Global Paraformaldehyde Market Size, Share, And Business Benefits By Type (Solid, Liquid), By Grade (Industrial Grade, Laboratory Grade), By Applications (Resins, Agrochemicals, Pharmaceuticals, Additives, Oil Well Drilling Chemicals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 149939

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

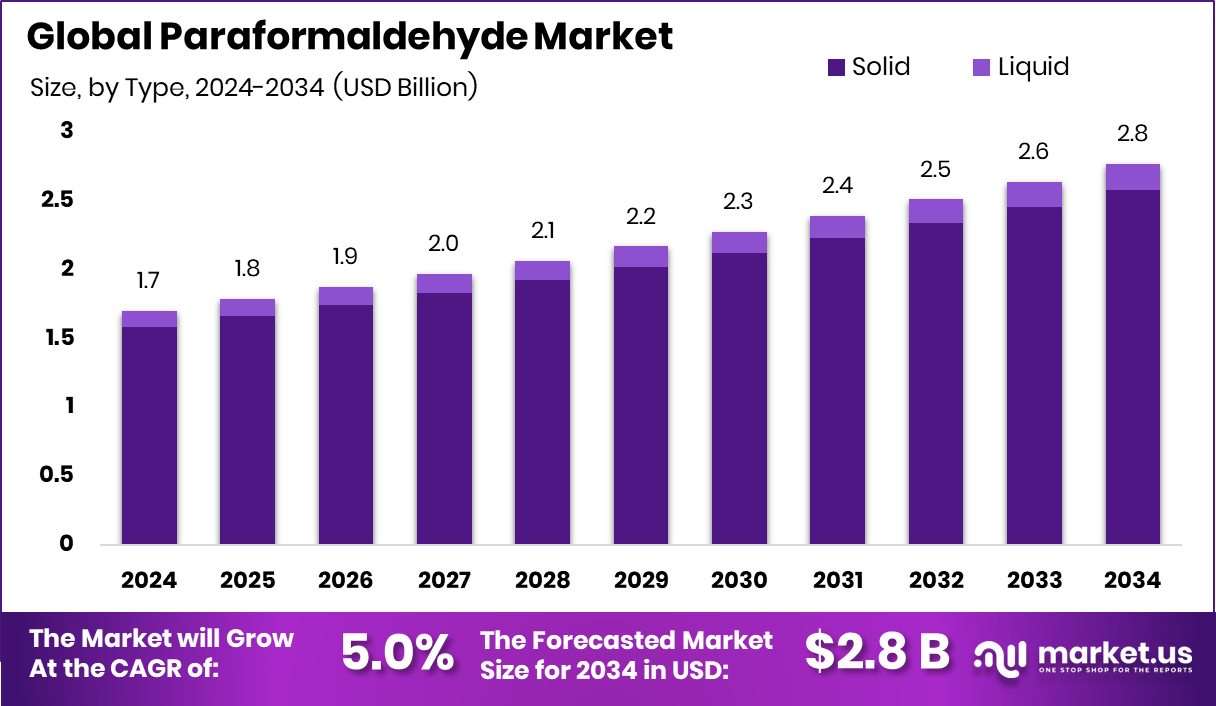

Global Paraformaldehyde Market is expected to be worth around USD 2.8 billion by 2034, up from USD 1.7 billion in 2024, and grow at a CAGR of 5.0% from 2025 to 2034. High agrochemical and resin demand pushed Asia-Pacific’s 45.3% market dominance in 2024.

Paraformaldehyde is a white, powdery polymer of formaldehyde used as a disinfectant, fixative, fumigant, and chemical intermediate. It’s essentially a solid form of formaldehyde with a concentration typically between 91% and 99%. When heated or dissolved, it depolymerizes back to formaldehyde gas, making it a convenient way to transport and handle formaldehyde in industries like agriculture, pharmaceuticals, resins, and coatings.

The Paraformaldehyde market is driven by its wide use across multiple sectors. Its growing demand in agrochemicals, especially herbicides and pesticides, has helped it gain industrial importance. It’s also a critical raw material in the production of thermosetting resins and pharmaceuticals. Countries with strong agriculture and chemical manufacturing bases have become major consumers, shaping a steady global demand outlook.

One of the major growth factors is the rising need for durable and high-performance resins in the automotive and construction industries. Paraformaldehyde is essential in producing these resins, especially where heat resistance and hardness are needed. Additionally, its use in the synthesis of specialty chemicals continues to rise, particularly in developing regions where manufacturing capacities are expanding.

