Global Natural Surfactants Market By Source (Plant Based, Animal Based), By Product (Anionics, Nonionics, Cationics, Amphoterics), By Application (Personal Care, Industrial and Institutional Cleaning, Agriculture, Pharmaceuticals, Oilfield Chemicals, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158660

- Number of Pages: 239

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

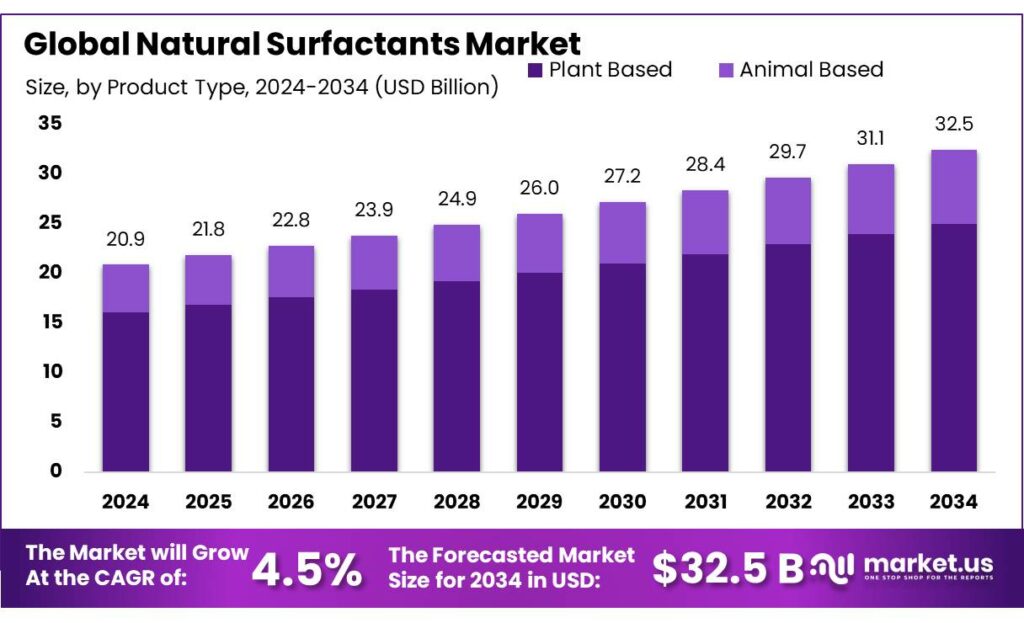

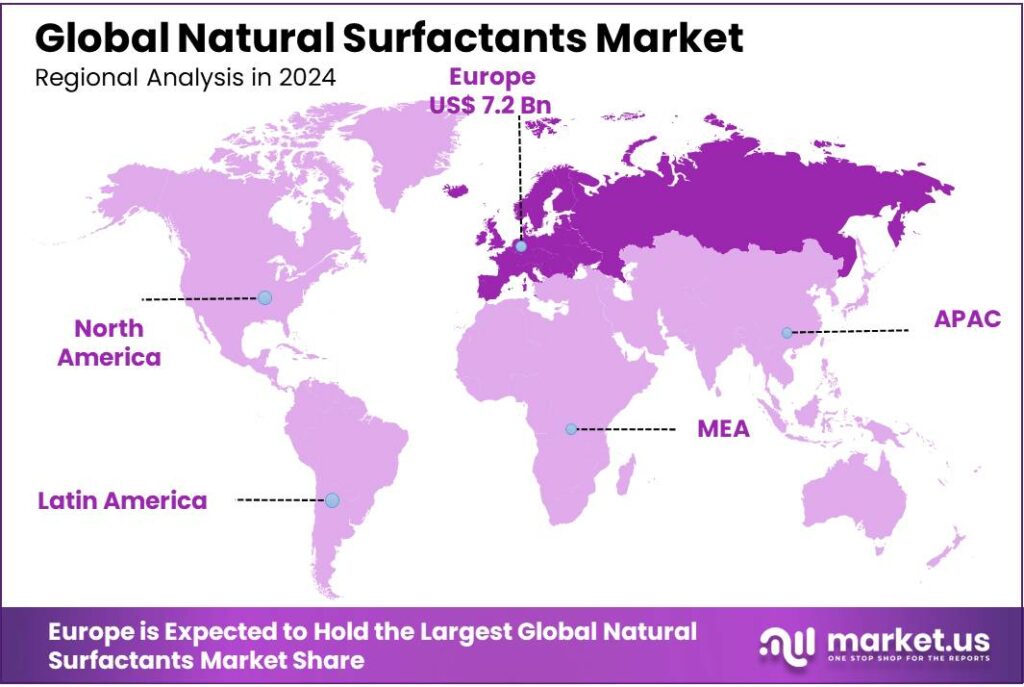

The Global Natural Surfactants Market size is expected to be worth around USD 32.5 Billion by 2034, from USD 20.9 Billion in 2024, growing at a CAGR of 4.5% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 34.9% share, holding USD 7.2 Billion in revenue.

