Global Organic Poultry Market Size, Share, And Enhanced Productivity By Product Type (Organic Meat, Organic Eggs), By Processing Type (Fresh, Frozen, Processed), By Distribution (Hypermarkets / Supermarkets, Retail, Specialty Store, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 176080

- Number of Pages: 299

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

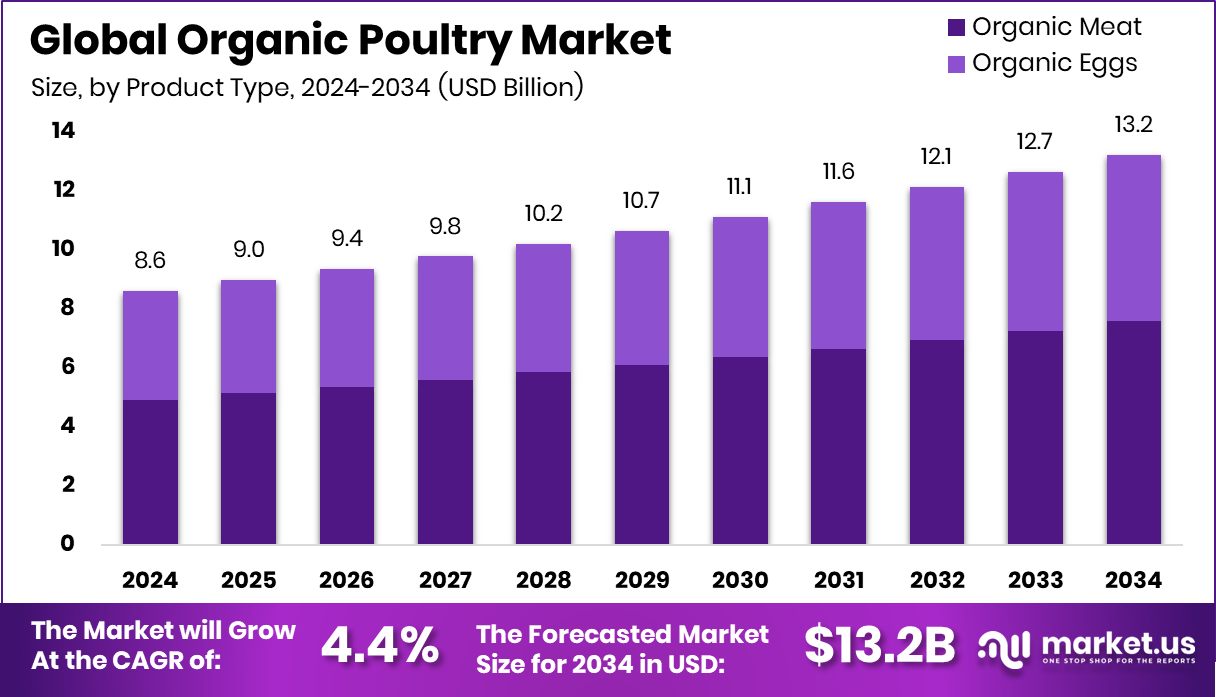

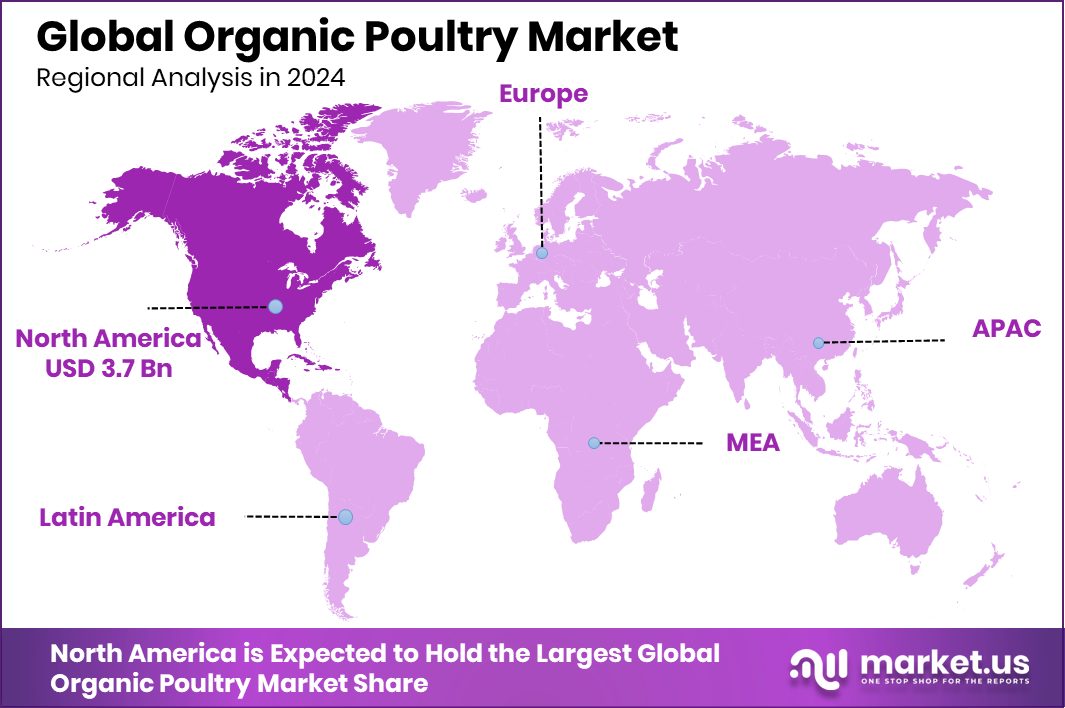

The Global Organic Poultry Market is expected to be worth around USD 13.2 billion by 2034, up from USD 8.6 billion in 2024, and is projected to grow at a CAGR of 4.4% from 2025 to 2034. Strong demand lifts the North America Organic Poultry Market to 43.1% and USD 3.7 Bn.

Organic poultry refers to birds raised under strict organic standards, where they are fed certified organic feed, given access to outdoor areas, and raised without antibiotics, growth hormones, or synthetic additives. This approach focuses on animal welfare, natural growth, and cleaner production methods. The Organic Poultry Market includes the production and sale of organic meat and organic eggs across fresh, frozen, and processed categories. It also covers distribution through supermarkets, retail stores, specialty outlets, and online platforms as more households shift toward healthier protein choices.

Growth in this market is supported by rising consumer awareness around clean-label foods and strong government backing. A $3.34 million USDA grant is actively helping strengthen organic poultry development. Demand is also boosted by rising organic spending, with organic sales reaching $71.6 billion, where poultry contributes significantly due to its everyday consumption.

Opportunities are expanding as investors support innovations in organic farming. S2G Ventures’ $3.7 million investment in an organic poultry producer shows growing private-sector confidence. New inputs are also emerging—Nitricity’s $10 million raise for an organic fertilizer plant and Innovafeed’s $11.8 million USDA grant for insect-based fertilizer support sustainable poultry feed development. Additionally, NutraMaize’s $650,000 USDA grant to advance orange corn research offers future potential to enhance poultry health and improve natural egg yolk pigmentation.

Key Takeaways

- The Global Organic Poultry Market is expected to be worth around USD 13.2 billion by 2034, up from USD 8.6 billion in 2024, and is projected to grow at a CAGR of 4.4% from 2025 to 2034.

- Organic Poultry Market sees strong growth as organic meat leads consumption with a 57.3% share.

