Global Optical Lens Edger Market By Product Type (Automatic, Manual, and Others), By Application (Eyeglass Lens, Microscope Lens, and Others), By End-user (Ophthalmology Hospitals & Clinics, Independent Optical Stores, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 156810

- Number of Pages: 395

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

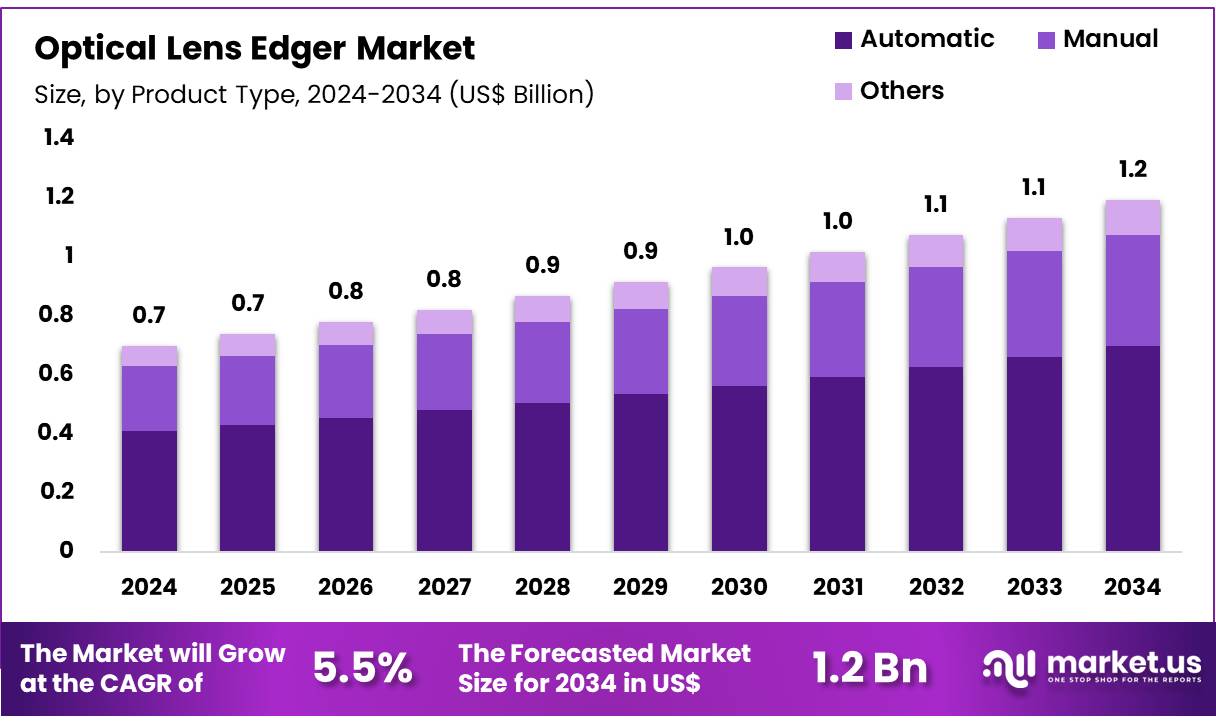

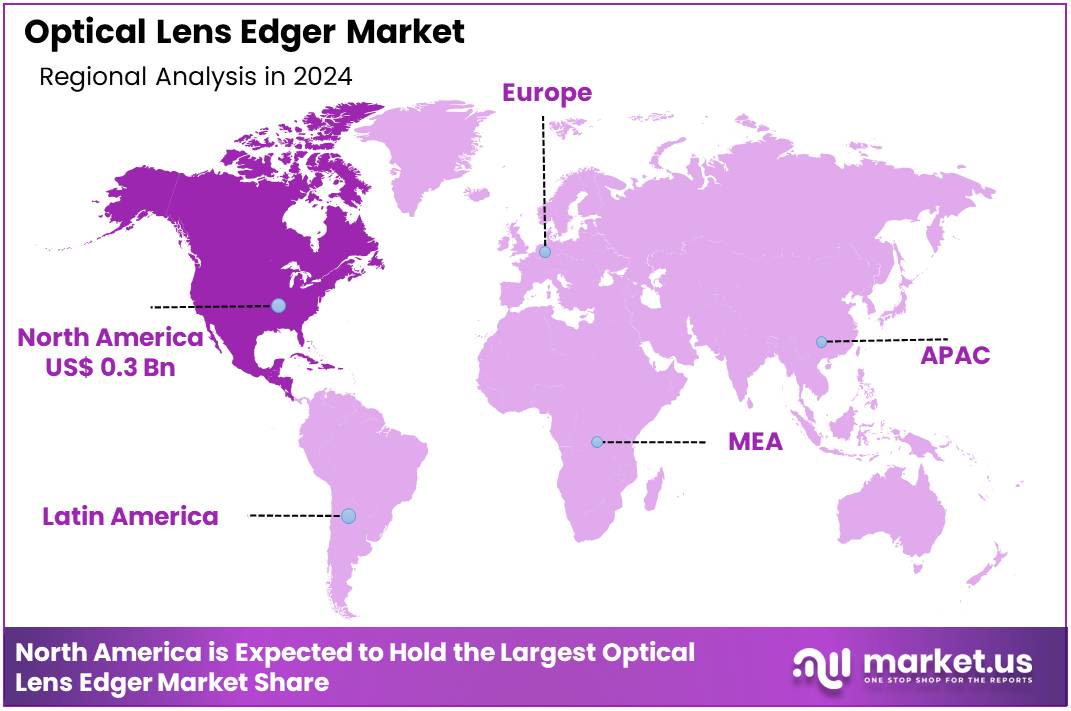

Global Optical Lens Edger Market size is expected to be worth around US$ 1.2 Billion by 2034 from US$ 0.7 Billion in 2024, growing at a CAGR of 5.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.6% share with a revenue of US$ 0.3 Billion.

Rising prevalence of vision impairment and the increasing demand for high-quality, customized eyewear are the primary drivers of the optical lens edger market. According to a 2023 report from the World Health Organization (WHO), uncorrected refractive errors are a leading cause of vision impairment globally, affecting at least 2.2 billion people. This profound statistic underscores the immense and ongoing need for corrective lenses.

As consumers become more discerning about the aesthetics and functionality of their eyewear, the demand for precision lens cutting and shaping has intensified. Optical lens edgers are essential tools that enable opticians and laboratories to produce perfectly fitted lenses, from standard single-vision prescriptions to complex progressive and high-index designs.

