Global Organic Waste Management Solution Market Size, Share, And Business Benefit By Product Type (Organic Waste Bins, Digesters, Composting Systems, Biofertilizers), By Service Type (Collection Services, Processing Services, Consultation Services), By Application (Composting, Anaerobic Digestion, Biogas Generation, Vermicomposting, Soil Amendment, Others), By End-Use (Commercial, Residential, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 165858

- Number of Pages: 247

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

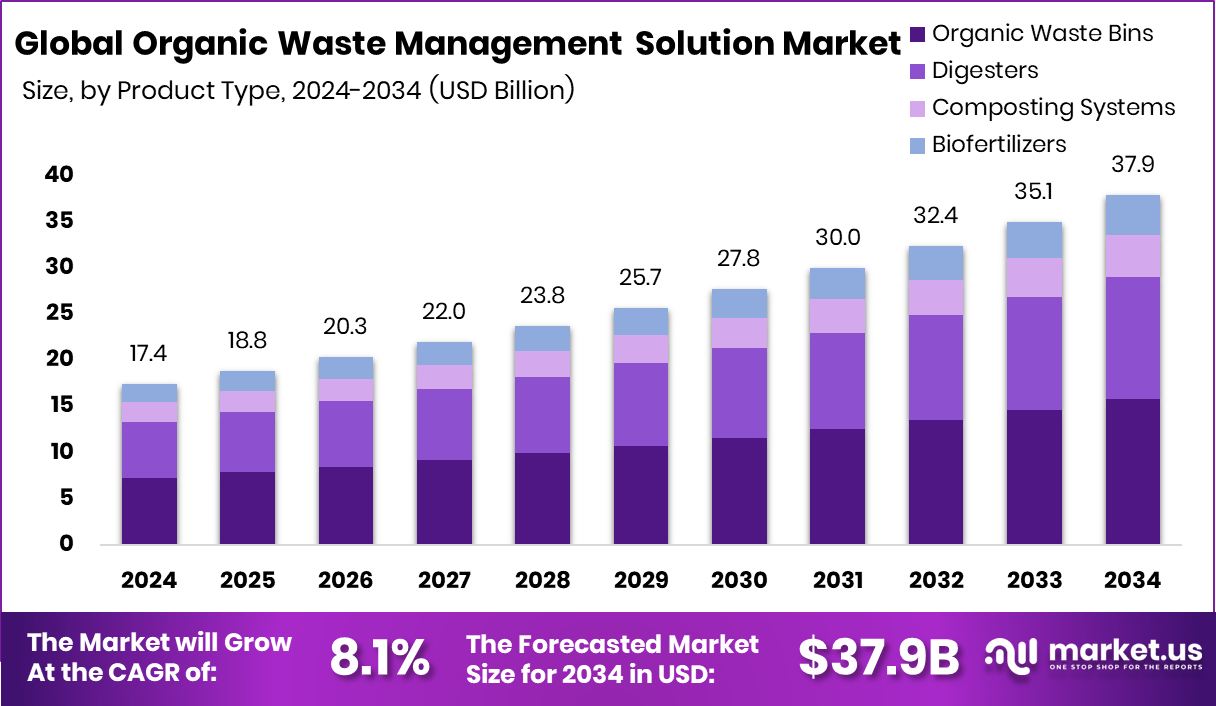

The Global Organic Waste Management Solution Market is expected to be worth around USD 37.9 billion by 2034, up from USD 17.4 billion in 2024, and is projected to grow at a CAGR of 8.1% from 2025 to 2034. Growing regional programs strengthen North America’s 43.80% share and USD 7.6 Bn value.

Organic waste management solution refers to a set of systems, technologies, and practices used to collect, process, recycle, or convert organic waste—such as food scraps, agricultural residues, and biodegradable materials—into useful outputs like compost, biofertilizer, or renewable energy. These solutions help reduce landfill pressure, cut methane emissions, and support circular economy goals by turning everyday organic waste into valuable resources.

