Global Pizza Crust Mix Market Size, Share, And Enhanced Productivity By Product Type (Whole Grain Pizza Crust Mix, Semolina Flour, Gluten-Free Pizza Crust Mix), By Packaging Type (Pouches, Jars/Containers), By Distribution Channel (Direct Sales, Retail Sales), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 172048

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

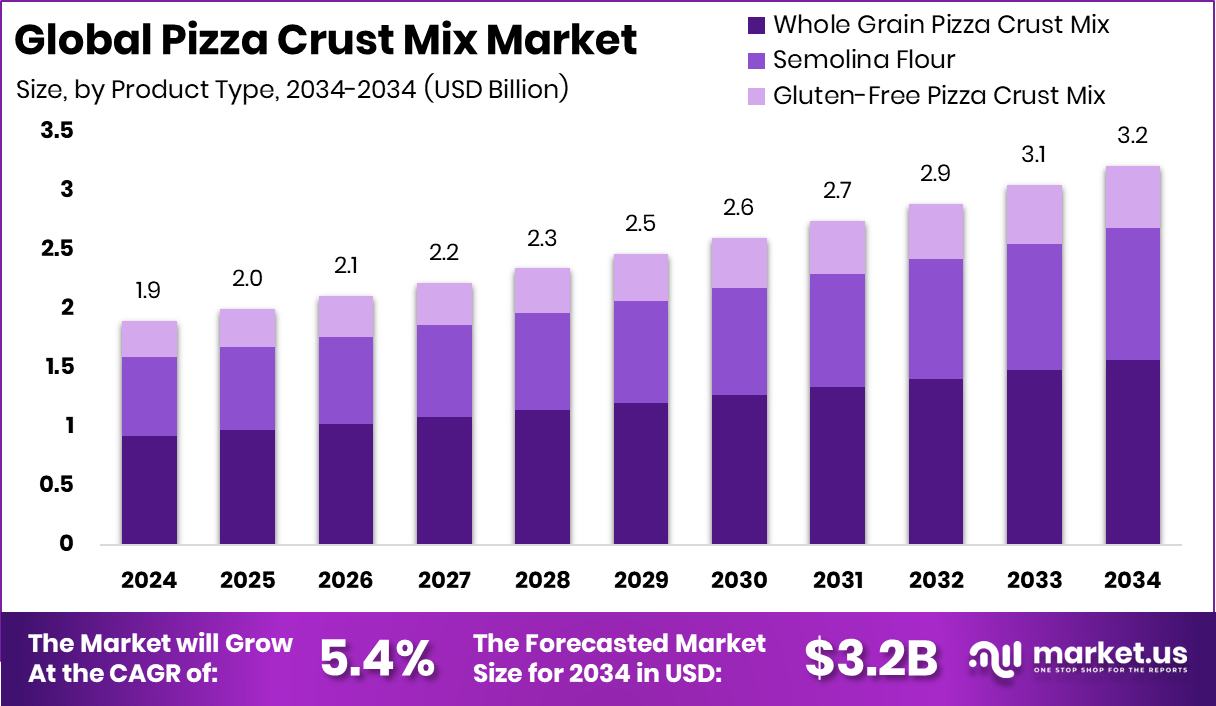

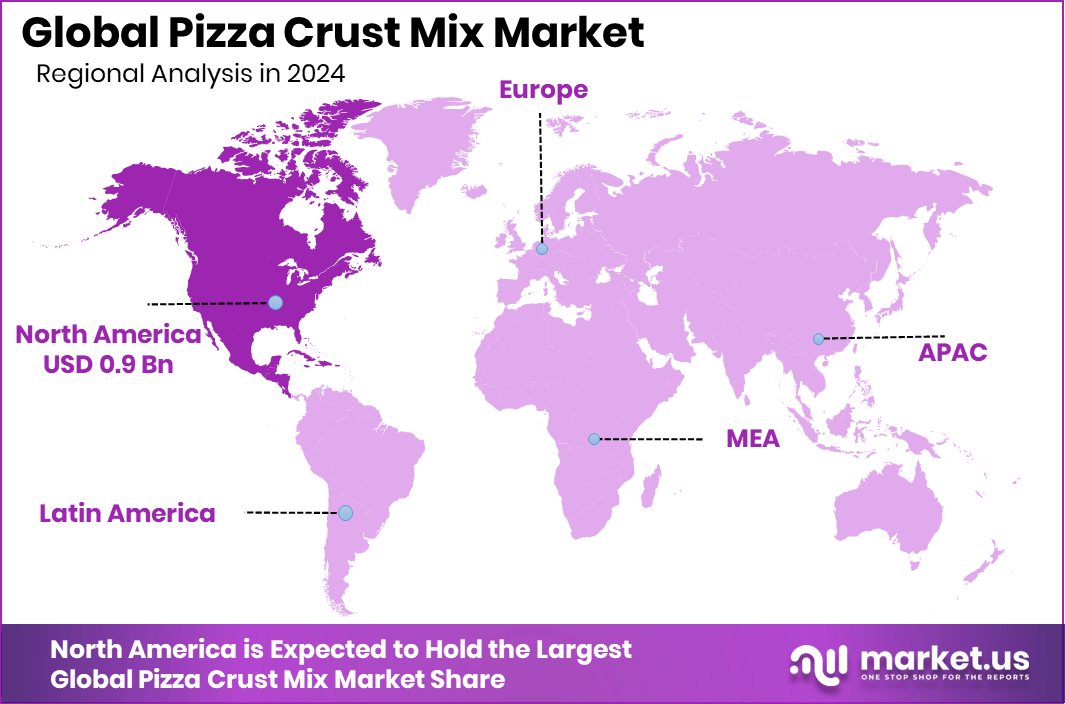

The Global Pizza Crust Mix Market is expected to be worth around USD 3.2 billion by 2034, up from USD 1.9 billion in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034. With 48.10% share, North America records USD 0.9 Bn Pizza Crust Mix sales.

Pizza crust mix is a pre-blended baking mix designed to help people make pizza dough easily at home. It contains flour and other key ingredients that allow users to prepare pizza bases without measuring individual components. The mix simplifies the dough-making process and ensures consistent texture and taste, making it ideal for busy households that want fresh pizza without the complexity of traditional dough preparation.

The pizza crust mix market refers to the commercial trade of these ready-to-use mixes sold through retail channels, grocery stores, and online platforms. This market includes a variety of formats that cater to different preferences, from whole-grain mixes to gluten-free options. It reflects consumer behavior around at-home meal preparation and the demand for convenient baking solutions that fit contemporary lifestyles.

A strong growth factor for the pizza crust mix market is increased investment in food innovation and supply chain capabilities. A California startup securing $10M in funding for an organic fertilizer plant underscores the broader trend of strengthening agricultural inputs, which supports reliable wheat and flour supplies used in pizza crust mixes.

