Global Organic Light Emitting Diode Market Size, Share, And Business Benefit By Type (Substrates, Encapsulation, Anode, Cathode, Emissive Layer (EML), Electron Transport Layer (ETL), Others), By Application (Display, Lighting), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 164224

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

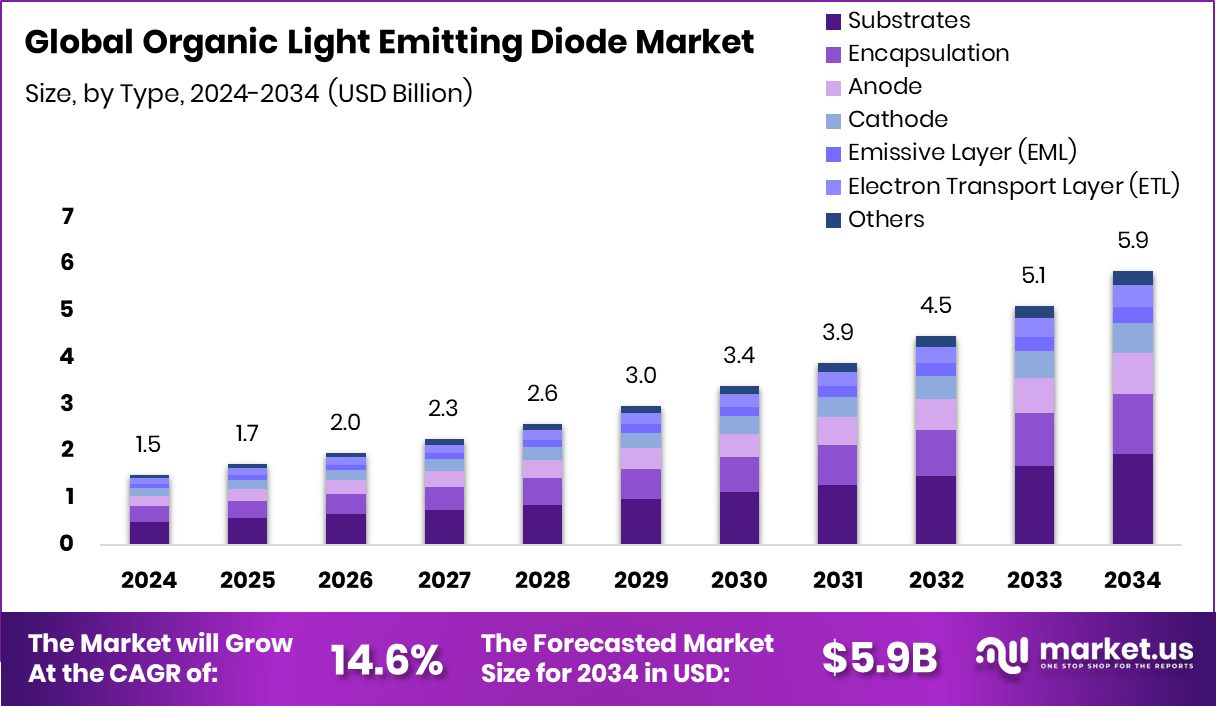

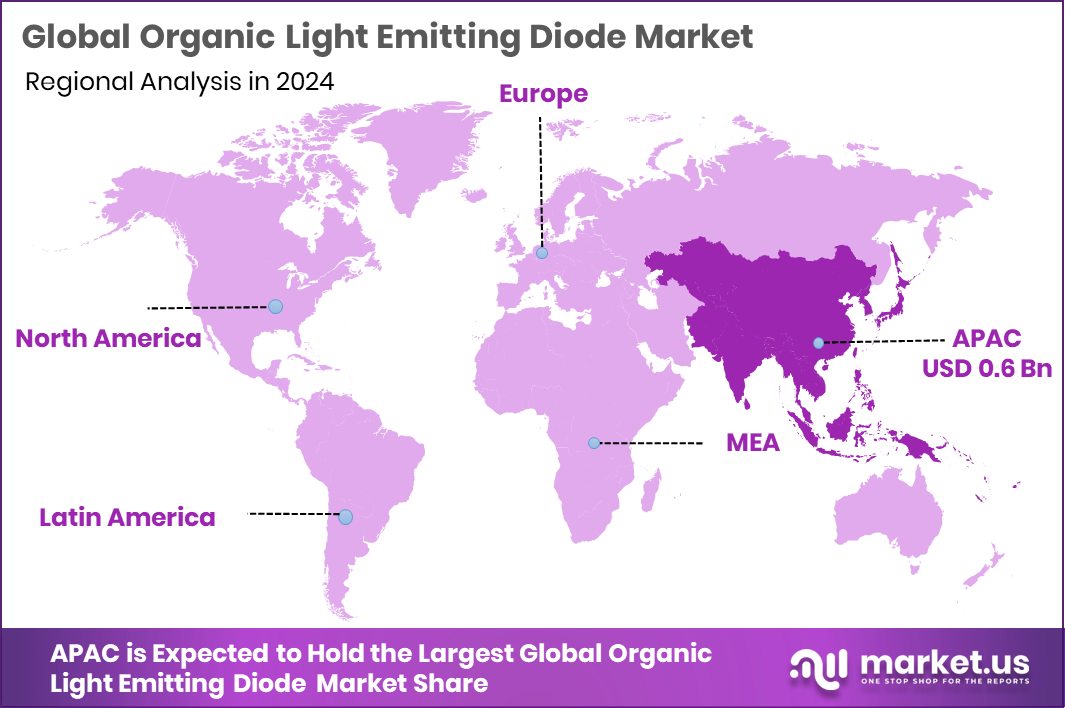

The Global Organic Light Emitting Diode Market is expected to be worth around USD 5.9 billion by 2034, up from USD 1.5 billion in 2024, and is projected to grow at a CAGR of 14.6% from 2025 to 2034. Rapid industrial growth and advanced manufacturing positioned Asia-Pacific at 46.20%, reaching a USD 0.6 Bn value.

An organic light-emitting diode (OLED) is a thin-film light-emitting technology made from organic compounds that emit light when electricity passes through them. Unlike traditional LEDs, OLEDs don’t need a backlight, making them lighter, thinner, and more flexible. They provide vivid color, deep contrast, and wide viewing angles, making them ideal for modern displays and lighting. Their use has expanded across televisions, smartphones, wearables, automotive panels, and decorative lighting, combining energy efficiency with sleek design possibilities.

The OLED market covers the manufacturing, supply, and integration of OLED panels, materials, and related technologies across consumer electronics, automotive, and lighting applications. It is driven by rising demand for premium, energy-efficient, and flexible display products. With continuous innovations in materials, production efficiency, and sustainability, the OLED industry is transforming into a multi-billion-dollar ecosystem.

The OLED market is growing due to increasing adoption of energy-efficient and flexible display technologies. Consumers prefer thinner, brighter, and eco-friendly screens that provide a premium viewing experience. Technological advancements in organic materials and scalable manufacturing are also contributing to growth.

Moreover, strong funding in advanced material innovation supports the ecosystem—Anaphite secured $13.7 M to scale dry-coating EV battery technology; QUT received $2.2 M to revolutionize cathode material supply chains; Tozero obtained €3.5 M to recover cathode materials; the Faraday Institution committed £9 M for battery research; and ACT-ion raised $7.5 M for cathode active materials. Such funding indirectly accelerates OLED material science and device efficiency.

Demand for OLEDs continues to rise with the global push for high-definition, flexible, and sustainable display solutions. The growing popularity of foldable smartphones, curved televisions, electric vehicles, and smart wearables enhances the need for OLED panels. These displays offer superior brightness, contrast, and energy savings compared to conventional technologies. With industries shifting toward greener and more efficient solutions, OLEDs are emerging as the preferred choice for next-generation consumer and industrial applications.

