Global OTR Tires Market Size, Share, Growth Analysis By Tire Type (Radial, Bias, Solid), By Vehicle Type (Earthmovers, Loaders & Dozers, Tractors, Forklift, Others), By Tire Size (31-40 inches, Below 31 inches, 41-45 inches, Above 45 inches), By Material (Rubber Compound, Reinforcing Material, Others), By Tire Weight (Upto 2000 lbs, 2001 to 4000 lbs, Above 4000 lbs), By Industry (Construction, Agriculture, Mining, Others), By Sales Channel (Aftermarket, OEM), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169396

- Number of Pages: 389

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Tire Type Analysis

- Vehicle Type Analysis

- Tire Size Analysis

- Material Analysis

- Tire Weight Analysis

- Industry Analysis

- Sales Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key OTR Tires Company Insights

- Recent Developments

- Report Scope

Report Overview

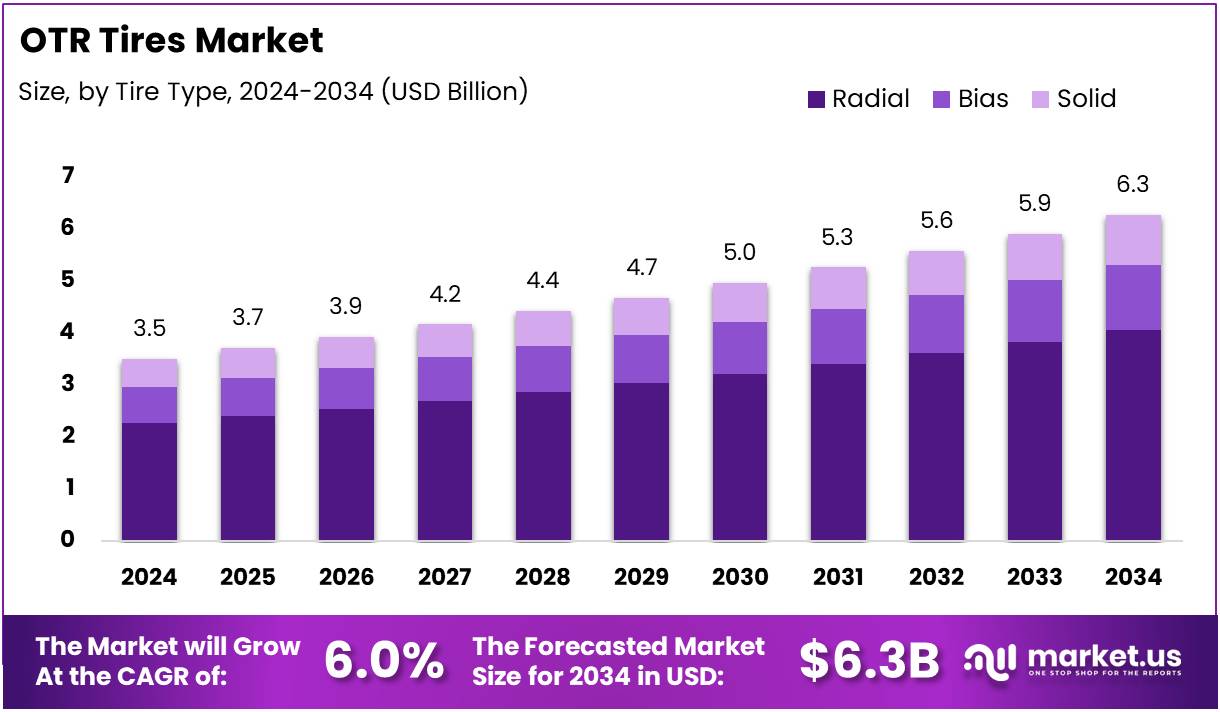

The Global OTR Tires Market size is expected to be worth around USD 6.3 Billion by 2034, from USD 3.5 Billion in 2024, growing at a CAGR of 6% during the forecast period from 2025 to 2034.

