Global Mobile Phone Insurance Ecosystem Market Size, Share, Industry Analysis Report Analysis By Phone Type (Budget phones, Mid & high-end phones, Premium smartphones) ,By Coverage (Physical damage, Internal component failure, Theft & loss protection, Virus & data protection, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 157159

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role of Gen AI

- Analysts’ Viewpoint

- Investment and Business benefits

- U.S Market Size

- By Phone Type

- By Coverage types

- Key Market Segments

- Emerging Trends

- Top 5 Use Cases

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- SWOT Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

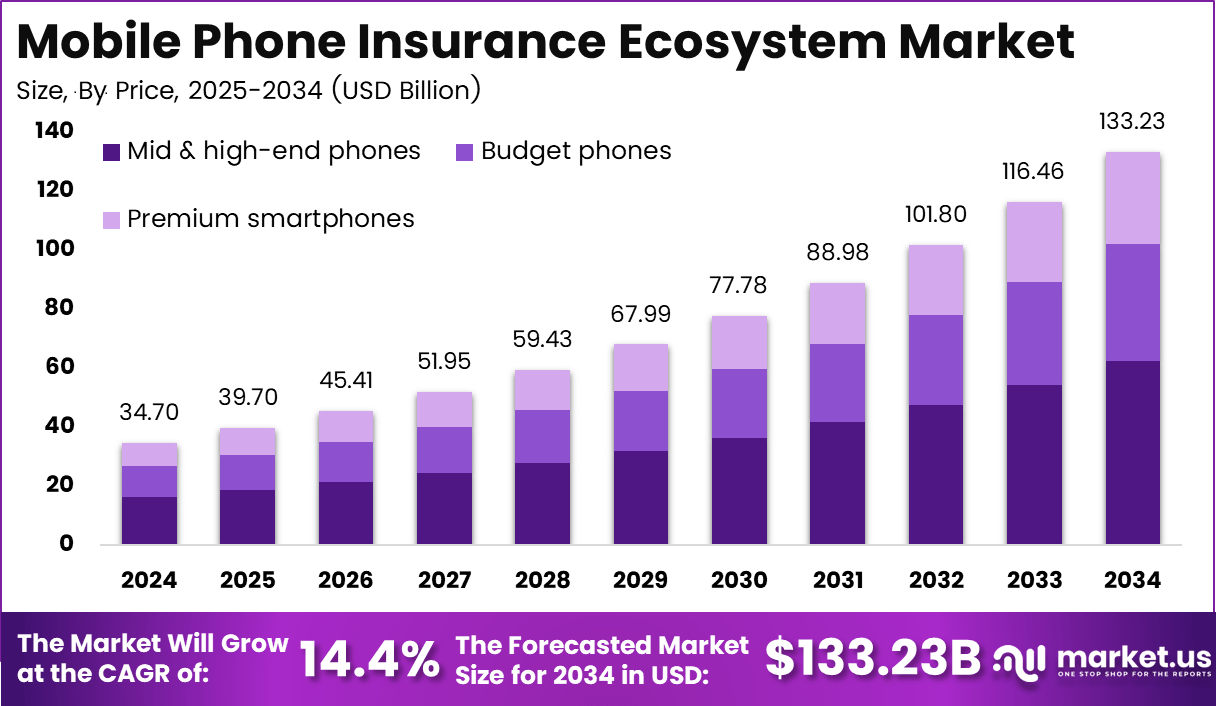

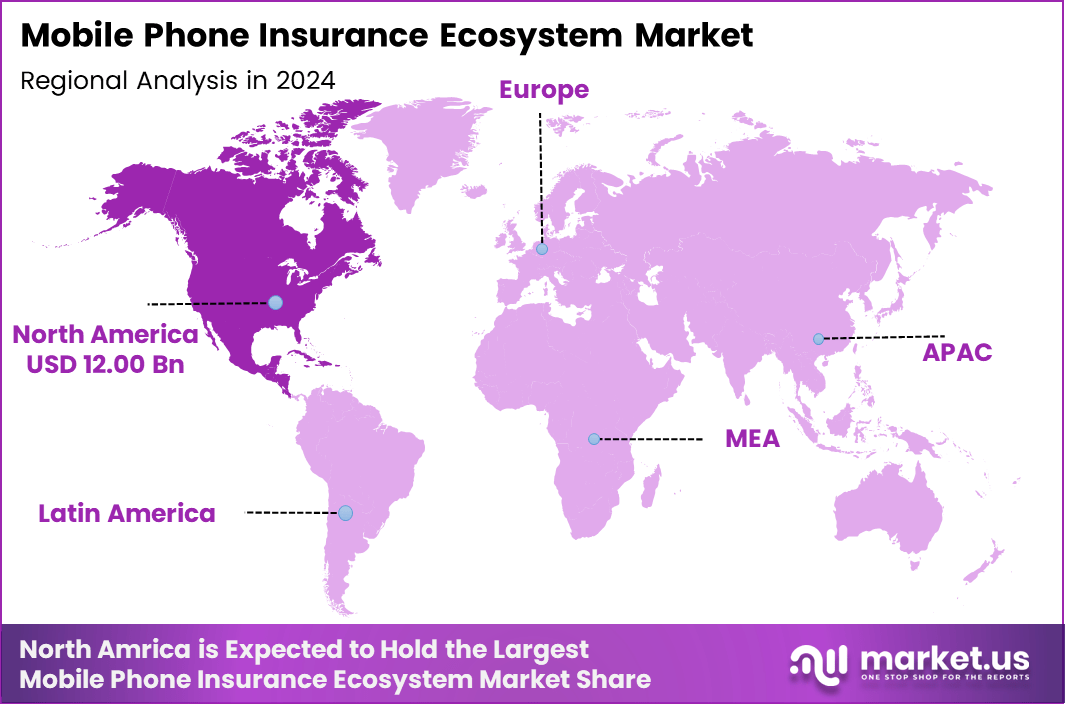

The Global Mobile Phone Insurance Ecosystem Market size is expected to be worth around USD 133.23 Billion By 2034, from USD 34.7 billion in 2024, growing at a CAGR of 14.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34.6% share, with USD 12.0 billion revenue.

The Mobile Phone Insurance Ecosystem Market includes all stakeholders and services involved in providing protection plans, extended warranties, and insurance coverage for mobile devices. This ecosystem consists of insurers, device manufacturers, telecom operators, third-party administrators, and service providers. The goal of these services is to protect users against financial loss caused by accidental damage, theft, malfunction, or device loss.

The growing value of smartphones and increasing dependence on mobile connectivity are key factors contributing to the growth of this market. As mobile phones become more expensive and integral to daily life, users are looking for ways to secure their investment. The rising cost of screen repairs, battery replacements, and hardware malfunctions is encouraging consumers to opt for insurance coverage.

Demand analysis shows that consumers value protection against costly repairs or replacements, especially with fragile smartphone designs that include advanced glass and thin profiles. The growing reliance on phones for daily work, communication, and online activities also pushes users toward insurance solutions that provide peace of mind and financial security.

Key Takeaways

- By phone type, Mid & High-end phones dominated the market, capturing 46.7% share.

