Global Nitrous Oxide Market Size, Share, And Enhanced Productivity By Grade (Medical Grade, Food Grade, Industrial Grade, Ultra-high-Purity Grade), By Application (Automotive, Medical, Electronics, Food and Beverages, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 173521

- Number of Pages: 336

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

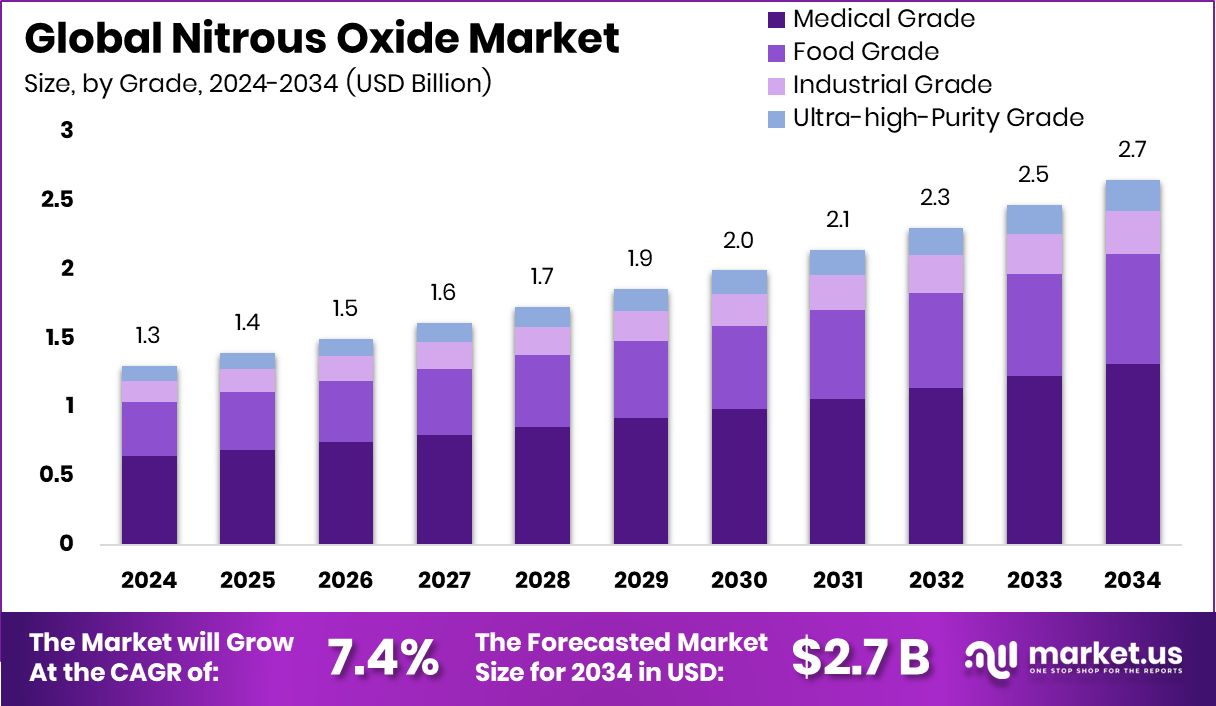

The Global Nitrous Oxide Market is expected to be worth around USD 2.7 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 7.4% from 2025 to 2034. Growth across Asia Pacific supports the Nitrous Oxide Market at 43.8%, USD 0.5 Bn.

Nitrous oxide is a colorless gas with a slightly sweet smell, widely known for its use in medical care, agriculture, and industry. In hospitals and dental clinics, it is used for pain relief and mild anesthesia because it works quickly and wears off fast. In agriculture and manufacturing, nitrous oxide is linked to nitrogen-based processes, making it important but also sensitive due to its environmental impact.

The Nitrous Oxide Market refers to the production, supply, and use of this gas across medical, agricultural, industrial, and environmental applications. Growth in this market is closely tied to healthcare needs, food production systems, and emission management efforts. Governments and institutions are increasingly focusing on balancing its benefits with environmental responsibility.

