Global Plant Extracts Market Size, Share, And Enhanced Productivity By Form (Liquid Oil, Solid Powder), By Type (Essential Oils, Oleoresins, Flavonoid, Alkaloids, Carotenoids, Others), By End Use Industry (Food and Beverages, Cosmetics and Personal Care, Pharmaceuticals, Nutraceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171420

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

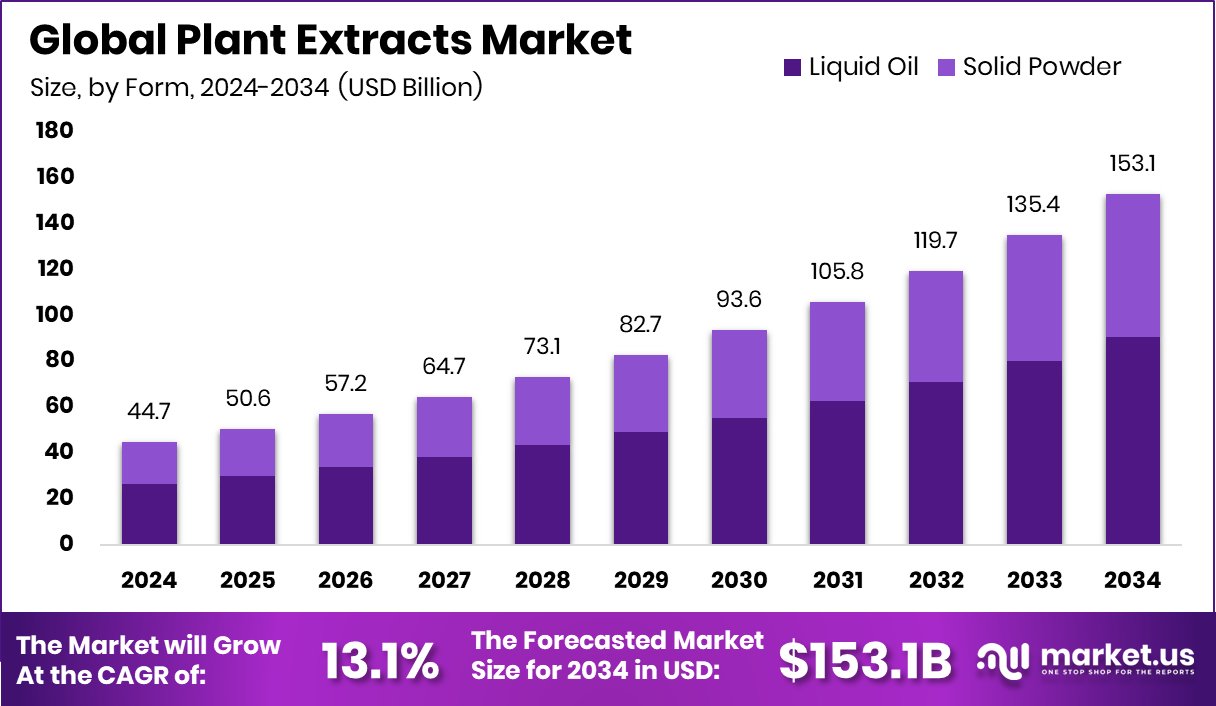

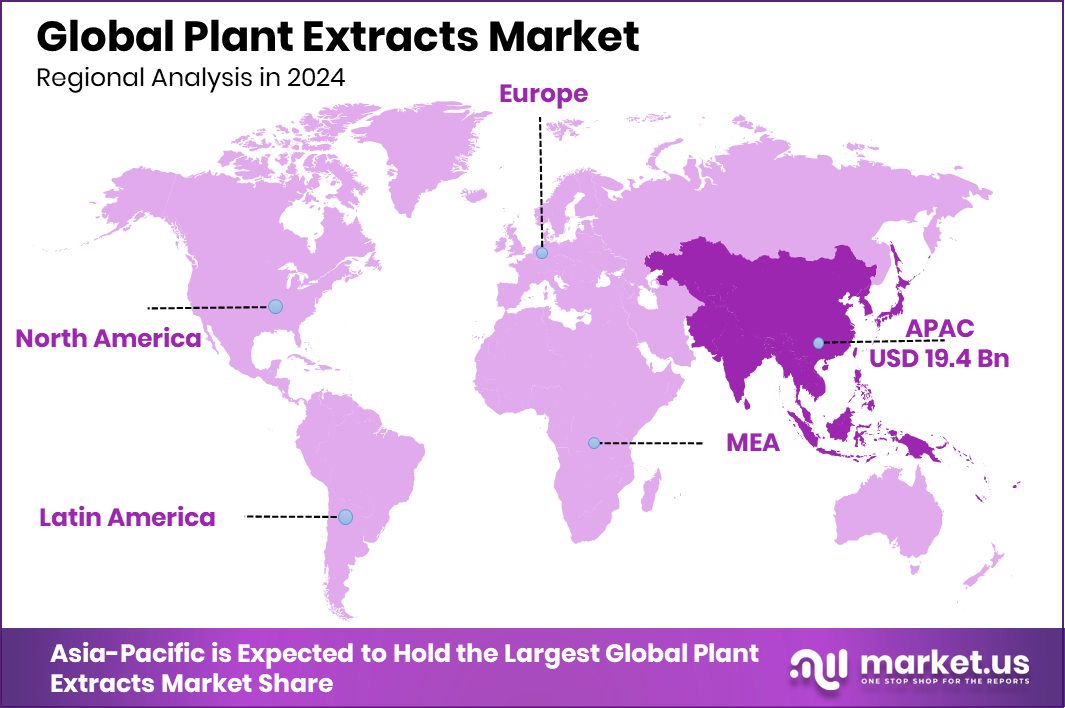

The Global Plant Extracts Market is expected to be worth around USD 153.1 billion by 2034, up from USD 44.7 billion in 2024, and is projected to grow at a CAGR of 13.1% from 2025 to 2034. The Asia-Pacific region led the plant extracts market, holding 43.50% and generating USD 19.4 Bn.

Plant extracts are concentrated substances obtained from leaves, roots, seeds, bark, or flowers using physical, chemical, or biological extraction methods. These extracts capture the natural compounds of plants, such as flavors, colors, nutrients, or bioactive elements, and are used where consistency and purity are important. Their value comes from retaining plant functionality in a usable and stable form.

The plant extracts market refers to the commercial ecosystem involved in producing, processing, and supplying these plant-derived concentrates across multiple applications. The market connects agriculture, extraction technologies, and downstream industries that rely on natural raw materials. It continues to evolve as extraction science improves and natural resource efficiency becomes more important.

Growth factors for the market are closely linked to advances in extraction technologies and biological innovation. For example, Genomines raised $45 million to extract critical metals using bioengineered plants, showing how plant-based extraction is expanding beyond traditional uses. Similarly, WVU researchers received $8 million to develop a rare earth extraction facility, highlighting institutional support for plant-linked extraction systems.

Demand is rising as industries seek more sustainable and efficient extraction routes. Projects such as a Japanese-funded $500 million initiative to extract hydrogen and a $1 million grant for DNA extraction technology reflect broader interest in plant and bio-based extraction methods. These developments reinforce long-term demand for refined extraction outputs.

- Standard Lithium and Equinor secured a $225 million U.S. grant to develop a lithium extraction facility, underlining how extraction-focused investments can scale rapidly and open new commercial pathways for extract-driven markets.

Key Takeaways

- The Global Plant Extracts Market is expected to be worth around USD 153.1 billion by 2034, up from USD 44.7 billion in 2024, and is projected to grow at a CAGR of 13.1% from 2025 to 2034.

- In the plant extracts market, the liquid oil form leads with 59.3% share, driven by applications.

- In the plant extracts market, essential oils type accounts for 38.4%, reflecting strong aromatherapy demand.