Additionally, specialty chemicals startup Distil’s $7.7M Series A funding and Equilibrium’s $3M seed funding encourage formulation improvements and ingredient quality in baking mixes. These funding activities highlight financial support for ingredient and supply innovation that can improve mix performance and consumer trust.

Consumer demand is rising as more people choose home-cooked meals and baking experiences. An IPO-bound Rebel Foods raising $210 million indicates strong market belief in scalable food platforms catering to evolving tastes and convenience. Meanwhile, Qapita’s $26.5M for equity and fund management solutions reflects broader financial confidence in food sector growth. These funding trends link to increased interest in at-home baking categories like pizza crust mixes, driven by convenience and quality.

Future opportunities for the pizza crust mix market include product diversification and expanded retail reach. BUA Foods’ growing revenue to 1.07tn in nine months highlights the potential of large-scale food distribution and consumer access. This trend suggests that pizza crust mix makers can tap into expanding retail networks and evolving consumer lifestyles. There is room to innovate with new formats and ingredient blends that appeal to health-conscious and convenience-seeking buyers, shaping sustained market growth.

Key Takeaways

- The Global Pizza Crust Mix Market is expected to be worth around USD 3.2 billion by 2034, up from USD 1.9 billion in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034.

- Whole Grain Pizza Crust Mix led the Pizza Crust Mix Market with a 48.7% share.

- Pouches dominated the Pizza Crust Mix Market packaging, holding a 67.2% share overall globally today.