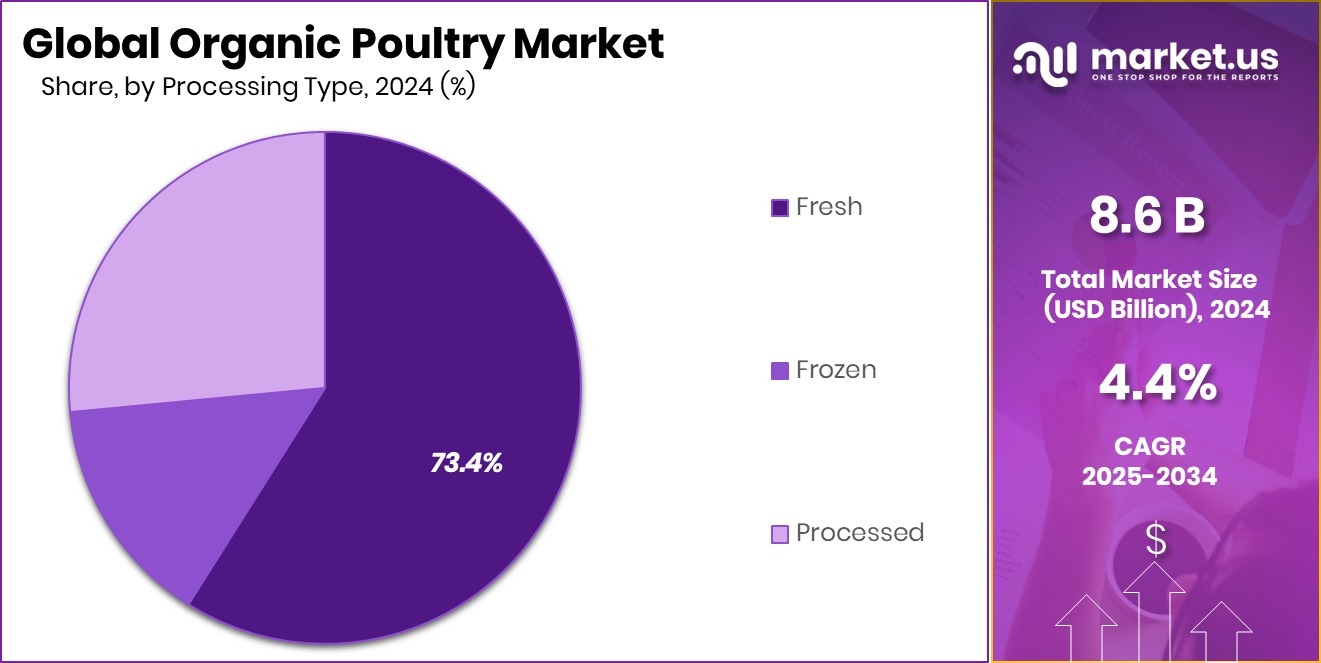

- Demand in the Organic Poultry Market rises as fresh processing dominates purchases with 73.4% preference.

- Expansion of the Organic Poultry Market continues as hypermarkets and supermarkets contribute 54.6% distribution share.

- North America drives the Organic Poultry Market growth with 43.1% share and USD 3.7 Bn.

By Product Type Analysis

Organic Poultry Market sees strong momentum as Organic Meat captures 57.3%.

The Organic Poultry Market is increasingly shaped by shifting consumer preferences toward cleaner, chemical-free protein sources. Within this landscape, organic meat holds a dominant 57.3% share, reflecting strong trust in poultry raised without synthetic hormones, antibiotics, or genetically modified feed.

Shoppers are becoming more aware of how farming practices influence both nutrition and long-term health, encouraging them to choose poultry products that offer transparency and higher welfare standards. This demand is also supported by families prioritizing safer food options for daily consumption.

As retailers expand dedicated organic sections and farmers adopt certified practices, organic poultry continues to strengthen its appeal, positioning itself as a leading choice across households seeking purity and better-quality protein.

By Processing Type Analysis

Fresh products lead the Organic Poultry Market with a dominant 73.4% share.

Fresh organic poultry stands out as the strongest segment in the market, holding 73.4% of the processing type share, showing consumers’ clear preference for minimally handled products. People increasingly associate freshness with reliability, better texture, and enhanced nutritional value. This shift has pushed producers to improve cold-chain systems and reduce transit times to keep products at optimal quality.