OTR tires represent heavy-duty products designed for construction, mining, and agricultural equipment operating on difficult terrains. These tires support high load cycles and demanding field conditions. The OTR Tires Market continues growing as industries invest in durable components that improve productivity, equipment stability, and operational safety across extreme applications.

Moving forward, market expansion is supported by strong infrastructure development across global regions. Governments continue increasing spending on road building, mining exploration, and rural development. These investments directly raise demand for heavy machinery, which drives consistent procurement of high-performance OTR tires engineered for tough and uneven work environments.

Additionally, regulations focused on workplace safety and equipment standards encourage frequent upgrades. Fleet operators increasingly prefer advanced materials, stronger treads, and heat-resistant structures. These shifts support consistent market growth as buyers look for reliable OTR tire solutions that reduce downtime, improve traction, and maintain stability under intense usage conditions.

Opportunities also expand as the industry adopts smart tires, predictive maintenance systems, and improved rubber compounds. These innovations help reduce operating costs and improve lifecycle performance. The growing shift toward automated and high-capacity machinery further boosts demand for OTR tires capable of sustaining heavier loads and continuous duty cycles.

Sustainability programs are also influencing the market. Companies are investing in environmentally responsible materials, cleaner manufacturing processes, and recycling technologies. Pyrolysis has become a valuable method for extracting useful resources from end-of-life OTR tires, improving circular economy adoption across industrial sectors and supporting long-term waste management objectives.

In terms of product characteristics, OTR tires can weigh up to 8,450 pounds and may reach an overall diameter of 140.7 inches with a width of 45.1 inches. These large dimensions reflect the heavy operational demands and load-bearing expectations common in mining and large construction equipment.

Moreover, during pyrolysis, OTR tyres typically yield 31–36% fuel-oil, 10–13% non-condensable gases, 31–38% carbon black, and 18–25% steel wire. These recovery levels highlight strong recycling value, reinforcing sustainability advantages and enhancing long-term economic opportunities within the global OTR Tires Market.

Key Takeaways

- Global OTR Tires Market expected to reach USD 6.3 Billion by 2034 from USD 3.5 Billion in 2024, growing at a CAGR of 6%.

- Radial tires dominate the market with 64.8% share due to superior performance and durability.

- Earthmovers lead the vehicle type segment with 33.6% share driven by infrastructure and mining activities.

- 31-40 inches tires capture 38.7% market share across multiple applications.

