Global Off-grid Energy Storage System Market Size, Share Analysis Report By Battery Type (Lithium-ion Batteries, Lead-Acid Batteries, Flow Batteries, Others), By Capacity (Small Scale, Medium Scale, Large Scale), By Application (Residential, Commercial, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160139

- Number of Pages: 290

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

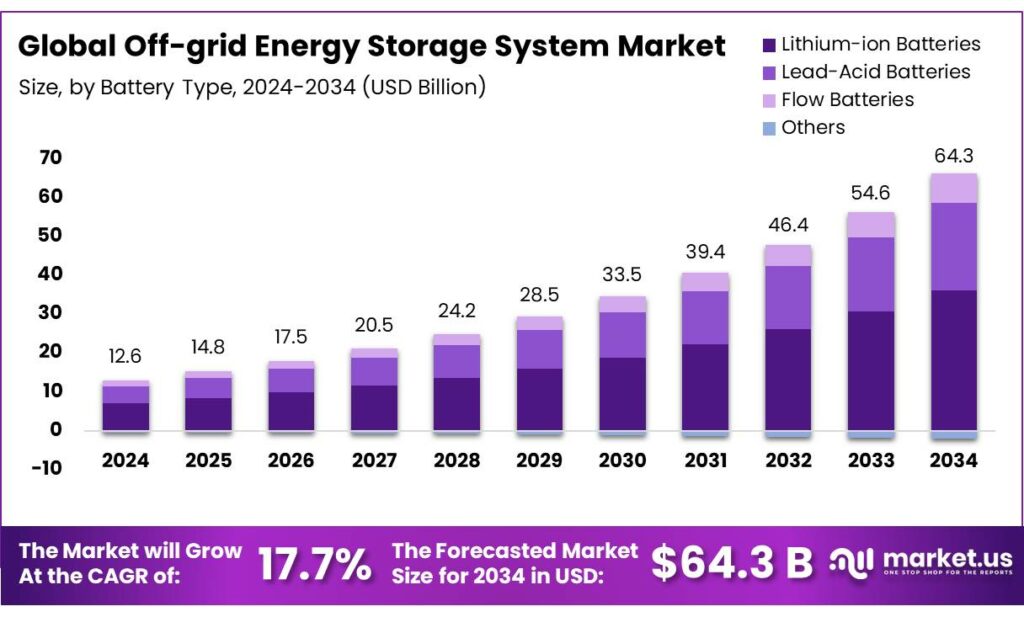

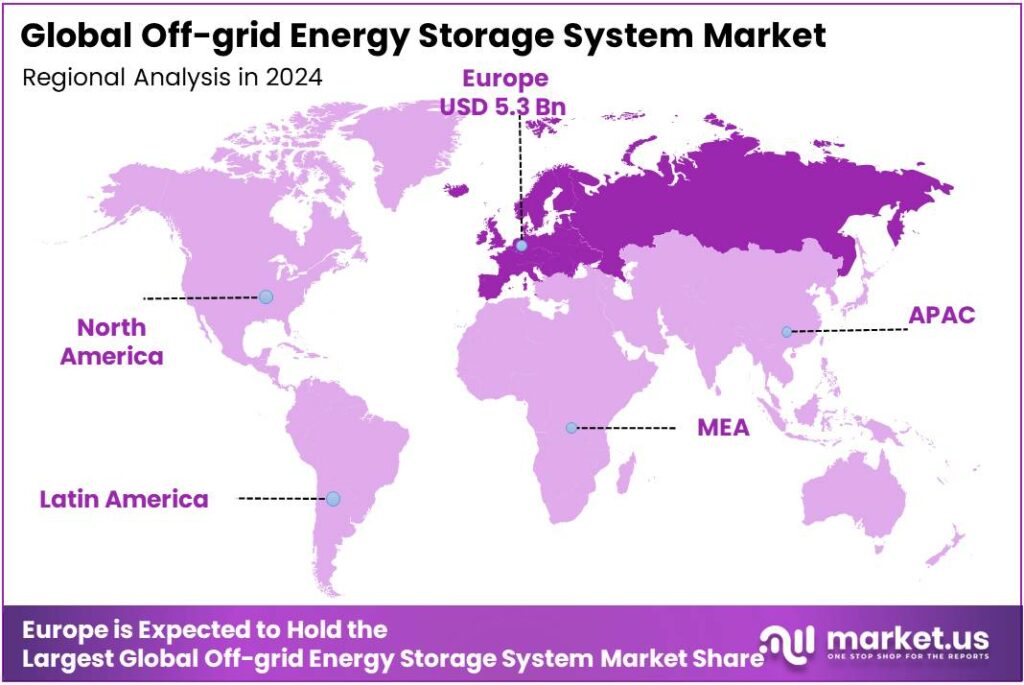

The Global Off-grid Energy Storage System Market size is expected to be worth around USD 64.3 Billion by 2034, from USD 12.6 Billion in 2024, growing at a CAGR of 17.7% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 42.3% share, holding USD 5.3 Billion in revenue.

