Global Monosodium glutamate Market Size, Share, And Business Benefits By Form (Crystal, Liquid, Powder), By Source (Chemical Synthesis, Extraction, Fermentation), By Grade (Feed Grade, Food Grade, Pharmaceutical Grade), By Application (Noodles, Soups and Broth, Meat Products, Seasonings and Dressings, Others), By Distribution Channel (Hypermarkets and Supermarkets, Online Retail, Convenience Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150644

- Number of Pages: 391

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

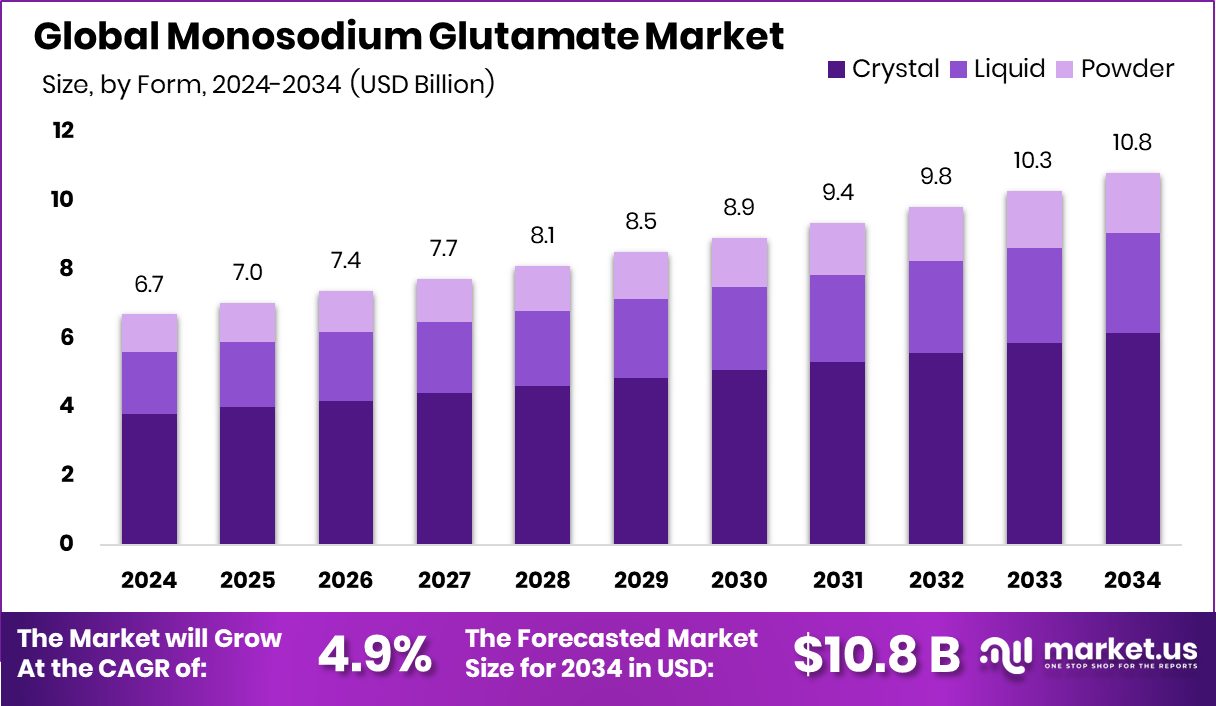

Global Monosodium glutamate Market is expected to be worth around USD 10.8 billion by 2034, up from USD 6.7 billion in 2024, and grow at a CAGR of 4.9% from 2025 to 2034. High demand for savory foods drives Asia-Pacific’s 34.7% strong position in the market.

Monosodium glutamate (MSG) is a sodium salt of glutamic acid, a naturally occurring amino acid found in many foods such as tomatoes, cheese, and mushrooms. It is commonly used as a flavor enhancer, especially in Asian cuisine and processed foods, due to its ability to intensify savory (umami) tastes. MSG is typically available as a white crystalline powder and is widely used in seasonings, ready meals, snacks, canned soups, and instant noodles.