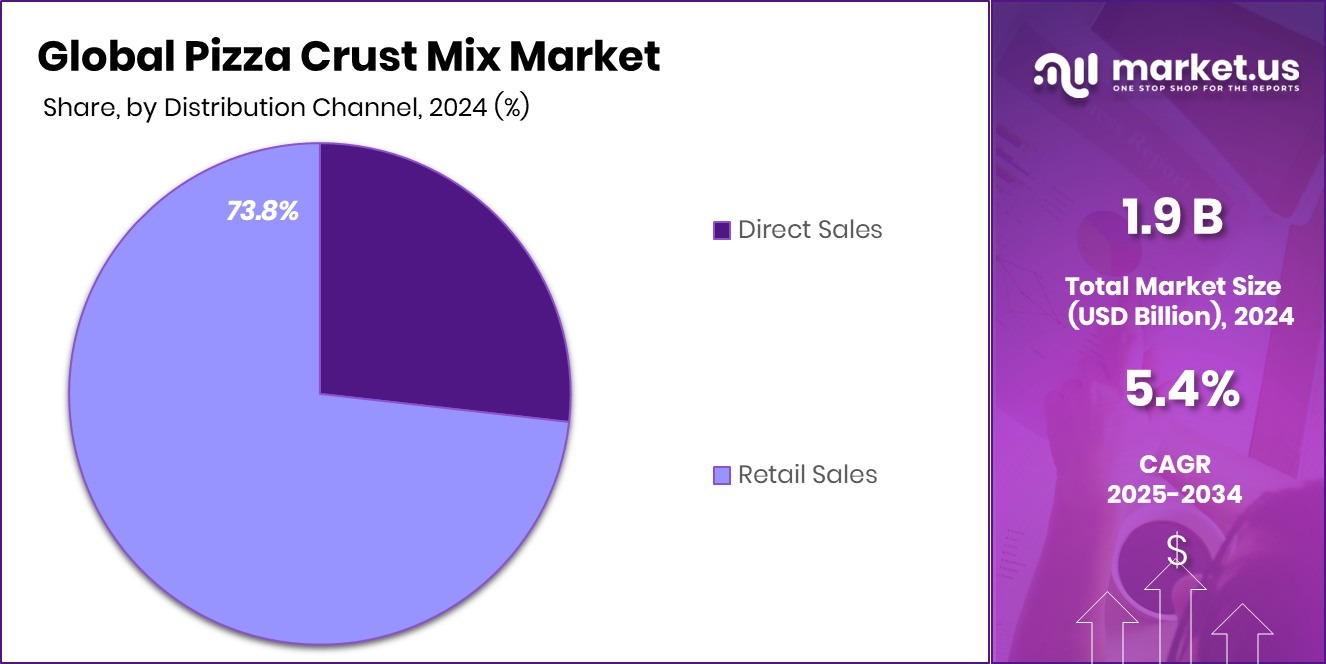

- Retail Sales controlled the Pizza Crust Mix Market distribution with a 73.8% share worldwide currently.

- Pizza Crust Mix Market in North America reaches USD 0.9 Bn, holding 48.10%.

By Product Type Analysis

Whole Grain Pizza Crust Mix led the Pizza Crust Mix Market with 48.7% share.

In 2024, Whole Grain Pizza Crust Mix held a dominant market position in the By Product Type segment of the Pizza Crust Mix Market, with a 48.7% share. This leadership reflects strong consumer interest in crust mixes that align with everyday home cooking needs while offering familiar preparation methods. Whole grain formats are widely accepted in household kitchens, supporting steady demand and repeat purchases.

The 48.7% share also indicates broad retail visibility and consistent consumer trust in this product type. Its ease of use and suitability for regular meal preparation help maintain stable sales volumes. As a result, whole-grain pizza crust mix remains a core contributor to overall market performance.

By Packaging Type Analysis

Pouches dominated the Pizza Crust Mix Market, accounting for 67.2% share.

In 2024, Pouches held a dominant market position in By Packaging Type segment of the Pizza Crust Mix Market, with a 67.2% share. This dominance highlights the strong preference for convenient, lightweight, and easy-to-store packaging formats. Pouches support freshness, portion control, and simple handling, which are important factors for home users.