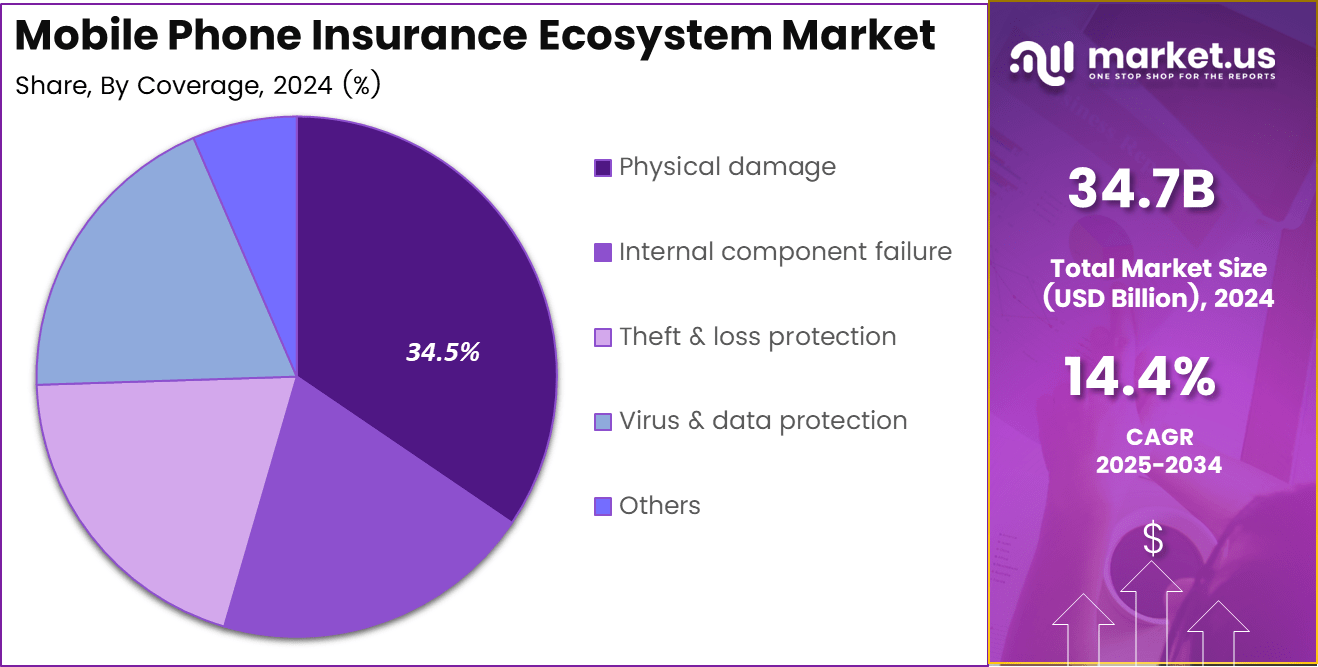

- By coverage, Physical damage protection led the segment, holding 34.5% share.

- Regionally, North America accounted for 34.6% share of the global market.