The MSG market continues to grow steadily, driven by rising demand from the food processing sector. As packaged and convenience foods gain popularity in both developed and emerging economies, MSG usage is increasing due to its cost-effective flavor-enhancing properties. Growing urbanization, evolving food habits, and the rapid expansion of fast-food chains have significantly boosted product demand.

Consumer preference for flavor-rich foods is also influencing demand. Many manufacturers are reducing sodium in recipes while still maintaining taste, and MSG helps achieve this balance. Its low sodium content compared to regular salt allows food producers to meet health-conscious goals without compromising flavor. According to an industry report, Zappfresh raises $4.3 million to Revolutionize Meat Delivery in India

A major growth opportunity lies in the expanding processed food industry in Asia, Africa, and Latin America. MSG adoption is expected to rise as these regions develop stronger food manufacturing capabilities. Additionally, the increasing penetration of modern retail formats is helping reach more end-users, driving future demand.

Key Takeaways

- Global Monosodium glutamate Market is expected to be worth around USD 10.8 billion by 2034, up from USD 6.7 billion in 2024, and grow at a CAGR of 4.9% from 2025 to 2034.

- Crystal form dominates the Monosodium Glutamate market, accounting for 56.9% of the total share.

- Fermentation remains the primary source for MSG production, contributing to 67.1% of market volume globally.

- Food-grade MSG leads demand, making up 81.3% of the total monosodium glutamate market share.

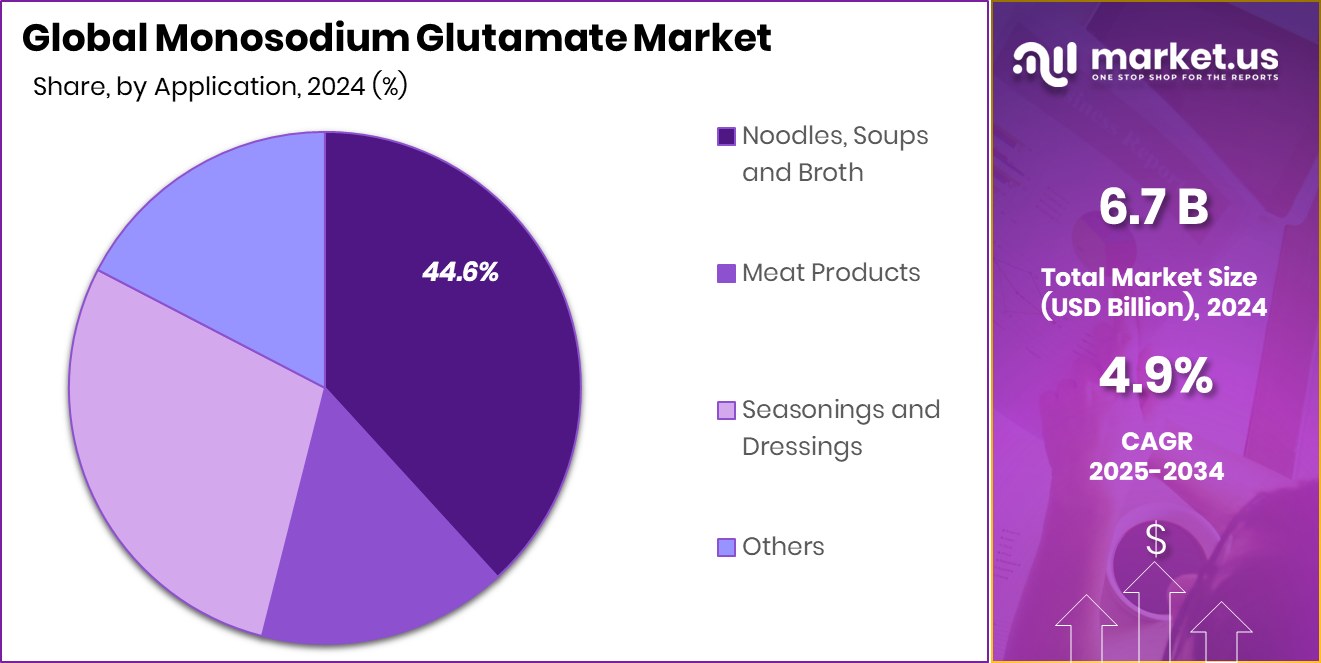

- Noodles, soups, and broth represent 44.6% of MSG application, reflecting strong processed food usage.

