Global Pipe Coating Market Size, Share, And Business Benefits By Type (Thermoplastic Polymer Coatings, Fusion Bonded Epoxy Coatings, Bituminous, Concrete, Others), By Form (Liquid, Powder), By Application (Oil and Gas, Water and Wastewater, Chemical Processing, Mining, Agriculture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 160882

- Number of Pages: 213

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

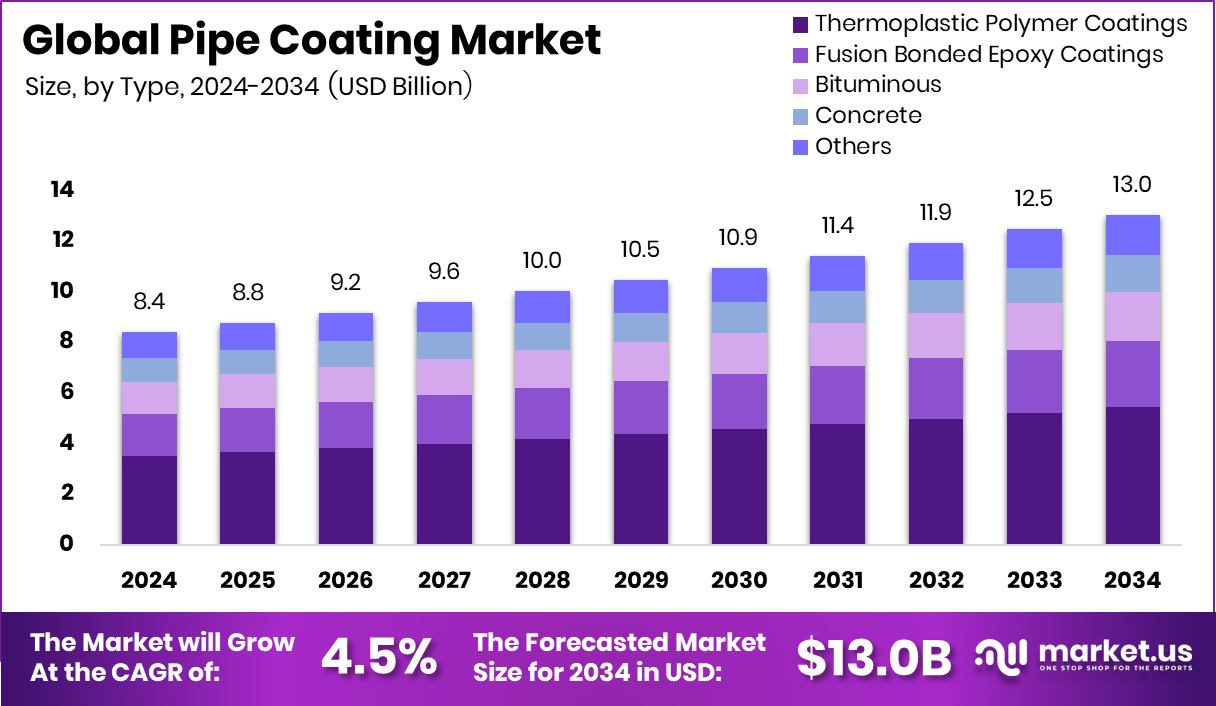

The Global Pipe Coating Market is expected to be worth around USD 13.0 billion by 2034, up from USD 8.4 billion in 2024, and is projected to grow at a CAGR of 4.5% from 2025 to 2034. Rising oil, gas, and water pipeline projects strengthened North America’s 42.8% share leadership in the pipe coatings.

A pipe coating is a protective layer applied to pipelines to guard against corrosion, abrasion, and degradation from external environments. As infrastructure investments grow and energy transportation expands, the pipe coating market is seeing heightened activity.

Recently, Loam Bio raised $73 million in a Series B round (from Lowercarbon, Acre, and others) aimed at bolstering soil carbon strategies; Koh secured a $1.5 million DOE grant to advance pipeline coating technologies; Welspun Corp received new orders worth ₹2,400 crore to supply coated pipes in the U.S.; and in the water sector, the Designer Liner initiative obtained £3.3 million in funding via Ofwat’s Innovation Fund to reduce leaks in water pipelines. These developments underscore rising interest and investment in coating technologies across sectors.

