Global Nitrobenzene Market Size, Share Analysis Report By Form (Liquid, Powder), By Application (Chemical Synthesis, Explosives, Pyrotechnics, Pesticides, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152138

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

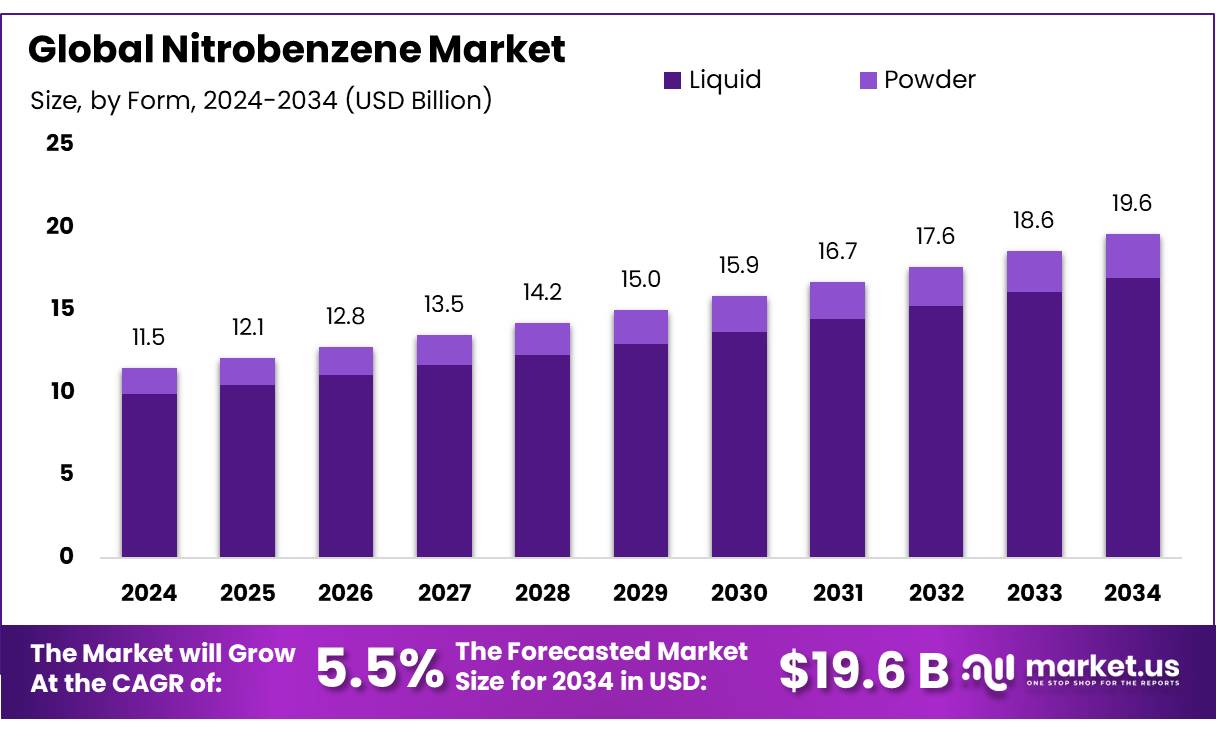

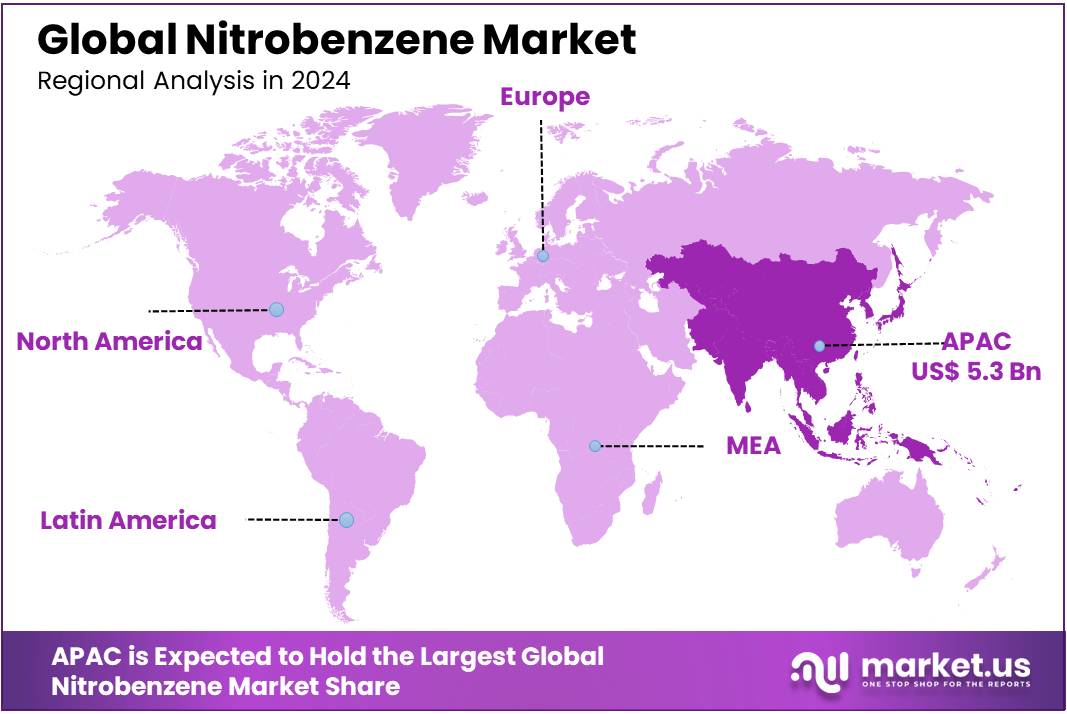

The Global Nitrobenzene Market size is expected to be worth around USD 19.6 Billion by 2034, from USD 11.5 Billion in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position, capturing more than a 46.9% share, holding USD 5.3 billion revenue.

Nitrobenzene (C6H5NO2) is primarily synthesized via nitration of benzene with nitric and sulfuric acids—a process critical to the production of aniline, a precursor for polyurethane (MDI) and various industrial chemicals. Approximately 95% of industrially produced nitrobenzene is hydrogenated to aniline.

Governments have introduced chemical management regulations to ensure safe Nitrobenzene usage. For example, the Australian government’s Industrial Chemicals (Notification and Assessment) Act of 1989 (NICNAS) mandates pre-introduction assessment, annual registration, and fees ranging from AU$ 395 to AU$ 9,201 based on volume/value thresholds.

Technological innovations targeting sustainable and green chemistry are anticipated to drive future process optimization. Industry movement toward closed-loop nitration systems—with U.S. Environmental Protection Agency (EPA) indicating <2% nitrobenzene loss to wastewater in 1990s-era U.S. production.

Environmental regulation remains a critical constraint. The U.S. Environmental Protection Agency (EPA) assigns nitrobenzene a reference concentration (RfC) of 0.002 mg/m³ based on hematological and renal toxicity evidence. Furthermore, annual U.S. aggregate production volumes during 2016–2019 ranged between 1–5 billion pounds (~0.45–2.3 million tonnes), per U.S. Toxicological. Stringent occupational exposure limits (e.g., OSHA TWA at 5 mg/m³) drive compliance investments across the industry.

Key Takeaways

- Nitrobenzene Market size is expected to be worth around USD 19.6 Billion by 2034, from USD 11.5 Billion in 2024, growing at a CAGR of 5.5%.

- Liquid held a dominant market position, capturing more than an 86.4% share of the global nitrobenzene market.