- Hypermarkets and supermarket channels contribute 47% of MSG distribution due to wide consumer access and availability.

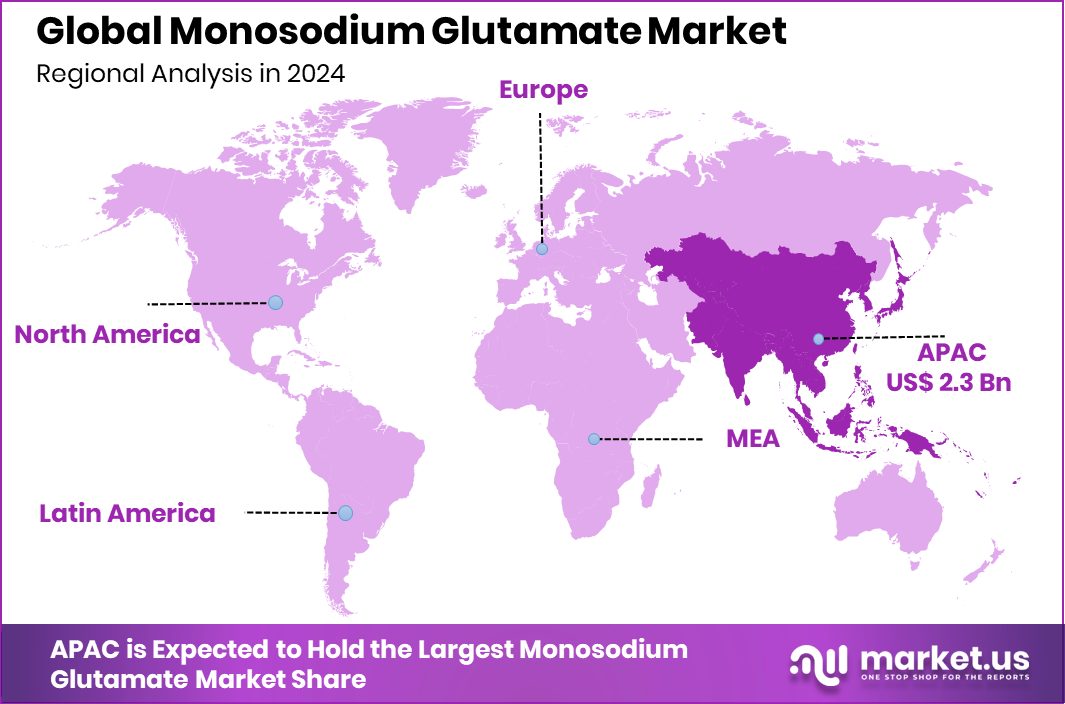

- The Asia-Pacific accounted for USD 2.3 billion in total market revenue generation.

By Form Analysis

Crystal form dominates the monosodium glutamate market with 56.9% global share.

In 2024, Crystal held a dominant market position in the By Form segment of the Monosodium Glutamate Market, with a 56.9% share. This strong foothold is primarily attributed to its widespread usage across food processing applications, owing to its ease of solubility, longer shelf life, and cost-effective bulk storage. The crystalline form of MSG is particularly favored by manufacturers of instant noodles, savory snacks, seasonings, and ready-to-eat meals due to its uniformity, handling convenience, and efficient blending during mass production.

The demand for crystal form MSG is further supported by its compatibility with large-scale food manufacturing equipment, allowing consistent dispersion of umami flavor in processed foods. Additionally, its stable nature makes it suitable for long-distance exports, particularly to regions with growing consumption of packaged and convenience food products. Food processors also prefer crystal MSG as it ensures accurate dosing and predictable taste outcomes, which is essential in maintaining product quality across batches.