Off-grid energy storage systems (OESS) are pivotal in India’s transition to a sustainable and resilient energy future. These systems, encompassing technologies like lithium-ion and flow batteries, enable the storage of renewable energy in remote and off-grid regions, ensuring a consistent power supply and reducing dependence on conventional grids. Their significance is underscored by India’s ambitious renewable energy targets, aiming for 500 GW of non-fossil fuel capacity by 2030.

The industrial scenario is characterized by wide downstream use and regulatory oversight. 2-EHMA is reported on the OECD High Production Volume (HPV) lists and is produced in volumes greater than 1,000 tonnes per year in at least one OECD member country, a fact that has motivated grouped hazard and exposure assessments under international HPV/SIDS frameworks. Registration and use notifications are recorded in regulatory inventories, indicating ongoing manufacture, import and formulation activities in multiple jurisdictions.

The Indian government has implemented several initiatives to promote the adoption of off-grid energy storage solutions. In February 2024, the government launched the PM Surya Ghar: Muft Bijli Yojana, with an outlay of ₹75,021 crore, aiming to install rooftop solar systems in one crore households. This scheme provides subsidies ranging from ₹30,000 to ₹78,000 per household, along with up to 300 units of free electricity monthly.

The market for off-grid energy storage systems in India is experiencing significant growth. In 2024, the country added 341 MWh of battery storage capacity, a sixfold increase from 51 MWh in 2023, bringing the total cumulative capacity to 442 MWh. Approximately 60% of this capacity was from solar-plus-storage systems, 36% from other renewables, and 4% from standalone units.

Financial support for energy storage projects includes a ₹54 billion scheme approved by the central government to support 30 GWh of battery energy storage. Furthermore, the Maharashtra State Electricity Distribution Company Ltd (MSEDCL) has proposed a ₹20,000 crore project to establish battery-based storage units for managing 16,000 MW of solar power, aiming to store surplus energy for use during peak demand hours.

Key Takeaways

- Off-grid Energy Storage System Market size is expected to be worth around USD 64.3 Billion by 2034, from USD 12.6 Billion in 2024, growing at a CAGR of 17.7%.

- Lithium-ion batteries held a dominant market position in the off-grid energy storage system segment, capturing more than a 56.3% share.

- Medium-scale capacity held a dominant market position in the off-grid energy storage system segment, capturing more than a 44.6% share.

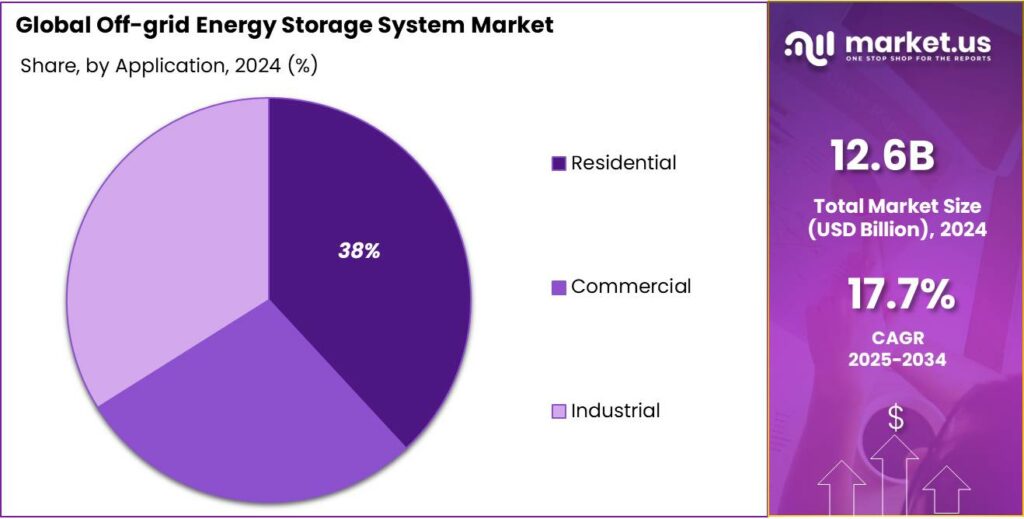

- Residential applications held a dominant market position in the off-grid energy storage system segment, capturing more than a 38.2% share.