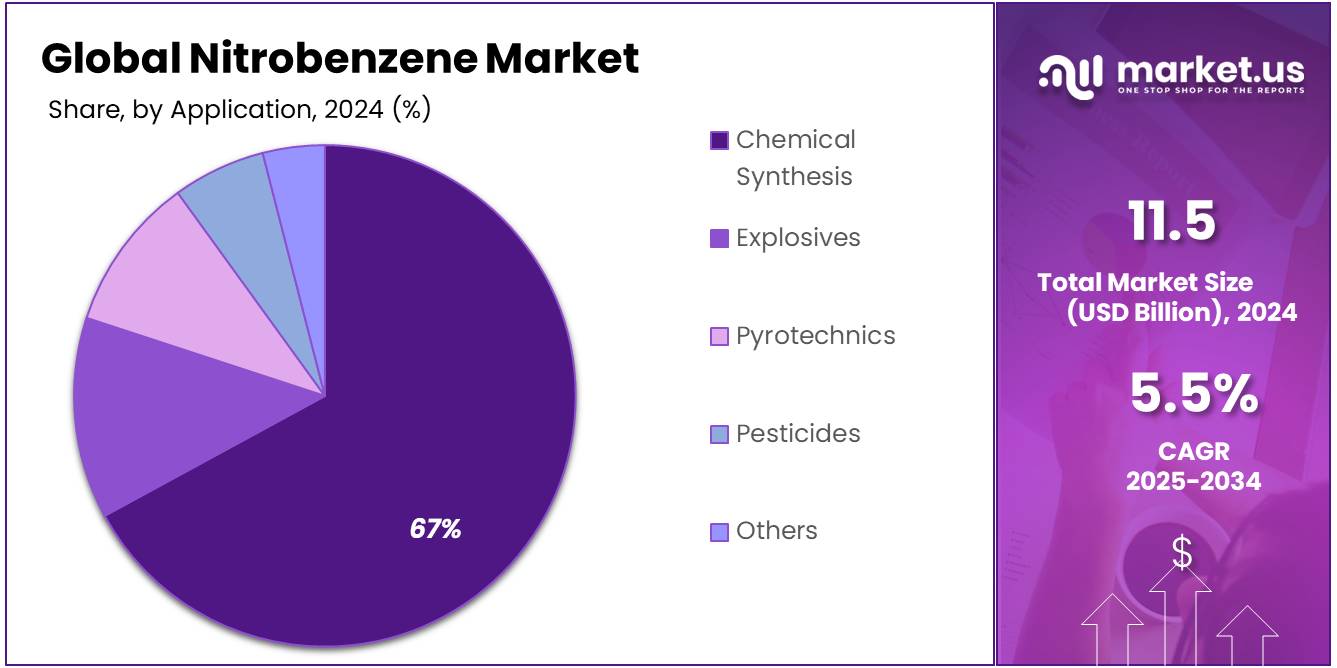

- Chemical Synthesis held a dominant market position, capturing more than a 67.2% share of the global nitrobenzene market.

- Asia-Pacific (APAC) region emerged as the dominant player in the global nitrobenzene market, accounting for a substantial 46.9% share, valued at approximately USD 5.3 billion.

By Form Analysis

Liquid Form Leads with 86.4% Share in 2024 Due to Industrial-Scale Use

In 2024, Liquid held a dominant market position, capturing more than an 86.4% share of the global nitrobenzene market by form. This strong market presence can be attributed to its widespread use in large-scale industrial applications, particularly in the production of aniline, dyes, and agricultural chemicals. The liquid form is preferred due to its ease of handling, transport, and processing in continuous manufacturing systems.

Major chemical manufacturers across Asia-Pacific, Europe, and North America have integrated liquid nitrobenzene into their production lines to support demand from downstream sectors like construction, automotive, and pharmaceuticals. The liquid form also ensures higher purity and consistency, which is essential in high-volume synthesis processes. This trend is expected to continue into 2025 as industries prioritize reliable and efficient inputs for bulk chemical synthesis.

By Application Analysis

Chemical Synthesis Leads with 67.2% Share in 2024 Due to High Aniline Demand

In 2024, Chemical Synthesis held a dominant market position, capturing more than a 67.2% share of the global nitrobenzene market by application. This significant share is mainly driven by nitrobenzene’s critical role as a precursor in the production of aniline, which is further used in manufacturing polyurethane, rubber chemicals, dyes, and pharmaceuticals.

Industries such as construction, automotive, and textiles rely heavily on aniline-based products, and the consistent rise in demand from these sectors has directly supported the growth of chemical synthesis applications. The ability of nitrobenzene to deliver efficient yields in downstream reactions makes it a preferred input in bulk chemical processes. This trend remained strong in 2025, as developing countries continued to expand their industrial chemical output, further cementing chemical synthesis as the largest application area within the nitrobenzene market.

Key Market Segments

By Form

- Liquid

- Powder

By Application

- Chemical Synthesis

- Explosives

- Pyrotechnics

- Pesticides

- Others

Emerging Trends

Adoption of Green Chemistry and Sustainable Production Methods

A notable emerging trend in the nitrobenzene industry is the increasing adoption of green chemistry principles and sustainable production methods. As environmental concerns and regulatory pressures intensify, manufacturers are exploring cleaner, more efficient processes to produce nitrobenzene and its derivatives.