One major growth driver is the increasing demand for energy and water infrastructure modernization, pushing utilities and oil & gas firms to replace aging pipelines and upgrade to better-coated systems. Another catalyst is evolving regulatory norms and standards mandating longer pipeline lifespans and stricter environmental safeguards, which encourage the adoption of advanced, high-performance coatings. Finally, innovations in coating materials—such as nanocomposites, smart coatings with self-healing capacity, and environmentally friendly formulations—are expanding capabilities and applications, thus fueling market expansion.

The demand for pipe coatings is especially strong in sectors where asset integrity is critical: oil & gas (onshore and offshore), municipal water supply systems, wastewater lines, and industrial piping systems (chemicals, power plants). As aging pipelines deteriorate, operators increasingly seek reliable coatings to extend service life and reduce maintenance costs.

Opportunities abound in retrofitting and rehabilitation markets: applying interior or external coatings to existing pipelines can help reduce leaks, reduce downtime, and delay costly replacements. The water utilities sector offers a compelling chance, especially with global concerns over water loss and infrastructure leakage—initiatives like the Designer Liner funding show support for innovation here. In addition, developing coatings engineered for next-gen energy transport (like hydrogen pipelines or CO₂ sequestration systems) presents a fresh frontier, particularly as the energy transition gathers pace.

Key Takeaways

- The Global Pipe Coating Market is expected to be worth around USD 13.0 billion by 2034, up from USD 8.4 billion in 2024, and is projected to grow at a CAGR of 4.5% from 2025 to 2034.

- In 2024, thermoplastic polymer coatings dominated the Pipe Coating Market with a 41.7% share.

- Liquid coatings held a 63.8% share in the Pipe Coating Market during 2024.

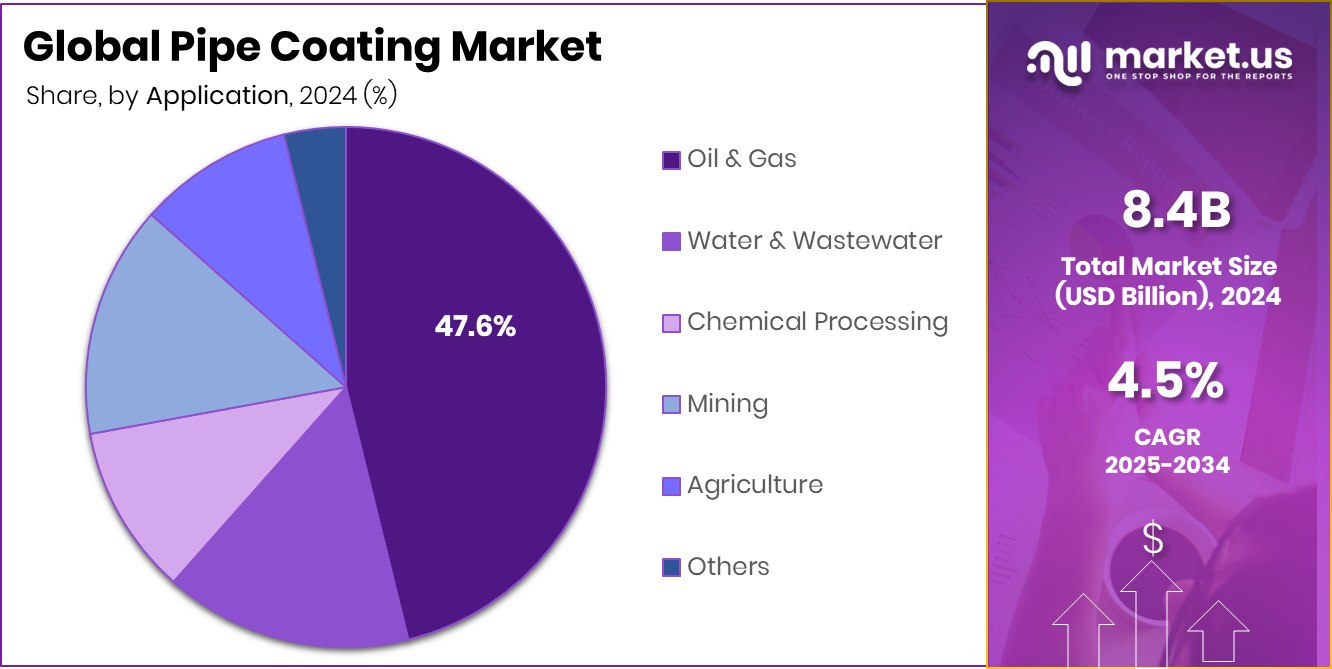

- The oil and gas segment led the Pipe Coating Market with a 47.6% share.