Urban buyers, in particular, are drawn to fresh organic chicken and turkey for everyday cooking because it aligns well with their desire for wholesome, straightforward meals. The growing presence of organic butcher counters and farm-to-store supply relationships further supports the demand. Fresh organic poultry has essentially become the benchmark for trust in the category.

By Distribution Analysis

Hypermarkets and Supermarkets drive the Organic Poultry Market through 54.6% distribution.

Hypermarkets and supermarkets remain the most preferred shopping points for organic poultry, accounting for 54.6% of the distribution share. Their strong presence is driven by convenience, consistent product availability, and the ability for shoppers to physically evaluate freshness before purchase. These retail outlets have expanded their organic sections significantly, giving customers clear labeling, traceability information, and a wider assortment of cuts and brands.

Many stores also partner directly with certified organic farms, improving quality assurance while keeping prices stable. For consumers transitioning from regular to organic poultry, supermarkets serve as the easiest access point, offering both familiarity and variety. As awareness grows, these large retail chains continue playing a central role in promoting organic poultry adoption.

Key Market Segments

By Product Type

- Organic Meat

- Organic Eggs

By Processing Type

- Fresh

- Frozen

- Processed

By Distribution

- Hypermarkets / Supermarkets

- Retail

- Specialty Store

- Online

- Others

Driving Factors

Rising demand for clean organic protein

The Organic Poultry Market is moving forward as more people look for clean and trustworthy organic protein options in their daily diets. This shift is strongly supported by consumer interest in foods raised without synthetic additives or routine antibiotics. A notable development influencing this demand is the recent funding momentum across organic-focused food companies.

For example, Matr Foods secured €40 million to scale its organic, fermented plant-based meat alternatives. While this funding is directed at plant-based products, it reflects a wider consumer movement toward natural and responsibly produced proteins, a trend that also strengthens the demand for organic poultry. Together, rising health awareness and increased investment activity help build a stronger market environment for organic poultry offerings.

Restraining Factors

Higher production costs limit expansion

Despite its growth, the Organic Poultry Market continues to face challenges, mainly due to higher production costs associated with certified organic feed, outdoor access requirements, and slower animal growth cycles. These factors make it harder for producers to scale rapidly. Compounding the issue, even companies in the broader organic protein ecosystem have needed significant funding to handle cost pressures.

Shenandoah Valley Organic raised $15 million to support its operations, while The Better Meat Co. secured $8.1 million to strengthen its alternative protein processes. These funding events show that cost burdens are real and widespread, affecting companies working with cleaner and more natural production methods. For organic poultry producers, these financial hurdles slow expansion and limit supply stability.

Growth Opportunity

Investments boosting organic poultry innovation

Opportunities in the Organic Poultry Market are expanding as new investments strengthen farm practices, processing systems, and feed technologies. Companies and research groups working on cleaner and more sustainable production methods are receiving support that indirectly benefits organic poultry. For example, BioBetter raised USD 10 million to use tobacco plants in solving cultivated meat bottlenecks, a breakthrough that may influence future organic feed or ingredient innovation.

At the same time, FreshToHome raised $20 million in a Series B round, showing continued investor confidence in healthier and naturally sourced proteins. These funding activities highlight the growing interest in improving supply chains, enhancing product quality, and meeting rising organic poultry demand.

Latest Trends

Growing shift toward sustainable fertilizers

Recent trends in the Organic Poultry Market show a clear shift toward sustainable and environmentally responsible inputs. As farms move toward regenerative practices, demand for natural fertilizers and eco-friendly agriculture solutions is rising. This transition is supported by strong investor activity, including Grosvenor Food & AgTech’s $23 million Series B investment, which focuses on advancing sustainable agricultural technologies.

While not exclusive to poultry, such investments contribute to improving the broader organic farming ecosystem. With producers exploring ways to reduce chemical use and enhance soil health, sustainable fertilizers and resource-efficient farming tools are becoming central trends influencing how organic poultry is raised and positioned in the market.