Natural surfactants, particularly biosurfactants, are gaining prominence in India due to their eco-friendly properties and alignment with sustainable industrial practices. These surface-active agents, derived from renewable resources such as plant oils and agricultural by-products, offer biodegradable and non-toxic alternatives to traditional synthetic surfactants. Their applications span various sectors, including personal care, agriculture, and environmental remediation, contributing to a significant shift towards green chemistry in the country.

Several factors are driving this growth. There is a growing consumer preference for natural and biodegradable products, leading to increased adoption of natural surfactants in personal care, household cleaning, and agricultural applications. Advancements in microbial fermentation technologies have enhanced the production efficiency of biosurfactants, making them more commercially viable. Government initiatives, such as the National Action Plan for Climate Change, promote sustainable practices and the use of eco-friendly products, further supporting the growth of the natural surfactants industry.

Government initiatives play a crucial role in promoting the adoption of natural surfactants. Policies encouraging the use of renewable resources and the development of green technologies are facilitating the growth of this market. In India, for example, the government’s focus on sustainability and environmental protection is driving the demand for eco-friendly products, including natural surfactants.

Key Takeaways

- Natural Surfactants Market size is expected to be worth around USD 32.5 Billion by 2034, from USD 20.9 Billion in 2024, growing at a CAGR of 4.5%.

- Plant-based surfactants held a dominant position in the Indian biosurfactants market, capturing more than a 77.2% share.

- Anionic surfactants held a dominant market position, capturing more than a 39.7% share of the Indian surfactants market.

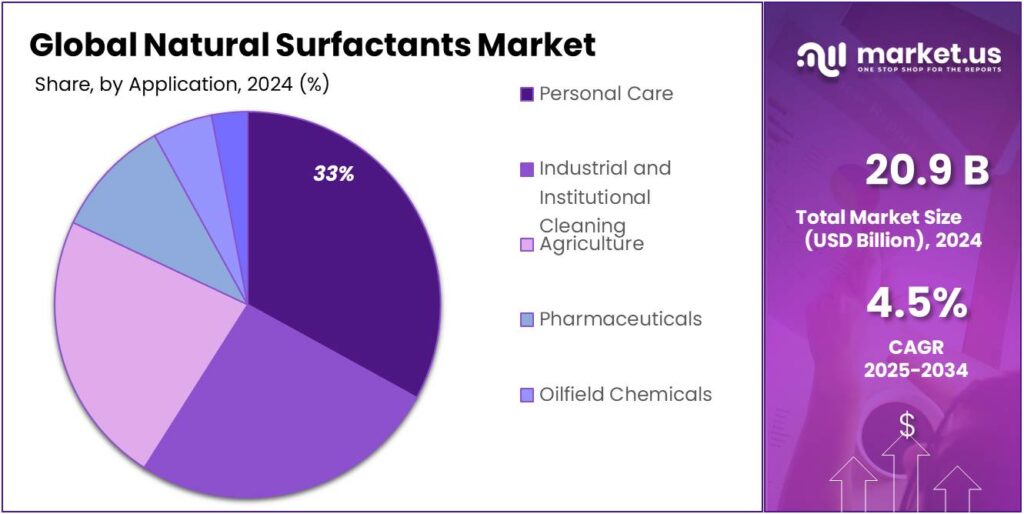

- Personal care segment dominated the natural surfactants market, capturing more than a 33.5% share.

- Europe emerged as the leading region in the global natural surfactants market, capturing a substantial 34.9% share, equating to approximately USD 7.2 billion.

By Source Analysis

Plant-Based Surfactants Lead with 77.2% Market Share in 2024

In 2024, plant-based surfactants held a dominant position in the Indian biosurfactants market, capturing more than a 77.2% share. This significant market share underscores the growing preference for sustainable and eco-friendly alternatives to traditional synthetic surfactants. The increasing consumer awareness regarding environmental issues and the harmful effects of synthetic chemicals has propelled the demand for plant-based surfactants across various industries.

The personal care and cosmetics sector is a major contributor to this growth, with plant-based surfactants being utilized in products like shampoos, body washes, and facial cleansers. These surfactants are favored for their gentle properties and biodegradability, aligning with the rising consumer demand for natural and organic products. Additionally, the agricultural sector has seen a surge in the use of plant-based surfactants as adjuvants in pesticide formulations, enhancing the efficacy and environmental safety of agricultural practices.