On the demand side, there’s an uptick in pharmaceutical and medical research applications. Paraformaldehyde is used in tissue preservation and cell fixation in histology and pathology labs. This has helped maintain demand in the healthcare sector, especially with more diagnostic labs and research institutions being established globally.

Key Takeaways

- Global Paraformaldehyde Market is expected to be worth around USD 2.8 billion by 2034, up from USD 1.7 billion in 2024, and grow at a CAGR of 5.0% from 2025 to 2034.

- In 2024, solid paraformaldehyde held a 93.2% share, dominating the market due to easy handling.

- Industrial grade paraformaldehyde accounted for 88.3%, driven by strong demand across agriculture and chemical industries.

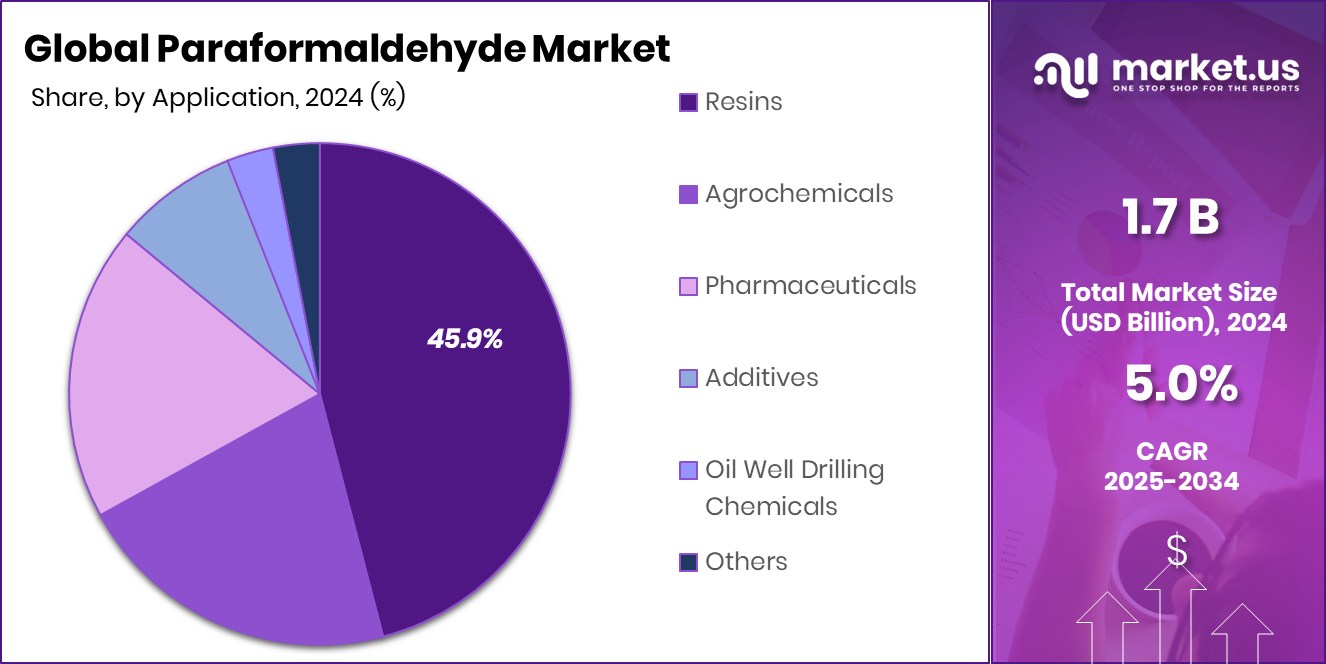

- Resins led application usage with a 45.9% share, fueled by growth in automotive and construction sectors globally.