Growing technological sophistication is a key trend shaping the market, with innovations enhancing efficiency and accuracy. Modern edgers are now equipped with automation, AI integration, and advanced CAD/CAM software, which streamlines the entire process from lens tracing to final polishing. This technological evolution allows for the precise edging of complex lens geometries, including freeform designs, with minimal human error.

For instance, companies are introducing new high-precision edger lines to meet the demand for accurate edging of complex lens designs and coatings. This focus on automation and digital integration enables a faster turnaround time for consumers and greater consistency in production for optical labs.

Increasing consolidation and strategic vertical integration within the vision care industry are creating significant opportunities for market expansion. Major corporations are acquiring smaller players to enhance their manufacturing capabilities and control the entire supply chain, from frame design to lens finishing. In September 2022, FYi Health Group expanded its eyewear offerings by acquiring WestGroupe, a move that strengthened its vertical integration and solidified its position in the Canadian market.

This trend is leading to the establishment of more in-house labs and large-scale manufacturing hubs that require high-throughput, fully automated edgers. With the Agency for Healthcare Research and Quality (AHRQ) reporting that outpatient visits for vision-related issues in the US total in the millions annually, the continuous flow of patients and prescriptions ensures a steady demand for this essential ophthalmic equipment.

Key Takeaways

- In 2024, the market for optical lens edger generated a revenue of US$ 0.7 billion, with a CAGR of 5.5%, and is expected to reach US$ 1.2 billion by the year 2034.

