Global Neurological Biomarkers Market By Type (Genomic, Proteomic, Metabolomic, Imaging, Others) By Application (Alzheimer’s Disease, Parkinson’s Disease, Multiple Sclerosis, Autism Spectrum Disorders, Others) By End-User (Research Organizations, Pharma & Biotech Companies, Clinical Diagnostics, Others) Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160582

- Number of Pages: 235

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

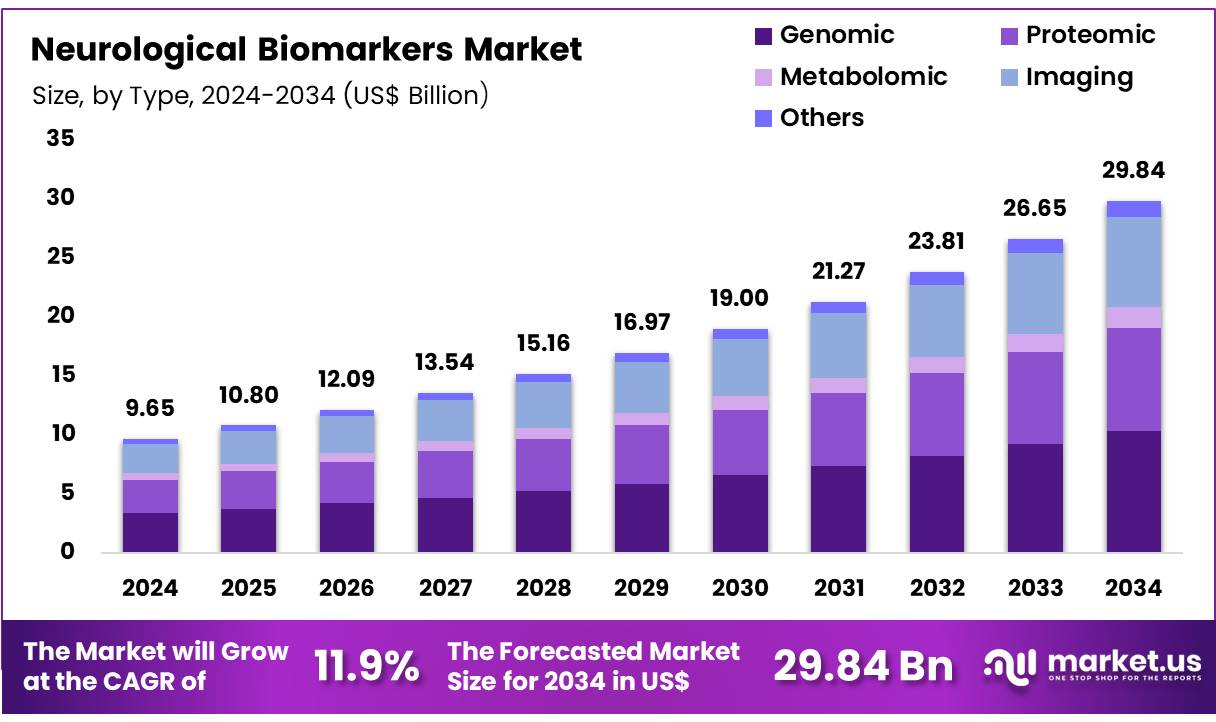

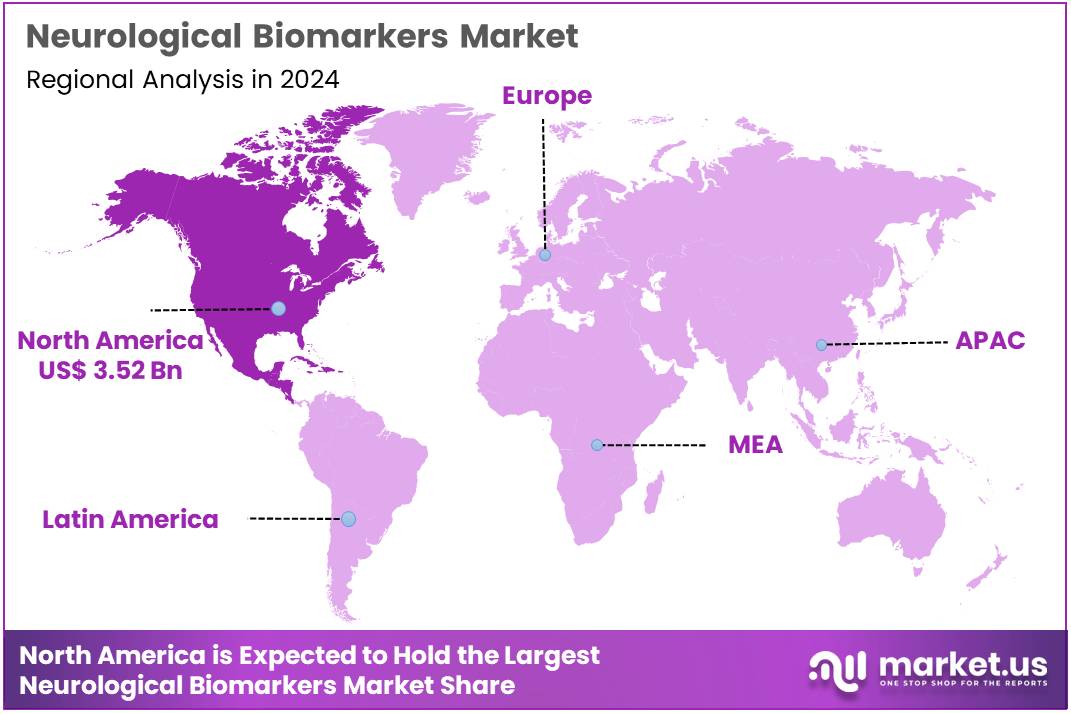

Global Neurological Biomarkers Market size is expected to be worth around US$ 29.84 Billion by 2034 from US$ 9.65 Billion in 2024, growing at a CAGR of 11.9% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 36.5% share with a revenue of US$ 3.52 Billion.

The market for neurological biomarkers is experiencing significant expansion, driven by the rising burden of brain diseases and demographic changes. Dementia represents a primary driver of this growth. According to the World Health Organization (WHO), 57 million people were living with dementia in 2021, with nearly 10 million new cases annually. Projections indicate a rise to 78 million cases by 2030 and 139 million by 2050, underscoring the urgent need for validated biomarkers that support early detection, prognosis, and monitoring.

Population ageing further amplifies this demand. Within OECD countries, the proportion of people aged 65 years and above is expected to increase from 18% in 2021 to 27% by 2050. Since neurodegenerative disorders are strongly associated with advanced age, this demographic trend ensures sustained uptake of neurological biomarkers in both clinical care and clinical trials.

Beyond dementia, cerebrovascular conditions and injuries contribute substantially to demand. Stroke remains a leading cause of disability worldwide, with absolute numbers increasing alongside ageing populations. In the United States alone, the Centers for Disease Control and Prevention (CDC) recorded over 69,000 traumatic brain injury (TBI)–related deaths in 2021 and more than 214,000 TBI-related hospitalizations in 2020. Such figures highlight the clinical need for rapid and objective biomarkers to aid in triage, outcome prediction, and recovery assessment.