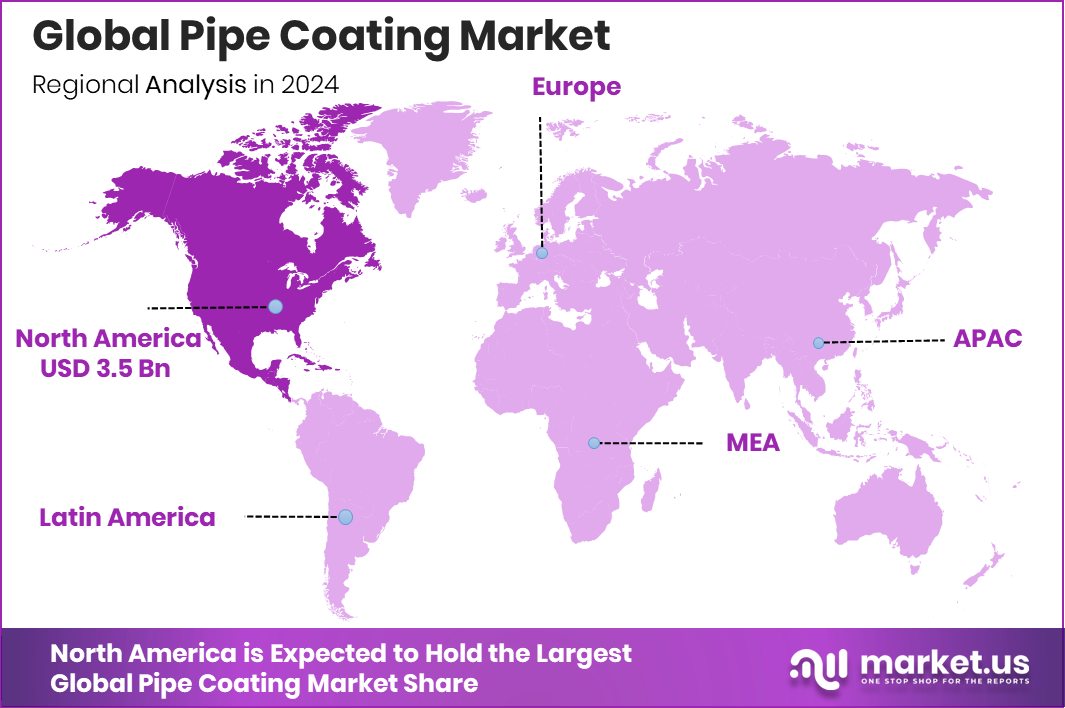

- The North American market value reached approximately USD 3.5 billion, driven by infrastructure investments.

By Type Analysis

In 2024, thermoplastic polymer coatings dominated the Pipe Coating Market.

In 2024, Thermoplastic Polymer Coatings held a dominant market position in the By Type segment of the Pipe Coating Market, with a 41.7% share. These coatings are widely preferred for their superior resistance to corrosion, abrasion, and chemical exposure, making them suitable for both onshore and offshore pipeline applications. Their ability to provide a durable barrier against moisture and harsh environmental conditions ensures extended pipeline life and reduced maintenance costs.

Growing infrastructure projects and increasing demand for efficient oil, gas, and water transportation systems have strengthened the adoption of thermoplastic polymer coatings. Additionally, advancements in application technologies and improved thermal performance have reinforced their position as the leading choice across industrial and utility pipeline systems.

By Form Analysis

Liquid coatings held the largest share in the Pipe Coating Market.

In 2024, Liquid held a dominant market position in the By Form segment of the Pipe Coating Market, with a 63.8% share. Liquid coatings are widely used due to their excellent adhesion, uniform coverage, and ability to protect complex pipeline surfaces against corrosion and chemical degradation. Their versatility allows easy application on both new and existing pipelines, making them ideal for maintenance and repair operations.