- The product type segment is divided into automatic, manual, and others, with automatic taking the lead in 2023 with a market share of 58.4%.

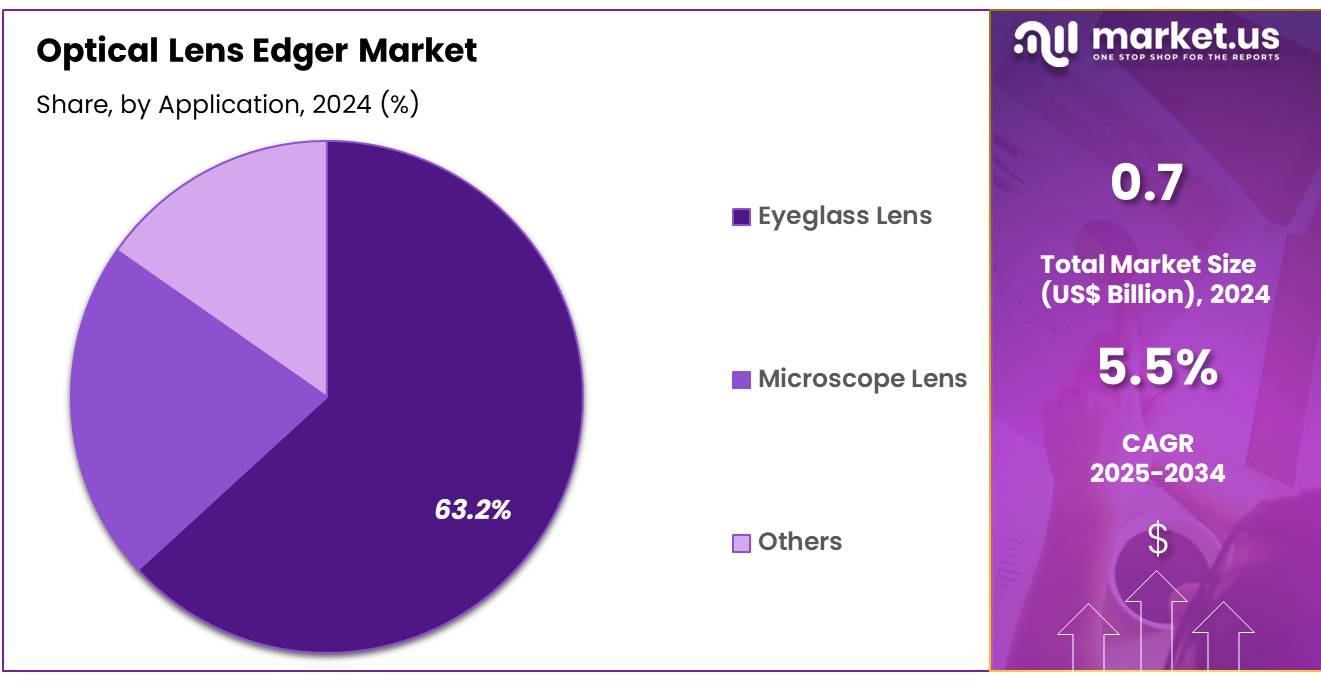

- Considering application, the market is divided into eyeglass lens, microscope lens, and others. Among these, eyeglass lens held a significant share of 63.2%.

- Furthermore, concerning the end-user segment, the market is segregated into ophthalmology hospitals & clinics, independent optical stores, and others. The ophthalmology hospitals & clinics sector stands out as the dominant player, holding the largest revenue share of 55.7% in the optical lens edger market.

- North America led the market by securing a market share of 38.6% in 2023.

Product Type Analysis

Automatic optical lens edgers account for 58.4% of the product type segment in the market. Their growth is projected to continue as these devices offer high precision and reduce human error compared to manual edgers. Optical laboratories and retail stores increasingly adopt automatic systems for faster processing and improved lens quality. Technological innovations, including computerized edge tracing and automated beveling, are expected to enhance efficiency and productivity. The rising demand for multifocal, progressive, and high-index lenses is anticipated to drive the use of automatic lens edgers.