The organic waste management solution market represents the overall industry that develops, deploys, and maintains these solutions. It includes composting systems, anaerobic digestion units, waste-to-energy technologies, and smart waste-collection tools adopted by municipalities, institutions, and households. The market is expanding as countries tighten sustainability standards and invest more in resource-efficient waste systems.

Growing awareness around climate responsibility is pushing governments and local bodies to adopt better waste solutions. Funding activities—such as Limetrack securing €1 million to scale smart bins in the UK and Europe, and an additional £1.3 million raised for similar bin expansion—show rising trust in digital waste tools. These investments signal a broader shift toward cleaner, data-driven waste systems.

Demand is also rising as public agencies confront budget pressures and service gaps. A council facing a £1.3 million shortfall for waste collection highlights the need for efficient systems, while approved spending of £2 million for food-waste collections shows authorities prioritizing long-term sustainability over short-term costs.

Opportunity continues to grow through grants that encourage community composting and local recycling programs. North Carolina’s $25 million grant effort, a $3 million state grant for curbside compost expansion, and Bethel receiving $521,000 to build a composting program reflect how funding support is opening new paths for innovation and wider adoption of organic waste solutions.

Key Takeaways

- The Global Organic Waste Management Solution Market is expected to be worth around USD 37.9 billion by 2034, up from USD 17.4 billion in 2024, and is projected to grow at a CAGR of 8.1% from 2025 to 2034.

- Organic Waste Management Solution. The market is dominated by organic waste bins with a 34.8% share.

- The organic waste management solution market is dominated by collection services, holding a 48.3% share globally.

- The organic waste management solution market is dominated by composting applications at a 37.9% share globally.

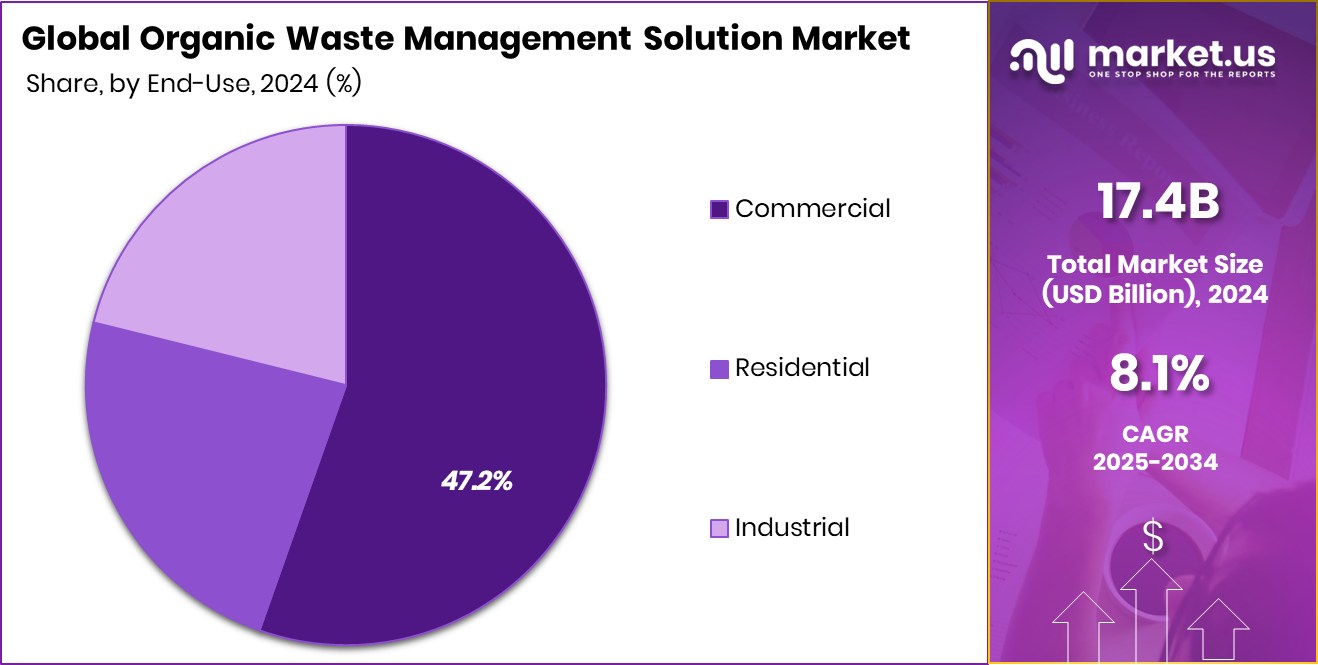

- The organic waste management solution market is dominated by commercial end-users with a 47.2% share.