By Product Analysis

Anionic Surfactants: Leading the Market with 39.7% Share in 2024

In 2024, anionic surfactants held a dominant market position, capturing more than a 39.7% share of the Indian surfactants market. This significant share underscores their widespread application and essential role across various industries.

The personal care and household cleaning sectors are the primary drivers of this dominance. Anionic surfactants, known for their excellent foaming properties and effective cleaning action, are integral in products like shampoos, body washes, dishwashing liquids, and laundry detergents. Their ability to remove dirt and oils efficiently makes them indispensable in daily hygiene and cleaning routines.

By Application Analysis

Personal Care Surfactants Lead with 33.5% Market Share in 2024

In 2024, the personal care segment dominated the natural surfactants market, capturing more than a 33.5% share. This significant market presence reflects the growing consumer preference for eco-friendly and biodegradable ingredients in personal care products. Surfactants derived from natural sources are increasingly being incorporated into formulations for shampoos, body washes, facial cleansers, and other personal care items due to their gentle cleansing properties and reduced environmental impact.

The demand for natural surfactants in personal care applications is further driven by rising consumer awareness about the harmful effects of synthetic chemicals and a shift towards sustainable and green beauty products. This trend is supported by regulatory frameworks and government initiatives promoting the use of natural and organic ingredients in consumer products. As a result, manufacturers are investing in research and development to innovate and introduce new formulations that align with consumer expectations for safety and sustainability.

Key Market Segments

By Source

- Plant Based

- Animal Based

By Product

- Anionics

- Nonionics

- Cationics

- Amphoterics

By Application

- Personal Care

- Industrial and Institutional Cleaning

- Agriculture

- Pharmaceuticals

- Oilfield Chemicals

- Others

Emerging Trends

Increased Adoption of Natural Surfactants in Food Processing

A significant trend in the natural surfactants industry is their growing adoption in food processing, driven by consumer demand for cleaner, safer, and more sustainable products. Natural surfactants, such as sucrose esters, are increasingly utilized as emulsifiers and stabilizers in various food applications.

In the United States, the Food and Drug Administration (FDA) has recognized sucrose fatty acid esters as Generally Recognized As Safe (GRAS) for use in food products. This designation allows manufacturers to incorporate these natural surfactants into their formulations without the need for premarket approval, streamlining the product development process.

Sucrose esters are particularly valued for their ability to improve texture and stability in products like baked goods, dairy items, and beverages. The FDA’s GRAS status underscores the safety and efficacy of these ingredients in food applications

The adoption of natural surfactants is further supported by regulatory frameworks that encourage the use of safer, bio-based alternatives. For instance, the European Food Safety Authority (EFSA) has evaluated the safety of sucrose esters and established guidelines for their use in food products. These guidelines ensure that natural surfactants used in food applications are safe for consumption and meet regulatory standards

Drivers

Consumer Demand for Sustainable Products

A significant driving force behind the growing adoption of natural surfactants is the increasing consumer demand for sustainable and eco-friendly products. As consumers become more environmentally conscious, they are actively seeking products that align with their values, leading to a shift in market dynamics.

In the United States, this trend is particularly evident. According to a 2021 survey by the Retail Industry Leaders Association, 75% of consumers reported they are willing to pay more for sustainable products. This willingness to invest in environmentally friendly options is influencing manufacturers to reformulate their products to meet these preferences. Companies like Unilever and Procter & Gamble have already started incorporating natural surfactants into their product lines to cater to this demand.

Government initiatives also play a crucial role in promoting the use of natural surfactants. For instance, the U.S. Environmental Protection Agency (EPA) has established programs under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) to regulate and promote the use of safer chemicals in products. These regulations encourage manufacturers to adopt natural ingredients, including surfactants, to comply with safety standards.

The growing preference for natural surfactants is not limited to personal care products. The food industry is also witnessing a shift towards the use of natural surfactants. Sucrose esters, for example, are used as food additives in various products. The European Food Safety Authority (EFSA) has evaluated the safety of sucrose esters and established guidelines for their use in food products. These guidelines ensure that natural surfactants used in food applications are safe for consumption and meet regulatory standards.

Restraints

High Production Costs and Raw Material Availability

One of the primary challenges facing the natural surfactants industry is the high production costs and limited availability of raw materials. Natural surfactants, derived from plant-based sources such as coconut oil, palm oil, and other vegetable oils, often incur higher production costs compared to their synthetic counterparts. The extraction and processing of these natural ingredients typically involve more complex and costly methods, requiring specialized equipment and techniques. Additionally, the purification processes needed to meet quality standards can further increase production expenses.