Regulatory initiatives are also accelerating adoption. The U.S. Food and Drug Administration (FDA) operates the Biomarker Qualification Program (BQP), providing a structured pathway for biomarker validation as drug development tools. Public “Letters of Support” further encourage data sharing and collaboration. In parallel, the European Medicines Agency (EMA) offers qualification advice and processes for innovative methodologies, including biomarkers. These frameworks enhance confidence among stakeholders and reduce barriers to investment in biomarker technologies.

Standardization efforts are also shaping the market. The FDA–NIH BEST Resource defines biomarker categories such as diagnostic, prognostic, predictive, monitoring, and pharmacodynamic, thereby promoting consistent study design and regulatory alignment. This clarity benefits developers and supports integration into clinical practice.

Public health policies reinforce the focus on early diagnosis. The WHO Global Action Plan on the Public Health Response to Dementia (2017–2025) encourages national dementia strategies, research, and surveillance, monitored through the Global Dementia Observatory. As countries adopt these plans, health systems increasingly invest in validated diagnostic tools, including biomarkers.

Finally, public funding and clinical research activity provide strong momentum. The U.S. National Institute on Aging reported support for 495 clinical trials in Alzheimer’s disease and related dementias by the end of FY2024. This investment expands biobanking, assay validation, and longitudinal data resources, which are essential for advancing biomarker discovery and translation into clinical practice.

Key Takeaways

- Market Size: Global Neurological Biomarkers Market size is expected to be worth around US$ 29.84 Billion by 2034 from US$ 9.65 Billion in 2024.

- Market Growth: The market growing at a CAGR of 11.9% during the forecast period from 2025 to 2034.

- Type Analysis: The genomic biomarkers segment is projected to dominate the market with a 34.6% share.

