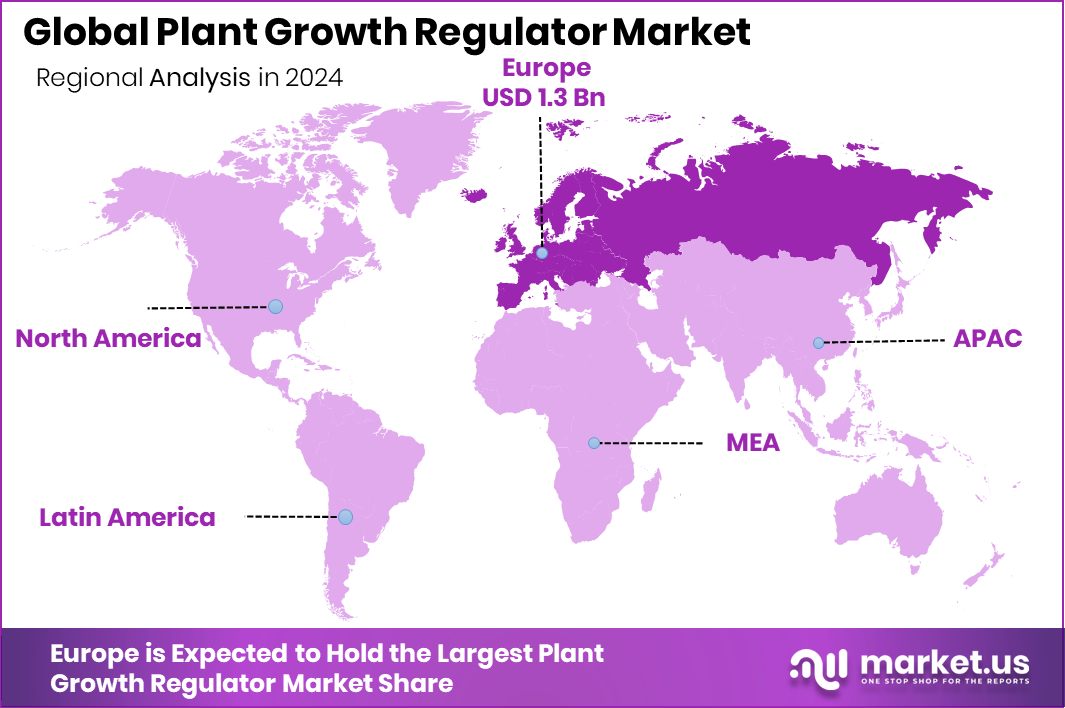

- The European market value reached approximately USD 1.3 billion during the same year.

By Type Analysis

Cytokinins dominate Plant Growth Regulator Market with a 34.2% share.

In 2024, Cytokinins held a dominant market position in the By Type segment of the Plant Growth Regulator Market, with a 34.2% share. This strong performance can be attributed to their crucial role in promoting cell division, delaying leaf senescence, and enhancing nutrient mobilization within plants.

Cytokinins are widely used in agriculture and horticulture to improve crop yield and quality, particularly in fruits, vegetables, and flowers. Their ability to regulate shoot growth and influence various stages of plant development, including germination and flowering, has made them a preferred choice among cultivators seeking higher productivity with precision.

The increasing adoption of Cytokinins is further supported by the global emphasis on sustainable and efficient farming practices. With rising concerns over soil health and excessive agrochemical use, Cytokinins offer a less invasive, plant-friendly solution that aligns with evolving agricultural standards.

Their application has also gained traction in controlled environment agriculture and greenhouse settings, where managing plant growth phases is critical to ensuring timely and quality output. As growers continue to focus on optimizing plant physiology for maximum yield with minimal inputs, the demand for Cytokinins is expected to remain strong, reinforcing their leading share in the market.

By Crop Type Analysis

Fruits and Vegetables lead with 39.8% in the Plant Growth Regulator Market.

In 2024, Fruits and Vegetables held a dominant market position in the By Crop Type segment of the Plant Growth Regulator Market, with a 39.8% share. This leading position reflects the increasing reliance on plant growth regulators to enhance the size, appearance, and shelf life of horticultural produce.