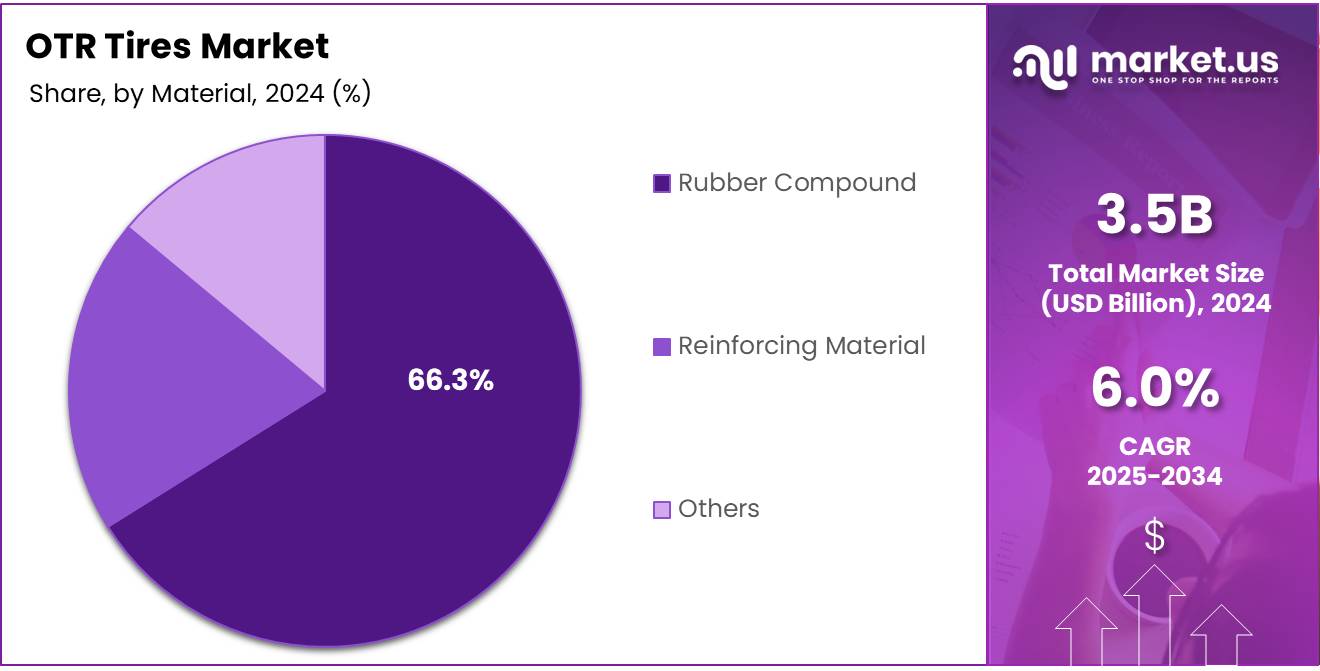

- Rubber Compound is the leading material segment at 66.3%.

- Tires weighing Upto 2000 lbs dominate with 44.9% share.

- Construction industry drives demand with 48.2% share of the market.

- Aftermarket sales channel leads with 71.4% share.

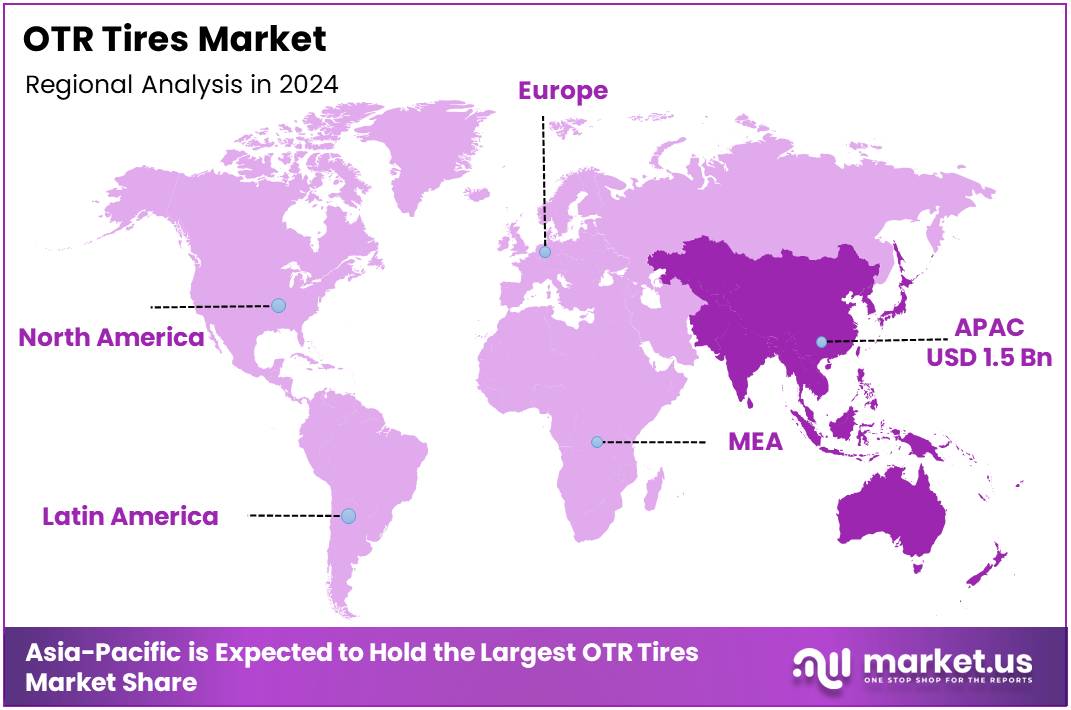

- Asia Pacific dominates the regional market with 43.8% share, valued at USD 1.5 Billion.