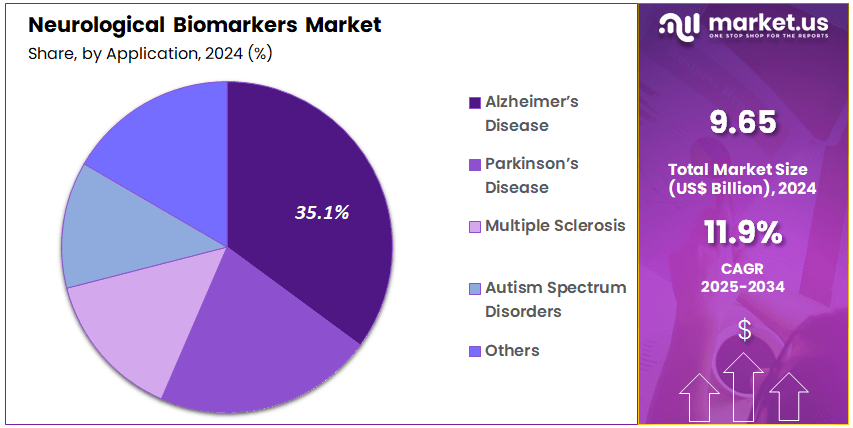

- Application Analysis: In 2024, the Alzheimer’s disease segment is expected to dominate the market, accounting for a 35.1% share.

- End-Use Analysis: In 2024, research organizations are anticipated to dominate the market, holding a 40.8% share.

- Regional Analysis: North America led the market, achieving over 3.52% share with a revenue of US$ 3.52 Billion.

Type Analysis

The genomic biomarkers segment is projected to dominate the market with a 34.6% share. This strong position can be attributed to the increasing adoption of genomic sequencing technologies, the rising prevalence of neurological disorders with genetic underpinnings, and the growing use of genomics in personalized medicine approaches. The integration of next-generation sequencing (NGS) and advanced bioinformatics has further enhanced the clinical utility of genomic biomarkers in early detection and treatment selection.

The proteomic biomarkers segment is expected to witness steady growth, driven by the identification of protein expression patterns linked to neurodegenerative diseases such as Alzheimer’s and Parkinson’s. Proteomic profiling provides valuable insights into disease mechanisms, thereby supporting drug discovery initiatives.

Metabolomic biomarkers are gaining traction due to their ability to detect biochemical pathway alterations in neurological conditions, offering a non-invasive and sensitive approach to disease monitoring. Meanwhile, the imaging biomarkers segment remains vital, supported by the increasing use of advanced imaging modalities, such as PET and MRI, in clinical practice and research for tracking disease progression.

The others segment, including epigenetic and transcriptomic biomarkers, represents an emerging category with potential for growth as research advances. Overall, type segmentation highlights the dominance of genomics while underscoring the complementary role of proteomic, metabolomic, and imaging biomarkers in driving innovation across the neurological biomarkers landscape.

Application Analysis

The neurological biomarkers market is segmented by application into Alzheimer’s disease, Parkinson’s disease, multiple sclerosis, autism spectrum disorders, and others, with demand primarily driven by the increasing prevalence of neurodegenerative and developmental conditions.

In 2024, the Alzheimer’s disease segment is expected to dominate the market, accounting for a 35.1% share. This dominance is primarily attributed to the growing global burden of Alzheimer’s, the rising geriatric population, and the increasing demand for early diagnostic tools. The development of biomarkers such as amyloid-β and tau proteins has significantly advanced disease detection and progression monitoring. Moreover, the approval of biomarker-based diagnostics and therapeutics is further reinforcing market expansion in this segment.

The Parkinson’s disease segment is projected to register steady growth, driven by rising incidence rates and expanding biomarker research focused on α-synuclein and dopamine-related pathways. Early detection through biomarkers is becoming a critical component in therapeutic strategies for Parkinson’s.

Multiple sclerosis (MS) represents another significant application area, supported by the development of biomarkers that track disease activity, treatment response, and patient prognosis. The increasing use of neurofilament light chain (NfL) biomarkers in MS management is fueling growth.

The autism spectrum disorders (ASD) segment is gaining attention, with ongoing research into biomarkers that can enable earlier and more accurate diagnosis. The others segment, covering conditions such as epilepsy and traumatic brain injury, is also expanding, supported by rising R&D investments.

End-User Analysis

The neurological biomarkers market is segmented by end user into research organizations, pharmaceutical and biotechnology companies, clinical diagnostics, and others. Each segment plays a crucial role in advancing biomarker discovery, validation, and commercialization for neurological disorders.