Additionally, as ophthalmology hospitals and clinics aim to improve patient turnaround and accuracy in lens fitting, automatic systems are likely to see increased adoption. The growing trend of integrating advanced software and automated calibration systems is expected to further accelerate market growth. With rising consumer expectations for high-quality eyewear, automatic lens edgers are likely to dominate the market in coming years.

Application Analysis

Eyeglass lens applications account for 63.2% of the application segment in the optical lens edger market. This growth is expected to continue as eyeglasses remain the primary vision correction device worldwide. Increasing vision disorders, including myopia, hyperopia, and presbyopia, are anticipated to drive the demand for customized lenses that require precise edging.

The rise in fashion-conscious eyewear and the popularity of premium lens coatings, such as anti-reflective and blue-light filters, are projected to increase the adoption of advanced lens edging solutions. Optical stores and hospitals are likely to focus on improving turnaround time and reducing rework, making accurate edging essential. The growing elderly population with declining eyesight and increasing awareness of eye health is expected to further support market growth. As lens manufacturers continue innovating in material technology and design, the demand for precise edging of eyeglass lenses is projected to rise steadily.

End-User Analysis

Ophthalmology hospitals and clinics represent 55.7% of the end-user segment in the optical lens edger market. Their growth is projected to continue as these facilities require precise and efficient lens processing for a high volume of patients. The increasing prevalence of vision disorders and the rising number of cataract, refractive, and retinal procedures are expected to drive demand. Hospitals and clinics aim to reduce patient waiting time while ensuring high-quality lenses, which makes automated and precise edgers essential.

Investments in advanced ophthalmic equipment and modernization of hospital infrastructure are likely to boost adoption. The increasing preference for one-stop optical services, where lens cutting, edging, and fitting are performed onsite, is anticipated to strengthen the segment. Furthermore, hospitals and clinics are expected to adopt edgers compatible with various lens types and materials, supporting overall market growth in the foreseeable future.

Key Market Segments

By Product Type

- Automatic

- Manual

- Others

By Application

- Eyeglass Lens

- Microscope Lens

- Others

By End-User

- Ophthalmology Hospitals & Clinics

- Independent Optical Stores

- Others

Drivers

The rising global prevalence of vision disorders and the increasing demand for corrective eyewear is driving the market.

The market for optical lens edgers is experiencing significant growth, primarily driven by the escalating global prevalence of vision-related disorders and the subsequent demand for corrective eyewear. Conditions such as myopia, hyperopia, and astigmatism are becoming more common across all age groups, necessitating an increasing number of prescription glasses. The World Health Organization (WHO) estimates that by 2050, nearly half of the global population, close to 5 billion people, may be myopic. This demographic shift creates a consistent and expanding patient base that requires custom-fit spectacles.

The need for precise and rapid lens processing to meet this demand directly fuels the need for efficient lens edgers. As the consumer desire for personalized and high-quality eyewear grows, optical practices and labs are investing in equipment that can handle a variety of lens materials, coatings, and complex frame shapes, ensuring a perfect fit and high-quality final product.

Restraints

The high capital cost of equipment and the need for skilled personnel are restraining the market.

A significant restraint on the market is the substantial capital investment required to purchase and maintain advanced lens edging equipment. Modern, highly automated edgers are complex machines that come with a high price tag, often representing a major financial barrier for smaller optometric practices or independent optical shops. This high cost of entry limits the widespread adoption of the latest technology and can slow the rate of market penetration, particularly in developing regions.

Additionally, while automation has streamlined the process, a skilled workforce is still essential for operating the machinery, performing quality control, and troubleshooting issues. The US Bureau of Labor Statistics data for 2023 noted that employment of opticians is projected to grow 3 percent, which is about as fast as the average for all occupations. This indicates a consistent, but not rapidly expanding, workforce. The need for specialized training for these technicians and the cost associated with this expertise adds to the overall operational expense for a business.