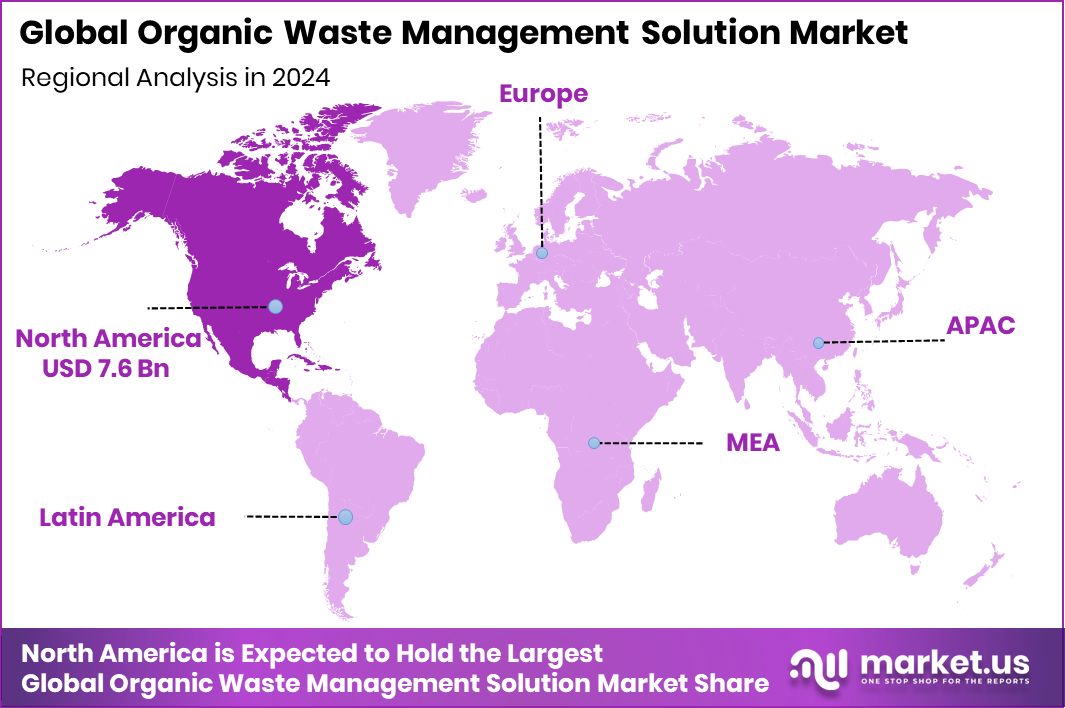

- The market in North America reached USD 7.6 Bn, driven by sustainability efforts.

By Product Type Analysis

The organic waste management solution market is dominated by organic waste bins, with 34.8%.

In 2024, Organic Waste Bins held a dominant market position in the By Product Type segment of the Organic Waste Management Solution Market, with a 34.8% share. Their strong adoption comes from their practicality, ease of use, and essential role in separating biodegradable waste at the source. Municipal bodies, institutions, and households increasingly rely on these bins to streamline organic waste sorting and collection.

The 34.8% share reflects how source-segregation tools remain the backbone of efficient waste systems, especially in areas shifting toward structured composting and recycling programs. As communities focus on reducing landfill dependence, the demand for reliable organic waste bins continues to rise, reinforcing their leadership within the product category.

By Service Type Analysis

The organic waste management solution market is dominated by collection services at 48.3%.

In 2024, Collection Services held a dominant market position in the By Service Type segment of the Organic Waste Management Solution Market, with a 48.3% share. This lead reflects the strong reliance on organized pickup systems that ensure the timely movement of organic waste from households, institutions, and commercial sites to processing facilities. The 48.3% share highlights how essential structured collection networks are for enabling smooth composting and recycling operations.