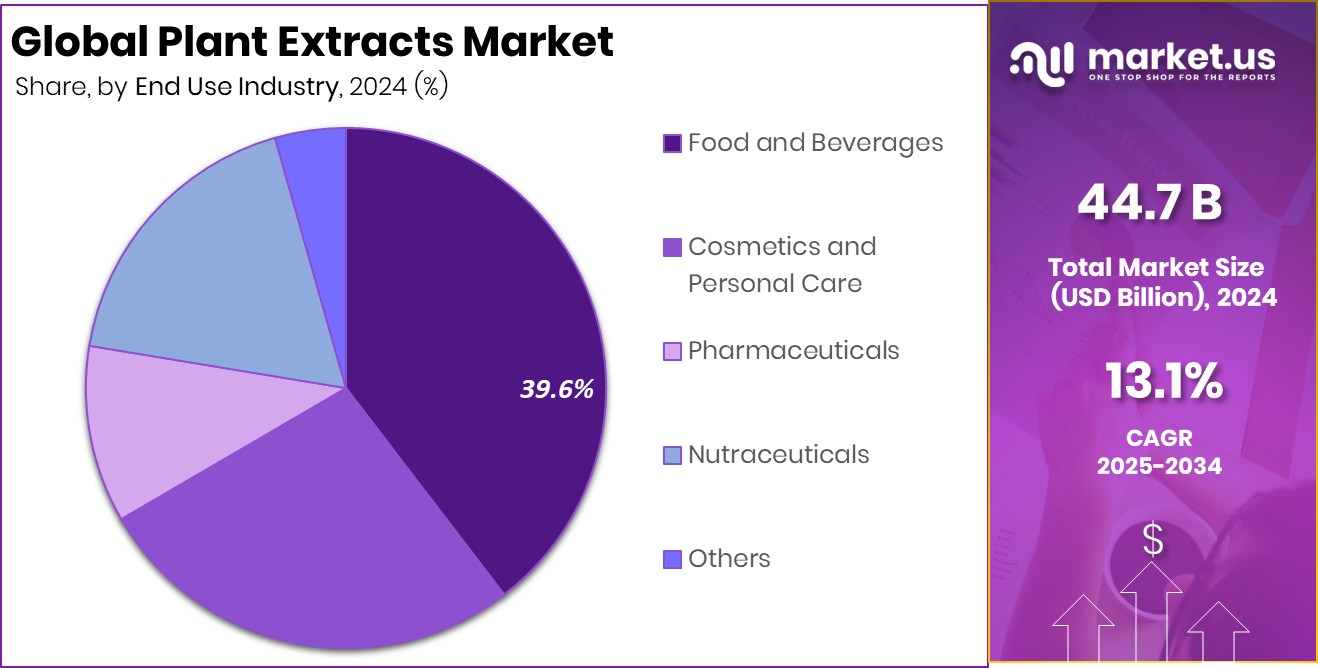

- In the plant extracts market, food and beverages end use holds 39.6%, driven by clean-label trends.

- The plant extracts market in Asia-Pacific reached 43.50%, accounting for USD 19.4 Bn in value.

By Form Analysis

Liquid oil form dominates the plant extracts market, holding a 59.3% share due to its versatility.

In 2024, Liquid Oil held a dominant market position in the By Form segment of the Plant Extracts Market, with a 59.3% share. This strong position reflects the widespread preference for liquid oil extracts across commercial applications where consistency, ease of blending, and controlled dosing are essential. Liquid oil formats allow manufacturers to integrate plant extracts smoothly into formulations without altering texture or stability, supporting their broad industrial acceptance.

The dominance of liquid oil is also linked to its efficient absorption and uniform dispersion properties, which enhance functional performance in finished products. These characteristics make liquid oil extracts reliable for large-scale processing, helping manufacturers maintain product uniformity and predictable outcomes. As a result, the segment continued to command a leading share in 2024, reinforcing its role as a preferred form within the plant extracts market.

By Type Analysis

Essential oils lead the plant extracts market by type, with 38.4% demand globally.

In 2024, Essential Oils held a dominant market position in the By Type segment of the Plant Extracts Market, with a 38.4% share. This leadership highlights the sustained demand for concentrated plant-derived oils valued for their strong aromatic profiles and functional characteristics. Essential oils remain a core category due to their natural origin and the high potency achieved through extraction processes.

The significant share held by essential oils also reflects their established commercial relevance and consistent demand across downstream value chains. Their concentrated nature allows for efficient usage in small quantities while delivering desired effects, supporting cost efficiency for manufacturers. In 2024, the essential oils segment maintained its dominance by balancing performance reliability with natural positioning, securing a substantial portion of the overall plant extracts market.