Opportunities

The increasing adoption of in-house edging by optical retailers and optometrists is creating growth opportunities.

The market is presented with significant opportunities from a broader shift towards in-house lens finishing by retail optical stores and independent optometrists. Traditionally, many of these businesses would send lens orders to large central laboratories, which often resulted in longer turnaround times for customers. However, advancements in edger technology have made compact, user-friendly models more accessible and affordable, allowing practices to perform edging on-site. This capability provides a competitive advantage by enabling same-day service for many prescriptions.

According to a 2024 report on US optical retail, the top 50 US optical retailers saw their total sales rise by 4.0 percent, a portion of which is driven by consumer demand for faster service. Providing immediate access to new eyewear greatly improves customer satisfaction and loyalty. The ability to control the entire production process from start to finish also ensures a higher level of quality control and accuracy for the final product, solidifying this trend as a key growth area.

Impact of Macroeconomic / Geopolitical Factors

The market for optical lens edgers is navigating a complex macroeconomic and geopolitical landscape that affects both manufacturing costs and consumer spending. Global inflationary pressures have continued to increase the cost of essential raw materials, particularly the various plastics and electronic components used in the production of these sophisticated machines. According to the US Bureau of Economic Analysis (BEA), US personal consumption expenditures on healthcare services, which includes vision care, have shown consistent growth in 2024, reflecting an overall increase in health-related spending.

However, geopolitical tensions have introduced an additional layer of risk, with trade route disruptions and export restrictions creating volatility in the global supply chain for key components, such as microchips and high-performance plastics. A 2024 report highlighted how geopolitical events, such as regional conflicts and trade disputes, led to significant delays in shipping, affecting the availability of essential materials. However, the industry demonstrates resilience by proactively adapting to these conditions. Many manufacturers are strategically diversifying their supplier base to mitigate these risks and are investing in more localized production to ensure a more secure and stable supply for their customers.

Current US tariff policies are fundamentally reshaping the global supply chain for medical and optical equipment, creating both fiscal challenges and new strategic opportunities. The imposition of duties on imported optical instruments and their electronic components has increased the final cost of these products for US-based optical practices and labs. A 2024 report from the US Department of Commerce highlighted that tariffs on certain optical goods from specific countries directly impacted their import value, a cost that is often passed on to consumers. This directly impacts the procurement budgets of optical practices and can influence their purchasing decisions. However, this same dynamic is also creating a powerful incentive for domestic manufacturing.

Many companies are now accelerating plans to establish or expand production facilities within the United States to bypass these import duties. A recent report from a government-sponsored trade initiative noted a significant increase in capital expenditure for the localization of critical medical device manufacturing. This strategic shift is fostering a resurgence of domestic production, thereby strengthening the US manufacturing base and creating a more secure supply chain.

Latest Trends

The development of automated and robotic edging systems is a recent trend.

A significant trend in 2024 is the shift toward developing fully automated and robotic lens edging systems for high-volume optical labs. These systems are designed to handle every step of the lens finishing process, from blocking and edging to drilling and grooving, with minimal human intervention. This trend is driven by a need to increase efficiency, reduce labor costs, and improve the consistency and quality of the finished product. These robotic systems can operate continuously, processing a high volume of lenses with extreme precision, thereby reducing human error and waste.

According to data from the World Intellectual Property Organization (WIPO), the number of international patent applications filed in 2024 for automated systems in the optical and medical device fields has shown an increase, indicating a clear focus on innovation in this area. This automation is enabling laboratories to scale their operations and meet the growing demand for eyewear, all while maintaining a high standard of quality.

Regional Analysis

North America is leading the Optical Lens Edger Market

The North American optical lens edger market held a substantial 38.6% share of the global market in 2024. This leadership is directly attributed to a high prevalence of vision impairment, a sophisticated optical retail infrastructure, and a strong emphasis on technological innovation. The prevalence of vision-related issues in the US creates a large and consistent demand for corrective eyewear.