In the United States, the Environmental Protection Agency (EPA) has been instrumental in promoting sustainable chemical manufacturing practices. The EPA’s initiatives encourage industries to adopt cleaner technologies and reduce hazardous waste, aligning with the industry’s shift towards greener production methods.

These advancements not only contribute to environmental conservation but also offer economic benefits by improving process efficiency and reducing waste. As global demand for sustainable products grows, the nitrobenzene industry is poised to benefit from these innovations, ensuring its relevance and competitiveness in a rapidly evolving market.

Drivers

Government Support and Increasing Demand for Nitrobenzene

One of the key driving factors for the growth of the nitrobenzene market is the increasing demand for this chemical in various industrial applications, particularly in the production of aniline, which is a vital precursor for many industries such as automotive, agriculture, and textiles. Nitrobenzene is primarily used in the manufacture of synthetic rubber, pesticides, and other specialty chemicals, all of which are witnessing rising demand globally.

In 2023, the global consumption of nitrobenzene reached approximately 2.5 million metric tons. This growth is largely attributed to the increasing industrial activities across regions such as Asia Pacific, where industrialization is on the rise. Additionally, as governments worldwide push for cleaner, more efficient manufacturing processes, there has been a growing emphasis on improving the production of nitrobenzene through more sustainable methods.

Government initiatives and regulations are also contributing significantly to this demand. For example, in the United States, the Environmental Protection Agency (EPA) has introduced regulations that encourage industries to adopt cleaner production techniques, which directly benefit the nitrobenzene sector. Furthermore, in the European Union, investments into the chemical manufacturing industry, including funding for R&D in sustainable chemical production, have led to the development of more environmentally friendly production processes for nitrobenzene.

Restraints

Environmental and Health Concerns

One major restraining factor for the growth of the nitrobenzene market is the increasing concern about its environmental and health impacts. Nitrobenzene is considered a hazardous substance, with exposure potentially leading to severe health issues such as neurological damage, respiratory problems, and skin irritation. The growing awareness of these dangers has led to stricter environmental regulations and health safety standards, which are limiting the expansion of nitrobenzene production and its widespread use.

In 2023, the global regulatory landscape around hazardous chemicals became more stringent, with the European Union’s REACH regulation targeting chemicals that pose significant risks to health and the environment. Nitrobenzene is among the substances listed under these regulations, requiring manufacturers to adopt more complex safety measures, which increases production costs and reduces market competitiveness.

Governments are also pushing for the adoption of safer and more sustainable alternatives in the production of chemicals. In the United States, the Environmental Protection Agency (EPA) has increasingly focused on reducing the exposure of workers and consumers to harmful chemicals, including nitrobenzene, by enforcing stricter workplace safety guidelines and promoting green chemistry initiatives. These actions are influencing industries to seek less hazardous substitutes for nitrobenzene in various applications.

Opportunity

Growing Demand for Agricultural Chemicals

A significant growth opportunity for the nitrobenzene market lies in its expanding use in the agricultural sector, particularly in the production of pesticides and herbicides. Nitrobenzene is a key precursor in the synthesis of aniline, which is then used to produce various agrochemicals. With global agriculture facing increasing pressure to meet food security demands, the adoption of advanced agricultural chemicals is on the rise, creating a favorable market for nitrobenzene.

In 2023, global pesticide consumption reached nearly 4.1 million metric tons, with the Asia Pacific region contributing significantly to this demand due to its large agricultural base. The increasing focus on improving crop yield and quality, especially in developing countries, is driving the demand for pesticides and herbicides, which are essential for protecting crops from pests and diseases. This surge in agrochemical usage presents a major opportunity for nitrobenzene, as its role in producing aniline-based pesticides is pivotal.

Additionally, government initiatives that support sustainable agricultural practices are boosting this trend. For example, the United States Department of Agriculture (USDA) has been actively promoting the use of efficient, high-performance agrochemicals to optimize crop production. In 2024, the USDA launched initiatives that encourage the adoption of advanced technologies and chemicals that improve agricultural efficiency, further increasing the demand for nitrobenzene-derived products.