By End Use Industry Analysis

Food and beverages remain the key end uses, capturing 39.6% of the plant extracts market.

In 2024, Food and Beverages held a dominant market position in the By End Use Industry segment of the Plant Extracts Market, with a 39.6% share. This leading share underscores the strong integration of plant extracts into food and beverage formulations, where natural sourcing and flavor enhancement remain important. Plant extracts are widely utilized to support taste, aroma, and product differentiation within this industry.

The dominance of the food and beverages segment is further supported by steady demand for natural ingredients that align with evolving consumer preferences. Manufacturers continue to rely on plant extracts to maintain consistency and appeal across product portfolios. As a result, the food and beverages industry retained its leading role in 2024, accounting for a substantial share of overall plant extract consumption.

Key Market Segments

By Form

- Liquid Oil

- Solid Powder

By Type

- Essential Oils

- Oleoresins

- Flavonoid

- Alkaloids

- Carotenoids

- Others

By End Use Industry

- Food and Beverages

- Cosmetics and Personal Care

- Pharmaceuticals

- Nutraceuticals

- Others

Driving Factors

Rising Nutraceutical Demand Accelerates Plant Extracts Usage

Growing interest in daily nutrition and preventive wellness is a major driving factor for the Plant Extracts Market. Consumers are increasingly choosing nutraceutical products made with plant-derived ingredients because they are easy to consume and perceived as natural. This shift is pushing brands to rely more on standardized plant extracts for capsules, powders, and functional formats. The trend is clearly reflected in funding activity across nutraceutical start-ups that depend on plant-based inputs for formulation and differentiation.

In this context, nutraceutical ingredient start-up Zeus Hygia raised $2.5 million, strengthening ingredient innovation pipelines that often rely on plant extracts. Similarly, a brand producing stick-on supplements secured ₹50 lakhs on Shark Tank India, highlighting demand for convenient delivery formats using concentrated plant ingredients. Meanwhile, gut health-focused nutraceutical brand The Good Bug raised ₹100 crore, underlining strong investor confidence in plant-backed wellness solutions.

Restraining Factors

High Compliance Costs Restrain Plant Extracts Expansion

Rising regulatory and formulation compliance costs remain a key restraining factor for the Plant Extracts Market. Companies using plant extracts must invest heavily in safety validation, quality testing, and documentation to meet evolving standards. These requirements slow product approvals and increase operating expenses, especially for nutrition and wellness brands that rely on multiple botanical inputs. As a result, smaller players often face delays in scaling extract-based offerings, while even established firms must allocate significant capital to compliance instead of expansion.

This pressure is visible despite strong funding flows. Zingavita secured Rs 10 crore from Anicut Capital, while ARTAH Nutrition raised £2.85 million to grow its supplement business, both signaling growth intent alongside rising costs. Meanwhile, Bactolife raised over $32.9 million, yet must navigate complex compliance for microbiome and plant-linked formulations.

Growth Opportunity

Clean-Label Innovation Unlocks New Market Expansion

Rising investment in food and wellness innovation is creating a strong growth opportunity for the Plant Extracts Market. Brands expanding into clean-label, natural, and functional products increasingly rely on plant extracts to improve taste, nutrition, and differentiation. As production scales, extract demand grows alongside new product development, especially where natural ingredients replace synthetic inputs. This shift supports long-term volume growth for plant extracts across food, beverage, and wellness formulations.

Funding activity clearly reflects this opportunity. Chobani raised $650 million to expand production capacity and support innovation, reinforcing demand for natural and plant-based ingredients at scale. At the emerging brand level, Secret Alchemist secured $500,000 in seed funding, while Colipi raised EUR 1.8 million to advance its early-stage innovation, both relying on specialized natural inputs. These investments highlight how growth capital accelerates the adoption of plant extracts across both established and emerging businesses.

Latest Trends

Science-Backed Innovation Reshapes Plant Extract Applications

A key latest trend in the Plant Extracts Market is the shift toward science-backed research and responsible innovation. Companies and institutions are placing stronger emphasis on validated research to ensure plant extracts are used correctly, safely, and effectively. This trend is visible as research partnerships focus on separating proven plant benefits from unsupported claims, helping rebuild trust and credibility around extract-based products. The focus is no longer only on traditional uses, but on evidence-driven development and controlled applications.