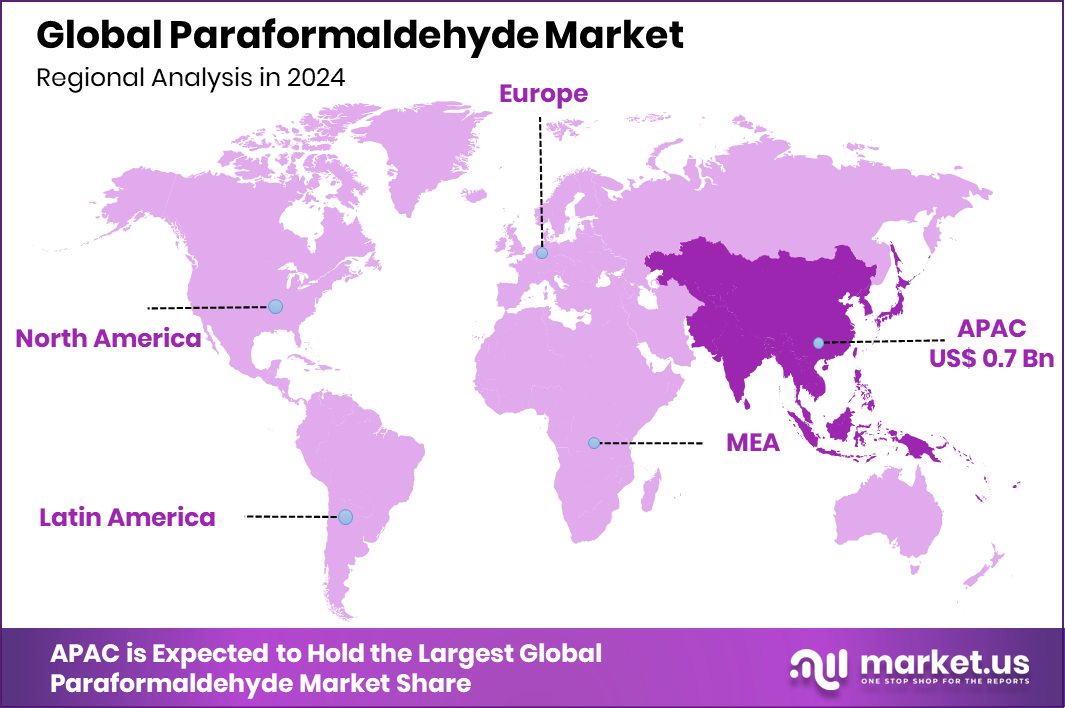

- The Asia-Pacific Paraformaldehyde Market reached a value of USD 0.7 billion in 2024.

By Type Analysis

In 2024, solid type dominated the Paraformaldehyde Market with a 93.2% share.

In 2024, Solid held a dominant market position in the By Type segment of the Paraformaldehyde Market, with a 93.2% share. The solid form of paraformaldehyde is widely preferred due to its high purity levels, ease of storage, and safer handling compared to liquid formaldehyde.

Its ability to depolymerize back to formaldehyde upon heating makes it a highly efficient intermediate in various industrial applications. Industries such as agrochemicals, resins, pharmaceuticals, and coatings rely heavily on solid paraformaldehyde for consistent quality and performance during synthesis and formulation processes.

The dominance of solid paraformaldehyde in the market is further strengthened by its compatibility with large-scale manufacturing systems, especially in pesticide production and resin molding. The low moisture content in the solid variant also ensures longer shelf life and less degradation, which is crucial for export-oriented chemical industries.

With stringent global transportation and safety regulations around liquid formaldehyde, solid paraformaldehyde offers a safer alternative while maintaining effectiveness. Its 93.2% market share highlights its established preference among industrial users who prioritize efficiency, safety, and reliability in chemical operations.

By Grade Analysis

Industrial grade Paraformaldehyde led by 88.3%, driven by widespread industrial processing applications.

In 2024, Industrial Grade held a dominant market position in the By Grade segment of the Paraformaldehyde Market, with an 88.3% share. This grade is widely utilized across key industries such as agrochemicals, resins, and chemical manufacturing, where high volumes and cost efficiency are critical.

The strong demand from pesticide and herbicide producers has particularly driven the consumption of industrial-grade paraformaldehyde, given its effectiveness as a precursor in synthesizing active ingredients. Its suitability for large-scale processing and consistent quality output makes it the preferred choice in high-throughput industrial setups.

Industrial Grade paraformaldehyde is also favored for its role in producing thermosetting resins used in construction and automotive sectors. These resins require a stable and reactive input material, which this grade reliably delivers. Additionally, its ease of handling and storage further support its wide acceptance across production facilities globally.

The 88.3% share reflects the dominance of applications that prioritize volume-driven usage and chemical performance over laboratory-grade precision. As industrial activities expand, especially in developing economies with growing infrastructure and agriculture demand, the use of this grade is expected to maintain its strong foothold.

By Applications Analysis

Resins application held a strong 45.9% share in the global Paraformaldehyde Market usage.

In 2024, Resins held a dominant market position in the By Applications segment of the Paraformaldehyde Market, with a 45.9% share. This significant share is driven by paraformaldehyde’s crucial role in manufacturing thermosetting resins such as phenol-formaldehyde, melamine-formaldehyde, and urea-formaldehyde.

