Global Organic Lamb Market Size, Share, And Enhanced Productivity By Product Type (Raw, Processed), By Production Method (Grass-Fed, Grain-Fed, Mixed-Fed), By End Use (Household, Food Industry), By Sales Channel (Supermarkets/Hypermarkets, Specialty Organic Stores, Convenience Stores, Online Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 175789

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

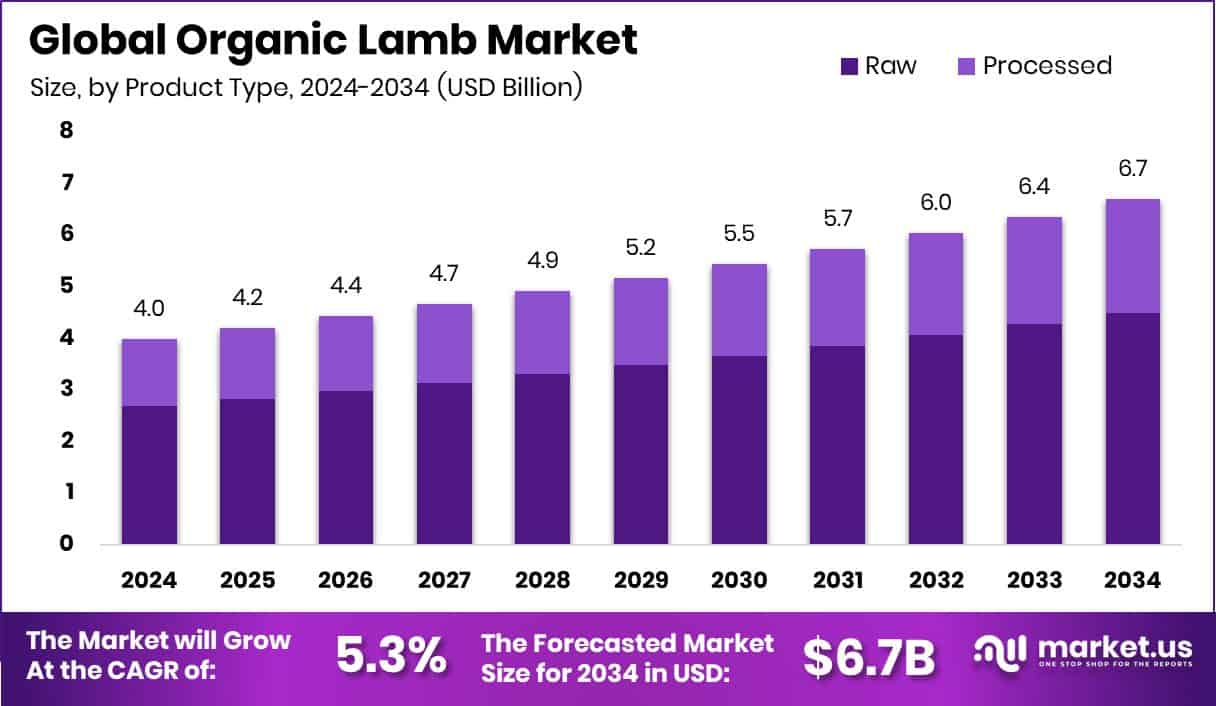

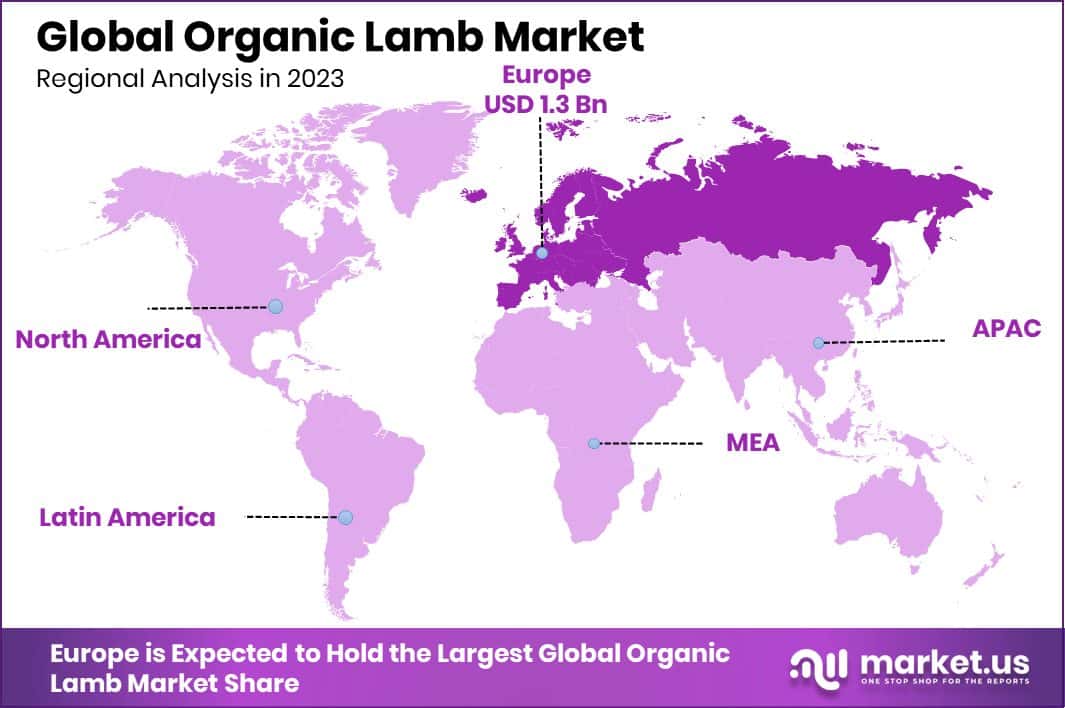

The Global Organic Lamb Market is expected to be worth around USD 6.7 billion by 2034, up from USD 4.0 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034. The European Organic Lamb Market grew steadily, holding 34.8% and generating USD 1.3 Bn revenue.

Organic lamb refers to meat produced from sheep raised under certified organic standards, meaning the animals graze on natural pastures, are not given synthetic hormones or routine antibiotics, and are managed with strong welfare practices. The Organic Lamb Market represents the growing trade of such ethically produced meat across retail, food service, and household consumption channels, driven by consumers who want cleaner, traceable protein options. Demand continues to rise as more buyers value natural grazing systems and healthier meat profiles, supported by increasing global interest in sustainable livestock farming.

Growth in this market is reinforced by strong sector-focused funding and farmer participation. Recent support includes £50k blockchain funding to help a Welsh tech consortium unlock lamb export opportunities, along with €3 million dedicated to ten organic sector projects. These investments strengthen supply chains and add confidence for producers adopting organic standards.

Demand is also boosted by shifting consumer habits, with 67% of Irish shoppers purchasing organic products monthly, showing expanding acceptance of premium, naturally raised meat. The number of farmers in the Organic Farming Scheme has now reached 5,700, ensuring a steady supply and broader adoption of organic grazing practices.

Opportunity continues to widen as governments reopen support systems, including the €1.5 million allocated to revive an organic processing scheme and nearly $743,000 provided to MSU for research and courses connected to sheep and organic farming. These initiatives enhance skills, processing capacity, and long-term market development, creating a supportive ecosystem for the Organic Lamb Market’s future.

Key Takeaways

- The Global Organic Lamb Market is expected to be worth around USD 6.7 billion by 2034, up from USD 4.0 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034.

- The Organic Lamb Market sees strong dominance in raw product type, with 67.2% consumer preference.

- Grass-fed production significantly boosts the organic lamb market, contributing 56.9% to overall category demand.