The strong preference for liquid coatings is also driven by their compatibility with various materials and ability to withstand extreme environmental conditions. Moreover, rising investments in energy, water, and industrial infrastructure projects have further supported the use of liquid coatings, ensuring durable protection and extended service life of pipelines across diverse applications.

By Application Analysis

Oil and gas pipelines remained the top application for the pipe coating market.

In 2024, Oil and Gas held a dominant market position in the by-application segment of the pipe coating market, with a 47.6% share. The segment’s growth is strongly driven by the extensive use of coated pipelines for transporting crude oil, natural gas, and refined products over long distances and across challenging terrains. Pipe coatings in this sector provide crucial protection against corrosion, moisture, and chemical exposure, ensuring safety and efficiency in high-pressure operations.

Increasing investments in pipeline infrastructure, exploration projects, and cross-border energy transportation have further boosted demand. The focus on extending pipeline lifespan and reducing maintenance costs has positioned coating solutions as an essential component in oil and gas transmission and distribution networks.

Key Market Segments

By Type

- Thermoplastic Polymer Coatings

- Fusion Bonded Epoxy Coatings

- Bituminous

- Concrete

- Others

By Form

- Liquid

- Powder

By Application

- Oil and Gas

- Water and Wastewater

- Chemical Processing

- Mining

- Agriculture

- Others

Driving Factors

Rising Infrastructure Renewal Boosting Pipe Coating Demand

One of the key driving factors for the Pipe Coating Market is the growing focus on upgrading and replacing aging infrastructure. Many countries are investing heavily to renew old water and gas pipelines to prevent leaks, corrosion, and contamination. A major example includes the $10 million in funding expected to replace lead pipes in Buffalo, highlighting the importance of safe and durable pipeline systems.

Such projects are creating strong demand for advanced pipe coatings that can extend pipeline life and resist harsh conditions. Governments and utilities are increasingly adopting protective coatings to ensure long-term performance, improve water quality, and reduce maintenance costs, making infrastructure renewal a powerful force driving the market forward.

Restraining Factors

High Installation Costs Limiting Market Expansion Potential

One major restraining factor for the pipe coating market is the high installation and maintenance costs associated with advanced coating systems. Applying specialized coatings often requires costly equipment, skilled labor, and strict environmental conditions, which increase project expenses. These costs can discourage small-scale pipeline operators and municipal projects from adopting premium coating solutions.

Additionally, fluctuations in raw material prices, especially polymers and resins, further impact affordability and project budgets. While funding initiatives such as infrastructure renewal programs aim to support upgrades, the overall expense of coating application remains a challenge. As a result, despite growing awareness of the long-term benefits, high initial investment continues to limit the widespread adoption of coated pipelines across cost-sensitive regions.

Growth Opportunity

Lead Pipe Replacement Creating Major Growth Opportunity

A major growth opportunity for the Pipe Coating Market lies in large-scale lead pipe replacement projects. Regions such as Wisconsin, which faces nearly $1 billion in costs to replace private lead lines, highlight the urgent need for safe and durable pipeline systems. This growing focus on clean water supply and public health is encouraging the use of protective coatings to prevent corrosion and contamination in new pipes.

Advanced coating materials can extend pipeline lifespan and improve resistance to moisture and chemicals, reducing long-term maintenance costs. As governments prioritize replacing hazardous water lines, the demand for effective coating solutions is expected to rise sharply, creating significant opportunities for innovation and expansion in the global pipe coating industry.

Latest Trends

Shift Toward Bio-Based Coatings Enhancing Sustainability Goals

A key trend shaping the Pipe Coating Market is the growing shift toward bio-based and sustainable coating materials. With increasing global focus on reducing environmental impact, manufacturers are exploring renewable alternatives to traditional petroleum-based polymers. A notable example is Lignin Industries raising €3.9 million to commercialize bio-based thermoplastics, reflecting strong momentum toward greener innovations.

Bio-based coatings not only help lower carbon footprints but also provide excellent protection against corrosion and chemical exposure. These materials are gaining popularity in water and gas pipeline applications due to their eco-friendly composition and performance efficiency. As sustainability becomes a key procurement criterion across industries, the adoption of bio-derived pipe coatings is expected to accelerate, redefining material standards and supporting cleaner infrastructure development.