Its dominance in the segment reflects the growing emphasis on flavor optimization in industrial food production. With urban dietary shifts and increased demand for time-saving meals, the crystal form of MSG continues to play a central role in enhancing the savory appeal of processed foods on a global scale.

By Source Analysis

Fermentation remains the leading production source, accounting for 67.1% of market volume.

In 2024, Fermentation held a dominant market position in the By Source segment of the Monosodium Glutamate Market, with a 67.1% share. The widespread adoption of fermentation-based production is driven by its cost-efficiency, scalability, and ability to meet global food-grade quality standards. This method uses naturally available substrates such as sugarcane, tapioca, or molasses and employs microbial strains to produce glutamic acid, which is then converted into monosodium glutamate.

Fermentation offers a sustainable and consistent production route, enabling manufacturers to produce MSG in large quantities with controlled purity. It is also considered environmentally friendly compared to traditional chemical synthesis, as it involves fewer harmful by-products and operates under milder reaction conditions. This advantage makes fermentation particularly attractive for large-scale industrial players looking to meet both volume demand and compliance with clean-label initiatives.

The dominance of fermentation-based MSG also reflects the growing demand in emerging markets, where agricultural feedstock is abundant and production costs are lower. The high share of this segment underlines the global shift toward more sustainable sourcing and manufacturing practices, which is expected to continue driving the expansion of fermentation-derived MSG in the food industry.

By Grade Analysis

Food-grade monosodium glutamate captures 81.3% share due to high culinary demand.

In 2024, Food Grade held a dominant market position in the By Grade segment of the Monosodium Glutamate Market, with an 81.3% share. This dominance is largely driven by the ingredient’s extensive use in enhancing the umami flavor of a wide variety of packaged, processed, and ready-to-eat food products. Food-grade MSG is specifically manufactured to meet stringent food safety and purity standards, making it suitable for direct consumption in food applications.

The high market share of the food grade segment reflects the growing consumption of convenience foods, particularly in urban markets where busy lifestyles have led to a greater reliance on instant noodles, soups, frozen meals, and snack products. Food processors continue to rely heavily on MSG as a flavor enhancer due to its proven efficacy in improving taste while maintaining cost efficiency.

Furthermore, the consistent performance, safe profile, and ease of formulation of food-grade MSG have ensured its firm integration into mass-market food production processes, securing its leading position in this segment globally.

By Application Analysis

Noodles, soups, and broth drive application usage with a 44.6% market contribution.

In 2024, Noodles, Soups, and Broth held a dominant market position in the By Application segment of the Monosodium Glutamate Market, with a 44.6% share. This leadership position is directly tied to the ingredient’s strong role in intensifying umami flavor, which is a core taste element in these food products. MSG enhances the savory depth and palatability of noodle seasonings and soup bases, making it an essential additive for manufacturers aiming to deliver consistent and satisfying taste profiles.

The dominance of this segment is also supported by the global surge in consumption of instant and packaged noodles and ready-to-cook soups. These products are particularly popular across Asia-Pacific and increasingly in emerging markets, where fast-paced lifestyles and demand for convenient meals are driving growth. The long shelf life and flavor stability that MSG provides further contribute to its extensive use in this category.

Additionally, product innovation within the noodles and broth segment, such as spicy variants, regional flavors, and healthier versions with reduced salt, continues to depend on MSG for taste enhancement. Its ability to work effectively even at low concentrations helps maintain cost-effectiveness and quality, making it a preferred choice in the formulation of these staple products, thereby sustaining its dominant application share.

By Distribution Channel Analysis

Hypermarkets and supermarkets lead distribution channels, holding 47% of global MSG sales.

In 2024, Hypermarkets and Supermarkets held a dominant market position in the By Distribution Channel segment of the Monosodium Glutamate Market, with a 47% share. This dominance is primarily driven by the wide accessibility, strong shelf visibility, and consumer trust associated with organized retail formats. These outlets offer a broad range of MSG products, often in multiple packaging sizes and price points, catering to both individual consumers and small food businesses.