Opportunities in the OLED market revolve around new material development, manufacturing advancements, and application diversification. Emerging areas such as automotive lighting, transparent displays, and wearable devices are expanding OLED’s reach. As production costs decline and efficiency improves, OLEDs will enter mid-range product segments, increasing mass-market penetration. The strong momentum in global funding for advanced materials research also provides a favorable ecosystem for innovation.

Key Takeaways

- The Global Organic Light Emitting Diode Market is expected to be worth around USD 5.9 billion by 2034, up from USD 1.5 billion in 2024, and is projected to grow at a CAGR of 14.6% from 2025 to 2034.

- In 2024, substrates dominated the Organic Light Emitting Diode Market, capturing 26.7% share globally.

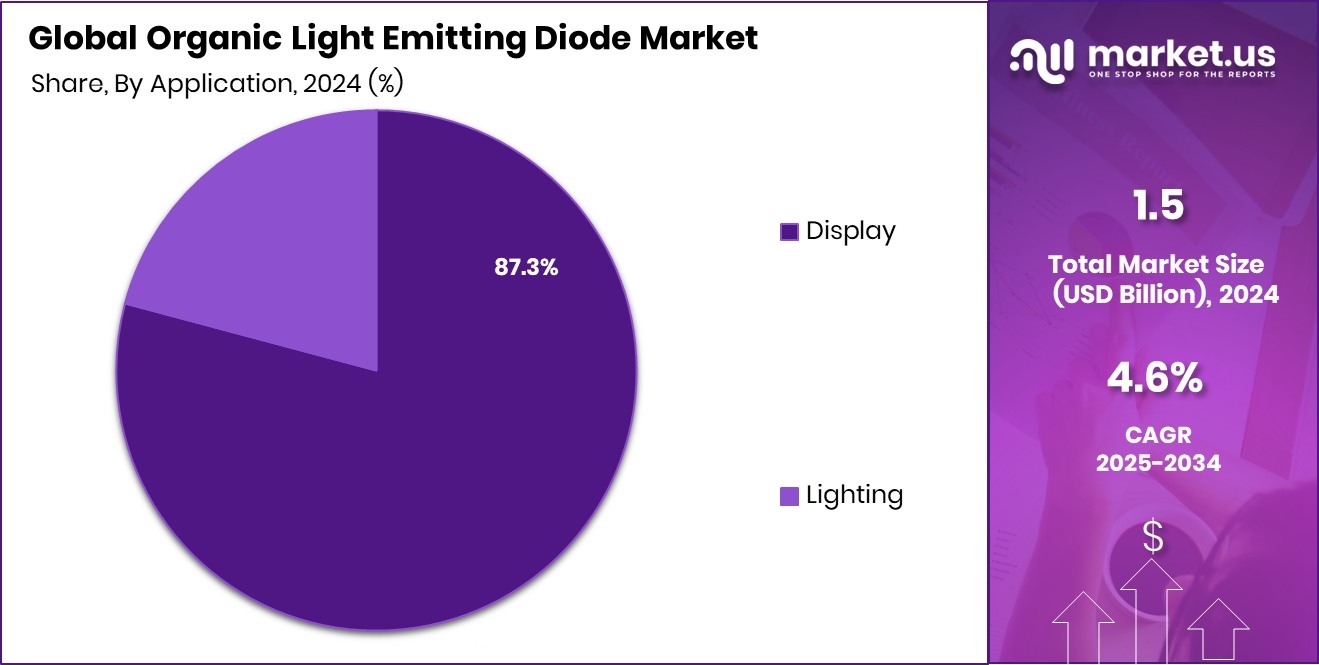

- Displays held the leading position in the Organic Light Emitting Diode Market with an 87.3% share.

- The Asia-Pacific region recorded a strong market value of USD 0.6 billion in 2024.

By Type Analysis

In the Organic Light Emitting Diode Market, substrates accounted for a 26.7% share.

In 2024, Substrates held a dominant market position in the By Type segment of the Organic Light-emitting diode (OLED) Market, capturing a 26.7% share. This leadership reflects the growing importance of advanced substrate materials that support flexible, lightweight, and high-resolution OLED displays. Substrates play a crucial role in ensuring device stability, heat resistance, and durability, particularly in foldable and curved display applications.