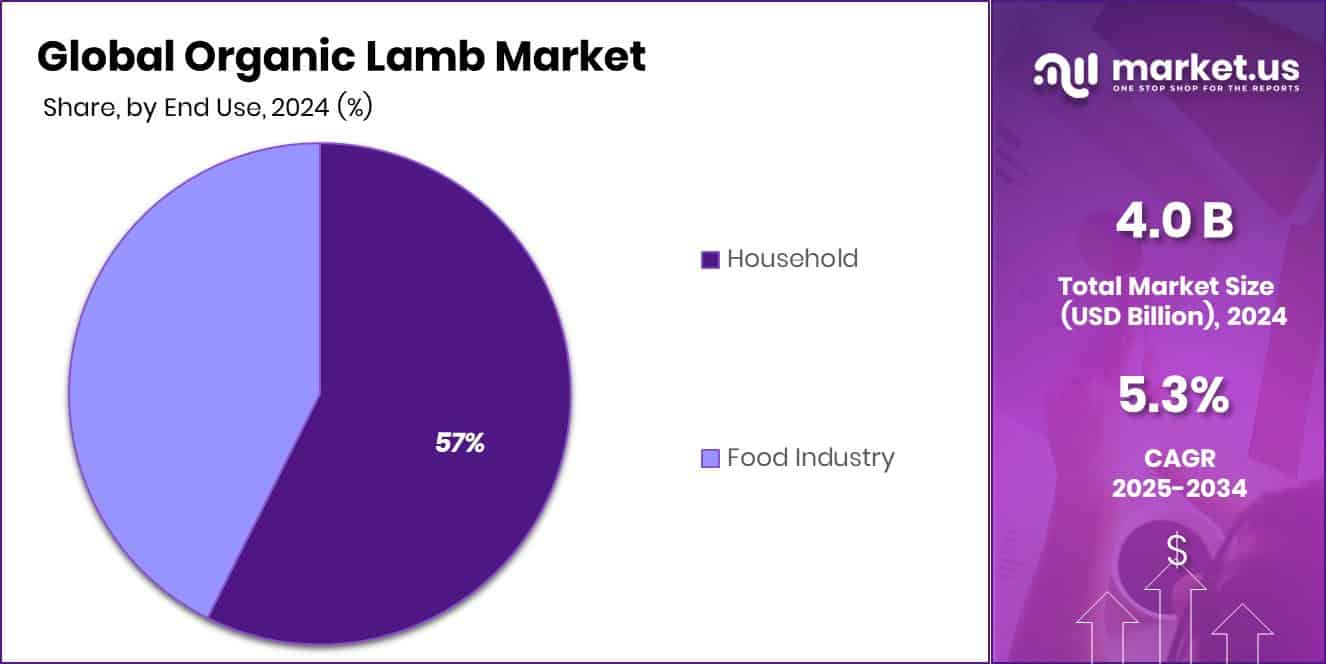

- Household end-use drives the Organic Lamb Market forward, accounting for 57.4% of total consumption.

- Supermarkets and hypermarkets lead the organic lamb market distribution channels, capturing a notable 37.5% share.

- Europe maintained strong organic lamb demand with a 34.8% share and USD 1.3 Bn value.

By Product Type Analysis

In the Organic Lamb Market, Raw products dominated with 67.2% share.

In 2024, the Organic Lamb Market saw raw organic lamb maintain a dominant position, accounting for 67.2% of overall demand. This dominance reflects the rising consumer shift toward minimally processed, ethically sourced, and clean-label meat options. Households and restaurants increasingly prefer raw organic cuts because they offer versatility across multiple cuisines and preserve natural texture, flavour, and nutrient integrity.

Growing awareness of antibiotic-free and hormone-free meat also strengthened purchasing behaviour, especially in premium retail chains and speciality butcher outlets. Additionally, expanding cold-chain networks and improved livestock management practices supported smooth supply flows for raw organic lamb. As consumers prioritised freshness and traceability, the raw segment continued to set the benchmark for quality within the global organic lamb landscape.

By Production Method Analysis

The organic lamb market saw Grass-Fed production dominate strongly at 56.9%.

In 2024, the Organic Lamb Market recorded strong momentum for grass-fed organic lamb, which captured 56.9% of the market due to its superior nutritional profile and natural rearing practices. Buyers increasingly valued meat from animals raised on open pastures without synthetic feed or chemicals, aligning with the broader movement toward sustainable agriculture.

Grass-fed lamb is perceived as richer in omega-3 fatty acids and lean protein, attributes that appeal to health-focused consumers and premium culinary establishments. Moreover, retailers expanded their organic and pasture-raised labels, strengthening consumer trust in origin-certified products. As governments promoted regenerative grazing and eco-friendly livestock farming, grass-fed organic lamb held a strong competitive edge, reinforcing its leadership position across developed and emerging markets alike.

By End Use Analysis

In the Organic Lamb Market, Household end use dominated with a 57.4% share.

In 2024, the Household segment accounted for 57.4% of the Organic Lamb Market, supported by rising home-cooking trends, cleaner food preferences, and higher interest in premium animal protein. Consumers increasingly chose organic lamb for its natural flavour, ethical sourcing, and absence of harmful additives. Enhanced accessibility through organised retail, farm-to-home delivery services, and branded organic meat providers further encouraged household adoption.