These resins are widely used in construction, automotive, furniture, and electrical industries due to their durability, thermal resistance, and strong bonding properties. Paraformaldehyde acts as a key intermediate that enhances polymer cross-linking, offering superior performance in high-strength adhesives, molded products, and laminates.

The resin segment benefits from large-scale demand for engineered wood products, insulation materials, and industrial coatings—all of which rely on consistent resin quality. With construction and infrastructure activities rising across emerging economies, the use of paraformaldehyde in resin synthesis has seen a corresponding increase. The 45.9% market share reflects its embedded use across value chains where high-volume resin output is essential.

Additionally, the solid form of paraformaldehyde used in resins offers manufacturers better control over reactivity and formulation stability. The dominance of this segment is expected to continue as resin applications expand into new areas such as lightweight composites and heat-resistant coatings.

Key Market Segments

By Type

- Solid

- Liquid

By Grade

- Industrial Grade

- Laboratory Grade

By Applications

- Resins

- Agrochemicals

- Pharmaceuticals

- Additives

- Oil Well Drilling Chemicals

- Others

Driving Factors

Growing Use of Agrochemicals Boosts Demand Rapidly

A key driving factor for the paraformaldehyde market is its increasing use in agrochemicals. Paraformaldehyde is a major raw material in making herbicides, pesticides, and fungicides. As farmers aim for higher crop yields and better protection against pests, the demand for agrochemicals is rising worldwide. This is especially true in countries with large farming sectors like India, China, and Brazil.

Since paraformaldehyde helps create effective crop protection products, its market is growing fast. It is easy to transport and use, which makes it more attractive for large-scale agrochemical companies. As agricultural practices shift toward modern, chemical-based methods, the need for paraformaldehyde continues to rise, making this one of the strongest growth drivers for the market today.

Restraining Factors

Health and Safety Risks Limit Market Growth

One major restraining factor for the paraformaldehyde market is the health and safety concerns linked to its use. Paraformaldehyde releases formaldehyde gas, which is known to be toxic and potentially cancer-causing with long-term exposure. Workers in factories or labs where paraformaldehyde is used must follow strict safety rules, including protective gear and proper ventilation.

These extra safety measures increase costs and limit their use in smaller or poorly equipped industries. In many countries, regulations on handling and transporting paraformaldehyde are becoming stricter, which can slow down production or distribution. Due to these health risks and regulatory hurdles, some manufacturers are looking for safer alternatives, which can affect the future growth of the paraformaldehyde market.

Growth Opportunity

Eco-Friendly Coatings and Biocides Drive Market Growth

A significant growth opportunity for the paraformaldehyde market lies in its expanding application in eco-friendly coatings and biocides. As industries shift towards sustainable practices, there’s a growing demand for low-emission and environmentally friendly products. Paraformaldehyde plays a crucial role in producing resins used in water-based coatings, which are preferred for their reduced volatile organic compound (VOC) emissions.

Additionally, its use in manufacturing biocides aligns with the increasing need for effective antimicrobial agents in various sectors, including paints, coatings, and water treatment. The push for greener alternatives and stricter environmental regulations is prompting manufacturers to adopt paraformaldehyde-based solutions that meet these new standards.

Latest Trends

Eco-Friendly Coatings and Biocides Drive Market Growth

A significant growth opportunity for the paraformaldehyde market lies in its expanding application in eco-friendly coatings and biocides. As industries shift towards sustainable practices, there’s a growing demand for low-emission and environmentally friendly products.

Paraformaldehyde plays a crucial role in producing resins used in water-based coatings, which are preferred for their reduced volatile organic compound (VOC) emissions. Additionally, its use in manufacturing biocides aligns with the increasing need for effective antimicrobial agents in various sectors, including paints, coatings, and water treatment.

The push for greener alternatives and stricter environmental regulations is prompting manufacturers to adopt paraformaldehyde-based solutions that meet these new standards. This trend not only supports environmental goals but also opens new avenues for market expansion, positioning paraformaldehyde as a key component in the development of sustainable industrial products.

Regional Analysis

In 2024, Asia-Pacific led the Paraformaldehyde Market with 45.3% regional share.

In 2024, the Asia-Pacific region dominated the Paraformaldehyde Market, holding a significant share of 45.3%, with a market value of USD 0.7 billion. This dominance is primarily driven by high demand in agrochemicals, resins, and chemical manufacturing sectors. Countries like China, India, and Japan lead the market due to strong industrial activities and growing agricultural requirements. The expanding use of paraformaldehyde in pesticide production and resin manufacturing in these countries contributes significantly to this regional growth.