One key growth factor is sustainability-driven healthcare and public infrastructure. A sustainable design project supporting a greener NHS received a £3M funding boost, encouraging hospitals to adopt cleaner gas usage and recovery systems. This supports safer handling and reduced emissions without compromising patient care.

Demand is also shaped by agriculture and emission control. A device that recycles farm nitrogen secured a $1.2m government-industry boost, while a WSU engineering professor led a $2 million grant to curb nitrous oxide emissions. These efforts respond to rising concerns, especially as methane emissions have increased by 20 per cent over 20 years.

Future opportunities lie in clean nitrogen solutions. British NZN raised €5.6 million for a biofertiliser offering farmers a green cost advantage, while NetZeroNitrogen received $1.6m to develop nitrogen fixation products without a green premium. These innovations open new, environmentally responsible pathways for the nitrous oxide ecosystem.

Key Takeaways

- The Global Nitrous Oxide Market is expected to be worth around USD 2.7 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 7.4% from 2025 to 2034.

- Medical grade nitrous oxide dominated the market with a 49.6% share, driven by anesthesia demand.

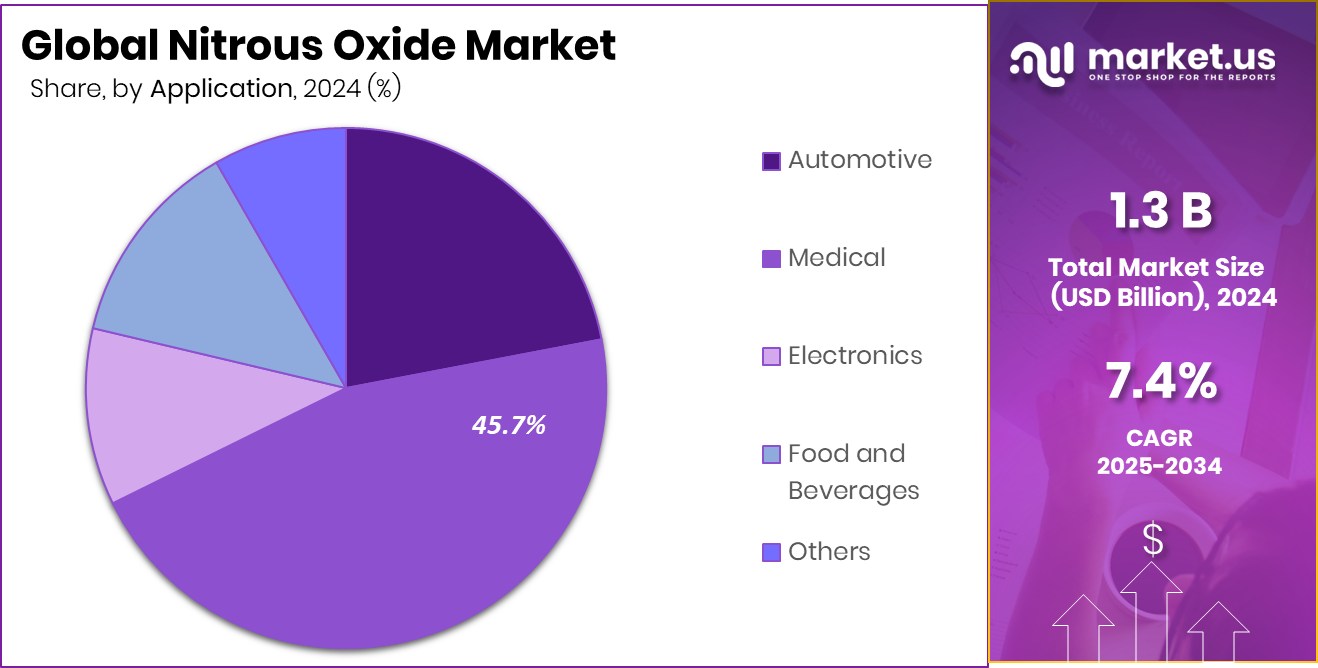

- Medical applications held 45.7% share, supported by expanding surgical procedures and emergency care usage.