Regional Insights

In 2024, the Asia-Pacific (APAC) region emerged as the dominant player in the global nitrobenzene market, accounting for a substantial 46.9% share, valued at approximately USD 5.3 billion. This commanding presence is largely attributed to the region’s expanding industrial base, particularly in countries such as China, India, Japan, and South Korea.

APAC’s dominance is driven by its thriving agrochemical, pharmaceutical, and construction industries—key end-use sectors that utilize nitrobenzene extensively, especially in the production of aniline, which is a critical intermediate for manufacturing methylene diphenyl diisocyanate (MDI). MDI is widely used in the production of polyurethane foams, adhesives, sealants, and coatings.

China continues to lead the region with significant capacity expansions and domestic demand for downstream derivatives of nitrobenzene. India is also witnessing rapid growth due to increasing investment in infrastructure and construction projects, which has escalated demand for polyurethane-based products. Moreover, the region benefits from lower production costs, favorable government policies, and growing foreign direct investment (FDI) in chemical manufacturing, further supporting the expansion of the nitrobenzene market.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Wanhua Chemical Group Co., Ltd is a leading player in the global nitrobenzene market, primarily known for its extensive production of methylene diphenyl diisocyanate (MDI), which relies on nitrobenzene as a key intermediate. The company’s vertically integrated supply chain and robust R&D capabilities enable efficient and large-scale nitrobenzene utilization. Headquartered in China, Wanhua continues to expand its footprint across Asia and Europe, supported by rising demand in construction and automotive applications for polyurethane-based materials.

Covestro AG is a prominent German chemical manufacturer, actively involved in nitrobenzene-based production of aniline and MDI for polyurethane systems. The company’s operations are deeply tied to construction, automotive, and insulation sectors. With manufacturing sites across Europe, Asia-Pacific, and the Americas, Covestro leverages sustainability-focused initiatives to reduce environmental impact while maintaining high-volume nitrobenzene processing. The firm’s strong position in downstream polyurethane markets further enhances its influence in the global nitrobenzene value chain.

BASF SE, one of the world’s largest chemical companies, plays a crucial role in the nitrobenzene market through its integrated aniline and polyurethane production operations. The company operates multiple nitrobenzene manufacturing units globally, particularly in Europe and North America. BASF’s broad product portfolio and emphasis on energy efficiency support its long-term competitiveness. Nitrobenzene is a key feedstock for BASF’s MDI production, which is essential for applications in insulation, construction materials, and consumer goods industries.

Top Key Players Outlook

- Wanhua Chemical Group Co. , Ltd

- Covestro AG

- BASF SE

- Huntsman Corporation

- Vizag chemical

- Akshar International

- Aarati Industries

- Par Industries

- Shiv Chemicals

- CDH Fine Chemical

- Kamal Plastic

- Greenwell Biotech

- Panoli

Recent Industry Developments

Covestro AG is a leading global supplier in the nitrobenzene and aniline value chain, supplying essential chemicals for industries like polyurethanes, coatings, electronics, and automotive. In 2023, it generated €14,377 million in sales and invested €374 million in R&D, with a workforce of 17,520 employees.

BASF SE remains a major player in the global nitrobenzene and aniline markets, underpinning a wide range of industrial applications. In 2023, the company reported €68,902 million in sales and generated a net income of €225 million, supported by a team of 111,991 employees.

Report Scope

Report Features Description Market Value (2024) USD 11.5 Bn Forecast Revenue (2034) USD 19.6 Bn CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid, Powder), By Application (Chemical Synthesis, Explosives, Pyrotechnics, Pesticides, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Wanhua Chemical Group Co, Ltd, Covestro AG, BASF SE, Huntsman Corporation, Vizag chemical, Akshar International, Aarati Industries, Par Industries, Shiv Chemicals, CDH Fine Chemical, Kamal Plastic, Greenwell Biotech, Panoli Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Wanhua Chemical Group Co. , Ltd

- Covestro AG

- BASF SE

- Huntsman Corporation

- Vizag chemical

- Akshar International

- Aarati Industries

- Par Industries

- Shiv Chemicals

- CDH Fine Chemical

- Kamal Plastic

- Greenwell Biotech

- Panoli