In 2024, research organizations are anticipated to dominate the market, holding a 40.8% share. This leadership position is driven by increasing academic and government-funded initiatives focused on neurological disease mechanisms, as well as the growing emphasis on translational research. Research institutions serve as the foundation for biomarker identification and validation, which are subsequently adopted for clinical and therapeutic applications. Collaborative projects between universities, government agencies, and healthcare providers further support the segment’s strong performance.

The pharmaceutical and biotechnology companies segment is projected to grow steadily, fueled by the rising adoption of biomarkers in drug discovery, clinical trials, and personalized medicine approaches. Biomarkers are increasingly being integrated into companion diagnostics and regulatory approval pathways, thereby enhancing their importance to the biopharma sector.

Clinical diagnostics represent another key segment, supported by the increasing demand for early disease detection and non-invasive diagnostic solutions. With rising prevalence of Alzheimer’s, Parkinson’s, and multiple sclerosis, diagnostic laboratories are adopting biomarker-based tests to improve accuracy and patient outcomes.

The others segment, which includes contract research organizations (CROs) and healthcare providers, also contributes to market growth by facilitating validation studies and clinical application. Overall, end-user segmentation highlights the dominance of research organizations while demonstrating expanding adoption across clinical and commercial domains.

Key Market Segments

By Type

- Genomic

- Proteomic

- Metabolomic

- Imaging

- Others

By Application

- Alzheimer’s Disease

- Parkinson’s Disease

- Multiple Sclerosis

- Autism Spectrum Disorders

- Others

By End-User

- Research Organizations

- Pharma & Biotech Companies

- Clinical Diagnostics

- Others

Driving Factors

A principal driver of the neurological biomarkers market is the rising prevalence of neurodegenerative diseases globally. Aging populations increase incidence of Alzheimer’s, Parkinson’s, and multiple sclerosis, thus raising demand for precise diagnostics. Reports indicate the global neurological biomarkers market is expected to grow from USD ~9–10 billion in mid-2020s to ~USD 18–31 billion by the early 2030s.

Moreover, governmental and research funding supports biomarker discovery e.g., the National Institute of Neurological Disorders and Stroke (NINDS) supports biomarker programs for neurotherapeutics. At the regulatory level, agencies such as FDA run a Biomarker Qualification Program to integrate biomarkers into drug development tools. These funding and regulatory structures strengthen the commercial viability of neurological biomarker development.

Trending Factors

One major trend is the growing integration of multi-modal biomarkers including imaging, proteomics, genomics, metabolomics, and digital biomarkers. Imaging biomarkers (MRI, PET) remain dominant, supported by advances in resolution and analytics. Concurrently, digital biomarkers (derived from wearables, mobile sensors) are gaining traction, offering continuous, non-invasive monitoring.

Another trend is the adoption of AI and machine learning to interpret complex biomarker data, improve predictive power, and reduce noise in signals. Also, standardization of biomarker assays and data sharing initiatives (e.g., Alzheimer’s Disease Neuroimaging Initiative, ADNI) promote reproducibility across studies. Thus, convergence of technologies and collaborative frameworks shapes the evolving market landscape.

Restraining Factors

The neurological biomarkers market faces significant restraints in regulatory and validation complexity. Obtaining regulatory acceptance of novel biomarkers involves rigorous qualification protocols under agencies like FDA, which demand robust clinical evidence, reproducibility, and defined “context of use” (COU). Securing this validation is time-consuming and costly.

In addition, many neurological biomarkers remain in exploratory stages with limited clinical utility, constraining adoption. Another constraint is the high cost of biomarker assays, data acquisition (e.g. advanced imaging), and infrastructure, which may limit access and clinical uptake, especially in low- and middle-income regions. Finally, heterogeneity in disease pathology and biomarker variability across populations poses challenges in standardization and generalizability.

Opportunity

A key opportunity lies in non-invasive fluid biomarkers (blood, plasma, CSF) for early detection and monitoring, especially for Alzheimer’s and related disorders. Validated blood-based biomarkers would lower barriers to screening and broaden reach. The FDA’s recent acceptance of a letter of intent for neurofilament (a neuronal protein) qualification for frontotemporal degeneration exemplifies regulatory paths opening for novel fluid biomarkers.