Tire Type Analysis

Radial dominates with 64.8% due to its superior performance and durability in heavy-duty applications.

Radial tires command the largest market share at 64.8%, driven by their exceptional load-bearing capacity and extended lifespan. These tires feature reinforced steel belts that provide enhanced stability and reduced heat generation during prolonged operations. Industries favor radial construction for its fuel efficiency benefits and superior traction on challenging terrains, making them ideal for mining and construction equipment.

Bias tires maintain significant presence in specific applications where flexibility and sidewall strength are prioritized. Their cross-ply construction offers excellent cut resistance and performs well in low-speed, high-torque operations. These tires are particularly valued in agricultural settings and certain construction environments where cost considerations and specific performance characteristics align with operational requirements.

Solid tires serve specialized segments requiring puncture-proof solutions for material handling and industrial applications. Their construction eliminates air-filled chambers, ensuring zero downtime from flats. These tires excel in controlled environments like warehouses and manufacturing facilities where debris and sharp objects pose constant threats, providing uninterrupted operations despite harsh working conditions.

Vehicle Type Analysis

Earthmovers dominates with 33.6% due to extensive infrastructure development and mining activities globally.

Earthmovers represent the dominant segment at 33.6%, reflecting massive investments in infrastructure projects and resource extraction worldwide. These heavy-duty vehicles demand specialized tires capable of handling extreme loads and abrasive surfaces. The segment’s growth correlates directly with construction booms in developing economies and continuous mining operations, driving substantial tire replacement demand across quarries, mines, and large-scale construction sites.

Loaders & Dozers constitute a crucial market segment requiring tires designed for pushing, loading, and grading operations. These vehicles operate in demanding conditions where traction and stability are paramount. The segment benefits from ongoing urbanization projects and land development activities that necessitate reliable equipment performance, ensuring consistent tire demand throughout construction and mining sectors.

Tractors form an essential agricultural vehicle category requiring tires optimized for field operations and soil preservation. These specialized tires balance traction with minimal ground compaction, supporting modern farming techniques. The segment experiences steady demand driven by agricultural mechanization trends and the need for efficient farming equipment capable of handling diverse terrain conditions throughout planting and harvesting seasons.

Forklifts represent the material handling segment requiring tires designed for indoor and outdoor warehouse operations. These vehicles demand tires offering stability, maneuverability, and longevity in repetitive load-bearing tasks. The segment grows alongside e-commerce expansion and logistics infrastructure development, where efficient material movement remains critical for operational success.

Others encompass specialized vehicles including graders, scrapers, and articulated trucks serving niche applications. This diverse category addresses specific operational requirements across various industries, contributing to overall market diversity and ensuring comprehensive coverage of off-the-road tire applications.

Tire Size Analysis

31-40 inches dominates with 38.7% due to its versatility across multiple vehicle types and applications.

31-40 inches tires capture the largest market share at 38.7%, representing the sweet spot for medium to large construction and mining equipment. This size range accommodates popular vehicle models including mid-sized loaders, compact earthmovers, and various agricultural machinery. The segment’s dominance stems from balanced performance characteristics that suit diverse operational requirements while maintaining cost-effectiveness for fleet operators managing multiple equipment types.

Below 31 inches tires serve compact equipment and specialized machinery operating in confined spaces and lighter-duty applications. This segment supports small loaders, compact tractors, and material handling equipment where maneuverability and space constraints dictate size requirements. These tires remain essential for urban construction projects and smaller agricultural operations requiring agile equipment solutions.

41-45 inches tires cater to larger earthmoving equipment and heavy-duty mining vehicles requiring enhanced load capacity. This segment supports substantial construction projects and mining operations where equipment size directly correlates with productivity. The category experiences demand from major infrastructure developments and large-scale resource extraction activities requiring robust tire solutions.