Hypermarkets and supermarkets also play a key role in educating consumers about food ingredients, with in-store promotions, demonstrations, and clear labeling practices. This has helped reinforce confidence in MSG as a safe and effective flavor enhancer. Additionally, urbanization and rising disposable incomes have contributed to the growing preference for modern retail over traditional grocery stores, particularly in developing countries.

The strong presence of MSG in these retail channels is also a result of established supply chains and robust distribution networks, ensuring product availability across urban and semi-urban markets. This structured retail environment has enabled hypermarkets and supermarkets to retain their leadership in MSG sales, maintaining their significant share in the distribution landscape.

Key Market Segments

By Form

- Crystal

- Liquid

- Powder

By Source

- Chemical Synthesis

- Extraction

- Fermentation

By Grade

- Feed Grade

- Food Grade

- Pharmaceutical Grade

By Application

- Noodles, Soups, and Broth

- Meat Products

- Seasonings and Dressings

- Others

By Distribution Channel

- Hypermarkets and Supermarkets

- Online Retail

- Convenience Stores

- Others

Driving Factors

Rising Demand for Flavor-Boosting Ingredients Globally

One of the key driving factors in the monosodium glutamate (MSG) market is the rising global demand for flavor-enhancing ingredients. As people consume more ready-to-eat and processed foods, especially in cities, food producers are using MSG to make meals taste better. It is widely used in snacks, noodles, soups, frozen foods, and sauces to add the umami flavor that many people enjoy.

Because MSG is affordable, easy to store, and enhances taste without needing too much salt, it is becoming more common in packaged food. As food industries grow in countries like India, China, Brazil, and parts of Africa, the use of MSG is expected to keep increasing to meet flavor and cost demands in mass production.

Restraining Factors

Health Concerns and Misconceptions Impacting Consumer Trust

A major factor holding back the growth of the monosodium glutamate (MSG) market is the ongoing health concerns and misconceptions about its safety. Although many food safety authorities around the world have confirmed that MSG is safe to eat in normal amounts, some consumers still believe it causes headaches, allergies, or other health problems. This negative image has led certain people to avoid foods that list MSG on the label.

As a result, some food companies choose to advertise “No MSG” to appeal to health-conscious buyers. These public concerns—whether scientifically proven or not—continue to affect the market, especially in regions where consumer awareness is shaped more by perception than by official health guidelines.

Growth Opportunity

Expansion in Emerging Markets with Growing Consumption

A major growth opportunity for the monosodium glutamate (MSG) market lies in expanding into emerging markets where food consumption patterns are rapidly changing. Countries in Asia, Africa, and Latin America are seeing a rise in urban populations, busier lifestyles, and greater demand for ready-to-eat and flavorful food. As more people shift toward packaged meals and convenience foods, the use of MSG in food production is expected to increase.

In these regions, local food manufacturers are also investing in flavor enhancers like MSG to meet the taste expectations of a growing middle class. With better retail infrastructure and increasing product availability, these markets offer strong potential for MSG suppliers to grow and capture new customer bases in the coming years.

Latest Trends

Clean Label MSG Products Gaining More Attention

One of the latest trends in the monosodium glutamate (MSG) market is the growing interest in clean-label products. Many consumers today want to know exactly what’s in their food and prefer items with fewer artificial ingredients. In response, some companies are promoting MSG made from natural sources using fermentation, such as sugarcane or molasses, to align with clean label standards.

These products are marketed as “naturally derived” or “non-synthetic,” which helps improve MSG’s image. This trend is especially visible in health-conscious markets where consumers still want flavor but with transparency and cleaner formulations. As demand for simple and recognizable ingredients grows, naturally sourced MSG is becoming more accepted in both packaged foods and restaurant offerings.

Regional Analysis

In 2024, Asia-Pacific led the Monosodium Glutamate Market with a 34.7% share.