Regional Analysis

Organic Poultry Market in North America holds 43.1%, reaching a USD 3.7 Bn value.

The Organic Poultry Market shows varied performance across global regions, with North America emerging as the leading market, holding a 43.1% share valued at USD 3.7 Bn. This dominance is supported by strong consumer preference for clean-label proteins and well-established organic certification systems. In Europe, demand remains steady as households prioritize animal welfare standards and consistent regulatory frameworks that support organic farming practices.

The Asia Pacific region continues to expand gradually, driven by a rising middle class and growing awareness of healthier poultry choices in urban centers. Meanwhile, the Middle East & Africa region records moderate progress, supported by retail modernization and increasing interest in premium food categories.

Latin America also contributes to overall growth, with consumers slowly shifting toward organic poultry products as supermarkets broaden their assortments. Across all these regions, adoption differs based on income levels, availability, and cultural preferences, yet the influence of North America’s 43.1% share and USD 3.7 Bn valuation remains the most significant benchmark in shaping global organic poultry dynamics.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Tyson Foods, Inc. remains one of the most recognized names in the poultry sector, and its involvement in organic offerings strengthens the credibility of this category. The company’s scale, long-standing processing expertise, and investments in cleaner farming practices allow it to meet rising demand for organic chicken across retail and foodservice channels. Tyson’s broad distribution reach also helps organic poultry become accessible to a wider consumer base.

Perdue Farms, Inc. plays an equally strong role, especially with its long-term focus on raising poultry without antibiotics and prioritizing animal welfare practices. Perdue has developed a strong connection with consumers who seek transparency and responsibly raised organic meat. Its emphasis on certified organic feed, improved farm environments, and closer farmer relationships supports the market’s shift toward higher-quality protein choices.

Sanderson Farms continues to influence the organic poultry landscape through its established production systems and operational efficiency. Although the company is widely known for conventional poultry, its participation in the organic segment contributes to improved supply consistency. Sanderson’s processing capabilities and distribution strength add stability, helping the market support increasing household demand for safer, cleaner poultry options.

Top Key Players in the Market

- Tyson Foods, Inc.

- Perdue Farms, Inc.

- Sanderson Farms

- Foster Farms

- Bell & Evans

- Plainville Farms LLC

- Murray’s Organic Chicken

- Eversfield Organic

- Many Hands Organic Farm

- Nick’s Organic Farm

Recent Developments

- In February 2025, Plainville Farms LLC received an official inspection grant from the U.S. Department of Agriculture (USDA) for its poultry processing operations in Liverpool, New York. This means the company’s plant met federal standards and can continue processing turkey and related products under USDA supervision.

- In March 2024, Foster Farms appointed Jayson Penn as its new CEO, guiding the company’s overall strategy after its acquisition by Atlas Holdings. This leadership update reflects a shift as the company moves into its next growth phase in poultry processing.

- In January 2024, Bell & Evans was recognized with the Innovation in Sustainability Award by Messer for excellence in poultry industry sustainability. This award highlighted the company’s commitment to using new sustainable technologies in poultry processing,

Report Scope

Report Features Description Market Value (2024) USD 8.6 Billion Forecast Revenue (2034) USD 13.2 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Organic Meat, Organic Eggs), By Processing Type (Fresh, Frozen, Processed), By Distribution (Hypermarkets / Supermarkets, Retail, Specialty Store, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Tyson Foods, Inc., Perdue Farms, Inc., Sanderson Farms, Foster Farms, Bell & Evans, Plainville Farms LLC, Murray’s Organic Chicken, Eversfield Organic, Many Hands Organic Farm, Nick’s Organic Farm Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Tyson Foods, Inc.

- Perdue Farms, Inc.

- Sanderson Farms

- Foster Farms

- Bell & Evans

- Plainville Farms LLC

- Murray's Organic Chicken

- Eversfield Organic

- Many Hands Organic Farm

- Nick's Organic Farm