Above 45 inches represents the ultra-large tire segment designed for massive mining trucks and the largest earthmoving equipment. These specialized tires command premium pricing due to advanced engineering requirements and limited production volumes, serving exclusive applications in major mining operations worldwide.

Material Analysis

Rubber Compound dominates with 66.3% due to its essential role in tire structure and performance characteristics.

Rubber Compound holds the dominant position at 66.3%, forming the fundamental material basis for OTR tire construction. Advanced synthetic and natural rubber blends provide critical properties including elasticity, wear resistance, and heat dissipation. Manufacturers continuously innovate compound formulations to enhance durability and performance across varying operational conditions. The segment’s dominance reflects rubber’s irreplaceable role in achieving optimal traction, load-bearing capacity, and longevity required for demanding off-road applications.

Reinforcing Material encompasses steel belts, fabric plies, and wire beads that provide structural integrity and strength to tire construction. These materials enable tires to withstand extreme loads and impacts encountered in mining and construction environments. Steel cord reinforcement particularly enhances puncture resistance and maintains tire shape under heavy loads, proving essential for radial tire construction and overall performance reliability.

Others include specialty materials such as carbon black, silica, and various chemical additives that enhance specific tire properties. These components improve aging resistance, optimize rolling resistance, and contribute to overall tire performance characteristics, supporting manufacturers’ efforts to develop increasingly sophisticated tire solutions.

Tire Weight Analysis

Upto 2000 lbs dominates with 44.9% due to widespread use in compact and mid-sized equipment applications.

Upto 2000 lbs tires command the largest market share at 44.9%, serving compact to medium-sized equipment prevalent across construction, agriculture, and material handling sectors. This weight category aligns with popular vehicle models including small loaders, compact tractors, and standard forklifts. The segment’s dominance reflects the widespread adoption of versatile mid-range equipment that balances capability with operational flexibility, making these tires essential for diverse applications requiring reliable performance without extreme load requirements.

2001 to 4000 lbs tires support larger construction equipment and heavy-duty agricultural machinery requiring enhanced load-bearing capacity. This segment addresses growing equipment sizes and increasing operational demands in modern construction and farming operations. These mid-weight tires provide crucial performance capabilities for substantial earthmoving tasks and intensive agricultural work while remaining manageable for typical equipment configurations.

Above 4000 lbs represents the heavy-weight category designed for massive mining trucks and ultra-large earthmoving equipment. These specialized tires support extreme loads in the most demanding applications, commanding premium pricing due to advanced engineering and materials requirements essential for safe operation in heavy-duty mining environments.

Industry Analysis

Construction dominates with 48.2% due to global infrastructure investments and urbanization trends.

Construction leads the market with 48.2% share, driven by unprecedented infrastructure development across emerging and developed economies. This sector encompasses residential, commercial, and public infrastructure projects requiring extensive earthmoving and material handling equipment. Growing urbanization, smart city initiatives, and transportation network expansion fuel continuous equipment deployment and tire replacement demand. The segment’s dominance reflects construction’s role as the primary driver of OTR tire consumption worldwide.

Agriculture represents a substantial market segment requiring specialized tires for farming equipment and field operations. Modern agricultural mechanization trends drive demand for reliable tire solutions that minimize soil compaction while maximizing traction. This segment benefits from increasing global food production requirements and the adoption of advanced farming equipment across developing agricultural economies.

Mining constitutes a critical high-value segment demanding ultra-durable tires for resource extraction operations. This sector requires tires capable of withstanding extreme loads, abrasive surfaces, and continuous operation in harsh environments. The segment commands premium pricing due to specialized performance requirements and the critical nature of equipment uptime in mining operations.

Others encompass diverse applications including forestry, port operations, and industrial material handling. These specialized segments contribute to market diversity by addressing specific operational requirements across various industries requiring off-road tire solutions.

Sales Channel Analysis

Aftermarket dominates with 71.4% due to continuous tire replacement needs and equipment maintenance cycles.