- Europe held a dominant position in the off-grid energy storage system market, capturing more than a 42.3% share, valued at approximately USD 5.3 billion.

By Battery Type Analysis

Lithium-ion Batteries dominate Off-grid Energy Storage Systems with 56.3% share in 2024 due to high efficiency and long lifecycle.

In 2024, Lithium-ion batteries held a dominant market position in the off-grid energy storage system segment, capturing more than a 56.3% share. Their widespread adoption is primarily driven by their superior energy density, long lifecycle, and low maintenance requirements compared to traditional lead-acid batteries. These batteries have become the preferred choice for residential and commercial off-grid installations, particularly in remote and rural areas where reliable power supply is critical.

The performance advantages of lithium-ion technology, including faster charging, higher round-trip efficiency, and better thermal stability, have further strengthened their market position. By 2025, the demand for lithium-ion batteries is expected to continue its upward trajectory as solar and wind energy installations expand, supporting the growing need for autonomous energy solutions. The integration of smart energy management systems with lithium-ion storage also enhances grid independence, making them a key enabler for sustainable off-grid electrification.

By Capacity Analysis

Medium-scale capacity leads Off-grid Energy Storage Systems with 44.6% share in 2024 due to balanced efficiency and cost-effectiveness.

In 2024, medium-scale capacity held a dominant market position in the off-grid energy storage system segment, capturing more than a 44.6% share. This segment has become increasingly preferred for commercial establishments, small industrial units, and community-based energy projects that require a reliable power supply without the high investment associated with large-scale systems. Medium-scale storage systems offer an optimal balance between storage capacity, cost, and ease of installation, making them a practical choice for decentralized energy needs.

The demand for medium-scale off-grid storage is expected to rise further in 2025 as renewable energy adoption accelerates and rural electrification initiatives expand. These systems are particularly suited for integrating solar and wind energy sources, providing consistent energy output for multiple applications, including irrigation, small manufacturing units, and local microgrids. Their moderate capacity allows for efficient energy management while maintaining flexibility in scaling according to consumption requirements.

By Application Analysis

Residential applications lead Off-grid Energy Storage Systems with 38.2% share in 2024 due to rising home energy needs and renewable adoption.

In 2024, residential applications held a dominant market position in the off-grid energy storage system segment, capturing more than a 38.2% share. The growth in this segment is driven by increasing demand for reliable electricity in homes, particularly in rural and semi-urban areas where grid connectivity is inconsistent. Homeowners are increasingly adopting off-grid storage solutions paired with solar panels to ensure uninterrupted power supply for lighting, appliances, and heating or cooling systems.

The residential segment is expected to maintain strong growth in 2025 as more households invest in sustainable energy solutions. Falling costs of lithium-ion batteries and the availability of medium-scale storage systems suitable for individual homes have made residential off-grid storage more accessible. Additionally, the integration of smart energy management systems enables homeowners to optimize energy consumption, further enhancing the appeal of residential solutions.

Key Market Segments

By Battery Type

- Lithium-ion Batteries

- Lead-Acid Batteries

- Flow Batteries

- Others

By Capacity

- Small Scale

- Medium Scale

- Large Scale

By Application

- Residential

- Commercial

- Industrial

Emerging Trends

Harnessing Off-Grid Energy Storage to Reduce Post-Harvest Losses

In regions where access to reliable electricity is limited, off-grid energy storage systems are proving to be a game-changer for the agricultural sector. These systems, often powered by renewable sources like solar energy, provide farmers with the tools they need to store their produce safely, thereby reducing post-harvest losses and contributing to food security.

Post-harvest losses are a significant issue in many parts of the world, particularly in sub-Saharan Africa and parts of Asia. In Kenya, for example, it’s estimated that between 40% and 50% of food is lost or wasted throughout the entire food chain, from farm to fork. This is twice the global average, leading to a loss of approximately $1.5 billion worth of food annually

For instance, in rural areas where access to the main power grid is limited or non-existent, solar-powered cold storage units allow farmers to store their produce until they can access markets, thereby reducing the pressure to sell immediately at potentially lower prices. This not only helps in reducing spoilage but also empowers farmers to sell their goods at more favorable times, improving their income.