With a 67.2% share, pouch packaging clearly outperforms other formats by meeting practical storage and usability expectations. Its wide acceptance also supports efficient shelf placement and consumer convenience, reinforcing its leading role within the packaging landscape of the pizza crust mix market.

By Distribution Channel Analysis

Retail Sales led the Pizza Crust Mix Market with a 73.8% share.

In 2024, Retail Sales held a dominant market position in the By Distribution Channel segment of Pizza Crust Mix Market, with a 73.8% share. This reflects the strong reliance on physical and organized retail outlets for purchasing pizza crust mixes. Consumers prefer retail stores for product comparison, immediate availability, and routine grocery shopping.

The 73.8% share underscores retail’s role as the primary access point for this category. Consistent shelf presence and direct consumer engagement help sustain high sales volumes, making retail sales the most influential distribution channel in the pizza crust mix market.

Key Market Segments

By Product Type

- Whole Grain Pizza Crust Mix

- Semolina Flour

- Gluten-Free Pizza Crust Mix

By Packaging Type

- Pouches

- Jars/Containers

By Distribution Channel

- Direct Sales

- Retail Sales

Driving Factors

Sustainable Packaging Awareness Supports Pizza Crust Mix Growth

One major driving factor for the pizza crust mix market is the growing focus on sustainability and waste reduction across food packaging and supply chains. Consumers increasingly prefer food products that align with environmental responsibility, which strengthens demand for packaged mixes produced with mindful practices. This shift is supported by real action, as the Glass Recycling Foundation awards $150K in grants to improve recycling systems. According to the foundation, nearly 1,660 tons of glass have been diverted from landfills through these efforts.

Such progress raises awareness around sustainable materials, waste management, and responsible consumption. As shoppers become more conscious of packaging impact, they favor brands and food categories that reflect these values. Pizza crust mixes, often sold in recyclable or lightweight packaging, benefit from this mindset. Overall, sustainability-driven initiatives help build consumer trust, improve brand perception, and support steady market growth for convenient baking products.

Restraining Factors

Rising Packaging Capacity Pressures Pizza Crust Mix Costs

A key restraining factor for the pizza crust mix market is rising pressure from packaging supply shifts and cost sensitivity. Moldova’s glass container company, announcing plans to expand production by 60%, highlights how packaging capacity is increasing faster than food demand in some regions. While this expansion improves availability, it can also create pricing imbalances and volatility in packaging contracts. For pizza crust mix producers, packaging is a critical cost element, and sudden changes in supply dynamics can affect margins.

Smaller producers may struggle to absorb higher minimum order requirements or fluctuating packaging prices. As packaging suppliers scale up operations, food brands must adjust sourcing strategies and logistics planning. This situation can slow product launches, limit packaging flexibility, and increase operational complexity. Overall, expanding packaging capacity without aligned food demand can indirectly restrain growth by adding cost pressure and planning challenges for pizza crust mix manufacturers.

Growth Opportunity

Home Cooking Trends Create Strong Market Expansion

A major growth opportunity for the pizza crust mix market comes from the steady rise in home cooking and do-it-yourself meal preparation. More consumers are choosing to cook meals at home to save time, manage costs, and control ingredients. Pizza remains one of the most popular homemade meals, and crust mixes make preparation easier without requiring baking expertise. This convenience attracts busy households, students, and first-time cooks. Pizza crust mixes also fit well with family meals, weekend cooking, and casual gatherings, supporting frequent usage.

As kitchens become centers for simple, enjoyable cooking experiences, demand for ready-to-use baking mixes increases. Retail availability and easy storage further strengthen this opportunity. Producers can benefit by offering clear instructions, consistent results, and flexible portion sizes. Overall, changing lifestyles and growing comfort with home baking create long-term expansion potential for the pizza crust mix market.

Latest Trends

Healthier Ingredients and Clean Label Demand Rising

A key latest trend in the pizza crust mix market is the growing focus on healthier ingredients and clean-label products. Today’s consumers are more careful about what they eat and want mixes made with whole grains, no artificial additives, and clear ingredient lists. People also look for mixes that support dietary preferences like whole wheat, high fiber, or simple grain blends that are easy to understand. This trend pushes brands to rethink formulations so that pizza crust mixes feel more natural and nourishing, not just convenient.