For instance, according to data from the Centers for Disease Control and Prevention (CDC), in 2022, approximately 34 million Americans over the age of 40 were nearsighted, and over 14 million were farsighted. This significant patient pool, coupled with the increasing consumer trend of treating eyewear as a fashion accessory, fuels the demand for high-end, customized lenses. The market is also driven by the widespread adoption of advanced automated edgers in both independent optical stores and larger retail chains, which seek to improve efficiency and reduce turnaround times.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific optical lens edger market is anticipated to experience the fastest growth during the forecast period. This is largely a result of the region’s vast and aging population, rising disposable incomes, and a significant increase in the prevalence of vision impairments. For instance, a 2022 study published in Scientific Reports on a large-scale population in China found the overall prevalence of myopia to be 54.75% in the adult population, with uncorrected refractive error being a leading cause of visual impairment.

The World Health Organization (WHO) has also highlighted the substantial burden of vision impairment in the South-East Asia region, where 30% of the global 2.2 billion people with vision impairment reside. This high disease prevalence fuels the need for efficient and accessible vision correction solutions. The market’s growth is further supported by proactive government initiatives, such as India’s National Programme for Control of Blindness and Visual Impairment, which has set targets to address the backlog of cataract surgeries and distribute free spectacles, thereby increasing the overall demand for optical services and the equipment required to provide them.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading players in the optical lens edger market actively pursue growth by integrating automation and artificial intelligence into their equipment. These companies focus on developing advanced systems that enhance precision, optimize workflow, and minimize human error, catering to the rising demand for intricate lens designs and customized prescriptions. They are also expanding their technological capabilities through strategic acquisitions and partnerships, aiming to broaden product portfolios and enter new geographic regions.

A key emphasis lies in creating user-friendly interfaces and robust software to improve operational efficiency and provide comprehensive digital solutions to optical labs and retail chains. These efforts improve customer satisfaction and increase market presence.

Founded in 1971 in Gamagori, Japan, NIDEK Co., Ltd. is a global manufacturer of ophthalmic equipment, specializing in diagnostic, surgical, and vision care products. The company’s core philosophy centers on using optical and electronic engineering to develop distinctive eye care solutions. NIDEK has a history of innovation, including the launch of one of the first automatic refractometers in Japan and its pioneering role in creating patternless edging systems. The company’s strategy focuses on a global market presence, offering a diverse range of products to eye care practitioners worldwide while emphasizing technological differentiation and customer satisfaction.

Top Key Players

- Topcon Corporation

- Signet Jewelers

- Rodenstock

- Nikon Corporation

- Marcolin Group

- Marchon Eyewear

- Luxottica Group

- Kering Eyewear

- HOYA Corporation

- EssilorLuxottica

- Essilor

- Carl Zeiss Meditec

Recent Developments

- In June 2025, researchers at ETH Zurich developed ultra-thin lithium-niobate metalenses that are 40 times thinner than a human hair. This breakthrough opens the door for large-scale production of compact optical components, which require specialized hybrid edge finishing.

- In May 2025, Coburn Technologies launched the Cobalt NXT generator, featuring advanced automation capabilities for next-generation lens surfacing. The system is engineered to meet the demands of high-volume optical laboratories.

Report Scope

Report Features Description Market Value (2024) US$ 0.7 Billion Forecast Revenue (2034) US$ 1.2 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Automatic, Manual, and Others), By Application (Eyeglass Lens, Microscope Lens, and Others), By End-user (Ophthalmology Hospitals & Clinics, Independent Optical Stores, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Topcon Corporation, Signet Jewelers, Rodenstock, Nikon Corporation, Marcolin Group, Marchon Eyewear, Luxottica Group, Kering Eyewear, HOYA Corporation, EssilorLuxottica, Essilor, Carl Zeiss Meditec. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Topcon Corporation

- Signet Jewelers

- Rodenstock

- Nikon Corporation

- Marcolin Group

- Marchon Eyewear

- Luxottica Group

- Kering Eyewear

- HOYA Corporation

- EssilorLuxottica

- Essilor

- Carl Zeiss Meditec