The use of PGRs in fruits and vegetables has become an essential practice, especially in commercial cultivation, where uniformity and visual appeal directly influence market value. Growers apply these substances to manage flowering, improve fruit set, and regulate ripening, which not only improves yield consistency but also allows better control over harvest timing.

The strong share of this segment is also driven by growing consumer demand for high-quality, fresh produce. With rising health awareness and dietary shifts toward plant-based nutrition, fruits and vegetables have gained prominence, pushing farmers to adopt techniques that ensure maximum productivity per hectare.

In addition, the export of horticultural crops often requires strict quality standards, further reinforcing the use of growth regulators to meet international criteria. The application of these products in intensive farming and protected cultivation methods, such as greenhouses, has also contributed to their widespread acceptance, securing the segment’s leading position in the overall market.

Key Market Segments

By Type

- Cytokinins

- Auxins

- Gibberellins

- Ethylene

- Others

By Crop Type

- Fruits and Vegetables

- Fruits

- Vegetables

- Cereals and Grains

- Corn

- Wheat

- Rice

- Others

- Oilseeds and Pulses

- Cotton

- Soybean

- Sunflower

- Others

- Turf and Ornamentals

Driving Factors

Rising Demand for Higher Agricultural Productivity

One of the major driving factors behind the growth of the Plant Growth Regulator (PGR) market is the rising demand for higher agricultural productivity. As the global population increases, so does the need for more food production. Farmers are now under pressure to grow more crops using the same or even fewer natural resources.

Plant growth regulators help achieve this goal by improving plant health, increasing crop yields, and controlling growth stages more effectively. They support better flowering, fruiting, and root development, which leads to more efficient farming. With limited land and changing climate conditions, PGRs offer a reliable solution for producing more food without harming the environment, making them a valuable tool in modern agriculture.

Restraining Factors

Strict Government Rules Limit Product Usage Worldwide

A key restraining factor in the Plant Growth Regulator (PGR) market is the presence of strict government regulations around their production, sale, and usage. Since PGRs are chemical substances that influence plant growth, they are closely monitored for safety and environmental impact. Many countries require detailed approvals, testing, and labeling before these products can be used. This process can be time-consuming and expensive, especially for new or smaller companies.

In some regions, certain PGRs are banned due to health or ecological concerns, which limits market reach. These regulations often slow down product launches and restrict adoption, particularly in developing areas where approval systems are not fully established, making it harder for the market to grow freely.

Growth Opportunity

Organic Farming Creates New Market Growth Opportunity

The growing shift toward organic farming presents a strong opportunity for the Plant Growth Regulator (PGR) market. As more consumers prefer food grown without synthetic chemicals, farmers are adopting organic practices to meet this demand. To support plant health and improve crop yield in organic systems, natural PGRs derived from plants and microbes are being used more widely.

These organic-friendly regulators help in seed germination, flowering, and overall growth, without harming the environment or soil quality. This opens up a promising market segment focused on natural and sustainable products. As governments and consumers push for cleaner farming methods, the demand for eco-friendly PGRs is expected to grow, creating fresh business opportunities for manufacturers and suppliers.

Latest Trends

Use of Biostimulants Alongside Growth Regulators Rising

A major trend in the Plant Growth Regulator (PGR) market is the increasing use of biostimulants along with traditional growth regulators. Farmers are combining these two products to improve plant performance naturally while still managing growth stages effectively. Biostimulants, which are made from natural materials like seaweed extracts, beneficial bacteria, and amino acids, help improve soil health and increase the plant’s resistance to stress like heat or drought.

When used with PGRs, they create a balanced solution that enhances crop yield and quality without heavy chemical input. This trend is gaining popularity, especially in environmentally conscious farming, as it supports sustainable practices while maintaining high productivity across a wide range of crops.

Regional Analysis

In 2024, Europe led the Plant Growth Regulator Market with a 41.9% share.

In 2024, Europe held a dominant position in the global Plant Growth Regulator Market, capturing 41.9% of the total share, which translated to a market value of approximately USD 1.3 billion. The region’s leadership can be attributed to its strong agricultural infrastructure, advanced farming practices, and increased emphasis on high-value crops.