North America and Europe hold substantial shares in the market, driven by the demand for paraformaldehyde in pharmaceuticals, textiles, and chemical manufacturing. The North American market benefits from a well-established chemical industry, particularly in the United States, where paraformaldehyde is used extensively in the production of formaldehyde-based resins. Europe’s market, although smaller compared to Asia-Pacific, continues to see stable demand, especially for paraformaldehyde in high-performance resin applications.

The Middle East & Africa and Latin America hold smaller market shares. However, these regions are seeing growth due to increasing industrialization and agricultural activities. Latin America’s demand is driven by expanding agricultural practices, while the Middle East & Africa is focusing on improving industrial production capabilities, boosting paraformaldehyde usage.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Resins Holding GmbH solidified its status as Europe’s leading paraformaldehyde producer, with an annual output exceeding 125,000 tons. Leveraging over a century of expertise in methanol derivatives, Prefere Resins has optimized its products for low CO₂ emissions, aligning with the industry’s shift towards sustainable practices. Their extensive product range, including formaldehyde, paraformaldehyde, and various resins, caters to diverse applications in resins, coatings, and agrochemicals.

Alder S.p.A continued to be a notable player in the paraformaldehyde industry, contributing to the market’s diversity and competitiveness. While specific production figures for Alder S.p.A was not disclosed, the company’s inclusion among key market participants highlights its role in meeting global paraformaldehyde demand.

Simalin Chemical Industries Pvt Ltd, headquartered in Vadodara, India, has maintained a strong foothold in the paraformaldehyde market. Despite a slight moderation in operating revenue to ₹267 crore in fiscal 2024, down from ₹314 crore the previous year due to a fall in product prices, the company’s financial health remains robust. Simalin’s diversified product portfolio, including formaldehyde, hexamine, and methanol, caters to various industrial applications, reinforcing its market position.

Synthite, based in the United Kingdom, has a long-standing history as a chemicals manufacturer since its founding in 1920. The company supplies paraformaldehyde and other chemical products, serving industries such as resins, surface coatings, and textile finishes. Synthite’s commitment to quality, reliability, and flexibility has earned it a prestigious customer base and a solid reputation in the market.

Top Key Players in the Market

- Celanese Corporation

- Chemanol

- Ercros S.A

- Dover Chemical

- Prefere Resins Holding GmbH

- Alder S.p.A

- Merck KGaA

- Kothari Phytochemicals & Industries Ltd.

- Simalin Chemical Industries Pvt Ltd

- Synthite

- NANTONG JIANGTIAN CHEMICALS CO., LTD

- Jinan xiangrui chemical co., ltd

- Ekta International

Recent Developments

- In April 2025, Chemanol’s board initiated a forensic audit into the acquisitions of both GCI and ADDAR Chemicals Company (ACC). This decision, based on the audit committee’s recommendation, sought to assess the feasibility and strategic value of these deals, ensuring transparency and safeguarding shareholder interests.

- In March 2024, Ercros is actively implementing its “3D Plan” for 2021–2025, focusing on diversification, digitalization, and decarbonization. This strategic initiative includes 20 projects with a total investment of €92 million, aiming to transform Ercros into a more sustainable and innovative company.

Report Scope

Report Features Description Market Value (2024) USD 1.7 Billion Forecast Revenue (2034) USD 2.8 Billion CAGR (2025-2034) 5.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Solid, Liquid), By Grade (Industrial Grade, Laboratory Grade), By Applications (Resins, Agrochemicals, Pharmaceuticals, Additives, Oil Well Drilling Chemicals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Celanese Corporation, Chemanol, Ercros S.A, Dover Chemical, Prefere Resins Holding GmbH, Alder S.p.A, Merck KGaA, Kothari Phytochemicals & Industries Ltd., Simalin Chemical Industries Pvt Ltd, Synthite, NANTONG JIANGTIAN CHEMICALS CO., LTD, Jinan xiangrui chemical co., ltd, Ekta International Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Celanese Corporation

- Chemanol

- Ercros S.A

- Dover Chemical

- Prefere Resins Holding GmbH

- Alder S.p.A

- Merck KGaA

- Kothari Phytochemicals & Industries Ltd.

- Simalin Chemical Industries Pvt Ltd

- Synthite

- NANTONG JIANGTIAN CHEMICALS CO., LTD

- Jinan xiangrui chemical co., ltd

- Ekta International