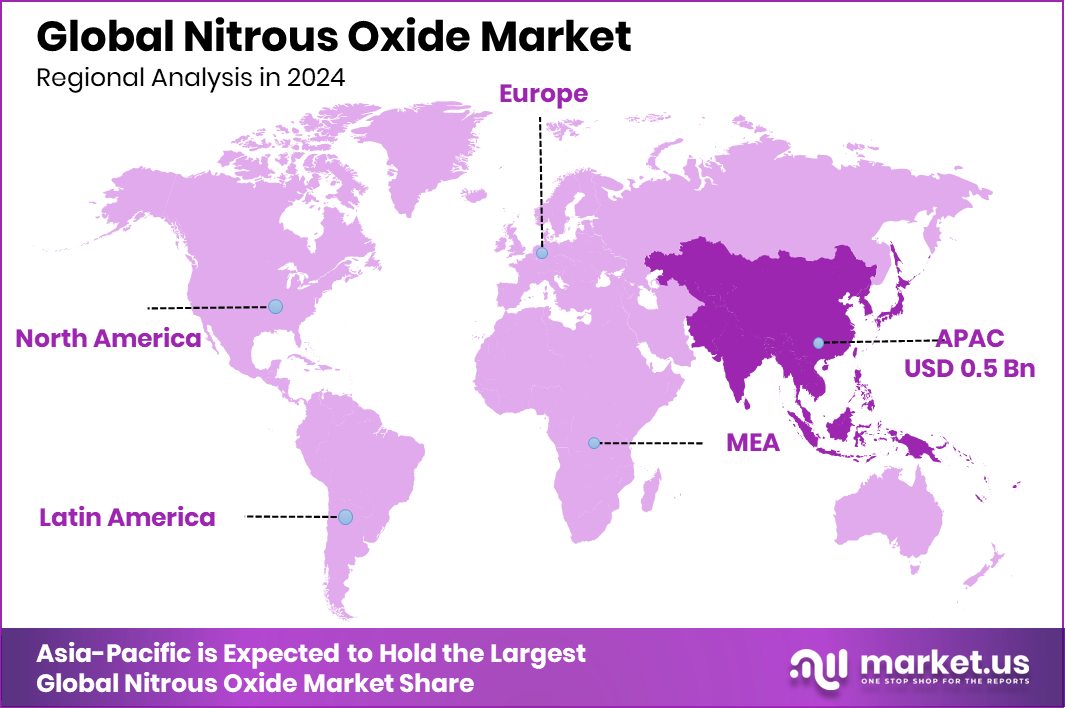

- Asia Pacific Nitrous Oxide Market reached 43.8% share, totaling USD 0.5 Bn region.

By Grade Analysis

Medical grade nitrous oxide dominated the market with 49.6% share globally.

In 2024, Medical Grade Nitrous Oxide held a dominant position in the Nitrous Oxide Market with a 49.6% share, reflecting its critical role in modern healthcare settings. Medical-grade nitrous oxide is produced under strict purity and safety standards, making it suitable for direct patient use.

Hospitals and clinics rely on it extensively for anesthesia, pain management, and sedation during minor surgical and dental procedures. The growing number of surgical interventions, coupled with rising dental care awareness, continues to support demand. Additionally, expanding healthcare infrastructure in emerging economies and increased access to medical insurance have strengthened consumption.

Regulatory bodies also emphasize certified medical gases, which further supports preference for medical-grade products. Together, these factors reinforce the steady growth and long-term importance of medical-grade nitrous oxide in the global market landscape.

By Application Analysis

Medical applications accounted for 45.7% share driven by anesthesia usage worldwide.