European farmers have shown a consistent shift toward regulated crop growth methods to enhance yield quality and meet stringent food safety standards. In North America, the market showed steady performance, supported by the rising focus on precision farming and increased adoption of plant-based agricultural inputs.

The Asia Pacific region experienced growing interest, particularly in countries with expanding agricultural economies, as the need for improving crop efficiency became more critical. Meanwhile, Latin America and the Middle East & Africa represented emerging markets with developing agricultural sectors.

Although their shares remained smaller, both regions are gradually embracing growth-enhancing technologies to improve crop resilience and output. Overall, Europe remained the largest contributor in 2024, with its well-established farming sector, technological readiness, and proactive regulatory support continuing to reinforce its leading position in the global plant growth regulator market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Arysta LifeScience continued to position itself as a specialized firm focused on niche PGR products. With its lean organizational structure and agile research and development pipeline, the company effectively delivers targeted solutions for specific crops and growing conditions. Its strength lies in deep product customization and fast commercialization, positioning it as a sought‑after partner in regions requiring tailored agronomic support.

BASF SE maintained a solid presence by integrating its PGR portfolio within broader crop protection and seed treatment programs. Leveraging scale benefits, BASF offered value through bundled agronomic solutions that incorporate regulators with fungicides and insecticides. The company’s global distribution network and cross‑segment expertise gave it a competitive edge in cross‑selling PGRs to established agricultural customers seeking one‑stop vendors.

Bayer AG strengthened its market position by combining PGR products with digital agronomy tools and seed biology platforms. Its holistic approach, integrating regulators into seed treatment and precision spraying systems, reflected a broader strategy to meet modern growers’ demands. Bayer’s focus on digital traceability and compliance further allowed customers to justify PGR investment while meeting traceability and sustainability benchmarks.

Corteva, Inc. reinforced its role in the PGR space through partnerships and strong outreach in emerging economies. The company emphasized education and extension services, helping farmers in Asia and Latin America adopt advanced regulatory solutions. This farmer-centric engagement, alongside Corteva’s substantial investments in formulation improvement, reinforced its image as a growth-focused and farmer‑oriented PGR provider.

Top Key Players in the Market

- Arysta Life science

- BASF SE

- Bayer AG

- Corteva, Inc.

- FMC Corporation

- Nufarm Ltd.

- Sichuan Guoguang Agrochemical Co., Ltd

- Sumitomo Chemical Australia

- Syngenta AG

- TATA Chemicals Limited

- UPL Limited

Recent Developments

- In September 2024, BASF Ag Solutions highlighted the use of PGRs (e.g., Caryx®) for autumn application in oilseed rape (OSR) to counteract early drilling and milder winters—boosting yield potential by preserving bud formation.

- In June 2024, Bayer announced its goal to develop ten high-impact products over the next decade, including PGRs integrated with its Crop Science portfolio. Each blockbuster is projected to generate over €500 million in annual sales, reflecting Bayer’s strong investment in advanced agricultural solutions that boost crop yield and support regenerative farming practices.

Report Scope

Report Features Description Market Value (2024) USD 3.3 Billion Forecast Revenue (2034) USD 9.5 Billion CAGR (2025-2034) 11.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Cytokinins, Auxins, Gibberellins, Ethylene, Others), By Crop Type (Fruits and Vegetables (Fruits, Vegetables), Cereals and Grains (Corn, Wheat, Rice, Others), Oilseeds and Pulses (Cotton, Soybean, Sunflower, Others), Turf and Ornamentals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Arysta Life science, BASF SE, Bayer AG, Corteva, Inc., FMC Corporation, Nufarm Ltd., Sichuan Guoguang Agrochemical Co., Ltd, Sumitomo Chemical Australia, Syngenta AG, TATA chemicals limited, UPL Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Plant Growth Regulator MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Plant Growth Regulator MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Arysta Life science

- BASF SE

- Bayer AG

- Corteva, Inc.

- FMC Corporation

- Nufarm Ltd.

- Sichuan Guoguang Agrochemical Co., Ltd

- Sumitomo Chemical Australia

- Syngenta AG

- TATA Chemicals Limited

- UPL Limited