The rising use of OLEDs in smartphones, televisions, and automotive lighting has further increased the demand for high-performance substrate materials. Continuous innovations in glass, plastic, and flexible substrates have enhanced manufacturing efficiency and product lifespan, making substrates a key contributor to the overall expansion and technological progress of the OLED market.

By Application Analysis

In the Organic Light Emitting Diode Market, displays captured 87.3% overall share.

In 2024, Display held a dominant market position in the By Application segment of the Organic Light Emitting Diode (OLED) Market, accounting for an 87.3% share. This dominance is driven by the rapid adoption of OLED displays across smartphones, televisions, laptops, and wearable devices. The display segment benefits from OLED’s superior brightness, contrast ratio, flexibility, and thinner design compared to traditional technologies.

Growing consumer demand for high-quality visuals and energy-efficient screens has significantly boosted its market share. Additionally, advancements in flexible and foldable display technology have strengthened OLED’s position in next-generation electronics. The combination of performance, design versatility, and visual excellence makes the display segment the primary revenue driver in the OLED market.

Key Market Segments

By Type

- Substrates

- Encapsulation

- Anode

- Cathode

- Emissive Layer (EML)

- Electron Transport Layer (ETL)

- Others

By Application

- Display

- Lighting

Driving Factors

Rising Demand for Advanced Display Technologies Worldwide

One of the main driving factors for the Organic Light Emitting Diode (OLED) market is the growing demand for advanced, energy-efficient, and high-quality display technologies. Consumers increasingly prefer OLED screens for their thin design, flexibility, and superior picture quality in smartphones, TVs, and automotive displays. The shift toward foldable and transparent displays is accelerating this trend.

Furthermore, innovations in material science and manufacturing are making OLEDs more durable and cost-efficient. Strong global funding for advanced material development continues to boost this growth, such as Cyprium Metals securing A$80 million to fund its cathode project restart, which indirectly supports material innovation in electronics. These advancements are strengthening the OLED industry’s foundation for sustained technological and market expansion.

Restraining Factors

High Manufacturing Costs and Complex Production Process

One major restraining factor for the Organic Light Emitting Diode (OLED) market is its high manufacturing cost and complex production process. OLED fabrication requires precise layer deposition, cleanroom environments, and expensive organic materials, which increase overall production expenses. These factors make OLEDs costlier than traditional display technologies, limiting their adoption in lower-priced devices.

Additionally, maintaining consistent yield and quality during large-scale manufacturing remains a challenge, particularly for flexible and large-screen panels. However, ongoing innovations in material efficiency and process optimization aim to reduce these costs over time. Supportive investments in related technologies, such as ARENA’s $30 million funding for battery cathode technology, highlight the broader industry push toward cost-effective, sustainable material development that could eventually benefit OLED production economics.

Growth Opportunity

Expansion into Automotive and Lighting Applications Globally

A major growth opportunity for the Organic Light Emitting Diode (OLED) market lies in its expanding use across automotive and lighting applications. Automakers are increasingly integrating OLED panels in dashboards, taillights, and ambient lighting systems to enhance design flexibility and energy efficiency.

Similarly, OLED lighting is gaining traction in architectural and commercial spaces due to its thin structure, low power use, and superior light quality. This broad adoption is creating new revenue avenues beyond traditional display markets.

Moreover, rising investments in material innovation strengthen the industry’s foundation, such as Northvolt raising $1.1 billion to expand battery and cathode production, reflecting the growing global focus on advanced materials that indirectly support OLED technological development and future scalability.

Latest Trends

Growing Adoption of Flexible and Transparent OLED Displays

One of the latest trends in the Organic Light Emitting Diode (OLED) market is the rising adoption of flexible and transparent display technologies. These displays are revolutionizing product design, allowing foldable smartphones, curved televisions, automotive dashboards, and even see-through smart windows. Their lightweight structure and energy efficiency make them ideal for next-generation devices focused on aesthetics and performance.