Additionally, younger families and health-conscious buyers preferred organic lamb due to its perceived purity and better digestibility compared to conventionally raised livestock. Growing disposable incomes in urban regions and expanding awareness of sustainable meat choices also strengthened demand. As a result, household consumption remained the backbone of market growth throughout 2024.

By Sales Channel Analysis

Supermarkets and hypermarkets dominated the organic lamb market sales with a 37.5% share.

In 2024, Supermarkets and Hypermarkets represented 37.5% of total Organic Lamb Market sales, driven by consumers’ preference for reliable quality, clear labelling, and convenient access to certified organic meat ranges. Large retail chains expanded their organic meat portfolios, offering chilled and fresh lamb cuts with strict traceability, which built strong shopper confidence.

Promotional pricing, attractive packaging, and dedicated organic sections further increased footfall and conversions. These outlets also benefited from robust cold-storage infrastructure, ensuring consistent freshness and availability across urban and semi-urban regions. With customers seeking trustworthy and regulated retail environments, supermarkets and hypermarkets continued to be the primary purchase point for organic lamb, strengthening their role as a preferred sales channel in 2024.

Key Market Segments

By Product Type

- Raw

- Processed

By Production Method

- Grass-Fed

- Grain-Fed

- Mixed-Fed

By End Use

- Household

- Food Industry

By Sales Channel

- Supermarkets/Hypermarkets

- Speciality Organic Stores

- Convenience Stores

- Online Retail

- Others

Driving Factors

Rising preference for naturally raised meat

The Organic Lamb Market continues to gain strength as consumers steadily shift toward naturally raised and minimally processed animal protein. Shoppers increasingly look for lamb produced through pasture-based systems where animals graze freely, resulting in cleaner, richer meat qualities that align with modern dietary preferences. This shift is reinforced by the broader movement toward natural and grass-fed foods, where transparency, welfare, and purity hold strong appeal. The segment also benefits from the rising visibility of premium animal-based products across retail shelves.

Developments in other natural food categories, such as the expansion activities seen in the clean-label space, including growth movements like the Ghee startup 4th & Heart raising $7.6M, highlight the broader consumer momentum supporting naturally sourced foods, indirectly strengthening demand for organic lamb.

Restraining Factors

Higher production costs limit affordability

In the Organic Lamb Market, higher production costs remain one of the most consistent challenges, making organic lamb less accessible to price-sensitive buyers. Organic farming requires certified feed, pasture management, and extensive animal welfare processes, all of which increase operational expenditure for producers. These costs directly influence retail prices, often placing organic lamb in premium brackets compared to conventional lamb.

As a result, consumers seeking affordability may hesitate to purchase organic cuts regularly. This challenge mirrors pressure seen in other pasture-based livestock sectors, such as the investment growth surrounding premium dairy initiatives, including Hart Dairy securing $20 million to strengthen grass-fed farming systems. While such efforts highlight consumer interest in natural products, they also underscore the financial commitment required, reinforcing why organic lamb remains a higher-priced option.

Growth Opportunity

Expanding government incentives supporting organics

The Organic Lamb Market is well-positioned to benefit from expanding government incentives aimed at promoting organic farming and improving sustainable livestock practices. Supportive policies encourage farmers to convert land to organic systems, enhance certification uptake, and participate in long-term regenerative programs. These initiatives increase supply stability and attract new producers who see opportunity in premium livestock categories.

Growing governmental backing across agricultural sectors—illustrated by expansion activity in natural food industries such as a free-range milk company raising $10M to advance pasture-based production—shows the rising confidence in organic and ethical farming. As more programs focus on improving grazing systems, ecological balance, and farmer participation, organic lamb producers gain stronger foundations for long-term growth, helping the market widen its reach across retail and export channels.

Latest Trends

Blockchain adoption improves lamb traceability

One of the most notable trends shaping the Organic Lamb Market is the growing use of blockchain technology to strengthen traceability and transparency across the supply chain. Consumers increasingly want proof of origin, grazing practices, and organic certification, and blockchain offers an immutable and accessible record of each step from farm to shelf. This digital shift reassures buyers that the lamb they purchase genuinely meets organic and welfare standards.