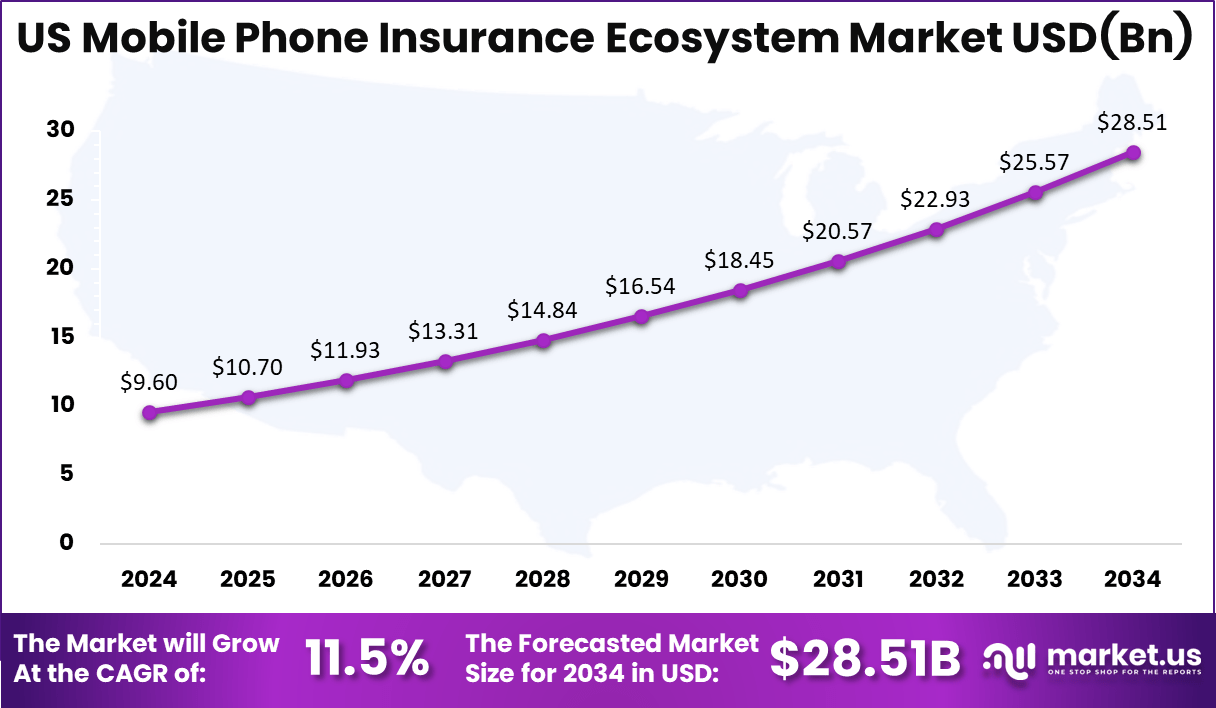

- The U.S. market was valued at USD 9.60 Billion, growing at a strong 11.5% CAGR.

Role of Gen AI

- Faster Claims – Automates assessment of device damage using text, image, or video inputs, reducing settlement time.

- Fraud Detection – Generates synthetic scenarios to train systems, helping insurers detect and prevent fraudulent claims.

- Personalized Policies – Analyzes user behavior and device usage to create tailored insurance packages with dynamic pricing.

- Customer Engagement – Powers conversational chatbots and virtual assistants for seamless, 24/7 support and upselling.

- Ecosystem Innovation – Simulates new models like predictive maintenance and integrated protection plans for insurers, retailers, and telecoms.

Analysts’ Viewpoint

Technologies increasingly adopted in this market include artificial intelligence and data analytics for risk assessment and streamlined claims processing. Mobile apps enable customers to manage policies, file claims, and receive instant support. Emerging technologies like telematics allow insurers to personalize premiums based on user behavior data, improving risk management and customer satisfaction.

Key reasons for adopting these technologies are enhancing operational efficiency, reducing fraud, providing personalized products, and improving customer service experience. Automation and mobile distribution reduce manual effort, accelerate policy issuance, and lower customer acquisition costs, all crucial for competitive performance.

Investment and Business benefits

Investment opportunities in the mobile phone insurance sector are particularly strong. Expanding digital sales channels, especially through AI-driven claims systems, present a valuable opportunity. The use of AI in underwriting is expected to improve underwriting efficiency by 30-40%, reducing operational costs for insurers. Additionally, subscription-based insurance models are projected to account for 50% of the market by 2030, providing stable, recurring revenue streams.

There is also substantial potential in integrating insurance offerings into telecom bundles and retail ecosystems, which could lead to up to 20% higher customer adoption rates. The increasing focus on enabling instant claims through mobile applications and digital customer engagement platforms could increase customer satisfaction by 15-20%.

For businesses involved in the mobile phone insurance ecosystem, the ability to tap into the growing global smartphone penetration, which reached 6.8 billion active mobile users worldwide in 2024, offers a significant market. Collaborations between insurers, manufacturers, and telecom providers are expected to expand customer reach by 15-20% , improving operational strength and market presence.

From a regulatory standpoint, consumer protection and data privacy regulations like GDPR are crucial for maintaining trust in the industry. Compliance with these regulations is expected to cost insurers USD 5-8 million annually, but failure to comply could lead to fines of up to 4% of global annual turnover, reinforcing the importance of maintaining transparency and fair pricing practices.