Manufacturers are investing heavily in new materials and production techniques to improve flexibility, durability, and lifespan. The global shift toward sustainable electronics also supports this innovation wave. Recently, BatX Energies raised $5 million in pre-series A funding for lithium battery recycling, highlighting the growing investment momentum in clean, circular, and material-efficient technologies that complement OLED’s sustainable evolution.

Regional Analysis

In 2024, the Asia-Pacific region led the Organic Light Emitting Diode Market with a 46.20% share.

In 2024, Asia-Pacific dominated the global Organic Light Emitting Diode (OLED) Market, holding a 46.20% share and reaching a market value of USD 0.6 billion. The region’s leadership is driven by strong manufacturing infrastructure, rapid industrialization, and growing adoption of advanced display technologies across consumer electronics and automotive industries.

Countries such as China, South Korea, and Japan remain major production hubs for OLED panels and components, supported by continuous R&D investments and government incentives for high-tech manufacturing.

North America follows with rising demand for premium display devices and energy-efficient lighting solutions, particularly in the United States. Europe shows steady growth due to the increasing adoption of OLED lighting in architecture and automotive design.

Meanwhile, Latin America and the Middle East & Africa represent emerging markets, gradually adopting OLED technologies for consumer and commercial applications. The regional expansion reflects technological advancement, increasing disposable incomes, and sustainability-driven demand for efficient and flexible display materials.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Idemitsu Kosan Co., Ltd. continued to play a vital role in supplying high-performance organic materials that enhance brightness, durability, and efficiency in OLED panels. The company’s expertise in organic chemistry and luminescent materials positioned it as a core partner for display and lighting manufacturers seeking advanced emissive compounds.

Toray Industries leveraged its deep capabilities in polymer science and nanomaterials, driving improvements in OLED substrates and flexible films that enable thinner, lightweight, and foldable display designs. Its focus on sustainable and high-performance materials aligns with global trends toward eco-efficient manufacturing.

Solus Advanced Materials, known for its technological strength in high-purity electronic materials, supported OLED growth through advanced cathode and anode materials essential for improved conductivity and device lifespan. Together, these companies strengthened the OLED supply chain through innovation, stability, and scalable production.

Top Key Players in the Market

- Idemitsu Kosan Co.,Ltd.

- Toray Industries

- Solus Advanced Materials

- UNIVERSAL DISPLAY

- Novaled GmbH

- DUSKAN NEOLUX

- SAMSUNG SDI

- JiLin OLED Material Tech Co., Ltd

Recent Developments

- In May 2025, Solus Advanced Materials announced that its newly developed high-performance green phosphorescent host material for OLED displays (which offers low voltage, high efficiency, and long lifespan) has received customer approval and is now moving into the ready-for-mass-production stage. The material targets both large-area TV panels and smaller smartphone/wearable panels.

- In September 2024, Toray announced that it will commission new film production facilities at its Gifu Plant in Japan in 2025, aimed at boosting capacity for high-end films used in displays and electronic applications. This investment supports the company’s efforts to supply materials for next-generation displays, including OLED and flexible screens.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Billion Forecast Revenue (2034) USD 5.9 Billion CAGR (2025-2034) 14.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Substrates, Encapsulation, Anode, Cathode, Emissive Layer (EML), Electron Transport Layer (ETL), Others), By Application (Display, Lighting) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Idemitsu Kosan Co.,Ltd., Toray Industries, Solus Advanced Materials, UNIVERSAL DISPLAY, Novaled GmbH, DUSKAN NEOLUX, SAMSUNG SDI, JiLin OLED Material Tech Co., Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Organic Light Emitting Diode MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Organic Light Emitting Diode MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Idemitsu Kosan Co.,Ltd.

- Toray Industries

- Solus Advanced Materials

- UNIVERSAL DISPLAY

- Novaled GmbH

- DUSKAN NEOLUX

- SAMSUNG SDI

- JiLin OLED Material Tech Co., Ltd