At the same time, adjacent innovation is influencing extract usage. Ole Miss struck a $5 million research deal with a company previously warned over essential oil claims, signaling a move toward regulated, research-led extract studies. In parallel, Meatable raised $47 million in Series A funding to scale alternative protein production, where plant-derived inputs and extracts support flavor and formulation innovation.

Regional Analysis

Asia-Pacific dominated the plant extracts market with a 43.50% share, valued at USD 19.4 Bn.

The Plant Extracts Market shows varied regional dynamics across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, shaped by differences in consumption patterns and industrial usage. Asia-Pacific emerged as the dominating region, accounting for 43.50% of the market and reaching a value of USD 19.4 Bn, reflecting its strong production base and wide application of plant extracts across multiple end-use industries. The region’s dominance highlights its large-scale utilization of natural ingredients and well-established processing capabilities.

North America represents a mature market where plant extracts are widely adopted across established value chains, supported by steady demand for natural inputs. Europe continues to maintain a stable position, driven by consistent use of plant-derived ingredients in industrial and commercial formulations.

The Middle East & Africa market remains at a developing stage, with gradual adoption of plant extracts across emerging applications. Latin America contributes through its resource availability and growing processing activities, supporting regional demand.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ADM continues to play a structurally important role in the global Plant Extracts Market due to its deep integration across agricultural sourcing, processing, and ingredient solutions. The company’s strength lies in its ability to scale plant-based inputs efficiently while maintaining consistent quality across large volumes. ADM’s long-standing expertise in crop-based value chains supports stable extract production, positioning the company as a dependable supplier for industries seeking standardized plant-derived ingredients.

Aethon is viewed as a focused participant in the plant extracts landscape, emphasizing specialized formulations and targeted applications. In 2024, Aethon’s market relevance is tied to its ability to customize extract solutions that align with specific functional requirements. Its operational approach prioritizes flexibility and niche optimization, allowing it to address evolving customer needs while maintaining technical depth within selected extract categories.

BASF SE brings a strong scientific and process-driven perspective to the Plant Extracts Market. The company leverages advanced chemistry, formulation expertise, and global manufacturing capabilities to enhance extract stability and performance. In 2024, BASF SE’s presence reflects its strategic focus on integrating plant-based inputs within broader ingredient systems, reinforcing its role as a technology-oriented leader rather than a volume-driven supplier.

Top Key Players in the Market

- ADM

- Aethon

- BASF SE

- Botanic Healthcare

- Carbery Group

- Dohler

- Kerry

- Martin Bauer

- Symrise

- Truly Essential

Recent Developments

- In April 2025, BASF introduced three natural-based ingredient innovations at in-cosmetics Global 2025. These include Verdessence® Maize (a corn-derived plant styling polymer), Lamesoft® OP Plus (a high natural-content opacifier), and Dehyton® PK45 GA/RA (a betaine from Rainforest Alliance certified coconut oil). These products support more sustainable personal care formulations.

- In May 2024, ADM published its “Three Trending Botanical Stars for 2024,” featuring grapeseed extract, peppermint extract, and green rooibos extract as part of its core botanical portfolio. These plant extracts demonstrate ADM’s focus on high-quality, standardized botanical solutions for food, beverage, and wellness applications.

Report Scope

Report Features Description Market Value (2024) USD 44.7 Billion Forecast Revenue (2034) USD 153.1 Billion CAGR (2025-2034) 13.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid Oil, Solid Powder), By Type (Essential Oils, Oleoresins, Flavonoid, Alkaloids, Carotenoids, Others), By End Use Industry (Food and Beverages, Cosmetics and Personal Care, Pharmaceuticals, Nutraceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ADM, Aethon, BASF SE, Botanic Healthcare, Carbery Group, Dohler, Kerry, Martin Bauer, Symrise, Truly Essential Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ADM

- Aethon

- BASF SE

- Botanic Healthcare

- Carbery Group

- Dohler

- Kerry

- Martin Bauer

- Symrise

- Truly Essential