Retailers and shoppers increasingly seek products that deliver both taste and perceived health benefits. As a result, producers that highlight clean, recognizable ingredients are seeing stronger interest at store shelves and online carts. This shift toward mindful eating is shaping how pizza crust mix products are developed and marketed.

Regional Analysis

North America leads Pizza Crust Mix Market with 48.10% share, USD 0.9 Bn.

The Pizza Crust Mix Market shows varied performance across regions, shaped by consumption habits, retail penetration, and home-cooking trends. North America stands as the dominating region, accounting for 48.10% of the market and valued at USD 0.9 Bn. This strong position reflects widespread adoption of ready-to-use pizza solutions, high household penetration of packaged mixes, and established retail availability supporting regular purchases.

Europe represents a stable and mature regional market, supported by consistent demand for home-style pizza preparation and strong acceptance of packaged baking mixes. Asia Pacific shows gradual market development, driven by urban lifestyles, rising interest in Western-style foods, and expanding modern retail formats that improve product accessibility.

The Middle East & Africa region remains comparatively smaller but steady, with demand concentrated in urban centers where convenience foods are gaining popularity. Latin America reflects emerging growth potential, supported by changing food preferences and increased availability of packaged mixes through organized retail.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Bob’s Red Mill plays a meaningful role in the pizza crust mix market through its strong emphasis on ingredient transparency and traditional milling practices. The brand is widely recognized for offering dependable baking mixes that support home-style preparation. From an analyst perspective, Bob’s Red Mill benefits from consumer trust built around quality grains and consistent performance, which helps its pizza crust mixes remain relevant among everyday home bakers seeking reliable results.

Namaste Foods brings a focused value proposition by addressing specific dietary needs. Its pizza crust mixes cater to consumers who actively seek allergen-conscious and easy-to-prepare options. Analysts view Namaste Foods as an important niche contributor, strengthening market diversity by serving households that prioritize dietary clarity while still wanting convenient, at-home pizza solutions.

King Arthur Flour continues to influence the market through its deep-rooted baking expertise and strong educational approach. The company’s pizza crust mixes are positioned around consistency, technique, and baking confidence. From an analyst standpoint, King Arthur Flour stands out for reinforcing category credibility and encouraging repeat use through trusted formulations and strong engagement with home bakers.

Top Key Players in the Market

- Bobs Red Mill

- Namaste Foods

- King Arthur Flour

- Hodgson Mill

- Martha White

- King Arthur Flour

- ADM

- Pamela’s Product

- Namaste Foods

- Megabite Foods

- Bakers Spring

Recent Developments

- In February 2025, ADM announced its fourth quarter and full-year financial results for 2024, outlining earnings performance and reaffirming its strategic focus on simplifying its portfolio and increasing dividends to shareholders. This update underscores ADM’s efforts to align resources and drive long-term growth across its food and ingredient segments.

- In September 2024, King Arthur Baking Company brought pop-up shop experiences to Boston, MA, and Fairfax, VA, expanding its brand reach and offering fans direct access to its baking products and community activities. This initiative deepens engagement with home bakers and increases visibility for its mix products, including pizza crust mixs through experiential retail events.

Report Scope

Report Features Description Market Value (2024) USD 1.9 Billion Forecast Revenue (2034) USD 3.2 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Whole Grain Pizza Crust Mix, Semolina Flour, Gluten-Free Pizza Crust Mix), By Packaging Type (Pouches, Jars/Containers), By Distribution Channel (Direct Sales, Retail Sales) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bobs Red Mill, Namaste Foods, King Arthur Flour, Hodgson Mill, Martha White, King Arthur Flour, ADM, Pamela’s Products, Megabite Foods, Bakers Spring Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pizza Crust Mix MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Pizza Crust Mix MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bobs Red Mill

- Namaste Foods

- King Arthur Flour

- Hodgson Mill

- Martha White

- King Arthur Flour

- ADM

- Pamela's Product

- Namaste Foods

- Megabite Foods

- Bakers Spring