As communities focus on reducing landfill loads and improving waste segregation, dependable collection services remain the most preferred solution. Their consistency, accessibility, and ability to handle large daily volumes reinforce their top position within this service category.

By Application Analysis

The organic waste management solution market is dominated by composting applications, holding 37.9%.

In 2024, Composting held a dominant market position in the By Service Type segment of the Organic Waste Management Solution Market, with a 37.9% share. This strong position reflects the continued preference for converting organic waste into nutrient-rich compost that supports soil health and sustainable agriculture. The 37.9% share also indicates how widely composting is adopted by municipalities, institutions, and community programs aiming to divert biodegradable waste away from landfills.

As more regions emphasize circular practices, composting remains a favored solution due to its simplicity, low environmental impact, and ability to create usable end products. This steady demand solidifies its leadership within the service category.

By End-Use Analysis

Organic Waste Management Solution: the market is dominated by commercial end-use at 47.2%.

In 2024, Commercial held a dominant market position in the By End-Use segment of the Organic Waste Management Solution Market, with a 47.2% share. This leadership reflects the high volume of organic waste generated by restaurants, hotels, food processors, and retail outlets, making structured waste handling essential. The 47.2% share shows how businesses increasingly rely on organized systems to manage daily biodegradable waste efficiently and meet sustainability expectations.

Consistent collection needs, regulatory pressures, and growing awareness around responsible disposal continue to shape commercial adoption. As facilities aim to reduce landfill dependency and improve operational hygiene, the commercial segment maintains its strong hold within the overall market.

Key Market Segments

By Product Type

- Organic Waste Bins

- Digesters

- Composting Systems

- Biofertilizers

By Service Type

- Collection Services

- Processing Services

- Consultation Services

By Application

- Composting

- Anaerobic Digestion

- Biogas Generation

- Vermicomposting

- Soil Amendment

- Others

By End-Use

- Commercial

- Residential

- Industrial

Driving Factors

Growing Investments Boosting Waste Processing Capacity

A major driving factor for the Organic Waste Management Solution Market is the steady rise in financial support that helps expand waste-processing infrastructure. Governments and private players are now putting more money into systems that convert organic waste into useful resources. A strong example is Gruner Renewable Energy securing 60 million to set up new CBG plants, reflecting growing confidence in bio-based waste solutions.

Such investments encourage faster adoption of composting units, digestion systems, and organized waste-collection tools. As more funding enters the sector, cities and towns can improve their waste-handling capacity, reduce landfill dependence, and support cleaner community practices. This financial push strengthens the overall market and accelerates long-term sustainability goals.

Restraining Factors

Limited Infrastructure Slowing Waste Processing Expansion

A key restraining factor for the Organic Waste Management Solution Market is the slow development of reliable waste-processing infrastructure. Many regions still lack organized systems for the collection, treatment, and conversion of organic waste, which limits overall progress.

Even though positive investments exist—such as biogas-tech startup Sistema.bio securing $15 million to support its global growth—the gap between available funding and on-ground infrastructure remains wide.

Local bodies often struggle with outdated equipment, limited space for processing units, and insufficient manpower to manage rising waste volumes. These challenges delay large-scale implementation and reduce the effectiveness of organic waste solutions. As a result, infrastructure limitations continue to act as a major barrier to consistent market expansion.

Growth Opportunity

Rising Biogas Projects Creating Major Opportunities

A strong growth opportunity for the Organic Waste Management Solution Market comes from the rapid expansion of biogas projects supported by new funding. As communities push for cleaner energy and better waste use, these projects offer a practical way to convert organic waste into renewable fuel.

Recent investments highlight this momentum, such as Rybnik’s green energy center securing PLN 74 million for a biogas project and CEF Group obtaining €38 million to launch biogas plants in Jammu and Ahmedabad. These developments show how organic waste can drive energy production at a larger scale. With more regions adopting similar models, the market gains new pathways for expansion, improved waste handling, and long-term sustainability benefits.