In 2024, Asia-Pacific emerged as the leading region in the global Monosodium Glutamate (MSG) market, accounting for a dominant 34.7% share, valued at USD 2.3 billion. The region’s leadership is primarily driven by high consumption of processed and convenience foods, particularly in countries like China, Indonesia, Vietnam, and India, where MSG is a staple flavor enhancer in daily cooking and packaged food production.

Rapid urbanization, a growing middle-class population, and the strong presence of local food processing industries further support regional market expansion. North America and Europe also hold notable shares, fueled by rising demand in the foodservice sector and growing popularity of Asian cuisines. Meanwhile, Latin America and the Middle East & Africa show moderate growth, supported by changing dietary patterns and increased availability of MSG through modern retail formats.

However, their market value remains lower compared to more developed regions. Across all regions, hypermarkets and supermarkets are key distribution channels, ensuring consistent product availability. Asia-Pacific’s clear dominance highlights its deep cultural integration of MSG and the scale of its food production industry, positioning the region as the central hub for future MSG demand and production capacity in the global market landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Ajinomoto Co. Inc. continued to reinforce its leadership in the global monosodium glutamate (MSG) market by leveraging its long-standing expertise in amino acid technology. The company, widely recognized as the original developer of commercial MSG, maintained its strong market presence through continuous product innovation and sustainable fermentation-based production. Ajinomoto’s global manufacturing footprint and deep integration into both industrial and consumer food sectors enabled it to meet rising demand across diverse regions, especially in Asia-Pacific, where MSG remains a dietary staple.

COFCO, one of China’s largest state-owned food processing companies, played a significant role in boosting domestic MSG production to meet the country’s massive consumption levels. With China being a major consumer and exporter of MSG, COFCO’s scale and government backing gave it a strong competitive edge. The company focused on integrated value chains and efficient production models, helping it maintain supply stability and competitive pricing in both domestic and export markets.

Ningxia Eppen Biotech Co., Ltd, another China-based manufacturer, made significant strides in 2024 by enhancing its production capacity and expanding its reach in emerging international markets. Known for its large-scale fermentation capabilities and cost-efficient operations, Eppen remained focused on high-volume output and supplying MSG to food manufacturers globally.

Top Key Players in the Market

- Ajinomoto Co. Inc

- COFCO

- Ningxia Eppen Biotech Co., Ltd

- Meihua Holdings Group Co. Ltd

- Gremount International Company Limited

- Cargill Incorporated

- Shandong Qilu Biotechnology Group Co.

- Henan Lotus Flower Gourmet Powder Co.

Recent Developments

- In February 2025, Ajinomoto Health & Nutrition North America hosted its first Next Generation Taste & Texture Technologies (NGT3) pitch event, inviting startups developing new flavor compounds and related ingredients, including umami seasoning like MSG.

- In February 2024, Cargill expanded its partnership with ENOUGH, a food-tech company producing sustainable fermented protein called ABUNDA®. While this focuses on alternative proteins, it demonstrates Cargill’s expertise in fermentation, an important process shared with MSG production.

Report Scope

Report Features Description Market Value (2024) USD 6.7 Billion Forecast Revenue (2034) USD 10.8 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Crystal, Liquid, Powder), By Source (Chemical Synthesis, Extraction, Fermentation), By Grade (Feed Grade, Food Grade, Pharmaceutical Grade), By Application (Noodles, Soups and Broth, Meat Products, Seasonings and Dressings, Others), By Distribution Channel (Hypermarkets and Supermarkets, Online Retail, Convenience Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ajinomoto Co. Inc, COFCO, Ningxia Eppen Biotech Co. Ltd, Meihua Holdings Group Co. Ltd, Gremount International Company Limited, Cargill Incorporated, Shandong Qilu Biotechnology Group Co., Henan Lotus Flower Gourmet Powder Co. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Monosodium glutamate MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Monosodium glutamate MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ajinomoto Co. Inc

- COFCO

- Ningxia Eppen Biotech Co., Ltd

- Meihua Holdings Group Co,. Ltd

- Gremount International Company Limited

- Cargill Incorporated

- Shandong Qilu Biotechnology Group Co.

- Henan Lotus Flower Gourmet Powder Co.