Another opportunity is in digital biomarker expansion, leveraging wearable sensors, voice, gait, sleep metrics, and remote monitoring to track neurological health longitudinally. Moreover, opportunities exist in personalized neurology tailoring therapeutics using biomarker stratification in clinical trials and treatment. In emerging markets, improving health infrastructure and increasing R&D investment present openings for localized biomarker adoption.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 36.5% share and holding a market value of over US$ 3.52 billion. The region’s leadership is driven by advanced healthcare infrastructure, higher adoption of biomarker-based diagnostics, and significant research and development investments in neurology.

The strong presence of specialized neurology centers, coupled with increasing awareness about early detection of neurological disorders, has accelerated biomarker adoption. A large patient pool suffering from conditions such as Alzheimer’s disease, Parkinson’s disease, and multiple sclerosis further supports market expansion.

Government support in the form of funding and favorable regulatory frameworks has encouraged the commercialization of biomarker-based diagnostic tests. Furthermore, collaborations between research institutions and biotech companies have enabled faster validation of novel biomarkers, strengthening clinical applications.

The growing demand for personalized medicine has also fueled regional market growth. Neurological biomarkers are being increasingly used to tailor treatment plans, improving patient outcomes and reducing healthcare costs. The presence of key academic and commercial clinical trial networks has further established North America as a hub for biomarker development and validation.

Overall, the dominance of North America can be attributed to robust research capacity, strong regulatory support, and a higher prevalence of neurological diseases compared to other regions. This has positioned the region as the largest revenue generator in the global neurological biomarkers market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The neurological biomarkers market is characterized by the presence of established diagnostic solution providers, emerging biotech firms, and specialized assay developers. Key players focus on expanding portfolios through research partnerships, mergers, and acquisitions, particularly in neurodegenerative disease diagnostics. Investments are directed toward high-sensitivity immunoassays, digital biomarkers, and blood-based assays to enhance early detection and monitoring.

Competitive advantage is being pursued through technological innovation, integration of AI in biomarker analysis, and regulatory approvals for clinical applications. Strategic collaborations with research institutions and healthcare providers further strengthen market positioning while addressing growing demand for precision neurology and personalized medicine solutions.

Market Key Players

- Abbott Laboratories

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories, Inc.

- Quanterix Corporation

- Fujirebio Diagnostics, Inc.

- Siemens Healthineers AG

- QIAGEN N.V.

- PerkinElmer, Inc.

- Biogen Inc.

- Merck KGaA, Darmstadt, Germany

- Alseres Pharmaceuticals, Inc.

- Banyan Biomarkers, Inc.

- Eli Lilly and Company

- BioArctic AB

Recent Developments

- Abbott Laboratories: In February 2024, Abbott entered into a partnership with Fujirebio Diagnostics, Inc. to co-develop a Research Use Only (RUO) neurofilament light (NfL) biomarker assay tailored for Abbott’s Alinity® i platform.

- Quanterix Corporation: In July 2025, Quanterix launched novel p-Tau 205 and p-Tau 212 assays intended to advance Alzheimer’s disease research by enabling detection of tau phosphorylation at specific sites.

- Fujirebio Diagnostics, Inc.: Fujirebio’s most recent public move in the neurological biomarker domain is its February 2024 partnership with Abbott to co-develop the RUO NfL assay for Abbott’s Alinity i system.

Report Scope

Report Features Description Market Value (2024) US$ 9.65 Billion Forecast Revenue (2034) US$ 29.84 Billion CAGR (2025-2034) 3.52% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Genomic, Proteomic, Metabolomic, Imaging, Others) By Application (Alzheimer’s Disease, Parkinson’s Disease, Multiple Sclerosis, Autism Spectrum Disorders, Others) By End-User (Research Organizations, Pharma & Biotech Companies, Clinical Diagnostics, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Abbott Laboratories, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Quanterix Corporation, Fujirebio Diagnostics, Inc., Siemens Healthineers AG, QIAGEN N.V., PerkinElmer, Inc., Biogen Inc., Merck KGaA, Darmstadt, Germany, Alseres Pharmaceuticals, Inc., Banyan Biomarkers, Inc., Eli Lilly and Company, BioArctic AB Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Neurological Biomarkers MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Neurological Biomarkers MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Laboratories

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories, Inc.

- Quanterix Corporation

- Fujirebio Diagnostics, Inc.

- Siemens Healthineers AG

- QIAGEN N.V.

- PerkinElmer, Inc.

- Biogen Inc.

- Merck KGaA, Darmstadt, Germany

- Alseres Pharmaceuticals, Inc.

- Banyan Biomarkers, Inc.

- Eli Lilly and Company

- BioArctic AB