U.S Market Size

The mobile phone insurance ecosystem market was valued at USD 9.60 Billion in 2024 and is anticipated to reach approximately USD 28.5 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 11.8% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than 34.6% share and generating USD 12 billion in revenue in the mobile phone insurance ecosystem market.

In North America, the mobile phone insurance market is driven by the high cost of smartphone repairs. The average cost to repair a smartphone screen is USD 250, with premium devices often exceeding USD 400. This has led to a steady increase in insurance adoption, with 30% of smartphone owners insured, and an annual growth rate of 5-7% in adoption, especially with the rise of high-value devices.

Digital advancements are significantly improving the efficiency of claims processing, with AI-driven systems reducing claim times by 50%, from 7 days to 24-48 hours, boosting customer satisfaction rates to over 85%. Additionally, subscription-based insurance plans are growing in popularity, projected to make up 45% of the market by 2025, up from 35% in 2020.

Insurance providers are shifting toward repairs rather than replacements, reducing claims for replacements by 20-30% over the next five years, in favor of more sustainable repair options. Mobile insurance apps are also increasingly being used to file claims, with 60% of claims now processed via mobile apps, up from 40% two years ago. Furthermore, non-compliance with regulations like those set by the FCC can result in fines of USD 1 million per violation, ensuring transparency and consumer protection.

By Phone Type

In 2024, the mid and high-end phone segment accounted for a 46.7% share of the mobile phone insurance ecosystem market, driven by the rising value of smartphones equipped with advanced features. The average price of a high-end smartphone, such as the iPhone 15 Pro, is approximately USD 1,099 , with premium models exceeding USD 1,500 , making insurance increasingly appealing for users seeking to protect these costly devices.

As a result, demand for insurance policies tailored to mid and high-end devices has surged, with insurers offering coverage options that often include screen damage repair and cyber protection services . These policies are particularly attractive as premium smartphones account for 40% of total smartphone sales in North America.

By Coverage types

Physical damage coverage represented 34.5% of the market share in 2024. The high incidence of screen cracks, water damage, and hardware failures drives demand for this type of insurance. For example, the cost of replacing a cracked screen on a premium device can range from USD 200 to USD 500 , depending on the model.

The fragility of modern smartphones, with over 50% of claims related to screen damage, underscores the importance of physical damage coverage. AI-powered claims processing is improving efficiency, reducing claim processing times by 50%, and providing faster settlement for users, with 85% of claims now processed digitally.

Key Market Segments

By Phone Type

- Budget phones

- Mid & high-end phones

- Premium smartphones

By Coverage

- Physical damage

- Internal component failure

- Theft & loss protection

- Virus & data protection

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

- Embedded & checkout insurance: Increases attach rates by 25% and lowers customer acquisition costs, with 30% of users more likely to purchase insurance when offered at checkout.

- AI claims automation: Reduces claim processing times by 60% and fraud by 35%, improving loss ratios and efficiency with 80% less manual handling.

- Repair-first models: Cuts claim severity by 25-30% and improves customer satisfaction by 15% by prioritizing authorized repairs with genuine parts over cash settlements.

- Dynamic pricing by device state: Adjusts premiums based on device age, condition, and usage, ensuring 10-15% more accurate pricing and reducing over- or under-charging by 20%.

- Bundled digital safety services: Increases ARPU by 12-18% and customer retention rates by 30% by offering value-added services like identity protection and cloud backup.

- Refurb ecosystem tie-ins: Increases recovery values by 20-25%, reduces electronic waste by 15-20%, and promotes circularity through partnerships with refurbishment and resale channels.