Aftermarket commands the overwhelming majority at 71.4%, reflecting the ongoing nature of tire replacement throughout equipment lifecycles. This channel serves existing equipment fleets requiring regular tire changes due to wear, damage, or operational upgrades. The segment’s dominance stems from the substantially larger installed equipment base compared to new vehicle sales, creating continuous replacement demand. Aftermarket sales benefit from established distribution networks, competitive pricing dynamics, and fleet operators’ need for flexible tire sourcing options.

OEM channel represents original equipment manufacturer tire installations on new vehicles. This segment correlates directly with new equipment sales and production volumes across construction, mining, and agricultural machinery sectors. While smaller than aftermarket, OEM partnerships remain strategically important for tire manufacturers seeking to establish brand presence and influence future replacement purchases through quality initial installations and operator satisfaction.

Key Market Segments

By Tire Type

- Radial

- Bias

- Solid

By Vehicle Type

- Earthmovers

- Loaders & Dozers

- Tractors

- Forklift

- Others

By Tire Size

- 31-40 inches

- Below 31 inches

- 41-45 inches

- Above 45 inches

By Material

- Rubber Compound

- Reinforcing Material

- Others

By Tire Weight

- Upto 2000 lbs

- 2001 to 4000 lbs

- Above 4000 lbs

By Industry

- Construction

- Agriculture

- Mining

- Others

By Sales Channel

- Aftermarket

- OEM

Drivers

Expansion of Large-Scale Mining Projects Across Emerging Economies Drives Market Growth

The OTR tires market is witnessing strong momentum as mining activities expand across emerging economies. Large-scale mineral extraction projects are increasing the need for heavy-duty haul trucks, loaders, and drill rigs, all of which require durable OTR tires. This trend is pushing manufacturers to supply high-performance tire solutions that can handle extreme terrains and heavy loads effectively.

Additionally, the construction industry is rapidly adopting advanced earthmoving machinery to support infrastructure development. Modern excavators, graders, and bulldozers rely on specialized OTR tires designed for higher stability and wear resistance. As governments invest in roads, bridges, and urban expansion, the demand for these machines continues to rise, supporting consistent OTR tire consumption year over year.

Agriculture is also undergoing a steady shift toward mechanization, especially in regions increasing their cultivated acreage. Tractors, harvesters, and soil-handling equipment require OTR tires that deliver traction, soil protection, and long operational life. This mechanization trend is boosting the need for customized tire designs suited for varying field conditions. Together, these factors create a stable and expanding market environment for OTR tires across mining, construction, and agriculture sectors.

Restraints

Slow Integration of Smart Tire Technologies Restricts Market Efficiency

The OTR tires market faces restraint due to the slow integration of smart tire technologies across traditional mining fleets. Many operators still rely on older machinery that cannot support digital monitoring systems. This gap limits the adoption of advanced tires designed for real-time pressure, load, and temperature tracking. As a result, productivity improvements remain slower than expected, reducing the overall efficiency gains that modern OTR tires can offer.

Additionally, high upgrade costs discourage mining companies from shifting to digitally enabled tires. Budget constraints and long equipment replacement cycles delay the transition, creating a technological divide between advanced fleets and traditional operations. This directly impacts market growth, especially in regions where modernization speeds remain low.

Another key restraint is the performance limitation of OTR tires in extreme temperature environments. Tires used in very high-heat or sub-zero conditions face faster wear, reduced traction, and unpredictable failure rates. These conditions increase maintenance frequency and operational downtime, raising overall ownership costs for users.

Manufacturers continue improving rubber compounds and tread structures, but extreme climates still pose challenges for long-term durability. As mining and construction activities expand into harsher terrains, these performance issues may slow adoption until stronger material solutions become widely available.

Growth Factors

Advancements in Self-Healing Rubber Compounds Create New Market Opportunities

Growth opportunities in the OTR tires market are expanding as new material technologies gain momentum. One major opportunity comes from the development of self-healing rubber compounds designed for heavy-duty applications. These advanced materials reduce downtime, extend tire life, and lower maintenance costs, making them highly attractive for mining, construction, and agriculture operators seeking better productivity.