Blockchain also helps producers protect brand value by preventing mislabeling and building stronger relationships with retailers and export partners. As traceability becomes a decisive purchasing factor in premium meat categories, the adoption of blockchain systems aligns well with the organic sector’s focus on authenticity and ethical production, making it a defining trend shaping future market dynamics.

Regional Analysis

In Europe, the Organic Lamb Market reached 34.8%, valued at USD 1.3 Bn in 2024.

In 2024, Europe dominated the Organic Lamb Market with a strong 34.8% share, valued at USD 1.3 Bn, supported by mature organic livestock systems and high consumer preference for certified, pasture-based meat. Demand remained concentrated in countries with established organic regulations and strong retail penetration, helping Europe maintain its leadership position.

North America followed with steady growth driven by rising adoption of clean-label protein and expanding organic meat availability across retail shelves, supported by consumers prioritising traceable and chemical-free lamb products. In the Asia Pacific region, demand continued to build gradually as awareness of organic meat increased and urban populations shifted toward premium animal protein choices.

The Middle East & Africa region saw niche but improving traction, particularly in urban hubs where organic and halal-certified lamb categories gained visibility. Latin America displayed emerging interest as small-scale organic livestock practices expanded and higher-income groups explored premium meat options.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Tyson Foods, Inc. continued strengthening its position in the organic lamb market by expanding its premium and naturally sourced protein portfolio. The company’s focus remained on meeting rising consumer interest in clean, sustainably raised meat. Tyson’s investments in traceability, improved livestock standards, and transparent sourcing helped reinforce its credibility among customers seeking guaranteed organic quality. With growing attention on animal welfare, Tyson strategically aligned its production practices with evolving consumer expectations, enabling it to hold a relevant position within the organic lamb space.

Hormel Foods Corporation maintained a focused approach toward value-added and speciality protein offerings, supporting its participation in the organic lamb category. The company emphasised responsibly sourced meat products and strengthened its presence through established distribution networks. Hormel leveraged its strong brand recognition to cater to the segment of consumers prioritising natural, minimally processed lamb. Its continued commitment to product purity and ethical sourcing helped it remain competitive in the organic meat landscape.

Danish Crown A/S played a notable role in shaping the organic lamb sector due to its deep expertise in livestock and meat processing. The company prioritised high-quality standards and sustainable production practices. With strong European market influence, Danish Crown benefited from growing demand for certified organic lamb, reinforcing its strategic relevance in 2024.

Top Key Players in the Market

- Tyson Foods, Inc.

- Hormel Foods Corporation

- Danish Crown A/S

- Pick’s Organic Farm

- Saltbush Livestock Pty Ltd

- Windy N Ranch

- Mallow Farm & Cottage

- Neat Meat

- Minerva Foods S.A.

- Dawn Meats

Recent Developments

- In November 2025, Hormel Foods announced a corporate restructuring designed to better align resources with strategic priorities and support future growth. This included workforce changes and a focus on long-term competitiveness across its food brands.

- In September 2024, Windy N Ranch announced that it now ships its meats directly to customers’ doors, making it easier for people outside their local pickup area to receive pasture-raised products like their grass-fed lamb. This change expanded access to their certified organic, grass-fed lamb and other meats beyond local markets.

- In July 2024, Tyson Foods agreed to sell its Vienna, Georgia, poultry complex to another producer as part of reshaping its operations and focusing on core protein businesses. This deal shows Tyson’s strategy of optimising its facilities and resources across its meat product lines.

Report Scope

Report Features Description Market Value (2024) USD 4.0 Billion Forecast Revenue (2034) USD 6.7 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Raw, Processed), By Production Method (Grass-Fed, Grain-Fed, Mixed-Fed), By End Use (Household, Food Industry), By Sales Channel (Supermarkets/Hypermarkets, Speciality Organic Stores, Convenience Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Tyson Foods, Inc., Hormel Foods Corporation, Danish Crown A/S, Pick’s Organic Farm, Saltbush Livestock Pty Ltd, Windy N Ranch, Mallow Farm & Cottage, Neat Meat, Minerva Foods S.A., Dawn Meats Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Tyson Foods, Inc.

- Hormel Foods Corporation

- Danish Crown A/S

- Pick’s Organic Farm

- Saltbush Livestock Pty Ltd

- Windy N Ranch

- Mallow Farm & Cottage

- Neat Meat

- Minerva Foods S.A.

- Dawn Meats