In 2024, the Medical application segment accounted for 45.7% of the Nitrous Oxide Market, underlining its widespread use across healthcare services. Nitrous oxide is valued in medical applications for its rapid onset, ease of administration, and quick recovery time for patients. It is commonly used in dentistry, emergency care, obstetrics, and minor surgical procedures, where controlled pain relief is essential.

The rise in outpatient treatments and minimally invasive procedures has further increased its usage. Moreover, healthcare professionals favor nitrous oxide due to its cost-effectiveness and proven safety record when properly administered. Ongoing investments in hospital expansion, dental clinics, and medical training programs continue to support demand, ensuring that medical applications remain a core driver of the nitrous oxide market.

Key Market Segments

By Grade

- Medical Grade

- Food Grade

- Industrial Grade

- Ultra-high-Purity Grade

By Application

- Automotive

- Medical

- Electronics

- Food and Beverages

- Others

Driving Factors

Climate Research Investments Drive Nitrous Oxide Solutions

Rising concern over greenhouse gas emissions is a major driving factor for the Nitrous Oxide Market. Governments and research bodies are investing in scientific studies to better understand and reduce emissions in sensitive regions. A clear example is the allocation of €2.14 million to research greenhouse gas reduction in the Arctic, where nitrous oxide plays a role in climate change impacts. This funding supports advanced monitoring, data collection, and mitigation strategies in extreme environments.

Such research improves understanding of emission sources and encourages cleaner industrial and agricultural practices. As climate policies become stricter, industries are pushed to adopt better nitrogen management and emission control technologies. These actions increase demand for controlled nitrous oxide usage, monitoring systems, and alternatives, making climate-focused research investment a strong driver supporting long-term market development.

Restraining Factors

Medical Use Expansion Creates Usage And Control Challenges

One key restraining factor for the Nitrous Oxide Market is the growing concern over controlled medical usage and safety oversight. Nitrous oxide is increasingly used for pain relief in emergency care, which raises questions around proper handling, storage, and monitoring. Ambulance services gaining nitrous oxide for pain relief under a $2M Westmoreland opioid settlement fund highlight this challenge.

While this supports better patient care, it also increases regulatory pressure to prevent misuse, leakage, or environmental release. Health authorities must ensure training, compliance, and tracking systems are in place. These added requirements can slow adoption and raise operational costs. As a result, stricter controls and safety concerns act as restraints, limiting faster market expansion despite clear medical benefits.

Growth Opportunity

Advanced Nitrogen Science Unlocks Sustainable Market Opportunities

Scientific innovation presents a strong growth opportunity for the Nitrous Oxide Market, especially in nitrogen chemistry and emission reduction. Research aimed at improving nitrogen coupling and efficiency can reduce waste and environmental impact.

Western’s John Gilbertson and Tim Kowalczyk receiving a $373,813 grant from NSF for work on nitrogen coupling highlights this opportunity. Their work supports better understanding of nitrogen reactions, which can lead to cleaner industrial processes and improved agricultural inputs. These advancements help reduce unwanted nitrous oxide emissions while maintaining productivity.

As industries seek sustainable solutions without sacrificing performance, such research-driven breakthroughs open new applications and technologies. This creates long-term opportunities for cleaner nitrogen use and responsible nitrous oxide management.

Latest Trends

Hydrogen Expansion Accelerates Cleaner Nitrogen Ecosystem Trends

A major latest trend influencing the Nitrous Oxide Market is the integration of hydrogen and clean energy systems with nitrogen management. The facilitation of $50MM financing by US Capital Global to accelerate Charbone Hydrogen’s North American expansion reflects this shift. Clean hydrogen projects often align with low-emission industrial models, encouraging better control of nitrogen-related gases.

As industries modernize energy systems, attention turns to reducing by-product emissions, including nitrous oxide. This trend supports advanced gas capture, recycling, and low-impact production methods. The growing link between hydrogen infrastructure and cleaner chemical processes signals a market shift toward sustainability-focused operations, shaping how nitrous oxide is managed, reduced, and regulated in modern industrial ecosystems.