Additionally, the rising deployment of electric and autonomous off-highway vehicles is opening fresh avenues for specialized OTR tire designs. These next-generation machines require tires that offer stronger load support, low rolling resistance, and enhanced durability to manage continuous operations. As fleets upgrade to automated systems, the demand for smart and efficient tire solutions is expected to grow steadily in the coming years.

Another strong opportunity lies in the increasing need for OTR tires compatible with high-capacity loaders and haulers. These machines operate under extreme loads and require tires with superior strength, heat resistance, and structural stability. As industries scale up production and expand into harsher environments, the market for high-performance OTR tires will continue to benefit from these operational upgrades and equipment expansions.

Emerging Trends

Growing Use of RFID-Enabled Tires for Real-Time Equipment Traceability Drives Market Trends

The OTR tires market is witnessing strong traction as industries adopt RFID-enabled tire technologies for better equipment tracking. This trend helps fleet operators monitor tire conditions in real time, reducing downtime and improving site safety. As digital monitoring becomes more common, RFID integration is emerging as a key feature across new tire models.

Another major trend shaping the market is the shift toward sidewall-reinforced tire designs. These upgraded structures offer better durability, especially in harsh mining and construction environments. The reinforced sidewalls help increase load-bearing capacity and minimize tire failures, enabling operators to manage heavy-duty tasks with greater stability and confidence.

Sustainability is also gaining momentum, leading to faster adoption of eco-friendly material blends in next-generation OTR tires. Manufacturers are experimenting with bio-based compounds and low-emission rubber formulations to meet environmental standards. This shift not only reduces carbon footprint but also supports long-term cost efficiency through extended tire life.

Regional Analysis

Asia Pacific Dominates the OTR Tires Market with a Market Share of 43.8%, Valued at USD 1.5 Billion

Asia Pacific commands the largest share of the global OTR (Off-The-Road) tires market, accounting for 43.8% of the market share and valued at USD 1.5 billion. This dominance is primarily driven by rapid industrialization, extensive mining activities, and large-scale infrastructure development across China, India, and Australia. The region’s robust construction sector and increasing investments in mining operations create substantial demand for heavy-duty OTR tires, while the presence of major manufacturing facilities strengthens its market leadership.

North America OTR Tires Market Trends

North America represents a significant market for OTR tires, driven by well-established mining operations and advanced construction activities. The United States leads the regional market with substantial demand from coal mining, metal ore extraction, and infrastructure projects. The region’s focus on equipment efficiency and stringent quality standards encourages fleet operators to invest in premium OTR tire products offering enhanced performance and longer service life.

Europe OTR Tires Market Trends

Europe maintains a steady presence in the OTR tires market, characterized by its emphasis on sustainability and advanced tire technology. The region’s demand stems from mining activities in Germany, Russia, and Poland, along with ongoing infrastructure modernization. European participants increasingly prioritize eco-friendly tire solutions with reduced rolling resistance to comply with stringent environmental regulations while maintaining operational safety standards.

Middle East and Africa OTR Tires Market Trends

The Middle East and Africa region presents considerable growth opportunities, fueled by expanding mining operations, oil and gas exploration, and infrastructure development initiatives. Countries like South Africa, Saudi Arabia, and the UAE are investing heavily in construction and resource extraction. The region’s harsh operating environments necessitate specialized OTR tire solutions with superior heat resistance and durability to withstand extreme temperatures and challenging terrain.

Latin America OTR Tires Market Trends

Latin America exhibits promising growth potential, supported by rich mineral resources and expanding mining sectors in Brazil, Chile, and Peru. The region’s copper, iron ore, and gold mining operations require robust OTR tires for heavy equipment fleets. Agricultural activities in Brazil and Argentina also contribute to regional demand, though economic volatility and fluctuating commodity prices can create periodic variations in market performance.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key OTR Tires Company Insights

In 2024, Bridgestone Corporation continues to lead the OTR tires market with its focus on durable, high-performance tires for mining, construction, and industrial applications. The company invests heavily in R&D to enhance tire strength and longevity while integrating digital monitoring technologies for better operational efficiency. Its global distribution network ensures timely delivery and strong after-sales support, reinforcing customer trust and loyalty across regions.