Regional Analysis

In 2024, North America dominated the Pipe Coating Market with a 42.8% share.

In 2024, North America held a dominant position in the global Pipe Coating Market, accounting for 42.8% of the total share, valued at approximately USD 3.5 billion. The region’s leadership is supported by extensive oil and gas transmission networks across the United States and Canada, alongside growing investments in water and wastewater infrastructure modernization. Government initiatives aimed at replacing aging pipelines and improving corrosion protection have further strengthened market growth.

In Europe, steady demand stems from stringent environmental regulations and the region’s focus on sustainable and durable coating solutions. Asia Pacific continues to witness notable expansion driven by rapid urbanization, industrialization, and ongoing energy infrastructure development across China and India.

Meanwhile, the Middle East & Africa region benefits from large-scale oil exploration projects, which necessitate advanced coatings to withstand extreme environmental conditions. Latin America also shows gradual growth, with infrastructure rehabilitation and energy transport upgrades contributing to rising coating adoption.

Overall, North America remains the global leader due to its established industrial base, regulatory focus on safety, and continuous technological advancement in protective coating systems.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, PPG Industries, Inc. continued to strengthen its position in the global Pipe Coating sector by focusing on high-performance protective solutions designed for energy, water, and industrial pipelines. The company emphasized innovation in corrosion-resistant coatings that ensure long-term durability and environmental compliance. PPG’s advancements in liquid and powder-based coating technologies supported diverse pipeline applications, enhancing their operational efficiency and lifespan. Its continued investment in sustainable formulations also aligned with industry trends toward eco-friendly and low-emission coating systems.

Akzo Nobel N.V. maintained a strong presence in the market through its broad portfolio of high-performance coatings designed for both onshore and offshore pipeline systems. The company leveraged its deep expertise in industrial coatings to deliver solutions capable of withstanding extreme temperature and chemical exposure. Akzo Nobel’s focus on research and development allowed it to enhance coating durability and reduce maintenance needs, which is increasingly valued in modern infrastructure projects.

The Sherwin-Williams Company also played a key role, offering advanced protective coatings engineered to resist corrosion, abrasion, and harsh environmental conditions. Its continuous product development, emphasizing performance and environmental responsibility, contributed to its strong market footprint. The company’s focus on protective and marine coatings, combined with advanced application technologies, ensured high adoption across pipeline construction and rehabilitation projects.

Top Key Players in the Market

- PPG Industries, Inc.

- Akzo Nobel N.V.

- The Sherwin-Williams Company

- Valspar Industrial.

- Axalta Coating Systems, LLC

- WASCO ENERGY GROUP OF COMPANIES

- Arkema Group

- 3M

- Tenaris

- Winn & Coales (Denso) Ltd

Recent Developments

- In February 2025, in the offshore sector, AkzoNobel’s coatings designed for offshore steel pipe piles were highlighted for their ability to resist abrasion and mechanical damage in harsh marine conditions.

- In May 2024, Sherwin-Williams launched Pipeclad Frac-Shun ERC, a new erosion-resistant coating (ERC) technology to protect pipe interiors near fracking wellheads from abrasive grit, thereby reducing maintenance downtime.

Report Scope

Report Features Description Market Value (2024) USD 8.4 Billion Forecast Revenue (2034) USD 13.0 Billion CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Thermoplastic Polymer Coatings, Fusion Bonded Epoxy Coatings, Bituminous, Concrete, Others), By Form (Liquid, Powder), By Application (Oil and Gas, Water and Wastewater, Chemical Processing, Mining, Agriculture, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape PPG Industries, Inc., Akzo Nobel N.V., The Sherwin-Williams Company, Valspar Industrial, Axalta Coating Systems, LLC, WASCO ENERGY GROUP OF COMPANIES, Arkema Group, 3M, Tenaris, Winn & Coales (Denso) Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- PPG Industries, Inc.

- Akzo Nobel N.V.

- The Sherwin-Williams Company

- Valspar Industrial.

- Axalta Coating Systems, LLC

- WASCO ENERGY GROUP OF COMPANIES

- Arkema Group

- 3M

- Tenaris

- Winn & Coales (Denso) Ltd