The implementation of off-grid energy storage systems has shown promising results. In Kenya, small-scale farmers have reported significant improvements in their agricultural yields and income since adopting solar-powered cold storage solutions. These systems have enabled farmers to store a variety of perishable goods, including fruits, vegetables, dairy products, and fish, which are highly susceptible to spoilage without proper storage facilities

Drivers

Government Initiatives Driving the Growth of Off-Grid Energy Storage Systems in India

India’s commitment to expanding renewable energy sources has significantly influenced the development of off-grid energy storage systems. These systems are crucial for ensuring a stable and reliable power supply, especially in remote and rural areas where grid connectivity is limited or non-existent. Government initiatives have played a pivotal role in promoting the adoption of these technologies.

Muft Bijli Yojana, launched in February 2024. This ambitious scheme aims to empower one crore (10 million) households by providing them with rooftop solar installations and up to 300 units of free electricity monthly. The government has allocated ₹75,021 crore for this initiative, offering subsidies ranging from ₹30,000 to ₹78,000 per household, depending on the system capacity.

- As of March 2025, over 10 lakh (1 million) installations were completed, with expectations to reach 20 lakh by October 2025 and 40 lakh by March 2026. This program not only promotes clean energy but also reduces the financial burden on households while enhancing energy security in underserved regions.

Additionally, the Maharashtra State Electricity Distribution Company Ltd (MSEDCL) is undertaking a ₹20,000 crore project to establish battery energy storage systems (BESS) capable of supporting 16,000 MW of solar power. This initiative, part of the Mukhyamantri Saur Krishi Vahini Yojana 2.0, aims to store surplus solar energy for use during peak demand periods, thereby stabilizing the grid and ensuring a consistent power supply. The project includes the installation of BESS at 75 substations, with a pilot phase of 1,500 MWh capacity already underway. The central government has approved partial subsidies for this project, with further funding expected to be secured through viability gap funding.

These government-led initiatives underscore India’s proactive approach to integrating renewable energy solutions and off-grid storage systems. By providing financial support and infrastructure development, the government is facilitating the widespread adoption of these technologies, thereby contributing to the nation’s energy transition goals. As more regions benefit from these programs, the reliance on traditional, centralized power grids diminishes, leading to a more resilient and sustainable energy landscape.

Restraints

High Initial Capital Costs Hindering Off-Grid Energy Storage Adoption in India

One of the most significant barriers to the widespread adoption of off-grid energy storage systems in India is the high initial capital cost. Despite the government’s efforts to promote renewable energy through various schemes, the upfront investment required for battery energy storage systems (BESS) remains a substantial challenge for individuals, especially in rural areas.

- As of 2025, the cost of standalone BESS in India is estimated to be between ₹25,000 and ₹30,000 per kilowatt-hour (kWh), while grid-connected systems range from ₹18,000 to ₹22,000 per kWh. This translates to a significant financial burden for households and small businesses seeking to invest in energy storage solutions. For instance, a 5 kW system could cost between ₹1.25 lakh and ₹1.5 lakh, a considerable amount for many rural households.

To alleviate this financial strain, the Indian government has introduced the Viability Gap Funding (VGF) scheme, which offers subsidies covering up to 40% of the capital cost for BESS projects. In March 2025, the government increased its target for subsidized battery storage to 13.2 GWh, with a budget of ₹3,760 crore (approximately $455 million) allocated for this purpose . While this initiative aims to reduce the financial burden, the remaining 60% of the cost still poses a challenge for many potential adopters.

The high capital costs are further exacerbated by the limited availability of affordable financing options. Traditional lending institutions often perceive energy storage systems as high-risk investments due to their relatively new market presence and the technical complexities involved. This results in stringent loan conditions and higher interest rates, making it difficult for individuals, particularly in rural areas, to access the necessary funds.

Opportunity

Empowering Food Security through Off-Grid Energy Storage

In the evolving landscape of agriculture, off-grid energy storage systems are emerging as vital tools to enhance food security, particularly in regions with unreliable or no access to the central power grid. These systems, often integrated with renewable energy sources like solar power, offer a sustainable solution to the challenges faced by farmers and food producers in remote areas.