The Goodyear Tire & Rubber Company maintains a strong market presence by offering innovative OTR tire designs tailored to heavy-duty vehicles and specialized industrial machinery. Its sustainable manufacturing practices, combined with fuel-efficient tire solutions, align with the growing demand for eco-friendly products. Expansion into emerging markets and strategic collaborations with equipment manufacturers further strengthen its competitive positioning and market reach.

Balkrishna Tyres Ltd. (BKT) has steadily grown in the OTR segment, focusing on specialized tires for agriculture, mining, and industrial vehicles. The company emphasizes customized solutions, high-quality material usage, and continuous product development to meet specific client requirements. Expanding production capacities and strategic partnerships have enhanced its ability to serve both domestic and international markets efficiently.

Guizhou Tire Co. Ltd. is strategically expanding its footprint by offering cost-effective yet durable OTR tires, particularly in emerging economies. Its high load-bearing and heavy-duty tires cater to mining and construction applications while improvements in manufacturing processes ensure consistency and reliability. The company’s approach to balancing affordability with performance positions it as a competitive player in both local and global markets.

Top Key Players in the Market

- Bridgestone Corporation

- The Goodyear Tire & Rubber Company

- Balkrishna Tyres Ltd. (BKT)

- Guizhou Tire Co. Ltd.

- Linglong Tire

- Prinx Chengshan

- Double Coin Holdings

- Zhongce Rubber Group Co. Ltd.

- Shandong Taishan Tyre

- Shandong Yinbao

Recent Developments

- In February 2025, Houlihan Lokey advised Yokohama Rubber on its strategic acquisition of Goodyear’s OTR tire business, marking a significant move in the global OTR tire market.

- In May 2025, Yokohama Rubber expanded its manufacturing footprint by acquiring a former tyre-manufacturing plant in Drobeta-Turnu Severin, Romania, enhancing production capacity and regional reach.

- In August 2024, Bridgestone Corporation announced a ¥25 billion investment to upgrade its Kitakyushu Plant in Japan, strengthening its global OTR tyre production base and modernizing manufacturing capabilities.

- In December 2024, CEAT Limited acquired Camso brand’s Off-Highway tyres and tracks business, expanding its portfolio and presence in the specialized OTR tire segment.

Report Scope

Report Features Description Market Value (2024) USD 3.5 Billion Forecast Revenue (2034) USD 6.3 Billion CAGR (2025-2034) 6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Tire Type (Radial, Bias, Solid), By Vehicle Type (Earthmovers, Loaders & Dozers, Tractors, Forklift, Others), By Tire Size (31-40 inches, Below 31 inches, 41-45 inches, Above 45 inches), By Material (Rubber Compound, Reinforcing Material, Others), By Tire Weight (Upto 2000 lbs, 2001 to 4000 lbs, Above 4000 lbs), By Industry (Construction, Agriculture, Mining, Others), By Sales Channel (Aftermarket, OEM) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Bridgestone Corporation, The Goodyear Tire & Rubber Company, Balkrishna Tyres Ltd. (BKT), Guizhou Tire Co. Ltd., Linglong Tire, Prinx Chengshan, Double Coin Holdings, Zhongce Rubber Group Co. Ltd., Shandong Taishan Tyre, Shandong Yinbao Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bridgestone Corporation

- The Goodyear Tire & Rubber Company

- Balkrishna Tyres Ltd. (BKT)

- Guizhou Tire Co. Ltd.

- Linglong Tire

- Prinx Chengshan

- Double Coin Holdings

- Zhongce Rubber Group Co. Ltd.

- Shandong Taishan Tyre

- Shandong Yinbao