Latest Trends

Rapid Shift Toward Advanced Green Energy Systems

A key latest trend in the Organic Waste Management Solution Market is the rising focus on advanced green energy systems powered by stronger financial backing. Companies and cities are moving beyond basic composting and adopting high-efficiency technologies that convert organic waste into cleaner energy. Recent funding highlights this shift, such as BioCirc securing €40.2 million while aiming for a €134 million green energy milestone by 2025, showing strong confidence in sustainable waste-to-energy pathways.

Munich-based Reverion, raising €56 million for the serial production of renewable power plants, further strengthens this trend. These investments signal a broader move toward smarter, more scalable solutions that transform organic waste into reliable energy, supporting long-term climate and resource goals.

Regional Analysis

North America leads with 43.80%, showing strong adoption across the region.

North America dominated the Organic Waste Management Solution Market with a 43.80% share valued at USD 7.6 Bn, supported by strong collection systems, advanced composting facilities, and widespread adoption of structured waste programs. The region’s consistent policies and community participation continue to reinforce its leadership.

Europe shows steady growth driven by strict waste-reduction rules and rising focus on circular practices, encouraging higher use of composting and bio-processing systems across major countries. Asia Pacific is expanding rapidly, supported by large populations, rising urban waste volumes, and increasing awareness around organic waste recovery in growing cities.

The Middle East & Africa region is gradually improving its waste-handling approach, with governments promoting better segregation and modern treatment facilities. Latin America continues to develop its organic waste efforts, supported by municipal programs and growing interest in small-scale composting and resource recovery.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Renewi continued to strengthen its position in the global Organic Waste Management Solution Market by focusing on high-quality recycling and resource-recovery practices. The company’s model of turning organic waste into usable outputs aligns well with the growing demand for circular solutions. Renewi’s emphasis on improving collection efficiency and expanding processing capacity supports its long-term growth, especially as more regions prioritize sustainable waste handling.

GreenWaste Recovery also demonstrated solid progress by maintaining its commitment to community-focused waste collection and processing. The company’s ability to manage large volumes of organics—from residential to commercial streams—positions it well in a market where demand for structured waste services is rising. Its operational consistency and local engagement help it remain relevant as cities push for better composting and diversion rates.

Meanwhile, SUEZ continued to play a meaningful role with its integrated approach to organic waste treatment. The company’s focus on innovation, long-term contracts, and diversified treatment technologies supports its competitiveness in the market. SUEZ’s capability to manage both large-scale municipal programs and specialized organic waste streams allows it to adapt to evolving sustainability expectations.

Top Key Players in the Market

- Renewi

- GreenWaste Recovery

- SUEZ

- Clean Harbors

- Waste Connections

- Anaergia

- Remondis

- Waste Management

- Veolia

- Johnson Controls

Recent Developments

- In October 2024, SUEZ signed a research partnership with the MAScIR Foundation in Morocco (via four new agreements) to identify innovative solutions for treating and recovering organic matter.

- In September 2024, GreenWaste launched a pilot program of North America’s first hydrogen fuel-cell zero-emissions refuse collection truck in San Jose and neighboring areas. This initiative aims to reduce landfill-bound organics and lower vehicle emissions in its collection fleet.

Report Scope

Report Features Description Market Value (2024) USD 17.4 Billion Forecast Revenue (2034) USD 37.9 Billion CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Organic Waste Bins, Digesters, Composting Systems, Biofertilizers), By Service Type (Collection Services, Processing Services, Consultation Services), By Application (Composting, Anaerobic Digestion, Biogas Generation, Vermicomposting, Soil Amendment, Others), By End-Use (Commercial, Residential, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Renewi, GreenWaste Recovery, SUEZ, Clean Harbors, Waste Connections, Anaergia, Remondis, Waste Management, Veolia, Johnson Controls Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Organic Waste Management Solution MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Organic Waste Management Solution MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Renewi

- GreenWaste Recovery

- SUEZ

- Clean Harbors

- Waste Connections

- Anaergia

- Remondis

- Waste Management

- Veolia

- Johnson Controls