Moreover, the availability of raw materials for natural surfactants is subject to various environmental factors, seasonal variations, and potential supply disruptions. Factors such as climate change, natural disasters, and crop diseases can significantly impact the availability and quality of raw materials. Furthermore, the growing demand for these plant-based ingredients across various industries, including food and biofuels, creates competition for resources. This scarcity can lead to price volatility and supply chain uncertainties, making it challenging for manufacturers to maintain consistent production and meet the increasing market demand.

In response to these challenges, some companies are exploring alternative sourcing strategies and production methods to reduce costs and ensure a stable supply of raw materials. For example, the U.S. Department of Agriculture (USDA) has been promoting the use of bio-based chemicals through its BioPreferred Program, which encourages the development and adoption of renewable, plant-based products. Additionally, advancements in biotechnology are enabling the development of more efficient and cost-effective biosurfactants. For instance, microbial fermentation processes are being optimized to produce surfactants with higher purity and stability, potentially reducing production costs and dependence on traditional plant sources.

Opportunity

Adoption of Natural Surfactants in Food Processing

A significant growth opportunity for natural surfactants lies in their increasing adoption within the food processing industry. Natural surfactants, such as sucrose esters and ethyl lauroyl arginate (LAE), are gaining traction as safer and more sustainable alternatives to synthetic emulsifiers and preservatives. These natural surfactants offer benefits like biodegradability, low toxicity, and minimal environmental impact, aligning with the growing consumer demand for clean-label and eco-friendly food products.

In the United States, the Food and Drug Administration (FDA) has recognized LAE as Generally Recognized As Safe (GRAS) for use in various food products, including meats and poultry, at levels up to 200 parts per million. Similarly, the European Food Safety Authority (EFSA) has approved LAE as a food additive (E243), endorsing its safety and efficacy in extending the shelf life of food items without compromising quality. These regulatory approvals facilitate the incorporation of natural surfactants into food formulations, providing manufacturers with viable options to meet consumer preferences for natural ingredients.

Regional Insights

Europe Leads Natural Surfactants Market with 34.9% Share in 2024

In 2024, Europe emerged as the leading region in the global natural surfactants market, capturing a substantial 34.9% share, equating to approximately USD 7.2 billion in market value. This dominance reflects Europe’s strong commitment to sustainability, stringent environmental regulations, and a growing consumer preference for eco-friendly products.

The European market’s growth is further supported by the European Union’s Green Deal and the Circular Economy Action Plan, which promote the use of sustainable and biodegradable materials. These policies encourage industries to adopt natural surfactants, aligning with the region’s environmental objectives.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF is a key player in the natural surfactants market, focusing on the development of sustainable and bio-based surfactants. The company’s innovative product portfolio includes solutions for personal care, cleaning, and industrial applications. BASF is committed to meeting consumer demand for eco-friendly products, supported by its investments in green technologies and R&D for sustainable alternatives.

Evonik Industries AG leads the market with advanced natural surfactants, focusing on personal care, home care, and industrial applications. Known for its innovation, Evonik integrates sustainable technologies to produce bio-based surfactants. The company’s commitment to sustainability is evident through its consistent research and development efforts to create high-performance, environmentally friendly surfactants.

Kao Corporation is a global leader in natural surfactants, providing solutions for personal care, health, and industrial applications. The company prioritizes sustainability and green chemistry in its product offerings, focusing on natural and renewable ingredients. Kao’s commitment to reducing environmental impact is reflected in its development of eco-friendly and biodegradable surfactants.

Top Key Players Outlook

- BASF

- Croda International Plc

- Evonik Industries AG

- Dow

- CLARIANT

- Kao Corporation

- WHEATOLEO

- SEPPIC

- Indorama Ventures

- GALAXY

- Stepan Company

- Inolex, Inc

Recent Industry Developments

In 2024, BASF maintained a strong presence in the global natural surfactants market, with an estimated market share of approximately 16.51 billion USD.

In 2024, Croda’s Consumer Care segment achieved a 7% increase in sales, driven by an 11% rise in sales volumes.

Report Scope

Report Features Description Market Value (2024) USD 20.9 Bn Forecast Revenue (2034) USD 32.5 Bn CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Plant Based, Animal Based), By Product (Anionics, Nonionics, Cationics, Amphoterics), By Application (Personal Care, Industrial and Institutional Cleaning, Agriculture, Pharmaceuticals, Oilfield Chemicals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF, Croda International Plc, Evonik Industries AG, Dow, CLARIANT, Kao Corporation, WHEATOLEO, SEPPIC, Indorama Ventures, GALAXY, Stepan Company, Inolex, Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF

- Croda International Plc

- Evonik Industries AG

- Dow

- CLARIANT

- Kao Corporation

- WHEATOLEO

- SEPPIC

- Indorama Ventures

- GALAXY

- Stepan Company

- Inolex, Inc