Regional Analysis

Asia Pacific leads Nitrous Oxide Market with 43.8% share, USD 0.5 Bn value.

Asia Pacific emerged as the dominating region in the Nitrous Oxide Market, accounting for 43.8% of the total share and reaching a value of USD 0.5 Bn. This strong regional position is supported by expanding healthcare infrastructure, increasing surgical procedures, and rising demand for medical gases across hospitals and dental clinics in Asia Pacific.

In comparison, North America continues to represent a mature market, driven by established healthcare systems and consistent medical usage patterns, though growth remains steady rather than rapid. Europe maintains stable demand supported by stringent medical standards and widespread adoption of nitrous oxide in clinical and dental applications.

Meanwhile, Middle East & Africa shows gradual market development as healthcare access improves and medical infrastructure expands in key countries. Latin America reflects moderate growth, supported by increasing awareness of pain management solutions and gradual improvements in hospital capacity.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Praxair Technology, Inc. continued to play a technically influential role in the global Nitrous Oxide Market during 2024 through its strong focus on process efficiency, gas handling systems, and safety-driven innovation. The company’s expertise in gas separation, purification, and controlled delivery technologies supports reliable nitrous oxide usage in medical and industrial environments. Its emphasis on operational reliability and compliance-oriented engineering positions Praxair Technology as a trusted technology partner for healthcare gas systems, especially where precision and safety are critical.

Chart Industries, Inc. remained strategically important to the nitrous oxide value chain by supplying cryogenic equipment, storage systems, and distribution infrastructure. In 2024, the company’s capabilities in low-temperature handling and transport solutions supported the secure storage and movement of nitrous oxide across medical and industrial supply networks. Analysts view Chart’s engineering depth and project execution strength as key factors enabling stable gas availability, particularly in regions expanding hospital and specialty care infrastructure.

Linde plc continued to demonstrate leadership in the nitrous oxide market through its vertically integrated gas production and supply model. The company’s strong presence in medical gases, combined with standardized quality controls and global logistics expertise, reinforced its market relevance in 2024. From an analyst standpoint, Linde’s scale, operational discipline, and long-standing relationships with healthcare providers position it as a benchmark player shaping industry practices and long-term market stability.

Top Key Players in the Market

- Praxair Technology, Inc.

- Chart Industries, Inc.

- Linde plc

- MATHESON TRI-GAS, INC.

- SOL GROUP

- Air Liquide

- Airgas, Inc.

- Ellenbarrie Industrial Gases

Recent Developments

- In October 2025, Air Liquide agreed to acquire NovaAir, a well-known industrial gas producer in India. NovaAir supplies bulk industrial gases and specialty gases across key regions in the country. This acquisition strengthens Air Liquide’s presence in India, helping it serve more customers in industrial and healthcare sectors with gases including nitrous oxide and others. The deal expands Air Liquide’s reach into East and South India.

- In May 2024, Airgas expanded its supply network by acquiring Buckeye Welder Sales and NLR Welding Supply, Inc. These companies provide welding and gas supply services, which helps Airgas strengthen its distribution of gases and related products across more U.S. regions. Although this development focuses on welding supplies, the broader gas distribution network supports Airgas’s ability to deliver medical and specialty gases like nitrous oxide more effectively.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 2.7 Billion CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Medical Grade, Food Grade, Industrial Grade, Ultra-high-Purity Grade), By Application (Automotive, Medical, Electronics, Food and Beverages, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Praxair Technology, Inc., Chart Industries, Inc., Linde plc, MATHESON TRI-GAS, INC., SOL GROUP, Air Liquide, Airgas, Inc., Ellenbarrie Industrial Gases Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Praxair Technology, Inc.

- Chart Industries, Inc.

- Linde plc

- MATHESON TRI-GAS, INC.

- SOL GROUP

- Air Liquide

- Airgas, Inc.

- Ellenbarrie Industrial Gases