Top 5 Use Cases

- Screen & accidental damage repairs: covers cracked screens, liquid damage, and accidental drops

- Theft & loss protection: provides reimbursement or replacement for stolen or lost devices

- Extended warranty & component failures: covers hardware issues like battery or motherboard failure

- Cybersecurity & data protection: protects against malware, identity theft, and e-wallet fraud

- Accessory & multi-device coverage: extends protection to smartwatches, earbuds, and family bundles

Driver Analysis

Rising Smartphone Adoption

The growing adoption of smartphones worldwide is a clear driver for the mobile phone insurance ecosystem. As smartphones have become essential personal and professional tools, more consumers seek protection against costly repairs or replacements. Increased smartphone penetration means a larger base of users aware of the financial risk related to device damage or theft, which drives demand for insurance coverage.

For example, by 2025, it is estimated that in the UK, 95% of the population will own a smartphone, fueling the need for reliable insurance plans that offer repair and replacement services. This rising smartphone use not only expands the market but also encourages insurance providers to innovate flexible plans tailored to diverse consumer needs.

Moreover, the ongoing advancements in mobile technology, from higher resolution cameras to 5G connectivity, have increased the cost of devices. As flagship smartphones become more expensive, consumers find insurance policies vital to safeguard their investments. The costliness of repairs, especially for premium devices with fragile components like edge-to-edge displays, motivates consumers to buy mobile insurance for peace of mind.

Restraint Analysis

High Premium Costs and Limited Awareness

A significant restraint in the mobile phone insurance market is the high cost of premiums, which deters many price-sensitive consumers. Despite the clear benefits of device protection, some users – particularly in developing and rural markets – consider insurance an additional financial burden that they are unwilling or unable to bear. Premium costs vary widely by region, with a lack of standardized pricing further complicating affordability.

Additionally, there is insufficient awareness or misunderstanding about what mobile insurance covers. Many consumers confuse warranties with insurance or underestimate the need for comprehensive protection against theft and accidental damage. Limited communication and unclear policy terms create reluctance in buying or renewing policies.

This lack of consumer education slows market growth since users do not recognize the value or necessity of insurance until after device damage occurs. Closing this knowledge gap with better information and simplified products remains a challenge.

Opportunity Analysis

Expansion of Online and Subscription Models

The digital transformation of insurance channels presents a significant opportunity for the mobile phone insurance ecosystem. Increasing sales through e-commerce platforms and mobile apps simplify the insurance buying process, providing consumers with quick, easy access to plans at the point of sale.

These channels also allow insurers to offer flexible and customizable policies, catering to different device types and user behaviors. For instance, subscription-based models allow users to pay premiums in manageable, recurring installments instead of lump sums, making insurance more accessible and attractive to a broader audience.

Moreover, there is growing scope for product innovation supporting value-added services such as cybersecurity coverage, digital wallet protection, and eco-friendly insurance plans. Integration of AI for faster claims processing and real-time assistance through apps enhances customer experience and trust.

Challenge Analysis

Complex Claims Process and Customer Experience

One of the main challenges in the mobile phone insurance market is ensuring a smooth and transparent claims process. Consumers often experience delays, complicated paperwork, and unclear policy terms during claims, which leads to dissatisfaction and can deter policy renewals or new purchases.

Negative customer experiences, especially regarding claim approval times and support responsiveness, damage insurer reputations and inhibit market growth. Improving the claims process requires significant investment in technology and customer service improvements. Insurers must leverage digital tools, such as mobile claims apps and AI-driven fraud detection, to speed up claim settlement and reduce manual errors.

Simplifying communication and enhancing transparency throughout the policy lifecycle is essential for gaining consumer trust. Addressing these service-related challenges will be critical to sustain long-term growth and retain customers in a competitive landscape.

SWOT Analysis

Strengths

- Strong market growth with a projected size of USD 133.2 Bn by 2034.

- High adoption among premium smartphone users due to costly repairs.

- Embedded distribution through carriers and OEMs ensures high attach rates.

- AI-powered claims and fraud detection improve efficiency and customer trust.

- Robust repair/refurbishment ecosystem lowers indemnity costs and boosts margins.

Weaknesses

- High premiums limit adoption in budget and mid-tier segments.

- Complex policies and exclusions can reduce customer satisfaction.