One of the most significant impacts of off-grid energy storage in agriculture is the reduction of post-harvest losses. In many developing countries, inadequate storage facilities lead to substantial food waste, particularly in perishable goods. Off-grid cold storage units powered by solar energy allow farmers to store their produce for extended periods, reducing spoilage and enabling them to sell their products at more favorable times. For instance, in Kenya, small-scale farmers have seen a 150% increase in agricultural yields since 2016 through the use of such off-grid solutions

The implementation of off-grid energy storage systems contributes to the economic development of rural areas. By providing a reliable power source, these systems enable the establishment and growth of local businesses, including food processing units and cold storage facilities. This, in turn, creates employment opportunities and stimulates local economies. The U.S. Department of Agriculture’s Rural Energy for America Program offers grants and loans to agricultural producers and rural small businesses for renewable energy systems, underscoring the government’s commitment to supporting such initiatives

Recognizing the importance of energy access in agriculture, various governments have launched initiatives to promote off-grid energy solutions. In India, the National Solar Mission aims to establish the country as a global leader in solar energy, creating favorable conditions for solar technology diffusion across the country. Similarly, the U.S. Department of Energy’s Grid Deployment Office announced more than $5.4 billion in grid improvement grants in 2024, including support for off-grid energy projects.

Regional Insights

Europe leads Off-grid Energy Storage Systems with 42.3% share, valued at USD 5.3 billion in 2024, driven by renewable integration and grid resilience.

In 2024, Europe held a dominant position in the off-grid energy storage system market, capturing more than a 42.3% share, valued at approximately USD 5.3 billion. This leadership is attributed to the region’s robust investments in renewable energy integration, supportive government policies, and a growing demand for energy independence. The European Union’s commitment to achieving 42.5% of its energy from renewables by 2030 has spurred significant advancements in energy storage technologies, facilitating the transition towards a more sustainable and resilient energy infrastructure.

France and Italy are also enhancing their energy storage capabilities to support renewable energy integration and ensure grid stability. France’s efforts include expanding battery storage systems to accommodate the growing share of renewable energy sources, while Italy is investing in energy storage solutions to enhance grid resilience and reduce reliance on fossil fuels.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Tesla is a leader in the off-grid energy storage market, known for its innovative Powerwall and Powerpack systems. These energy storage solutions are designed to integrate with renewable energy sources, enabling homeowners and businesses to store solar energy for use during power outages or peak demand periods. Tesla’s battery technology is recognized for its efficiency and scalability, making it a key player in the transition to sustainable energy systems globally.

BYD, a major player in the global off-grid energy storage market, produces high-performance lithium iron phosphate (LiFePO4) batteries for energy storage applications. Its energy storage systems are widely used in residential, commercial, and industrial settings, offering solutions for both renewable energy integration and backup power. BYD’s focus on innovation and sustainable solutions has positioned it as a prominent player in the global energy storage sector.

LG Chem offers cutting-edge lithium-ion battery solutions for off-grid energy storage systems, primarily targeting residential and commercial markets. Their battery systems are known for high efficiency, long life cycles, and safety. LG Chem’s energy storage solutions are integrated with solar power systems, providing customers with reliable and cost-effective storage options to ensure energy availability during outages or peak usage periods.

Top Key Players Outlook

- Tesla, Inc.

- BYD Company Ltd.

- LG Chem Ltd.

- Samsung SDI Co., Ltd.

- EnerSys

- SMA Solar Technology AG

- Sumitomo Electric Industries, Ltd.

- Fronius International GmbH

- Enphase Energy, Inc.

- Fluence Energy, Inc.

Recent Industry Developments

In 2024 Samsung SDI Co., Ltd., introduced its next-generation Battery Box (SBB) 1.5, a 20-foot containerized energy storage system designed for easy integration into existing power grids.

In 2024 LG Chem Ltd,, the ESS segment contributed KRW 751.9 billion (approximately $570 million) to the operating profit, aided by U.S. tax credits under the Inflation Reduction Act.

Report Scope

Report Features Description Market Value (2024) USD 12.6 Bn Forecast Revenue (2034) USD 64.3 Bn CAGR (2025-2034) 17.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Battery Type (Lithium-ion Batteries, Lead-Acid Batteries, Flow Batteries, Others), By Capacity (Small Scale, Medium Scale, Large Scale), By Application (Residential, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Tesla, Inc., BYD Company Ltd., LG Chem Ltd., Samsung SDI Co., Ltd., EnerSys, SMA Solar Technology AG, Sumitomo Electric Industries, Ltd., Fronius International GmbH, Enphase Energy, Inc., Fluence Energy, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Off-grid Energy Storage System MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Off-grid Energy Storage System MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Tesla, Inc.

- BYD Company Ltd.

- LG Chem Ltd.

- Samsung SDI Co., Ltd.

- EnerSys

- SMA Solar Technology AG

- Sumitomo Electric Industries, Ltd.

- Fronius International GmbH

- Enphase Energy, Inc.

- Fluence Energy, Inc.