- Dependence on carriers and OEMs creates concentration risks.

- Fraudulent claims inflate costs, pressuring profitability.

- Limited consumer awareness in emerging markets.

Opportunities

- Rising smartphone penetration in emerging economies.

- Expansion of micro-insurance and pay-as-you-go models.

- Growing demand for cybersecurity, identity theft, and data protection add-ons.

- Partnerships with fintechs, e-commerce platforms, and insurtechs to scale reach.

- Increasing demand for bundled family or multi-device plans.

Threats

- Escalating smartphone repair costs, especially for foldables and advanced models.

- Intense competition among carriers, OEMs, and insurtechs eroding margins.

- Regulatory complexities across regions affecting compliance.

- Customer mistrust due to claim denials or slow settlements.

- Rapid tech evolution outpacing insurance product updates.

Key Players Analysis

The global mobile phone insurance ecosystem market is highly competitive, with contributions from carriers, OEMs, retailers, insurtechs, and underwriters. Carriers such as Verizon, AT&T, and T-Mobile dominate distribution in North America, embedding insurance within subscription and billing systems to ensure high attach rates.

OEMs, particularly Apple through AppleCare+ and Samsung with Samsung Care, leverage brand trust, device expertise, and authorized repair networks to capture a strong share of the premium segment. The integration of mobile insurance into carrier bills has proven effective, increasing attach rates by up to 25% compared to traditional distribution methods.Best Buy’s Geek Squad Protection generated USD 1.5 billion in 2024 but experiences 20-25% higher churn rates compared to carriers and OEMs due to lower customer loyalty.

Insurtechs, including Asurion, Assurant, and Bolttec, bring innovation through AI-driven claims processing, instant settlements, dynamic pricing, and fraud analytics, differentiating themselves in customer experience. Underwriters and reinsurers such as Allianz and Munich Re play a vital role in capacity building, risk management, and actuarial insights. Strategic partnerships, mergers, and ecosystem integration remain central to strengthening competitive positioning.

Top Key Players

- Apple Inc.

- American International Group, Inc.

- Assurant, Inc.

- Asurion

- AT&T Intellectual Property.

- AmTrust Financial

- Brightstar Corp.

- GoCare Warranty Group

- SquareTrade, Inc.

- Taurus Insurance Services Limited

- Others

Recent Developments

- In August 2025, Apple introduced an option to renew AppleCare coverage within 45 days after expiration, improving customer retention and extended protection. Apple’s ecosystem synergy supports easier digital insurance activation and claims processing.

- In 2025, Assurant continued providing comprehensive insurance plans that include theft, loss, water damage, and hardware issues beyond manufacturer warranties. Monthly premiums vary but can be as low as $ 6, extending flexible coverage options.

- In 2024, it emphasized hassle-free coverage with tech support and extensive in-person repair services at over 700 locations. Asurion’s partnerships with carriers allow quick claims and same-day repairs, pivotal for consumer convenience at scale.

Report Scope

Report Features Description Market Value (2024) USD 34.7 Bn Forecast Revenue (2034) USD 133.23 Bn CAGR(2025-2034) 14.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Phone Type(Budget phones, Mid & high-end phones, Premium smartphones), By Coverage (Physical damage, Internal component failure, Theft & loss protection, Virus & data protection, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Apple Inc., American International Group, Inc., Assurant, Inc., Asurion, AT&T Intellectual Property., AmTrust Financial, Brightstar Corp., GoCare Warranty Group, SquareTrade, Inc., Taurus Insurance Services Limited, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Mobile Phone Insurance Ecosystem MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Mobile Phone Insurance Ecosystem MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Apple Inc.

- American International Group, Inc.

- Assurant, Inc.

- Asurion

- AT&T Intellectual Property.

- AmTrust Financial

- Brightstar Corp.

- GoCare Warranty Group

- SquareTrade, Inc.

- Taurus Insurance Services Limited

- Others